Meeting of the Finance Audit & Risk Sub-committee

Date: Monday 9 November 2015

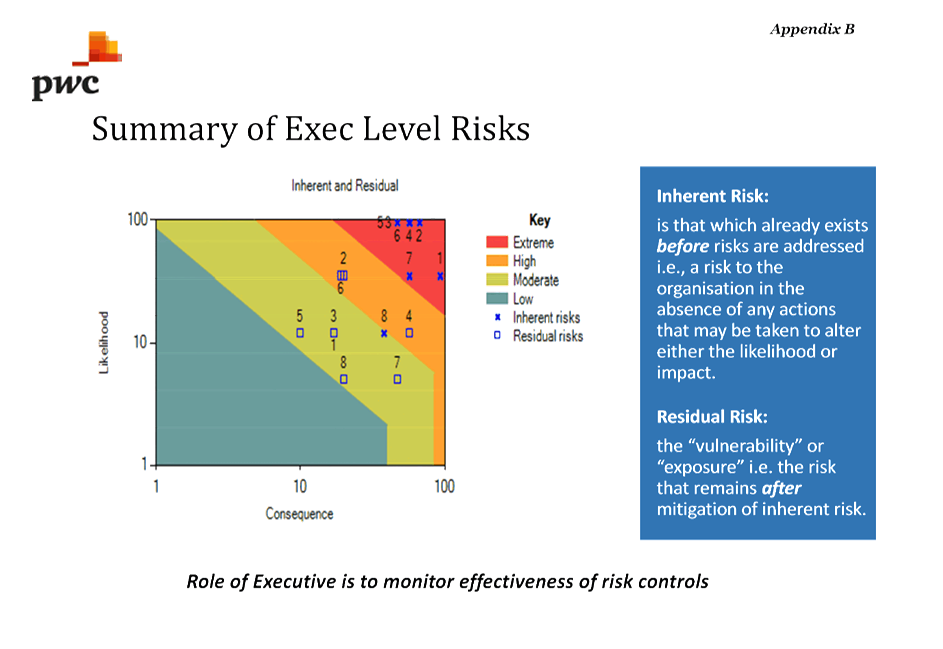

Time: 1.00pm

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of

Minutes of the Finance Audit & Risk Sub-committee held on 22 September 2015

4. Matters Arising from

Minutes of the Finance Audit & Risk Sub-committee held on 22 September 2015

5. Follow-ups from

Previous Finance Audit & Risk Sub-committee meetings 3

Decision Items

6. Charter for the

Finance Audit & Risk Sub-committee 9

7. Costings, Scope

and Priorities for Internal Audits 15

Information or Performance Monitoring

8. Risk Assessment

and Management 35

9. Council Insurance

Programme (1.45pm) 45

10. Work Programme Going Forward 47

Decision Items (Public Excluded)

11. Independent Member 49

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Monday 09 November 2015

SUBJECT: Follow-ups from Previous Finance

Audit & Risk Sub-committee meetings

Reason for Report

1. In order to track items raised at previous meetings that require

follow-up, a list of outstanding items is prepared for each meeting. All

follow-up items indicate who is responsible for each, when it is expected to be

completed and a brief status comment. Once the items have been completed and

reported to the Committee they will be removed from the list.

Decision

Making Process

2. Council is required to make a decision in

accordance with Part 6 Sub-Part 1, of the Local Government Act 2002 (the Act).

Staff have assessed the requirements contained within this section of the Act

in relation to this item and have concluded that as this report is for

information only and no decision is required in terms of the Local Government

Act’s provisions, the decision making procedures set out in the Act do

not apply.

|

Recommendation

1. That the Committee receives the report “Follow-ups

from Previous Finance Audit and Risk Sub-committee Meetings”.

|

|

Liz Lambert

Chief Executive

|

|

Attachment/s

|

1

|

Follow-ups

from Previous Meetings

|

|

|

|

Follow-ups

from Previous Meetings

|

Attachment 1

|

Follow-ups

from Finance, Audit & Risk Sub-committee Meetings

22 September 2015

|

|

Agenda Item

|

Follow-up / Request

|

Person Responsible

|

Status Comment

|

|

1

|

Follow-ups

|

Costs of the SLW legal

opinion and meeting attendance in relation to Members’ Liability at 3

June FA&R meeting

|

P Drury

|

Costs were:

$1972.25 including GST

|

|

2

|

Annual Report Audit

|

Discuss Port financial

reporting to 30 June being included in HBRC/HBRIC Ltd year end financial

reports if practicable

|

L Lambert/ P Drury

|

A meeting has been held

between HBRIC Ltd management and the new CFO at Napier Port regarding a

change to the Ports financial reporting period from 31 March to 30 June for

incorporation into the HBRIC Ltd/HBRC year end financial reports. Initial

indications from the Port were positive with the Port to discuss an

indicative timeline with its auditors to ensure it is able to meet the HBRIC

Ltd/HBRC reporting timelines.

|

|

3

|

Risk Management

|

Further development of

IT related risks around security, including risks to reputation related to

Councillors/ Directors document/ information management on personal devices/

computers

|

K Olsen /

P Drury

|

Currently all systems

and council-owned devices are password protected and only those staff with

appropriate credentials can access relevant systems. Access to systems from

personal (non-Council owned) such as email and remote access (Citrix) also

requires authentication that adhere with strict password policies.

|

|

4

|

Internal Audit / Work

programme

|

Attach Audit Universe

and list of suggested internal audits to sub-committee work programme and

seek cost estimates for those prioritised

|

P Drury

|

Agenda item for

consideration at 9 November meeting

|

|

5

|

Internal Audit

|

Managing conflicts of

interest for HBRC staff

|

P Drury

|

Executive complete a

‘related party transaction declaration’ each year and will also

complete a ‘conflict of interest declaration’. HBRC also has a

staff policy covering conflicts of interest. Copy attached following.

|

3 June 2015

|

|

Agenda Item

|

Follow-up / Request

|

Person Responsible

|

Status Comment

|

|

6

|

Role and Functions of

the Finance, Audit & Risk Sub-Committee

|

Draft a Charter for

consideration at the 22 September FA&R meeting

Clarification of

requirements and examples provided to enable draft to be prepared for

9 November meeting

|

L Lambert

|

Draft for consideration

at 9 November sub-committee meeting. Attached as separate agenda item.

|

Ref follow-up 5

|

Staff Policy

|

|

TITLE:

|

Conflict

of Interest

|

|

STAFF

POLICY NO:

|

SP028

|

|

POLICY

FIRST INTRODUCED:

|

November

2013

|

DATE

POLICY LAST REVIEWED:

|

|

|

PERSON

RESPONSIBLE FOR REVIEWING POLICY:

|

Human

Resources Manager

|

NEXT

REVIEW DUE:

|

November

2015

|

|

Rationale

|

|

This policy is

created to avoid or successfully manage conflicts of interest occurring and

to clarify the circumstances where activities, including secondary employment

would be incompatible with employment at the Council.

Council employees

can have a number of professional and personal interests and roles. Conflicts

of interest sometimes cannot be avoided but they need not cause problems when

promptly disclosed and well managed. This policy has been developed to

provide guidance and rules surrounding disclosing actual, potential and

perceived conflicts of interest.

What is a Conflict of

Interest?

· An employee has a

conflict of interest if their official duties or responsibilities to Council

could be affected or compromised by some other interest or duty that the

employee may have.

· The other interest or

duty might be:

- The employee’s own

financial or business affairs.

- A relationship [family or

otherwise] or other role the employee has; or

- A stated opinion or view

held by the employee.

· The question to keep in

mind is “might the employee’s other interest create an incentive

for them to act in a way that may not support the goals or objectives of

Council”?

|

|

Policy

|

|

1. Employees may undertake

activities, including other employment, provided that:

1.1. The employee has informed

their Group Manager of the employment/activity; and

1.2. Such employment/activity

does not cause a conflict of interest or potential for a perceived conflict

of interest with the employee’s or Hawke’s Bay Regional

Council’s roles and responsibilities; and

1.3. Such employment/activity

does not involve the use of Hawke’s Bay Regional Council materials or

plant, unless prior written approval has been obtained from the

employee’s Group Manager.

2. Employees must inform

their manager of any situation where there is any potential for a conflict of

interest. In such circumstances the interests of Council, as primary employer

will take priority, and an employee will not become involved in the other

activity unless and until prior written approval has been obtained from their

Group Manager. Written approval will only be granted if measures are taken

such that any conflict of interest is avoided.

3. Where, during any

activity [including secondary employment] a conflict of interest arises, an

employee must report this immediately to their manager and withdraw from any

involvement in the activity unless advised otherwise.

4. All employees are

expected to disclose all actual, potential or perceived conflicts of interest

they have. Employees should err on the side of caution in deciding whether to

make a disclosure. If they are unsure whether there is a conflict, they

should discuss the matter with their manager.

5. Disclosure should be made

to their manager at the earliest possible opportunity after the conflict

arises. If required by the manager, the disclosure must be in writing.

6. The manager, if the

conflict is particularly sensitive or serious, must involve their manager and

the Human Resources Manager. The manager must undertake an assessment of the

conflict to determine if it warrants intervention.

7. The assessment will take

into account factors such as:

7.1. The type and size of the

employee’s other interest;

7.2. The nature or

significance of the particular decision or activity being carried out by

Council;

7.3. The extent to which the

employee’s other interest could specifically affect, or be affected by

Council’s decision or activity; and

7.4. The nature or extent of

the employee’s current or intended involvement in Council’s

decision or activity.

8. The manager will decide

whether any changes to the employee’s role or any other measures are

required to manage the conflict. The manager will report this decision, in

writing, to their manager and the Manager Human Resources.

9. The types of changes or

other measures that may be appropriate in particular circumstances could

involve:

9.1. Seeking consent of all

affected parties or an exemption to the involvement of the employee;

9.2. Imposing additional

oversight or review over the employee;

9.3. Withdrawing from

discussion or decision-making on a particular issue;

9.4. Exclusion from a

committee or working group dealing with the issue;

9.5. Withholding certain

confidential information or placing restrictions on access to information;

9.6. Transferring the employee

[temporarily or permanently] to another position or project;

9.7. Relinquishing the private

interest;

9.8. Resignation or dismissal

from one or other position or entity.

10. The manager will inform

the employee, in writing, of the changes or measures to be put in place and

will monitor and review these changes or measures. The manager will report,

in writing, on the monitoring and review to their manager and to the manager

Human Resources.

11. If the conflict does not

justify taking any action because it is too indirect or insignificant, the

manager will record the disclosure and assessment and the decision to take no

further action.

12. This policy is breached

if an employee has a conflict of interest and knowingly withholds disclosure.

A breach of this policy may give rise to disciplinary action.

13. Employees may not be

involved in:

13.1. The decision to appoint

or employ a person with whom the employee has a personal connection [familial

or otherwise];

13.2. The decision to conduct

business with a person whom the employee has a personal connection [familial

or otherwise];

13.3. Influencing or

participating in a decision to award grants or contracts where the employee

is connected to a person or organisation that submitted an application or

tender;

13.4. Influencing or participating in

regulatory decisions [such as to grant a consent, certificate or license]

where the employee is connected to the applicant or a person who opposes the

application;

13.5. Investigating a complaint

where the employee has a personal connection [familial or otherwise] with

either the complainant or the person or entity complained about;

13.6. Influencing or

participating in any Enforcement Decision Group process where the employee

has a personal connection [familial or otherwise] with either the complainant

or the person or entity complained about.

14. Employees may not be

involved with the following activities unless they have the consent of their

manager:

14.1. Owning shares in or

working for organisations that have dealings with Council;

14.2. Making public submissions

to Council in a private capacity;

15. This policy is breached

if an employee has a conflict of interest and knowingly becomes involved or

continues to be involved in a limited activity without consent of their

manager. A breach of this policy may give rise to disciplinary action.

16. For the avoidance of

doubt, this policy does not preclude an employee from participating in

democratic processes such as submitting on resource consent or a council

proposal that directly affects them. However, they should make it clear that

they are making such a submission as a private citizen. It is recommended

that staff obtain advice from their manager before making such a submission.

17. Gifts of cash prohibited (See

policy SPO18 Offer of gifts or winning prizes)

18. Disclosure of gifts (See

policy SPO18 Offer of gifts or winning prizes)

19. Acceptance of gifts (See

policy SPO18 Offer of gifts or winning prizes)

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Monday 09 November 2015

Subject: Charter for the Finance

Audit & Risk Sub-committee

Reason for Report

1. The Finance,

Audit and Risk sub-committee has requested that a charter be prepared to

address the committee's objectives, authority

and responsibilities, composition, and how and when meetings will be held.

2. A Draft Charter

is attached for the sub-committee’s consideration.

Decision Making

Process

3. Council is required to make a decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements contained in Part 6 Sub Part 1 of the Act in relation

to this item and have concluded the following:

3.1. The decision does not significantly alter the service provision or

affect a strategic asset.

3.2. The use of the special consultative procedure is not prescribed by

legislation.

3.3. The decision does not fall within the definition of Council’s

policy on significance.

3.4. The decision is not inconsistent with an existing policy or plan.

3.5. Given the nature and significance of the issue to be considered and

decided, and also the persons likely to be affected by, or have an interest in

the decisions made, Council can exercise its discretion and make a decision

without consulting directly with the community or others having an

interest in the decision.

|

Recommendations

The Finance

Audit & Risk Sub-committee recommends that the Corporate & Strategic

Committee:

1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted policy on significance and that

Council can exercise its discretion under Sections 79(1)(a) and 82(3) of the

Local Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and significance

of the issue to be considered and decided.

2. Approves the Charter, as amended at today’s meeting, for the

Finance Audit & Risk Sub-committee.

|

|

Liz Lambert

Chief Executive

|

|

Attachment/s

|

1

|

Draft Finance

Audit & Risk Sub-committee Charter

|

|

|

|

Draft

Finance Audit & Risk Sub-committee Charter

|

Attachment 1

|

FINANCE, AUDIT AND RISK

SUB-COMMITTEE

CHARTER

INTRODUCTION

The Finance, Audit and Risk Sub-committee is a

committee established by resolution of the Hawke’s Bay Regional Council.

It makes recommendations to the Corporate and Strategic Committee which, in

turn, reports to Council.

OBJECTIVES

The objective of the Finance, Audit and Risk

Sub-committee is to assist the Council to fulfil its responsibilities in

relation to:

· The robustness of

risk management systems, processes and practices;

· The provision of

appropriate controls to safeguard the Council’s financial and

non-financial assets, the integrity of internal and external reporting and

accountability arrangements

· The independence

and adequacy of internal and external audit functions

· Compliance with

applicable laws, regulations, standards and best practice guidelines.

· The review of

Council’s expenditure policies and the effectiveness of those policies.

COMPOSITION

Members of the Finance, Audit and Risk sub-committee

shall comprise four members of Council and an external appointee.

The Chairman shall be a member of the sub-committee as

elected by the Council.

A quorum shall be not less than three councillor

members.

RESPONSIBILITIES AND DUTIES

In order to meet its objective the responsibilities

and duties of the Sub-committee on behalf of the Council will include the

following.

Risk Management

· Reviewing the principal risks contained in the risk

profile for Council on a twice-yearly basis

· Ensuring that management has established a risk

management framework which includes policies and procedures to effectively

identify, manage and monitor principal business risks

· At least annually assess the effectiveness of the

implementation of the risk management system

· Monitoring compliance with the risk management

framework

External and Internal Reporting

· Reviewing, and challenging where necessary, the

actions and judgements of management in relation to Council’s financial

statements, operating and financial reviews and related formal statements,

before submission to Council and clearance by the external auditors

· Providing advice to Council regarding the financial

statements (including whether appropriate action has been taken in response to

audit recommendations and adjustments) and recommending their adoption by the

Council

· Satisfying itself that the financial statements are

supported by appropriate management sign-off on the statements and on the

adequacy of the systems of internal controls

· Reviewing the processes in place to ensure that the

financial information included in the Annual Report, including the statement of

service performance, is consistent with the signed financial statements

External and Internal Audit functions

· Overseeing Council’s relationship with the

external auditor

· Approving the terms of engagement and the remuneration

to be paid to the external auditor in respect of audit services provided

· Discussing with the external auditor, before the audit

commences, the nature and scope of the audit

· Reviewing reports from the auditors on any material

findings in accounting and internal control systems that come to the

auditors’ attention

· Ensuring that recommendations in audit management

reports are considered and, if appropriate, actioned by management

· Reviewing the objectives and scope of the internal

audit function

· Ensuring those objectives are aligned with

Council’s overall risk management framework

· Reviewing significant matters reported by the internal

audit function and how management is responding to them

· Assessing the performance of the internal audit

function

· Ensuring that the function is adequately resourced and

has appropriate authority and standing within Council

Legislative Compliance

· Determining whether management has appropriately

considered legal and compliance risks as part of Council’s risk

assessment and management arrangements

· Reviewing the effectiveness of the system for

monitoring Council’s compliance with relevant laws, regulations and

associated government policies

Expenditure policies

· Reviewing whether management’s approach to

maintaining effective expenditure policies, including over external parties

such as contractors and consultants, is sound and effective

· Reviewing whether management has in place relevant

policies and procedures and that these are periodically reviewed and updated

· Determining whether the appropriate procedures are in

place to assess, at least once a year, whether expenditure policies and

procedures are complied with.

MEMBERS’ POWER AND AUTHORITY

The Finance, Audit and Risk sub-committee has the

authority of Council to:

· Obtain external legal or independent professional

advice in the satisfaction of its responsibilities and duties

· Secure the attendance at meetings of third parties

with relevant experience and expertise as appropriate

Management is responsible for:

· The preparation, presentation and integrity of the

financial statements

· Implementing and maintaining appropriate accounting

and financial reporting principles and policies and internal controls and

procedures that ensure compliance with accounting standards and relevant

regulations

· The risk management framework and compliance with

policies and regulations

REVIEW

The sub-committee shall undertake an annual

self-review of the Charter and of its Terms of Reference. The Charter and terms

of reference shall also be reviewed by Council.

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Monday 09 November 2015

Subject: Costings, Scope and

Priorities for Internal Audits

Reason for Report

1. To provide

details from Pricewaterhouse Coopers (PWC) of the terms of reference and the

costs of undertaking internal audit assignments during the current financial

year.

Background

2. At its meeting

on 22 September 2015 the Subcommittee discussed the internal audit assignments

proposed to be undertaken by PWC for the 2015-16 financial year.

3. The areas of

internal audit that the Subcommittee required terms of reference and costings

for from PWC were as follows:

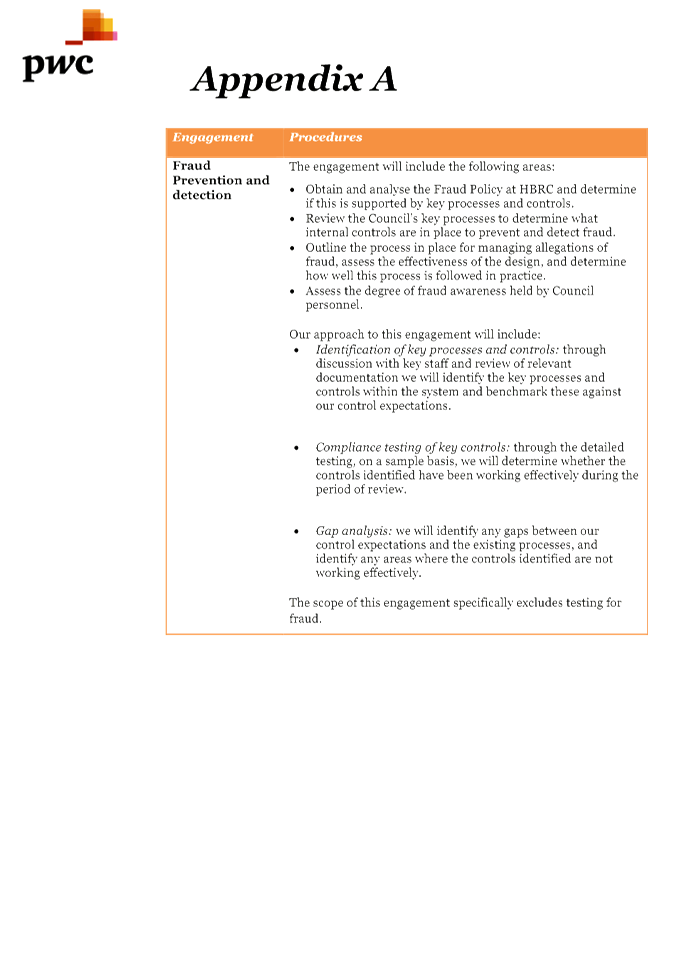

3.1. Business

continuity and disaster recovery plan.

3.2. Stakeholder

relationship management.

3.3. Fraud

prevention and detection review (includes conflicts of interest).

4. Further areas

were discussed that may require the attention of an internal audit in future

years, these included:

4.1. Conflicts of

interest both general and procurement.

4.2. Cyber

security risk.

4.3. Information

Communication Technology (ICT) general computer control.

4.4. Rating system

4.5. Health and

safety.

5. John Nixon,

Partner, PWC will be in attendance at the meeting to present the terms of

reference and provide any clarification required.

Information

supplied by Pricewaterhouse Coopers

6. Appended to

this paper as Attachment 1 are the terms of reference and estimated

costs for these audits as follows:

|

Audit

|

$ (excl GST and Disbursements)

|

|

Business

Continuity and Disaster Recovery Planning

|

$10,500 – $12,500

|

|

Stakeholder

Relationship Management

|

$5,000 to $ 6,500

|

|

Fraud

Prevention and Detection Review

|

$9,500 - $11,500

|

|

Total

|

$25,000 to $30,500

|

Financial

Provision in the Budget

7. The 2015-16

Annual Plan included a sum of $25,000 set aside for the cost of operating the

Finance Audit and Risk Committee including the internal audit assignments to be

undertaken. It is proposed that an appointment be made of an independent

member to this Subcommittee and the cost of that appointment for a six month

period (if the appointment is made at this Subcommittee meeting) would be

$4,000 for the remainder of this financial year.

8. The funding

therefore available for internal audit exercises is $21,000.

Decision Making

Process

9. Council is required to make a decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements contained in Part 6 Sub Part 1 of the Act in relation

to this item and have concluded the following:

9.1. The decision does not significantly alter the service provision or

affect a strategic asset.

9.2. The use of the special consultative procedure is not prescribed by

legislation.

9.3. The decision does not fall within the definition of Council’s

policy on significance and engagement.

9.4. There are no

persons affected by this decision.

9.5. Council has the option to approve all three of the internal audit

exercises (which would mean the financial provision would be overspent by up to

$9,000 plus cost disbursements or to approve two of the three proposed audits

and defer one to the 2016-17 year.

9.6. The decision is not inconsistent with an existing policy or plan.

9.7. Given the nature and significance of the issue to be considered and

decided, and also the persons likely to be affected by, or have an interest in

the decisions made, Council can exercise its discretion and make a decision

without consulting directly with the community or others having an

interest in the decision.

|

Recommendations

The Finance,

Audit and Risk Subcommittee recommends that the Corporate and Strategic

Committee:

1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted policy on significance and that

Council can exercise its discretion under Sections 79(1)(a) and 82(3) of the

Local Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision.

2. Agrees that two of the following three internal audits be carried

out during the current financial year (2015-16) with the remaining internal

audit being carried out during the 2016-17 financial year:

2.1 Business

continuity and disaster recovery plan.

2.2 Stakeholder

relationship management.

2.3 Fraud

prevention and detection review (includes conflicts of interest).

3. Notes that the cost of the two audits to be carried out in 2015-16

will be funded from the financial provisions set aside for such audits in the

Annual Plan.

|

|

Paul Drury

Group Manager

Corporate Services

|

Liz Lambert

Chief Executive

|

Attachment/s

|

1

|

Business

Continuance Internal Audit Proposal

|

|

|

|

2

|

Fraud

Prevention Internal Audit Proposal

|

|

|

|

3

|

Stakeholder

Relations Internal Audit Proposal

|

|

|

|

Business

Continuance Internal Audit Proposal

|

Attachment 1

|

|

Fraud Prevention Internal

Audit Proposal

|

Attachment 2

|

|

Stakeholder Relations

Internal Audit Proposal

|

Attachment 3

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Monday 09 November 2015

Subject: Risk Assessment and

Management

Reason for Report

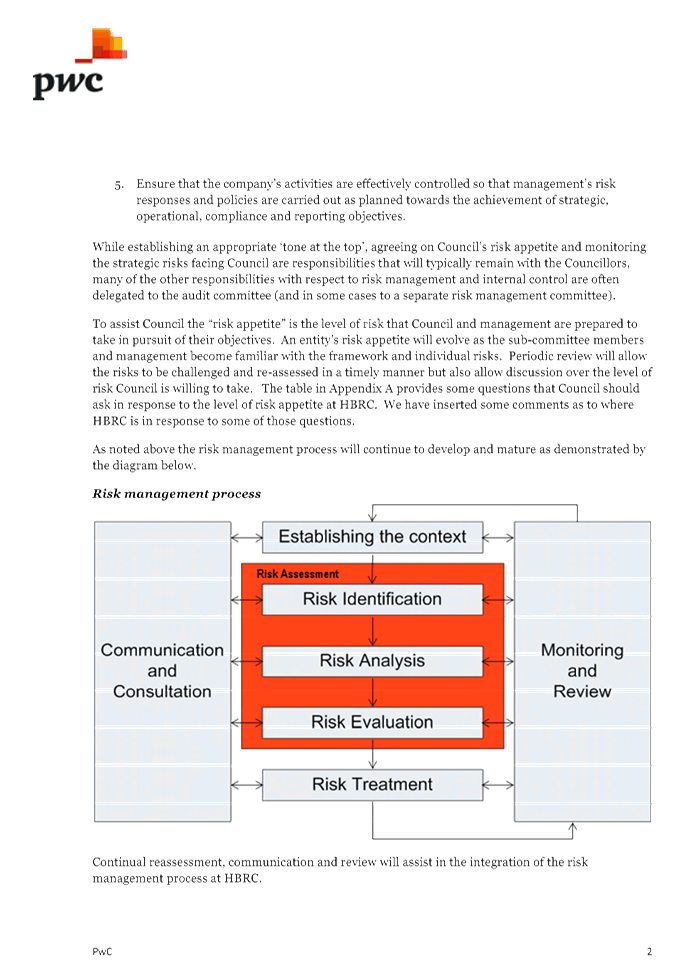

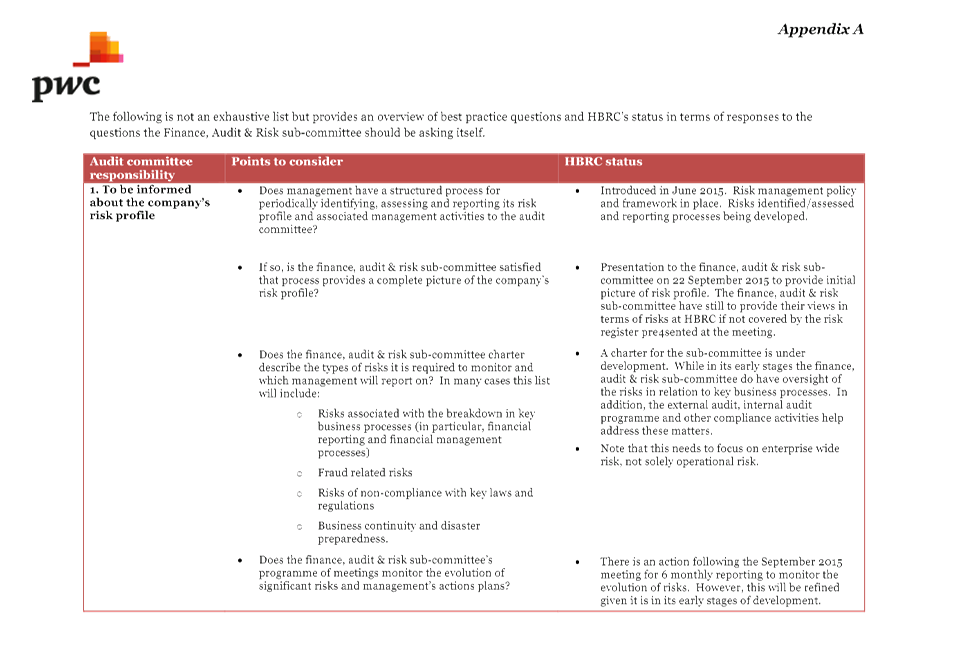

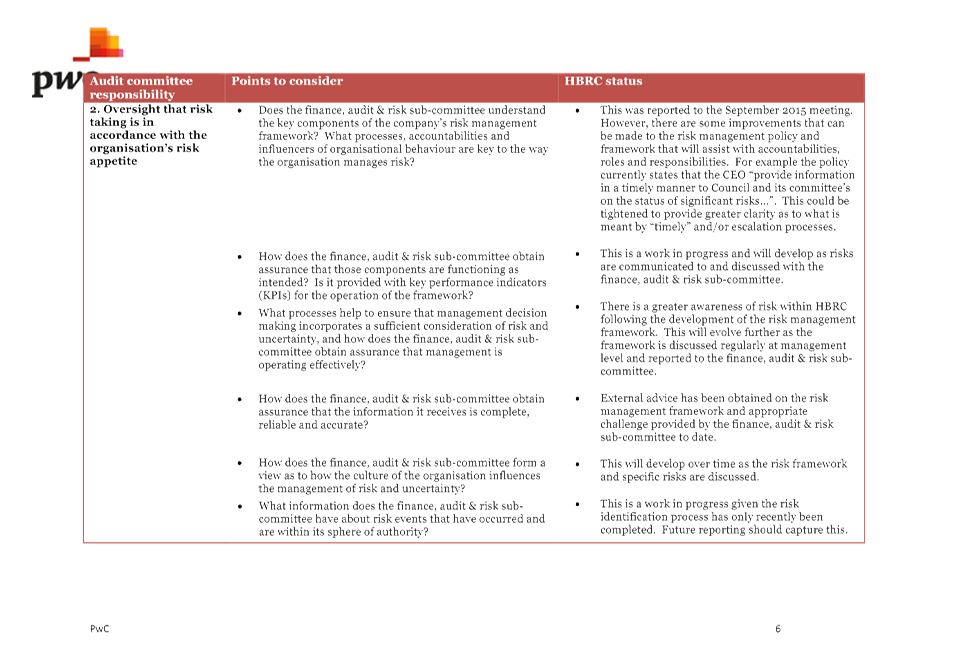

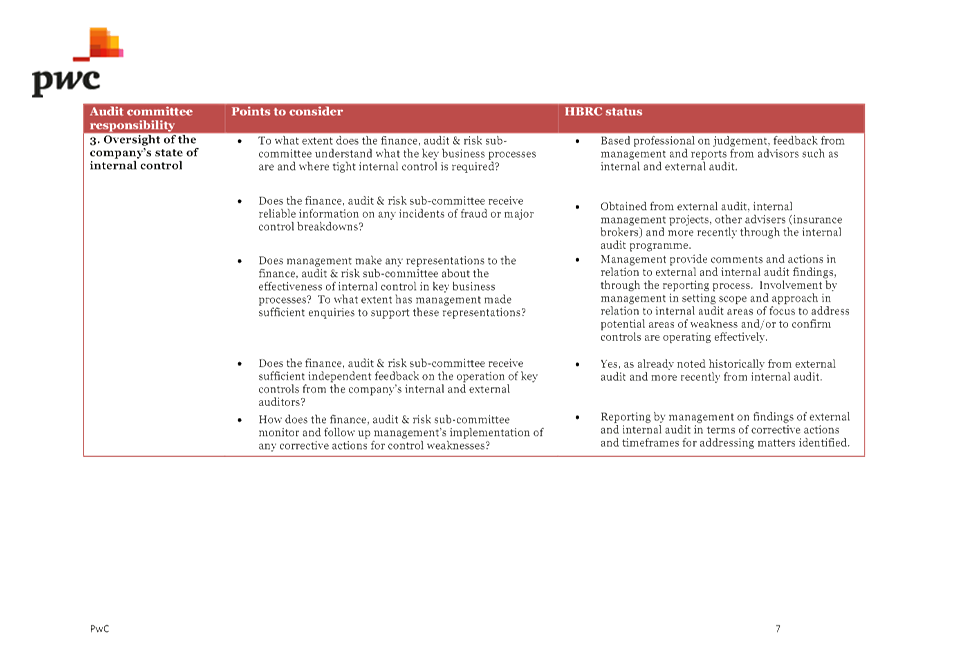

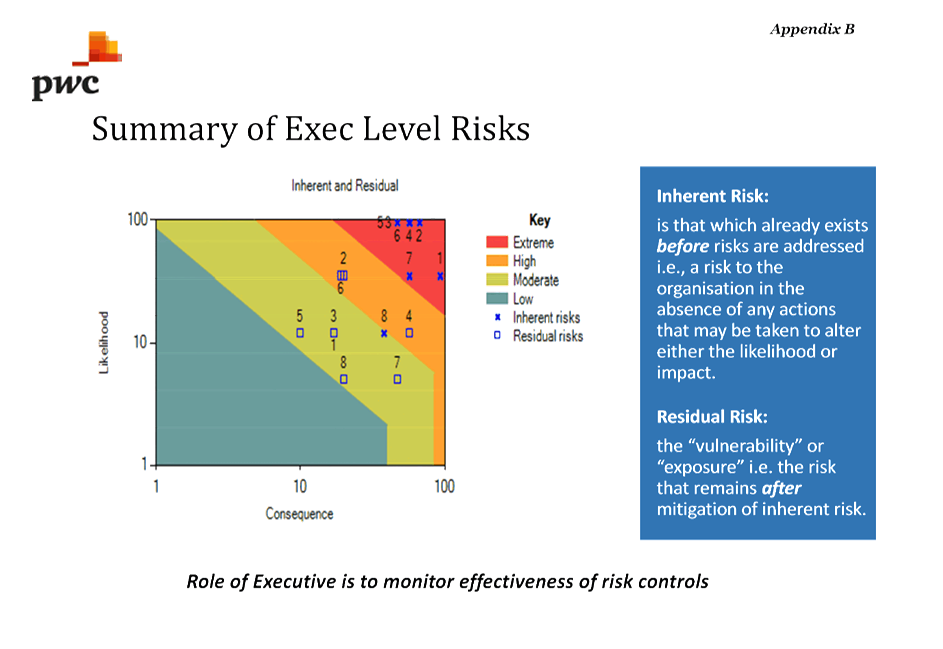

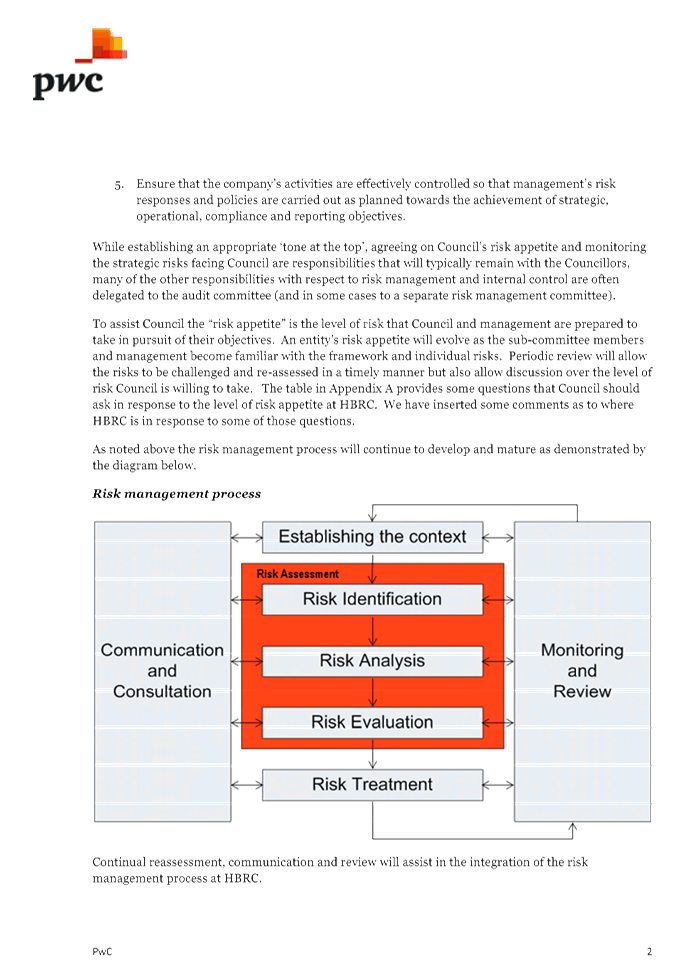

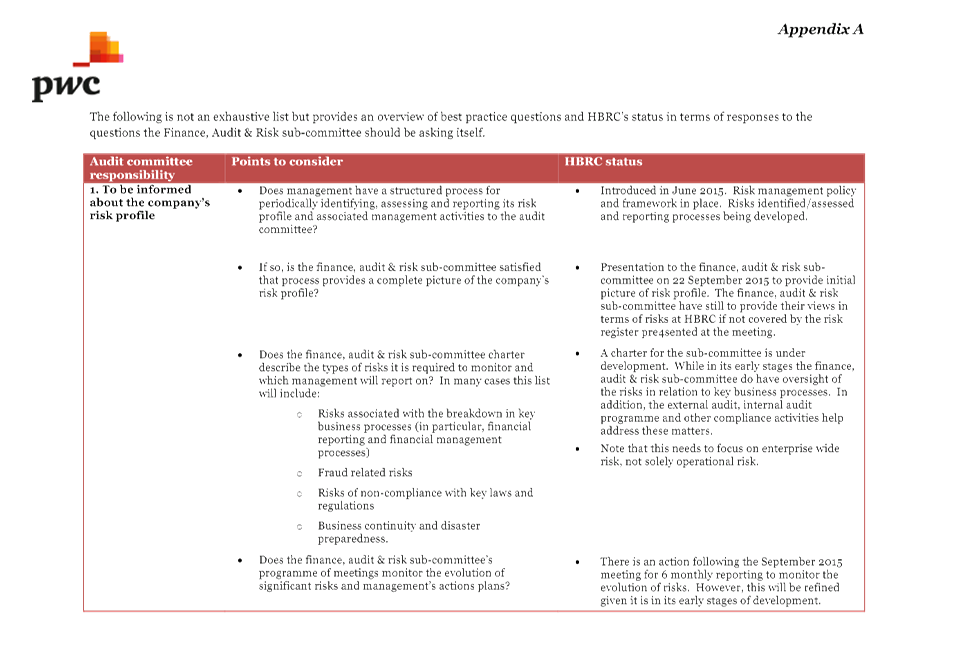

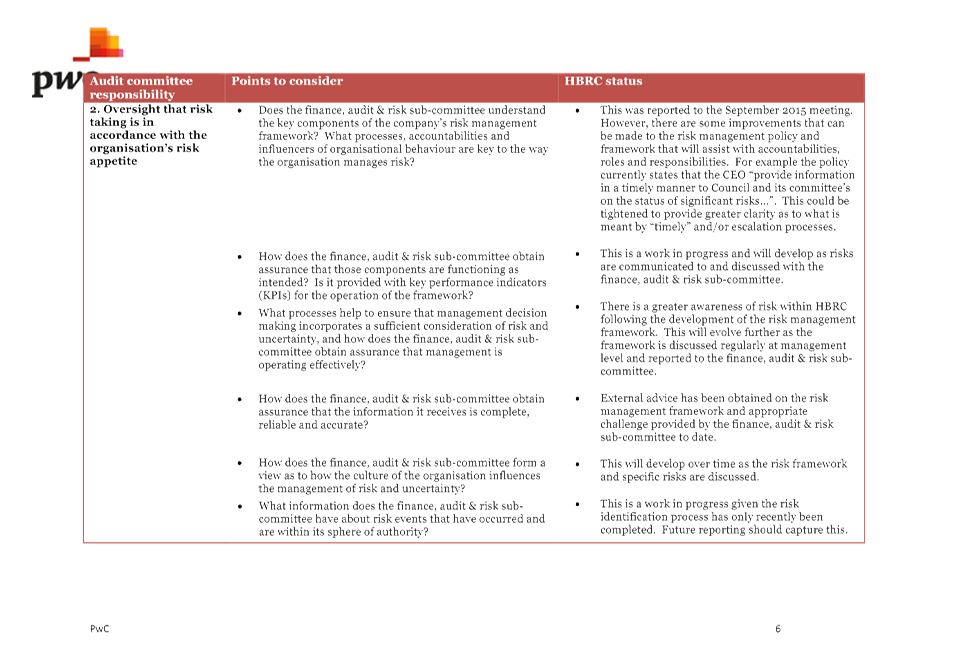

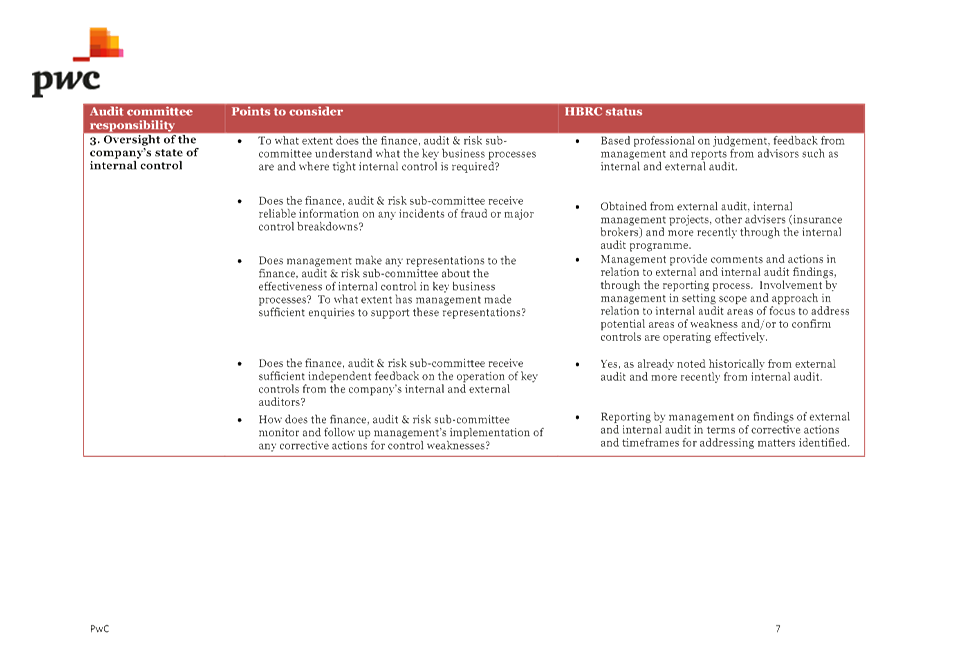

1. To provide clarification on the roles of governance and management

in relation to risk management and to address areas of appropriate delegations.

Comment

2. At the last Subcommittee meeting on 22 September 2015, during the

discussion on the paper covering Hawke’s Bay Regional Council (HBRC) risk

management as shown by the “Quantate” risk model, Councillors

requested that clarification be provided on the difference between governance

and management responsibility in relation to risk. John Dixon from

Pricewaterhouse Coopers (PWC) was in attendance at that meeting and gave some

useful insights to the different levels of decision making.

3. John offered to report back to this meeting on the difference

between the roles of governance and management, and his report addressing these

issues is appended as Attachment 1.

Decision Making

Process

4. Council is

required to make a decision in accordance with Part 6 Sub-Part 1, of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained within this section of the Act in relation to this item and have

concluded that, as this report is for information only and no decision is to be

made, the decision making provisions of the Local Government Act 2002 do not

apply.

|

Recommendation

1. That the Finance, Audit and Risk

Subcommittee receives the attached paper “Risk Assessment and

Management” from John Dixon, Pricewaterhouse Coopers.

|

|

Mike Adye

Group Manager

Asset Management

|

Paul Drury

Group Manager

Corporate Services

|

Attachment/s

|

1

|

PWC Risk

Management Report

|

|

|

|

PWC

Risk Management Report

|

Attachment 1

|

|

PWC

Risk Management Report

|

Attachment 1

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Monday 09 November 2015

Subject: Council Insurance

Programme

Reason for Report

1. To provide information to Councillors on the types of cover that

Council has in place for the 2015-16 financial year, the level of cover

provided by these policies and any excess that applies.

Comment

2. All Council insurance is placed through Jardine Lloyd Thompson (JLT)

as brokers with the exception of infrastructure insurance. The decision

as to which brokers were awarded what insurance business was subject to a

competitive process carried out by the Hawke’s Bay LASS.

3. Infrastructure insurance was placed through Aon following their

detailed assessment of risk in conjunction with the HBRC engineering team, and

the consideration by Council of quotes from alternative suppliers including JLT

and LAPP.

4. In attendance at this meeting will be Matt Meacham, Account Manager

for JLT, and representing Aon brokers will be Sam Ketley, Associate Director

and Ashley MacDonald, Aon Regional Manager, Hawke’s Bay.

5. The presentations given by these broker representatives will afford

the Subcommittee members the opportunity to more fully understand the insurance

policies currently covering Council’s exposures and will enable any

Subcommittee member to seek clarification on any policy issues.

Decision Making

Process

6. Council is

required to make a decision in accordance with Part 6 Sub-Part 1, of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained within this section of the Act in relation to this item and have

concluded that, as this report is for information only and no decision is to be

made, the decision making provisions of the Local Government Act 2002 do not

apply.

|

Recommendation

1. That the Finance Audit & Risk

Subcommittee receives the Council Insurance Programme report

and presentations provide by Jardine Lloyd Thompson and Aon as Council

appointed insurance brokers.

|

|

Mike Adye

Group Manager

Asset Management

|

Paul Drury

Group Manager

Corporate Services

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Monday 09 November 2015

Subject: Work Programme Going

Forward

Reason for Report

1. In order to ensure the sub-committee’s ability to effectively

and efficiently fulfill its role and responsibilities, an overall suggested

work programme is provided following.

|

Internal

Audits

|

· Business continuity and disaster recovery (from risk register)

· Stakeholder communications and relationship management –

processes, policies and procedures around (from risk register)

· Fraud prevention and detection (from risk register)

· Conflicts of interest – capturing and managing (general,

procurement)

· Cyber security

· IT general computer systems control

· Rating system – processes involved in striking the rate

· H&S compliance with policies and procedures

· Interests register for staff – has been initiated with

Executive team

· Stakeholder relationship management and risks in relation to

elected representatives, and how such an audit might be conducted

· Add resilience and reduction to disaster recovery

· Staff development and succession planning

· Future proofing IT systems

|

|

Risk

Assessment & Management

|

· Routine (6 monthly) reporting on risks to the FA&R

Sub-committee

· Review previous 6-month Risk Assessment to note changes /

improvements / areas that require attention

· Sub-committee carry out detailed review of individual

Group’s Risk Management (as part of the programmed reviews of Groups)

|

|

Annual Report

|

· Adoption of Audit report 20 September for recommendation to

Council

|

Decision Making Process

2. As this report

is for information only and no decision is to be made, the decision making

provisions of the Local Government Act 2002 do not apply.

|

Recommendation

1. That the Finance, Audit and Risk Sub-committee

receives and considers the “Work Programme Going Forward”

report.

|

|

Paul Drury

Group Manager

Corporate Services

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Monday 09 November 2015

Subject: Independent Member

That Council excludes the public

from this section of the meeting, being Agenda Item 11 Independent Member with

the general subject of the item to be considered while the public is excluded;

the reasons for passing the resolution and the specific grounds under Section

48 (1) of the Local Government Official Information and Meetings Act 1987 for

the passing of this resolution being as follows:

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS

RESOLUTION

|

GROUNDS UNDER SECTION 48(1)

FOR THE PASSING OF THE RESOLUTION

|

|

Independent Member

|

7(2)(a) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to protect

the privacy of natural persons.

|

The Council is specified, in

the First Schedule to this Act, as a body to which the Act applies.

|

|

Liz Lambert

Chief Executive

|

|