Meeting of the Finance Audit & Risk Sub-committee

Date: Wednesday 18 May 2016

Time: 1.00 pm

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of

Minutes of the Finance Audit & Risk Sub-committee held on 11 February 2016

4. Matters Arising from

Minutes of the Finance Audit & Risk Sub-committee held on 11 February 2016

5. Follow-ups from

Previous Finance Audit & Risk Sub-committee meetings 3

Decision Items (Public Excluded)

12. Internal

Audit Report – Cyber Security 61

13. Proposed

Council Insurance Programme for 2016-17 63

Decision Items

6. Six

Monthly Report on Risk Assessment and Management 7

7. Fraud

Policy 41

Information or Performance Monitoring

8. Business

Continuity and Disaster Recovery Plan Progress Update 49

9. HBRC

Staff Conflict of Interest Policy 53

10. Infrastructure

as a Service

11. 2016

Sub-committee Work Programme 59

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 18 May 2016

SUBJECT: Follow-ups from Previous Finance

Audit & Risk Sub-committee meetings

Reason for Report

1. In order to track items raised at previous meetings that require

follow-up, a list of outstanding items is prepared for each meeting. All

follow-up items indicate who is responsible for each, when it is expected to be

completed and a brief status comment. Once the items have been completed and

reported to the Committee they will be removed from the list.

Decision

Making Process

2. Council is required to make every decision in

accordance with the Local Government Act 2002 (the Act). Staff have assessed

the in relation to this item and have concluded that as this report is for

information only and no decision is required, the decision making procedures

set out in the Act do not apply.

|

Recommendation

1. That the Finance, Audit and Risk Sub-committee

receives and notes the report “Follow-ups from Previous Finance

Audit and Risk Sub-committee Meetings”.

|

|

Paul Drury

Group Manager Corporate Services

|

Liz Lambert

Chief Executive

|

Attachment/s

|

1

|

Follow-ups

from Previous Finance, Audit & Risk Sub-committee Meetings

|

|

|

|

Follow-ups

from Previous Finance, Audit & Risk Sub-committee Meetings

|

Attachment 1

|

Follow-ups

from Finance, Audit & Risk Sub-committee Meetings

11 February 2016

|

|

Agenda Item

|

Follow-up / Request

|

Person Responsible

|

Status Comment

|

|

1

|

Audit Management Letter

for 2014-15

|

HBRIC investment to be

appropriately recorded at fair value each year, rather than on 3-yearly cycle

|

P Drury

|

Discussions are

currently underway with Deloittes to undertake a desktop valuation as at 30

June 2016 which will provide an indication of how the value of the investment

is tracking.

|

|

2

|

Audit Management Letter

for 2014-15

|

· Policy on how Elected Reps

conflicts will be managed or mitigated to be developed and added to the

Register of Interests;

· Policy on what must be declared

on the Register of Interests to be developed; and

Both Policies to be

incorporated into an updated Code of Conduct for Elected Representatives

|

L Lambert

|

|

|

3

|

Finance Audit &

Risk Sub-committee Charter

|

Charter to be amended

and then approved by Corporate & Strategic Committee

|

L Lambert /L Hooper

|

Charter updated and

approved by C&S 17/2/16, with the inclusion of one additional amendment

re reviewing Council activities

|

|

4

|

Internal Audit –

Business Continuity & Disaster Recovery Plan

|

Update to be provided

to FA&R on progress and timelines to action PWC recommendations from BCP

audit

|

P Drury

|

On May FA&R

Subcommittee agenda

|

|

5

|

Risk Management Policy

& Framework

|

Update to be provided

to FA&R on progress and timelines to action PWC recommendations,

including:

∙ Strategy mapping exercise

∙ Fraud risk

∙ Health & Safety risks

∙ Cyber security identification &

assessment

∙ Large projects risks

∙ Procurement risk

|

L Lambert /M Adye

|

Cyber Security internal

audit approved within current budgets, to be reported to 18May16 FA&R.

Fraud Prevent Policy

included on this agenda.

|

9 November 2015

|

|

Agenda Item

|

Follow-up / Request

|

Person Responsible

|

Status Comment

|

|

6

|

Follow-ups

|

Staff ‘Conflict

of Interest’ policy review

|

L Lambert/ V Moule

|

On May FA&R

Subcommittee agenda.

|

|

7

|

Council Insurance

programme

|

Proposed 2016-17

Council insurance programme

|

P Drury

|

On May FA&R

Subcommittee agenda

Paper on insurances

attached to this agenda.

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 18 May 2016

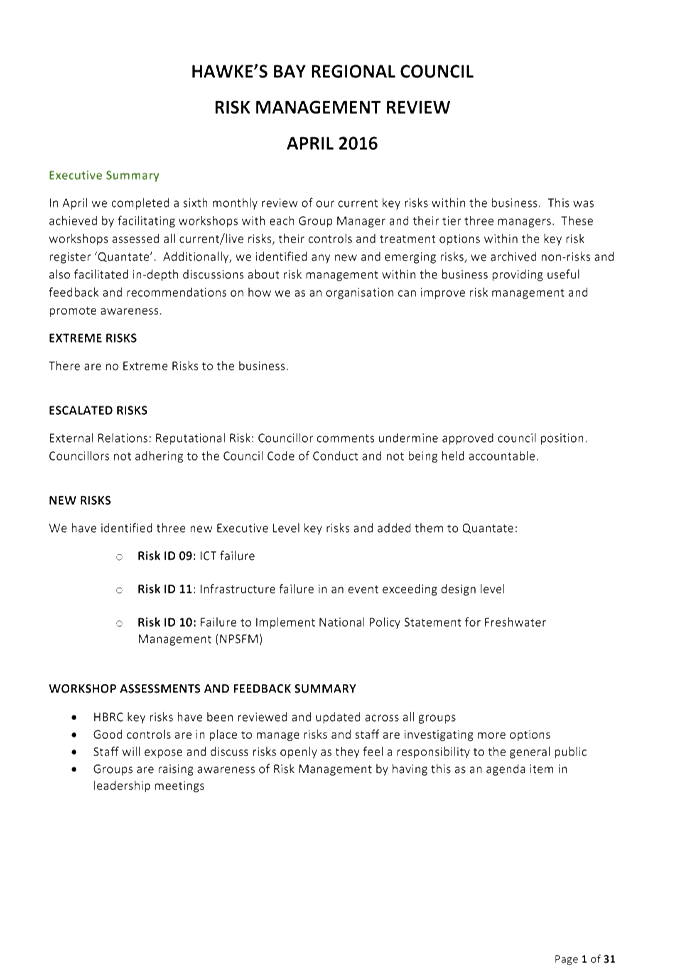

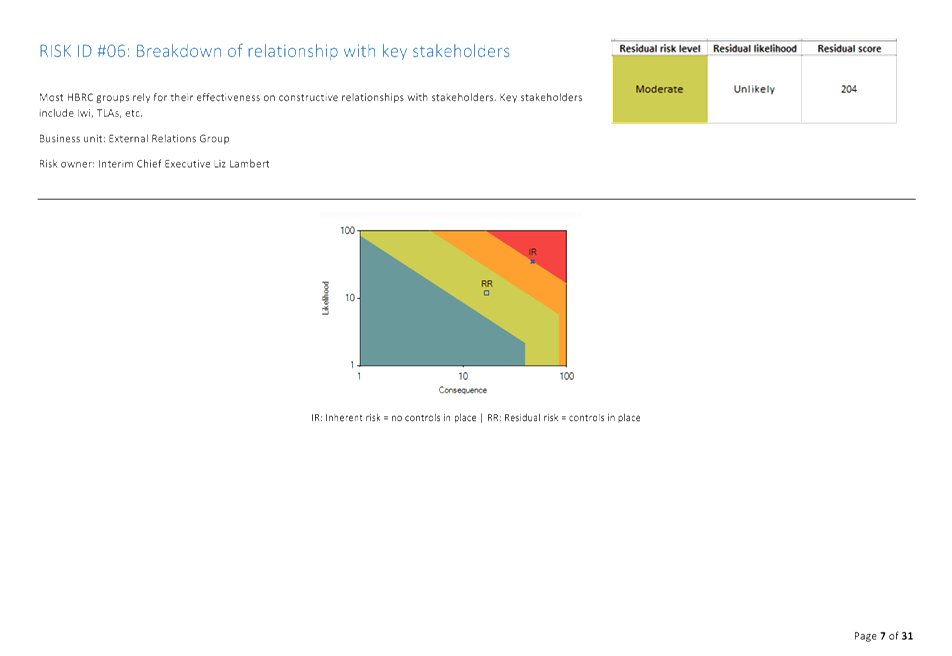

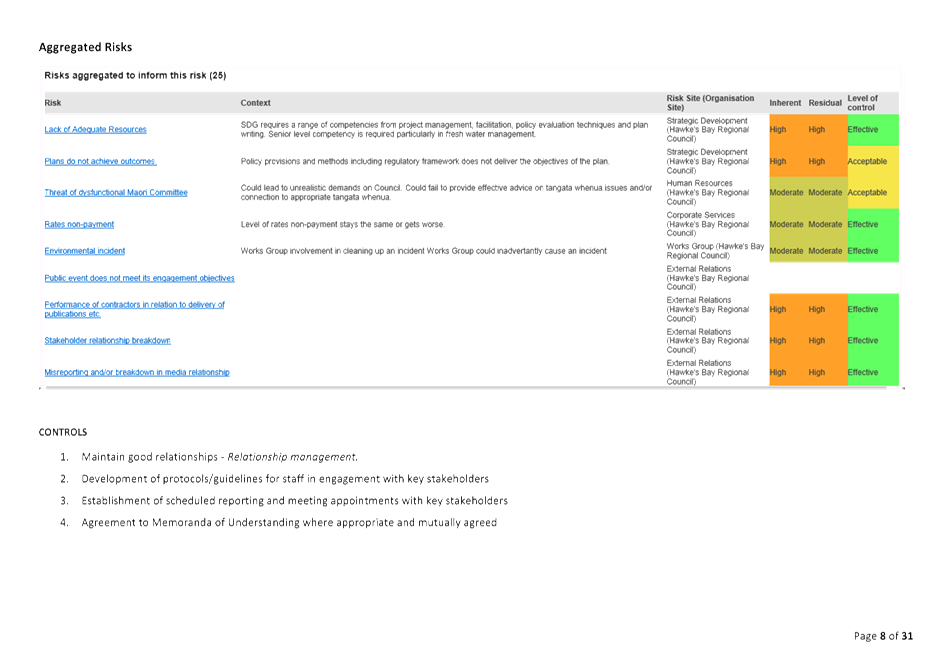

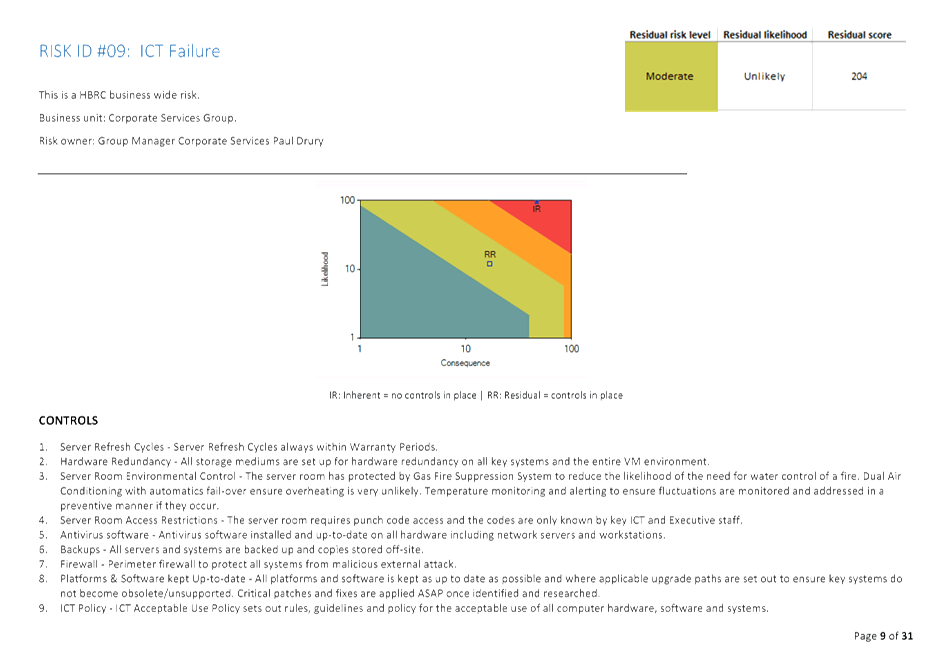

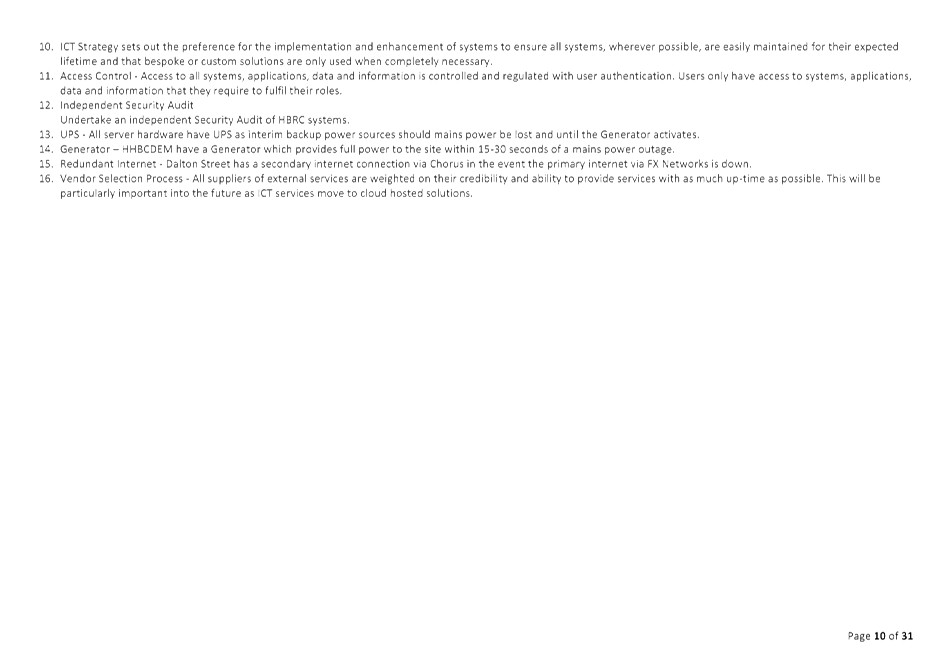

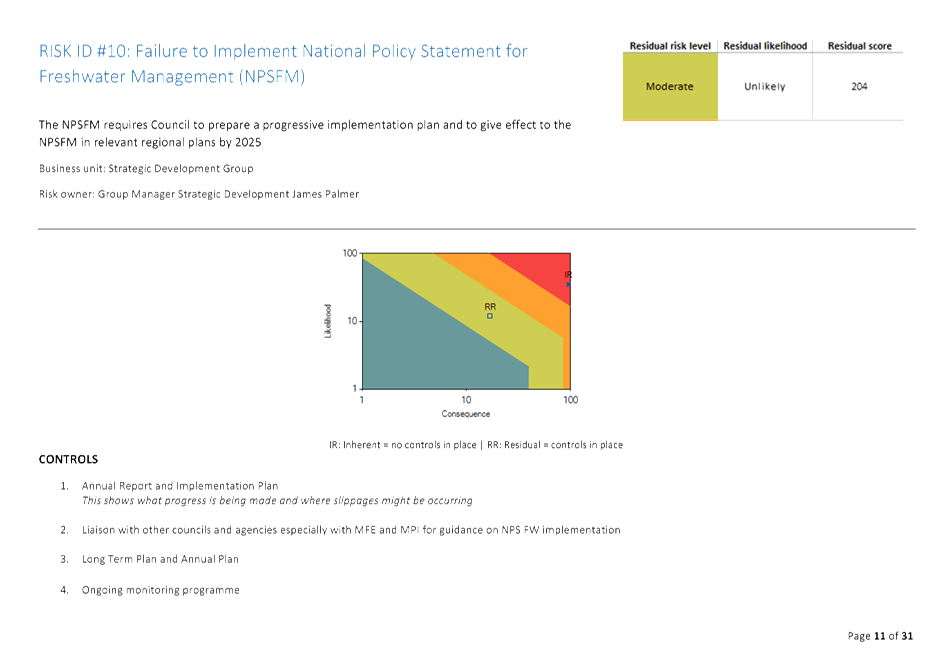

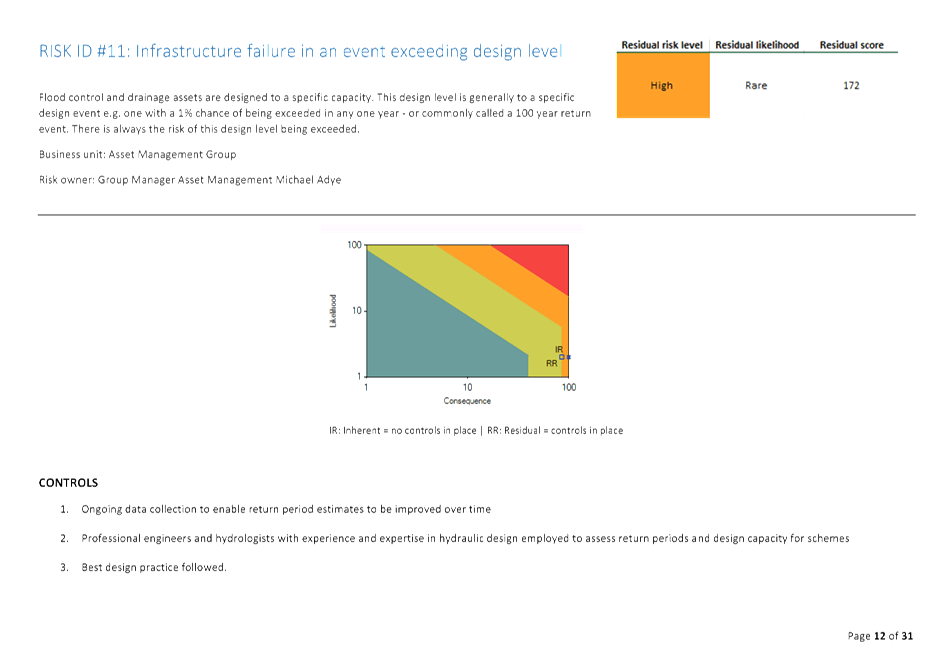

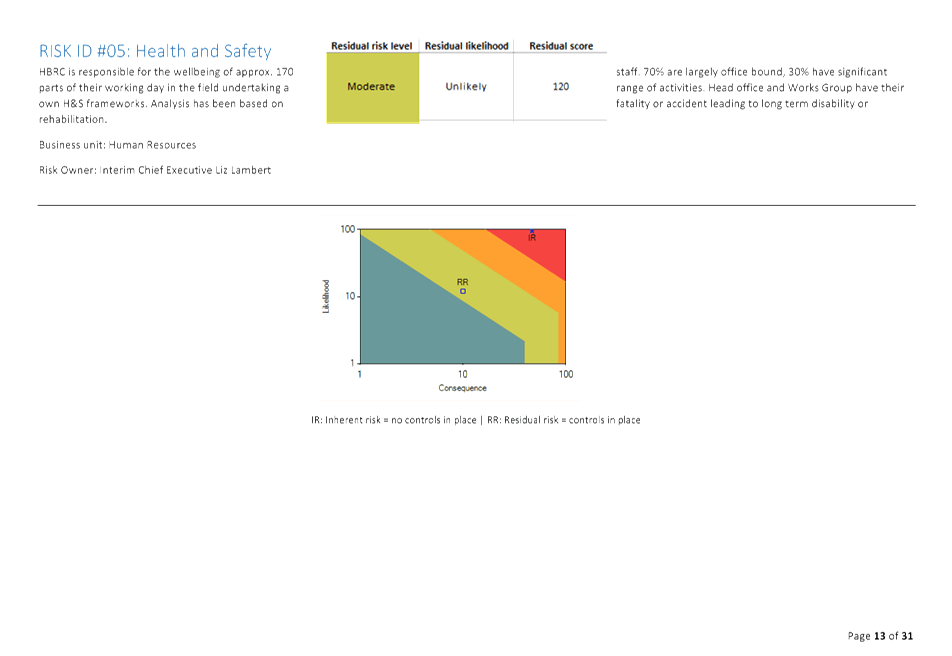

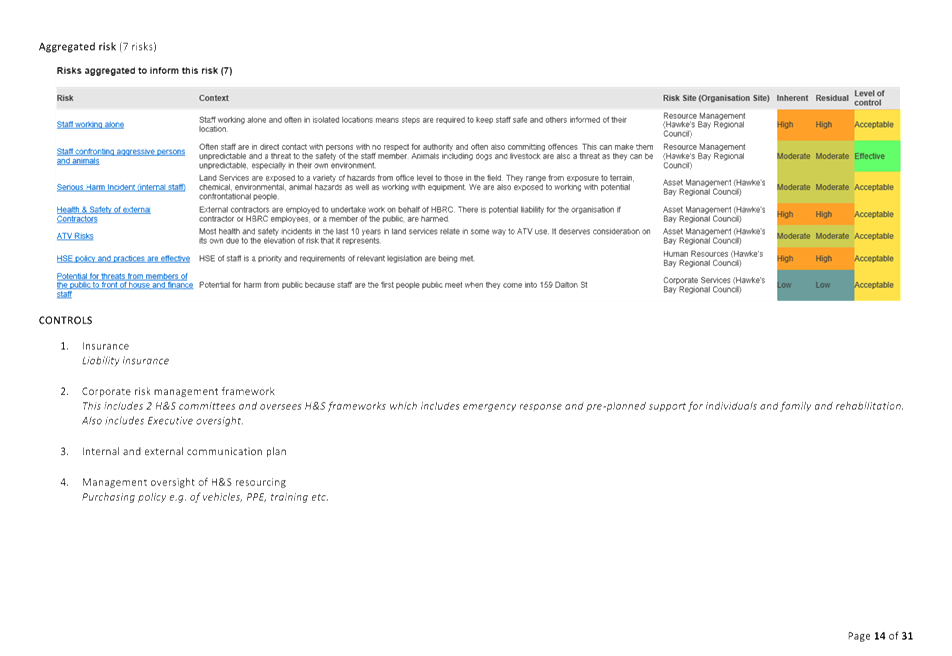

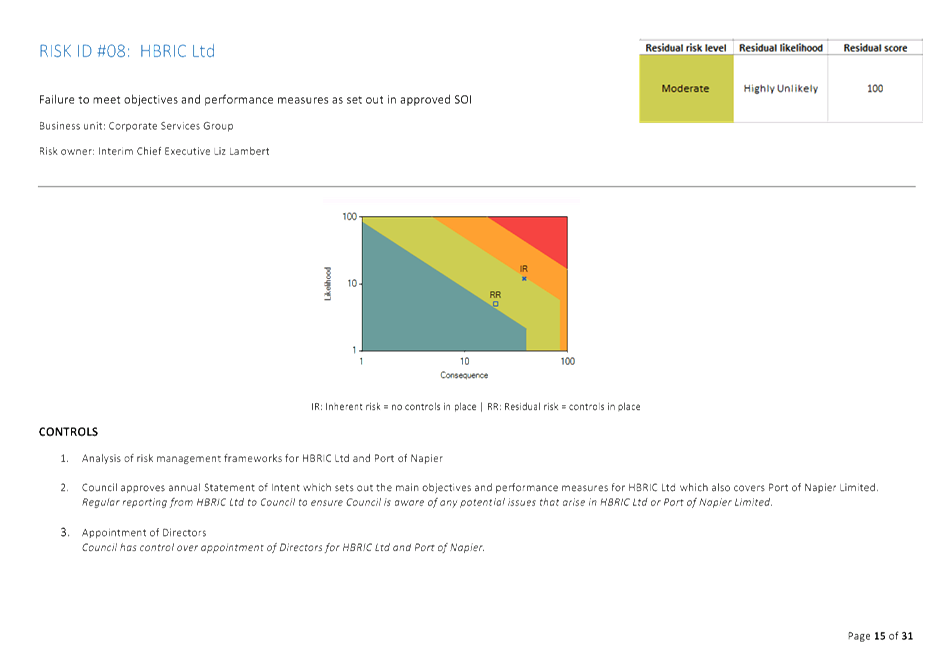

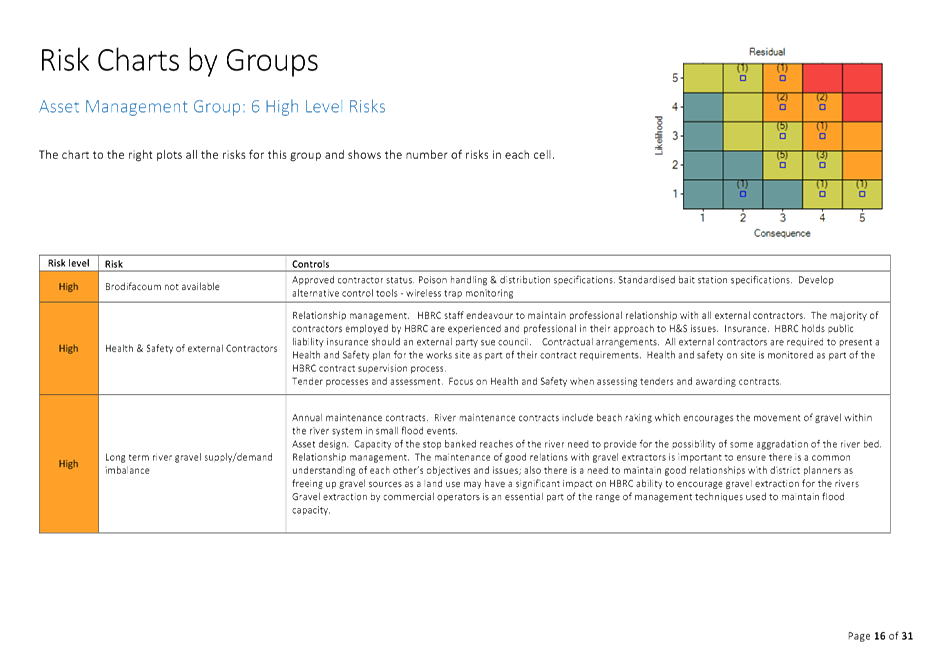

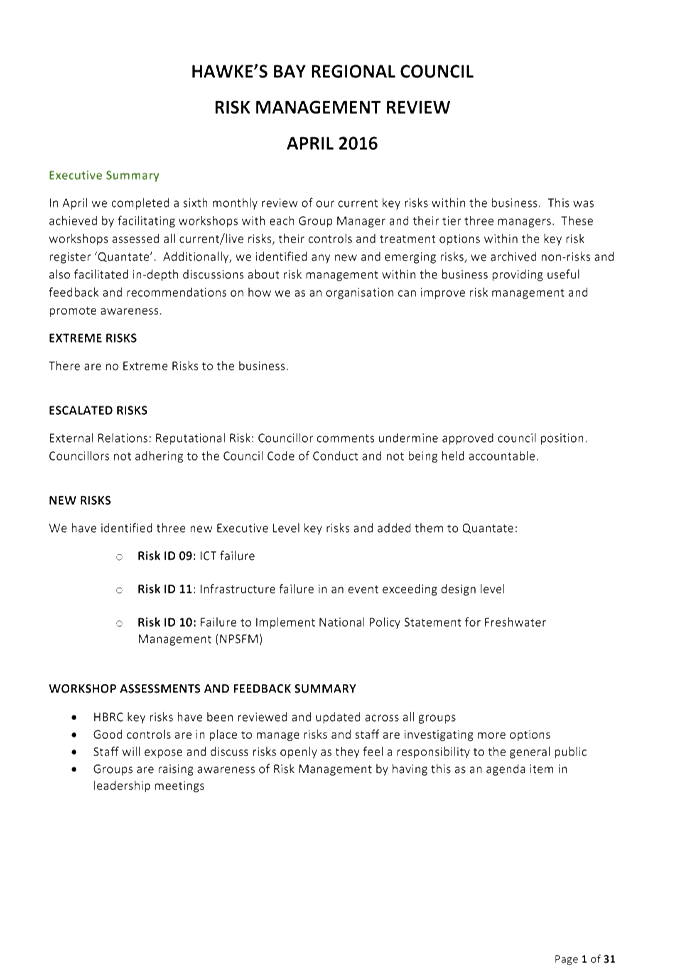

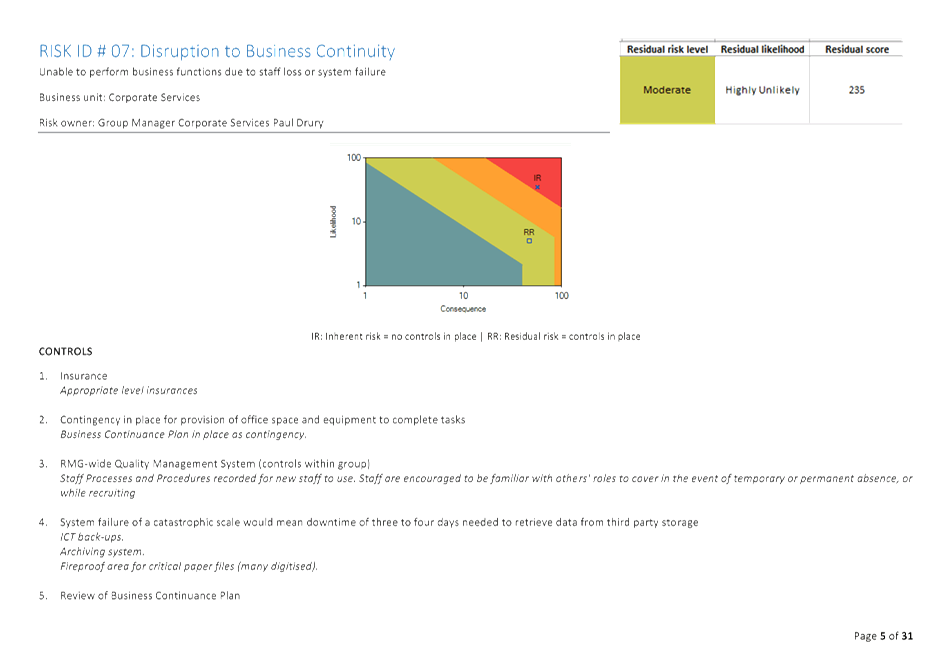

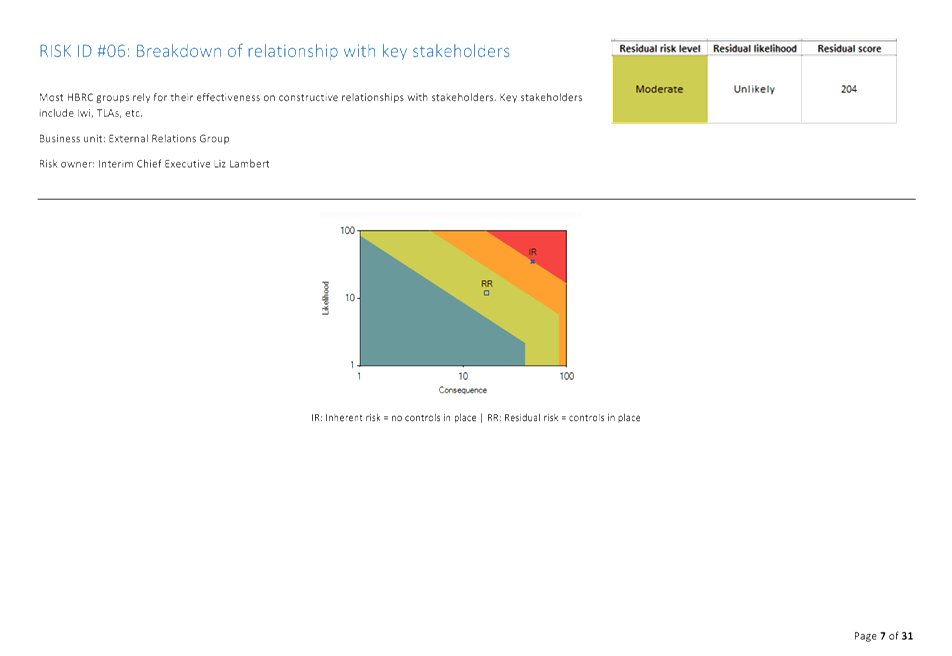

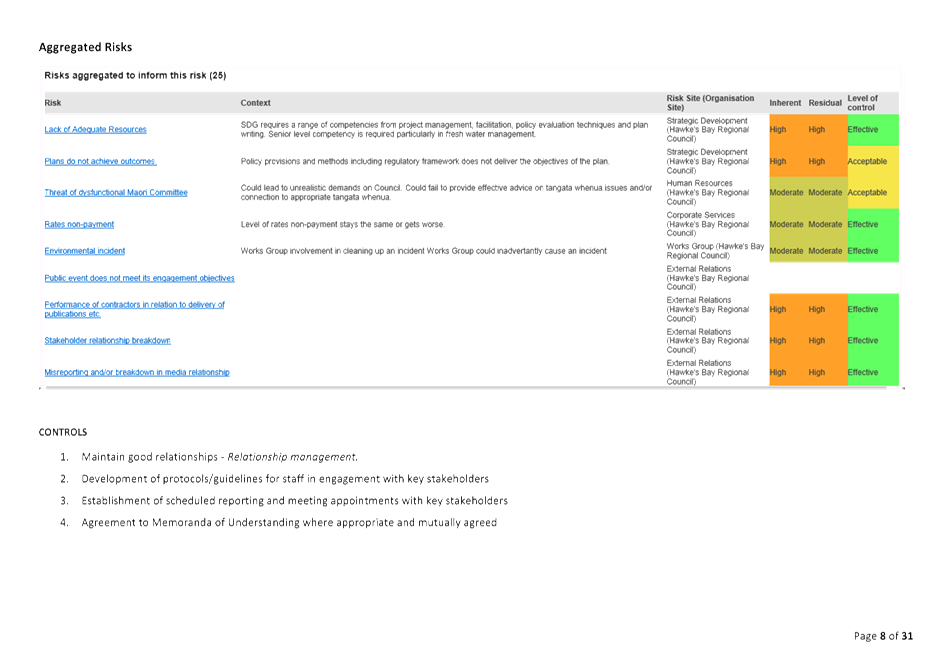

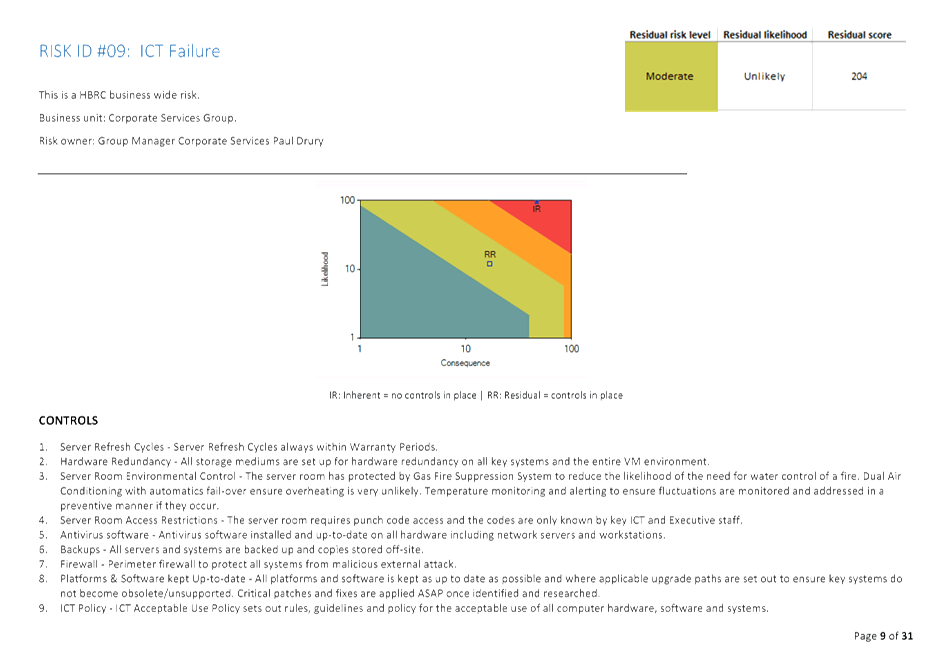

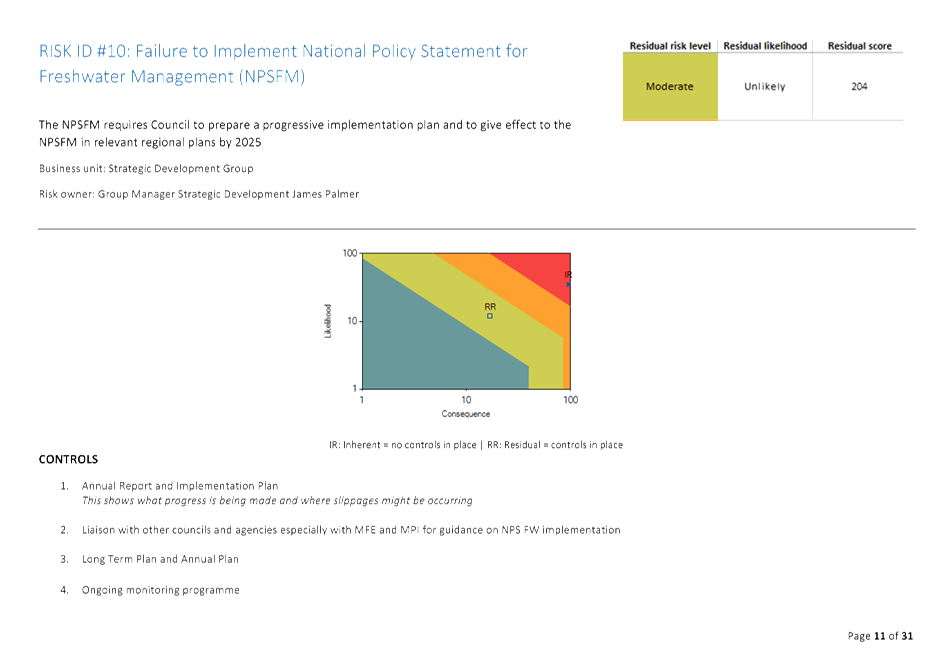

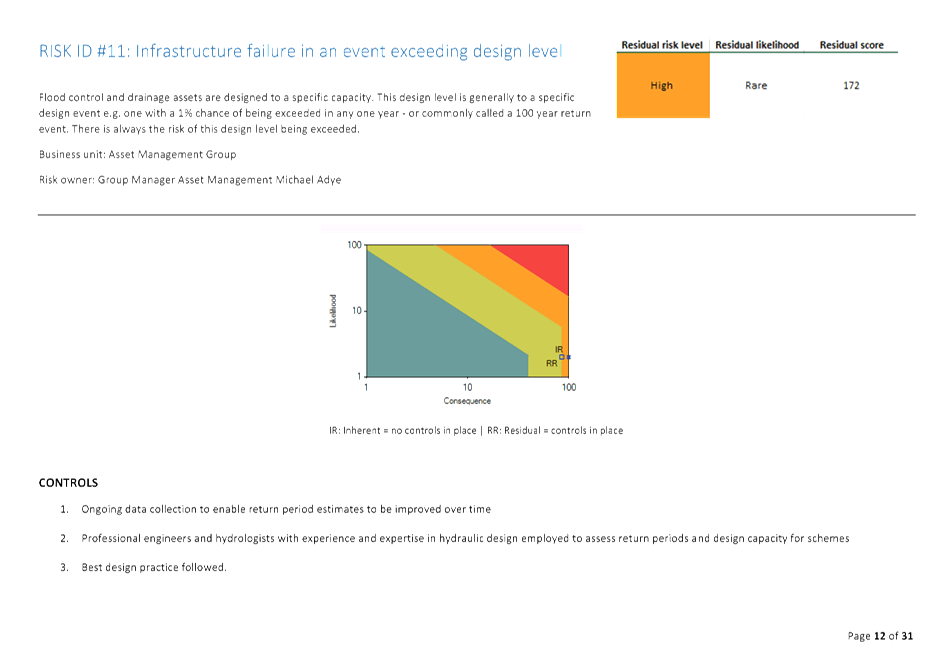

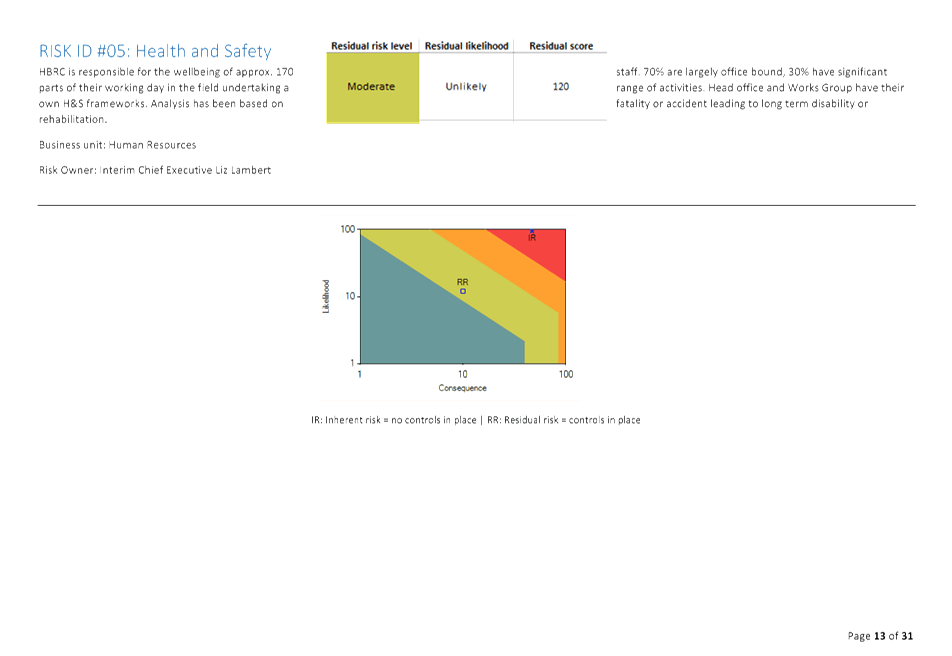

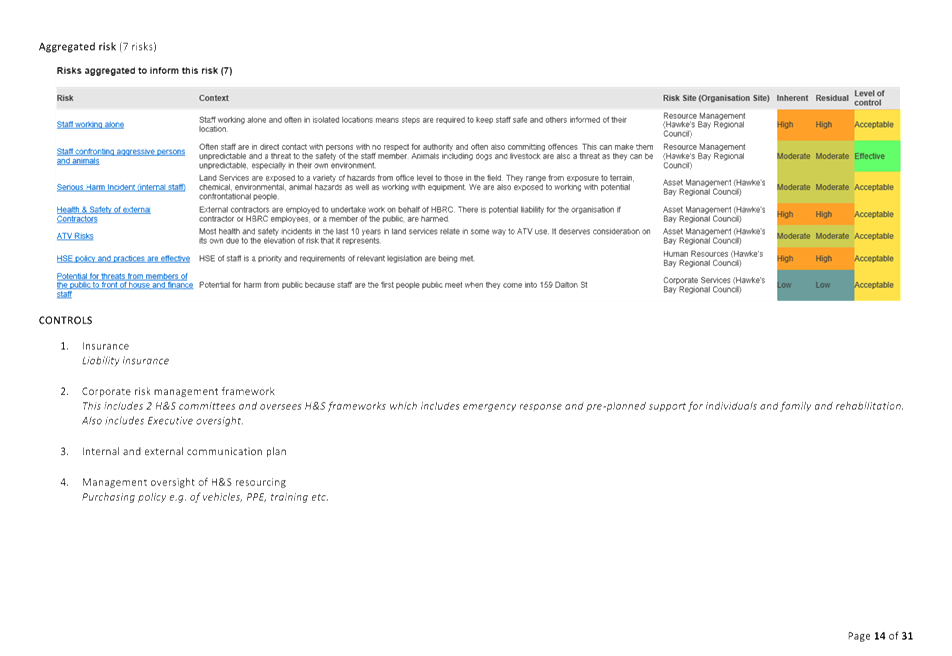

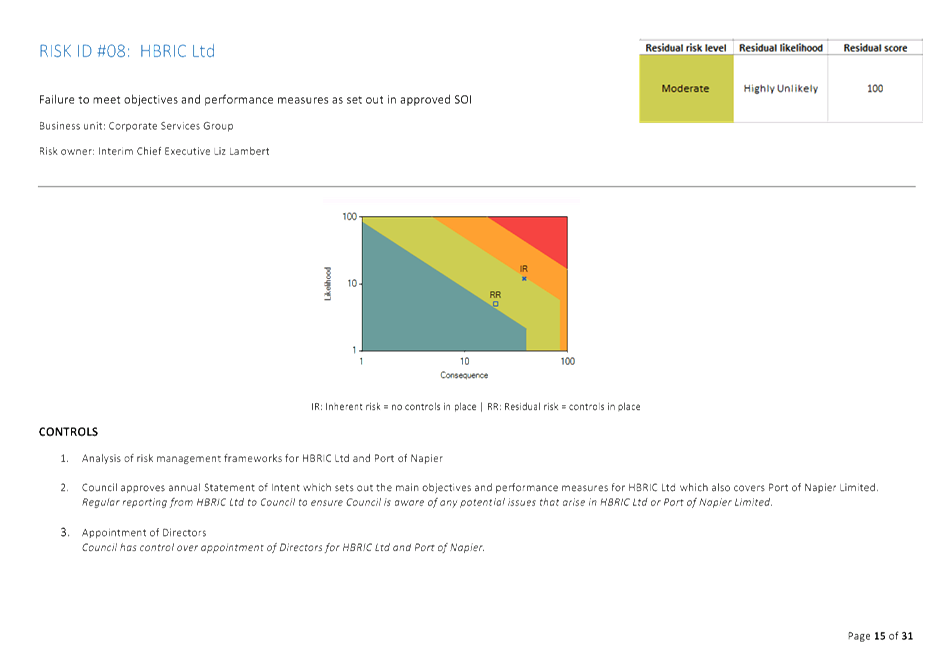

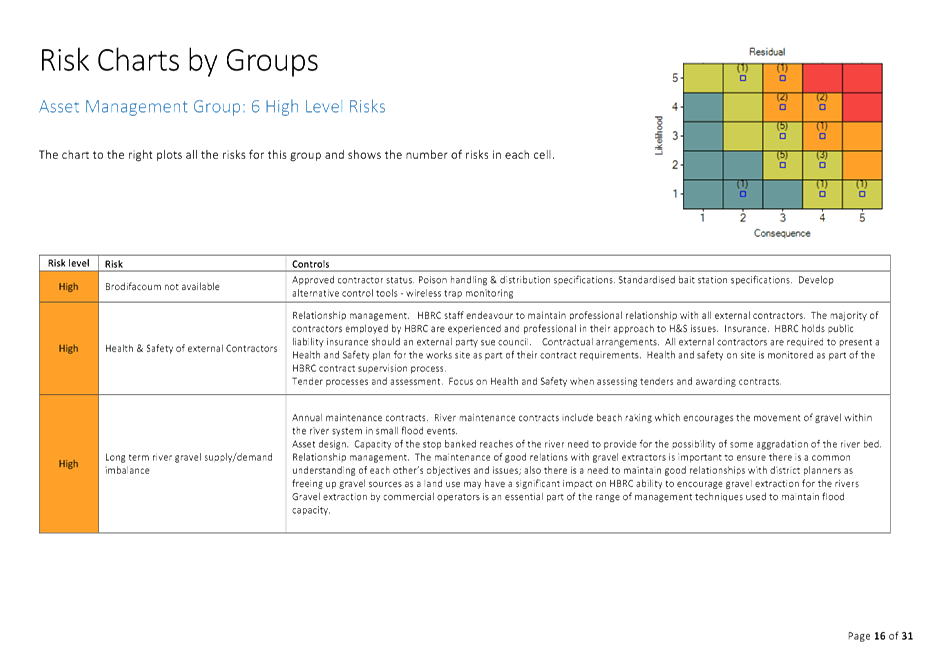

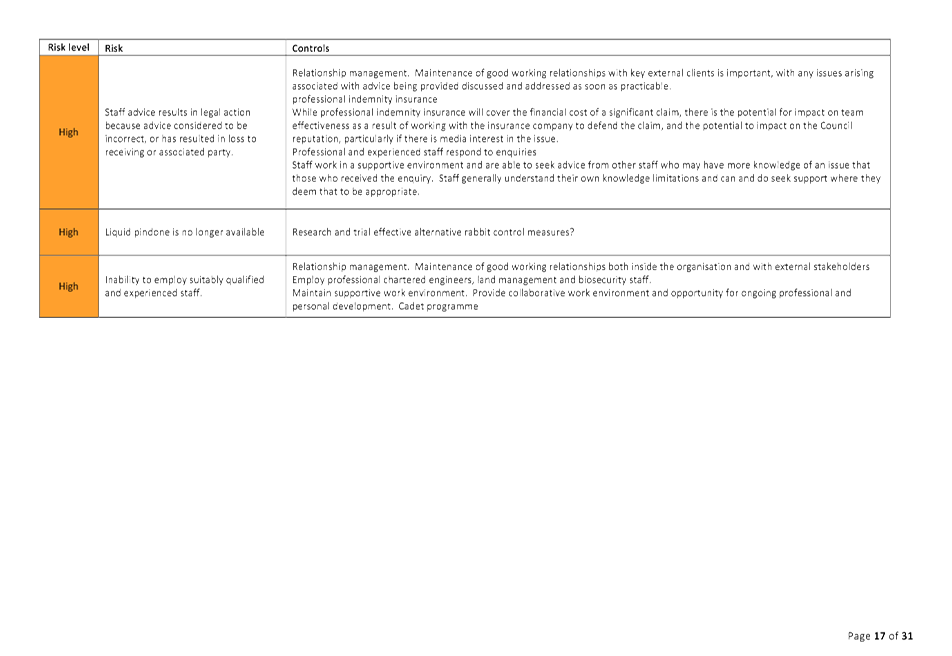

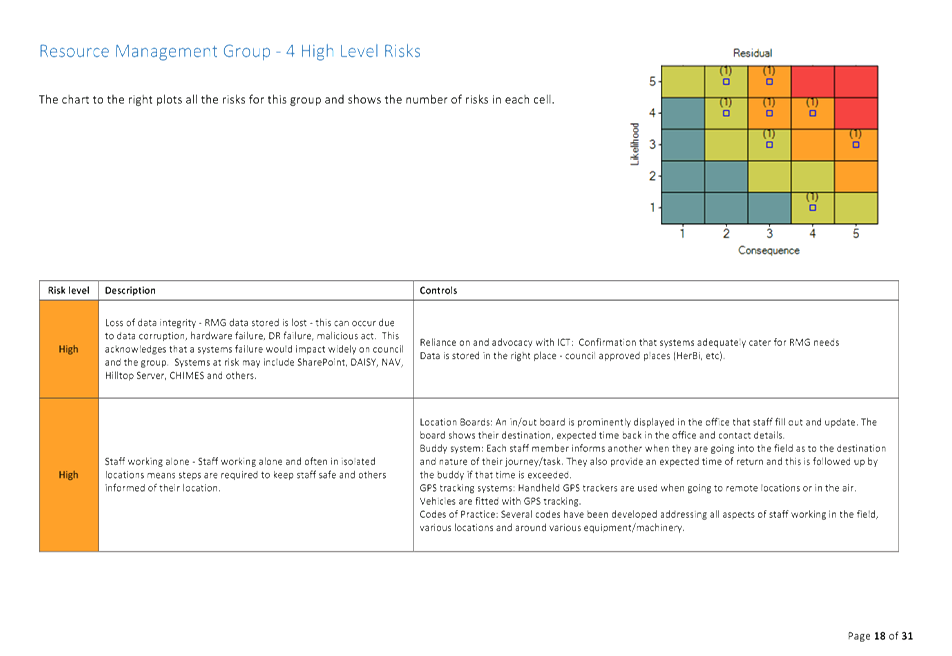

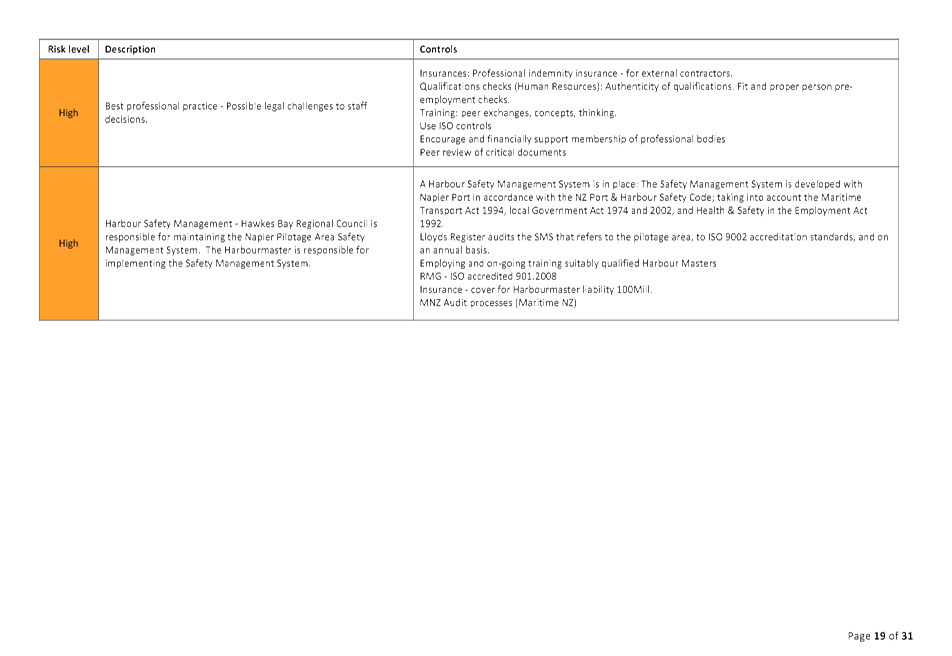

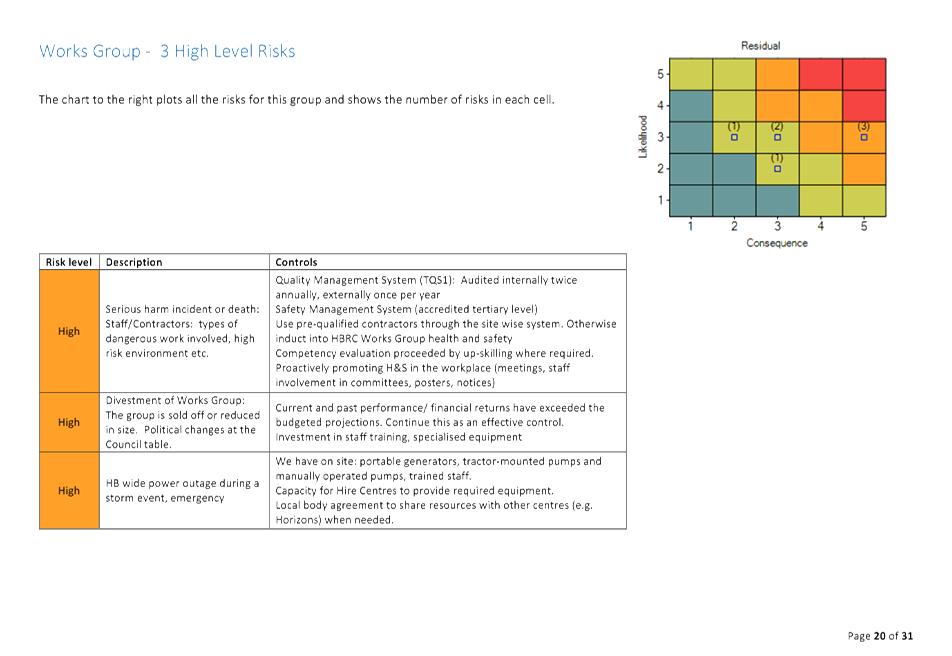

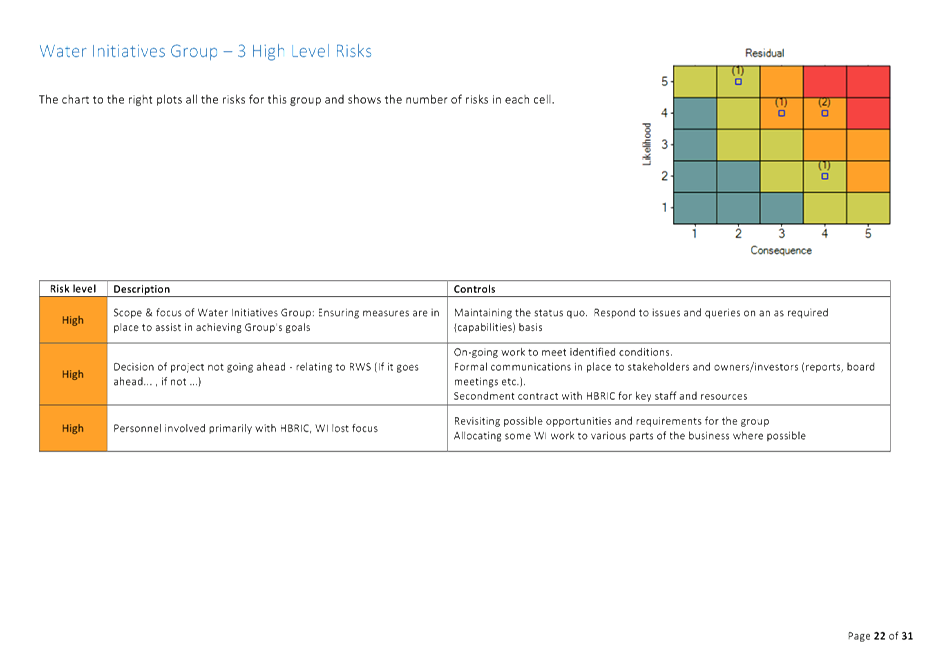

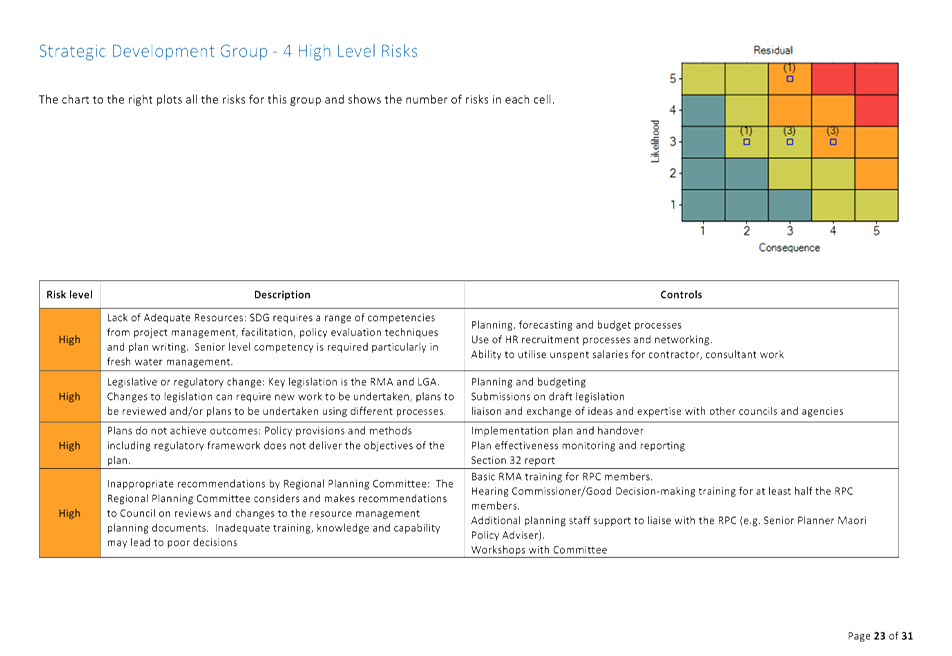

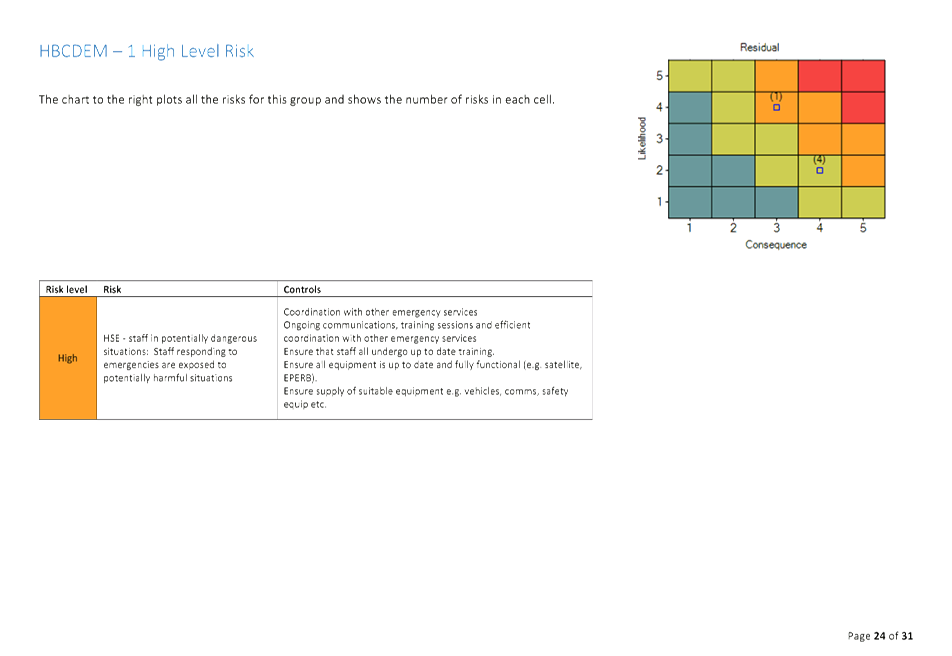

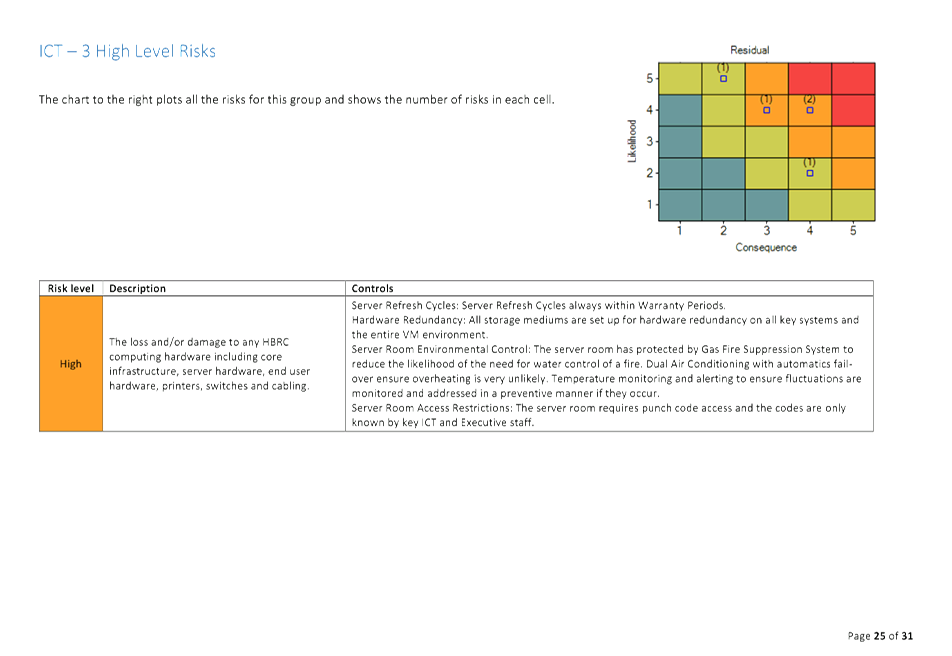

Subject: Six Monthly Report on

Risk Assessment and Management

Reason for Report

1. To provide the

Subcommittee with the six monthly review of the risks that Council is exposed

to and the mitigation actions in place to manage Council’s risk profile.

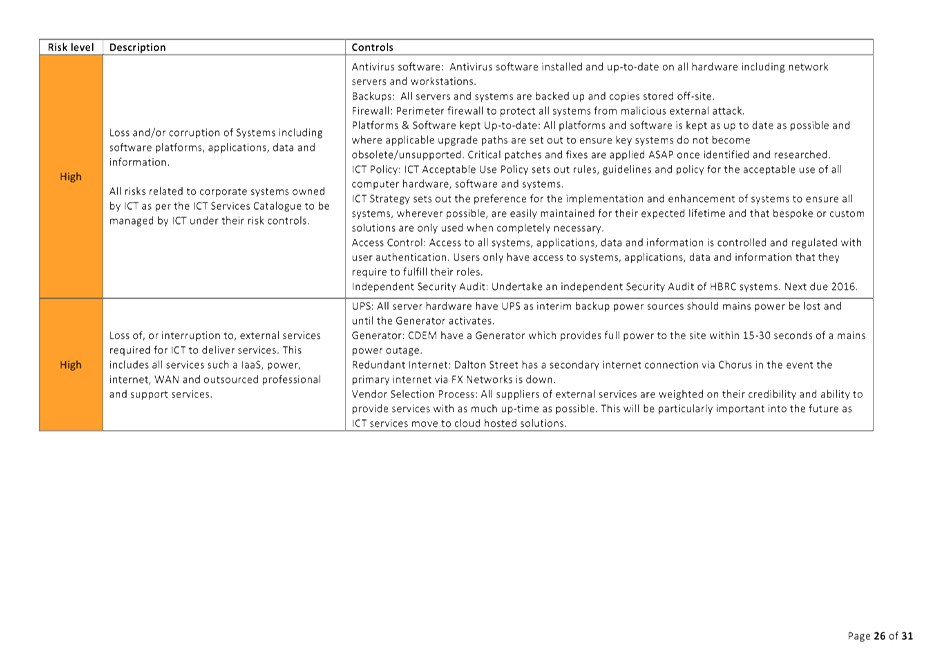

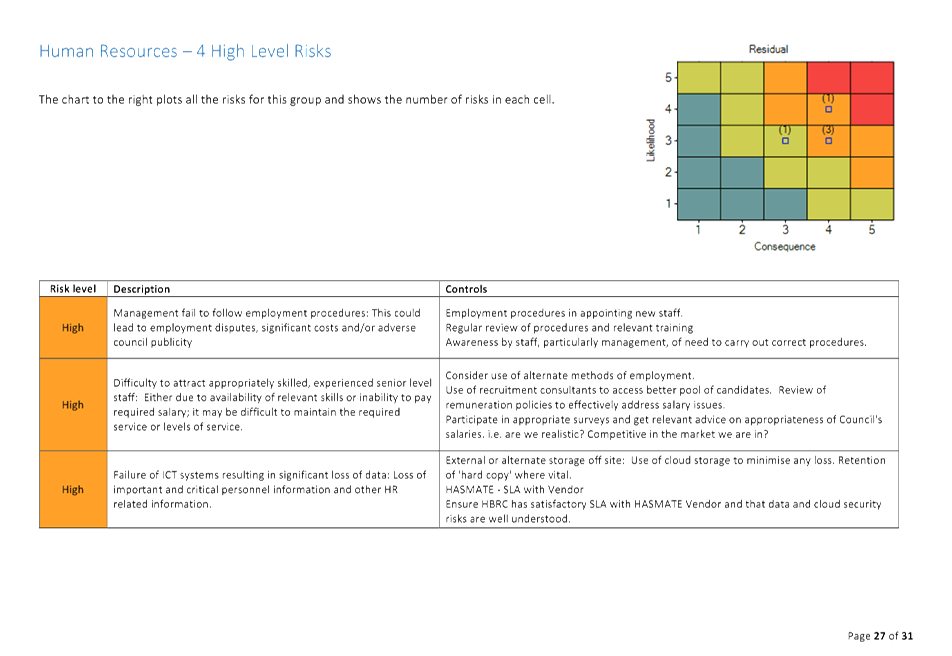

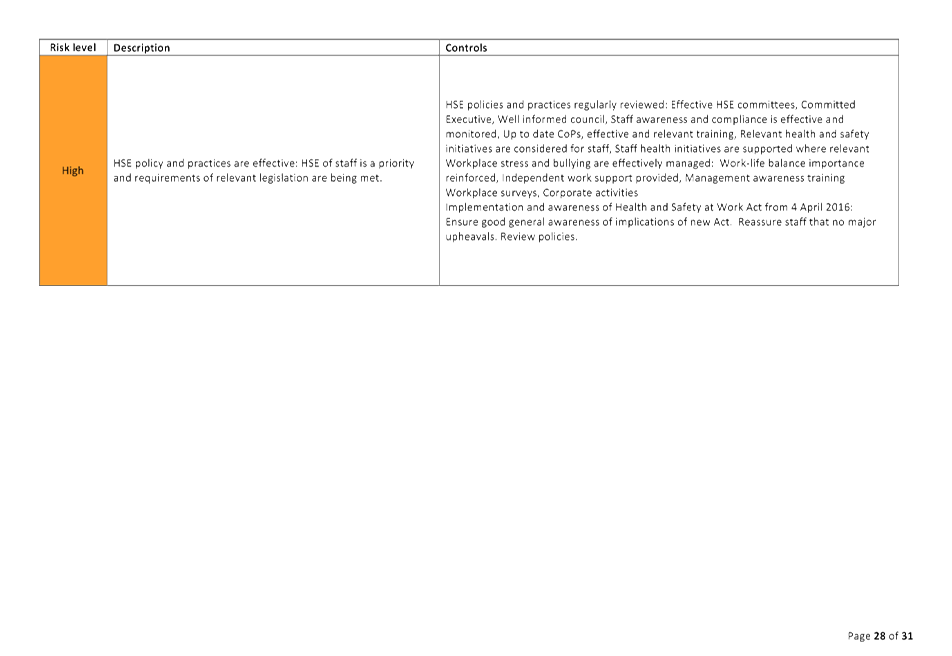

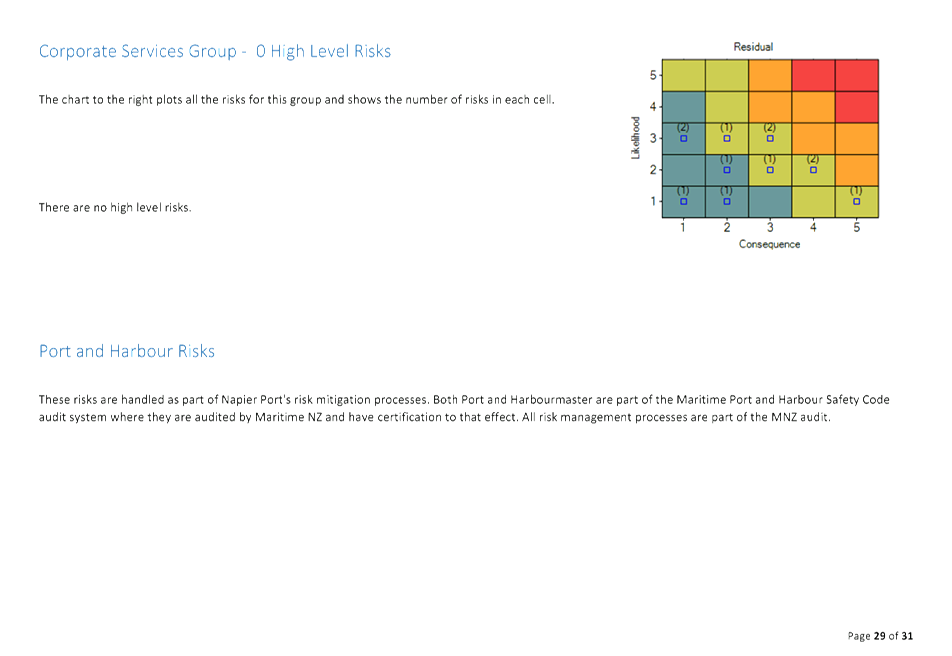

Comment

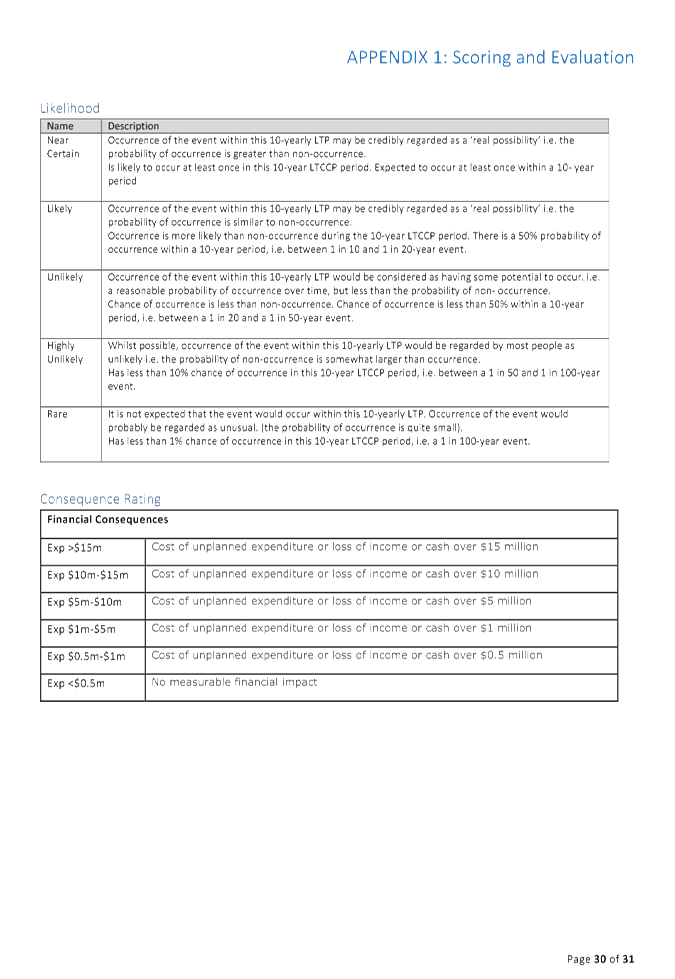

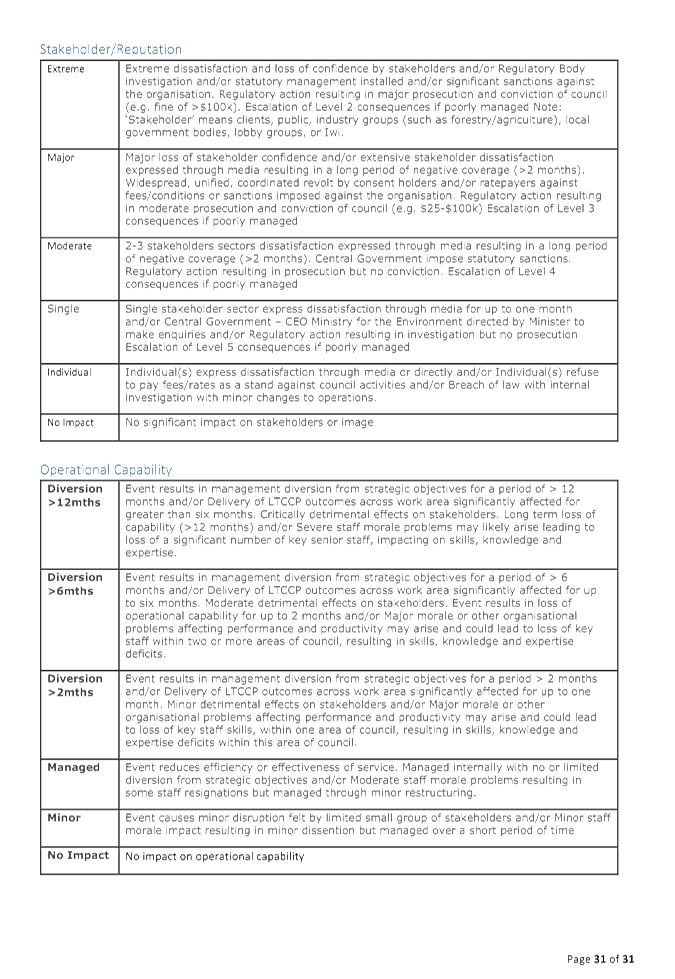

2. At its meeting

on 11 February 2016, the Subcommittee adopted the Hawke’s Bay Regional

Council (HBRC) Risk Management Policy and HBRC Risk Management Framework. These

documents drive the approach taken to risk assessment and management through

the use of the “Quantate” model.

3. This model is

updated every six months and all management staff are involved in reviewing the

risks and mitigation actions in place for their area of the business.

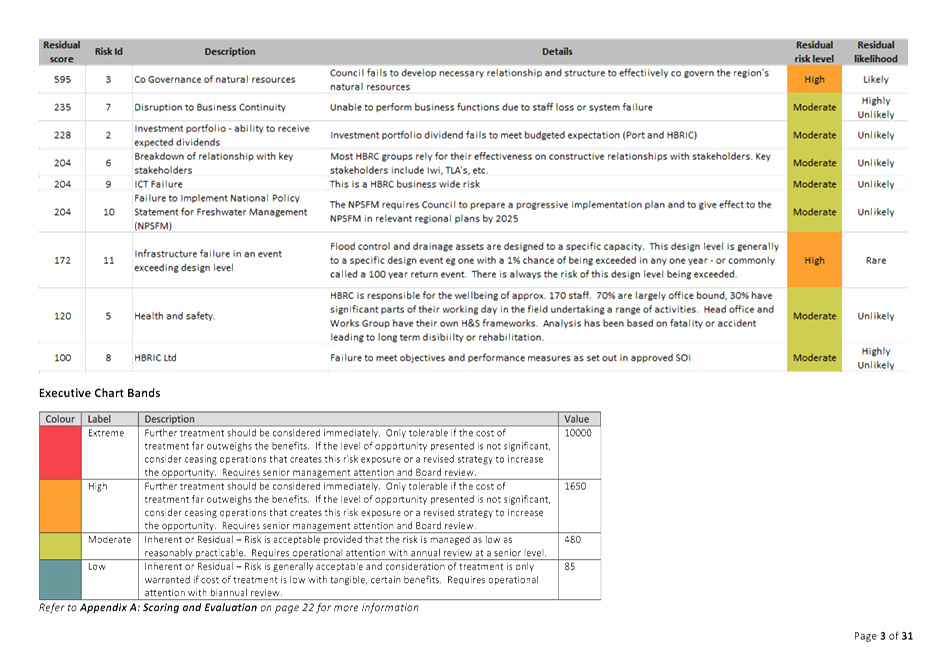

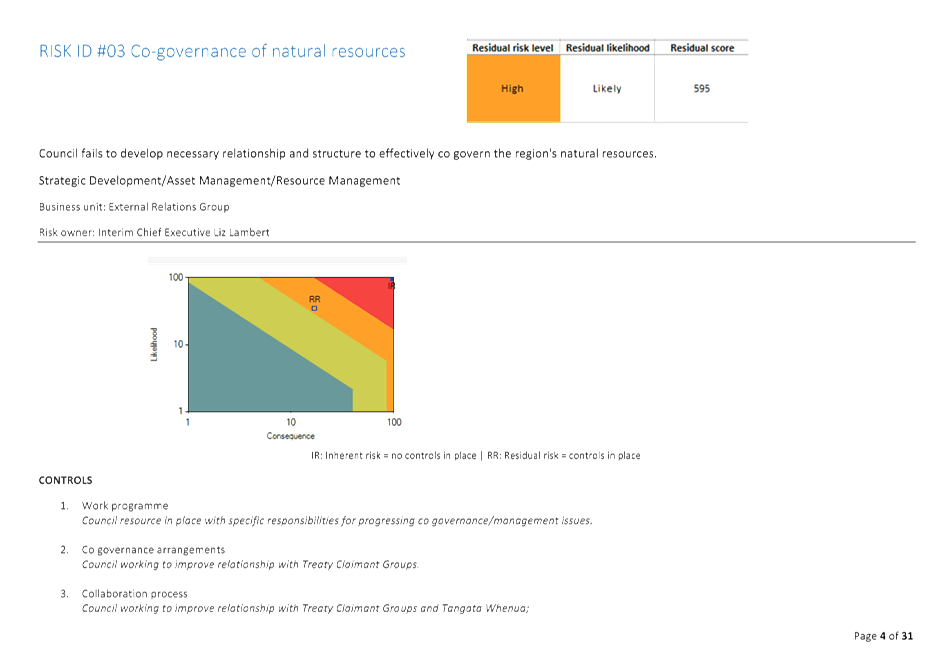

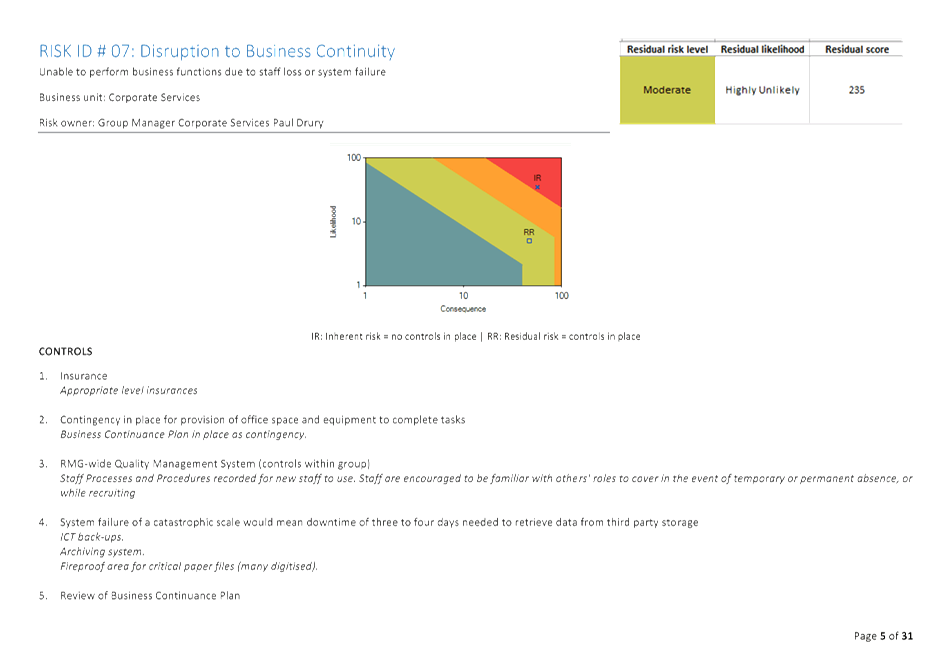

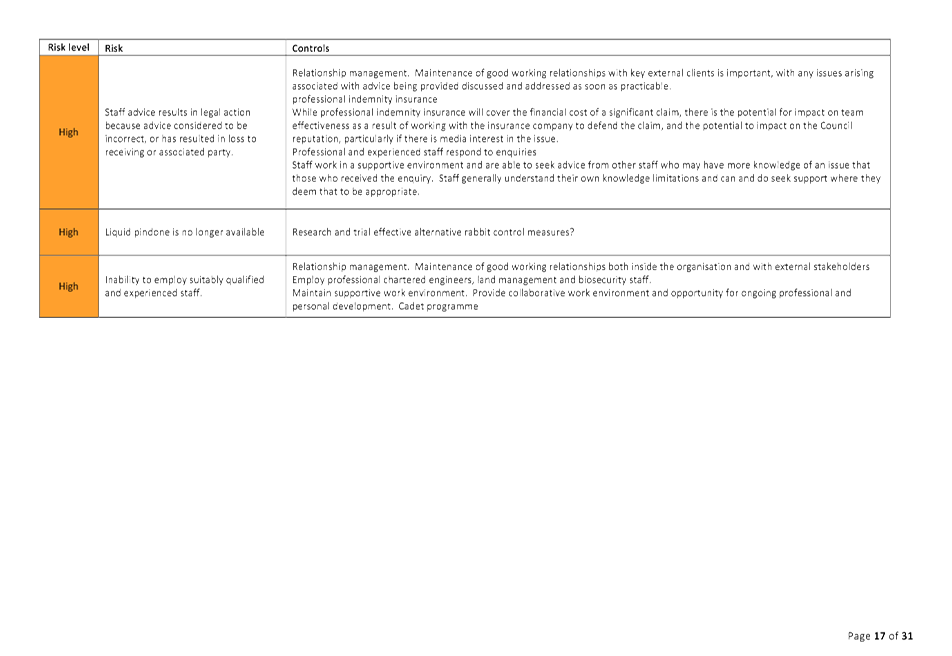

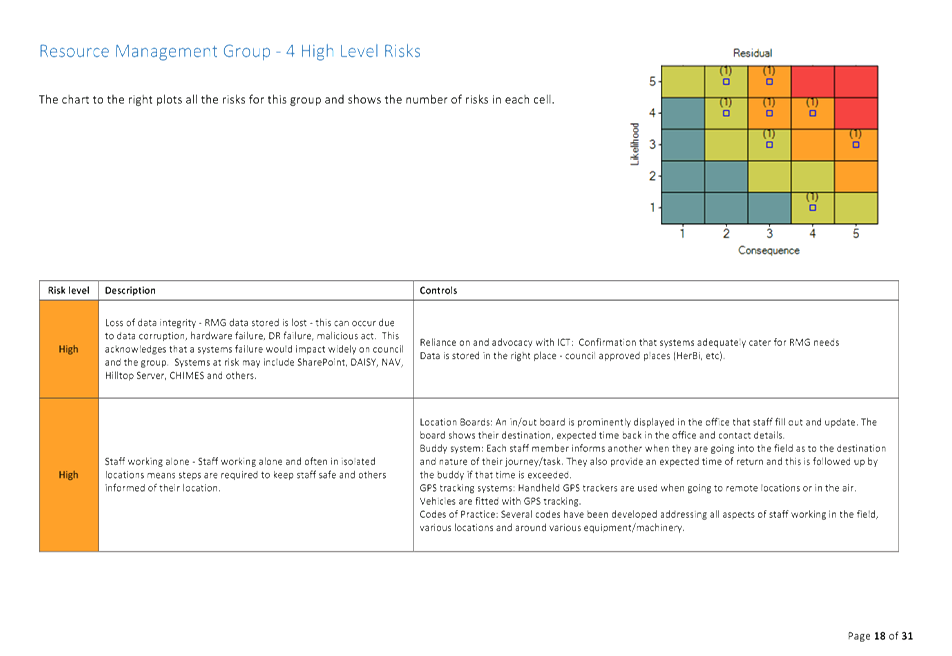

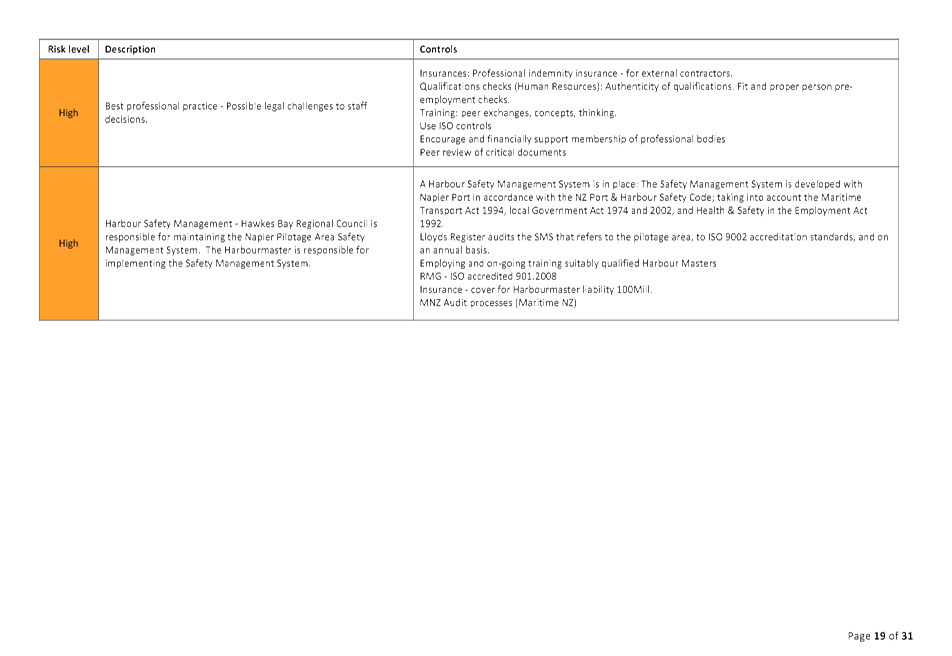

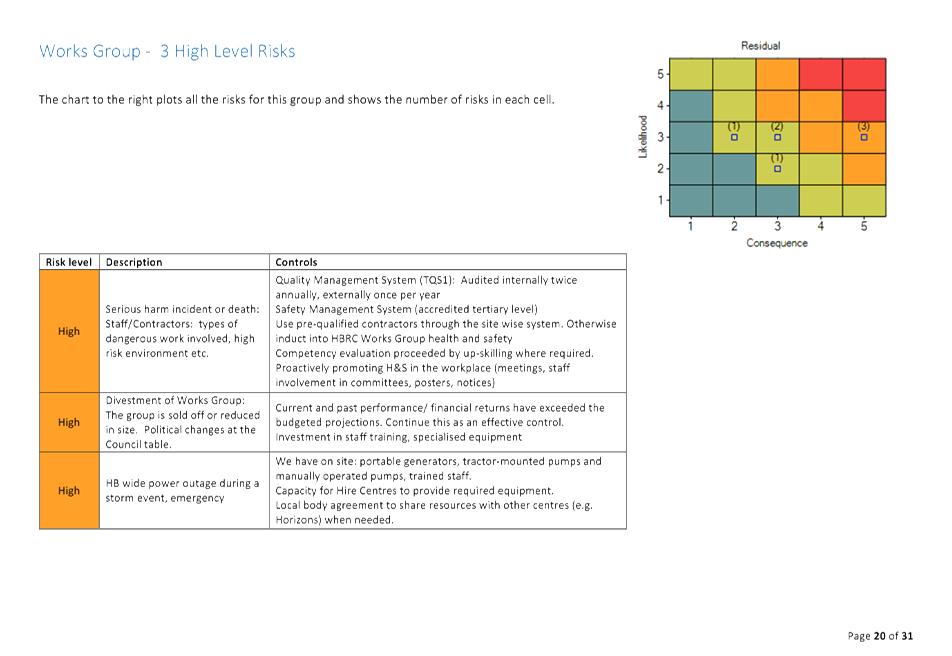

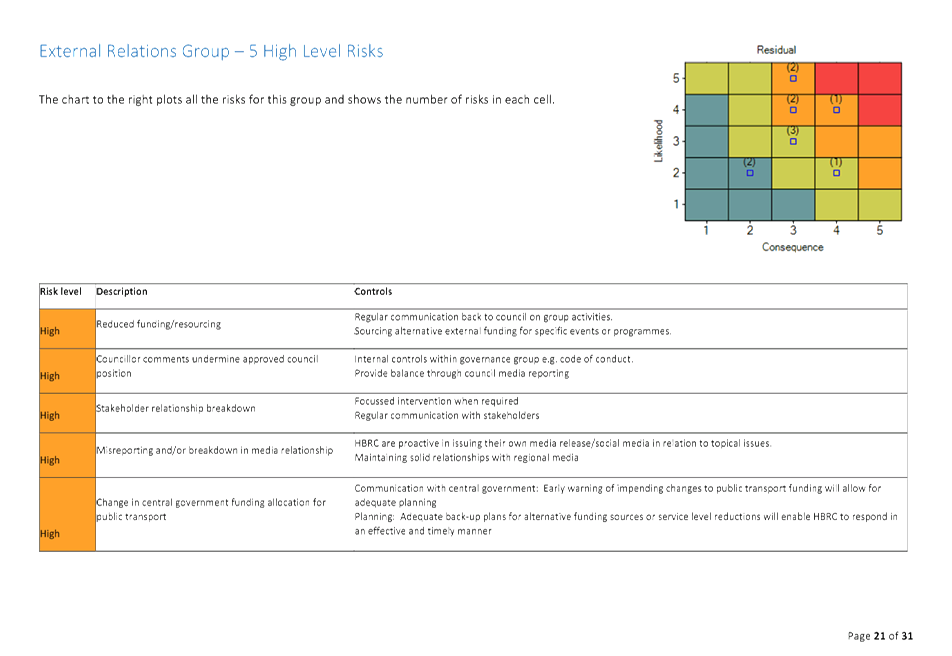

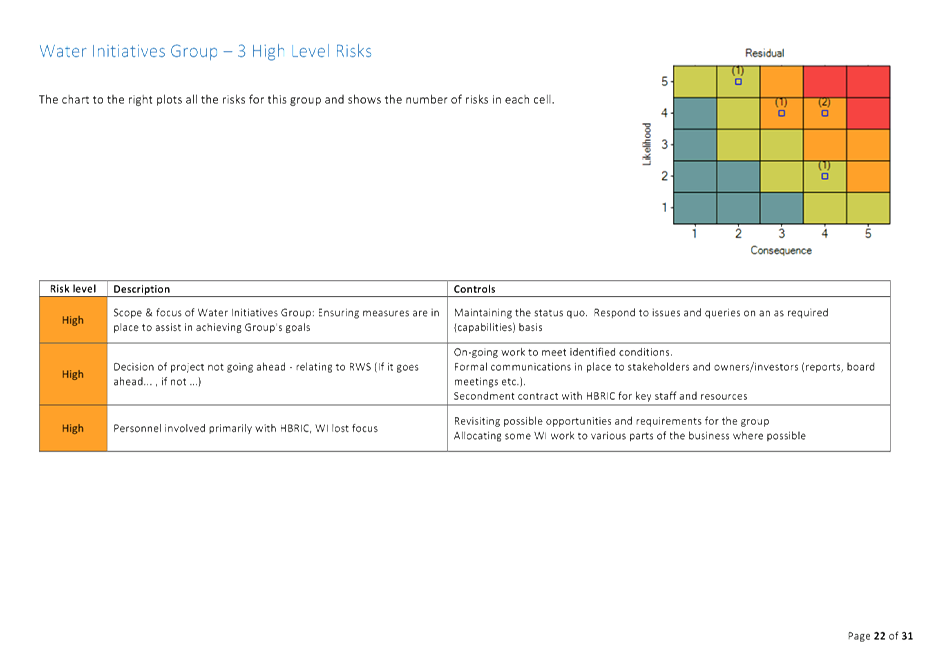

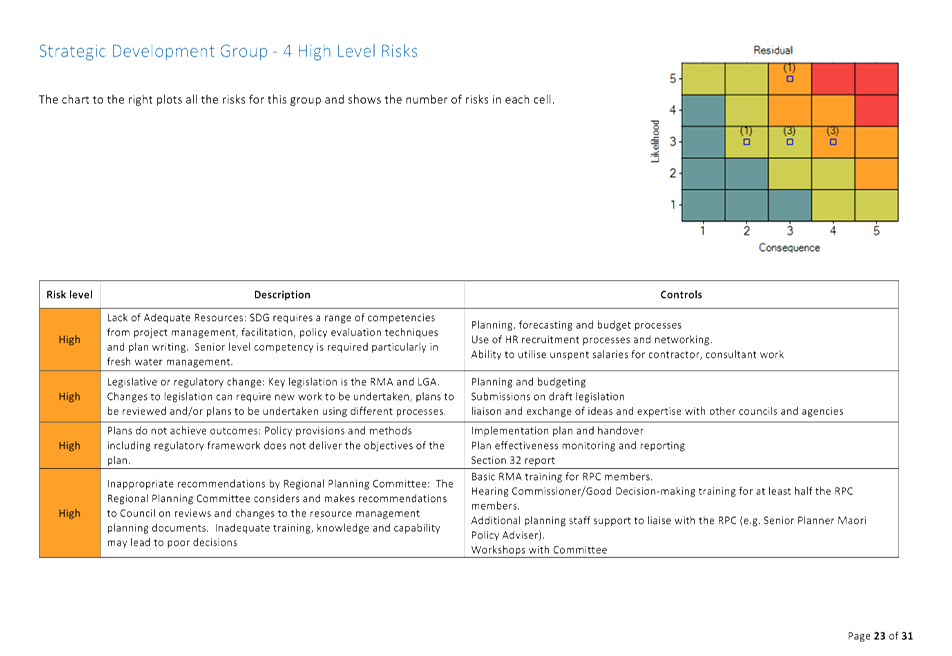

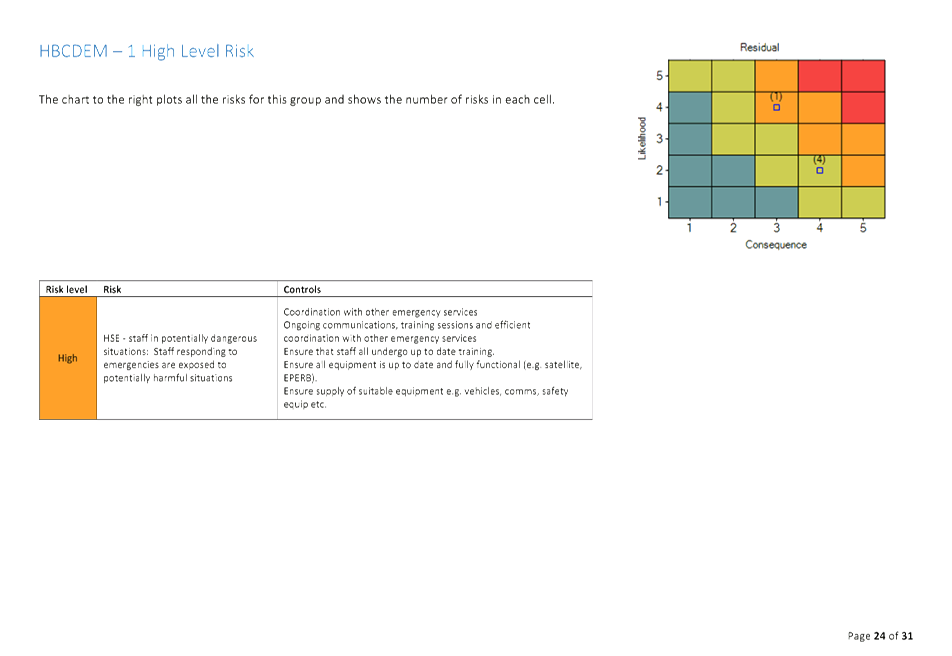

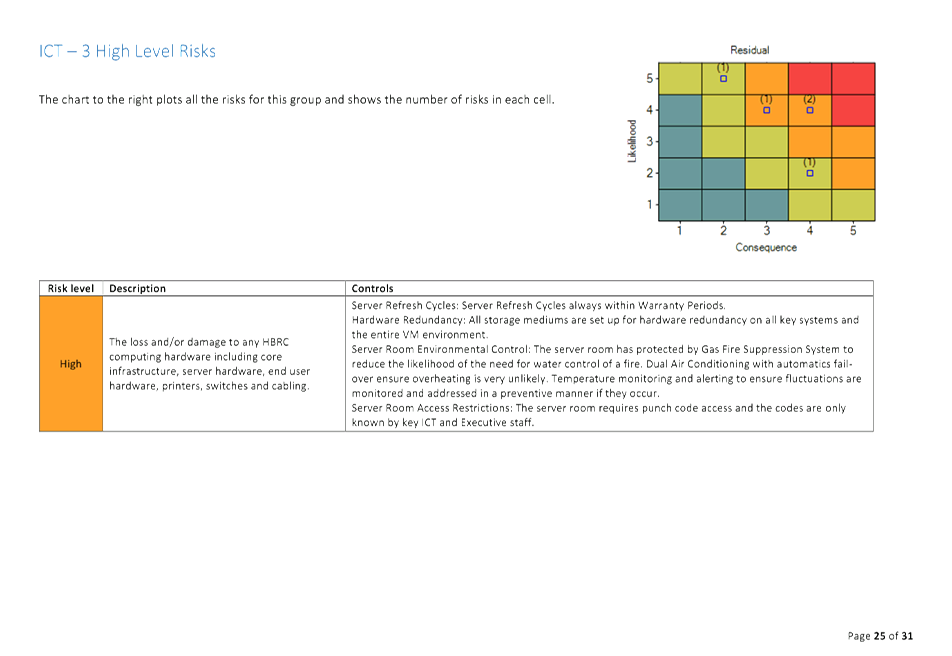

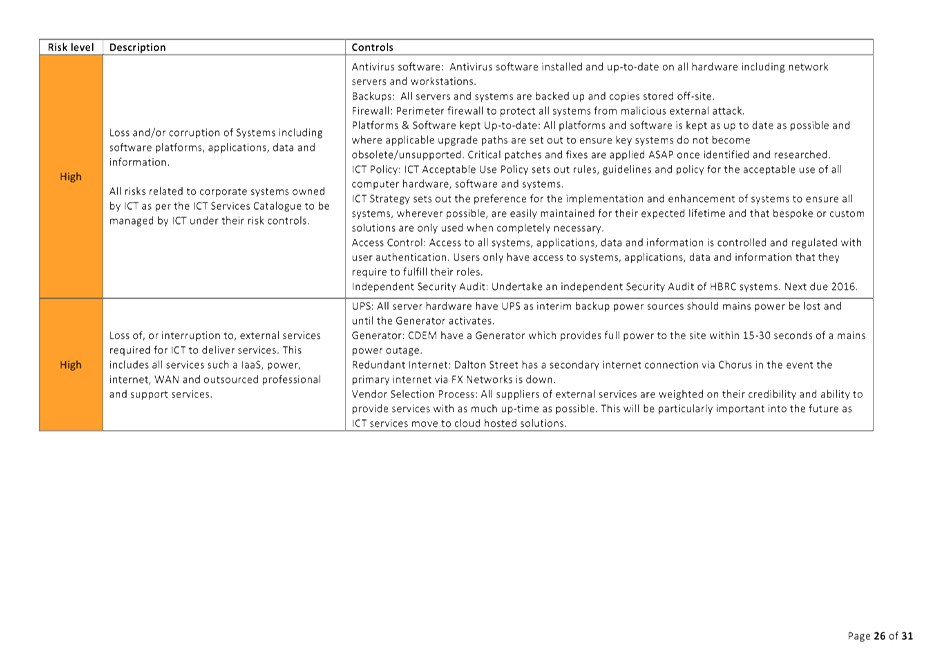

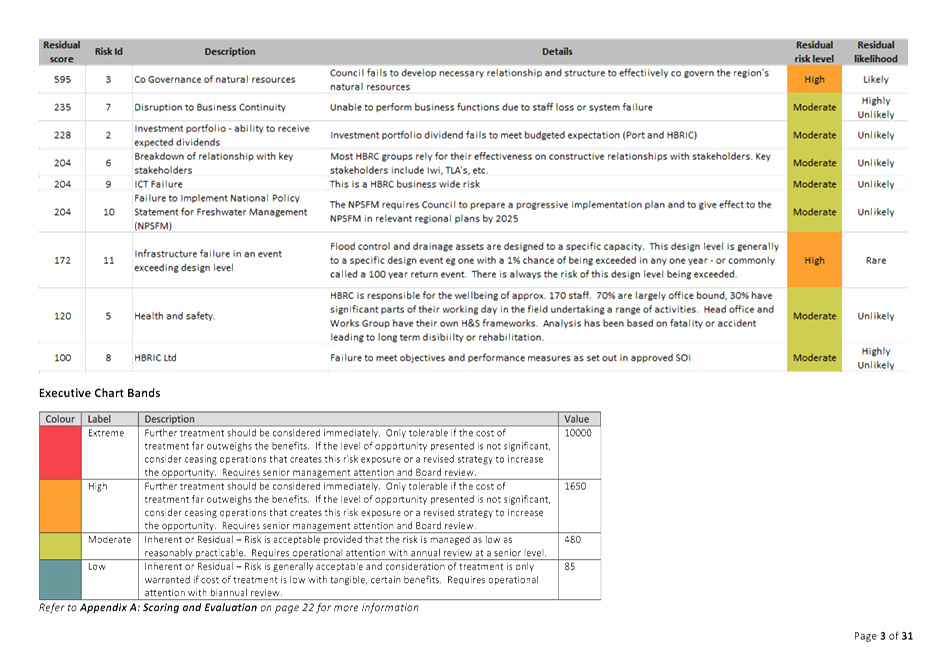

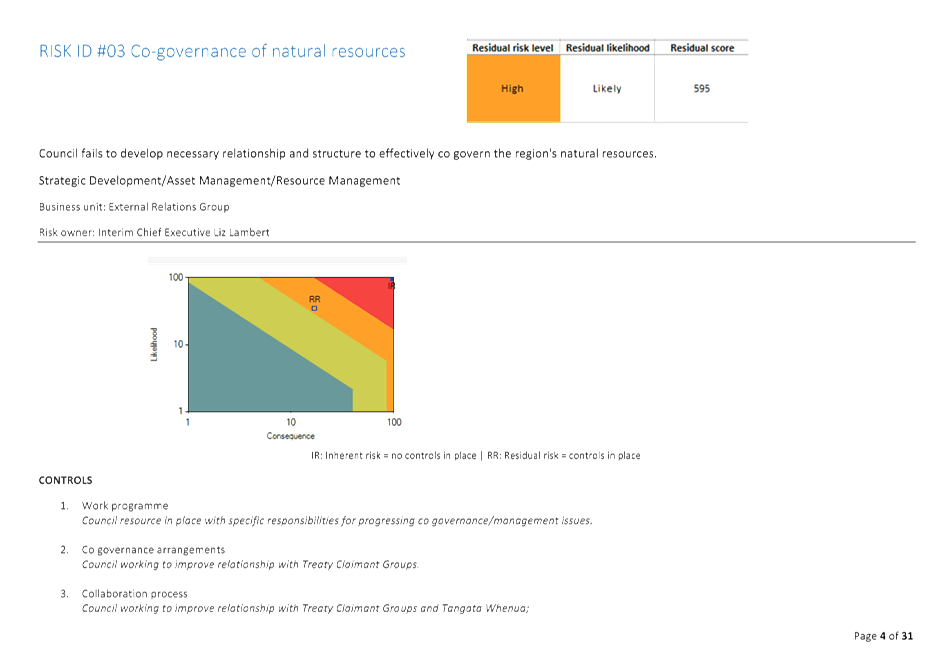

4. The six monthly

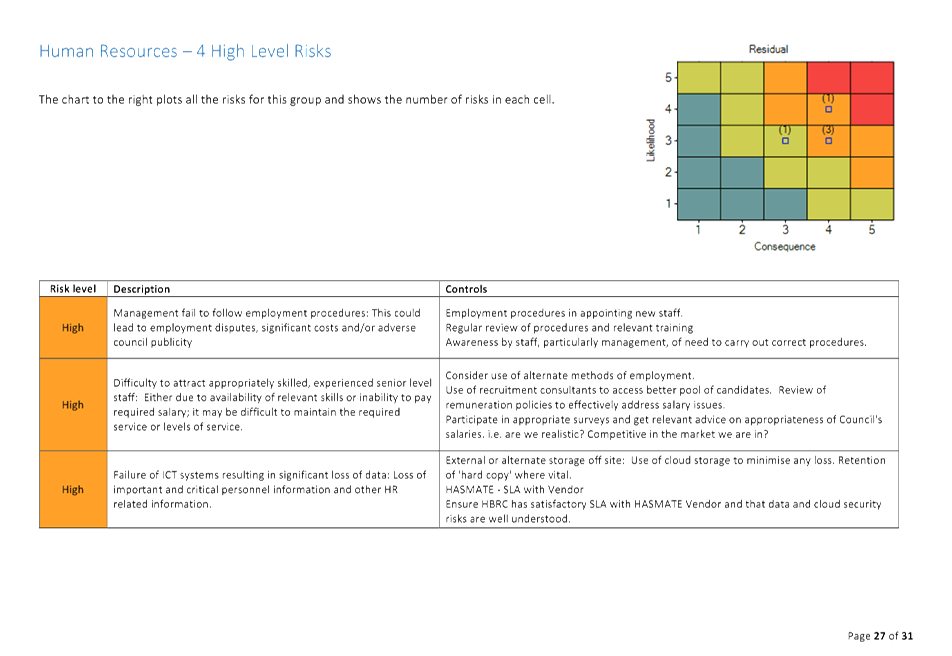

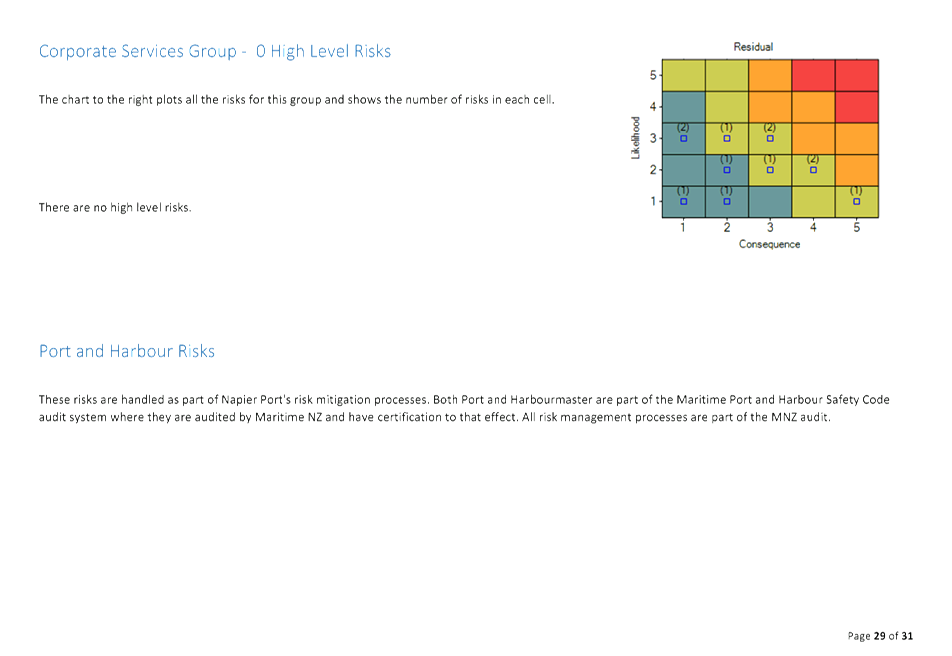

report is appended to this paper as Attachment 1. The main

emphasis of this paper is the strategic risks for Council and details are

provided for the mitigation actions currently in place to control such

risks. All other risks are shown for each management group within

Council, and the presentation to show this assessment is a colour pictorial

chart. Executive managers will be at this meeting to answer questions in

relation to the risks within their area of Council’s business.

Decision Making

Process

5. Council is required to make every decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements contained in Part 6 Sub Part 1 of the Act in relation

to this item and have concluded the following:

5.1. The decision does not significantly alter the service provision or

affect a strategic asset.

5.2. The use of the special consultative procedure is not prescribed by

legislation.

5.3. The persons

potentially affected by this decision are staff or persons in the community

that rely on Council services.

5.4. Options for Council in regard to this paper are to defer or not

consider risks that this Council is exposed to. This paper adopts the

option of Council reviewing the risk profile.

5.5. The decision is not inconsistent with an existing policy or plan.

5.6. Given the nature and significance of the issue to be considered and

decided, and also the persons likely to be affected by, or have an interest in

the decisions made, Council can exercise its discretion and make a decision

without consulting directly with the community or others having an

interest in the decision.

|

Recommendations

1. That the Finance Audit and Risk Subcommittee:

1.1 Considers

and receives the “HBRC Risk Assessment and Management Report”.

1.2 Advises

staff of specific risks where it believes the current level of risk is

unacceptable to Council, and request that staff report back to the

Subcommittee with options and associated resources required to modify the

risk profile.

2. That the Finance Audit and Risk Subcommittee recommends to the

Corporate and Strategic Committee that it:

2.1 Agrees

the decisions to be made are not significant under the criteria contained in

Council’s adopted Significance and Engagement Policy, and that Council

can exercise its discretion and make decisions on this issue without

conferring directly with the community.

2.2 Confirms

the Subcommittee’s confidence that the risk assessment process outlined

in the HBRC Risk Assessment and Management Report is an appropriate process

to identify and assess organisational risks.

|

|

Mike Adye

Group Manager

Asset Management

|

Paul Drury

Group Manager

Corporate Services

|

|

Liz Lambert

Chief Executive

|

|

Attachment/s

|

1

|

HBRC Risk

Management Review April 2016

|

|

|

|

HBRC

Risk Management Review April 2016

|

Attachment 1

|

|

HBRC

Risk Management Review April 2016

|

Attachment 1

|

|

HBRC

Risk Management Review April 2016

|

Attachment 1

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 18 May 2016

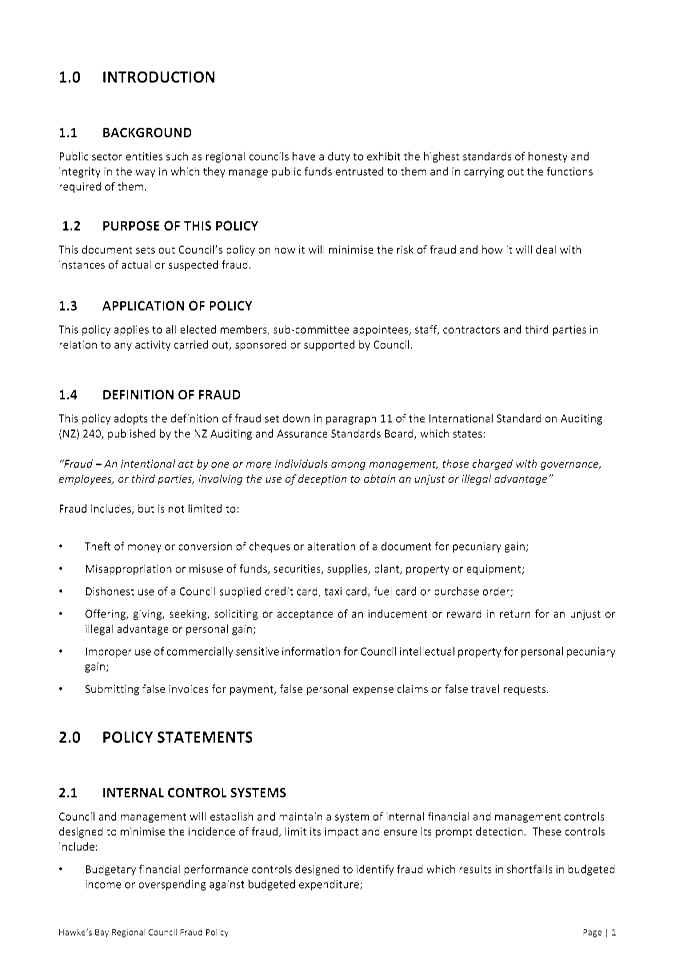

Subject: Fraud Policy

Reason for Report

1. To provide to

the Subcommittee, a copy of the Council’s adopted Fraud Policy which has

been put in place to protect the Council from the risk of fraud.

Comment

2. The Fraud

Policy is appended to this paper as Attachment 1 – this was adopted

by Council in July 2007. Since the time of adoption there have been no

instances of fraud reported in respect to activities undertaken by Council

elected members, staff and contractors etc.

3. The Audit

Office regularly checks that Council has an effective fraud policy and that

staff are aware of this policy. They also verify that frequent audits are

carried out of Council’s activities in relation to the financial internal

controls.

4. While the

external audit does a high level check on these internal control areas on an

annual basis, a more comprehensive audit has recently been undertaken by

Pricewaterhouse Coopers which focussed on financial and internal controls. The

last Pricewaterhouse Coopers audit covering these controls was reported to the

Finance Audit and Risk Sub-committee at its meeting on 3 June 2015.

5. Staff attention

has been drawn to this policy over the years since Council’s approval of

the policy, and a copy of the policy is on Council’s intranet for ease of

access by staff.

Decision Making

Process

6. As this paper is for information only for the Subcommittee, the

decision making process requirements of the Local Government Act 2002 do not

apply.

|

Recommendations

1. That the Finance, Audit and Risk Subcommittee receives and notes

the “Fraud Policy” report as reviewed and previously adopted by

Council.

|

|

Paul Drury

Group Manager

Corporate Services

|

Liz Lambert

Chief Executive

|

Attachment/s

|

1

|

Fraud Policy

- March 2016

|

|

|

|

Fraud

Policy - March 2016

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 18 May 2016

Subject: Business Continuity and

Disaster Recovery Plan Progress Update

Reason for Report

1. To provide the Subcommittee with an update on progress that is being

made on updating of Council’s Business Continuity

& Disaster Recovery Plan.

Comment

2. At its meeting on 11 February 2016 the Subcommittee received a

presentation from Price Waterhouse Coopers (PWC) on their audit of the

Council’s Business Continuity & Disaster

Recovery Plan. The management recommendation provided as part of this

audit acknowledged that the current Business Continuity & Disaster Recovery

Plan needed to be updated and advised that management was in the process of

developing a work plan to carry out this update.

3. A significant amount of work has been carried out to provide this

update, and a number of Council staff have been involved in this process.

Appended to this paper as Attachment 1 is a progress report which

includes a list of the sections of the Business

Continuity & Disaster Recovery Plan, together with details of the status of

updating for each of these sections.

Decision Making

Process

4. As this paper

does not require a decision of the Sub-committee, the provisions of the Local

Government Act 2002 (the Act) in relation to decision making do not apply.

|

Recommendation

1. That the Finance, Audit & Risk Sub-committee

recommends that the Corporate & Strategic Committee receives the progress

report on the updating of Council’s “Business Continuity & Disaster Recovery Plan”.

|

|

Paul Drury

Group Manager

Corporate Services

|

Liz Lambert

Chief Executive

|

Attachment/s

|

1

|

Business

Continuance Plan Review Progress Update

|

|

|

|

Business

Continuance Plan Review Progress Update

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

BUSINESS

CONTINUANCE PLAN (BCP) REVIEW

PROGRESS

UPDATE

From our PwC audit recommendations,

the following work plan has been outlined and is being completed by Jolene

Townshend – Contractor:

1. Review Business

Continuance Plan (BCP) – In progress

Current the BCP

document is being updated to reflect any changes in the business.

This

includes updating all 16 Appendices with the responsible owners.

2. Close off previous

mitigations (from Sept 2013) and establish new mitigations, if any – Completed.

All

mitigation tasks have been reviewed and updated and new mitigations added.

3. Review

Essential Functions and Services - Completed.

A review of

what is considered to be our essential functions and services of the business

has been reviewed by our Group Managers. The following is a reflection of

our essential functions and services for HBRC:

|

Management Functions

|

Information Needs:

|

|

Pollution Response

|

Computer Services

|

|

Marine Oil Spill Response Team

|

Records Management/ Access

|

|

Hydrology Flood Warning

|

Finance (Payroll)

|

|

Harbour Master Function

|

Telemetry

|

|

Duty Management

|

Digital Flood Prediction Computer Models

|

|

Emergency Coordination Centre (Group) &

Emergency Operations Centre (HBRC)

|

|

|

Asset Disaster Assessment

|

Resources

|

|

Manage Contractual Obligations

|

Vehicles / Generator

|

|

Coordinate Recovery incl HR & Health

& Safety

|

Radio Communications

|

|

Communications & Web

|

Telecommunications

|

|

|

Accommodation

|

4. Review ICT Systems

required to deliver essential functions and services – In progress

Each group

is to review our current catalogue of ICT systems, identify which systems are

required to continue operating essential functions

and services during and following an “interruption". And/or

how long they could manage without these. Also identify what they would

use as a back-up plan. This will allow ICT to establish a prioritised

disaster recovery plan based on business needs.

5. Create

simulation events – a schedule of exercises – In progress

Working with Group leaders to establish simulation exercises we

could conduct to test staff and our BCP.

6. Create BCP

Policy – In progress

We are creating an overarching policy that identifies the

BCP, the role staff should take and also a list of potential simulations that

could follow.

7. Communications

and Training – Next Steps

Promote awareness through adding a button on our intranet homepage

to ‘BCP page’ which has links to the plan and the policy and

general information about BCP.

Ask Managers to engage with their staff to promote awareness.

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 18 May 2016

Subject: HBRC Staff Conflict of

Interest Policy

Reason for Report

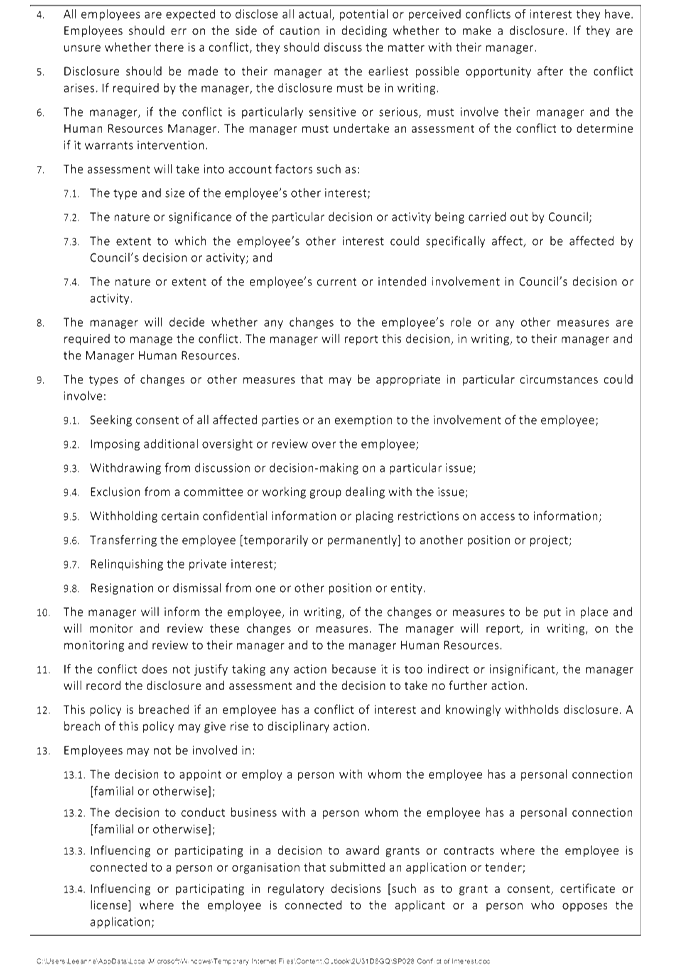

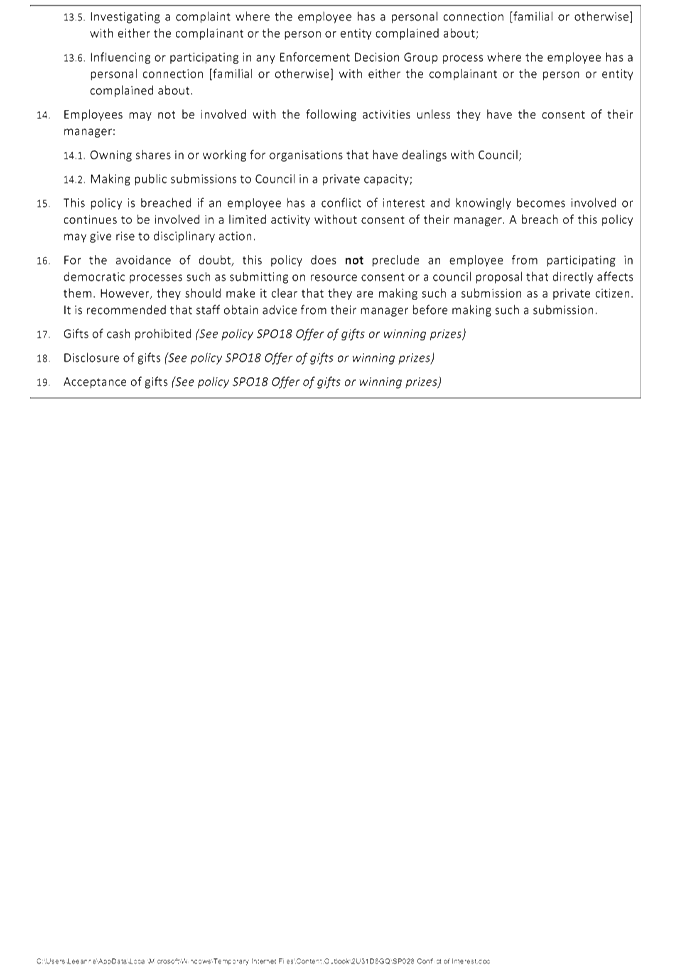

1. The Conflict of

Interest Staff Policy is attached to this agenda as Attachment 1. The policy is

one of a suite of staff policies that have been prepared and regularly reviewed

by the Executive.

2. The policy was

reviewed in February 2016.

3. Should the Committee advise that it wishes to see additional matters

covered by the policy, the Executive will review it accordingly and bring the

policy back to the next sub-committee meeting.

Decision Making

Process

4. As this paper

does not require a decision of the Subcommittee, the provisions of the Local

Government Act 2002 (the Act) in relation to decision making do not apply.

|

Recommendation

1. That the Finance,

Audit and Risk Sub-committee receives and considers the “Conflicts of

Interest Staff Policy” report.

|

|

Liz Lambert

Chief Executive

|

|

Attachment/s

|

1

|

Staff

Conflict of Interest Policy

|

|

|

|

Staff

Conflict of Interest Policy

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 18 May 2016

Subject: 2016 Sub-committee Work

Programme

Reason for Report

1. In order to ensure the sub-committee’s ability to effectively

and efficiently fulfill its role and responsibilities, an overall suggested

work programme is provided following.

|

Task

|

Item

|

Scheduled / Status

|

|

Internal Audits

|

Processes,

policies and procedures around stakeholder communications and relationship

management (from risk register)

|

2016-17

financial year

|

|

|

Fraud

prevention and detection (from risk register)

|

2016-17

financial year

|

|

|

Capturing

and managing general and procurement related Conflicts of Interest

|

· Staff policy to be presented at18 May

FA&R meeting

· Interests Register for Executive staff

initiated

· Policy on how potential conflicts will be

managed or mitigated being developed for addition to the Register of

Interests for Elected Representatives alongside the Policy on what Elected

Representatives must declare on the Register of Interests being developed

|

|

|

Cyber

security, including future proofing IT systems and IT general computer

systems control

|

Approved

17Feb16, to be reported back to FA&R 18May16

|

|

|

Rating

system – processes involved in striking the rate

|

tbc

|

|

|

Health &

Safety compliance with policies and procedures

|

tbc

|

|

|

Stakeholder

relationship management and risks in relation to elected representatives, and

how such an audit might be conducted

|

tbc

|

|

|

Staff

development and succession planning

|

tbc

|

|

Risk Assessment & Management

|

Routine (6

monthly) reporting on risks to the FA&R Sub-committee

|

December

FA&R meeting

|

|

|

Review

previous 6-month Risk Assessment to note changes / improvements / areas that

require attention

|

December

FA&R meeting

|

|

|

Sub-committee

carry out detailed review of individual Group’s Risk Management (as

part of the programmed reviews of activities)

|

tbc

|

|

Insurance

|

Council’s

proposed 2016-17 Insurance programme

|

FA&R

18May16

|

|

Annual Report

|

Adoption of

Audit report 20 September for recommendation to Council

|

Auditor

scheduled to attend September FA&R meeting

|

Decision Making Process

2. As this report

is for information only and no decision is to be made, the decision making

provisions of the Local Government Act 2002 do not apply.

|

Recommendation

1. That the Finance, Audit and Risk

Sub-committee receives and notes the “Sub-committee Work

Programme” report.

|

|

Paul Drury

Group Manager

Corporate Services

|

Liz Lambert

Chief Executive

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 18 May 2016

Subject: Internal Audit Report

– Cyber Security

1. That the Sub-committee excludes the public from

this section of the meeting, being Agenda Item 12 Internal Audit Report –

Cyber Security with the general subject of the item to be considered while the

public is excluded; the reasons for passing the resolution and the specific

grounds under Section 48 (1) of the Local Government Official Information and

Meetings Act 1987 for the passing of this resolution being:

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR THE

PASSING OF THE RESOLUTION

|

|

Internal Audit Report – Cyber Security

|

7(2)(b)(i) That the public conduct of this agenda item

would be likely to result in the disclosure of information where the

withholding of the information is necessary to ensure a trade secret is not

disclosed.

7(2)(j) That the public conduct of this agenda item would

be likely to result in the disclosure of information where the withholding of

the information is necessary to prevent the disclosure or use of official

information for improper gain or improper advantage.

|

The Council is specified, in the First Schedule to this

Act, as a body to which the Act applies.

|

2. That John Dixon and Sophie Hay from

Pricewaterhouse Coopers attend the public excluded part of the meeting to

present their audit report on Cyber Security.

|

Paul Drury

Group Manager

Corporate Services

|

Liz Lambert

Chief Executive

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 18 May 2016

Subject: Proposed Council

Insurance Programme for 2016-17

1.

That the Sub-committee

excludes the public from this section of the meeting, being Agenda Item 13

Proposed Council Insurance Programme for 2016-17 with the general subject of

the item to be considered while the public is excluded; the reasons for passing

the resolution and the specific grounds under Section 48 (1) of the Local Government

Official Information and Meetings Act 1987 for the passing of this resolution

being:

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1) FOR THE

PASSING OF THE RESOLUTION

|

|

Proposed Council Insurance Programme for 2016-17

|

7(2)(i) That the public conduct of this agenda item would

be likely to result in the disclosure of information where the withholding of

the information is necessary to enable the local authority holding the

information to carry out, without prejudice or disadvantage, negotiations

(including commercial and industrial negotiations).

|

The Council is specified, in the First Schedule to this

Act, as a body to which the Act applies.

|

2.

That Matthew Meachen from Jardine Lloyd Thompson

attends the public excluded section of this meeting to present his paper on

insurance matters.

|

Trudy Kilkolly

Financial Accountant

|

Mike Adye

Group Manager

Asset Management

|

|

Paul Drury

Group Manager

Corporate Services

|

Liz Lambert

Chief Executive

|