Extraordinary Meeting of the Hawke's Bay Regional

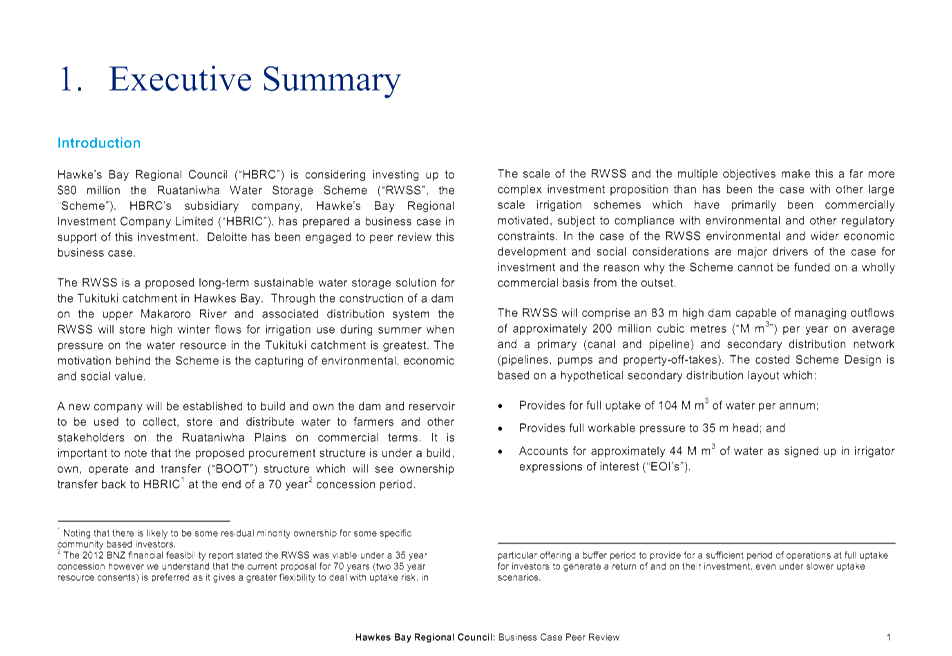

Council

Date: Friday 8 July 2016

Time: 10.30 am

|

Venue:

|

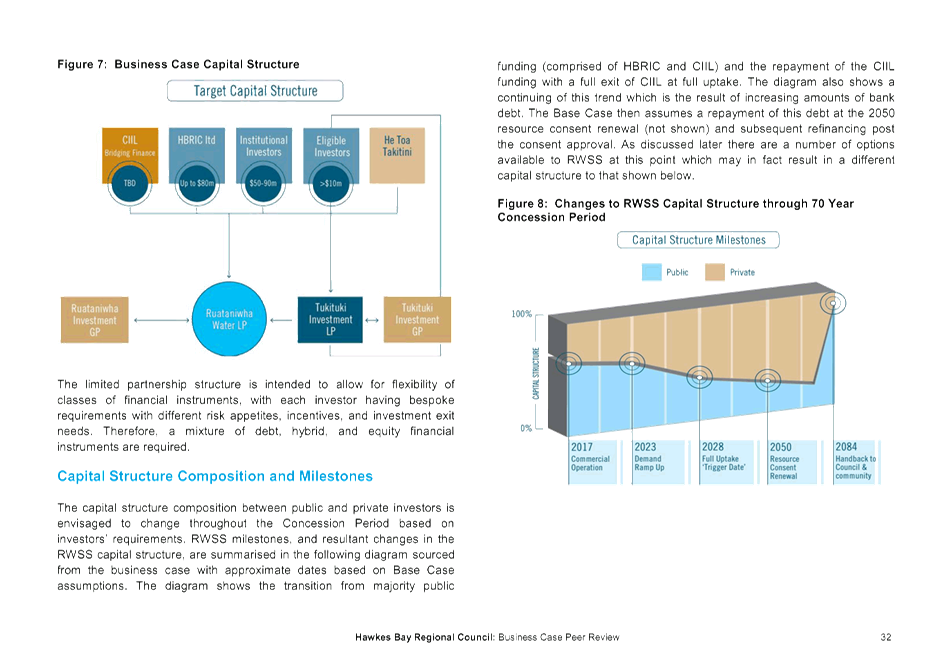

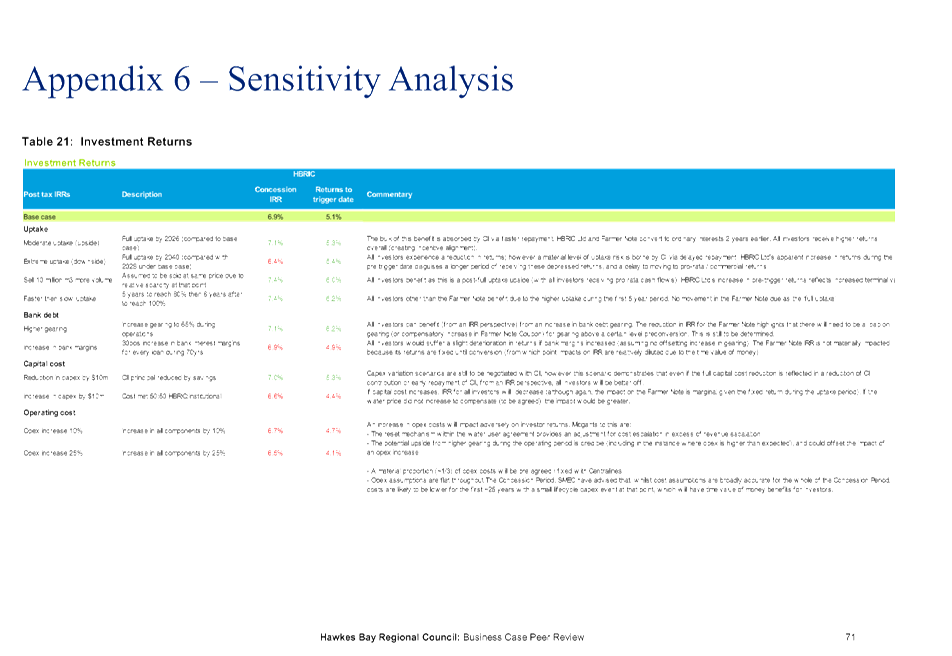

Council Chamber

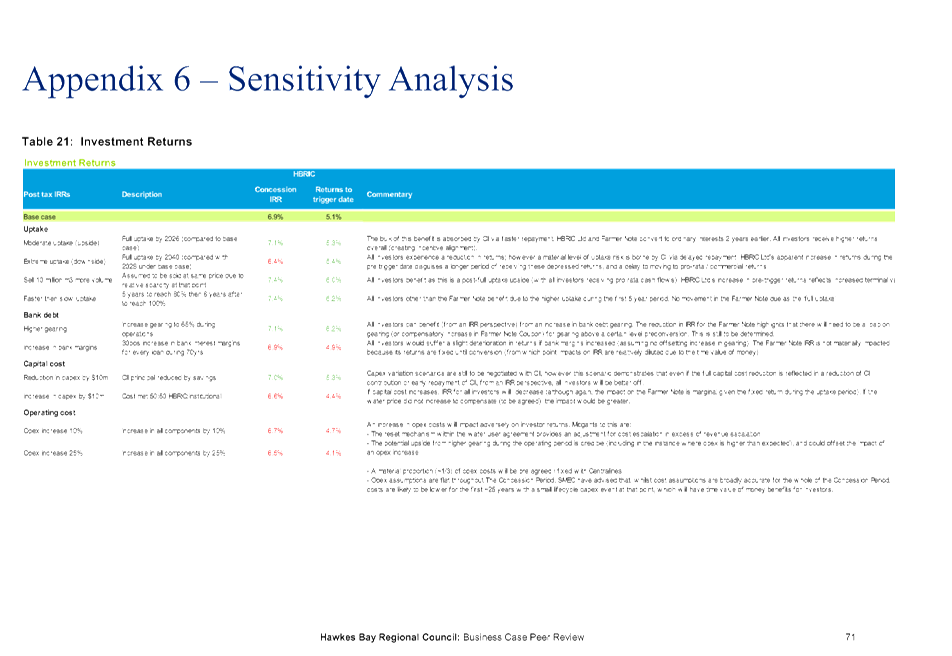

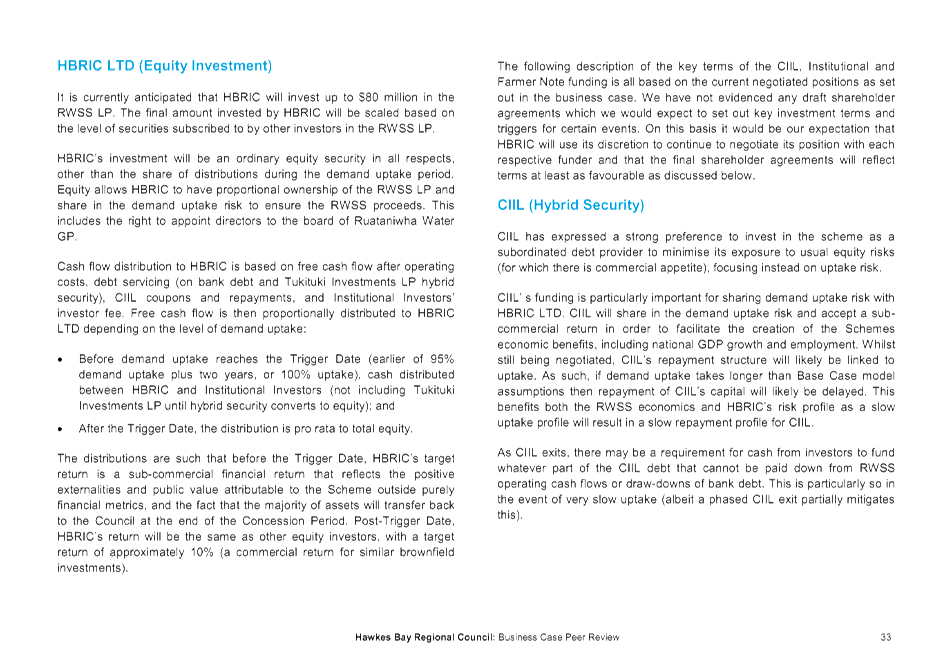

Hawke's Bay Regional Council

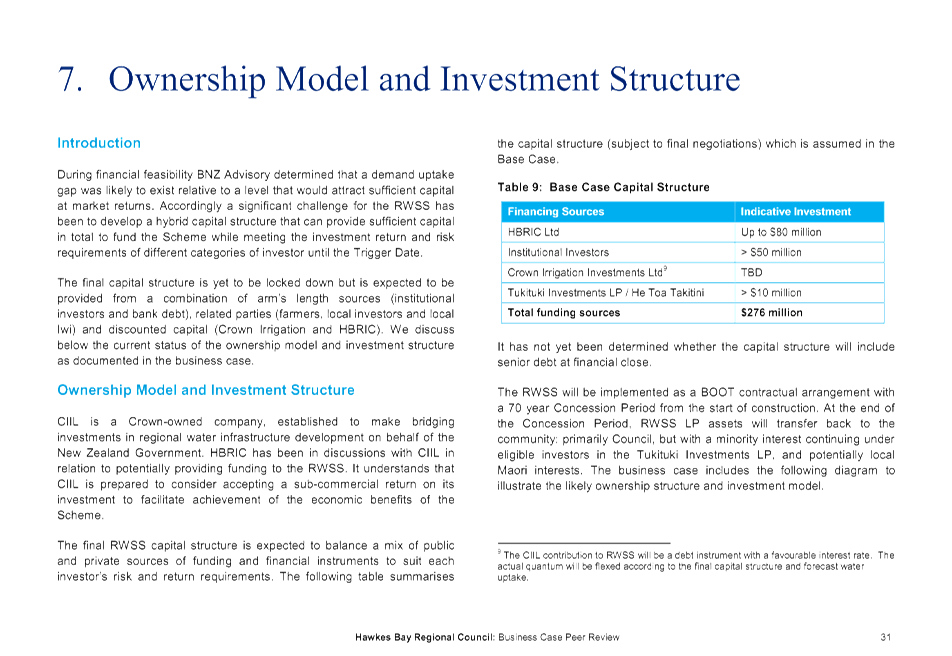

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Prayer/Apologies/Notices

2. Conflict

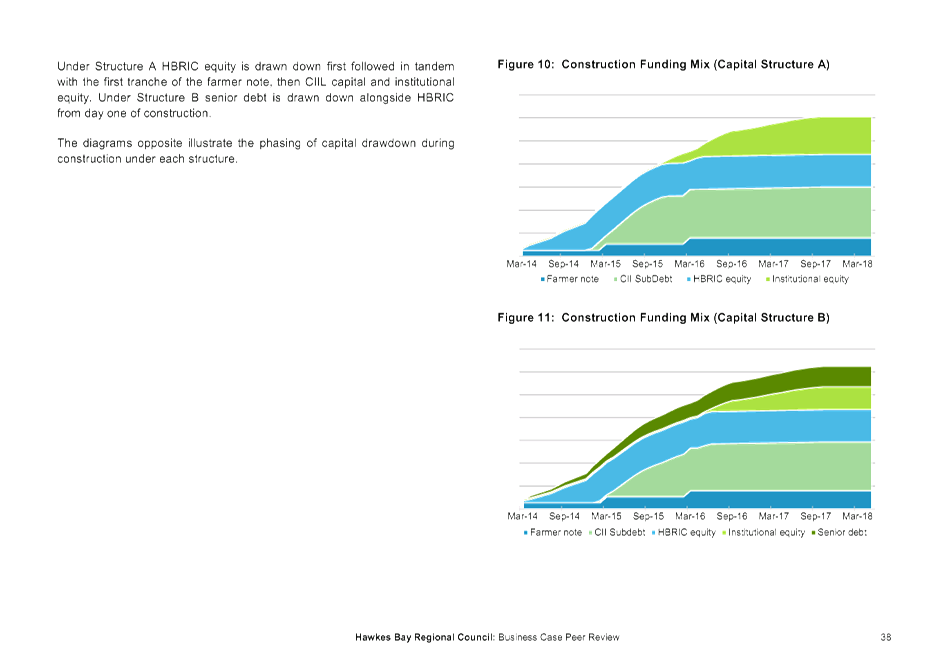

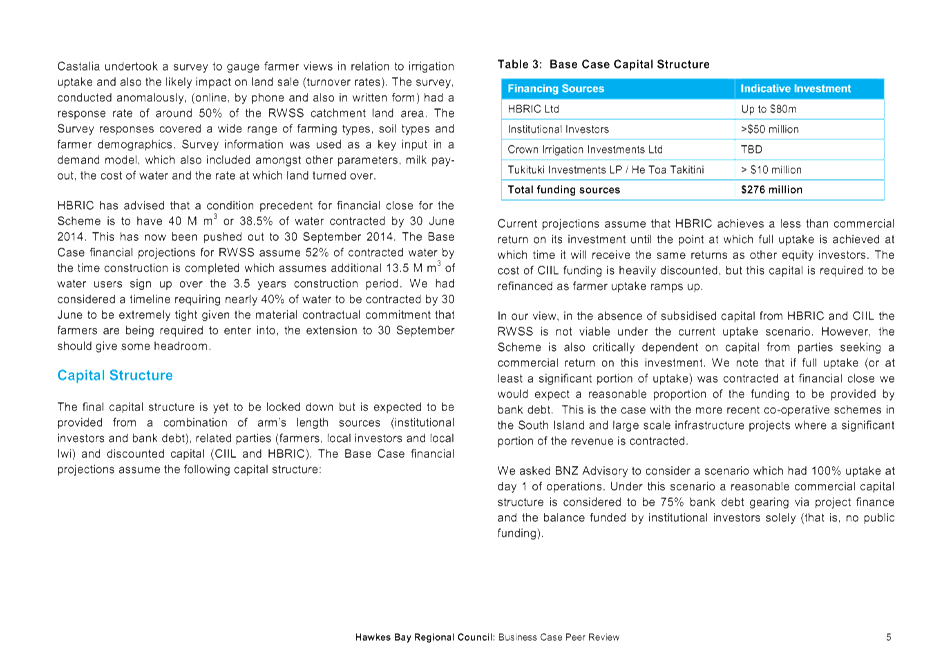

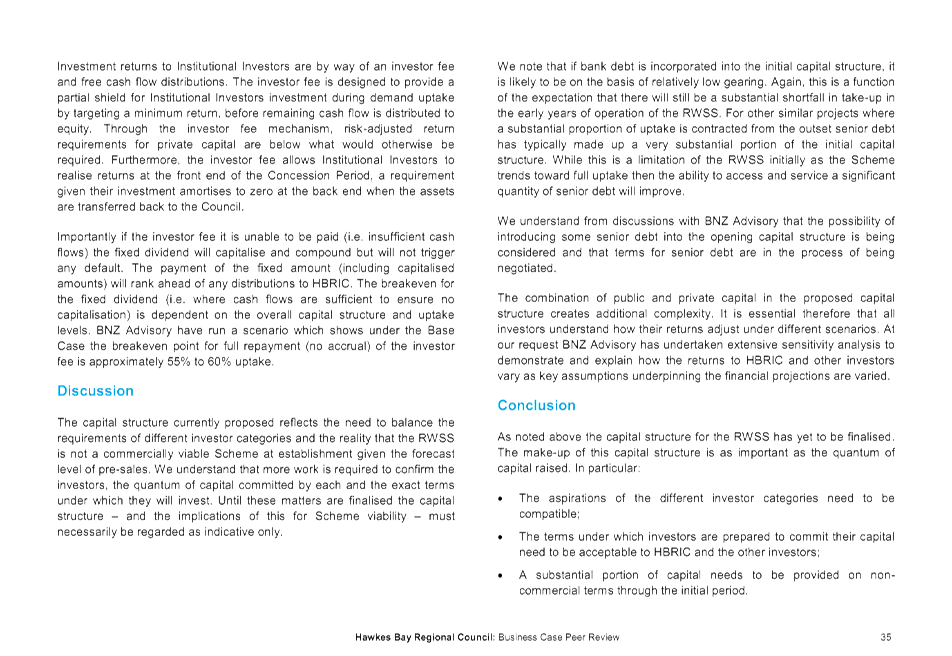

of Interest Declarations

3. Confirmation of

Minutes of the Regional Council Meeting held on 29 June 2016

4. Matters Arising

from Minutes of the Regional Council Meeting held on 29 June 2016

Decision Items (1.00pm)

5. HBRIC Ltd Report

on Ruataniwha Water Storage Scheme Conditions Precedent and Pre-conditions 3

6. Deloitte Peer

Review of the Final Ruataniwha Water Storage Scheme Business Case 23

Public Excluded Decision Items (10.30am)

7. Confirmation of

Public Excluded Meeting held on 29 June 2016 105

8. HBRIC Ltd Report

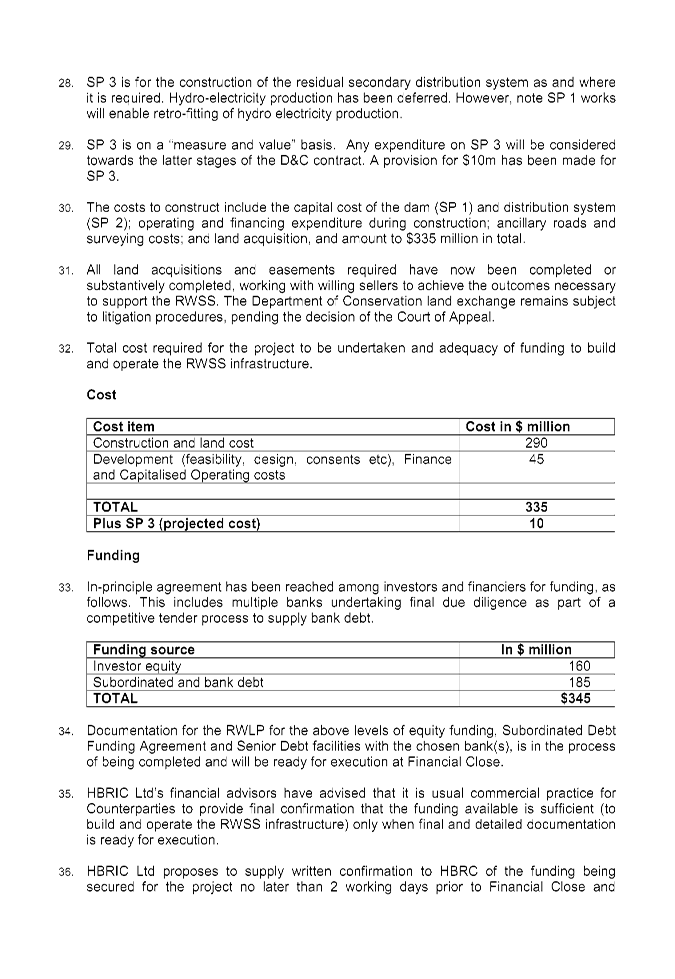

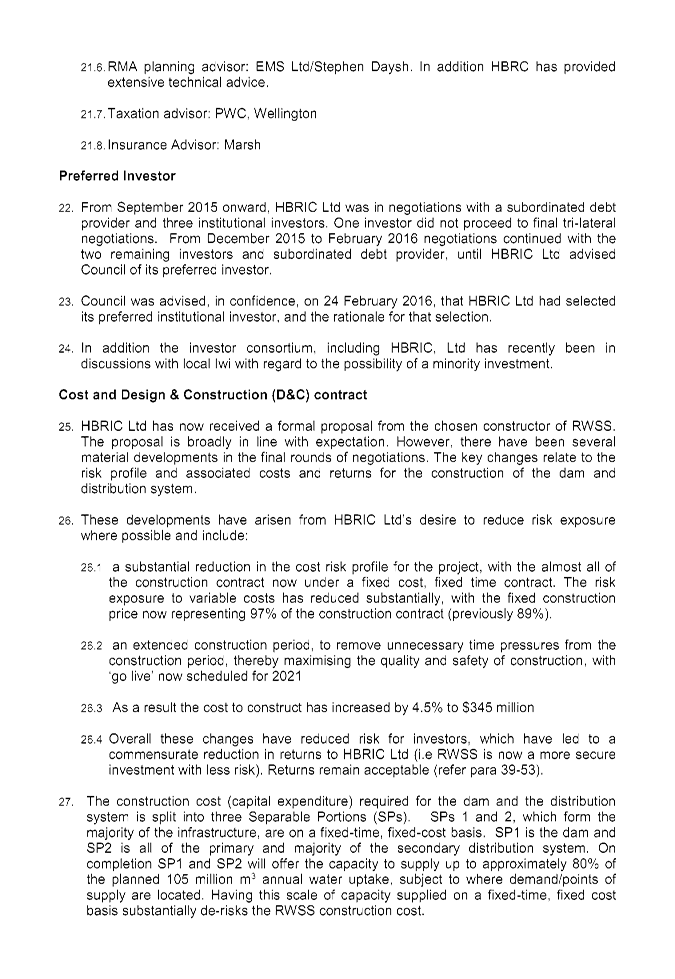

on RWSS Conditions Precedent – Confidential Documents 107

9. Deloitte RWSS

Business Case Peer Review – Confidential Information 109

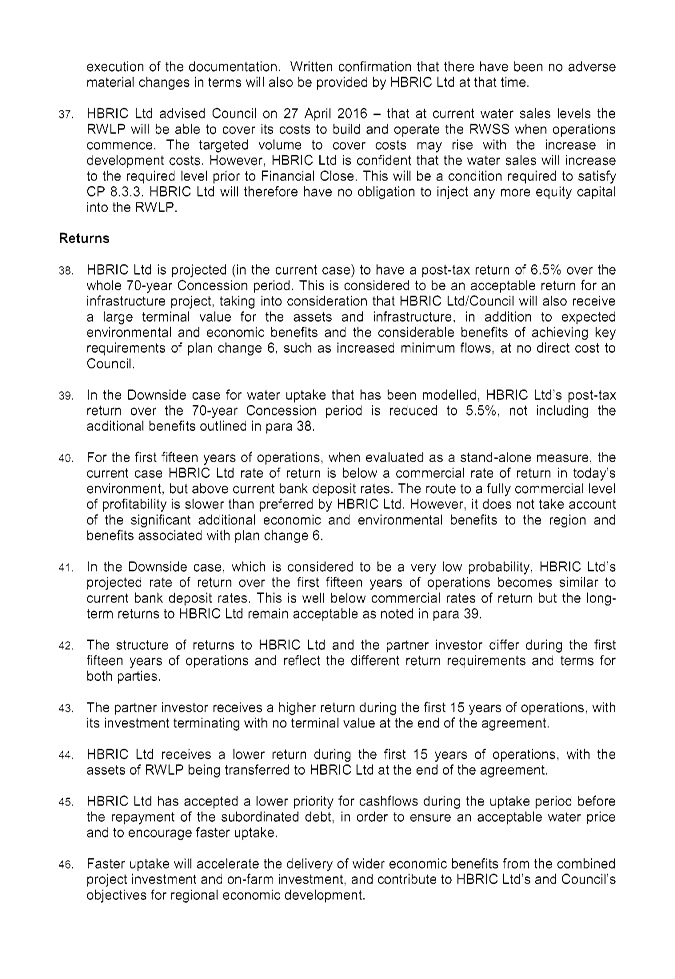

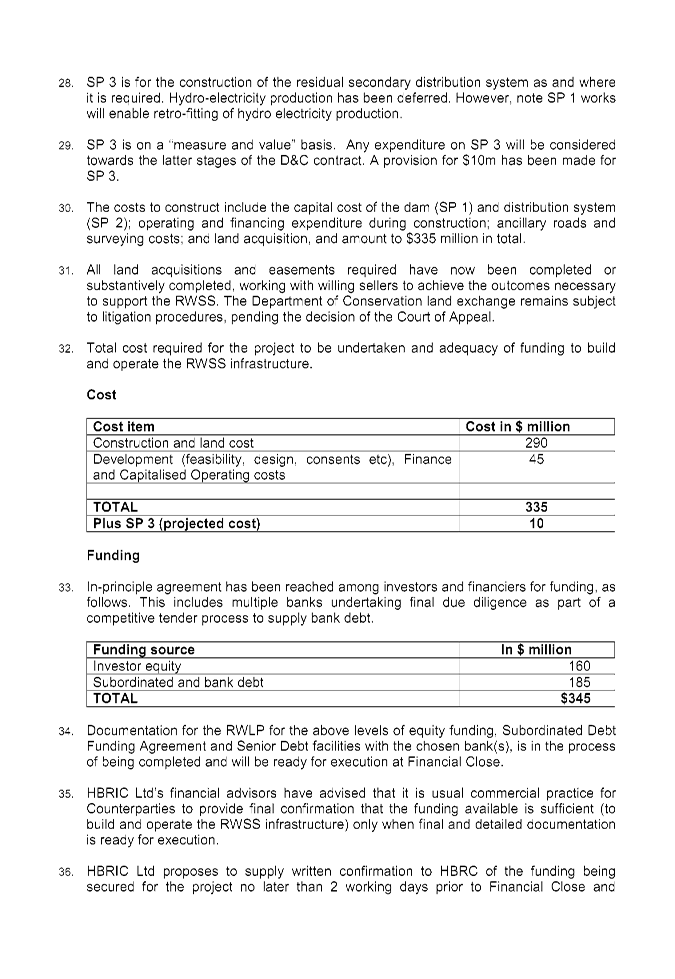

HAWKE’S BAY REGIONAL COUNCIL

Friday 08 July 2016

Subject: HBRIC

Ltd Report on Ruataniwha Water Storage Scheme Conditions Precedent and Pre-conditions

Reason for Report

1. The role of the

Hawke’s Bay Regional Council as the initiator of the feasibility work on

water storage options for the Tukituki catchment ultimately led to a delegation

of responsibility for preparing a business case for the Ruataniwha Water

Storage Scheme (RWSS) to HBRIC Ltd. Council itself retained responsibility for

the plan change for the catchment (Plan Change 6).

2. The

Hawke’s Bay Regional Investment Company Ltd (HBRIC Ltd) has now reported

back on the work which it was tasked to carry out and has made a suite of

recommendations to Council. Their report is appended as Attachment 1.

3. The Report from

HBRIC Ltd outlines the process undertaken by HBRIC Ltd., presents the relevant

decisions that have been made by HBRC to date, makes recommendations to HBRC on

the RWSS investment and describes the process that will occur should HBRC agree

to the recommendations in this agenda paper.

Strategic Context

4. The Tukituki Catchment Proposal, which includes both Plan

Change 6 and the RWSS, represents an integrated water management strategy,

integrating both regulation and infrastructure, not promoting one or the other.

5. It may be

useful to restate briefly the background for the water storage project:

5.1. HBRC committed to improving the

water quality of the Tukituki River following public concern expressed about

the river’s quality, especially in the lower reaches.

5.2. Among a range of tools to do

this was an increase in the minimum flows of the Tukituki and Waipawa Rivers.

5.3. As a regulatory measure it is

relatively straightforward to implement a plan change to increase minimum

flows; however the HBRC recognised that the Resource Management Act requires

that in promoting sustainable management Councils must manage the use, development,

and protection of natural and physical resources in a way, or at a rate, which

enables people and communities to provide for their social, economic, and

cultural well-being and for their health and safety.

5.4. In considering this requirement

HBRC recognised the potential effects on the economic and social wellbeing of

the catchment and wider region through lower water security potentially leading

to a downturn in economic output.

5.5. HBRC therefore made a conscious

decision to act in a non-regulatory way, in addition to its regulatory plan

change, and to assist with options for maintaining or even increasing the

security of supply for water for irrigation in the Tukituki catchment.

5.6. Several years investigations to

a range of multiple sites for small-scale water storage and medium scale water

storage eventually was revised to a larger-scale water storage project on the

Makaroro River site, for a range of reasons that have been canvassed

previously.

5.7. HBRC has taken an innovative

approach to its resource management responsibilities in response to the need to

balance the needs of the environment and the needs of people. HBRC creates and

maintains regional scale infrastructure to make the region more resilient when

there is too much water. It is now considering whether or not to invest

in regional scale infrastructure to make the region more resilient when there

is too little water.

5.8. HBRC’s

objectives for this investment are to:

5.8.1. Help achieve its strategic

development objectives for the Hawke’s Bay Region as a whole through

establishing and managing a key infrastructure resource to improve agricultural

production and productivity while enhancing environmental management of the

Tukituki catchment;

5.8.2. Encourage

and enable increased private sector investment in the Region’s export

oriented agricultural sector;

5.8.3. Generate

economic, social and cultural benefits in the region;

5.8.4. Help improve

management and control of environmental risks over the long term, especially

those relating to water quantity and water quality;

5.8.5. Generate

satisfactory tax paid returns to HBRC from the financial performance of the

invested assets;

5.8.6. Quantify and manage

particular investment risks.

Investment Decision

6. Council’s

decision on 25 June 2014 was:

That Council:

8. Resolves

to invest up to $80 million in RWSS subject to Council being satisfied

with:

8.1. its

own legal advice on the RWSS documents and all related legal matters;

8.2. a

further review of the final RWSS business case as at the new Financial Close

and Council being satisfied with its advice and the steps taken (if any) by

HBRIC Ltd to resolve key issues of concern (if any) then identified in the

course of Deloitte’s review;

8.3. advice

from HBRIC Ltd that all Conditions Precedent to Financial Close of the

investment by all investing parties in the Ruataniwha Water Storage Scheme

Limited Partnership (RWLP) have been either satisfied or waived by agreement of

the parties. These Conditions Precedent are:

8.3.1. The EPA granting satisfactory

resource consent conditions for RWSS infrastructure and operations, which in

turn are recommended as being workable by all investors;

8.3.2. Agreements to purchase a

minimum of 40 million cubic metres of water per annum (Water User Agreements) and

that the RWLP has committed to supply a minimum of 40 million cubic metres;

8.3.3. Securing the funding

required to build and operate the RWSS infrastructure; and,

8.3.4. Obtaining a bankable

construction contract which adequately addresses construction risk allocation

through a fixed-time, fixed-cost arrangement.

8.4. a

Certificate issued by HBRIC Ltd’s legal advisers:

8.4.1. summarising the terms of

all executed Water User Agreements;

8.4.2. identifying the water

user parties who executed the Agreements; and,

8.4.3. explaining the

enforceability or otherwise of the Agreements.

8.5. HBRIC

Ltd increasing its annual distributions to HBRC to provide a 6% return to HBRC

on the funds HBRIC Ltd draws down from HBRC from time to time to invest in the

RWSS, up to a maximum investment of $80 million.

9. Requires

HBRIC Ltd to keep the Council informed on progress toward meeting the

conditions stipulated in Recommendation 8.3 over the period to the new

Financial Close.

Conclusions

7. HBRC’s

decision in June 2014 to invest in the RWSS (subject to conditions precedent

and pre-conditions) sent a strong signal to the Hawkes Bay community that HBRC

would use its balance sheet, as well as its regulatory role, to drive economic

growth in the region while ensuring that the environment – land and water

– is sustainably managed.

8. Such an

approach has tended to polarise views on this project, and to harden views that

would suggest that both objectives – environmental protection and

economic development – cannot co-exist.

9. The RWSS is a

rare opportunity to drive economic growth within the Hawke’s Bay region.

From an HBRC investment perspective it has the potential to drive financial

benefits both through a return off the project itself and through higher

profitability for Napier Port.

10. At the same time the

availability of EPA Board of Inquiry consents for RWSS show the RWSS can be

implemented within explicit environmental parameters accompanied by ongoing

monitoring requirements.

11. Negotiations between the

investment parties will continue to occur up until financial close. Should any

material adverse changes occur between HBRC’s Councillors’ final

review of conditions precedent and preconditions today and that time HBRIC Ltd

will notify HBRC of such changes as they may impact upon Condition Precedent

8.3.3. (securing the funding required to build and operate the RWSS

infrastructure). In any event the investors and financiers will provide final

written confirmation, no later than two working days prior to Financial Close,

of the provision of funding that is required to build and operate the RWSS

infrastructure.

12. HBRIC Ltd has completed

its brief from HBRC in respect of the development of the business case for the

RWSS and importantly has concluded that:

“Investment in the RWSS,

on the terms agreed with counter-parties, continues to be an appropriate

investment for HBRIC Ltd and is consistent with HBRIC Ltd’s Statement of

Intent.”

13. HBRIC Ltd will be in

attendance at the meeting to make a presentation on their report.

Decision Making

Process

14. The recommendations in

this paper cover a proposal to invest up to $80 million in the Ruataniwha

Water Storage Scheme following public consultation undertaken under the Special

Consultative Procedure provisions of the Local Government Act 2002.

|

Recommendations

1. Council agrees that the Conditions

Precedent required by parts 8.3.1 and 8.3.4 of its 25 June 2014 resolution

regarding investing in the RWSS have been satisfied.

2. Council agrees that the Condition

Precedent set in 8.3.3 of Council’s minutes of 25 June 2014 will be

confirmed to Council management as being satisfied no later than two working

days prior to Financial Close, by Investors and financiers providing final

written confirmation of the funding that is required to build and operate the

RWSS infrastructure.

3. Council agrees that the

Pre-conditions required by parts 8.1, 8.4, 8.5 and 9 of its 25 June 2014

resolution regarding investing in the RWSS have been satisfied.

4. Council agrees that Pre-condition

8.2 and Condition Precedent 8.3.2 will be considered at the meeting on 8 July

2016 and if agreed will mean that all Conditions Precedent and

Pre-conditions, other than 8.3.3 have been satisfied, subject to no

further material adverse changes.

5. Council notes that, subject to investors and financiers

each receiving final approvals from investment Committee, Shareholders or

Credit Committee, as appropriate; and subject to HBRC being advised of any

material adverse changes prior to Financial Close:

5.1. HBRIC Ltd will proceed to Financial Close with counterparties in

July/August 2016, with the timing of financial draw-downs from Council to

HBRIC Ltd (and all other investor and financier draw-downs) being subject to

a Condition Subsequent/Precedent of either

5.1.1. obtaining full and unfettered access to the land being proposed

for exchange between Department of Conservation and the RWLP, or

5.1.2. any Council funds drawn down being adequately protected by

financial arrangements and/or legal agreements approved by Council.

6. That Council authorises HBRC management to prepare and

execute written agreements with HBRIC Ltd for funds amounting to $80 million

less the to-be-finalised sum (approximately $18 million) for capitalised

development expenses incurred by HBRIC Ltd before Financial Close:

6.1. to be drawn down from Council funds in accordance with the timing

and satisfaction of the Condition Subsequent/Precedent, and with the drawdown

schedule agreed with counterparties at Financial Close, and

6.2. for a combination of debt and subscription for new equity in HBRIC

Ltd with the proportions to be agreed between HBRIC Ltd and Council

management, reflecting advice from PWC on achieving both an appropriate

capital structure for HBRIC Ltd and an optimal balance of operating and

capital cashflows to Council from the expected returns on Council’s

investment, via HBRIC Ltd, in the RWSS.

7. That Council acknowledges the work undertaken by the Board

and staff of HBRIC Ltd on the RWSS project and expresses its gratitude for

their collective efforts.

|

|

Liz Lambert

Chief Executive

|

|

Attachment/s

|

1

|

HBRIC Ltd

Report on RWSS Conditions Precedent and Preconditions

|

|

|

|

HBRIC

Ltd Report on RWSS Conditions Precedent and Preconditions

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Friday 08 July 2016

Subject: Deloitte

Peer Review of the Final Ruataniwha Water Storage Scheme Business Case

Reason for Report

1. To assist Council with the decision making process surrounding the

possible investment in the Ruataniwha Water Storage Scheme, Deloitte was

appointed by HBRC in January 2014 to undertake an independent peer review of

the Business and Investment Case presented by HBRIC Ltd to HBRC.

2. Precondition

8.2 of the 25 June 2014 HBRC decision is as follows:

8. Resolves

to invest up to $80million in RWSS subject to:

8.1 ………….

8.2 Deloitte undertaking a

further review of the final RWSS business case as at the new Financial Close

and Council being satisfied with its advice and the steps taken (if any) by

HBRIC Ltd to resolve key issues of concern (if any) then identified in the course

of Deloitte’s review;

8.3 …………...

8.4 ……………

8.5 ……………

3. The independent

peer review of the business case is an important part of the overall assessment

process for HBRC and has relevance for the assessment of:

3.1. Financial

feasibility – is the Council’s investment supported by a sound

business case? What are the strengths and weaknesses of the business case?

3.2. Returns on investment – what

financial returns can the Council expect from its investment and over what time

period are these expected to occur?

3.3. Business

Risks – what risks does the company face and how will these be

managed or mitigated?

4. Out of

commercial sensitivity and commercial necessity much of the detailed

information provided by Deloitte in its review of the final business case has

had to be covered in a public–excluded session on at this meeting.

However it is appropriate HBRC deliberations on this matter are held in open

session.

May 2014

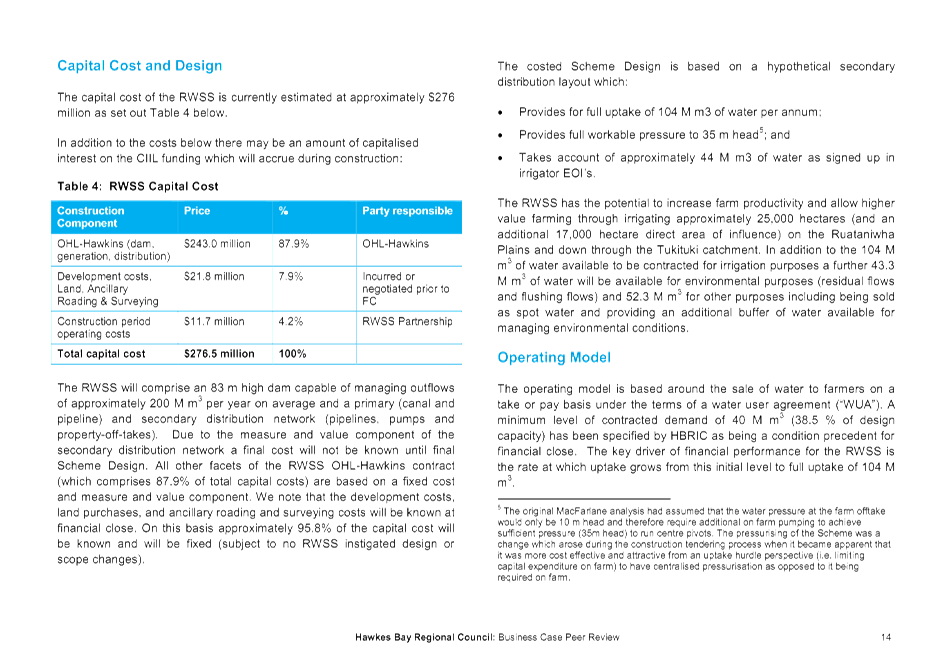

5. For the peer review of the Business Case Deloitte was tasked,

in particular, with assessing:

5.1. Whether HBRC

can have comfort that its exposure to calls on capital can be limited to its

current funding envelope of $60-80million

5.2. The

circumstances under which HBRC may be required to contribute additional capital

and where possible the quantity of those potential calls and the risks that

such calls could eventuate

5.3. The extent to

which HBRC can have comfort that the projected returns on its investment have

been accurately calculated and are based on reasonable assumptions

5.4. How investment

returns could vary under different scenarios

5.5. Any other

matters that Deloitte considers ought to be brought to HBRC’s attention

in connection with its assessment of the business case.

6. In its interim

report presented to Council’s Corporate and Strategic Committee meeting

on 16 April 2014, Deloitte identified the key interlocking components of the

business case from a financial perspective as being:

6.1. The up-front

capital investment in the physical infrastructure of the RWSS

6.2. The business

model which drives the operating cash flows necessary to provide the investor

returns

6.3. The ownership

model and related investment structure that allocates capital, risk and return

to the different investor

6.4. Fundamentally

however the critical factor is demand – how long it takes to get to full

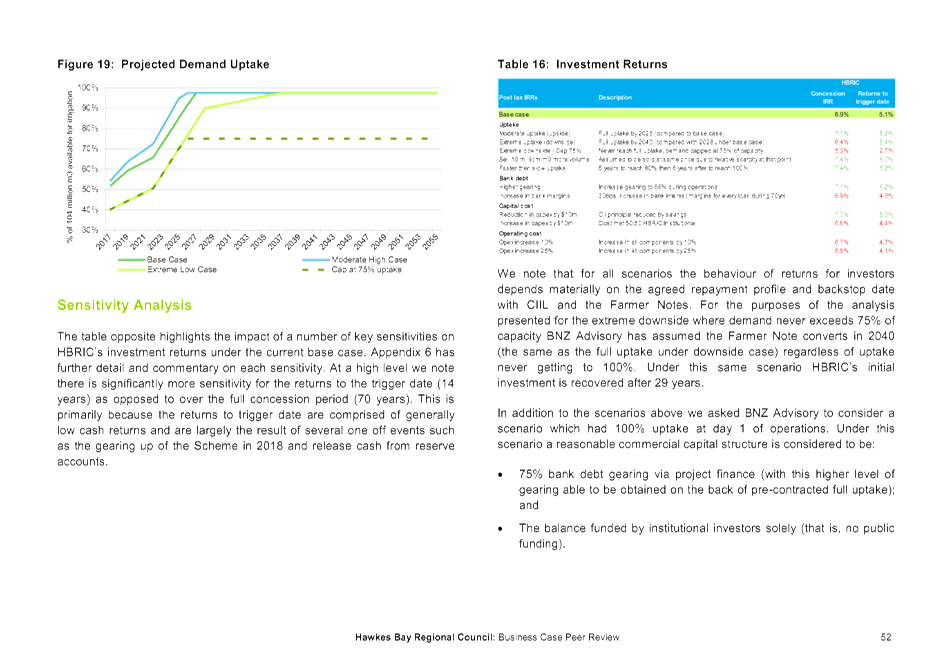

uptake and the profile of this uptake.

7. In assessing

these factors as the core building blocks of the project, Deloitte satisfied

itself as to the reasonableness of the assumptions supporting these building

blocks and the way the financial model has been constructed and returns

calculated within the HBRIC Ltd business case. They then used the model to:

7.1. Assess the

overall return on capital from the project under different uptake scenarios

7.2. Demonstrate

how the internal rate of returns have been calculated

7.3. Use

sensitivity analysis to identify which assumptions matter and which are

immaterial in terms of the financial case

7.4. Identify the

implications for HBRC capital requirements and returns under different

scenarios.

8. The key risk to the project as identified by Deloitte in 2014 is how

long the project takes to get to full uptake of water. This is important for

two reasons:

8.1. If the level and pace of uptake are lower and slower respectively

than the base case then there is a risk that HBRC will be called upon for

additional capital (together with all other investors)

8.2. There is a risk that HBRC’s rate of return may be lower than

that estimated in the business case e.g. the business case assumes a rate of

return of 6.9% at full uptake, but this could range between 6.4% and 7.4%

depending on the level and speed of uptake.

9. Deloitte is confident that the risks from any overruns in capital

costs during construction are well covered by the fixed price, fixed time

contract and will not impact upon HBRC.

10. Attachment 1 to this paper

(the May 2014 Deloitte Business Case Review report) has previously been

received by Council but is included in this agenda for completeness.

11. Deloitte noted that

the three major moving parts of the proposal, namely the construction contract,

the required level of initial contracted water and the capital structure, had

yet to be finalised. They also stated that is it not unusual for projects

of this nature to have a degree of uncertainty right up to the point of

financial close.

May 2016

12. Following receipt of the

business case review Council chose to retain the services of Deloitte to

undertake a final assessment of the proposal should there be any material change

between the base case and the situation at financial close.

13. Deloitte’s final

assessment is now presented in this agenda item. This is an

addendum to the 2014 Final Business Case and contains an assessments of any

changes in investor terms, the final contracted capital construction cost, and

any change to the demand curve resulting from the BoI final decision.

14. This report has been

prepared in accordance with the scope for this work as approved by Council on

16 December 2015, being to:

14.1. Review latest version of the

financial model and base case financial projections to:

14.1.1. understand calculation and

allocation of financial returns by investor category

14.1.2. identify key assumptions

14.1.3. confirm water take-up

breakeven point

14.1.4. undertake sensitivity

analysis to demonstrate the impact of cash flows and investor returns of

different water take-up assumptions beyond base case

14.2. Validation of key assumptions:

14.2.1. trace capital assumptions to

latest version of the D&C contract

14.2.2. trace investor assumptions

to investor term sheets and ownership model/investment structure

14.2.3. trace senior debt finance

(if any) assumptions to bank term sheets

14.2.4. test basis for water uptake

assumptions

15. At Council’s meeting

on 25 May 2016 Deloitte presented their preliminary findings on

the updated business case to Council. Material changes to the 2014 business

case were described and assessed.

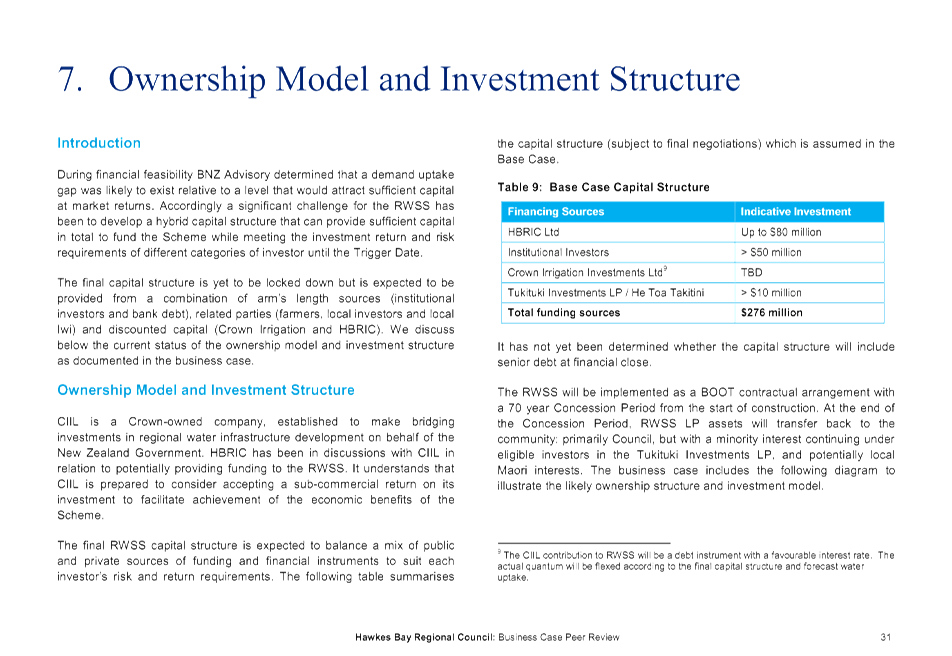

16. Key changes to the

financing structure since 2014 include a change in potential investors,

including the addition of an Institutional Investor that has risk exposures

(excluding demand risk); the addition of bank debt from financial close; and

HBRIC’s equity being drawn down first (with its development costs to-date

capitalised), followed by CIIL Sub Debt, bank debt and finally Institutional

equity.

17. Deloitte have concluded in

their May 2016 presentation that under the base case scenario, over the 70 year

life of the project:

17.1. HBRIC is repaid in full and

earns a positive return on capital (equity IRR exceeds required rate of return

of 6%);

17.2. the Institutional Investor is

repaid in full and earns a positive return on capital;

17.3. the Farmer Note is repaid in

full and earns a positive return on capital;

17.4. Bank debt is repaid in full

and earns base lending rate plus a margin; and

17.5. CIIL Sub Debt is repaid in

full.

18. Deloitte arrived at this

conclusion after calculating all the figures – and confirming the

underlying assumptions are reasonable.

July 2016

19. Deloitte has now completed

an update of the peer review focusing on the key areas that underpin the

assessment, being:

19.1. Financial case

19.2. Capital structure

19.3. Investor returns

19.4. Breakeven analysis

19.5. Water uptake

19.6. Sensitivity analysis

19.7. Risk analysis.

20. The presentation from

Deloitte will cover areas that are not commercially sensitive nor subject to

negotiations.

21. A final written report

from Deloitte will be publicly available subsequent to this meeting.

Decision Making

Process

22. The recommendations in

this paper cover a proposal to invest up to $80 million in the Ruataniwha

Water Storage Scheme following public consultation undertaken under the Special

Consultative Procedure provisions of the Local Government Act 2002.

|

Recommendations

That Council:

1. Receives and notes the Deloitte Ruataniwha Water Storage Scheme

Peer Review presentation.

2. Confirms that it is satisfied with advice received from

Deloitte and the steps taken (if any) by HBRIC Ltd to resolve key issues of

concern (if any) then identified in the course of Deloitte’s review.

|

|

Paul Drury

Group Manager

Corporate Services

|

Liz Lambert

Chief Executive

|

Attachment/s

|

1

|

Deloitte RWSS

Business Case Peer Review Report, May 2014

|

|

|

|

Deloitte

RWSS Business Case Peer Review Report, May 2014

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Friday 08 July 2016

SUBJECT: Confirmation of Public Excluded Minutes of the Regional

Council meeting held on 29 June 2016

That the Council excludes the public

from this section of the meeting being Confirmation of Public Excluded Minutes

Agenda Item 7

with the general subject of the item to be considered while the public is

excluded; the reasons for passing the resolution and the specific grounds under

Section 48 (1) of the Local Government Official Information and Meetings Act

1987 for the passing of this resolution being:

|

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR THE

PASSING OF THE RESOLUTION

|

|

Confirmation of Public Excluded Meeting

held on 15 June 2016

|

7(2)(a) That the public conduct of this

agenda item would be likely to result in the disclosure of information

where the withholding of the information is necessary to protect the

privacy of natural persons

|

The Council is specified, in the First

Schedule to this Act, as a body to which the Act applies.

|

|

RWSS Concession Deed and Project

Agreement

|

7(2)(b)(ii) That the public conduct of

this agenda item would be likely to result in the disclosure of information

where the withholding of that information is necessary to protect

information which otherwise would be likely unreasonably to prejudice the

commercial position of the person who supplied or who is the subject of the

information

7(2)(i) That the public conduct of this

agenda item would be likely to result in the disclosure of information

where the withholding of the information is necessary to enable the local

authority holding the information to carry out, without prejudice or

disadvantage, negotiations (including commercial and industrial

negotiations)

|

The Council is specified, in the First

Schedule to this Act, as a body to which the Act applies.

|

|

|

Leeanne Hooper

Governance & Corporate Administration

Manager

|

Liz Lambert

Chief Executive

|

HAWKE’S BAY REGIONAL

COUNCIL

Friday 08 July 2016

Subject: HBRIC

Ltd Report on RWSS Conditions Precedent – Confidential Documents

That Council excludes the public

from this section of the meeting, being Agenda Item 8 HBRIC Ltd Report on RWSS

Conditions Precedent – Confidential Documents with the general subject of

the item to be considered while the public is excluded; the reasons for passing

the resolution and the specific grounds under Section 48 (1) of the Local

Government Official Information and Meetings Act 1987 for the passing of this

resolution being:

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR THE

PASSING OF THE RESOLUTION

|

|

HBRIC Ltd Report on RWSS Conditions Precedent –

Confidential Documents

|

7(2)(b)(ii) That the public conduct of this agenda item

would be likely to result in the disclosure of information where the

withholding of that information is necessary to protect information which

otherwise would be likely unreasonably to prejudice the commercial position

of the person who supplied or who is the subject of the information.

7(2)(i) That the public conduct of this agenda item would

be likely to result in the disclosure of information where the withholding of

the information is necessary to enable the local authority holding the

information to carry out, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations).

|

The Council is specified, in the First Schedule to this

Act, as a body to which the Act applies.

|

|

Liz Lambert

Chief Executive

|

|

HAWKE’S BAY REGIONAL

COUNCIL

Friday 08 July 2016

Subject: Deloitte

RWSS Business Case Peer Review – Confidential Information

That Council excludes the public

from this section of the meeting, being Agenda Item 9 Deloitte RWSS Business

Case Peer Review – Confidential Information with the general subject of

the item to be considered while the public is excluded; the reasons for passing

the resolution and the specific grounds under Section 48 (1) of the Local

Government Official Information and Meetings Act 1987 for the passing of this

resolution being:

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR THE

PASSING OF THE RESOLUTION

|

|

Deloitte RWSS Business Case Peer Review –

Confidential Information

|

7(2)(b)(ii) That the public conduct of this agenda item

would be likely to result in the disclosure of information where the

withholding of that information is necessary to protect information which

otherwise would be likely unreasonably to prejudice the commercial position

of the person who supplied or who is the subject of the information.

7(2)(i) That the public conduct of this agenda item would

be likely to result in the disclosure of information where the withholding of

the information is necessary to enable the local authority holding the

information to carry out, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations).

|

The Council is specified, in the First Schedule to this

Act, as a body to which the Act applies.

|

|

Paul Drury

Group Manager

Corporate Services

|

Liz Lambert

Chief Executive

|