Meeting of the Finance Audit & Risk Sub-committee

Date: Tuesday 22 September 2015

Time: 9.00am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict

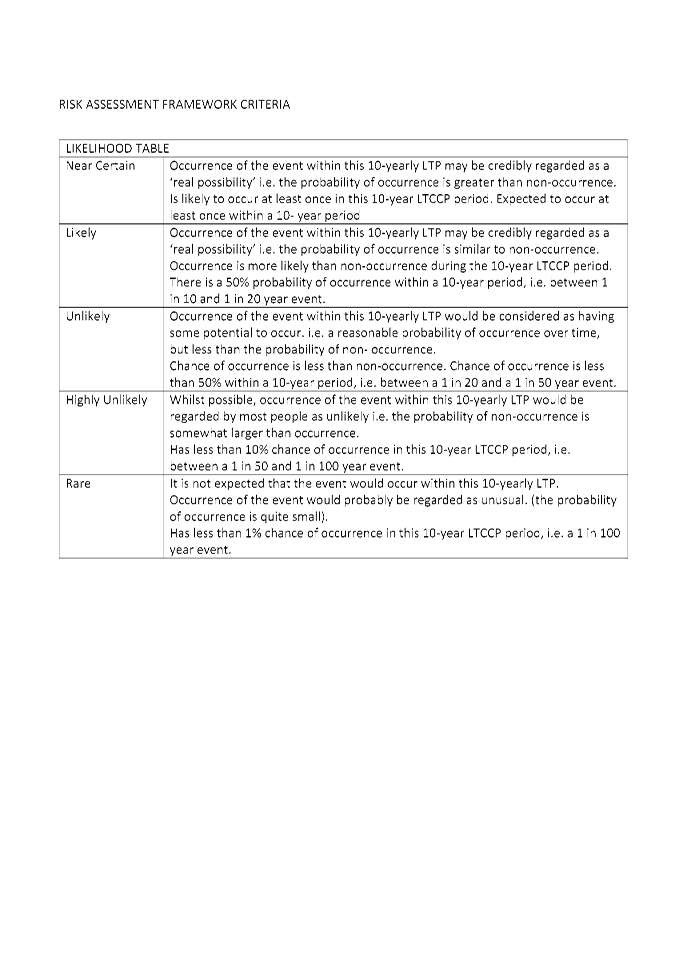

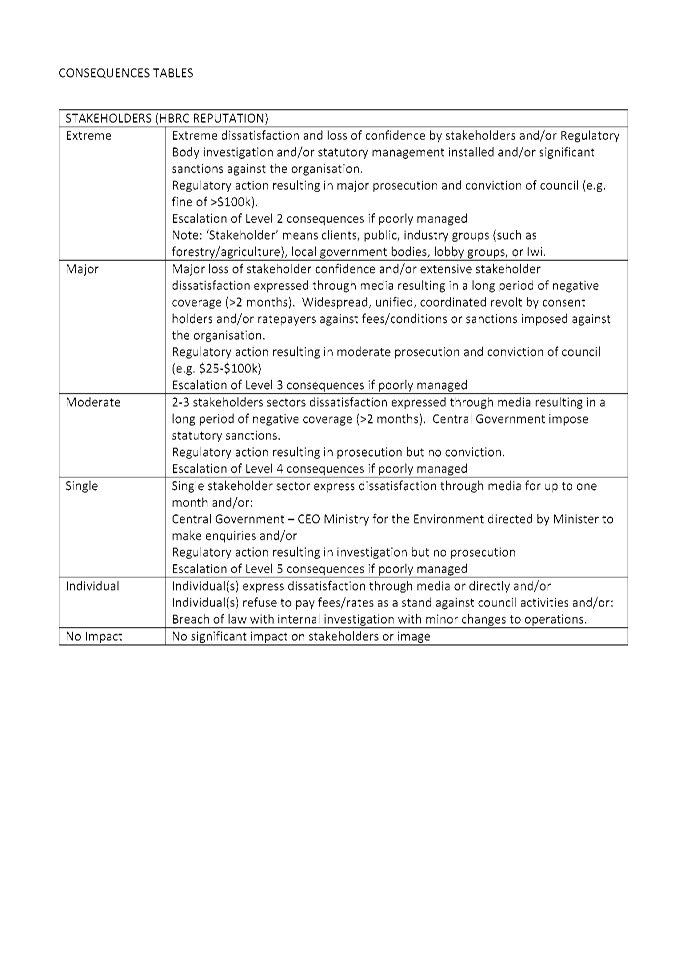

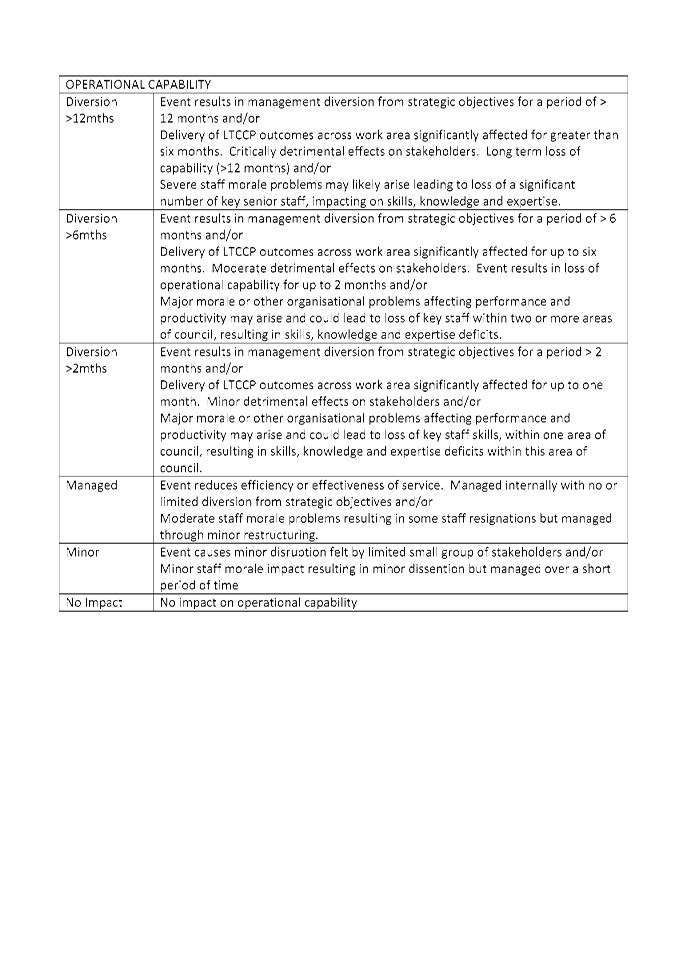

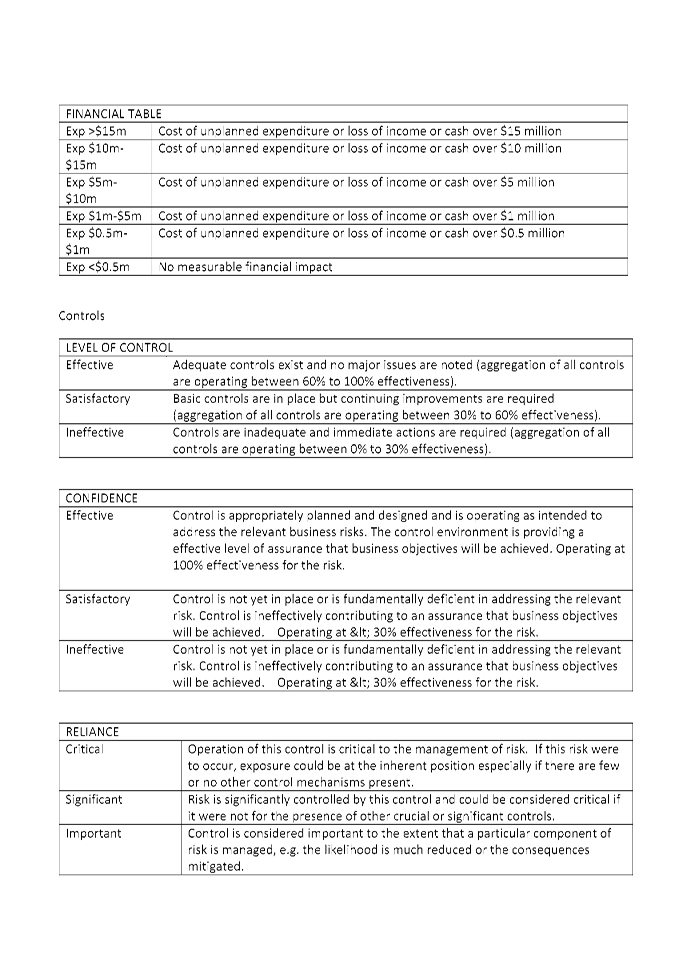

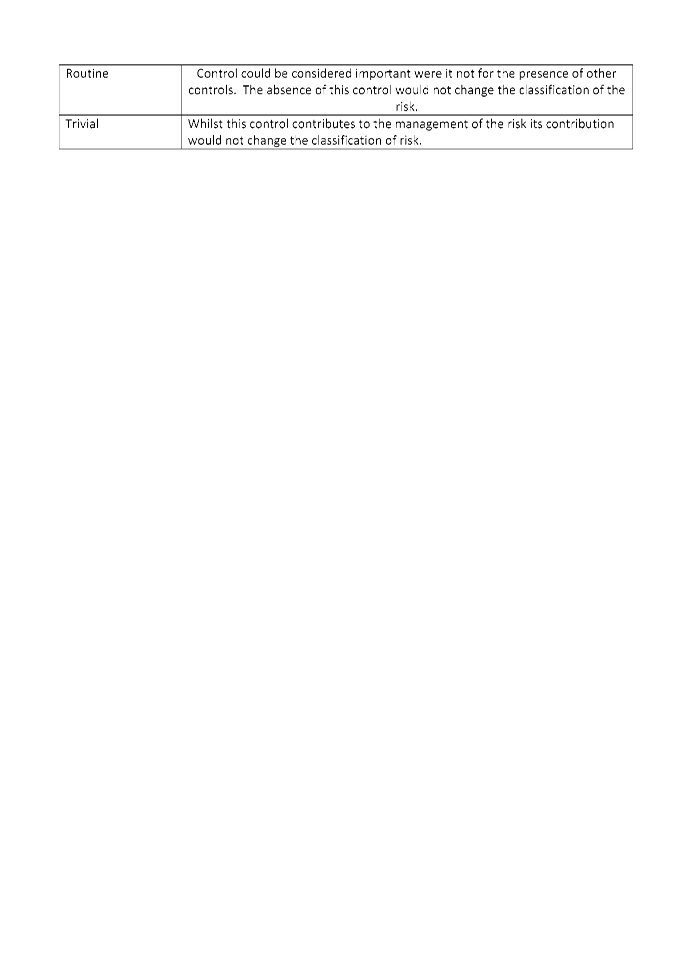

of Interest Declarations

3. Confirmation of

Minutes of the Finance Audit & Risk Sub-committee held on 3 June 2015

4. Matters Arising

from Minutes of the Finance Audit & Risk Sub-committee held on 3 June 2015

5. Follow-ups from

Previous Finance Audit & Risk Sub-committee meetings 3

Decision Items

6. Annual Report Year

Ending 30 June 2015 7

7. HBRC Risk

Management 13

8. Internal Audit

Programme 41

Information or Performance Monitoring

9. Work Programme

Going Forward 45

Decision Items (Public Excluded)

10. Independent Representative on

Finance Audit & Risk Sub-committee 47

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Tuesday 22 September 2015

Subject: Annual Report Year

Ending 30 June 2015

Reason for Report

1. To outline the

issues that Stephen Lucy, Director Audit NZ, proposes to discuss with the

Committee in relation to the audit of Hawke’s Bay Regional

Council’s (HBRC’s) financial statements for the year ending 30 June

2015.

Comment

2. During

Stephen’s presentation to the last meeting of the Finance Audit and Risk

Subcommittee held on Wednesday 3 June 2015, it was proposed that he attend this

meeting in order to discuss any issues that arose during the Audit of

HBRC’s Annual Report.

3. At the time of

writing this paper there were only a few items to be resolved before

Audit NZ would be in a position to complete their audit report. It

is therefore anticipated that by the time Stephen Lucy makes his presentation

to this meeting, the Annual Report audit would have been finalised.

4. Attached as Attachment

1 are the issues that Stephen Lucy proposes to discuss with the

Sub-committee.

5. At the

conclusion of these discussions there will be time for a Councillor only

discussion with Stephen.

6. The audited

Annual Report will be sent to Council for adoption at its meeting on

30 September 2015.

Decision Making

Process

7. As no decisions are required by this paper, the decision making

provisions of the Local Government Act 2002 do not apply.

|

Recommendations

1. That the Finance Audit and Risk Subcommittee receives the issues

forwarded by Stephen Lucy, Director Audit NZ, for discussion on HBRC’s

Annual Report for Year Ending 30 June 2015.

|

|

Paul Drury

Group Manager

Corporate Services

|

|

Attachment/s

|

1

|

Audit NZ

September 2015 Update for Finance Audit and Risk Subcommittee Meeting

|

|

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Tuesday 22 September 2015

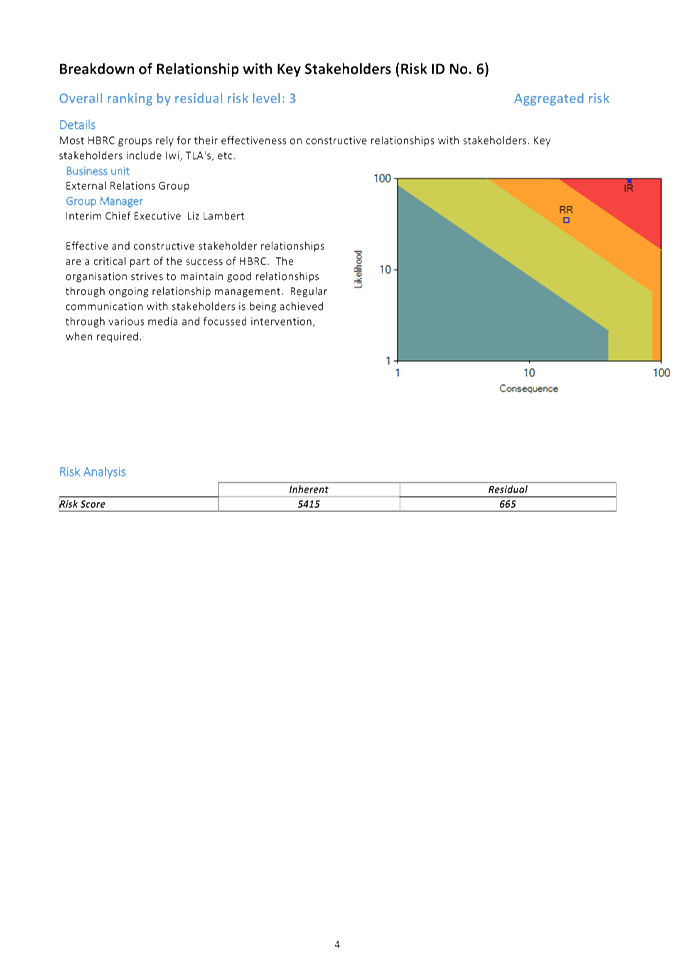

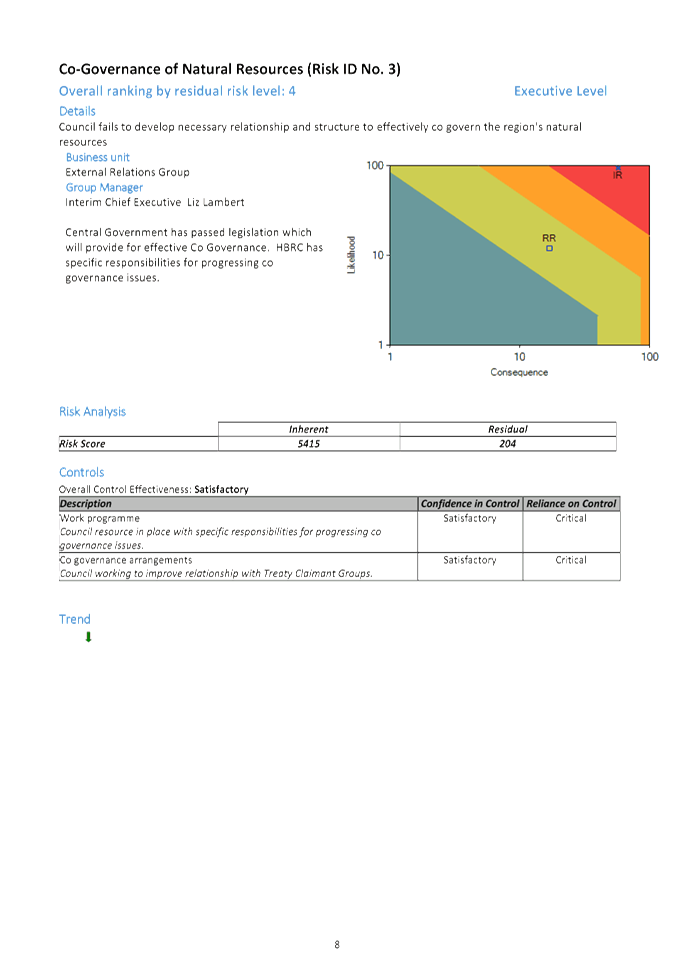

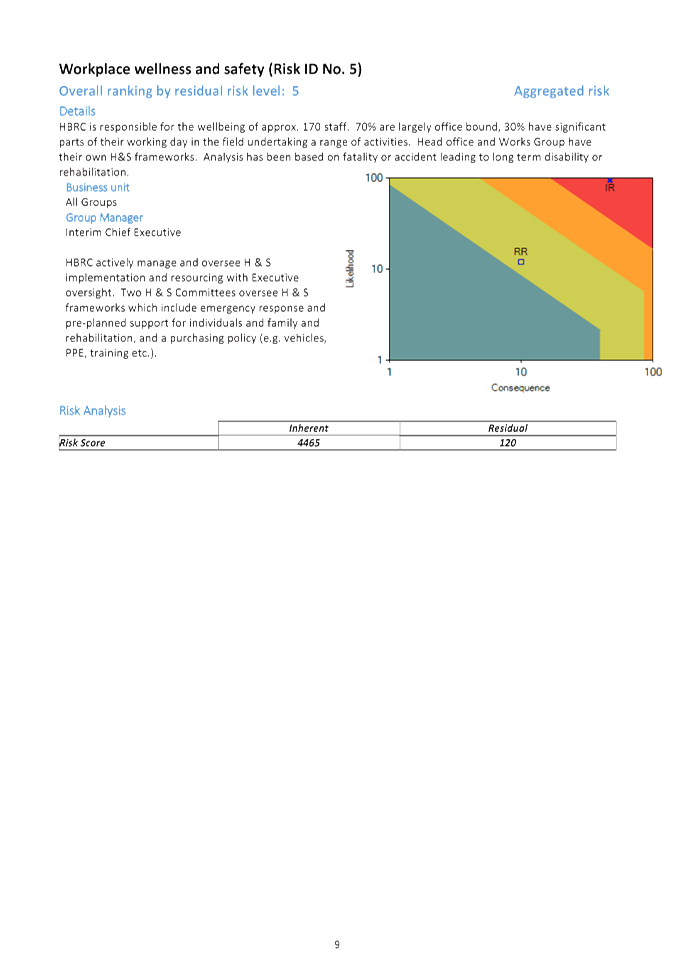

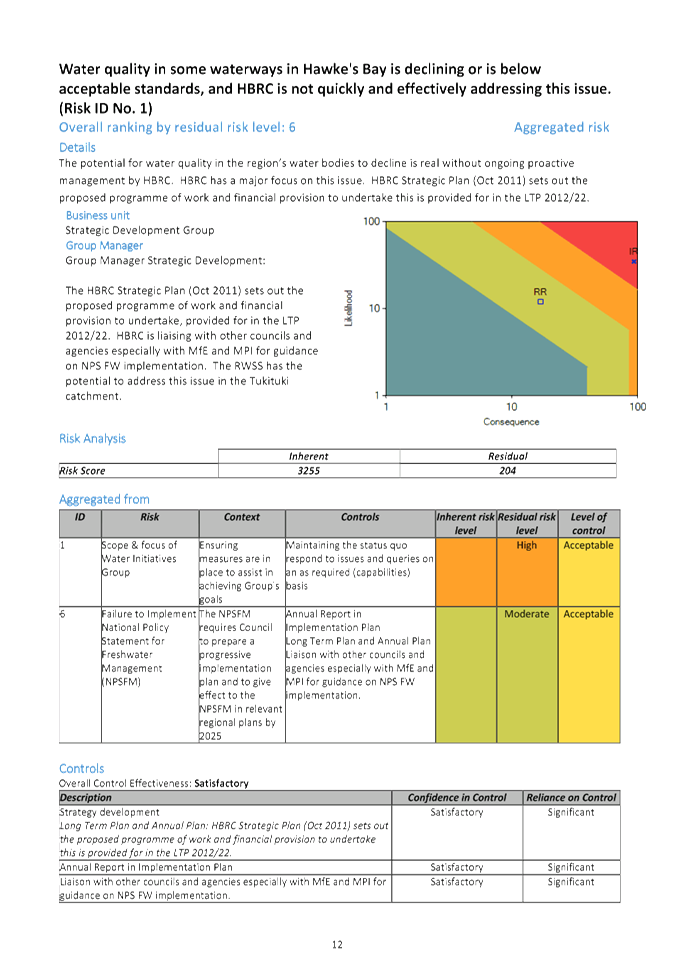

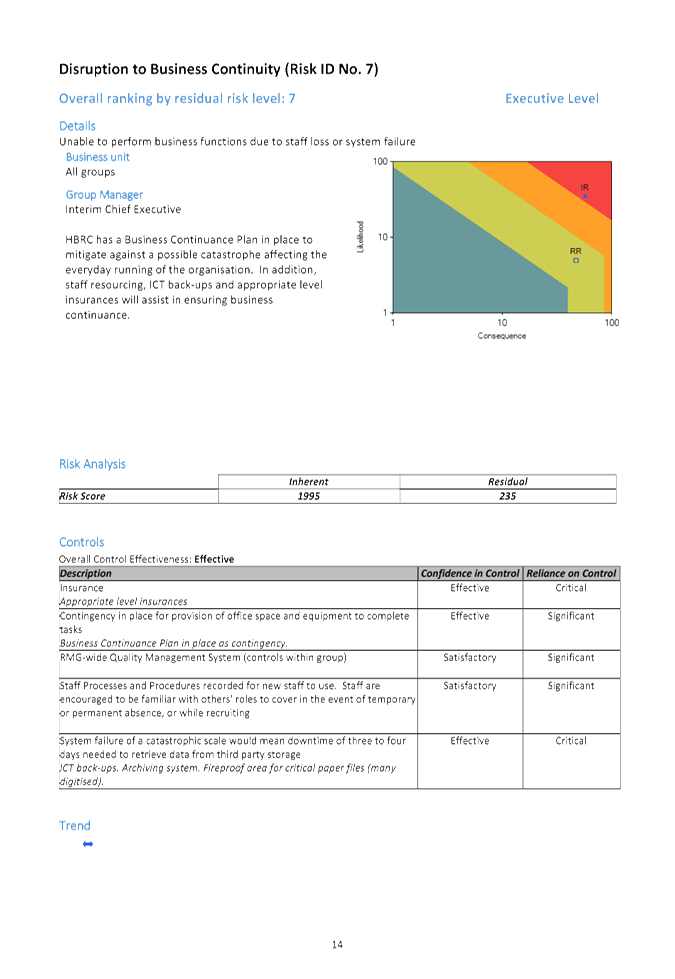

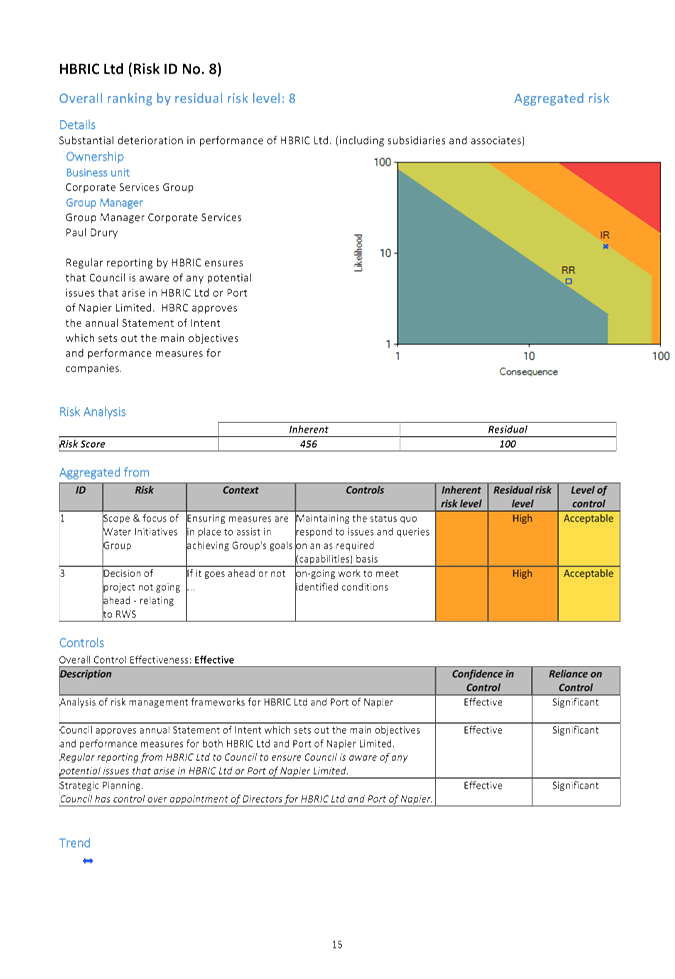

Subject: HBRC Risk Management

Reason for Report

1. At the meeting

on 3 June 2015, the Finance Audit and Risk Sub-committee considered a briefing

paper on risk assessment and management. This paper set out a draft risk

assessment and management framework. Since that time staff, with

assistance from an external consultant, have reviewed organisational risks for

each of the corporate groups.

2. The group risks

have, where appropriate, been aggregated up to higher level corporate risk.

3. This report

sets out the process in more detail and presents the risks.

Background

4. The purpose of

the Finance Audit and Risk Sub-committee is to report to the Corporate and

Strategic Committee on matters that will assist the Council to fulfil its

responsibilities for:

4.1. The

robustness of risk management systems, processes and practices

4.2. The provision

of appropriate controls to safeguard the Council’s financial and

non-financial assets, the integrity of internal and external reporting and

accountability arrangement

4.3. The

independence and adequacy of internal and external audit functions

4.4. Compliance

with applicable laws, regulations, standards and best practice guidelines

4.5. The review of

Council’s expenditure policies and the effectiveness of those policies.

5. This requires a

systematic mechanism with a robust framework in place to achieve confidence

that risk management is being carried out efficiently and effectively within

policy limits.

6. Each of the

management groups within Council are committed to identifying and mitigating or

managing all actual and potential risks associated with their work area and

implementing robust control measures.

7. For this

purpose the Council has utilised external resources, engaging a web-based Risk

and Assurance industry solution (Quantate), for a structured approach to

assessing and recording identified risks and their treatment approach.

8. Through the

identification and analysis of potential and actual risks, possible impacts on

the organisation can be quantified. The framework allows the Executive

management team to have an overview of risks, and to therefore provide, with

confidence, an overview of the key risks and how they are being managed.

9. Quantate is an

on-line program which can be used as a risk management register for simplified

and improved risk identification and reporting. Many councils across the

country (Greater Wellington Regional Council, Environment Canterbury, West

Coast Regional Council) and larger corporations and government organisations

(e.g. Spark, NZ Rail, CAA, Dept. of Internal Affairs) airports, ports, and

healthcare organisations use Quantate.

10. The programme can also be

used to provide risk control improvement plans, monitor internal controls, and

as a notification centre for reviews and/or updates. Several of the

benefits to the organisation in using Quantate are the capacity to:

10.1. Identify risks

10.2. Assess and evaluate

organisation-wide risks, via a set of standardised criteria

10.3. Record and assess the

risk controls

10.4. Rate the relative

importance of the controls

10.5. Monitor the controls and

their effectiveness.

11. Not all the tools

available within the Quantate program are currently being utilised. It is

proposed that these tools will be used in the future as the system is bedded

down across the organisation. It will however require additional resource

to rapidly develop more in-depth solutions for risk awareness, management and

control. There is the potential, for example, for Quantate to be used to a

greater degree for monitoring internal controls, setting up control improvement

plans, monitor control improvement plan activity, and set tasks.

Risk Assessment Framework

12. At the core of Risk

Management is the recognition and consideration of key risks facing an

organisation. Fundamental to this is for the governing body to

communicate to staff through the Chief Executive its risk tolerance. Risk

tolerance is defined as:

“the amount of risk an

organisation is willing to accept in pursuit of its strategic objectives”

13. The Finance, Audit and

Risk Committee therefore needs to provide feedback to staff on the risks

presented in this report and the assessment of the current level of risk

(residual risk) to which the organisation is exposed. If the Committee

believes that the residual risk is too great, then they are able to request

staff to report back to them with options for reducing that risk over time.

14. Council staff are required

to manage a variety of risks as part of their everyday responsibilities.

Each management group has assessed risks that may impact on their team’s

organisational and operational objectives. Council staff are required to

initially identify the risks pertaining to their work area and utilise

professional experience and qualifications to effectively manage those risks.

Group Managers (together with third tier managers) assemble and assess risks

identified along with controls.

15. Risks are then ranked

through Quantate using the standardised risk assessment criteria attached as

Attachment 1.

16. Responsibility for the

risk and control typically sits with Group Managers. Risks are mitigated

by ensuring controls are implemented and maintained.

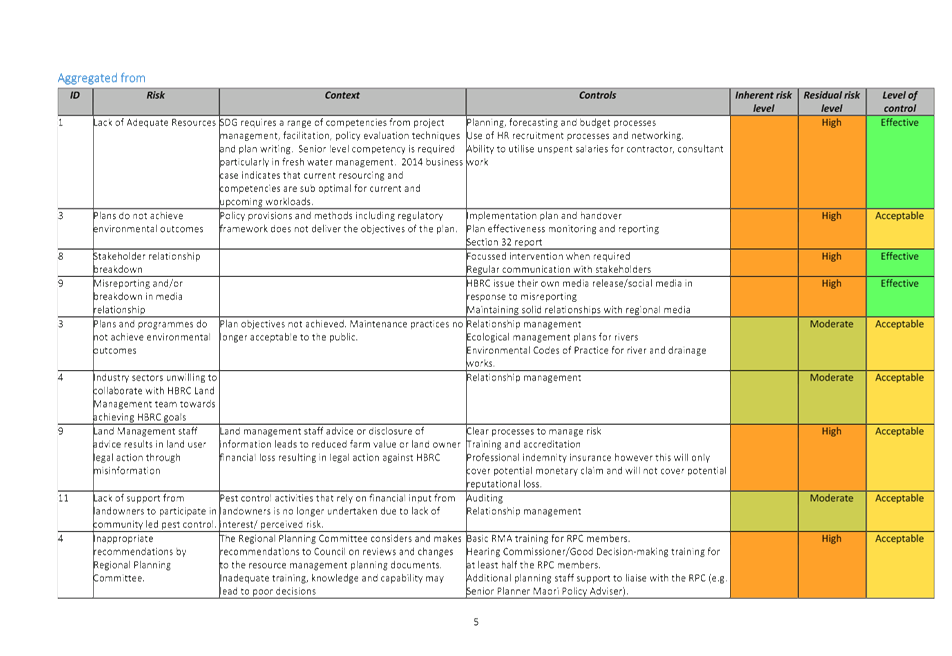

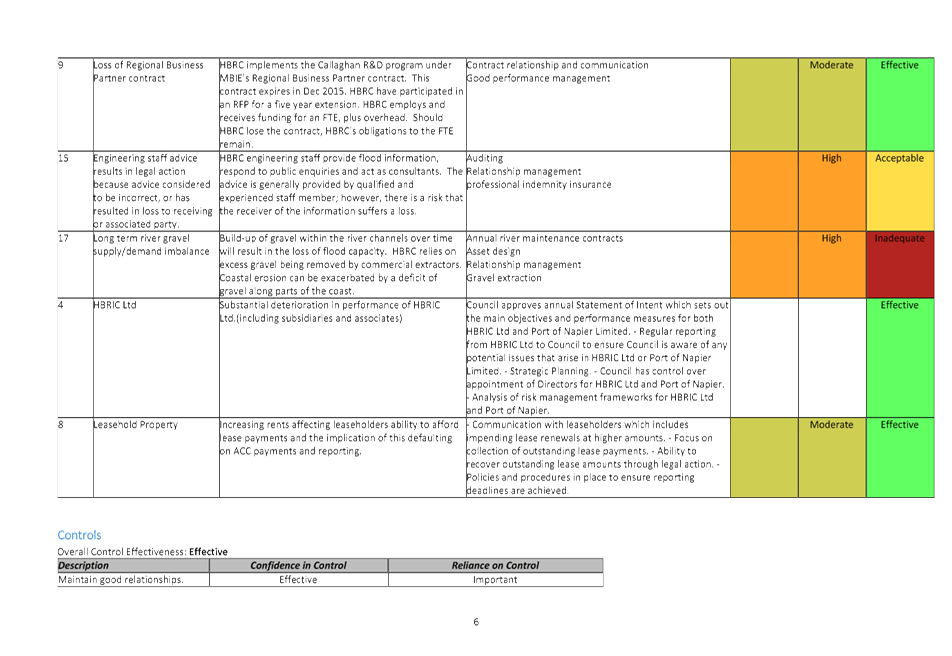

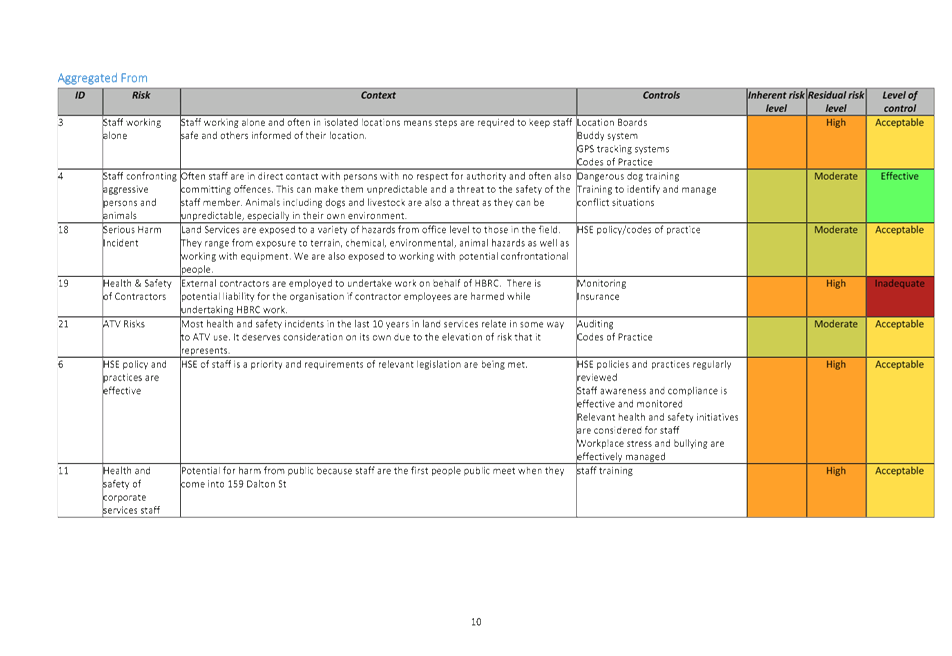

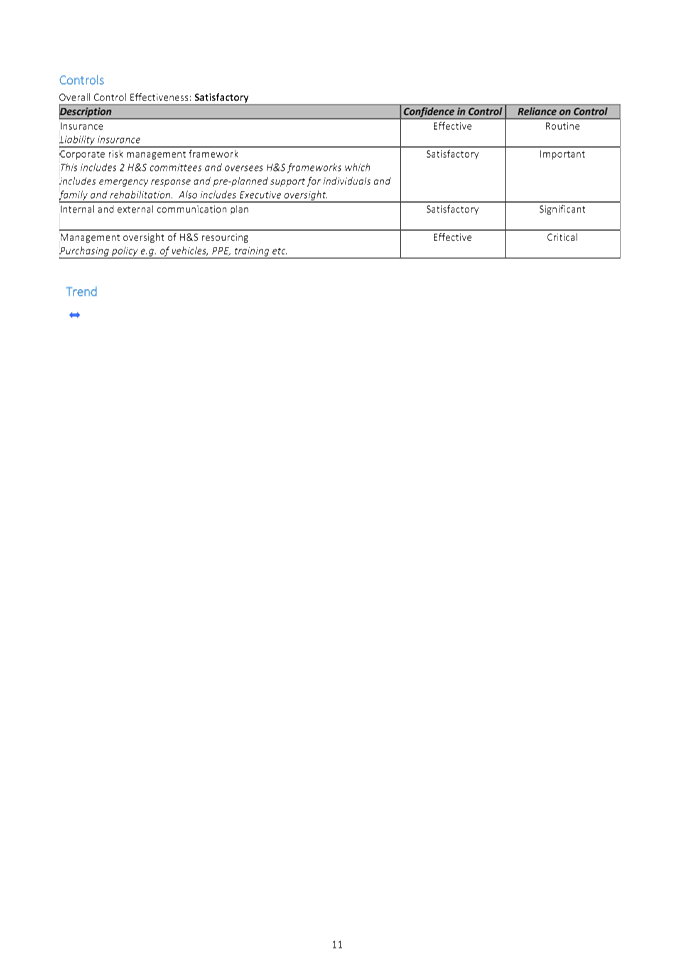

Aggregation of risks

17. Many risks are not unique

to particular Groups and some risks have the potential to be experienced by

more than one Group, while others have the potential to affect the organisation

as a whole. However, an individual Group may score a particular risk’s

consequences lower than another Group.

18. Risks common to many

Groups are ‘aggregated’ up to Executive Level. The Chief Executive

and executive team is responsible for reviewing the risks and assessing if the

risk controls are adequate. The Chief Executive will also review previous

risks; track the performance of the organisation from the previous review;

assess whether the risks facing the organisation are of an appropriate level;

and assess whether controls are being implemented.

Risk Assessment and Management reporting

19. Risks to the organisation

have been identified, reviewed and evaluated by staff members within each

management group. A presentation will be made at the meeting to explain

the process of assessing group level risks, and how key risks are aggregated up

to the Executive level.

20. The Executive Level risk

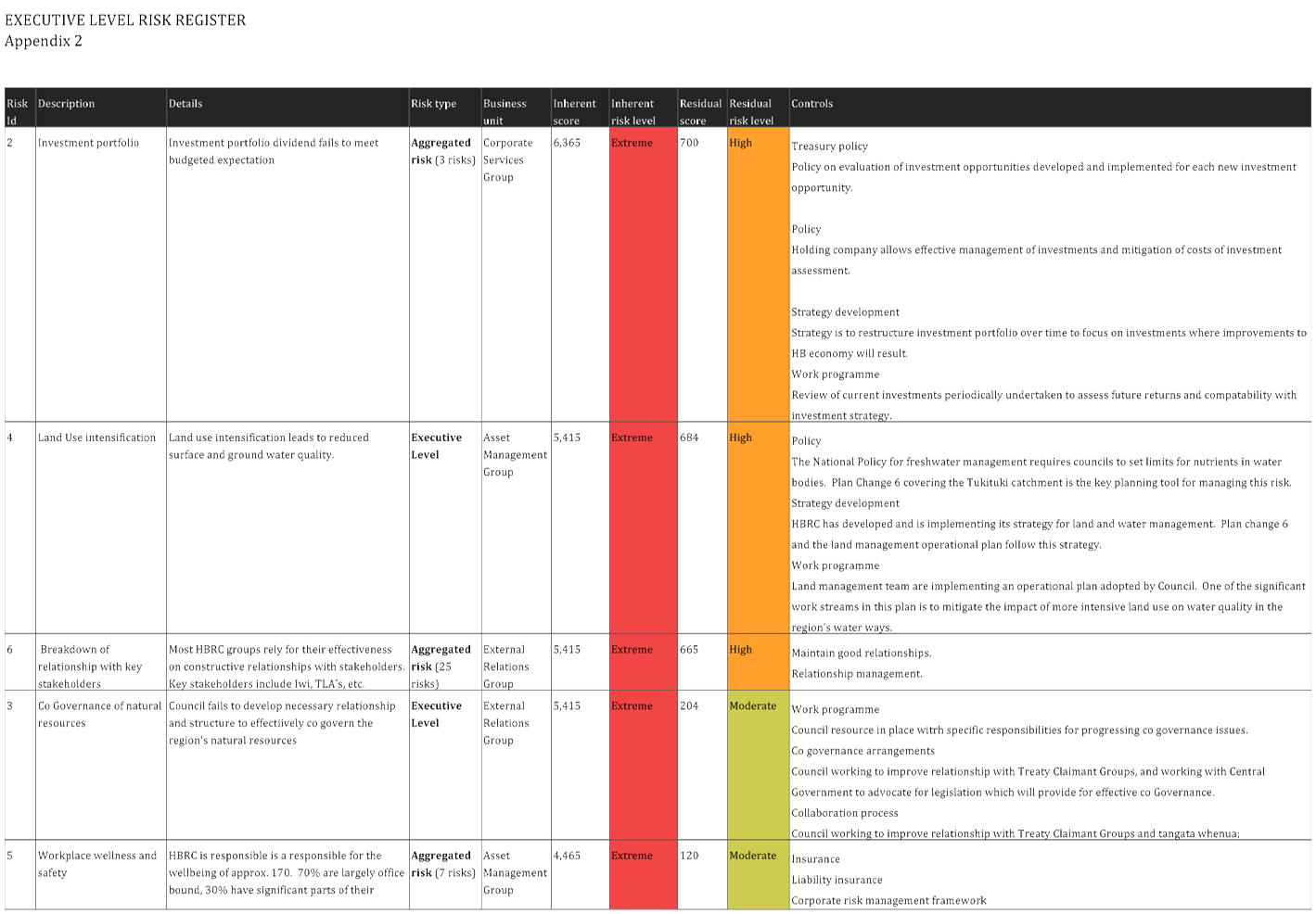

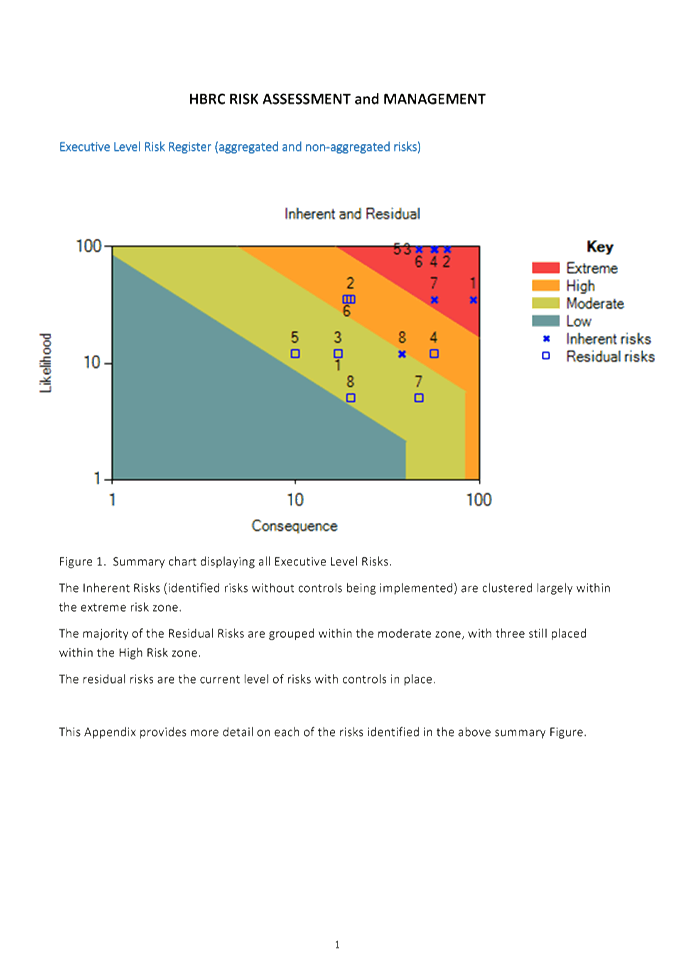

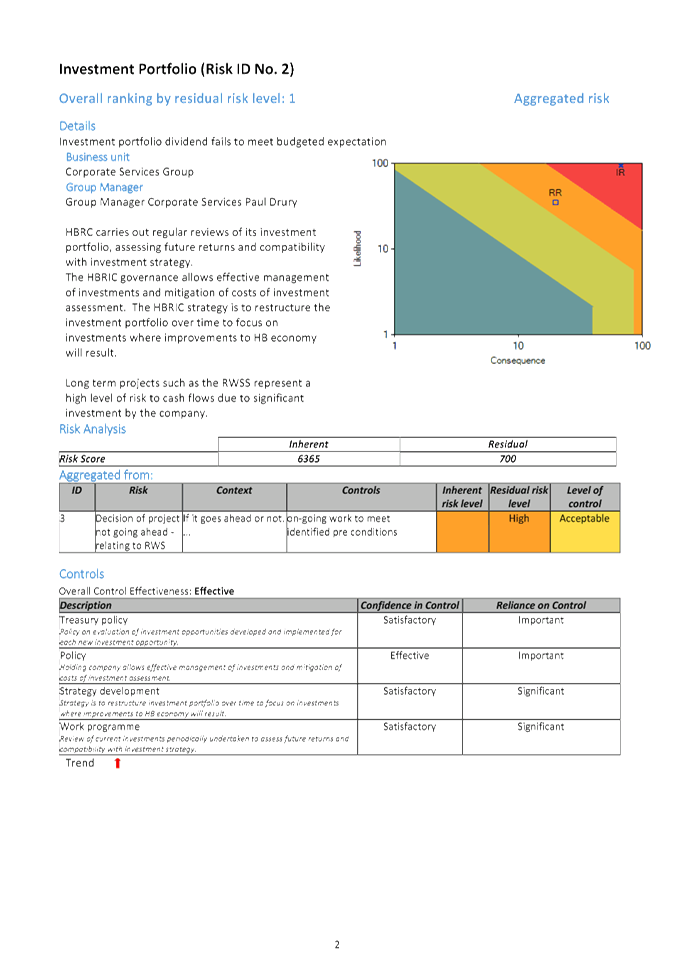

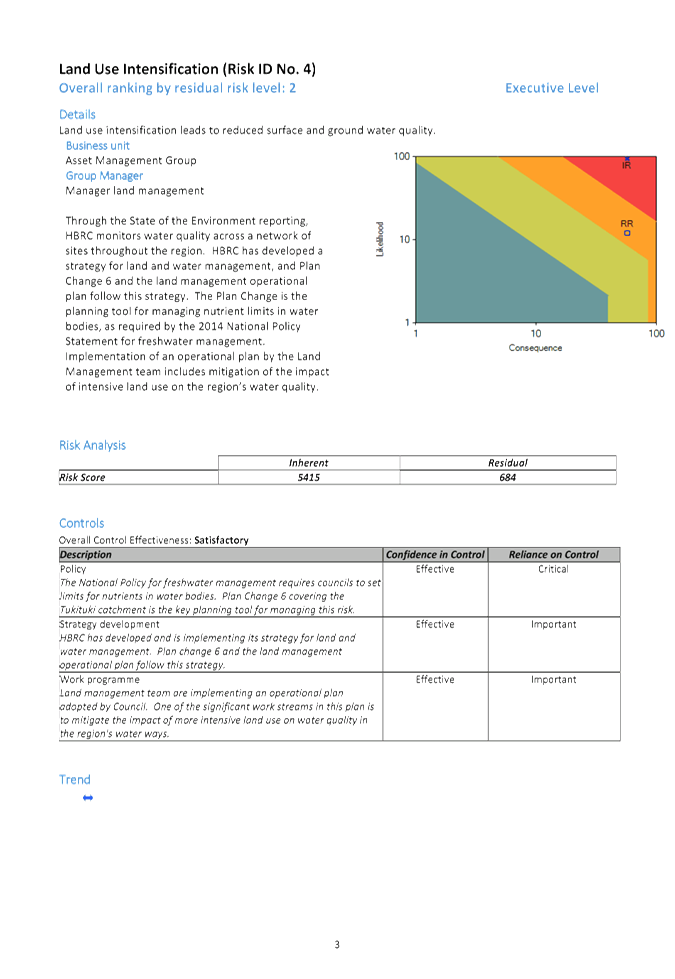

register is attached to this report in table form (Attachment 2), and in memo

form (Attachment 3). These present the key risks either identified directly

within the Executive Level or aggregated up from the management group

level. Health and Safety and Stakeholder Relationship risks are common to

many groups within Council, have been aggregated up to Executive level and are

included in the Executive level risk register.

21. Feedback is sought on the

presentation of risk information.

Decision Making

Process

22. Council

is required to make a decision in accordance with the requirements of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained in Part 6 Sub Part 1 of the Act in relation to this item and have

concluded the following:

22.1. The decision

does not significantly alter the service provision or affect a strategic asset.

22.2. The use of

the special consultative procedure is not prescribed by legislation.

22.3. The decision

does not fall within the definition of Council’s policy on significance.

22.4. The decision

is not inconsistent with an existing policy or plan.

|

Recommendations

That the Finance Audit & Risk Sub-committee:

1. Receives and considers the “HBRC Risk Management”

report

2. Advises staff of specific risks where the sub-committee believes

the current level of risk is unacceptable to Council, and requests that staff

report back to the sub-committee with options and associated resources

required to modify the risk profile.

3. The Finance Audit & Risk Sub-committee recommends that the

Corporate & Strategic Committee confirms the

Committee’s confidence that the risk assessment process outlined in the

“HBRC Risk Management” report and its attachments is an

appropriate process to identify and assess organisational risks.

|

|

Mike Adye

Group Manager

Asset Management

|

Liz Lambert

Chief Executive

|

Attachment/s

|

1

|

HBRC Risk

Assessment Framework Criteria

|

|

|

|

2

|

Executive

Level Risk Register

|

|

|

|

3

|

HBRC Risk

Assessment and Management

|

|

|

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Tuesday 22 September 2015

Subject: Internal Audit

Programme

Reason for Report

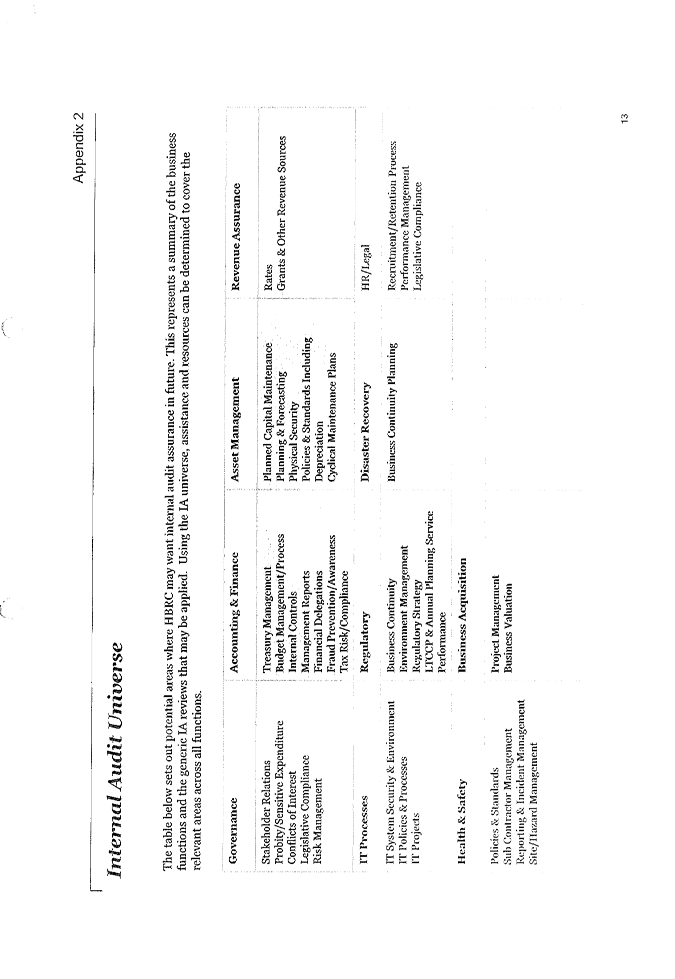

1. To continue

discussions with John Dixon, Partner PricewaterhouseCoopers, on the areas of

focus for the internal audit programme.

Comment

2. At the previous

meeting of the Subcommittee held on 3 June 2015, John Dixon set out the

recommendations from the internal audits that had been completed –

namely:

2.1. Accounts

payable

2.2. Treasury

management

2.3. Payroll.

3. John also discussed

other potential areas where Hawke’s Bay Regional Council (HBRC) may want

internal audit assurance in the future. Attached as Attachment 1 is a

document entitled “Internal Audit Universe” that John discussed at

the last meeting of the Subcommittee.

4. It is John’s

intention to attend this meeting of the Subcommittee to continue discussions

covering further areas of internal audit that the Subcommittee may wish to

commission to be completed. He also proposes to link his discussions in

with the areas covered in the paper entitled “HBRC Risk Management”

which is a separate paper on this meeting’s agenda.

Decision Making

Process

5. Council is required to make a decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements contained in Part 6 Sub Part 1 of the Act in relation

to this item and have concluded the following:

5.1. The decision does not significantly alter the service provision or

affect a strategic asset.

5.2. The use of the special consultative procedure is not prescribed by

legislation.

5.3. The decision does not fall within the definition of Council’s

policy on significance.

5.4. There are no

persons affected by this decision.

5.5. Options to be

considered by the Subcommittee will be which areas of internal audit should be

proceeded with.

5.6. The

decision is not inconsistent with an existing policy or plan.

|

Recommendations

1. That the

Finance Audit and Risk Subcommittee receives and notes the Internal Audit

Programme report and advises staff and the PricewaterhouseCoopers Auditor

which areas of HBRC business require an internal audit review.

2. The Finance

Audit and Risk Sub-committee recommends that the Corporate and Strategic

Committee:

2.1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted policy on significance and that

Council can exercise its discretion under Sections 79(1)(a) and 82(3) of the

Local Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision.

2.2. Approves

the schedule of Internal Audits to be carried out over the next 12 months as

determined by the Subcommittee.

|

|

Paul Drury

Group Manager

Corporate Services

|

|

Attachment/s

|

1

|

Internal

Audit Universe Table

|

|

|