|

Risk

Management Framework

Adopted

17 February 2016

The risk

management control system encompasses a number of elements that together

facilitate an effective and efficient risk assessment, enabling HBRC to

consider a variety of strategic, operational, financial, and commercial

risks. These elements include:

a. Policies

and procedures

Many of

the organisational risks are managed through policies and plans adopted by

the Council. These include Regional Plans developed according to

relevant legislation, their associated implementation plans, and policies or

protocols specific to a particular issue. The policies adopted by Council are

implemented and communicated through the Chief Executive to staff.

Written procedures support the policies were appropriate.

b. Reporting

Comprehensive

reporting is designed to communicate the monitoring of key risks and their

controls. Decisions to rectify problems are generally made by staff,

but may be at the direction of Council where a significant potential risk is

identified.

c.

Annual and 10 year planning and budgeting.

The

annual and 10 year planning and budgeting processes are used to set

objectives, a performance framework through which to monitor progress towards

achieving those objectives, develop and communicate work programmes, and

allocate resources. A number of the work programmes are designed

specifically to mitigate strategic risks. Progress towards meeting

annual and 10 year plan objectives is monitored regularly.

d. Risk

management framework

This

framework helps to facilitate the identification, assessment and ongoing monitoring

of risks to which HBRC is exposed. The framework is formally reviewed

in accordance with the timelines set out in Table 1 below, with all existing

risks reviewed and new and emerging risks added.

e.

Risk review programme.

The risk

review programme is an important element of the risk management

process. Apart from its normal programme of work, each member of the

executive management team is responsible for the review of the effectiveness

of the risk management framework within HBRC as set out in Table 1.

Table 1: Risk Management Allocation

|

Responsible Group

|

Decisions areas

|

Frequency

of review/reporting

|

|

Council

(through Finance, Audit and Risk Sub Committee)

|

·

Organisation

risk profile

·

Top

10 residual risks

·

Top

10 controls

·

Significant

new or emerging risks

·

Governance

risks

|

Six

months

Six

months

Six

months

As

they arise

Six

months

|

|

Chief

Executive (together with Exec Managers)

|

· Review

and monitoring Organisational risks including controls

· New

and emerging risks reporting to Council

|

6

monthly

As

they arise

|

|

Group

Managers (together with 3rd tier managers)

|

·

Review

and monitoring of:

- Risks

associated with Group’s risks including controls

- New

and emerging risks within group

|

6

monthly

As

they arise

|

|

Staff

|

· Effective

management of operational risks through implementation of controls

· Reporting

new or emerging risks as they arise

|

Ongoing

As

they arise

|

f.

Internal audit.

An

internal review of risks may be requested by Council or commissioned by the

Chief Executive from time to time as they deem appropriate. Such an

external review may cover the risk framework and all of the risks to which

HBRC is exposed, or may be restricted to specific risks or aspects of

risk. This internal audit function may be contracted to an external

provider.

g. Audit of

HBRC’s Long Term Plans and Annual Plans

These

audits are carried out by Audit NZ on behalf of the Controller and Auditor

General.

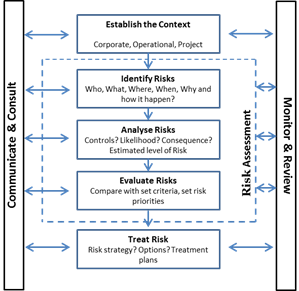

Risk

management is a continual process and is conducted across the Council’s

operations. Staff should continually apply this process when making business

decisions and in day to day management.

The key

process steps within the Council’s risk management procedures are:

1. Communicate

2. Establish

the context

3. Identify

risks

4. Analyse

risks

5. Evaluate

risks

6. Treat

risks

7. Monitor

and review

Table 2: Risk Management Process

Step1: Communicate

and consult

It is

important that Council regularly receives updates on the implementation of

its Risk Management Policy in public. This signals to its external

stakeholders and the general public the key risks that the organisation has

recognised, and what mitigation measures are in place to effectively manage

these risks. I also provides a transparent insight into the level of

risk the organisation recognises associated with individual goals and

objectives.

Public

ratepayers have the opportunity to comment and/or submit on the level of risk

associated with Councils activities through consultation process.

Step 2: Establish

the context

Establishing

the risk management context is a key step in the risk management process.

HBRC

activities involve the management of a range of risks. The range

includes risks with a very low likelihood but very high potential consequence

to the organisation and Hawke’s Bay community. There are also

risks with high likelihood but low consequence. The risk framework is

designed to identify and manage risks with the potential significant

financial, regulatory and operational capability consequences. Day to

day risks are expected to be managed by HBRC staff who have experience and

expertise in the ongoing management of such risks.

Establishing

the risk management context takes into account the goals, objectives,

strategies, scope and sets the parameters of the risk management process.

Step 3: Identify

Risks

Risk

identification is a key step in ensuring all the risks are identified and

listed. The identified risks will determine the “what”,

“why”, and “how” things can happen as a basis for

further analysis. These risks can derive from different sources.

Sources of Risk

Sources

of risk have the potential to create:

·

People

risks e.g. health and safety.

·

Local

government risks e.g. reputation/ image, legislative.

·

Organisational

management risks e.g. loss of service, financial

·

Environmental

risks.

Each

risk identified will be entered into the Council’s risk register by the

Risk Manager.

Step 4: Analyse

Risk

After

risks are identified it is important to adequately describe them. The key to

describing the risks include:

·

What

is the event? (e.g. Negative media publicity)

·

The

cause of the event? (e.g. Breakdown in communication)

·

The

impact of the event. (e.g. Reputational damage which leads to rate

payers/stakeholder dissatisfaction)

Risk

analysis aims at understanding the level of significance of a risk by

assessing its likelihood and consequences and taking into account the

processes and controls to mitigate it.

Inherent

risk level (Gross risk) would exist if the controls did not work as they were

intended. Residual risk level is the leftover risk after applying identified

controls effectively and risk treatment.

The aim

of controls is to reduce risk to an acceptable level, within the

Council’s risk management process. When evaluating the effectiveness of

controls, factors to consider are the consistency of application,

understanding of control content and documentation of the control.

Furthermore, the evaluation of the control process can include:

·

Control

self-assessment

·

Internal

Audit reviewing the effectiveness of controls

·

External

audit reviewing the effectiveness of controls

The

likelihood ratings identify how likely, or often, a particular event is

expected to occur, these are shown in Table 3 below. The descriptors are not

a mandatory category requirement, but act as a guide to assist in ranking the

probability in line with the nature of each risk.

Table 3: Likelihood of occurrence

Name

|

Full

Description

|

|

Almost

Certain

|

Occurrence

of the event within this 10-yearly LTCCP may be credibly regarded as a

‘real possibility’ i.e. the probability of occurrence is

greater than non-occurrence. Documented and frequent incidents.

Is likely to occur more than once in this 10-year LTCCP period.

|

|

Likely

|

Occurrence

of the event within this 10-yearly LTCCP may be credibly regarded as a

‘real possibility’ i.e. the probability of occurrence is

similar to non-occurrence. Documented and regular incidents. Is

likely to occur once in this 10-year LTCCP period.

|

|

Unlikely

|

Occurrence

of the event within this 10-yearly LTCCP would be considered as having some

potential to occur – ie, a reasonable probability of occurrence over time,

but less than the probability of non- occurrence. Documented but

infrequent incidents. Has less than 50% chance of occurrence in this

10-year LTCCP period.

|

|

Highly

Unlikely

|

Whilst

possible, occurrence of the event within this 10-yearly LTCCP would be

regarded by most people as unlikely i.e. the probability of non-occurrence

is somewhat larger than occurrence. Documented but few

incidents. Has less than 10% chance of occurrence in this 10-year

LTCCP period.

|

|

Rare

|

It is

not expected that the event would occur within this 10-yearly LTCCP.

Occurrence of the event would probably be regarded as unusual - (the

probability of occurrence is quite small). Has less than 1% chance of

occurrence in this 10 year LTCCP period.

|

The consequence descriptors in Table 4 indicate the

level of possible consequences for a risk.

Tables 4:

Consequence Rating

|

2.1

Financial Consequences

|

|

Level

1

|

Value

of investment(s) decreases by 30%.Loss of cash flow/income or increase in

unplanned expenditure of $5m over Note: Language to be appropriate

for all sections of council

|

|

Level

2

|

Value

of investment(s) decreases by 20%.Loss of cash flow/income or increase in

unplanned expenditure of $3m over

|

|

Level

3

|

Value

of investment(s) decreases by 10%.Loss of cash flow/income or increase in

unplanned expenditure of $2m over

|

|

Level

4

|

Value

of investment(s) decreases by 5%.Loss of cash flow/income or increase in

unplanned expenditure of $1m over

|

|

Level

5

|

Value

of investment(s) decreases by 3%.Loss of cash flow/income or increase in

unplanned expenditure of $0.5m over

|

|

No

Financial Impact

|

No

measurable financial impact

|

|

2.2

Stakeholder/Reputation

|

|

Level

1

|

Extreme

dissatisfaction and loss of confidence. Central government

investigation and/or statutory management installed. Regulatory

action resulting in major prosecution and conviction of council (eg - fine

of >$100k).Note: ‘Stakeholder’ means clients, public,

industry groups (such as forestry/agriculture), local government bodies,

lobby groups, or Iwi.

|

|

Level

2

|

Major

loss of stakeholder confidence. Extensive stakeholder dissatisfaction

expressed through media resulting in a long period of negative coverage

(>2 months). Widespread, unified, coordinated revolt by consent

holders and/or ratepayers against fees/conditions. Regulatory action

resulting in moderate prosecution and conviction of council (eg -

$25-$100k)

|

|

Level

3

|

2-3

stakeholders sectors dissatisfaction expressed through media resulting in a

long period of negative coverage (>2 months). Central Government

impose statutory sanctions. Regulatory action resulting in

prosecution but no conviction.

|

|

Level

4

|

Single

stakeholder sector express dissatisfaction through media for up to one

month. Central Government – CEO MFE directed by Minister to

make enquiries. Individual(s) express dissatisfaction through media or

directly.

|

|

Level

5

|

Individual(s)

express dissatisfaction through media or directly. Individual(s)

refuse to pay fees/rates as a stand against council activities. No

significant impact on stakeholders or image

|

|

No

Impact

|

No significant

impact on stakeholders or image

|

|

2.3

Operational Capability

|

|

Level

1

|

Event

results in management diversion from strategic objectives for a period of

> 2 months. Delivery of LTCCP outcomes across work area

significantly affected for greater than six months. Critically

detrimental effects on stakeholders. Long term loss of capability

(>2 months).Event results in management diversion from strategic

objectives for a period of <2 months.

|

|

Level

2

|

Event

results in management diversion from strategic objectives for a period of

<2 months. Delivery of LTCCP outcomes across work area

significantly affected for up to six months. Moderate detrimental

effects on stakeholders. Event results in loss of operational

capability for up to 2 months. Event results in management diversion

from strategic objectives for a period of a few days.

|

|

Level

3

|

Event

results in management diversion from strategic objectives for a period of a

few days. Delivery of LTCCP outcomes across work area significantly

affected for up to one month. Minor detrimental effects on

stakeholders. Event affects limited efficiency or effectiveness of

service. Managed internally.

|

|

Level

4

|

Event

affects limited efficiency or effectiveness of service. Managed

internally. Moderate staff morale problems resulting in some staff

resignations but managed through minor restructuring.

|

|

Level

5

|

Event

causes minor disruption felt by limited small group of stakeholders.

Minor staff morale impact resulting in minor dissention but managed over a

short period of time.

|

|

No

impact

|

No

impact on operational capability

|

|

|

|

Step 5: Evaluate

Risk

After

the likelihood and consequence factors have been determined, the level of

risk is calculated using the Likelihood of occurrence (Table 1) and

Consequence Rating (Table 2).

Raw Risk

= the likelihood of an event occurring X the consequence of such an event

Table

Five: Risk Assessment Matrix

The

final outcome is a risk rating. The risk rating enables definition between

those risks that are significant and those that are of a lesser significance.

Table 5: Risk rating

|

Comparative

Levels of Risk

|

|

E

|

Extreme

Risk

|

Immediate

action required to manage risk

|

|

H

|

High

Risk

|

Senior

management attention to manage risk

|

|

M

|

Medium

Risk

|

Management

responsibility must be specified and risk controls reviewed

|

|

L

|

Low

Risk

|

Managed

by routine procedures

|

|

I

|

Insignificant

Risk

|

Examine

where un-needed action can be reduced

|

Once the

impact has been assessed according to the relative risk level it poses, it is

then possible to target the treatment of the risk exposure, by beginning with

the highest level risks (Extreme risks) and identifying the potential

mitigation measures to reduce the risk to a level acceptable to the

organisation (risk appetite).

Initially,

the Raw Risk needs to be calculated, so the likelihood and consequences need

to be considered as if there were no controls or events in place to prevent

or mitigate the risk occurrence.

Step 6:

Treat Risks

Risk

treatment involves determining possible treatment options to determine the

most appropriate action for managing the risks identified.

Treatment

options are required where the current controls are not mitigating the risk

within defined tolerance levels as determined by the first step (defining the

context). This is called the treatment plan.

This

process may include consideration of a range of options, each will have a

different cost and provide a different level of certainty. The Finance,

Audit and Risk Sub-committee will need to consider the options and recommend

which they believe to be the most appropriate.

Once the

Raw Risk is determined it is possible to investigate the current systems and

processes starting with the highest ranked risk. Then formulate an

action plan to:

1. Reduce

the likelihood or;

2. Reduce

the consequence identified

Treatment options:

Treatment

options could involve applying existing or implementing additional controls.

Furthermore, treatment options can involve one or more of the following:

1. Accept

Risk

– Accept risk and consider options for treatment

2. Reduce

Risk

- Either

reduces the likelihood that a risk occurs, or minimises the negative

consequences if it does occur.

3. Transfer/Share

Risk

– Pass

the risk in part or whole to others (insurance or third party).

4. Retain

Risk

– Retain

the risk after evaluating its impact which is found to be minimal.

When

determining the preferred treatment option consideration should be given to

factors such as cost and potential effectiveness (Cost benefit analysis).

Treatment Actions:

Once the

treatment option is identified each emerging risk should be assigned a

treatment action.

·

The

treatment action should contain at a minimum the following: The cost of the

action.

·

Assigned

responsibility to a person/position.

·

A

due date (if appropriate), and;

·

Monitoring

and reporting requirements.

Progress

of the treatment action should be recorded in the risk register.

Note:

Risk Mitigation processes may involve work streams determined through the

Resource Management Act and/or Annual or Long Term plan processes.

These sort of projects are particularly relevant to HBRC strategic goals.

Residual Risk:

Residual

risk level is the risk left after the risk treatment process has been

implemented and controls applied. Residual risk needs to be monitored and

reported on a regular basis to identify changes in any performance level.

Step 7: Monitor and

review

Risks

are constantly changing due to the Council’s operating landscape.

Therefore, risks must be monitored and reported on a regular basis to ensure

they are current.

Furthermore,

risk owners and treatment action owners have key risk, control review and

updated responsibilities to ensure the information pertaining to those risks

are current. Also the Council’s risk register should undergo a six

monthly review to ensure all information captured are current.

The

effectiveness of the Council’s risk management framework also needs to

be monitored and reviewed six monthly. This review process will help refine

the Council’s risk management framework to facilitate continuous

improvement and overall risk maturity

|