Meeting of the Finance Audit & Risk Sub-committee

Date: Tuesday 20 September 2016

Time: 10.00am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of

Minutes of the Finance Audit & Risk Sub-committee held on 18 May 2016

4. Matters Arising

from Minutes of the Finance Audit & Risk Sub-committee held on 18 May 2016

5. Follow-ups from

Previous Finance Audit & Risk Sub-committee meetings 3

Decision Items

6. Annual Report Year

Ending 30 June 2016 7

7. Internal Audit

Programme Proposed for 2016-17 23

8. HB LASS - Proposed

Combined Approach to Internal Audits 55

9. Infrastructure

Insurance 59

10. Business Continuance Plan 79

Information or Performance Monitoring

11. 2016 Sub-committee Work

Programme 119

Decision Items (Public Excluded)

12. Confirmation of the Public

Excluded Minutes of the Finance, Audit & Risk Sub-committee Meeting held on

18 May 2016 121

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Tuesday 20 September 2016

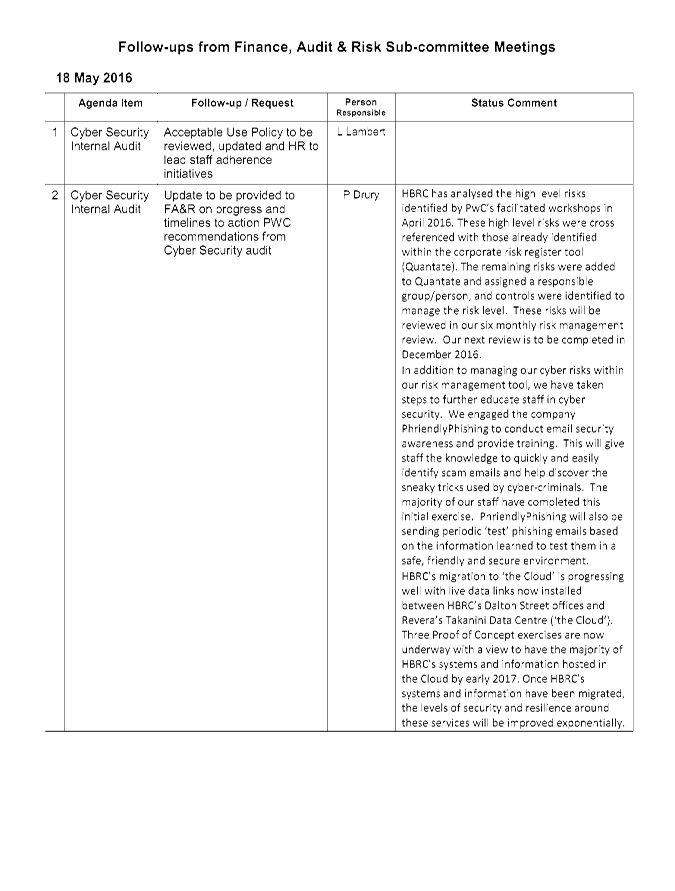

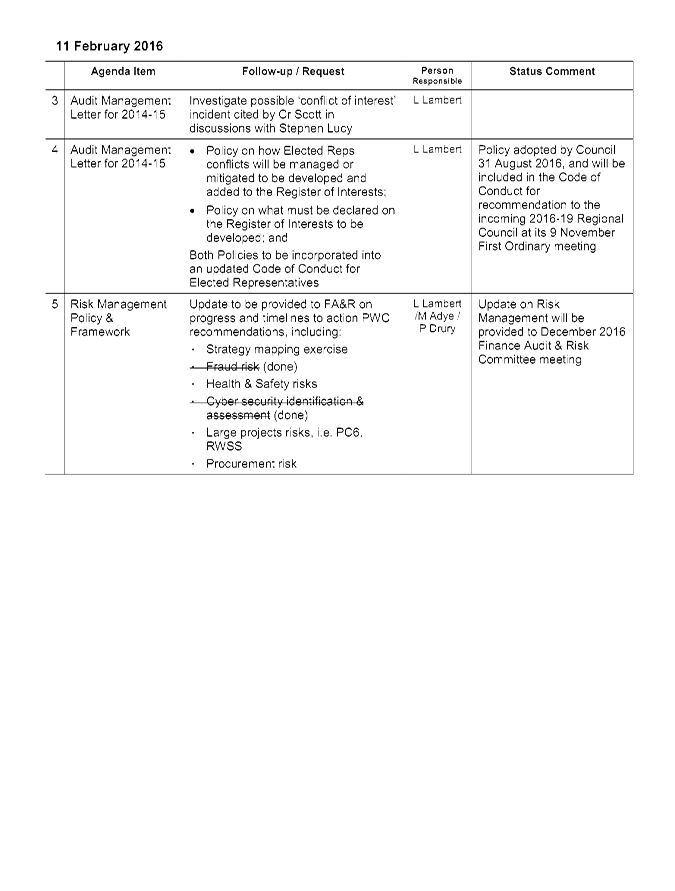

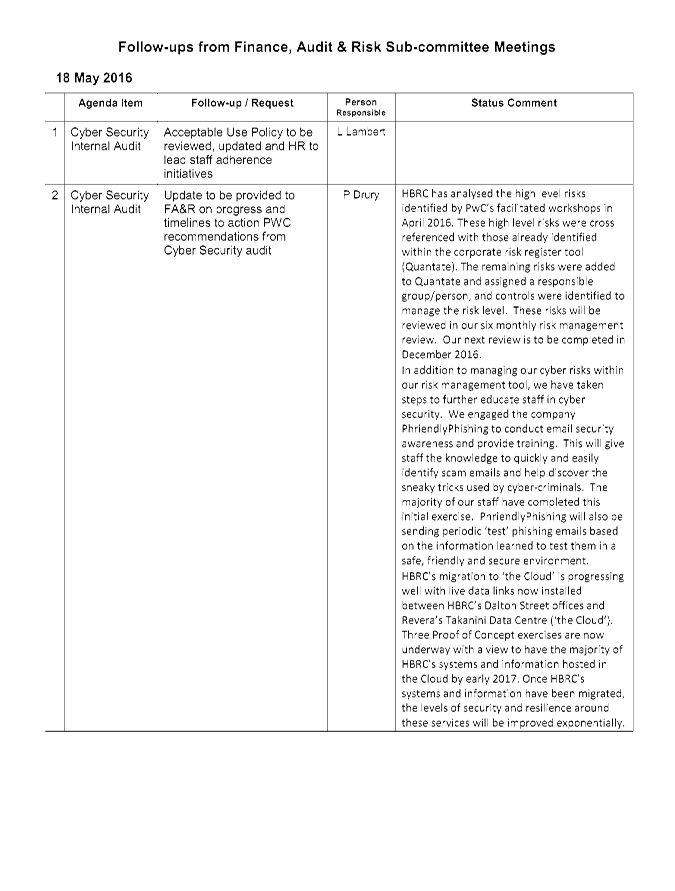

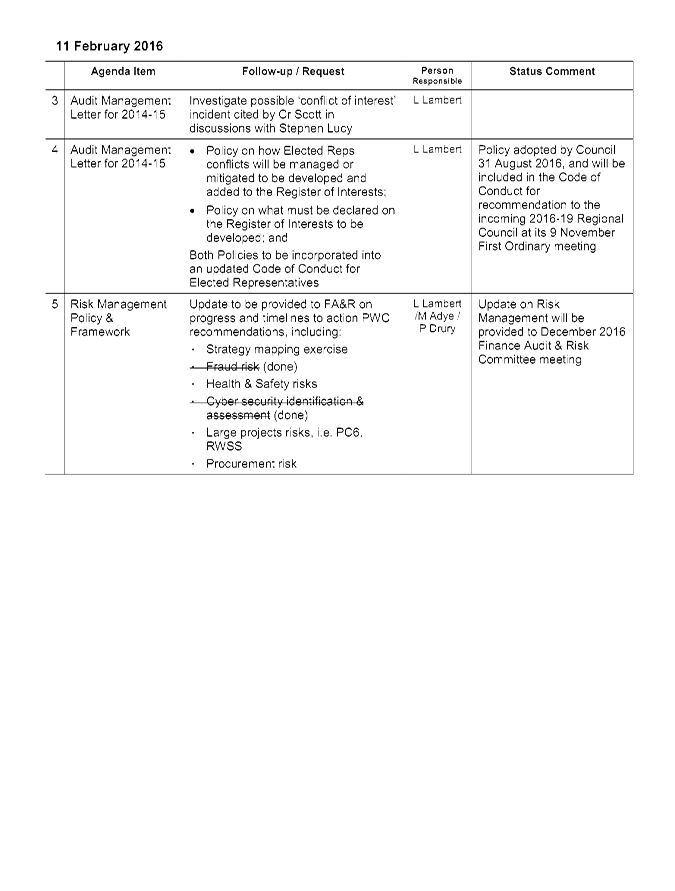

SUBJECT: Follow-ups from Previous Finance

Audit & Risk Sub-committee meetings

Reason for Report

1. In order to track items raised at previous meetings that require

follow-up, a list of outstanding items is prepared for each meeting. All

follow-up items indicate who is responsible for each, when it is expected to be

completed and a brief status comment. Once the items have been completed and

reported to the Committee they will be removed from the list.

Decision

Making Process

2. Council is required to make every decision in

accordance with the Local Government Act 2002 (the Act). Staff have assessed

the in relation to this item and have concluded that as this report is for

information only and no decision is required, the decision making procedures

set out in the Act do not apply.

|

Recommendation

That the Finance, Audit and Risk Sub-committee receives

and notes the report “Follow-ups from Previous Finance Audit and

Risk Sub-committee Meetings”.

|

Authored by:

|

Leeanne

Hooper

Governance & Corporate Administration

Manager

|

|

Approved by:

|

Paul Drury

Group Manager

Corporate Services

|

Liz Lambert

Chief Executive

|

Attachment/s

|

1

|

Follow-ups

from Previous Finance, Audit & Risk Sub-committee Meetings

|

|

|

|

Follow-ups

from Previous Finance, Audit & Risk Sub-committee Meetings

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Tuesday 20 September 2016

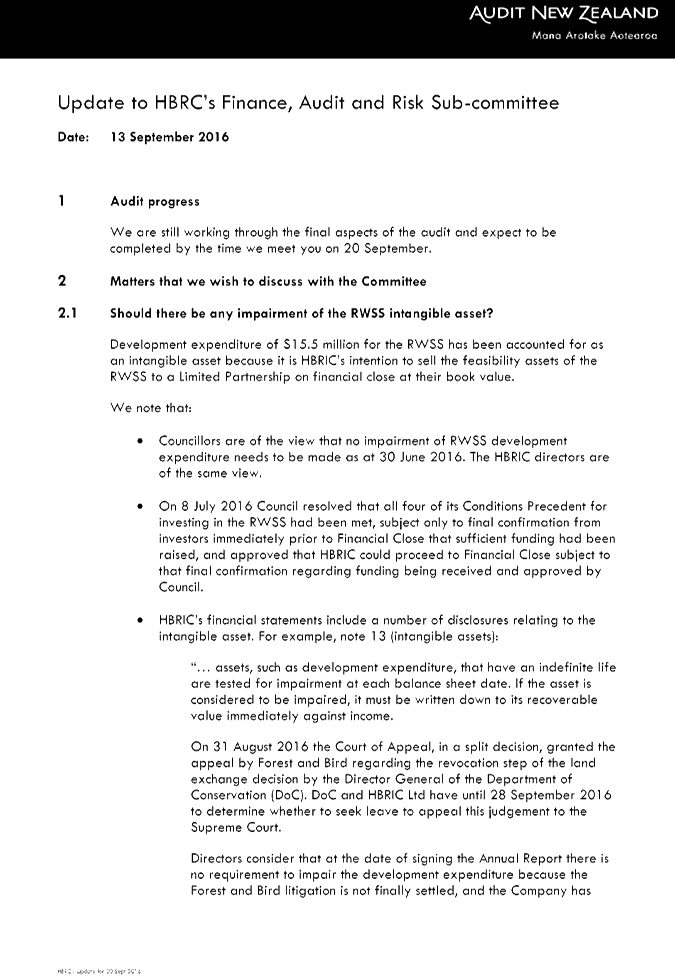

Subject: Annual Report Year

Ending 30 June 2016

Reason for Report

1. This report

outlines the issues that Stephen Lucy, Director Audit NZ, proposes to discuss

with the Subcommittee in relation to the audit of Hawke’s Bay Regional

Council’s (HBRC) financial statements for the year ending 30 June 2016.

Comment

2. At the time of

writing this paper there were only a few items to be resolved before

Audit NZ would be in a position to complete their audit report. It

is therefore anticipated that by the time Stephen Lucy makes his presentation

to this meeting, the Annual Report audit would have been finalised.

3. Further, at the

time of writing this paper both the Annual Report and associated

Audit Report for HBRIC Ltd are still in draft and have yet to be

finalised.

4. Appended as Attachment

1 are the issues that Stephen Lucy proposes to discuss with the

Subcommittee.

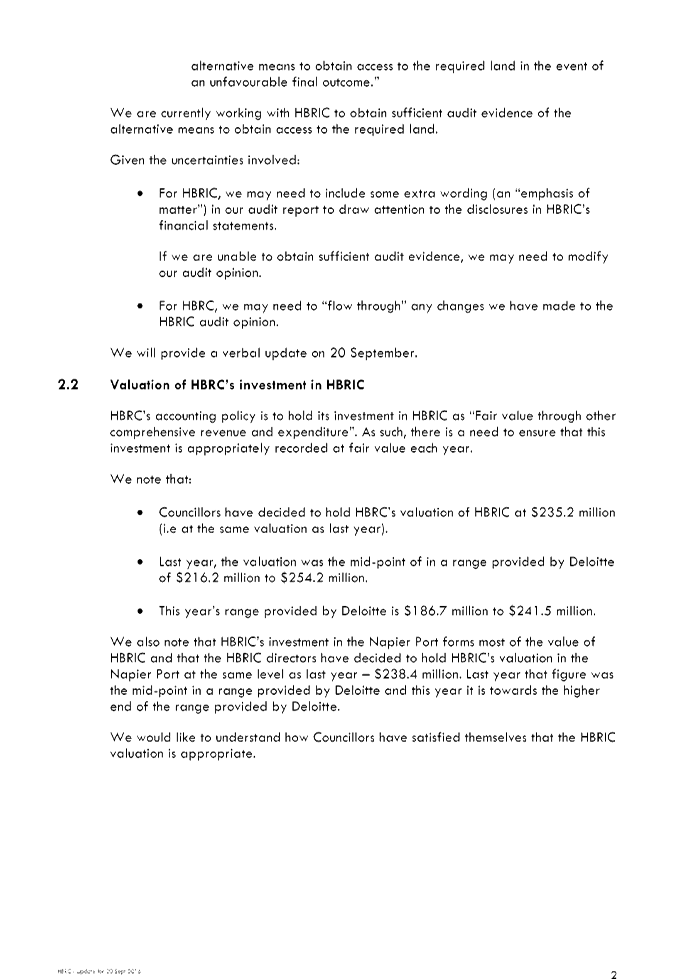

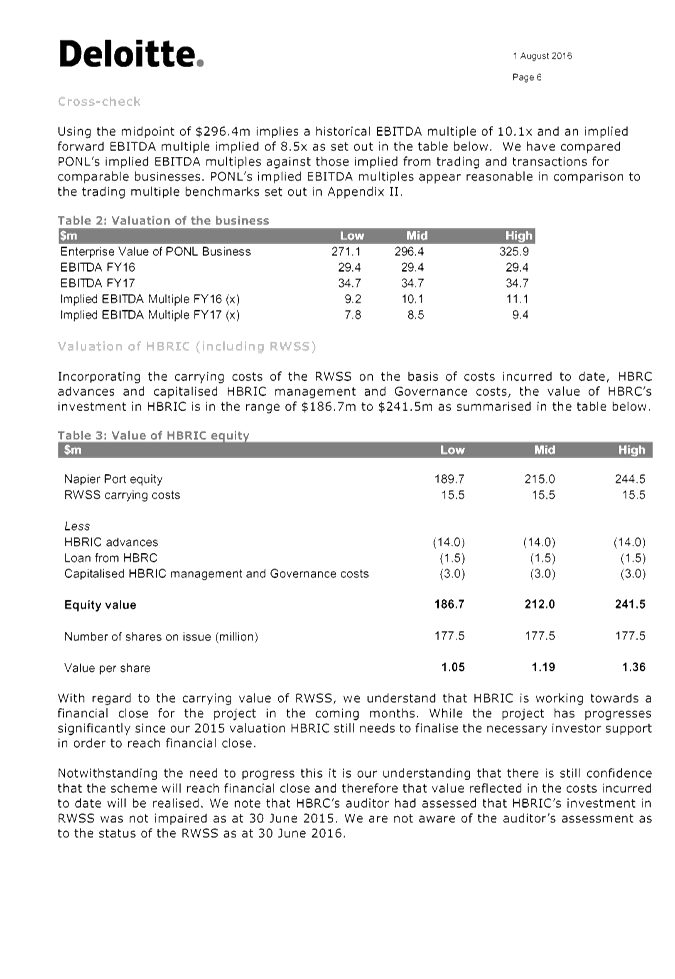

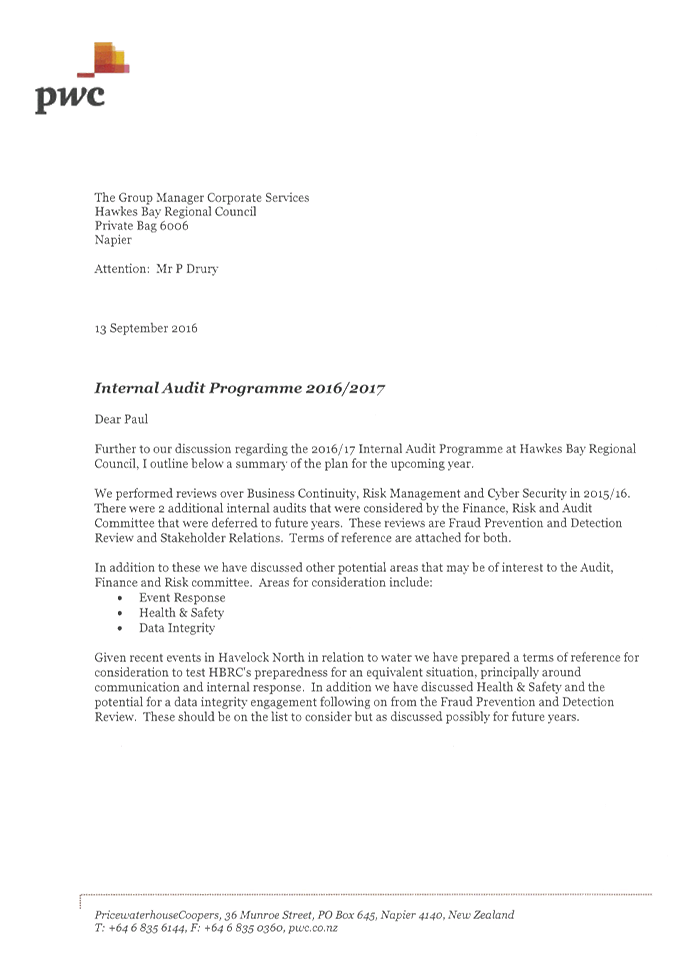

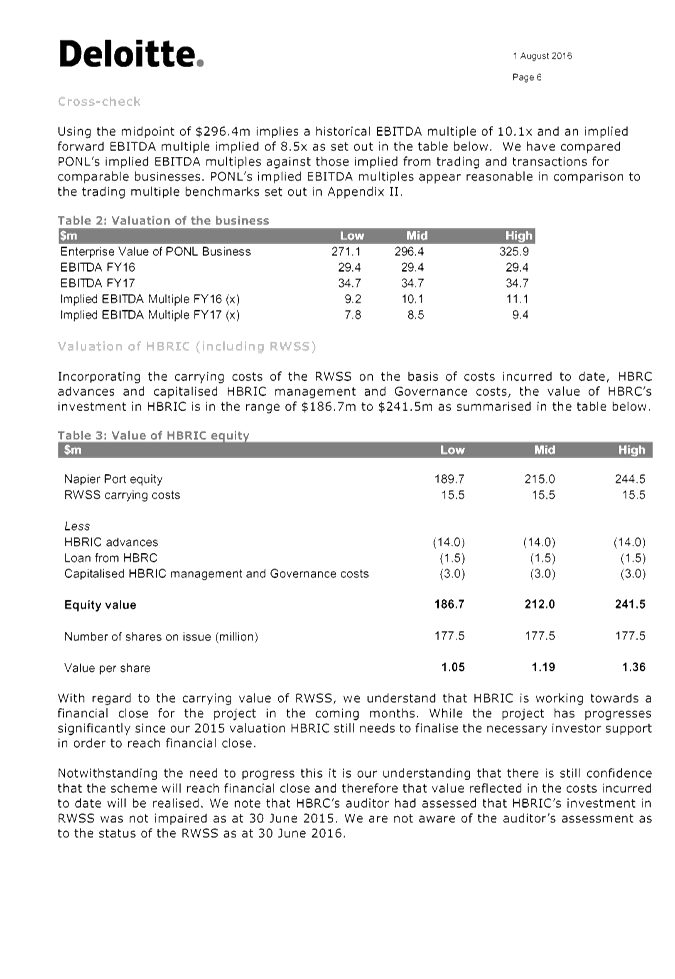

5. The

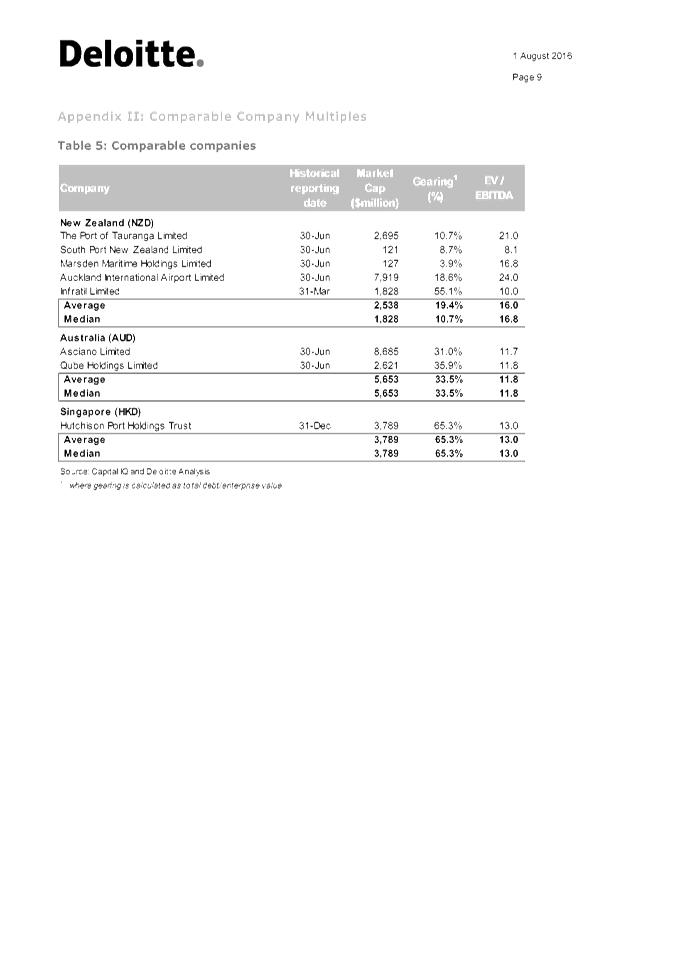

Deloitte’s report that recommends no change in the valuation of

HBRC’s investment in Hawke’s Bay Regional Investment Company Ltd

(HBRIC Ltd) is appended as Attachment 2. The conclusions of this

report are referred to in Stephen Lucy’s paper.

6. At the

conclusion of these discussions there will be an opportunity, if required, for

Sub‑committee member only discussion with Stephen.

7. The audited

Annual Report will be sent to Council for adoption at its meeting on

28 September 2016.

Decision Making

Process

8. As this report

is for information only and no decision is to be made, the decision making

provisions of the Local Government Act 2002 do not apply.

|

Recommendations

That the Finance Audit and Risk Sub-committee receives and notes

the issues provided by Stephen Lucy, Director Audit NZ, for discussion on

HBRC’s Annual Report for Year Ending 30 June 2016.

|

Authored by:

|

Paul Drury

Group Manager

Corporate Services

|

|

Approved by:

|

Liz Lambert

Chief Executive

|

|

Attachment/s

|

1

|

Audit NZ -

Issues Paper on Annual Report 2015-16

|

|

|

|

2

|

2016 HBRIC

Impairment Review - Final

|

|

|

|

Audit

NZ - Issues Paper on Annual Report 2015-16

|

Attachment 1

|

|

2016 HBRIC Impairment

Review - Final

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Tuesday 20 September 2016

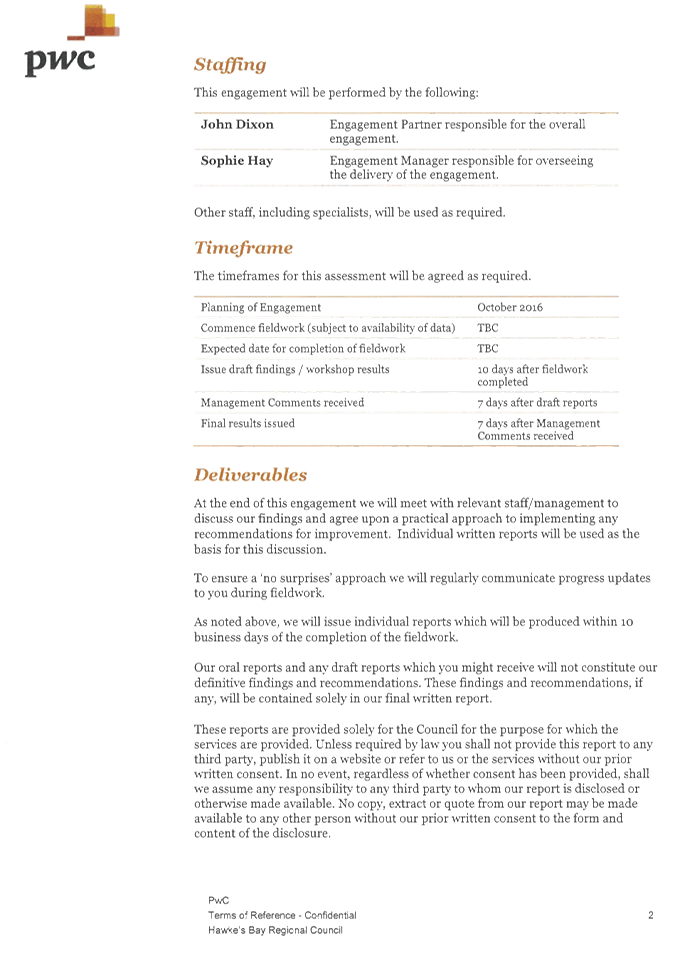

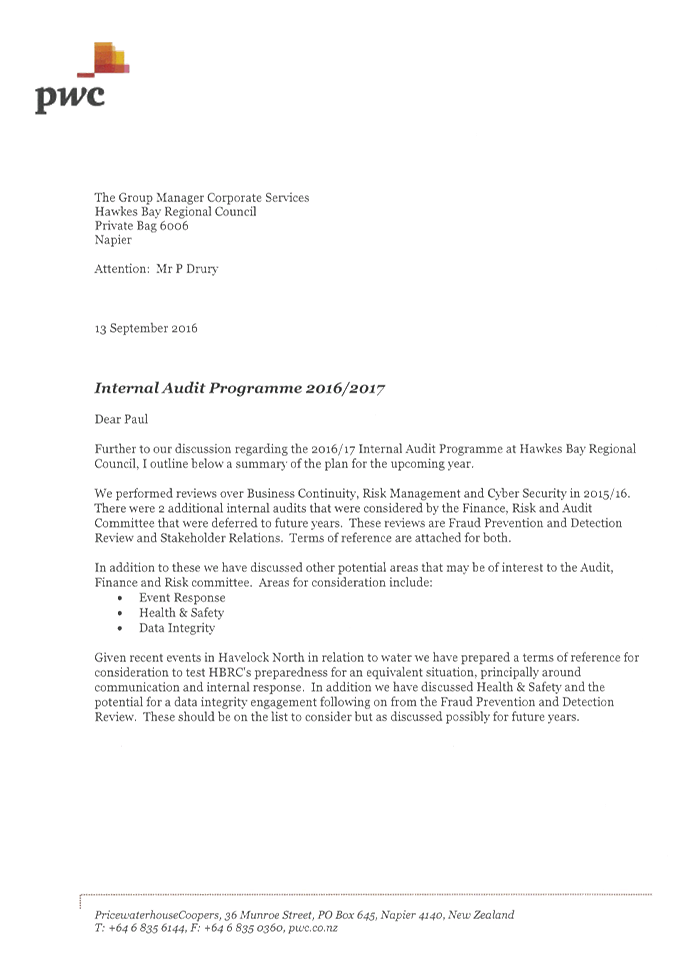

Subject: Internal Audit

Programme Proposed for 2016-17

Reason for Report

1. To set out a

proposed internal audit programme for the Subcommittee to consider, prioritise

and approve.

Comment

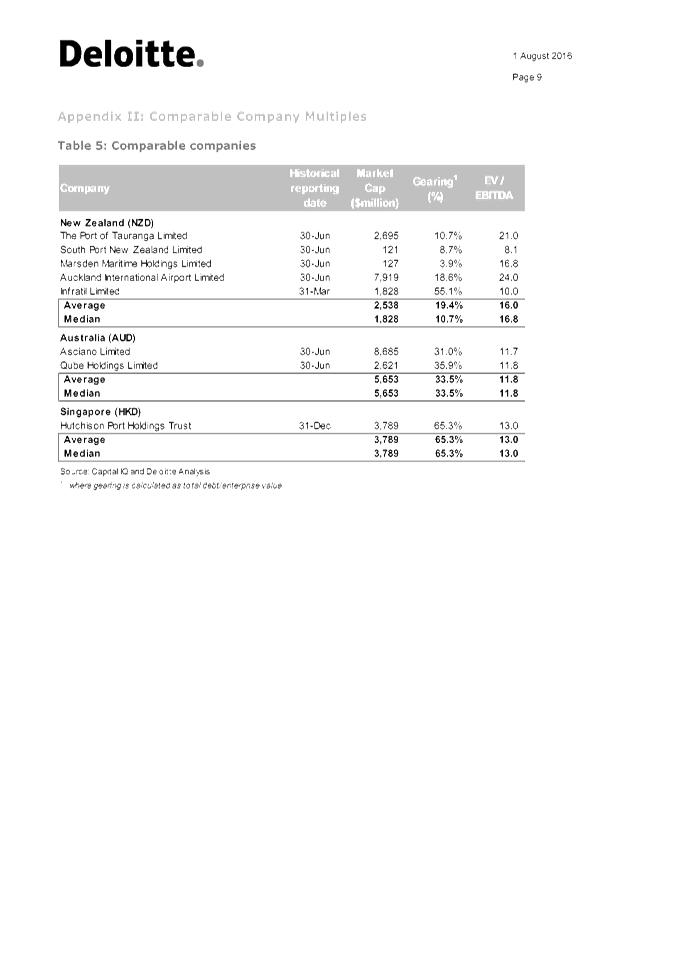

2. Internal audits

commissioned by this Council have, in the past been carried out by

Pricewaterhouse Coopers (PWC). Since the inception of the Finance Audit

and Risk Subcommittee in June 2015 the following audits have been undertaken by

PWC.

2014-15

2.1. Treasury

management.

2.2. Payroll.

2.3. Accounts

payable.

2015-16

2.4. Business

continuity and disaster recovery plan.

2.5. Cyber

security risk.

3. The budget for

internal audits for 2015-16 was $21,000, with $18,000 of this spent during that

year.

4. The budget to

cover internal audits for 2016-17 was increased to $30,000 to allow for a more

comprehensive programme of audit to be undertaken.

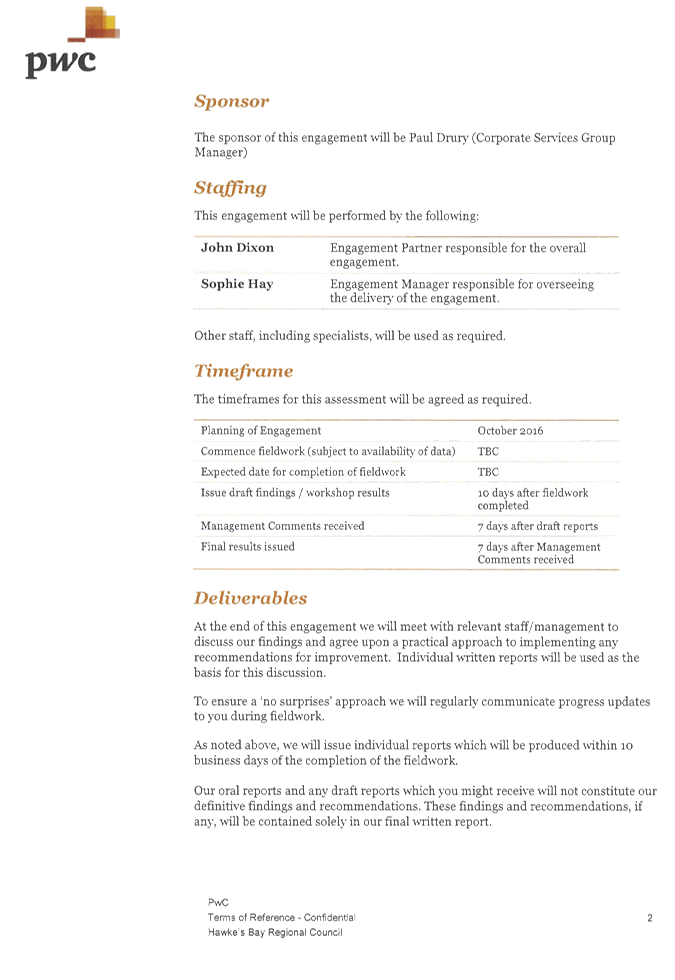

5. Representatives

from PWC, John Dixon (Partner), and Sophie Hay (Audit Manager), will attend

this meeting to discuss the recommendations for the 2016-17 audit

programme. This outline is appended to this paper as Attachment 1.

6. At a meeting of

this Sub-committee on 9 November 2015, a number of priority areas for internal

audit were set out for further consideration. These were:

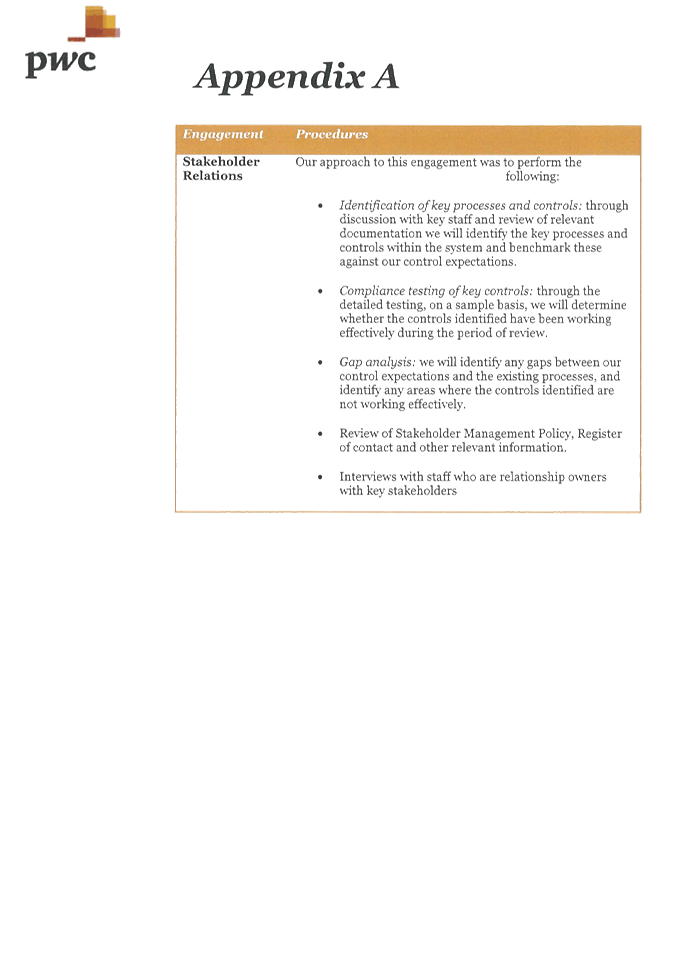

6.1. Stakeholder

Relationship Management (terms of reference submitted to the Sub‑committee

on 9 November 2015; priced at $5,000 - $6,500

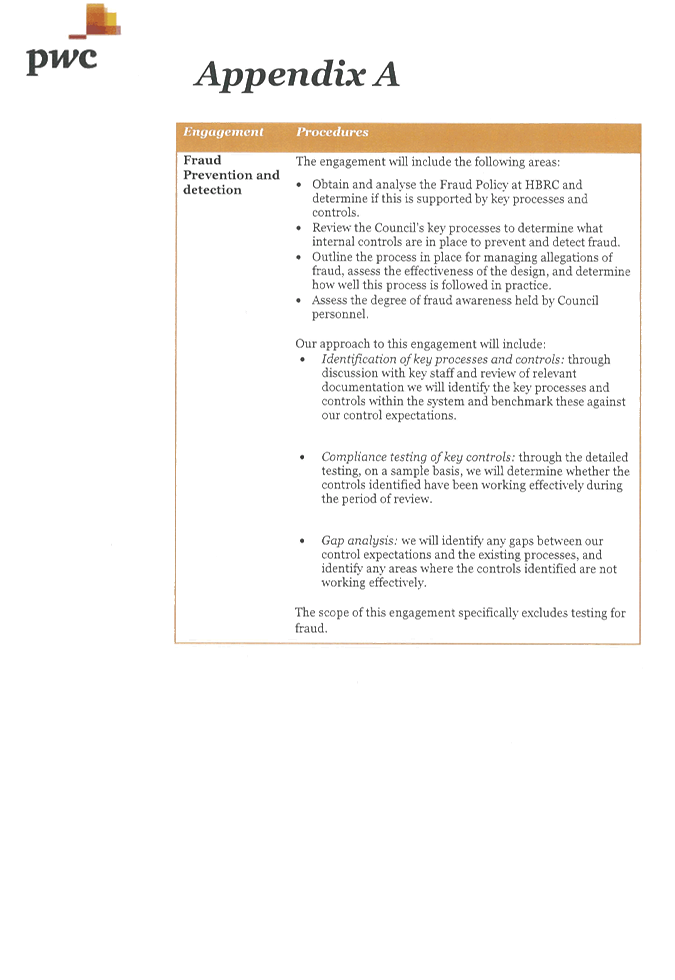

6.2. Fraud

Prevention Detection Review (terms of reference considered by the Sub‑committee

on 9 November 2015); priced at between $9,500 - $11,500.

6.3. Conflicts of

Interest both general and procurement

6.4. Information

Communication Technology (ICT) General Computer Control

6.5. Rating System

6.6. Health and

Safety.

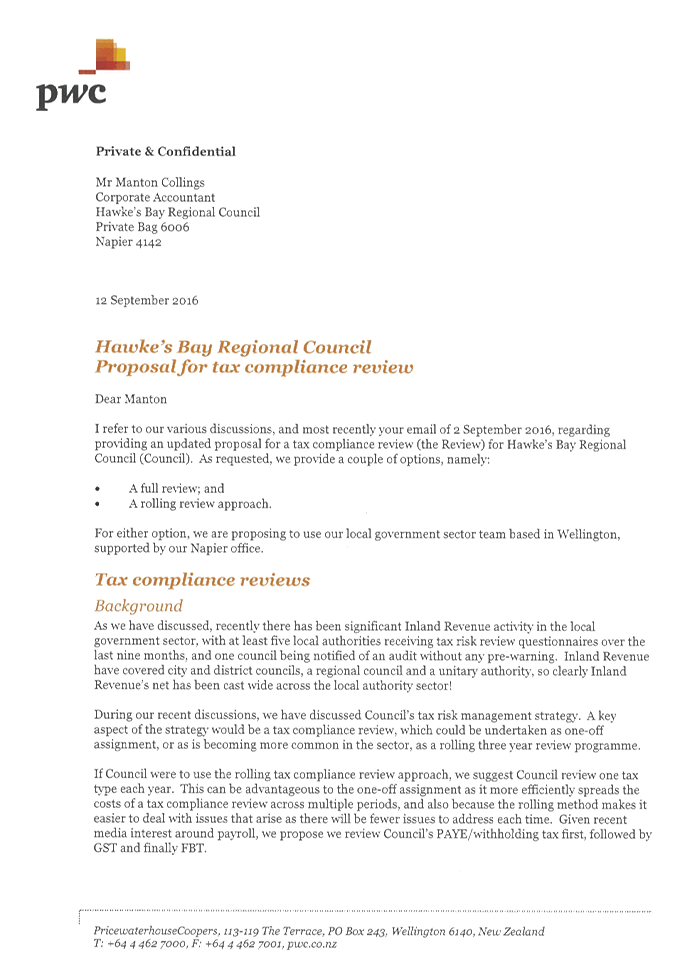

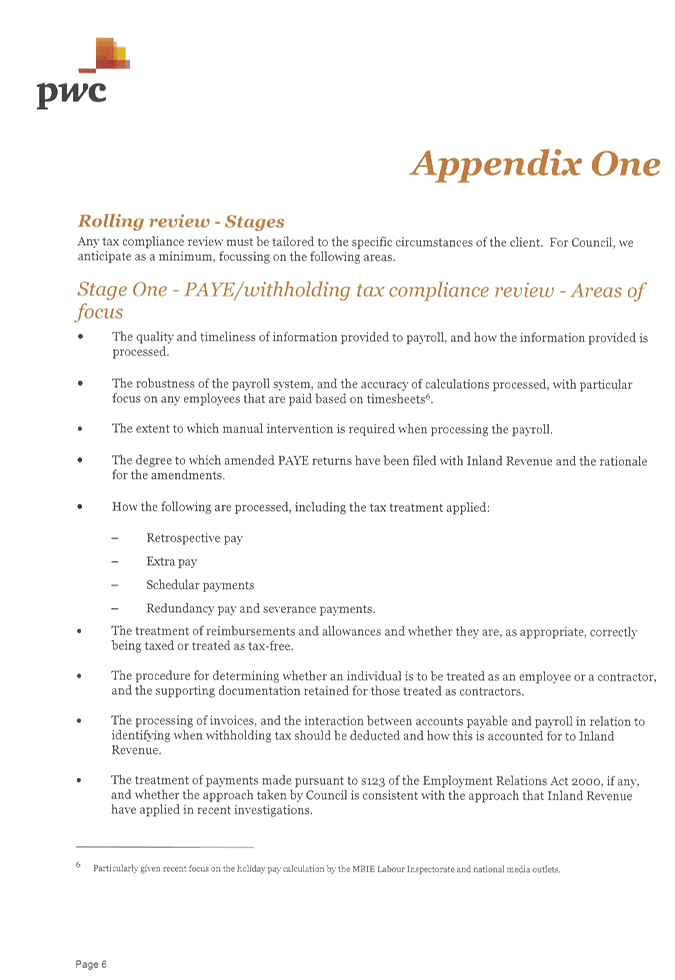

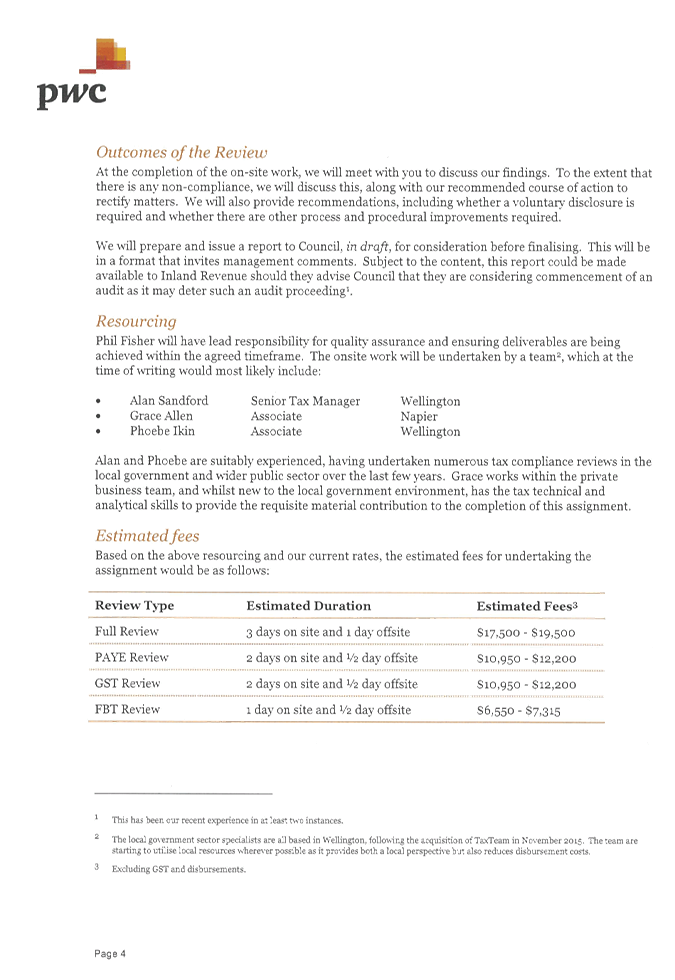

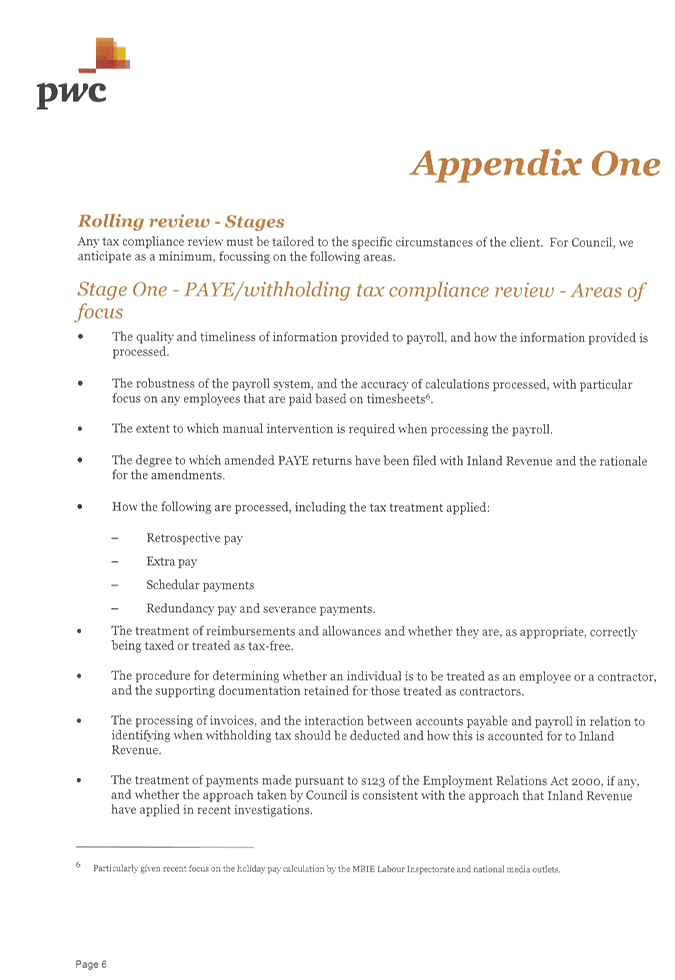

Internal Audit - Taxation Review

7. As part of

Council’s internal risk programme, a tax review has been undertaken every

three to four years to ensure compliance with our tax obligations. As

Council is exempt from income tax, the main focus of this audit review covers

GST, FBT and PAYE. These reviews have previously been carried out by Tax

Team Ltd who are the local government experts in taxation and are engaged by

the majority of councils throughout the country. Tax Team Ltd have

recently been sold to PWC but have kept their local government team based in

Wellington.

8. The last review

was undertaken by Tax Team Ltd in May 2013. There is a separate budget

provision in the Corporate Services budget for this three yearly audit.

The budget provision for this is $20,000 for the 2016-17 year.

9. PWC will

include recommendations for this tax review in Attachment 1.

Decision Making

Process

10. Council

is required to make a decision in accordance with the requirements of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained in Part 6 Sub Part 1 of the Act in relation to this item and have

concluded the following:

10.1. The decision

does not significantly alter the service provision or affect a strategic asset.

10.2. The use of

the special consultative procedure is not prescribed by legislation.

10.3. The decision

does not fall within the definition of Council’s policy on significance.

10.4. The effect of this decision on

determining what internal audits should be proceeded with will affect all

stakeholders.

10.5. The options available to

Council for a programme of internal audit are clearly set out in this paper.

10.6. The decision

is not inconsistent with an existing policy or plan.

|

Recommendations

1. That the Finance Audit and Risk Subcommittee receives and notes

the Internal Audit Programme report and advises staff which areas of HBRC

business require an internal audit review during the 2016-17 financial year.

2. The Finance

Audit and Risk Subcommittee recommends that Council:

2.1. Agrees that the decisions to be made are

not significant under the criteria contained in Council’s adopted

Significance and Engagement Policy, and can make decisions on this issue

without conferring directly with the community and persons likely to be affected

by or to have an interest in the decision.

2.2. That consideration be given to the areas of Council business that

should be subject to an internal audit and also to consider whether the tax

review should proceed for 2016-17.

|

Authored by:

|

Paul Drury

Group Manager

Corporate Services

|

|

Approved by:

|

Liz Lambert

Chief Executive

|

|

Attachment/s

|

1

|

PWC Report re

Internal Audit Programme 2016-17

|

|

|

|

PWC

Report re Internal Audit Programme 2016-17

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Tuesday 20 September 2016

Subject: HB LASS - Proposed

Combined Approach to Internal Audits

Reason for Report

1. This report

seeks endorsement by the sub-committee of a joint Hawke’s Bay LASS

approach for the provision of internal audit services.

Comment

2. Pricewaterhouse

Coopers (PWC) has been providing advice on risk framework and policy, approach

to the analysis of risk and the areas in the business that they believe are a

priority for internal audit exercises, to the sub-committee, since the latter

part of 2015. It is proposed that PWC continues with the provision of

internal audit for the financial year 2016-17.

3. This paper therefore

sets out options for internal audits commencing year 2017-18.

4. Hawke’s Bay LASS,

as part of its agenda to achieve improved Council services more efficiently and

at the optimum cost, has been considering a joint approach to the provision of

internal audit services. It is considered the merits of a combined

internal audit approach would include:

4.1. Councils

would have the same provider

4.2. There would

be a sharing of knowledge between councils on internal audit requirements and

delivery

4.3. There would

be economies of scale achieved in both approach and learnings which can be used

in each subsequent audit in the participating councils

4.4. Improved

access to skills, specifically in the specialist area audits, i.e. non‑traditional

financial audits.

5. It is envisaged

that if a common internal audit provider was agreed to, that the communication

between that provider and the Audit and Risk committees of each council would

continue to be retained.

Current

Situation

6. There is wide

disparity among the five councils forming the Hawke’s Bay LASS in their

approach to internal audit. Councils have different providers of internal

audit and the development of internal audits are at varying levels of

sophistication and delivery.

Options

for Future Internal Audit Delivery

7. Option 1:

Continue with Current Method for Delivering Internal Audit

7.1. The

continuation of Hawke’s Bay councils independently securing differing

levels of internal audit services is not considered the most effective and

efficient way of undertaking this important risk management process.

Opportunities for an improved collegial approach are reduced and opportunities

to look at improved cost effectiveness are also reduced if the councils

continue to operate independently of each other.

8. Option 2:

Creation of an Internal Audit Position for Sharing between Councils

8.1. It is

considered that this approach creates key person dependencies - whilst this

approach would provide routine financial audits, the skills would need to be

outsourced for audits in specialist areas, and there would be reduced

opportunity for collegial support for the internal audit staff member.

9. Option 3:

Tender for Internal Audit Services from Outside Providers

9.1. This is the

preferred option for Hawke’s Bay LASS and it is considered this approach

will deliver on all the benefits previously mentioned in this paper concerning

a combined approach to internal audit through Hawke’s Bay LASS’s

recommended tender process. It is believed this approach has the

potential to provide a very high quality outcome at a competitive price for auditing.

9.2. The tender

process would acknowledge that the Hawke’s Bay LASS councils recognise

that internal audit and risk management are essential responsibilities and wish

to appoint an external provider to develop and deliver internal audit work

plans that provide independent and objective assurance that the financial and

operational controls for Hawke’s Bay LASS councils are efficient,

effective, economical and ethical.

10. The approach as outlined

in option 3 above has been implemented by Bay of Plenty LASS (BOP LASS) and by

five councils from the Waikato LASS. Discussions with BOP LASS and the

Waikato LASS have established that the new arrangements provide each council

with a degree of flexibility in how they approach their respective internal

audit activities. It is also evident that the process has created a

number of additional benefits including the collegial nature of this

arrangement and some cost efficiencies.

Decision Making

Process

11. Council

is required to make a decision in accordance with the requirements of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained in Part 6 Sub Part 1 of the Act in relation to this item and have

concluded:

11.1. The decision

does not significantly alter the service provision or affect a strategic asset.

11.2. The use of

the special consultative procedure is not prescribed by legislation.

11.3. The decision

does not fall within the definition of Council’s policy on significance.

11.4. All stakeholders are affected

by this decision as the expectation is that Council will ensure that internal

audit activities are carried out efficiently and effectively.

11.5. Options for future

internal audit provision from 2017-18 are clearly set out in this paper.

11.6. The decision

is not inconsistent with an existing policy or plan.

|

Recommendations

1. That the Finance, Audit and Risk Sub-committee receives and notes

the “HB LASS Proposed Combined Approach to Internal Audits”

report.

2. The Finance, Audit and Risk Sub-committee recommends that Council:

2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion under Sections 79(1)(a)

and 82(3) of the Local Government Act 2002 and make decisions on this issue

without conferring directly with the community.

2.2. Subject to sufficient support from Hawke’s Bay councils,

participates in a joint request for proposal for internal audit services from

external providers.

|

Authored by:

|

Paul Drury

Group Manager

Corporate Services

|

|

Approved by:

|

Liz Lambert

Chief Executive

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Tuesday 20 September 2016

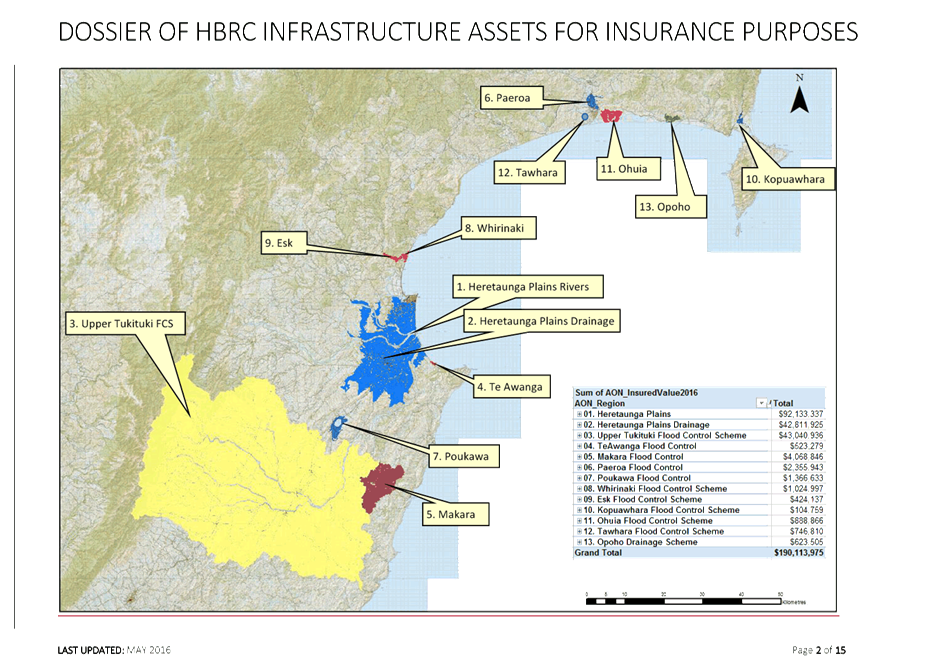

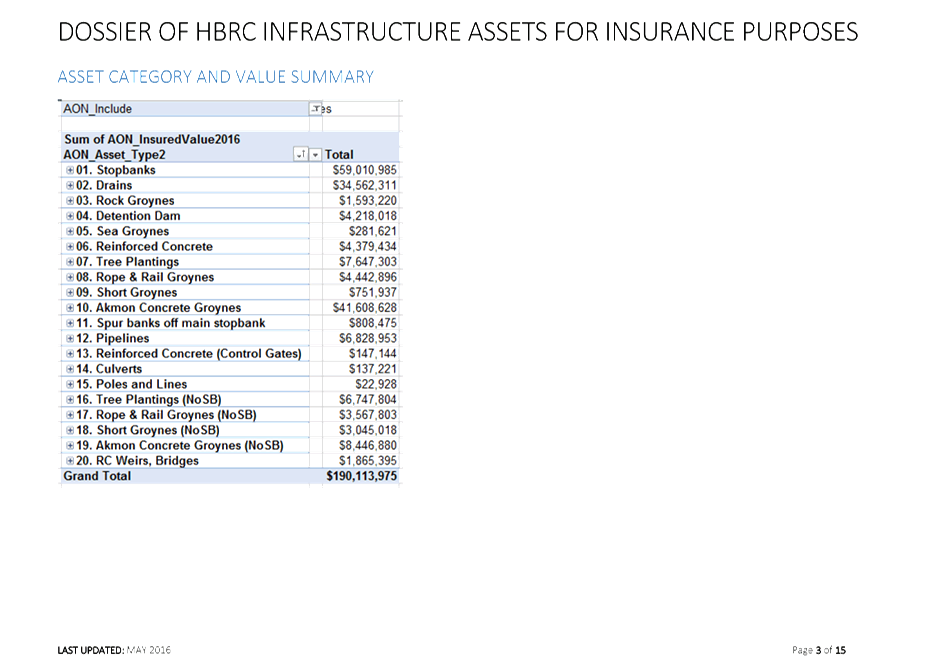

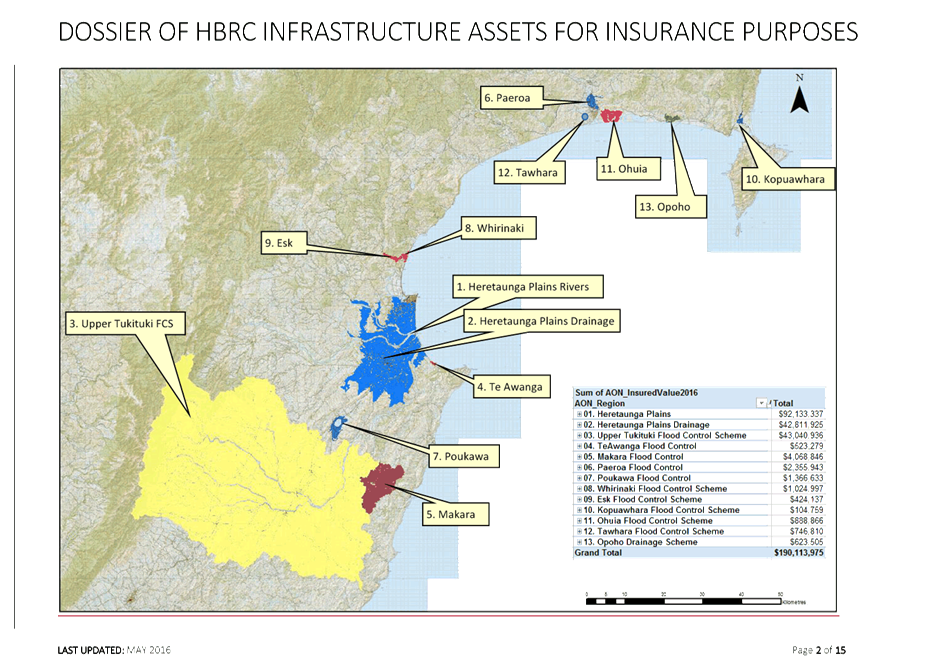

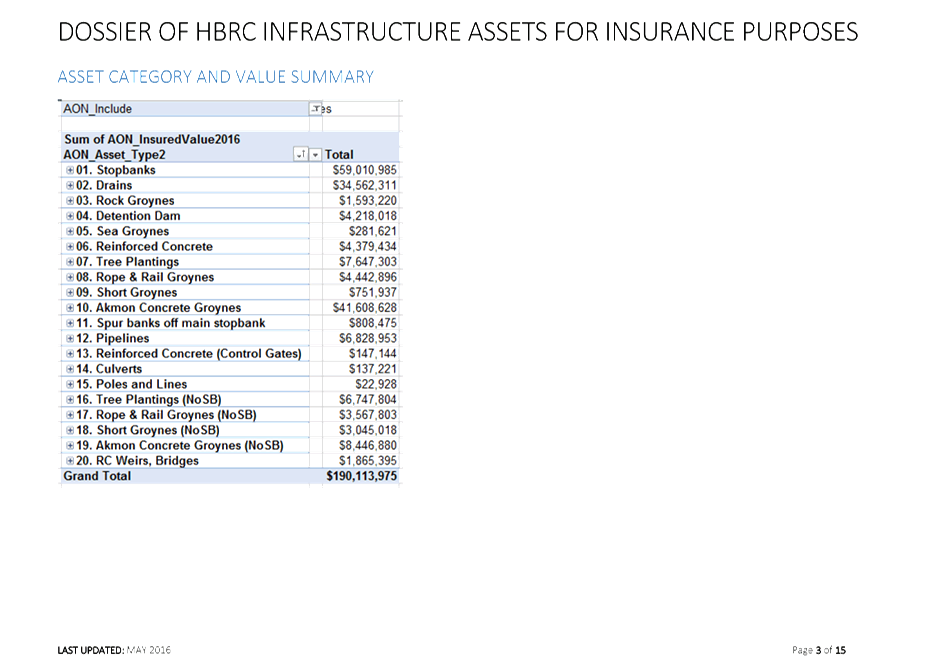

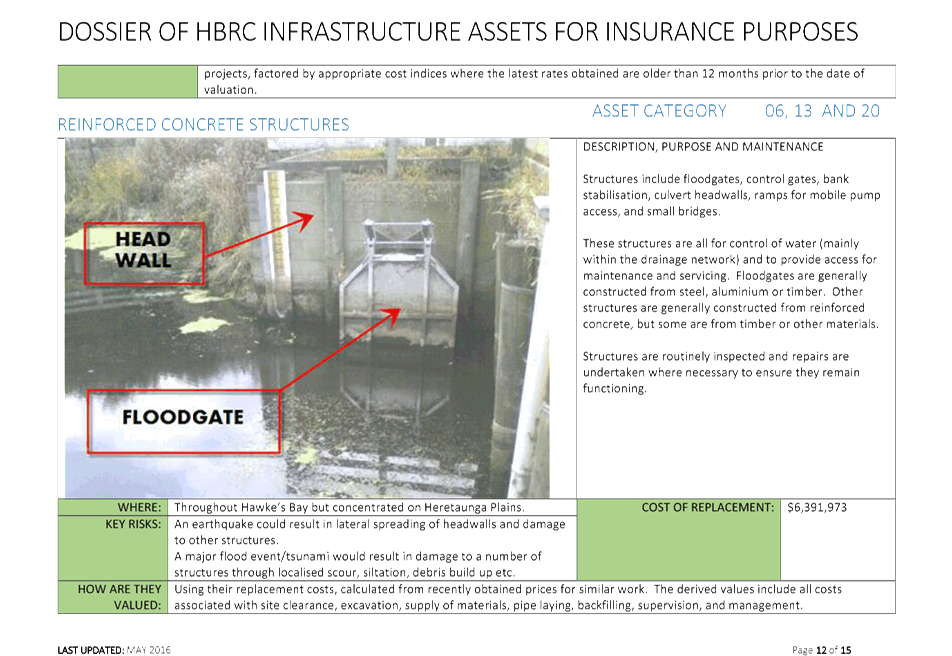

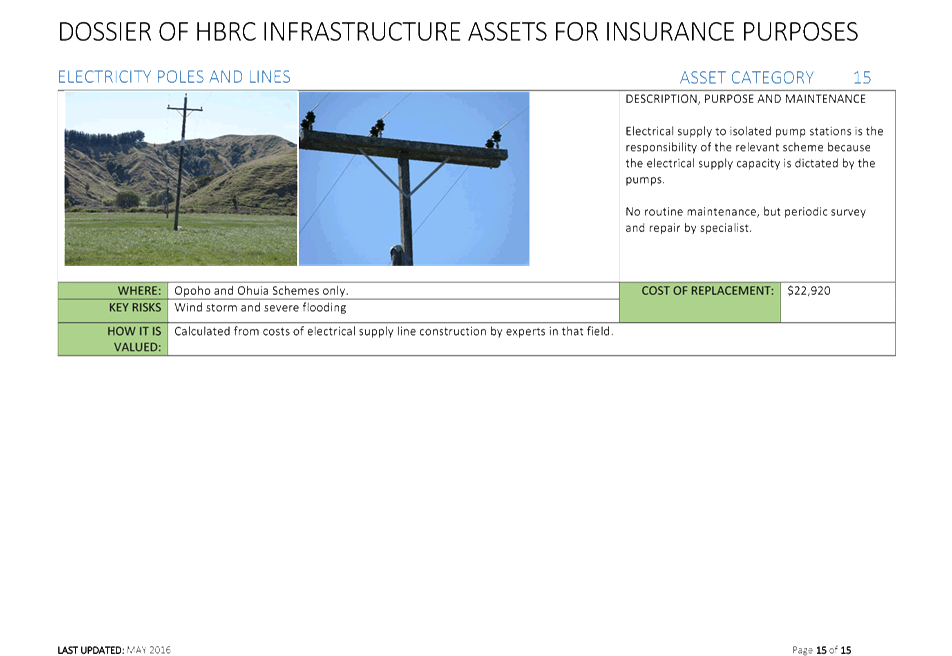

Subject: Infrastructure

Insurance

Reason for Report

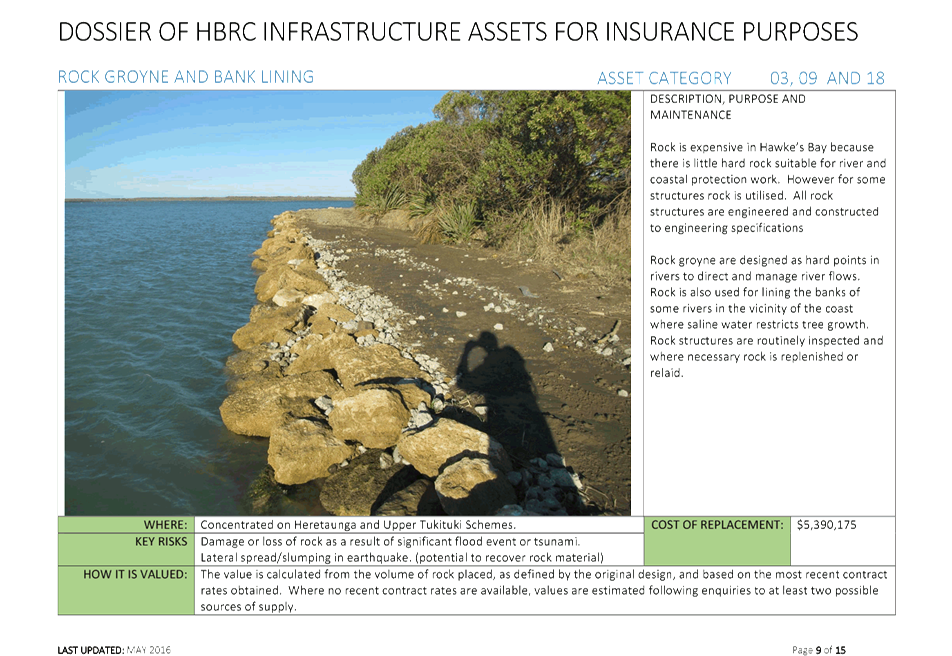

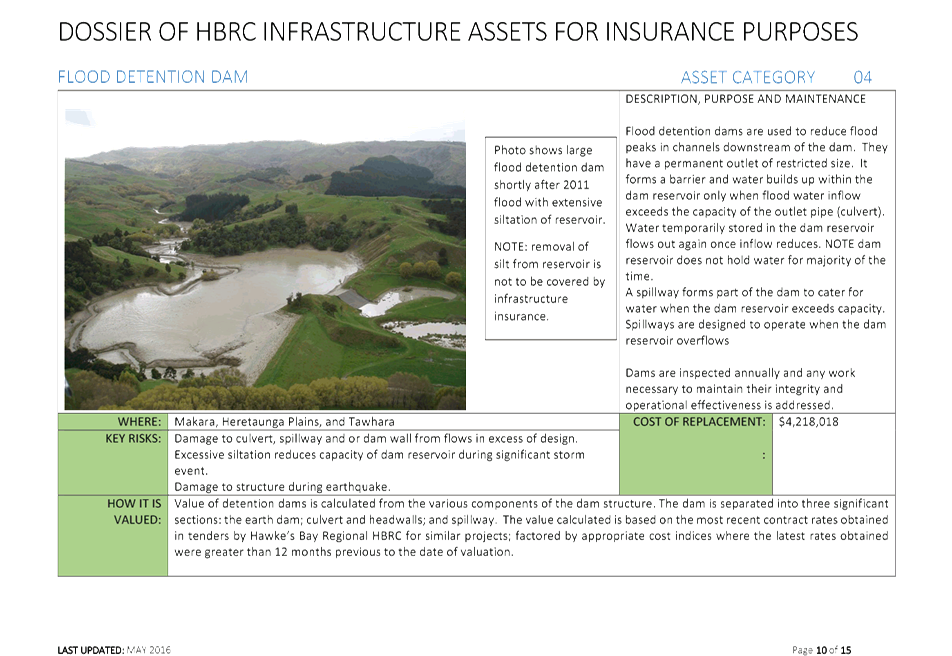

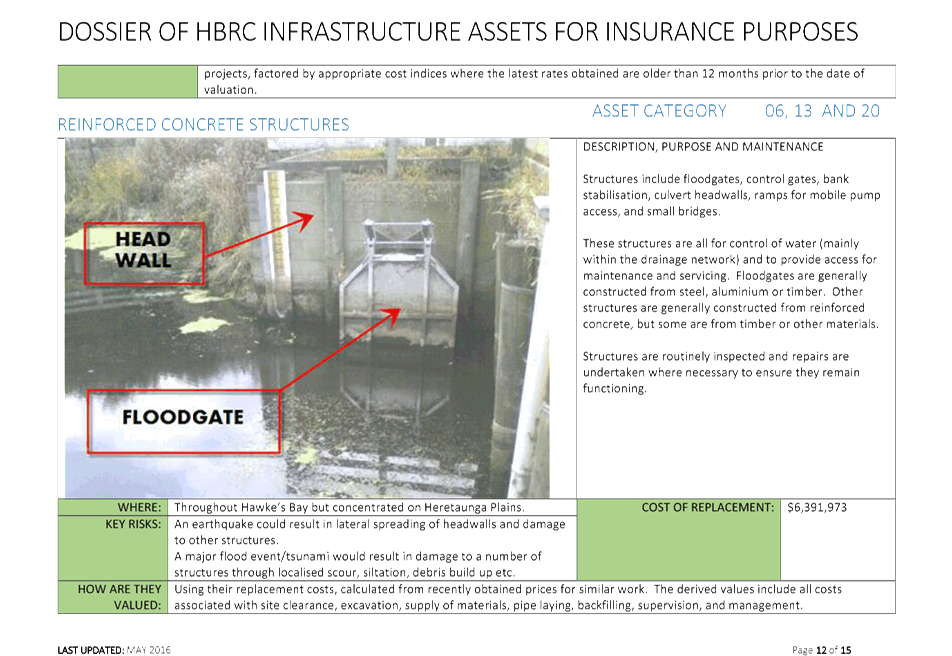

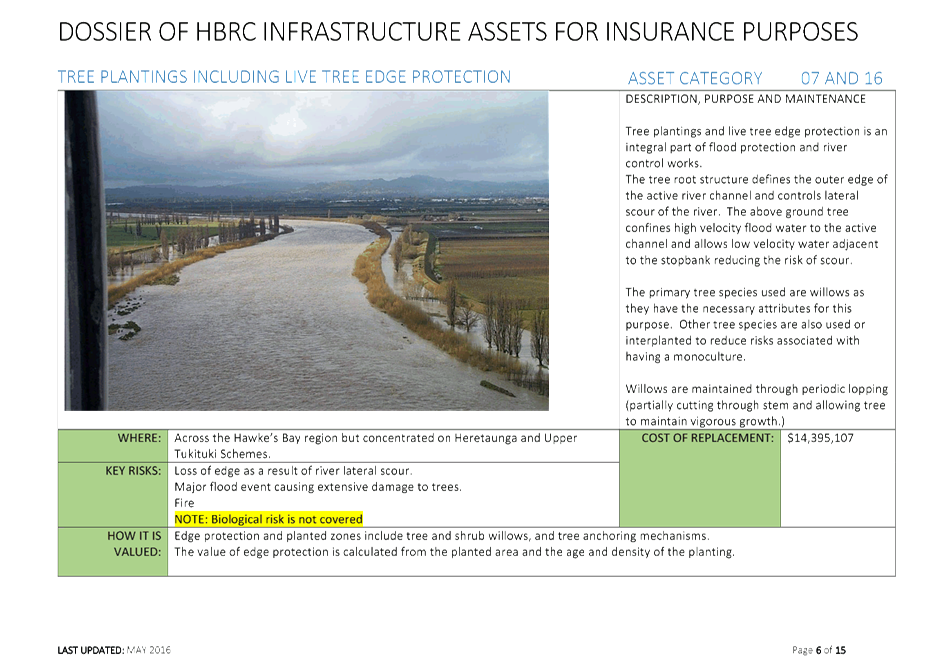

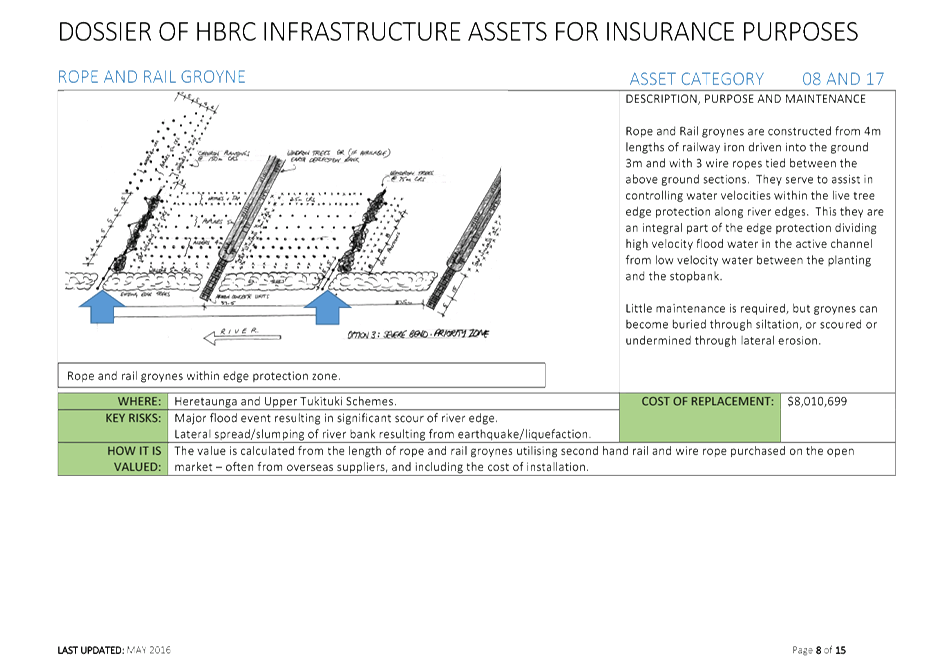

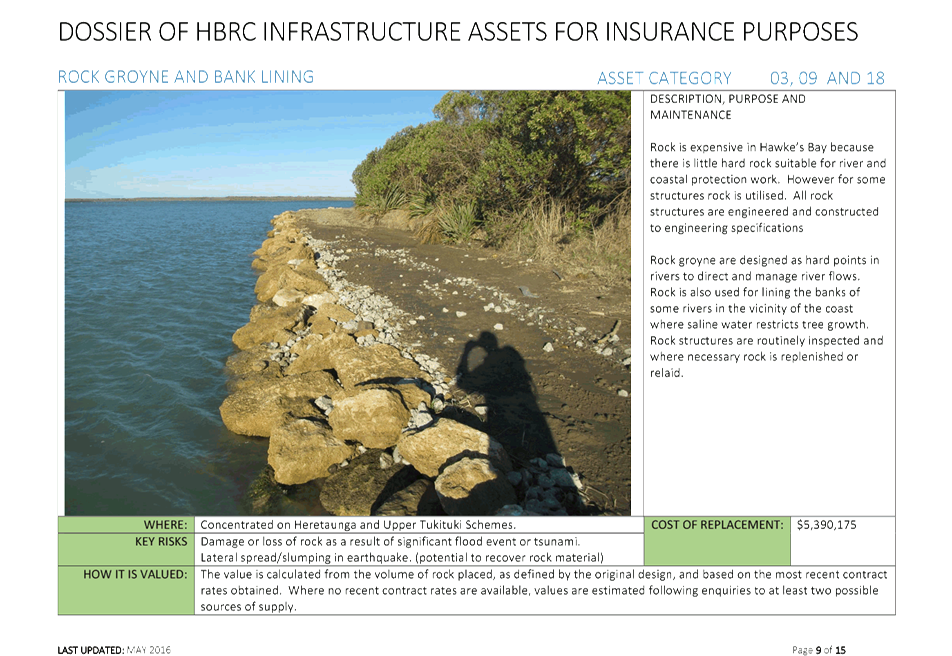

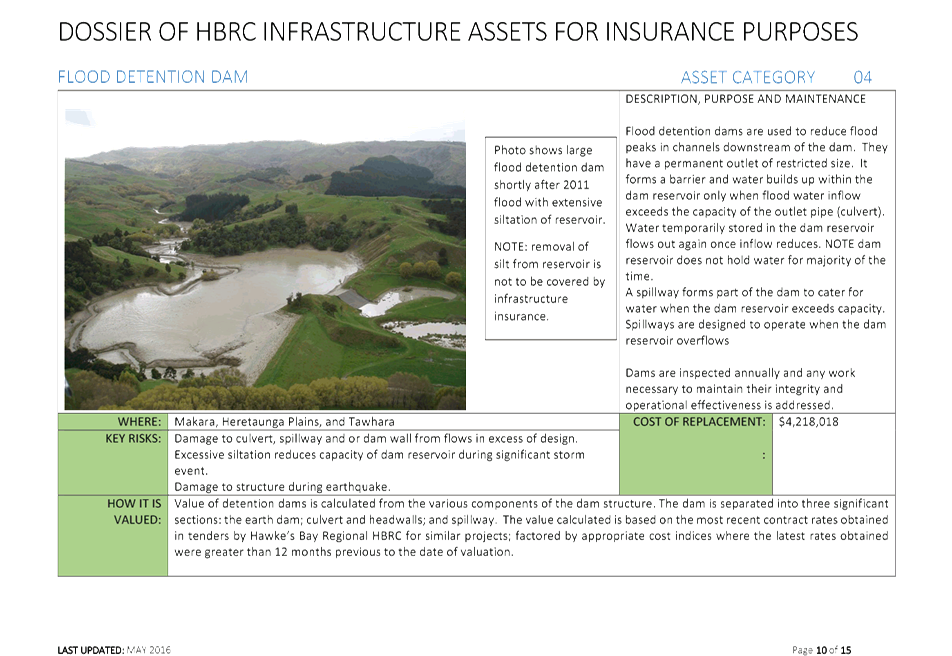

1. The current

insurance policy for insurance of HBRC infrastructure assets expires on

30 September 2016. Staff are currently awaiting quotations from

insurance broker Aon for renewal of the policy.

2. This paper sets

out the process HBRC has used to inform the level of infrastructure asset

insurance that it would be prudent for HBRC to seek cover for, and the

framework within which that infrastructure insurance is currently provided and

is expected to continue.

Background

3. In June 2015,

Council received a report on insurance for HBRC infrastructure assets and

agreed to take out insurance cover through Aon. The insurance policy

entered into was for 15 months from 1 July 2015 to 30 September 2016.

4. The level of

insurance was based on a report “Natural Hazard Loss Estimate Analysis

for River Management Assets – June 2015” which concluded that a

maximum credible earthquake event (> 1 in 2000 year event) will cause

between $11 and $59 million worth of damage to HBRC owned assets as set out in

the Loss Summary below. The high level of loss is because of the significant

concentration of assets on the Heretaunga Plains area and therefore the risk

from a significant earthquake of damage to those assets.

|

Scenario

|

ARI (Years)

|

Loss Estimate ($m)

|

|

Low

|

Medium

|

High

|

|

Earthquake

Scenario 1

|

2,100

|

11.0

|

24.1

|

59.0

|

|

Earthquake

Scenario 2

|

110 - 400

|

4.5

|

7.7

|

17.0

|

|

Earthquake

Scenario 3

|

26 – 110

|

2.7

|

4.1

|

7.8

|

|

Flood

Scenario (3 main schemes)

|

100

|

16.5

|

|

200

|

27

|

|

500

|

37.1

|

|

Volcano

|

500

|

4.6

|

|

Tsunami

|

500 (50th Percentile)

|

9.6

|

|

|

500 (84th Percentile)

|

14.4

|

|

|

2,500 (50th Percentile)

|

22.4

|

|

|

2,500 (84th Percentile)

|

35.5

|

5. Details of the

current insurance policy are:

5.1. Insurance is

taken out under the Horizons LASS

5.2. Loss

estimates are as per the report “Natural Hazard Loss Estimate Analysis

for River Management Assets – June 2015”.

5.3. There is a

sub-limit for HBRC of 40% of $60m (to provide an additional safety margin over

and above the earthquake loss estimate). The overall loss limit for the group

(Horizons LASS) policy is $125m.

5.4. Cover

includes 2 earthquake events up to the $60m during the period of insurance

(with the reinstatement at NIL premium).

5.5. The excess is

$1.5m.

5.6. The insurance

premium is the equivalent of $144,000 for each 12 month period.

5.7. Optimised

replacement cost/modern day equivalent value is the basis of valuation

6. Staff have met

with Aon representatives over the past month and have provided the attached

dossier of assets for informing insurers and reinsurers of the assets that

insurance cover is being sought. Aon representatives are currently in

London seeking quotations from insurance companies and will provide details of

the outcome of their discussions upon their return. Aon has indicated

that the premium is likely to be of a similar price to the current policy, but

with some possible adjustment due to exchange rates and inflation.

7. Staff seek

resolution from the Committee to recommend to Council that delegation be given

to the Interim Chief Executive to enter into an agreement with Aon for

insurance of HBRC infrastructure assets for a period of up to 2 years subject

to being satisfied with the premium offered.

8. Staff are aware

that central government are considering a review of their current policy which

is to reimburse 60% of eligible costs to regional authorities above a threshold

of 0.002 percent of net capital value of the region (approx. $600,000). Staff

are maintaining a watching brief with regard to any potential change in policy

and should a change to this policy be made, staff will work with the insurance

brokers to determine how HBRC should respond.

9. It should be

noted that any response to this possible change in policy will include a review

by staff of emergency reserves held by HBRC to cover small events, initial

response activity, the excess on any insurance policy, and the replacement of

uninsured assets.

Financial and Resource Implications

10. There are no

significant financial implications associated with the renewal of the insurance

policy as it is expected that the renewed premium will be close to budget

provisions.

Decision

Making Process

11. Council

is required to make every decision in accordance with the requirements of the

Local Government Act 2002 (the Act). Staff have assessed the requirements

in relation to this item and have concluded:

11.1. The decision

does not significantly alter the service provision or affect a strategic asset.

11.2. The use of

the special consultative procedure is not prescribed by legislation.

11.3. The decision

does not fall within the definition of Council’s policy on significance.

11.4. No persons are directly

affected by this decision.

11.5. Options have

been considered in previous reports to Council.

11.6. The decision

is not inconsistent with an existing policy or plan.

11.7. Given

the nature and significance of the issue to be considered and decided, and also

the persons likely to be affected by, or have an interest in the decisions

made, Council can exercise its discretion and make a decision without

consulting directly with the community or others having an interest in

the decision.

|

Recommendations

1. That the Finance, Audit and Risk Sub-committee receives and notes

the “Infrastructure Insurance” report.

2. The Finance, Audit and Risk Sub-committee recommends that Council:

2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion and make decisions on

this issue without conferring directly with the community or persons likely

to have an interest in the decision.

2.2. Delegates authority to the Interim Chief Executive to enter into

an agreement for insuring HBRC infrastructure assets commencing upon expiry

of the current policy, for a period of up to 2 years.

|

Authored and

Authorised by:

|

Mike Adye

Group Manager

Asset Management

|

|

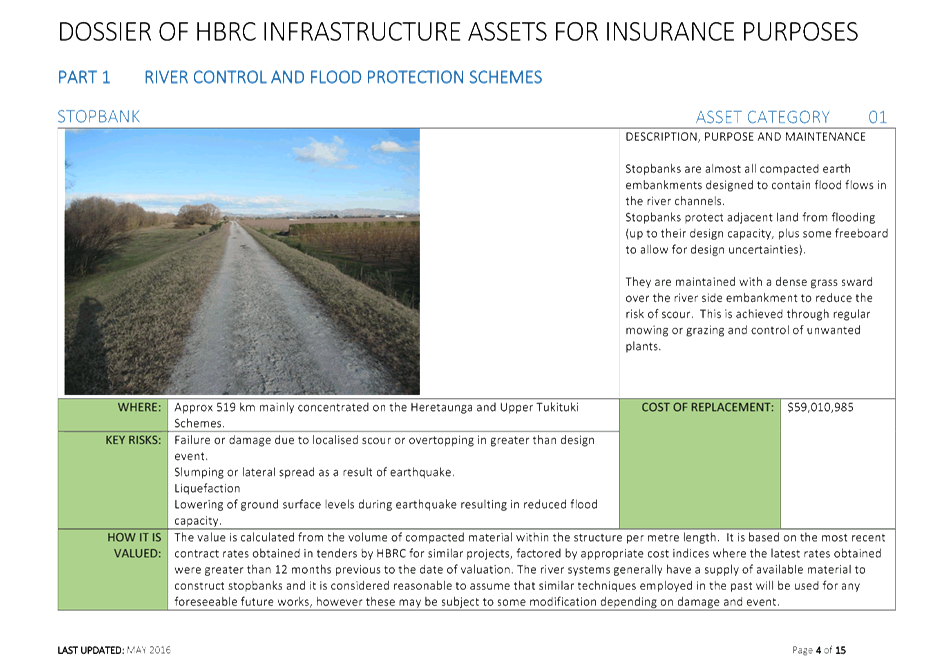

Attachment/s

|

1

|

Dossier of

HBRC Infrastructure Assets for Insurance Purposes

|

|

|

|

Dossier

of HBRC Infrastructure Assets for Insurance Purposes

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Tuesday 20 September 2016

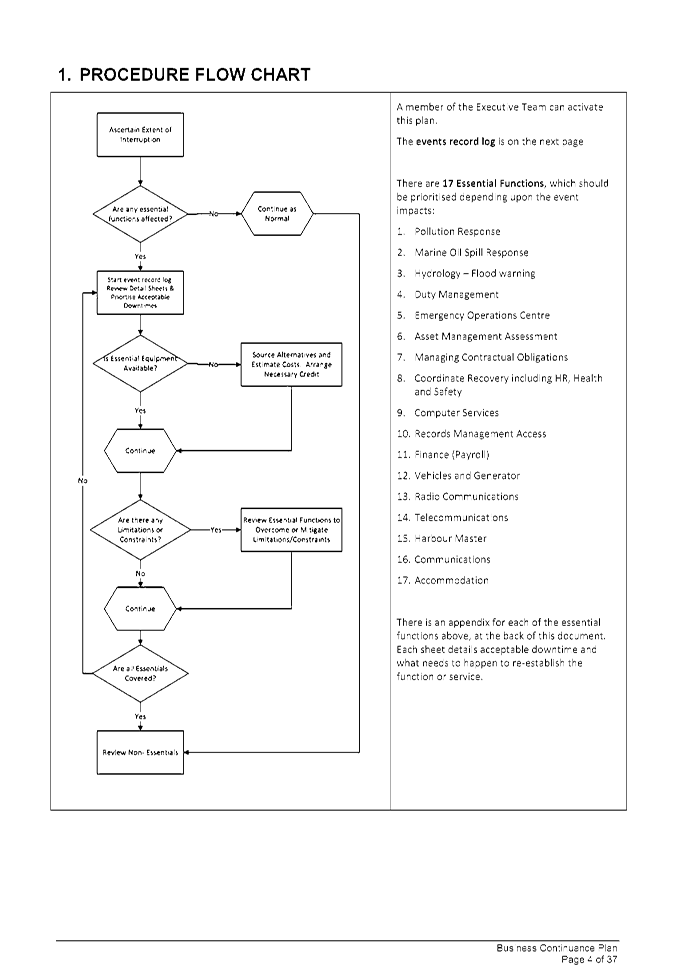

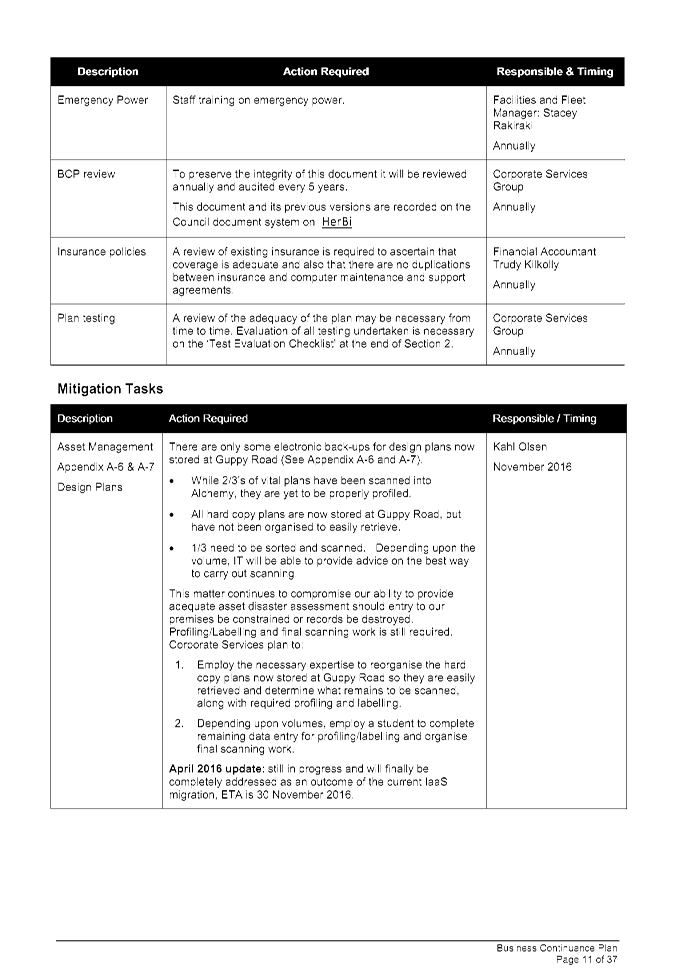

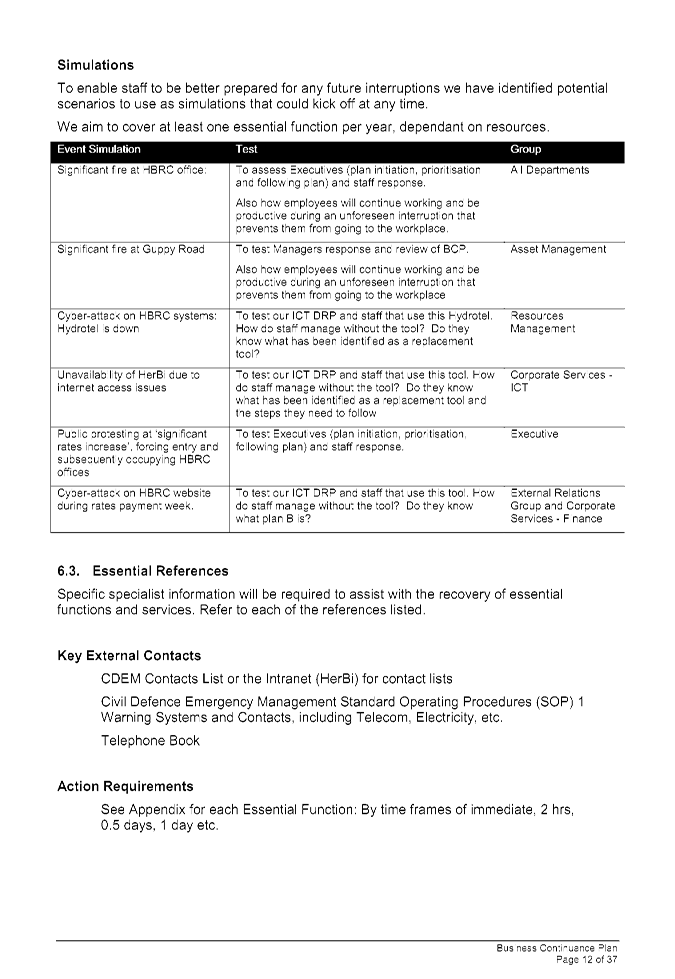

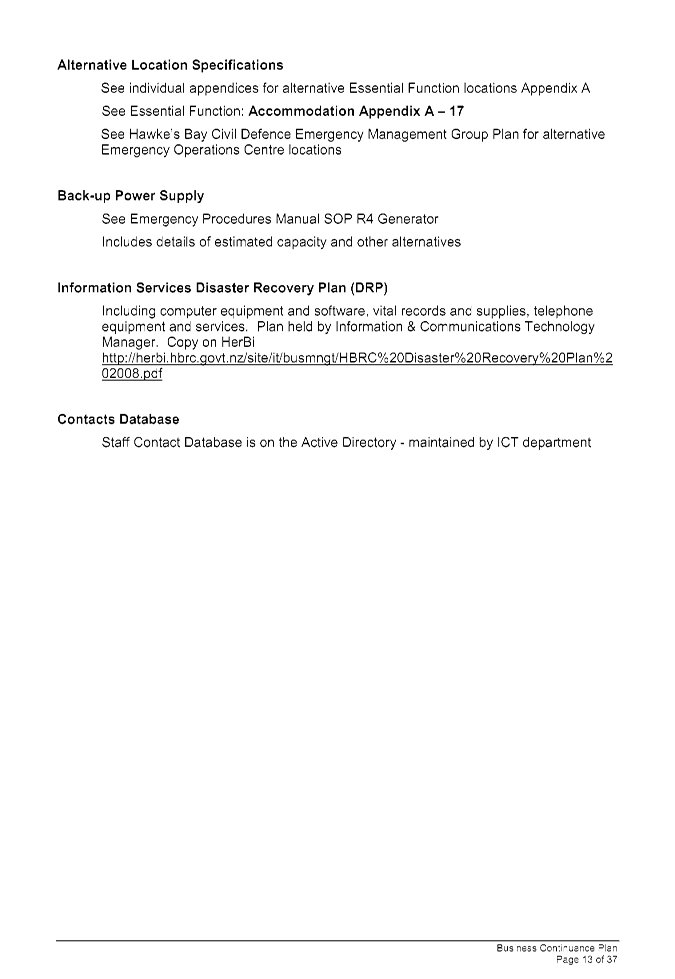

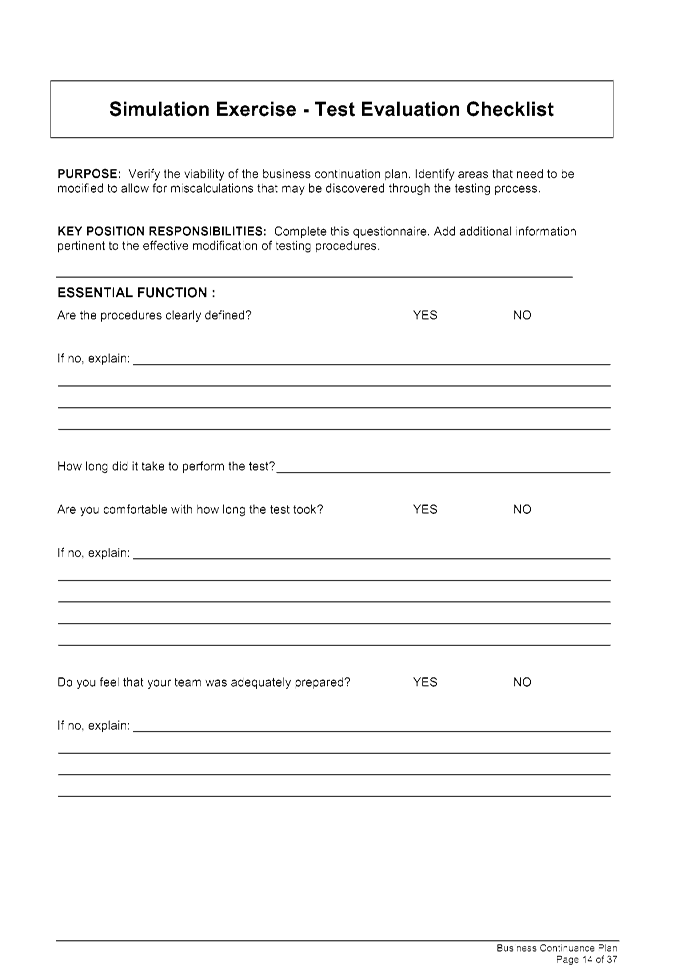

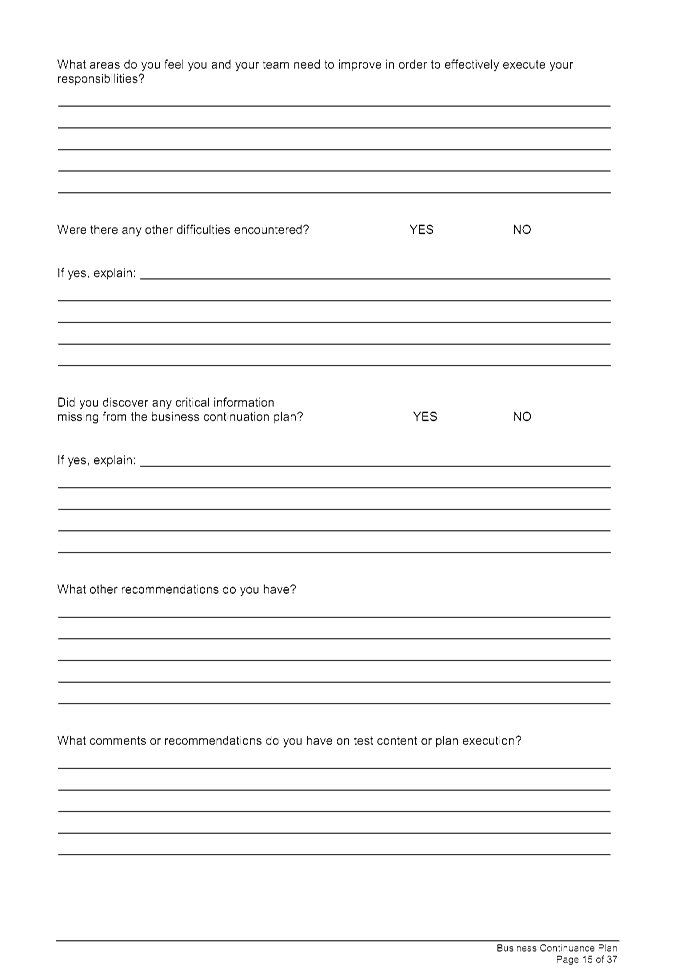

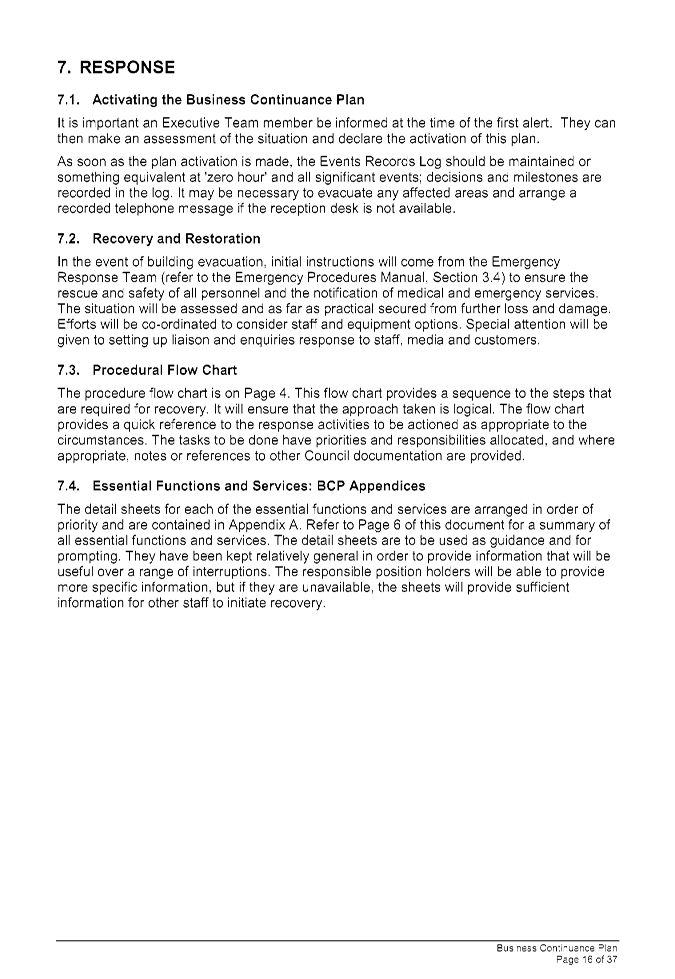

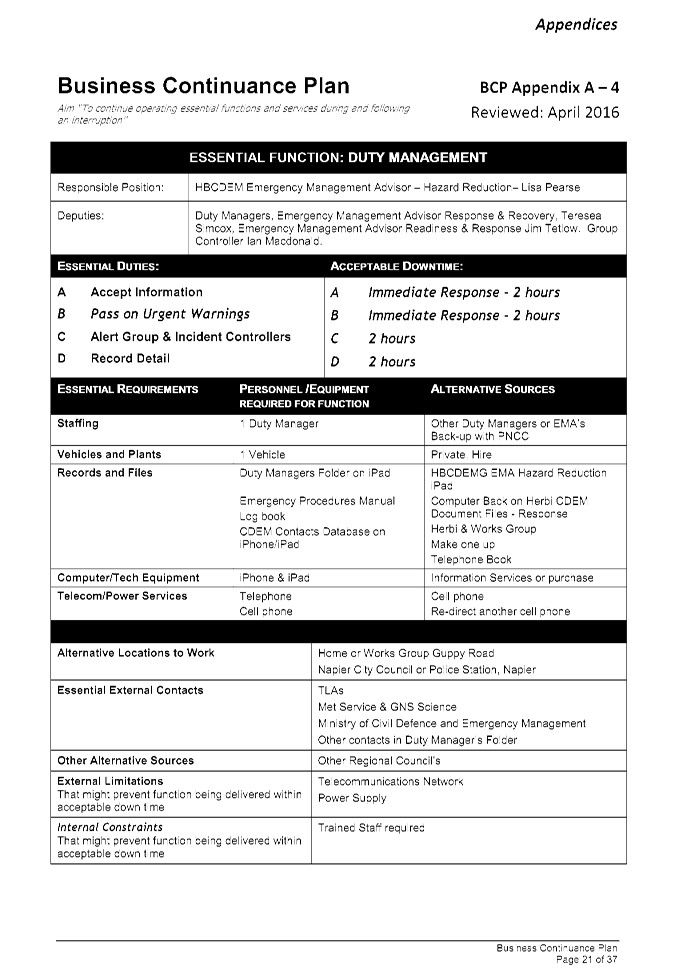

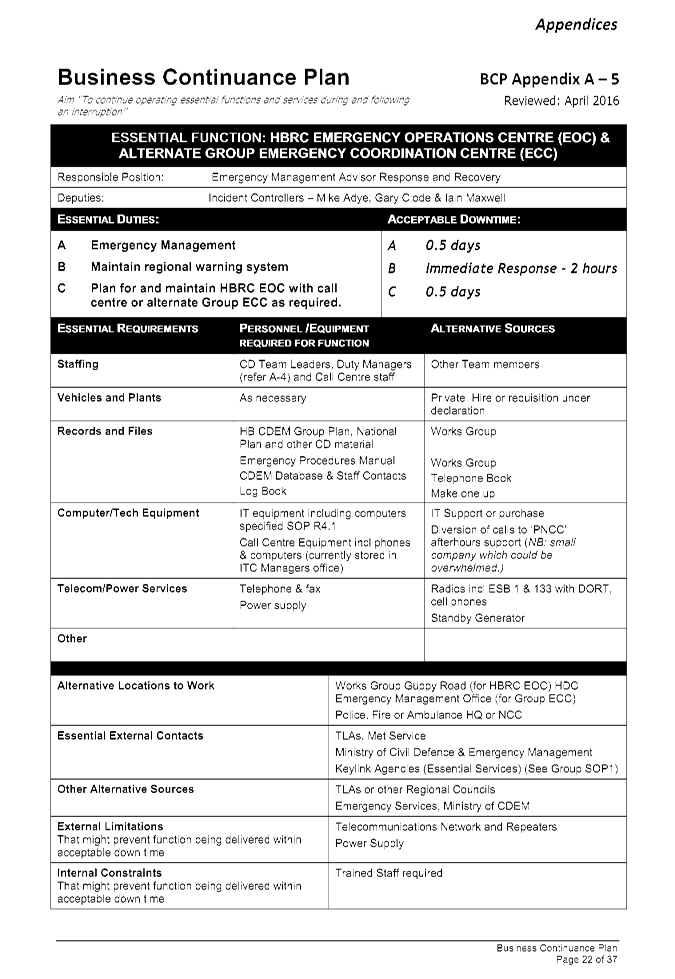

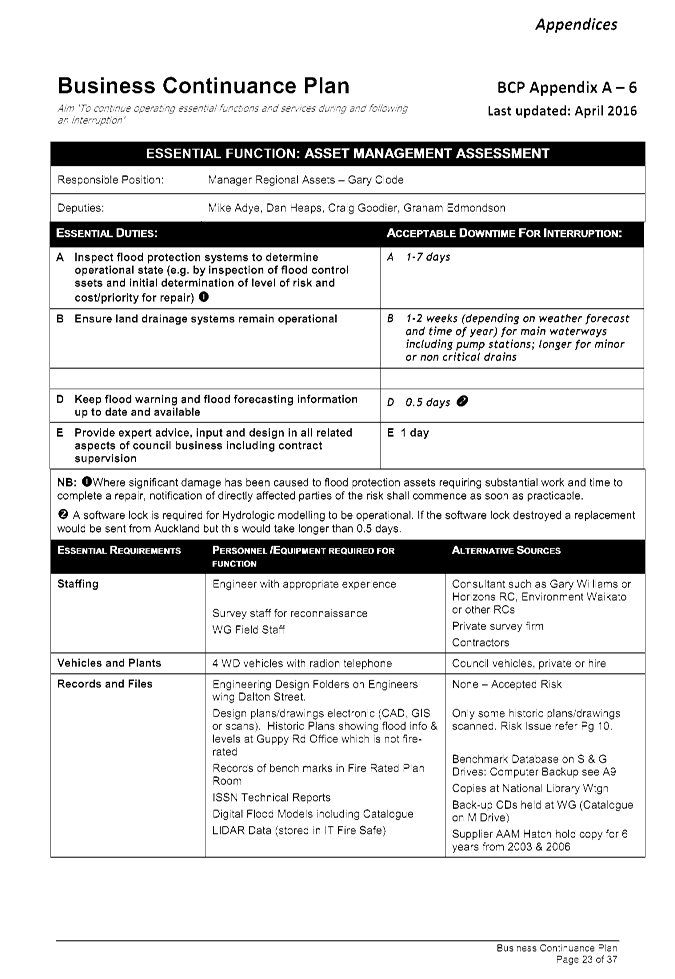

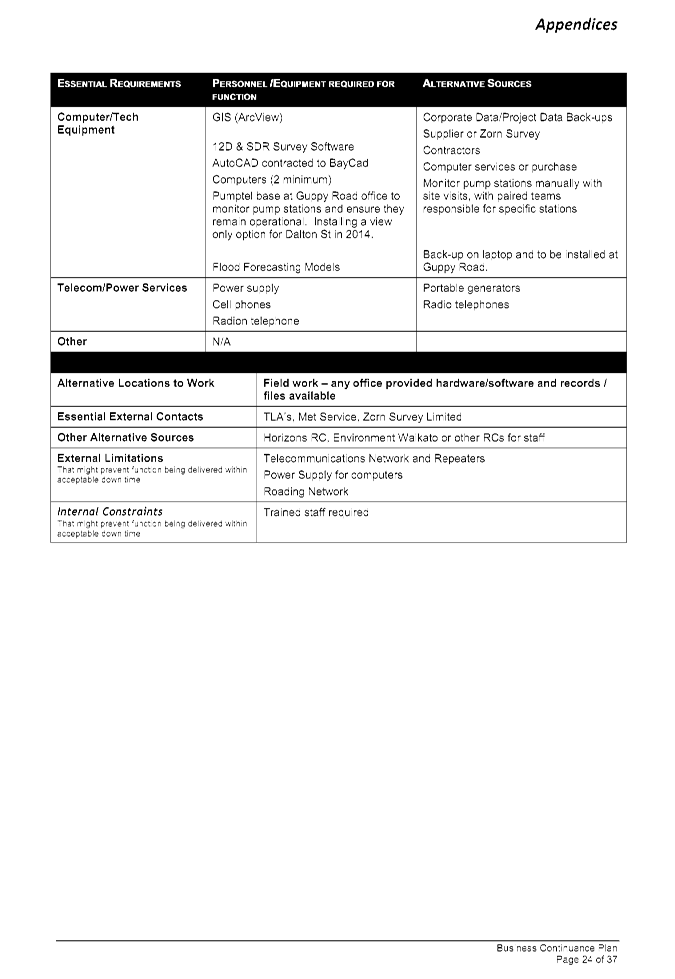

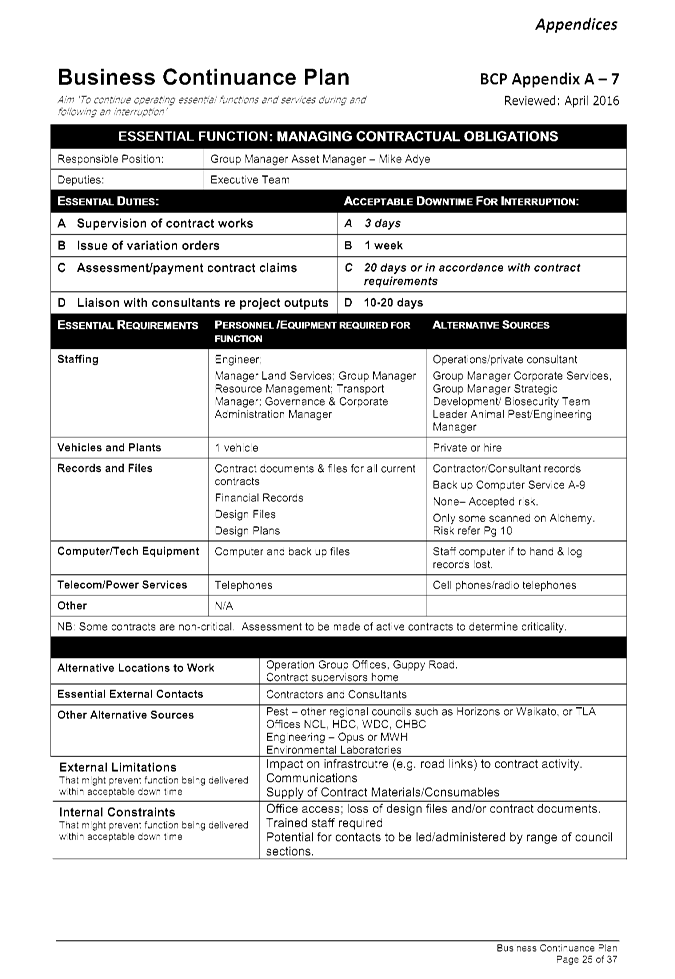

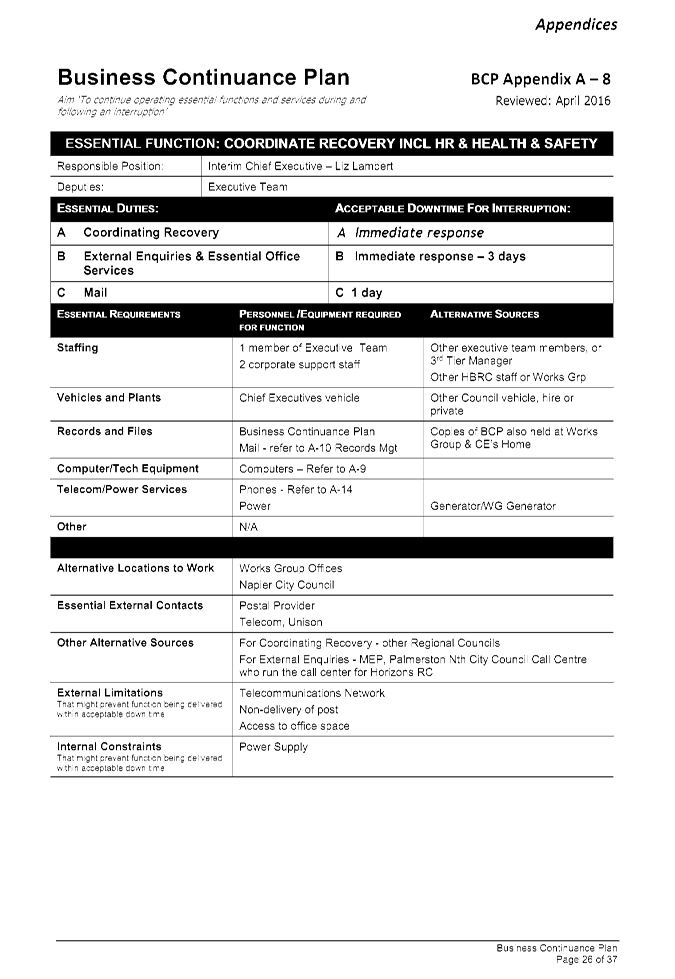

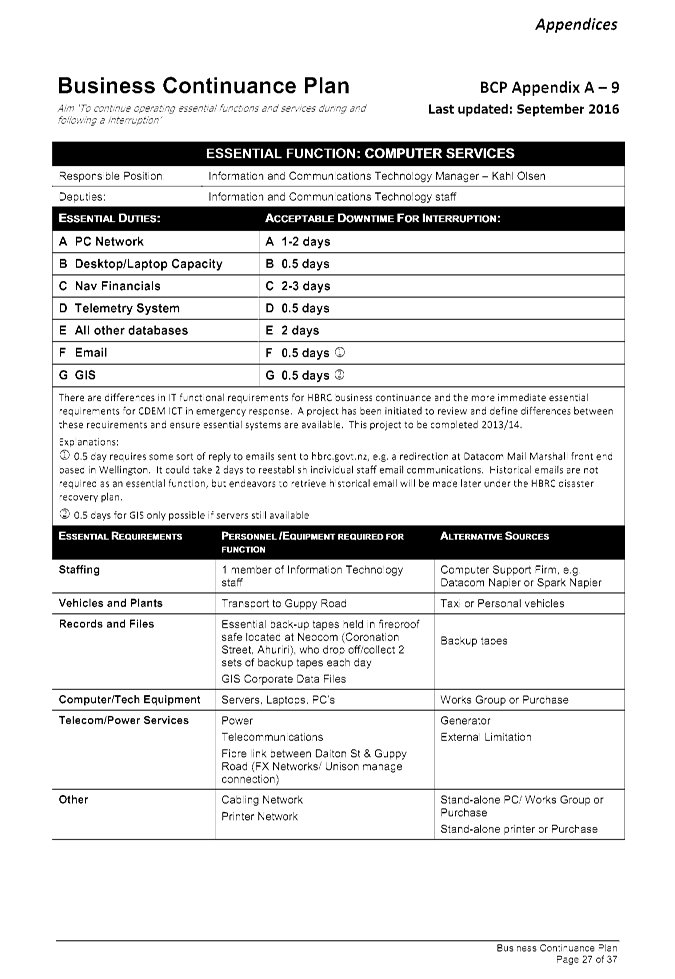

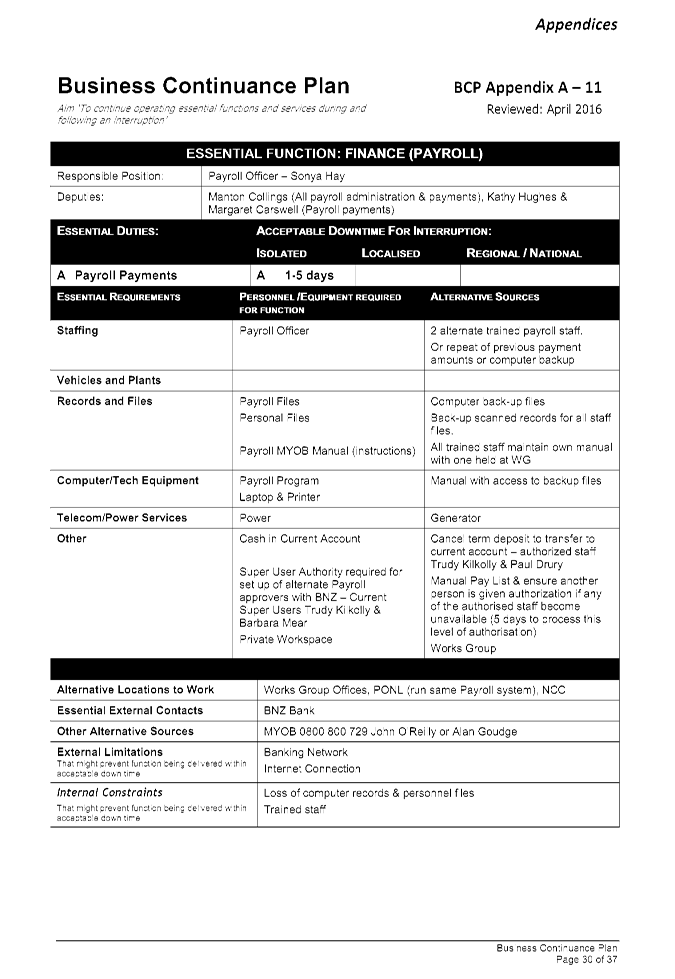

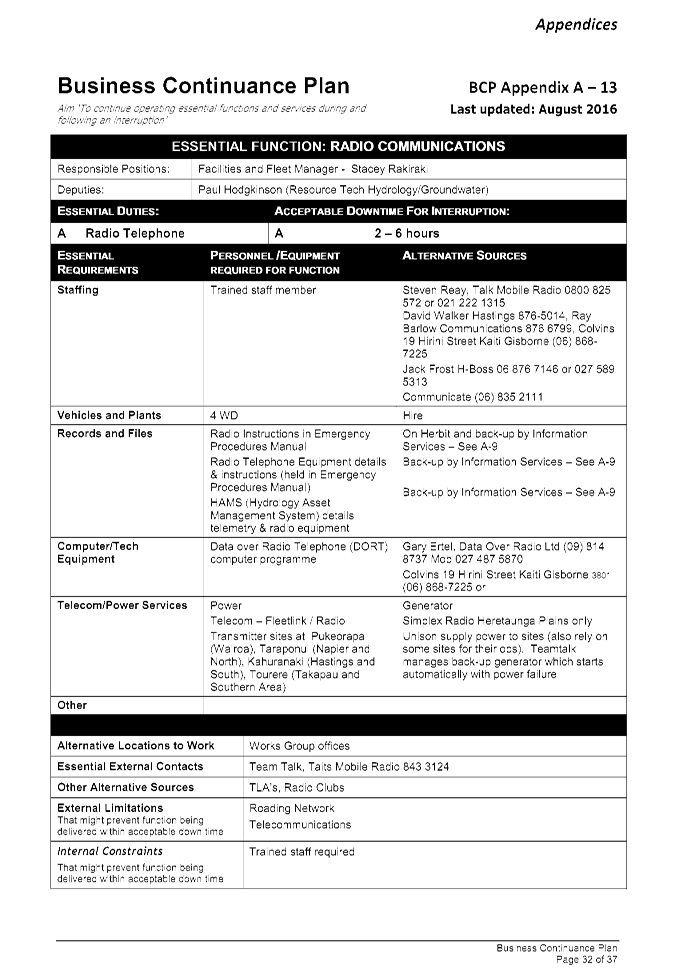

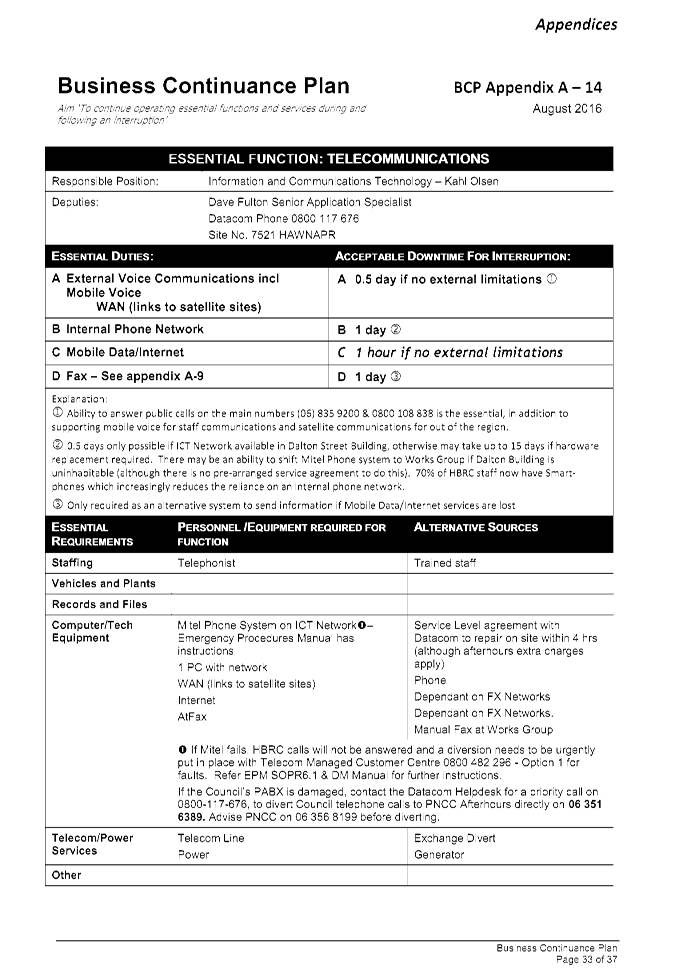

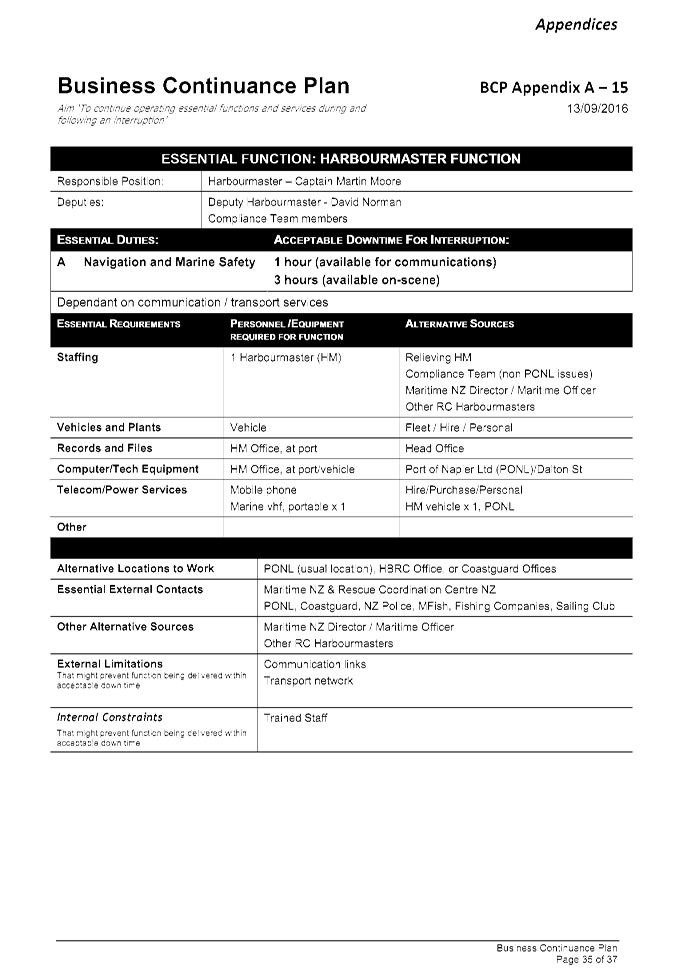

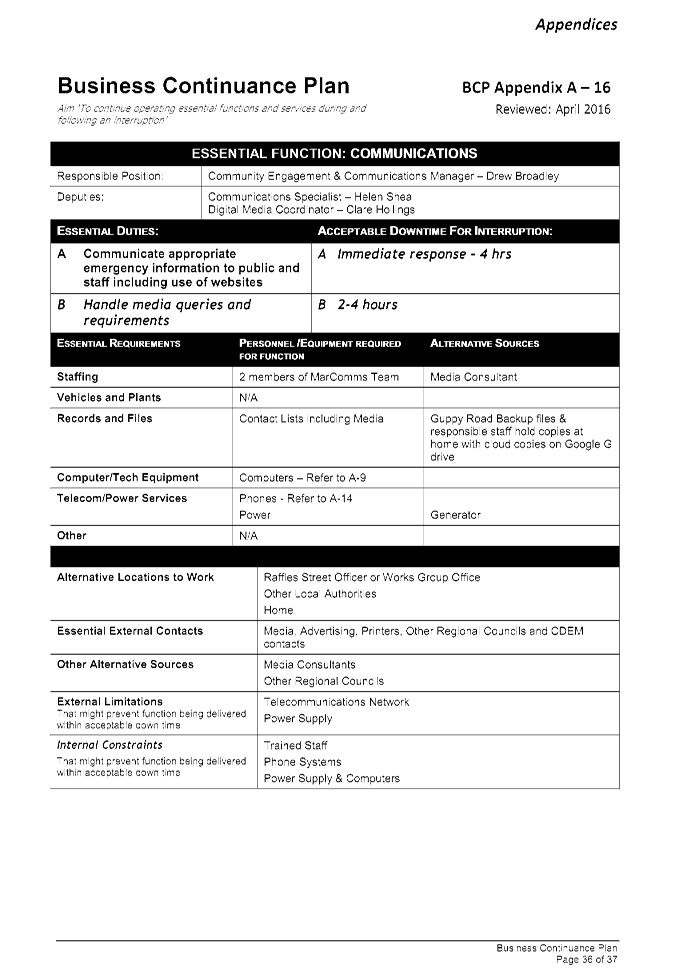

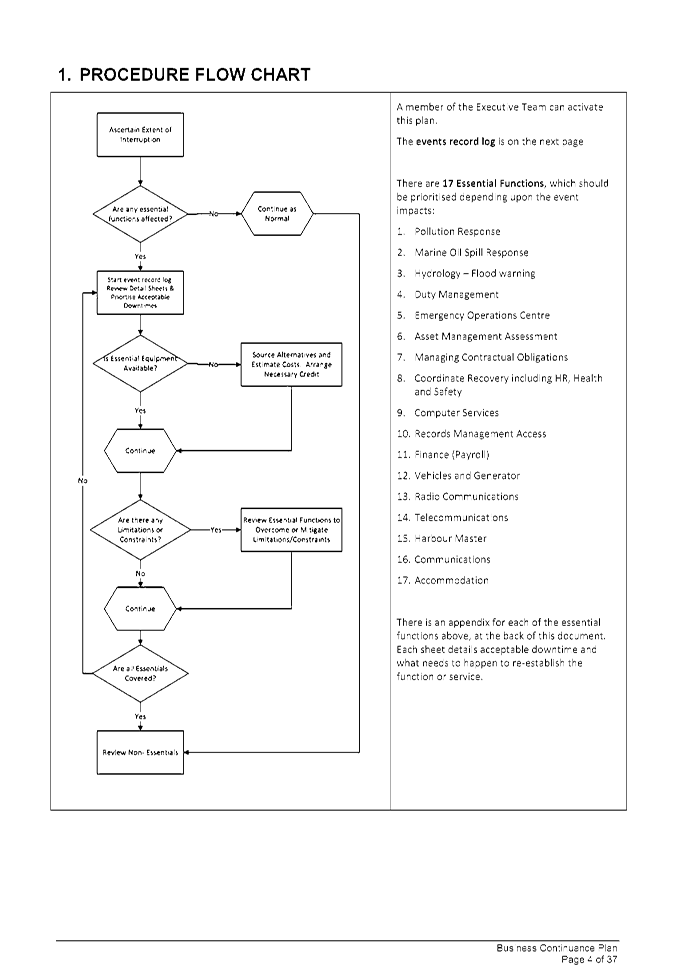

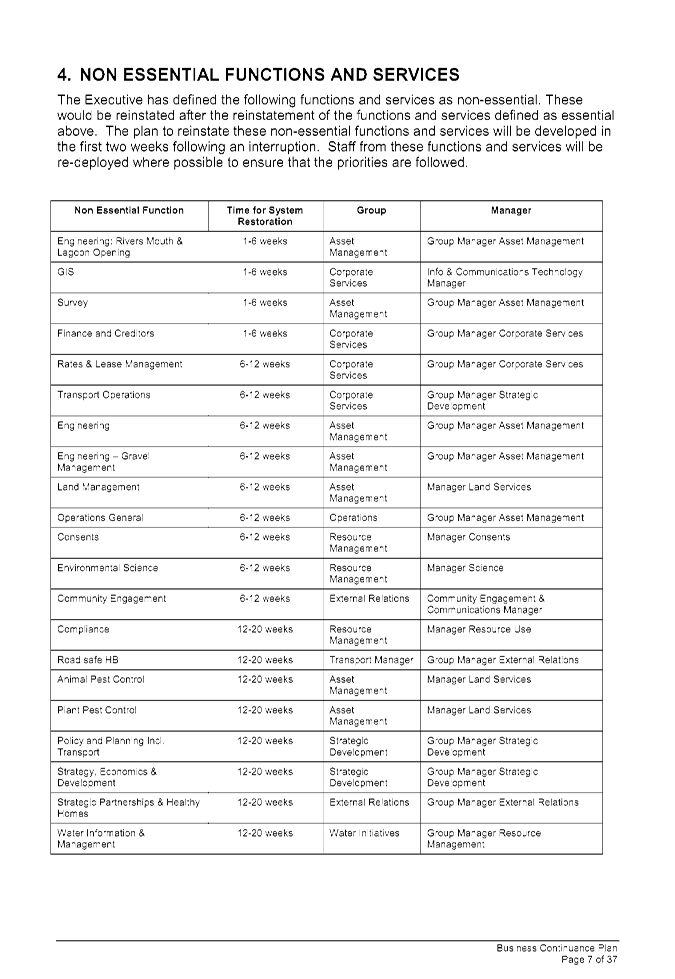

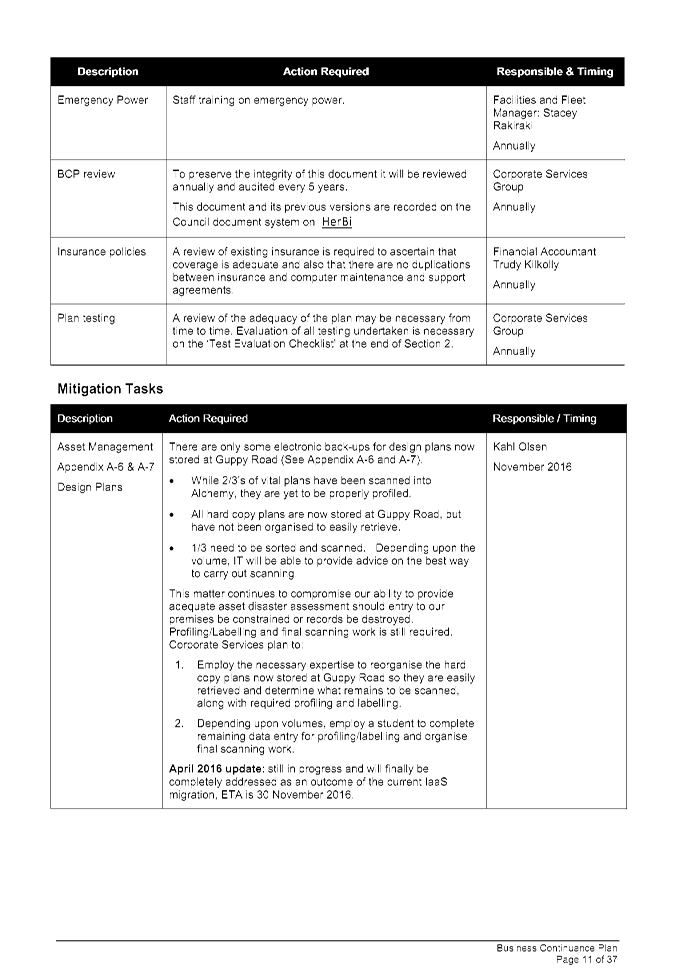

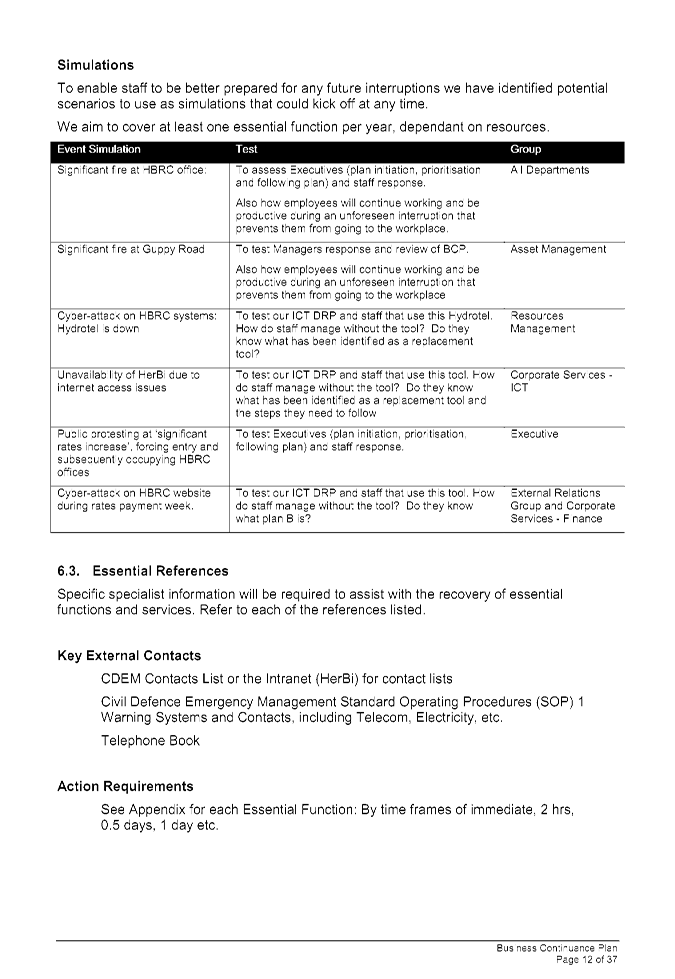

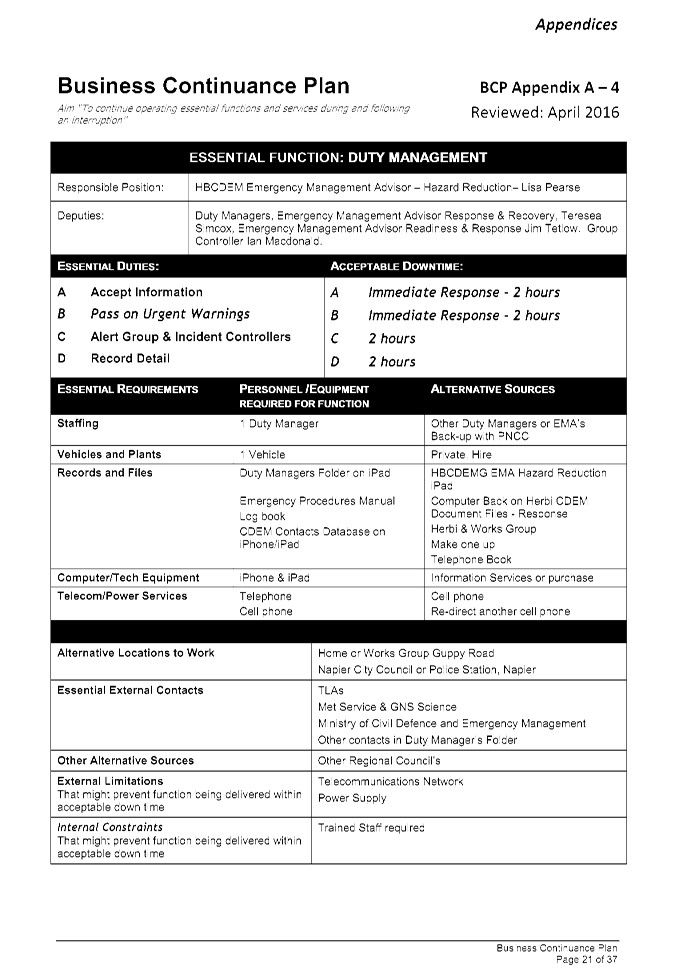

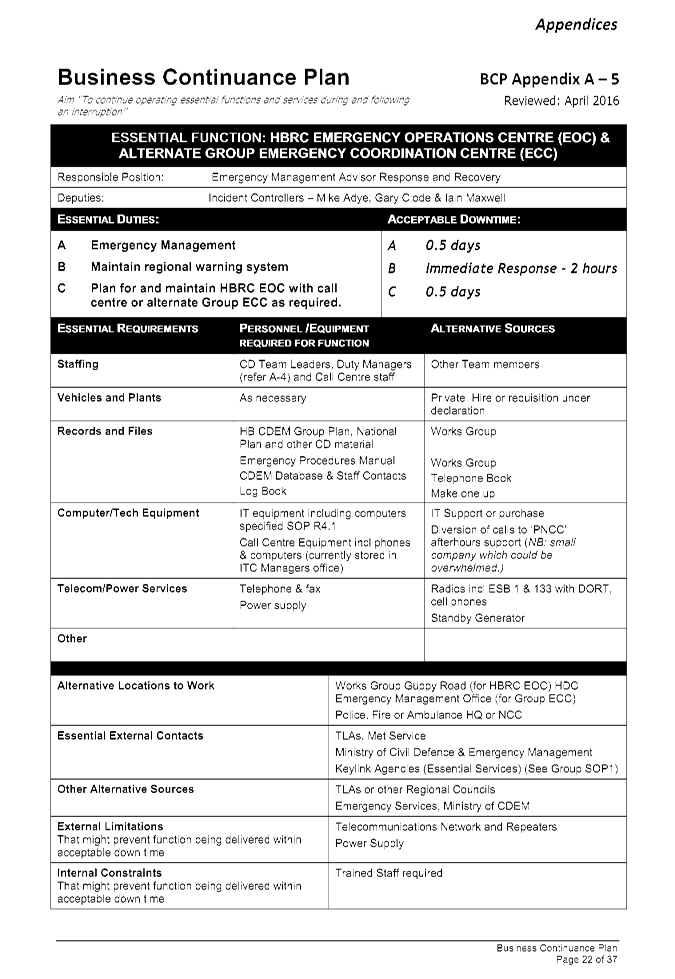

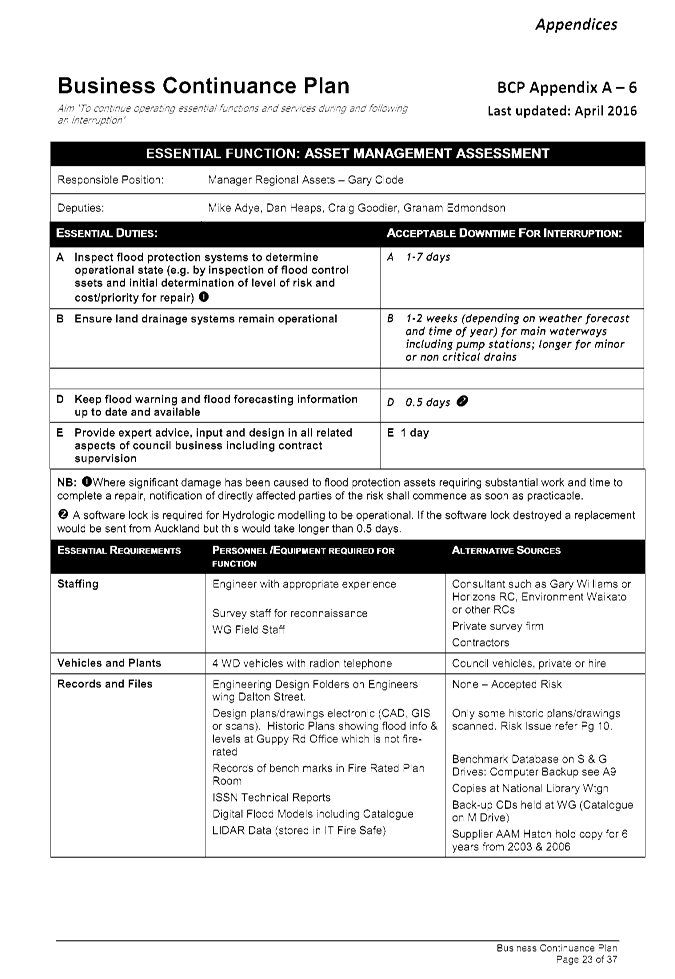

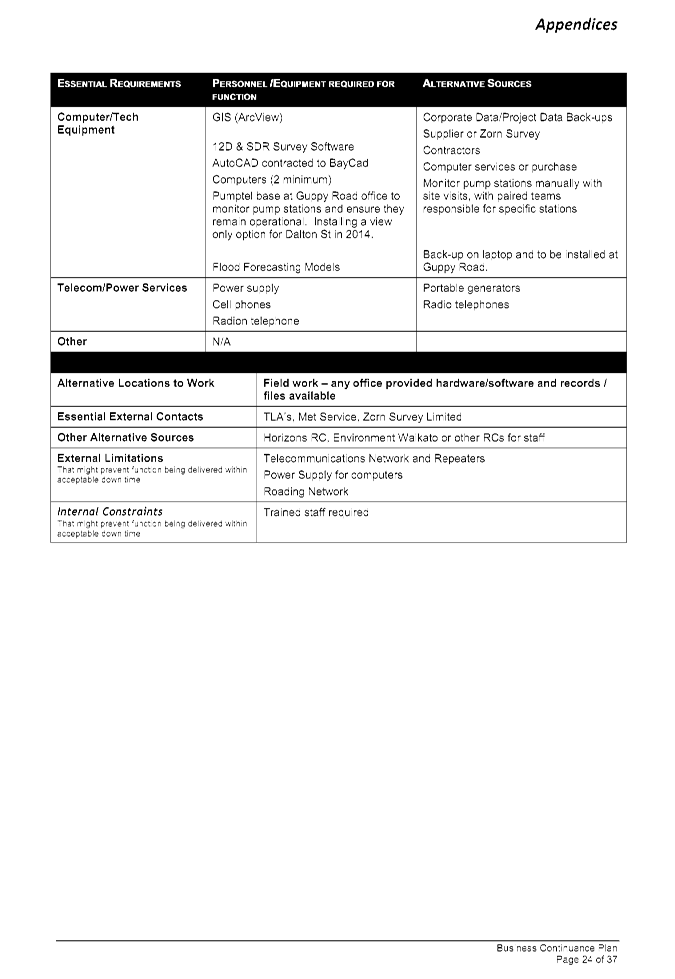

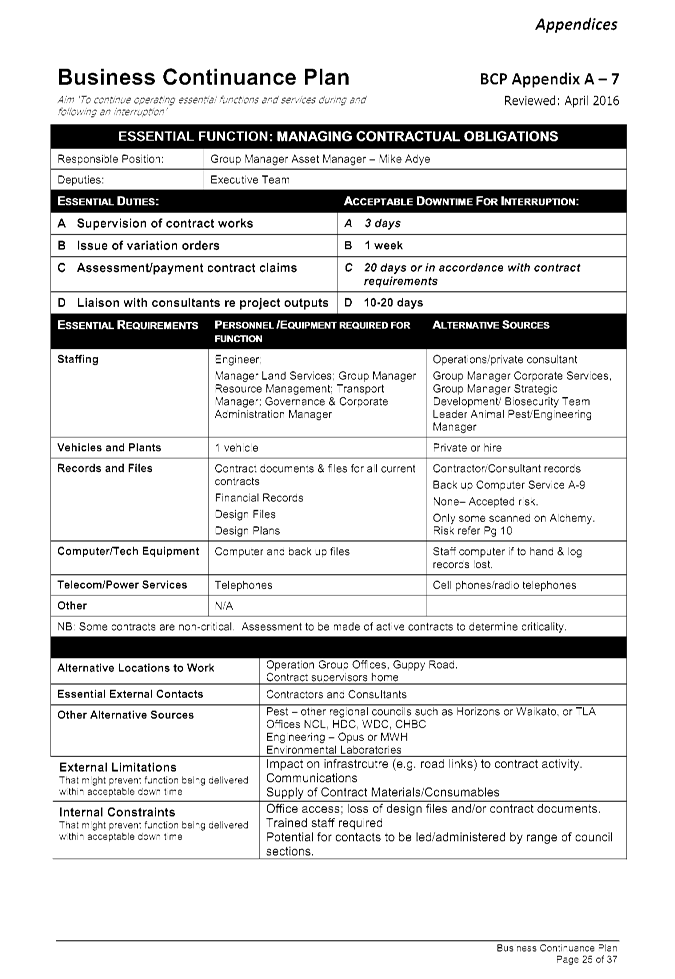

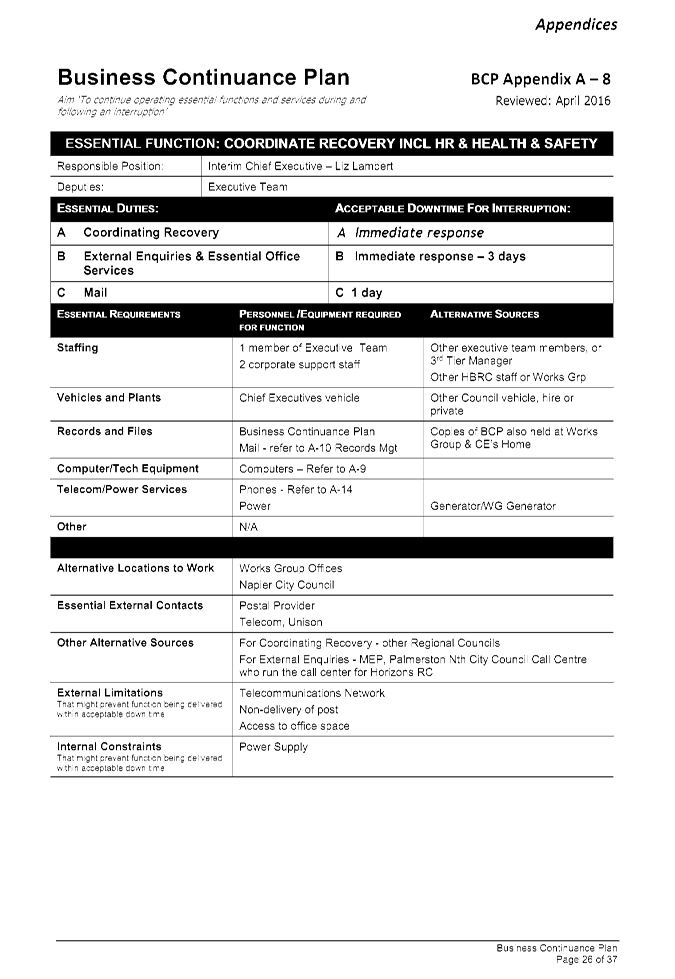

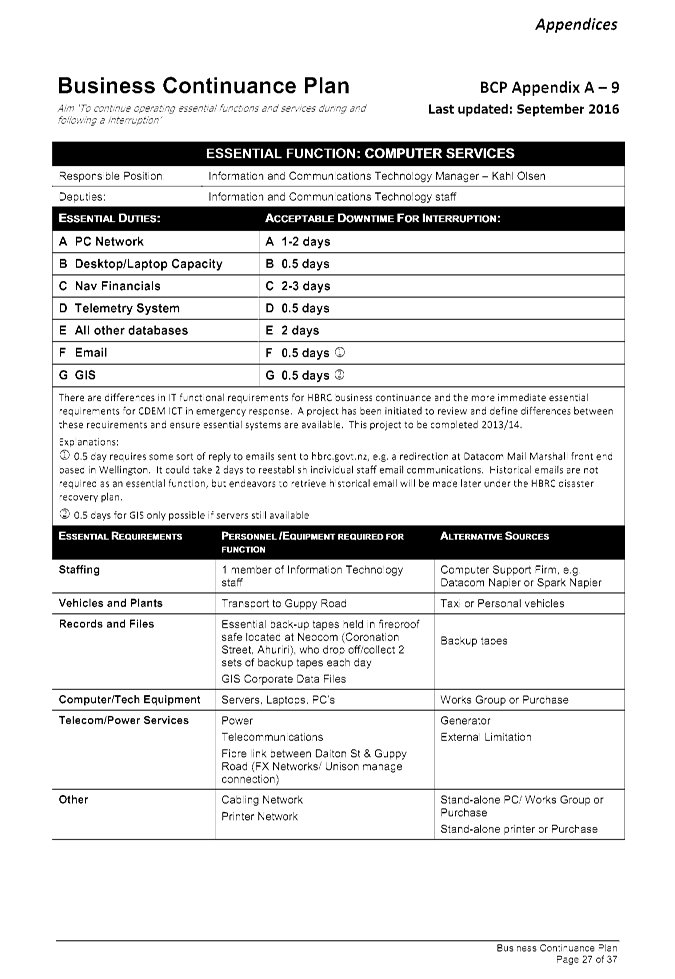

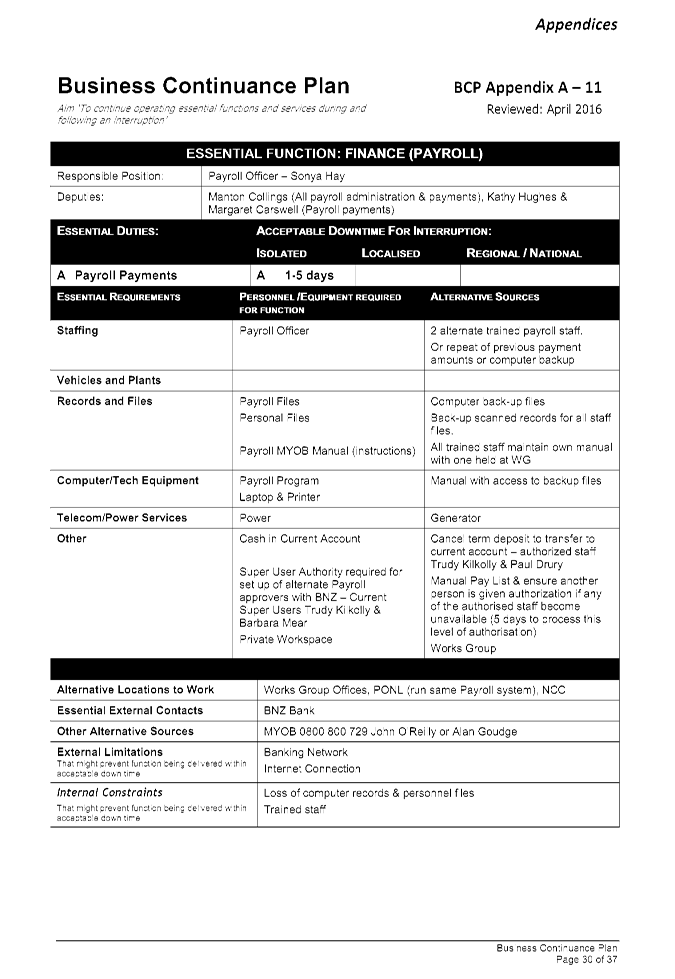

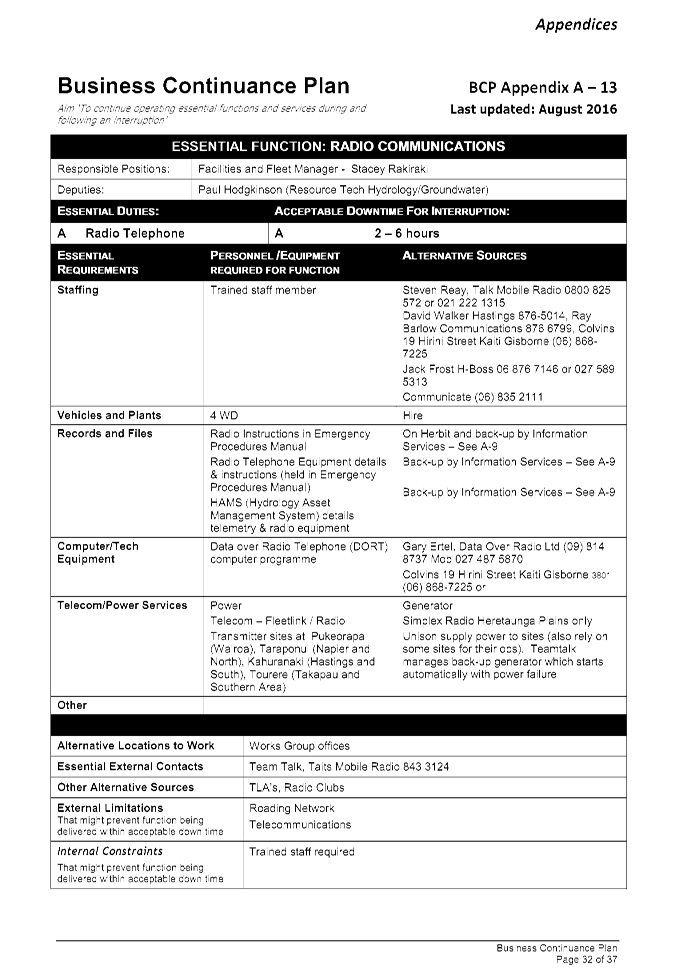

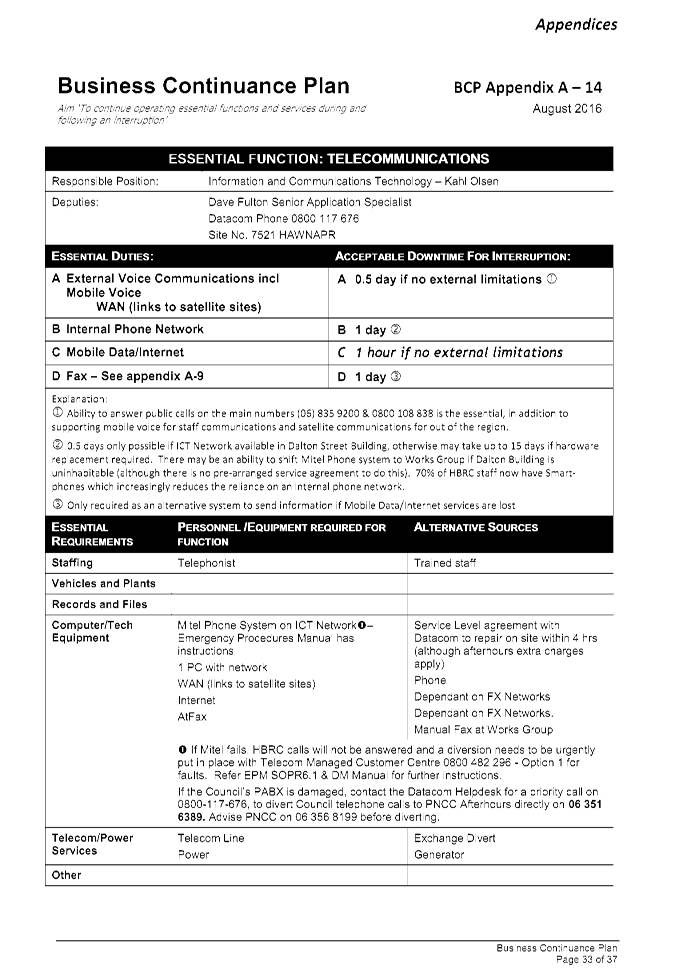

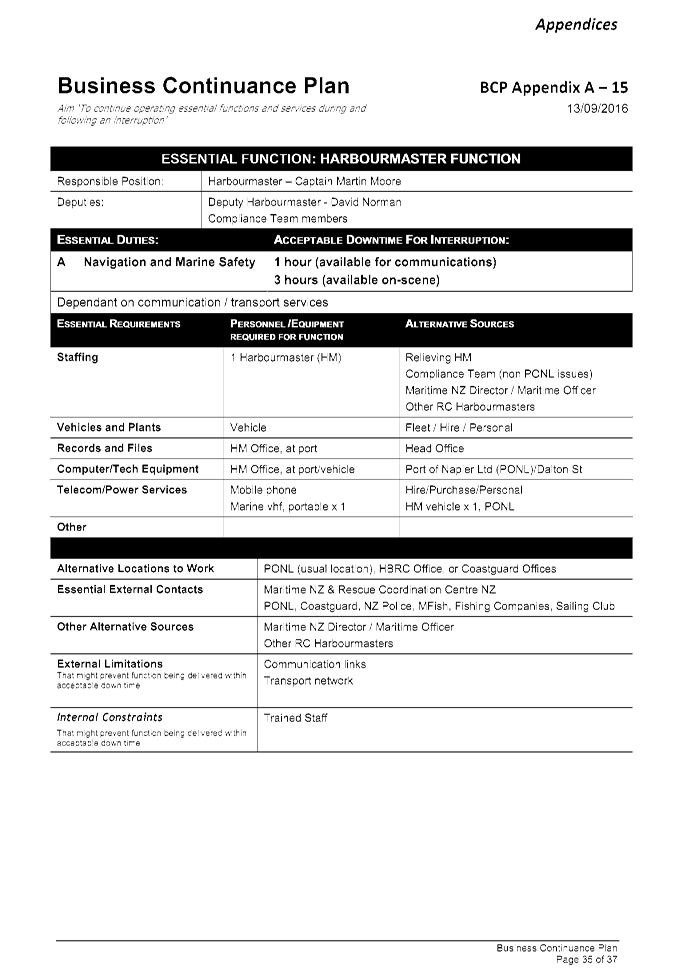

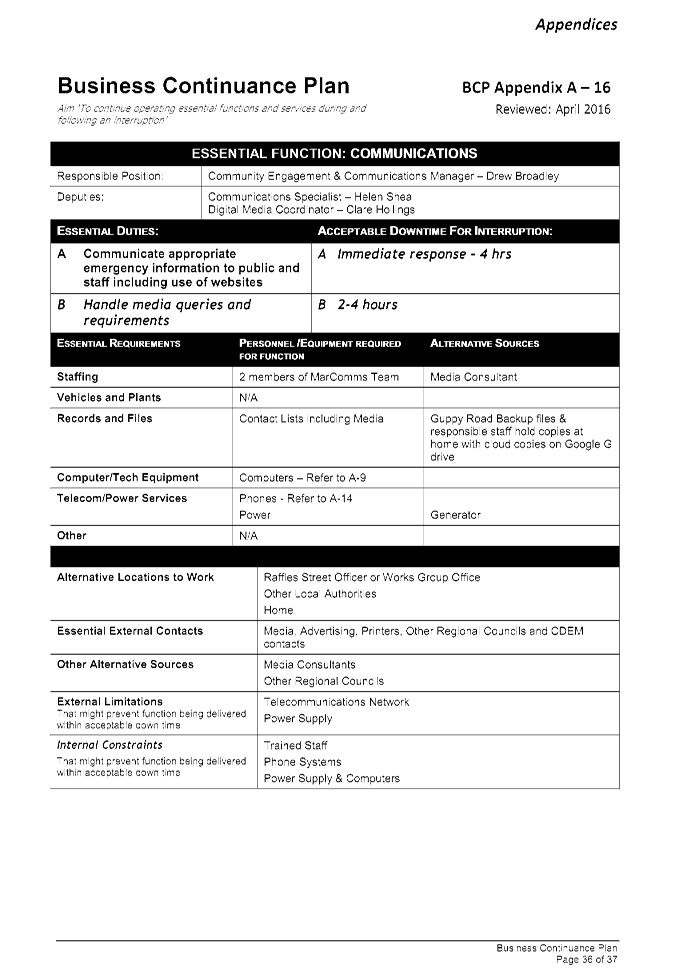

Subject: Business Continuance

Plan

Reason for Report

1. This report provides the Sub-committee with HBRC’s Business

Continuance Plan for consideration and recommendation

to Council for adoption.

Comment

2. At its meeting on 18 May 2016, the Subcommittee received an update

on progress on the Business Continuance Plan. This was in response to an audit

completed by Pricewaterhouse Coopers (PWC) on Council’s Business

Continuance Plan. The results of that Audit were presented to Council on

11 February 2016.

3. The Business Continuance Plan has now been completed and is appended

to this paper as Attachment 1 for the Subcommittee to receive and

note. It is proposed that this Plan be updated annually and be subject to

an internal audit every five years.

4. The main recommendations on the Business Continuance Plan audit as

recommended by PWC are set out below with comment as to their resolution.

Responsibility for

Business Continuance Plan in the Council:

4.1. This Plan is being completed by all managers in Council that are

responsible for aspects of business continuance. Overall responsibility

for the compilation of the Plan sits with the Group Manager Corporate Services.

Requirements of the

ICT System:

4.2. Each relevant business unit has identified the systems required by

them from ICT and have assessed the impacts that the non-availability of these

systems would have on their workflows. The Business Continuance Plan sets

out the mitigation processes and procedures to solve this.

Business

Continuance Plan Exercises to be Implemented

4.3. A schedule of exercises have been completed as part of the

Plan. These scenarios will test the integrity of the Plan and the

implementation of these exercises will be planned in the near future.

Communicating and

Acceptance of Business Continuance Plans

4.4. Human Resources have implemented a change in position descriptions

to incorporate, where appropriate, responsibility for understanding and implementing

business continuity as it relates to each Council position. The

introduction of this policy has been included in staff inductions.

Further, to promote awareness of the Business Continuance Plan a web page has

been created on the staff intranet to link to the Business Continuance Plan and

the policy.

Decision Making

Process

5. Council is required to make a decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements contained in Part 6 Sub Part 1 of the Act in relation

to this item and have concluded the following:

5.1. The decision does not significantly alter the service provision or

affect a strategic asset.

5.2. The use of the special consultative procedure is not prescribed by legislation.

5.3. The decision does not fall within the definition of Council’s

policy on significance.

5.4. The decision

is not inconsistent with an existing policy or plan.

|

Recommendation

1. That the Finance, Audit & Risk

Subcommittee receives and notes the updated “Business Continuance Plan”.

2. The Finance, Audit and Risk Sub-committee recommends that Council:

2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion under Sections 79(1)(a)

and 82(3) of the Local Government Act 2002 and make decisions on this issue

without conferring directly with the community.

2.2. Endorses the Hawke’s Bay Regional Council Business Continuance Plan.

|

Authored by:

|

Paul Drury

Group Manager

Corporate Services

|

|

Approved by:

|

Liz Lambert

Chief Executive

|

|

Attachment/s

|

1

|

Business

Continuance Plan

|

|

|

|

Business

Continuance Plan

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Tuesday 20 September 2016

Subject: 2016 Sub-committee Work

Programme

Reason for Report

1. In order to ensure the sub-committee’s ability to effectively

and efficiently fulfill its role and responsibilities, an overall suggested

work programme is provided following.

|

Task

|

Item

|

Scheduled / Status

|

|

Internal Audits

|

Processes,

policies and procedures around stakeholder communications and relationship

management (from risk register)

|

2016-17

financial year

|

|

|

Fraud

prevention and detection (from risk register)

|

2016-17

financial year

|

|

|

Capturing

and managing general and procurement related Conflicts of Interest

|

· Staff policy considered at 18 May

FA&R meeting

· Interests Register for Executive staff

initiated

· Policy on how potential conflicts will be

managed or mitigated on the Register of Interests for Elected Representatives

and is to be declared on the Register of Interests adopted by Council 31

August 2016.

|

|

|

Cyber

security, including future proofing IT systems and IT general computer

systems control

|

Approved

17Feb16, and reported back to FA&R 18May16

|

|

|

Rating

system – processes involved in striking the rate

|

tbc

|

|

|

Health &

Safety compliance with policies and procedures

|

tbc

|

|

|

Stakeholder

relationship management and risks in relation to elected representatives, and

how such an audit might be conducted

|

tbc

|

|

|

Staff

development and succession planning

|

tbc

|

|

Risk Assessment & Management

|

Routine (6

monthly) reporting on risks to the FA&R Sub-committee

|

December

FA&R meeting

|

|

|

Review

previous 6-month Risk Assessment to note changes / improvements / areas that

require attention

|

December

FA&R meeting

|

|

|

Sub-committee

carry out detailed review of individual Group’s Risk Management (as

part of the programmed reviews of activities)

|

tbc

|

|

Insurance

|

Council’s

proposed 2017-18 Insurance programme

|

tbc

|

|

Annual Report

|

Adoption of

Audit report 20 September for recommendation to Council

|

Auditor

scheduled to attend September FA&R meeting

|

Decision Making Process

2. As this report

is for information only and no decision is to be made, the decision making

provisions of the Local Government Act 2002 do not apply.

|

Recommendation

That the Finance, Audit and Risk

Sub-committee receives and notes the “Sub-committee Work

Programme” report.

|

Authored by:

|

Leeanne

Hooper

Governance & Corporate Administration

Manager

|

|

Approved by:

|

Paul Drury

Group Manager

Corporate Services

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Tuesday 20 September 2016

SUBJECT: Confirmation of Public Excluded Minutes of the Finance,

Audit and Risk Sub-committee meeting held 18 May 2016

That the Council excludes the public

from this section of the meeting being Confirmation of Public Excluded Minutes

Agenda Item 12 with the general subject of the item to be considered while the public

is excluded; the reasons for passing the resolution and the specific grounds

under Section 48 (1) of the Local Government Official Information and Meetings

Act 1987 for the passing of this resolution being:

|

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR THE

PASSING OF THE RESOLUTION

|

|

Internal Audit Report – Cyber

Security

|

7(2)(b)(i) That the public conduct of

this agenda item would be likely to result in the disclosure of information

where the withholding of the information is necessary to ensure a trade

secret is not disclosed

7(2)(j) That the public conduct of this

agenda item would be likely to result in the disclosure of information

where the withholding of the information is necessary to prevent the

disclosure or use of official information for improper gain or improper

advantage

|

The Council is specified, in the First

Schedule to this Act, as a body to which the Act applies.

|

|

Proposed Council Insurance Programme

for 2016-17

|

7(2)(i) That the public conduct of this

agenda item would be likely to result in the disclosure of information

where the withholding of the information is necessary to enable the local

authority holding the information to carry out, without prejudice or

disadvantage, negotiations (including commercial and industrial negotiations)

|

The Council is specified, in the First

Schedule to this Act, as a body to which the Act applies.

|

|

Authored by:

|

Leeanne

Hooper

Governance & Corporate Administration

Manager

|

|

Approved by:

|

Paul Drury

Group Manager

Corporate Services

|

|