Meeting of the Corporate and Strategic Committee

Date: Wednesday 18 November 2015

Time: 9.00 am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of

Minutes of the Corporate and Strategic Committee held on 23 September 2015

4. Matters Arising

from Minutes of the Corporate and Strategic Committee held on 23 September 2015

5. Follow-ups from

Previous Corporate and Strategic Committee meetings 3

6. Call for any Minor

Items not on the Agenda 7

Decision Items

7. Report and

Recommendations from the Finance Audit & Risk Sub-committee 9

8. November 2015

Public Transport Update and Fare Review 11

9. Recording of

Councillor Attendance 17

10. Objectives for Inter Council

Cooperation 27

Information or Performance Monitoring

11. Business Hawke’s Bay

Update (9.10am) 31

12. Health and Safety Update

Report for the Period 1 July 2015 to 30 October 2015 37

13. Minor Items not on the Agenda 45

Decision Items (Public Excluded)

14. Independent Member

Recommendation from the Finance Audit and Risk Sub-committee 47

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 18 November 2015

SUBJECT: Follow-ups from Previous Corporate

and Strategic Committee meetings

Reason for Report

1. In order to track items raised at previous meetings that require

follow-up, a list of outstanding items is prepared for each meeting. All

follow-up items indicate who is responsible for each, when it is expected to be

completed and a brief status comment. Once the items have been completed and

reported to the Committee they will be removed from the list.

Decision

Making Process

2. Council is required to make a decision in

accordance with Part 6 Sub-Part 1, of the Local Government Act 2002 (the Act).

Staff have assessed the requirements contained within this section of the Act

in relation to this item and have concluded that as this report is for

information only and no decision is required in terms of the Local Government

Act’s provisions, the decision making procedures set out in the Act do

not apply.

|

Recommendation

1. That the Committee receives the report “Follow-ups

from Previous Corporate and Strategic Committee Meetings”.

|

|

Liz Lambert

Chief Executive

|

|

Attachment/s

|

1

|

Follow-ups

from Previous Corporate and Strategic Committee Meetings

|

|

|

|

Follow-ups

from Previous Corporate and Strategic Committee Meetings

|

Attachment 1

|

Follow-ups

from Corporate and Strategic Committee Meetings

23 September 2015

|

|

Agenda Item

|

Follow-up / Request

|

Person Responsible

|

Status Comment

|

|

1

|

HB Tourism Update

|

Arrange a famil with

Councillors out in the field

|

A Dundas /L Lambert

|

A suitable date has yet

to be arranged.

|

|

2

|

HR annual report

|

Health

& Safety update to become a standing agenda item

|

L Hooper /V Moule

|

Added to next C&S

agenda as a standing item

|

|

3

|

HR annual report

|

Distribution

of merit payment criteria

|

V Moule

|

Emailed 1 October, ref follow-up

3 following

|

|

4

|

Gravel resource

inventory & gravel demand

|

Provide Gravel resource

management review programme timelines

|

M Adye

|

Paper for 8 December

E&S meeting

|

Follow-up 3

From: Leeanne Hooper Sent:

Thursday, 1 October 2015 2:46 p.m.

Subject: Criteria for Staff Merit Pay

Increases

Good

afternoon,

Following

up from a query at the Corporate & Strategic Committee meeting on 23

September, following is the criteria used when assessing staff performance for

Merit increases.

What are the criteria for being a recipient

of a staff recognition payment?

· Before being considered for

a staff recognition payment staff must be at, or near, the top of their range.

· There are two categories: ‘Exceptional

Performer’ – 110 to 115% and ‘Very Good Performer’ 103,

105, 107.5%.

Exceptional Performer:

Ø Widely recognised as producing

exceptional work of a consistently high standard.

Ø Very rarely fails to exceed

expectations.

Ø Has an excellent, positive attitude.

Ø Very highly motivated.

Ø Very strong commitment to continuous

improvement.

Ø Outcomes and outputs clearly show a

‘value added’ component on most occasions.

Ø High level of comfort dealing with

ambiguity.

Ø Clearly understands the ‘bigger

picture’ implications.

Ø Regularly looks for new opportunities,

‘breaks down barriers’ and shows high levels of initiative.

Ø Is widely recognised as a person with strong

positive influence both internally and externally.

Ø Regularly

gets great unsolicited feedback.

To achieve at 110 or 115% of EMV (Estimated Market

Value), all of the above criteria must be answered affirmatively.

Very Good Performer:

Ø Achieves at a high, if not

exceptional, level on a consistent basis.

Ø Exceeds expectations most of the time.

Ø Has a very positive attitude.

Ø Highly motivated.

Ø Often shows high levels of initiative

and ability to ‘break down barriers’.

Ø Considers ‘value added’ component

of outcomes/outputs in most instances.

Ø Is recognised as a person with

positive influence both internally and externally.

Ø Often receives unsolicited positive

feedback.

Ø Is comfortable dealing with ambiguity.

Ø Rarely gets concerned by the micro

issues.

Ø Strong

commitment to continuous improvement.

Very good performer would apply to 103, 105, 107% of EMV

(being the 100% market based salary level-Estimated Market Value).

For 105% and above all of the criteria need to be

answered affirmatively.

For 103% no more than two of the criteria may be

‘lacking’ but all others must be answered affirmatively.

Regards,

Leeanne

Hooper

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 18 November 2015

Subject: Call for any Minor

Items not on the Agenda

Reason

for Report

1. Under standing orders, SO 3.7.6:

“Where an item is not on the agenda

for a meeting,

(a) That item may be discussed

at that meeting if:

(i) that

item is a minor matter relating to the general business of the local authority;

and

(ii) the

presiding member explains at the beginning of the meeting, at a time when it is

open to the public, that the item will be discussed at the meeting; but

(b) No

resolution, decision, or recommendation may be made in respect of that item except

to refer that item to a subsequent meeting of the local authority for further

discussion.”

2. The Chairman will request any items Councillors

wish to be added for discussion at today’s meeting and these will be duly

noted, if accepted by the Chairman, for discussion as Agenda Item 13.

Recommendations

That

the Corporate and Strategic Committee accepts the following minor items not on

the agenda, for discussion as Item 13

|

Leeanne Hooper

GOVERNANCE & CORPORATE

ADMINISTRATION MANAGER

|

Liz Lambert

CHIEF EXECUTIVE

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 18 November 2015

Subject: Report and

Recommendations from the Finance Audit & Risk Sub-committee

Reason for Report

1. The following

matters were considered by the Finance Audit and Risk Sub-committee on 9

November 2015, and are now presented for consideration and approval.

Decision Making

Process

2. These items

have been specifically considered at the Sub-committee level.

|

Recommendations

That the

Corporate and Strategic Committee:

1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy.

2. Receives and notes the report from the 9 November 2015 Finance

Audit and Risk Sub-committee.

Costings, Scope and Priorities for

Internal Audits

3. Agrees that the Business Continuity and Disaster Recovery Plan

internal audit be carried out during the current financial year (2015-16)

with the following internal audits being carried out as the Sub-committee

approves and budgets allow.

3.1. Stakeholder relationship management

3.2. Fraud prevention and detection review (including conflicts of

interest).

4. Notes that the cost of the audit to be carried out in 2015-16 will

be funded from the financial provisions set aside for such audits in the

Annual Plan.

Reports Received

5. Notes that the following reports were provided to the Finance

Audit and Risk Sub-committee and feedback provided to staff:

5.1. Council Insurance Programme

5.2. Risk Assessment and Management

5.3. Draft Charter for the Finance Audit &

Risk Sub-Committee

|

|

Liz Lambert

Chief Executive

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 18 November 2015

SUBJECT: November 2015 Public Transport Update

and Fare Review

Reason

for Report

1. This purpose of this agenda item is to:

1.1. provide the Committee with an

update on Council’s public transport operations; and

1.2. provide the findings of a

review of bus fares in order to make a recommendation to Council.

General

Information

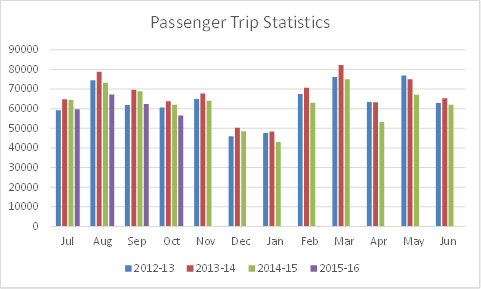

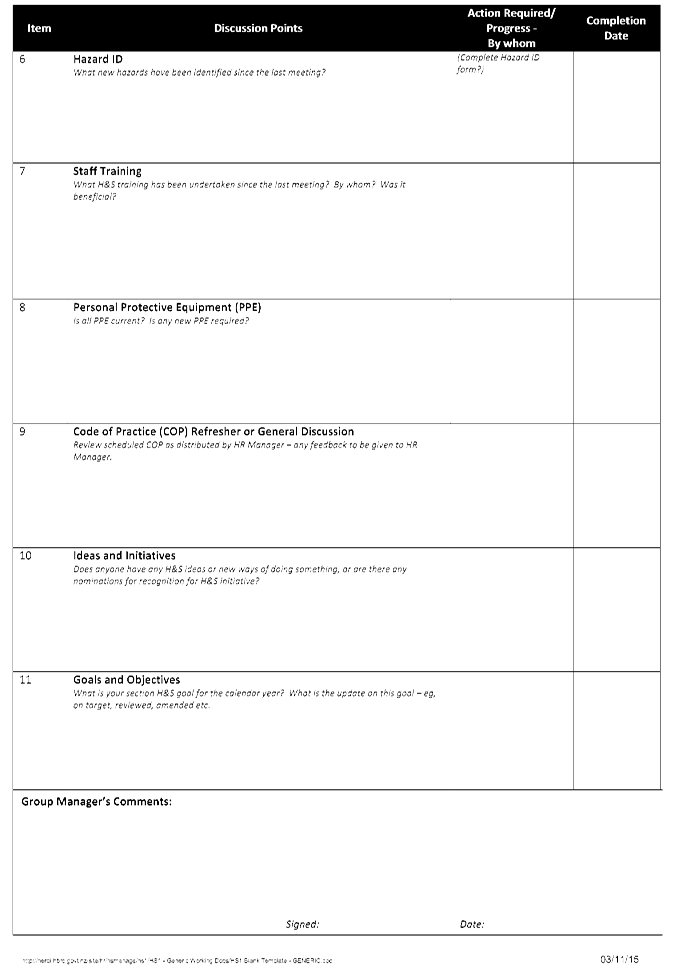

2. There were 8.4% fewer bus passenger trips in July to October than

during the same period last year. While this drop in passenger transport use is

concerning, it is consistent with most regions around the country where

services have not recently been increased. Lower petrol prices and improved

economic conditions are thought to have been the main contributing factors to

this.

3. A number of service improvements are currently being investigated by

the transport team and if considered worth trialling and subject to Council

approval, could be implemented with the commencement of the new contract in

August 2016.

Bus Passenger Trips

4. Diagram 1 shows total bus passenger trips during 2012-13, 2013-14,

2014-15 and 2015-16 YTD.

Diagram 1 – Passenger Trips –

2012-13, 2013-14, 2014-15, 2015-16 YTD

5. Average monthly patronage during 2012-13,

2013-14, 2014-15 and 2015-16 YTD is shown in Diagram 2.

Diagram 2 – Total Annual Passenger Trips and Monthly Averages

|

Year

|

Total Annual Trips

|

Monthly Average

|

|

2012-13

|

761,392

|

63,449

|

|

2013-14

|

799,845

|

66,653

|

|

2014-15

|

744,692

|

62,057

|

|

2015-16

(YTD)

|

245,869

|

61,467

|

Bus Service Costs

6. The following table shows the net cost (after fares and excluding

GST) of operating the goBay bus service in 2012-13, 2013-14, 2014-15 and

2015-16 YTD. The costs include base contract and quarterly incentive and

indexation costs, which accounts for the significant price fluctuations between

months.

Diagram 3 – Net Cost of Bus Service – 2012-13, 2013-14,

2014-15 and 2015-16 YTD

|

Year

|

Jul

|

Aug

|

Sep

|

Oct

|

TOTAL

|

|

2012-13

|

$224,406

|

$206,395

|

$217,298

|

$229,967

|

$878,066

|

|

2013-14

|

$186,170

|

$278,969

|

$182,220

|

$187,613

|

$834,972

|

|

2014-15

|

$168,720

|

$157,262

|

$264,227

|

$174,153

|

$764,362

|

|

2015-16

|

$142,779

|

$189,698

|

$213,309

|

$148,791

|

$694,577

|

(53% of this cost is met by the New Zealand Transport Agency).

Fare Recovery

7. Fare recovery is the portion of the total cost of the service that

is covered by fares (including Supergold payments from central government). The

following table shows fare recovery in 2012-13,

2013-14, 2014-15 and 2015-16(YTD).

Diagram 4 – Fare Recovery – 2012-13, 2013-14, 2014-15 and

2015-16 YTD

|

2012-13

|

34.26%

|

|

2013-14

|

38.24%

|

|

2014-15

|

38.69%

|

|

2015-16

(YTD)

|

40.60%

|

Bus Service

Tender

8. The bus service contract was recently re-tendered for a period of

nine years from 1 August 2016. Six conforming tenders were received, as

well as a number of alternative tenders. The contract was won by the current

operator, Go Bus Transport Ltd.

Bus Stops

9. NCC has commenced a programme of formalising Napier bus stops.

Review of Bus Fares

10. NZTA

policy requires regional councils to undertake a review of bus fares,

discounts, concession and ticket types annually.

11. The last

fare increase, of 3.6%, was implemented in September 2014. However, since then,

the NZTA Cost Index for Public Transport (which is used to adjust contract

prices to account for inflation) has fallen by 1.06%.

12. Current

fare details are set out in diagrams 5 and 6.

Diagram 5 - Current Fares

Single Trip Cash Fares

|

|

Adult

|

Tertiary Student/

Community Services Card

|

Child/High School Student/

Senior

|

|

1 Zone

|

$3.60

|

$2.40

|

$1.80

|

|

2 Zone

|

$5.40

|

$3.60

|

$3.00

|

|

Express

|

$4.20

|

|

|

Single Trip Smartcard Fares (approx. 20% cheaper than cash fares)

|

|

Adult

|

Tertiary Student/

Community Services Card

|

Child/High School Student/

Senior

|

|

1 Zone

|

$2.88

|

$1.90

|

$1.43

|

|

2 Zone

|

$4.28

|

$2.86

|

$2.14

|

|

Express

|

$3.65

|

|

|

Diagram 6 - Current Zones

|

1 Zone Trip

|

2 Zone Trip

|

|

Napier, Tamatea,

Taradale, and EIT

|

Napier, Tamatea

and Taradale (before EIT) to Hastings/Flaxmere/Havelock North

|

|

Hastings,

Havelock North, Flaxmere and EIT

|

Hastings,

Havelock North, Flaxmere to Taradale (after EIT), Tamatea or Napier

|

13. EIT students pay only a

one zone fare as EIT is the zone boundary. A single smartcard trip to/from EIT

is $1.90 (with EIT student ID).

14. SuperGold cardholders

travel free between 9am and 3pm Monday to Friday and anytime on weekend/public

holiday services. HBRC is reimbursed for these fares by the NZ Transport

Agency.

15. DHB patients travelling

from Napier to Hawke’s Bay Hospital, travel free of charge on production

of a valid DHB appointment card/letter. HBRC is reimbursed for these fares by

the DHB.

16. As seen in Diagram 7,

almost 86% of goBay fares are concessionary fares of one type or another.

Diagram

7 - Passenger Category Percentages 2014-15

|

2014-15

|

Trips

|

%

|

|

Adult

|

122,498

|

16.8%

|

|

Child/High

School student

|

204,468

|

27.5%

|

|

Community

Services Cardholder

|

125,300

|

16.8%

|

|

DHB

Appointment Cardholder

|

3,265

|

0.4%

|

|

Promo/10-trips

sold directly by HBRC

|

14,227

|

1.9%

|

|

Senior

|

16,357

|

2.2%

|

|

SuperGold

Cardholder

|

115,753

|

15.5%

|

|

Tertiary

Student

|

97,325

|

13.1%

|

|

Transfer

|

42,561

|

5.7%

|

|

Total

|

744,692

|

100.0%

|

17. Diagram 8 shows fare types

and fare recovery rates for other regions. It is not possible to directly

compare fares across regions, due to differences in fare structures and zone

sizes, but the fare recovery rate provides a suitable means of comparison.

Diagram 8 - A comparison with other regions based on 2014-15

information

|

Region/city

|

Fare Recovery

|

Tertiary Student Fare

|

Disabled Fare

|

Community Services Fare

|

|

Auckland

|

51%

|

√

|

√

|

|

|

Bay of Plenty

|

31%

|

√

|

|

|

|

Canterbury

|

40%

|

|

|

|

|

Greater

Wellington

|

55-60%

|

|

|

|

|

Hawke’s

Bay

|

39%

|

√

|

|

√

|

|

Horizons

|

44%

|

√

|

|

√

|

|

Invercargill

|

36%

|

|

|

|

|

Nelson

|

64%

|

√

|

|

√

|

|

Otago

|

48%

|

√

|

√

|

|

|

Taranaki

|

|

√

|

√

|

√

|

|

Waikato

|

38.96%

|

|

|

|

(All regions provide discount for children, high

school students and seniors/SuperGold cardholders).

18. Hawke’s

Bay, while not among the highest of fare recovery rates, is similar to other

comparable regions. The fare recovery has improved considerably, from 32% in

2011-12.

19. The new

lower contract price from 1 August 2016, will benefit both taxpayers and regional ratepayers, and ‘sharing’

this benefit with passengers by keeping fares at their current level may

encourage more uptake of public transport. Projections show that based on the

decreased cost of the services and assuming the current level of patronage and

revenue, the fare recovery rate is expected to increase to around 46%.

20. Given the

fluctuating petrol prices and the fall in public transport patronage during

2014-15, it is also possible a fare increase would have a further negative

effect on public transport usage.

21. In light

of the decline in patronage and decrease in the real cost of operating the

service, we therefore do not recommend an increase in fares during 2015-16.

However, a fare review should be undertaken again in 2016-17.

SuperGold Card Scheme

Update

22. Changes

have been made to the funding of the SuperGold scheme which provides free

off-peak bus travel for people with a SuperGold card. The Minister of Transport

has announced that from 2016-17 funding for this scheme will be capped and each

region will be bulk funded. Regional allocations will be adjusted

annually by the Consumer Price Index but there will be no funding to

accommodate growth in numbers of users of the scheme or in the number of trips

taken.

23. Regional

Council staff from around the country recently attended a workshop in

Wellington to try to work out an equitable way for the fund to be shared among

the councils. Several options are being modelled but no preferred options have

yet been identified. Regional councils will be formally consulted on several

options before NZTA makes a final decision in early 2016.

Total Mobility

24. The Total

Mobility Scheme, which is funded by regional council, local councils and the

NZTA, provides subsidised taxi transport for people who have a permanent

illness or disability which prevents them from using public transport.

25. The

following tables show the number of Total Mobility trips made during 2012-13,

2013-14 and 2014-15 and the corresponding costs (excl GST).

26. There

were 23,354 trips in the first three months of this year, compared with 23,947

in the same period last year, a decrease of 2.5%. Expenditure decreased by

6.8%, from $160,491 in the first quarter of 2014-15 to $149,471 this

year. The reasons for this are not yet clear (although Total Mobility use

can be very weather-dependent) and it is too early to tell whether this trend

will continue.

Diagram 9 – Total Mobility Trips – 2012-13, 2013-14,

2014-15

|

Year

|

Jul

|

Aug

|

Sep

|

Oct

|

Nov

|

Dec

|

Jan

|

Feb

|

Mar

|

Apr

|

May

|

June

|

Total

|

|

2012-13

|

6,753

|

6,839

|

6,471

|

7,256

|

6,925

|

6,447

|

6,022

|

6,320

|

6,614

|

6,850

|

7,106

|

6,382

|

79,985

|

|

2013-14

|

7,401

|

6,804

|

6,611

|

7,658

|

7,365

|

7,185

|

6,546

|

7,032

|

7,605

|

7,745

|

7,707

|

7,188

|

86,847

|

|

2014-15

|

8,320

|

7,950

|

7,677

|

8,267

|

7,701

|

7,948

|

6,354

|

6,901

|

8,245

|

7,328

|

7,737

|

7,852

|

92,280

|

|

2015-16

|

7,949

|

7,219

|

8,186

|

|

|

|

|

|

|

|

|

|

23,354

|

Diagram 10 – Total Mobility Cost ($, excl GST) – 2012-13,

2013-14, 2014-15, 2015-16 (YTD)

|

Year

|

Jul

|

Aug

|

Sep

|

Oct

|

Nov

|

Dec

|

Jan

|

Feb

|

Mar

|

Apr

|

May

|

June

|

Total

|

|

2012-13

|

44,451

|

44,877

|

43,241

|

46,216

|

45,382

|

39,880

|

37,347

|

40,862

|

44,382

|

43,927

|

47,613

|

43,394

|

521,572

|

|

2013-14

|

49,274

|

46,153

|

43,965

|

50,189

|

47,744

|

46,968

|

39,581

|

46,567

|

52,047

|

50,715

|

51,078

|

49,348

|

573,629

|

|

2014-15

|

55,780

|

53,489

|

51,222

|

54,492

|

53,590

|

49,973

|

38,990

|

45,943

|

52,581

|

46,747

|

50,972

|

51,422

|

605,201

|

|

2015-16 YTD

|

50,876

|

46,254

|

52,339

|

|

|

|

|

|

|

|

|

|

149,469 YTD

|

(60% of this cost

is met by the New Zealand Transport Agency).

Decision

Making Process

27. Council

is required to make a decision in accordance with the requirements of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained in Part 6 Sub Part 1 of the Act in relation to this item and have

concluded the following:

27.1. The

decision does not significantly alter the service provision or affect a

strategic asset.

27.2. The use

of the special consultative procedure is not prescribed by legislation.

27.3. The

decision has been considered in accordance with Council’s Significance

and Engagement Policy.

27.4. The persons affected by

this decision are bus users in the region.

27.5. Options

that have been considered include increases in bus fares and other fare

structures.

27.6. The

decision is not inconsistent with an existing policy or plan.

28. Given the

nature and significance of the issue to be considered and decided, and also the

persons likely to be affected by, or have an interest in the decisions made,

Council can exercise its discretion and make a decision without consulting

directly with the community or others having an interest in the

decision.

|

Recommendations

1. That the Corporate and Strategic Committee

receives the November 2015 Public Transport Update report.

2. The Corporate and Strategic Committee recommends that Council

2.1 Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion under Sections 79(1)(a)

and 82(3) of the Local Government Act 2002 and make decisions on this issue

without conferring directly with the community.

2.2 Agrees

that bus fares remain at current rates for the remainder of the 2015-16 financial

year, and to review fares again in 2016-17.

|

|

Megan Welsby

Sustainable Transport Coordinator

|

Anne Redgrave

Transport Manager

|

|

Liz Lambert

Chief Executive

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 18 November 2015

Subject: Recording of Councillor

Attendance

Reason for Report

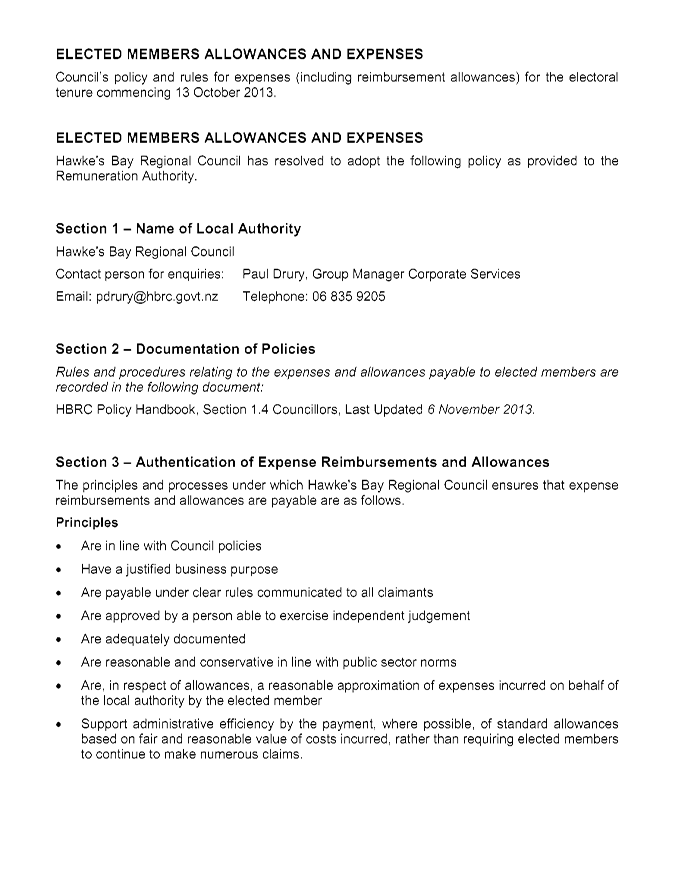

1. Councillors

have requested a re-consideration of what is recorded in relation to attendance

records for Council, Committee and other meetings and requirements of the

Remuneration Authority and Audit.

2. The following

information, including Council’s adopted Councillor Remuneration and

Allowances Policy (attached) is provided to inform the discussion and debate

for Councillors in reaching a decision as to what information they wish staff

to report in the Annual Report in relation to elected members’ attendance

at meetings.

Audit Requirements

3. Audit requires

there to be a record of attendance at meetings as relates to Travel Claims for

mileage to-from Council and Committee meetings, and any other meetings or

functions that Councillors are paid a travel allowance for, as part of the

disclosure of Councillor Remuneration/Payments.

4. How, or if,

that attendance record is provided as part of the Annual Report is a decision

for Council to make, however staff are required to record and maintain records

of transactions that are the source of whatever is reported upon request

– by Audit or by any member of the public (in accordance with LGOIMA).

5. If councillors

wish to claim travel or mileage for attendance at meetings, the detailed record

of attendance must be provided to staff for recording on the attendance

register and saving on Council’s EDRMS in accordance with the Public

Records Act and for Audit as supporting documentation.

6. In addition,

Audit requires that Council and Committee meeting attendance

‘overall’ is reported against the specific performance measures in

the Long Term Plan/ Annual Plan for the Governance, Community Engagement &

Services Activity 3 Community Representation & Regional Leadership. There

are two level of service measures, which are:

6.1. Councillors’

attendance at monthly Council and Committee meetings achieving at least 90%

attendance of elected and appointed members – with the required action to

achieve the performance target being to “monitor and record meeting

attendance”

6.2. Attendance at

Maori Committee meetings rate of at least 80% maintained – with the

required action to achieve the performance target being to “monitor and

record meeting attendance”.

Remuneration Authority Determination for

HBRC

7. The

Remuneration Authority, in accordance with the Local Government Act, determines

what remuneration, allowances and expenses elected representatives are entitled

to, and approval of the Council’s rules and policies for the payment of

those.

Local Government Act Requirements

8. The following sections of the Local

Government Act apply.

Subpart 1—Local

authorities

Governance

and management

39 Governance principles

A local authority must act in accordance with the following

principles in relation to its governance:

(a) a local authority should ensure that the role of

democratic governance of the community, and the expected conduct of elected

members, is clear and understood by elected members and the community; and

(b) a local authority should ensure that the governance

structures and processes are effective, open, and transparent; and

Remuneration of members

6 Remuneration Authority to determine remuneration

(1) The Remuneration Authority must determine the

remuneration, allowances, and expenses payable to—

(a) mayors, deputy mayors, chairpersons, deputy chairpersons,

and members of local authorities

(b) chairpersons of committees of local authorities …

(2) …

(3) The Remuneration

Authority may do 1 or more of the following things under subclause (1) or (2):

(a) fix—

(i) scales of

salaries

(ii) scales of

allowances

(iii) ranges of

remuneration

(iv) different forms of remuneration

(b) prescribe—

(i) rules for the

application of those scales, ranges, or different forms of remuneration

(ii) rules for reimbursing expenses incurred by members

(c) differentiate—

(i) between persons

occupying equivalent positions in different local authorities, community

boards, or local boards:

(ii) between persons occupying equivalent positions in the

same local authorities, community boards, or local boards:

(d) …

(e) approve rules proposed by a local authority for

reimbursing expenses incurred by members, subject to any conditions that the

Authority thinks fit.

Schedule 10 Long-term plans, annual plans, and annual reports

Part 3 Information to be included in annual reports

32 Remuneration issues

(1) An annual report

must include a report on the remuneration that, in the year to which the report

relates, was received by, or payable to, each of the following persons:

(a) the mayor or

chairperson of the local authority:

(b) each of the other

members of the local authority:

(c) the chief executive of the local authority.

(2) The report under subclause (1) must show, in relation to

each person specified in that subclause, that person's total remuneration for

the year.

(3) To avoid doubt, subclause (2) applies to the total

remuneration (including the value of any non-financial benefits) that, during

the year, was paid to the person, or was payable to the person, by the local

authority and any council organisation of the local authority.

Summary

9. Council is

requested to advise staff what they wish to have reported in the Annual Report

in relation to attendance at Council and other meetings while ensuring that all

legislative and audit requirements are complied with.

Decision Making

Process

10. Council

is required to make a decision in accordance with the requirements of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained in Part 6 Sub Part 1 of the Act in relation to this item and have concluded

the following:

10.1. The decision

does not significantly alter the service provision or affect a strategic asset.

10.2. The use of

the special consultative procedure is not prescribed by legislation, nor is the

decision inconsistent with an existing policy or plan.

10.3. Given the

nature and significance of the issue to be considered and decided, and also the

persons likely to be affected by, or have an interest in the decisions made,

Council can exercise its discretion and make a decision without consulting

directly with the community.

|

Recommendations

1. That the Corporate and Strategic Committee receives the “Recording of Councillor Attendance” report.

2. The Corporate and Strategic Committee recommends that Council:

2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted Significance and Engagement

Policy, and that Council can exercise its discretion under Sections 79(1)(a)

and 82(3) of the Local Government Act 2002 and make decisions on this issue

without conferring directly with the community.

2.2. Provides guidance to staff on the range of engagements (including

formal meetings) attended by councillors that are to be recorded and then

reported in the Council’s Annual Reports.

|

|

Leeanne Hooper

Governance & Corporate Administration

Manager

|

Liz Lambert

Chief Executive

|

Attachment/s

|

1

|

Councillor

Remuneration and Allowances Policy

|

|

|

|

Councillor

Remuneration and Allowances Policy

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 18 November 2015

Subject: Objectives for Inter

Council Cooperation

Reason for Report

1. The regional

debate around the proposed reorganisation of local government structures in

Hawke’s Bay saw regional collaboration and shared services promoted as

optimal vehicles for pursuing greater efficiency and cost-effectiveness in the

provision of services to Hawke’s Bay, and in gaining greater strategic

alignment on infrastructure priorities and investment.

2. Following the

reorganisation poll, the Mayors of the Region and the Regional Council Chairman

agreed that their Councils should consider a significant strengthening of

regional collaboration and shared services initiatives in order to deliver more

cost-effective and streamlined service provision for Hawke’s Bay.

3. On 30 November

all Hawke’s Bay councillors have been invited to attend a meeting where

the focus of discussion will be on activities that are carried out by all five

councils and how regional collaboration and shares services should be

prioritised.

4. The purpose of

this paper is to offer the committee an opportunity to identify priorities for

the Hawke’s Bay Regional Council, on the assumption that preparatory work

may be required ahead of the 30 November meeting.

HB LASS Ltd Progress

5. There are now a

number of active work streams that involve many staff from within each of the

shareholding councils.

5.1. The Board has

met with representatives of the Manawatu/Wanganui shared services organisation

(MW LASS Ltd) and this has provided a number of opportunities to participate in

shared services activities across a greater spread of Council organisations.

When reviewing the projects that

Manawatu/Wanganui LASS, Bay of Plenty Lass and Waikato Lass have implemented,

HB LASS Ltd was able to confirm that much of the ‘lower hanging

fruit’ (particularly in terms of cost savings) had already been achieved

by the Hawke’s Bay councils working together before the formation of HB

LASS.

5.2. As a direct

consequence of the meeting with Manawatu/Wanganui LASS HB LASS Ltd participated

in an Insurance Brokerage Tender process that involved councils that are

members of HB LASS, MW LASS, BOP LASS and a consortium of West Coast South

Island Councils. The Hawkes Bay councils spend in excess of $3 million per

annum on insurance; the scale provided by the large number of Councils

participating is generated opportunities for considerable financial benefits to

all the Councils. The savings, of in excess of $900,000 in the 2015/16

financial year are considered to be significantly greater than would have been

achieved by the five councils in Hawke’s Bay acting on their own.

5.3. In November

2014 the Board agreed on the letting of a tender for the provision of Digital

Ortho photography for the five Councils. The tender was for a total value of $547,000.

Officers of the Councils have identified that the collaboration on this project

will enable a contribution of $70,000 from Land Information New Zealand towards

the costs by and savings of in excess of $100,000 to be made across the five

Councils.

In September 2015 HB LASS Ltd launched

the Hawke’s Bay Viewer site. This aspect of the GIS project provides a

single entry point access to the Hawkes Bay CDEMG Hazards data and provides

access to all of the HB LASS councils GIS systems.

5.4. The Collaborative

Fleet Management Group continues to meet on a regular basis. The savings that

each Council gains from the participation in the syndicated fuel contract are

ongoing as are the benefits of shared information and practises.

5.5. HB LASS

sees the achievement of IS shared services as the foundation stone for progress

with other significant Shared Services projects.

The IS Advisory Group has developed and

implemented its short-term strategic plan with key objectives being aligning

the Information Services (IS) functions of the region’s five Councils,

achieving a level of shared service capability across IS infrastructure and

resourcing and to create a state of ‘enablement’ for the delivery

of future ‘operational’ shared services with other Councils, regionally

and nationally. The alignment of shared ICT infrastructure, operating

environments, application software and personnel has been challenging given

that each Council is on different purchasing cycles for expensive

infrastructure. However the project has now reached a milestone whereby the

Board has approved further work around a two-site ICT Shared Infrastructure

purchase.

5.6. Officers from

all the Councils have met to discuss options for an Asset Management project.

It has been agreed that it should initially progress one initiative from each

of 3 key themes being;

5.6.1. Procurement

Management

5.6.2. Consistency,

and

5.6.3. Support

services.

5.7. The Chief

Financial Officers from the five councils have presented a proposal for the

development of a business case to create a specialised internal audit function

providing internal audit support across the five councils.

5.8. Outside of

the formal projects that have been discussed above the and as a consequence of

the collaborative approach that follows from the work of HB LASS, other

individual arrangements have progressed over the last twelve months including

among other things the sharing of Human Resources capability between some

Councils, arrangements for Health & Safety, sharing of executive

staff.

S.17A Reviews

6. Since the

conclusion of the reorganisation poll the Chief Executives of the five councils

have met specifically to discuss s.17A reviews.

7. The amendments

to the LGA that came into effect in 2014 (the introduction of section 17A)

require councils to review the cost-effectiveness of current arrangements for

meeting the needs of communities within its district for good-quality local

infrastructure, local public services, and performance of regulatory functions.

The Act requires that regional approaches be considered as part of this work.

8. While a

separate paper will be prepared and presented to Council on this topic it is

worth noting that s 17A provides a mechanism to enable the Council to explore,

with its regional partners and potentially others, mechanisms and initiatives

for improving the funding, governance and delivery of local government services

in Hawke’s Bay in order to improve the quality and cost-effectiveness of

those services.

Conclusion

9. The 30 November

meeting will include a presentation on the reviewed Regional Economic

Development Strategy.

10. Identification of other

matters for discussion, either on that day or at a later opportunity, will be

of assistance so that any preparatory work can be undertaken.

Decision Making

Process

11. Council is required to

make a decision in accordance with Part 6 Sub-Part 1, of the Local Government

Act 2002 (the Act). Staff have assessed the requirements contained within

this section of the Act in relation to this item and have concluded that, as

this report is for information only and no decision is to be made, the decision

making provisions of the Local Government Act 2002 do not apply.

|

Recommendations

1. The Corporate and Strategic Committee receives

the report and provides guidance to staff on priority matters that may

require additional investigation prior to the 30 November meeting of all

Hawke’s Bay councillors.

|

|

Liz Lambert

Chief Executive

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 18 November 2015

Subject: Business Hawke’s

Bay Update

Reason for Report

1. Business Hawke’s Bay (BHB) receives $100,000 annually from

HBRC under a three year funding agreement dated 18 September 2013. This

agreement provides:

1.1. Council will receive, as requested but no less than 6 monthly, a

formal briefing on activity delivered and to be delivered in association with

the Council’s Economic Development Manager, and

1.2. Council will receive, annually in July, a short written report

outlining progress against KPIs, changes to KPIs and changes in Business

Hawke’s Bay strategy.

Background

2. Under the 2011 Regional Economic Development Strategy,

Council’s primary expectation is that BHB will drive initiatives that

promote greater collaboration between the region’s economic development

managers and stakeholders. To this end BHB has conceived, promoted and executed

the establishment of the Business Hub in Ahuriri.

3. In addition, BHB continues to support HBRC’s objective of

promoting primary sector resilience through its on-going management of the

workflows and opportunities that followed the Infant Formula Conference.

4. BHB is a key stakeholder in the 2015 REDS review process and has

provided numerous linkages and connections into the commercial sector to better

inform that process.

Decision Making

Process

5. Council is

required to make a decision in accordance with Part 6 Sub-Part 1, of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained within this section of the Act in relation to this item and have

concluded that, as this report is for information only and no decision is to be

made, the decision making provisions of the Local Government Act 2002 do not

apply.

|

Recommendation

1. That the Corporate and Strategic Committee

receives and notes the “Business Hawke’s Bay Update”

report.

|

|

Tom Skerman

Economic Development Manager

|

Liz Lambert

Chief Executive

|

Attachment/s

|

1

|

Business

Hawke's Bay Report

|

|

|

|

Business

Hawke's Bay Report

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 18 November 2015

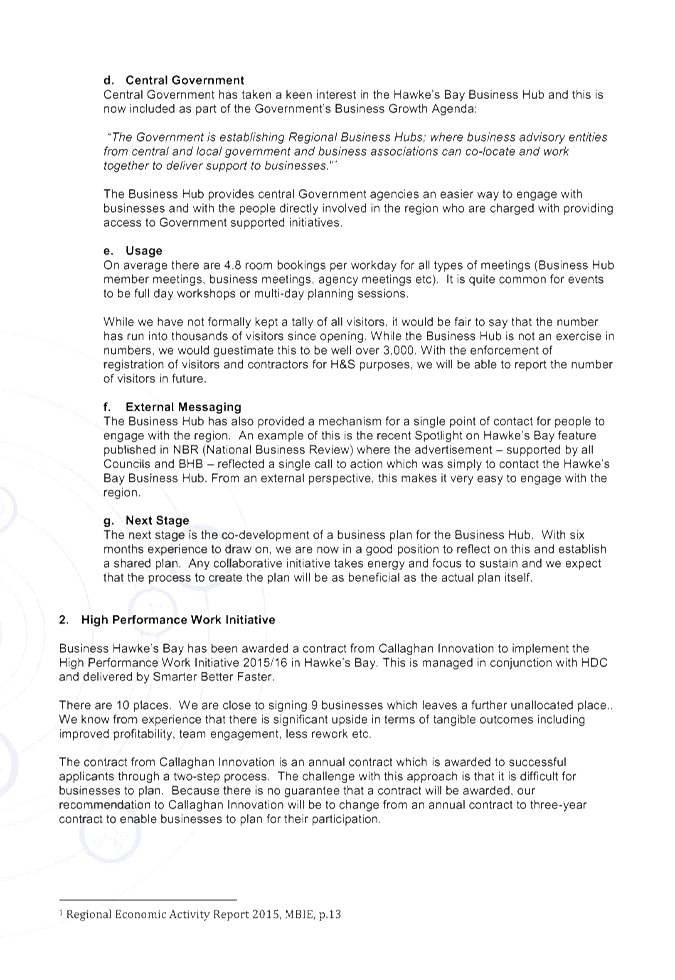

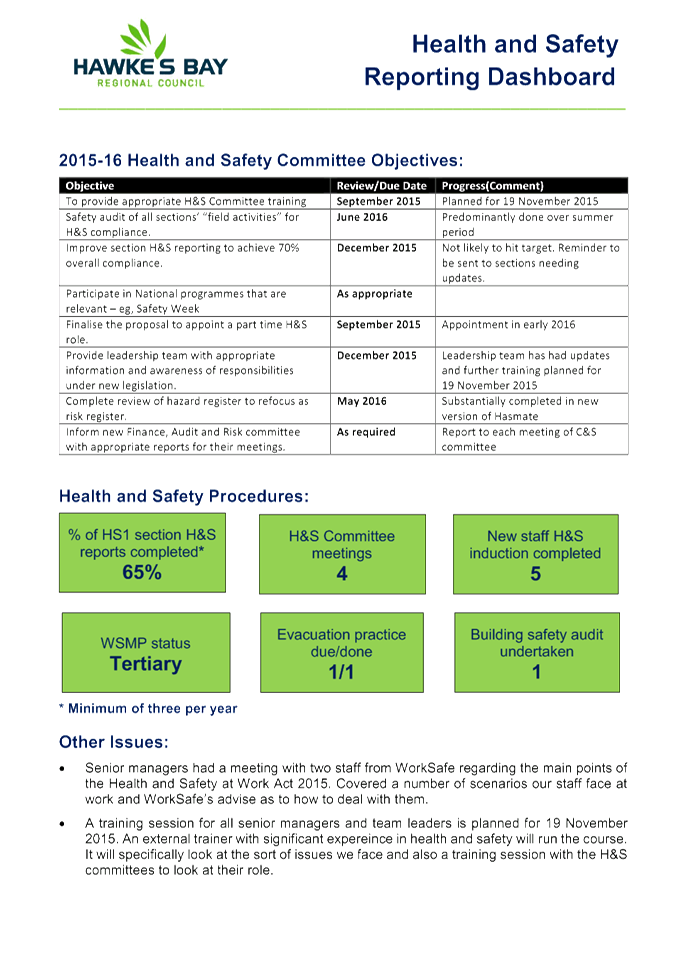

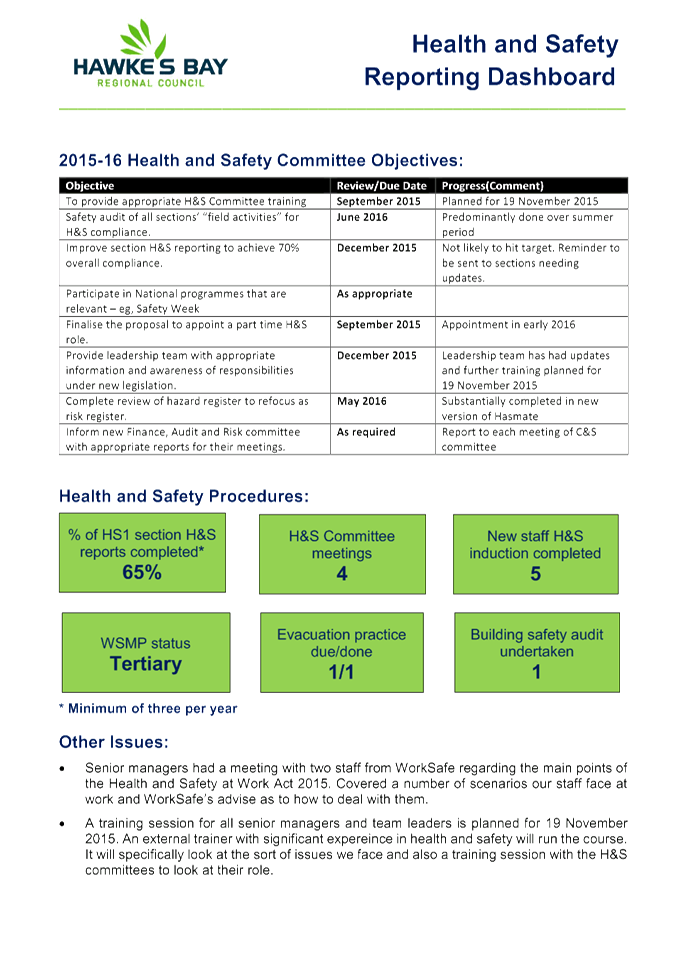

Subject: Health and Safety

Update Report for the Period 1 July 2015 to 30 October 2015

Reason for Report

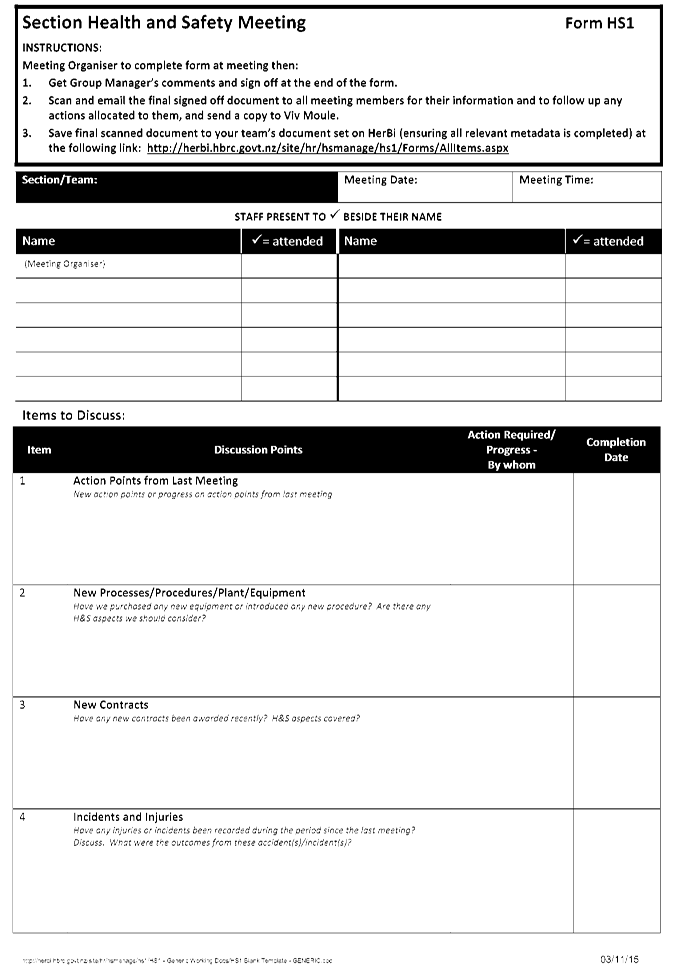

1. At the last meeting of the Corporate and Services Committee it was

decided that an update of key health and safety information should be presented

to each subsequent meeting of the committee.

Background

2. The first Health and Safety Reporting Dashboard is appended as Attachment

1 for the Committee’s information. The format and issues reported on

are a “starting point” and can be amended to reflect any changes

the Committee wishes to consider, or any additional issues it may wish to have

reported that are not presently covered.

3. For this report, no information has been provided on contractors and

contractors’ work sites audited as the information requires an across

Council reporting process that we don’t presently have. This should be

remedied for future reports.

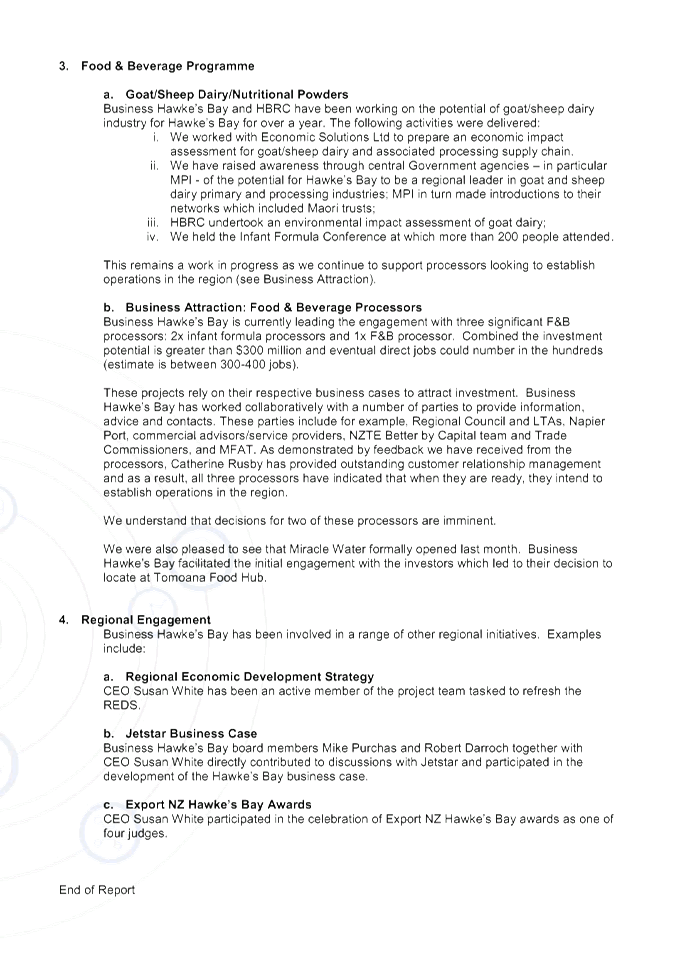

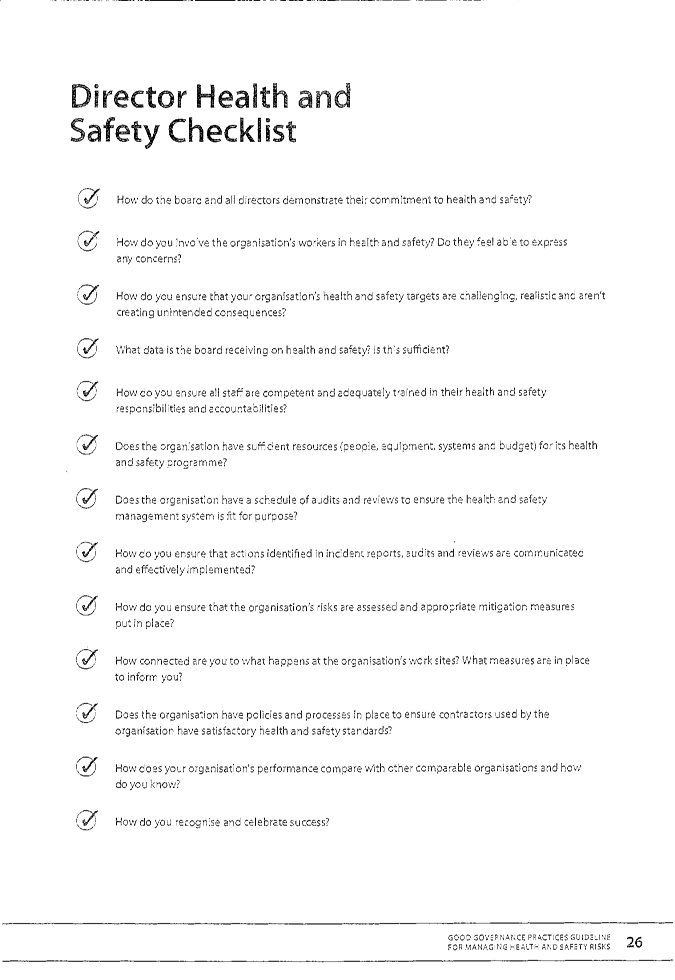

4. The following two documents are also attached.

4.1. Attachment 2: The “Director Health

and Safety Checklist” will assist councillors assess a “level of

comfort” that they are well informed regarding health and safety matters.

A number of these questions can be covered by the requirements of ACC’s

WSMP programme supplemented with information provided in the attached dashboard

– ie, what we see happening.

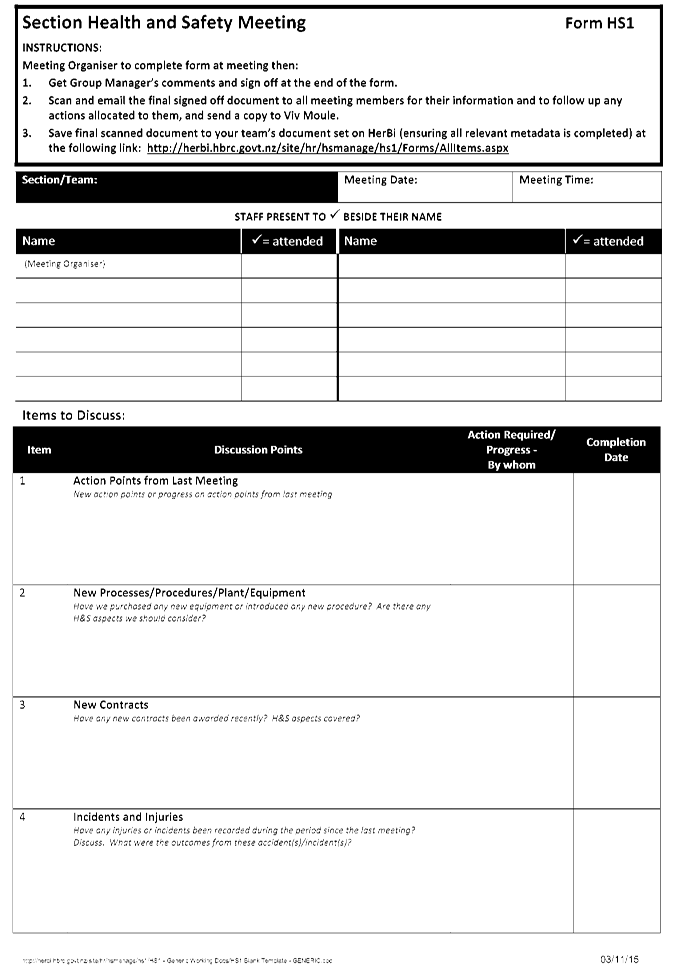

4.2. Attachment 3: The other document is the

“HS1” form template completed by each section of Council at their

staff meetings and highlights the various aspects of health and safety they are

asked to comment on.

Decision Making

Process

5. Council is

required to make a decision in accordance with Part 6 Sub-Part 1, of the Local

Government Act 2002 (the Act). As this report is for information only and

no decision is to be made, the decision making provisions of the Local

Government Act 2002 do not apply.

|

Recommendation

1. That the Corporate and Strategic Committee

receives the “Health and Safety Update Report for the Period 1

July 2015 to 30 October 2015”.

|

|

Viv Moule

Human Resources Manager

|

Liz Lambert

Chief Executive

|

Attachment/s

|

1

|

Health and

Safety Reporting Dashboard - 1 July 2015 to 30 October 2015

|

|

|

|

2

|

Director

Health and Safety Checklist

|

|

|

|

3

|

HS1 Form

Template

|

|

|

|

Health

and Safety Reporting Dashboard - 1 July 2015 to 30 October 2015

|

Attachment 1

|

|

Director Health and Safety

Checklist

|

Attachment 2

|

|

HS1 Form Template

|

Attachment 3

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 18 November 2015

Subject: Minor Items not on the

Agenda

Reason

for Report

This document has been

prepared to assist Councillors note the Minor Items Not on the Agenda to be

discussed as determined earlier in Agenda Item 6.

|

Item

|

Topic

|

Councillor

/ Staff

|

|

1.

|

|

|

|

2.

|

|

|

|

3.

|

|

|

|

4.

|

|

|

|

5.

|

|

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 18 November 2015

Subject: Independent Member

Recommendation from the Finance Audit and Risk Sub-committee

That Council excludes the public

from this section of the meeting, being Agenda Item 14 Independent Member

Recommendation from the Finance Audit and Risk Sub-committee with the general

subject of the item to be considered while the public is excluded; the reasons

for passing the resolution and the specific grounds under Section 48 (1) of the

Local Government Official Information and Meetings Act 1987 for the passing of

this resolution being as follows:

|

GENERAL SUBJECT OF THE ITEM TO BE CONSIDERED

|

REASON FOR PASSING THIS

RESOLUTION

|

GROUNDS UNDER SECTION 48(1)

FOR THE PASSING OF THE RESOLUTION

|

|

Independent Member Recommendation from the Finance Audit

and Risk Sub-committee

|

7(2)(a) That the public conduct of this agenda item would

be likely to result in the disclosure of information where the withholding of

the information is necessary to protect the privacy of natural persons.

|

The Council is specified, in the First Schedule to this

Act, as a body to which the Act applies.

|

|

Liz Lambert

Chief Executive

|

|