Meeting of the Corporate and Strategic Committee

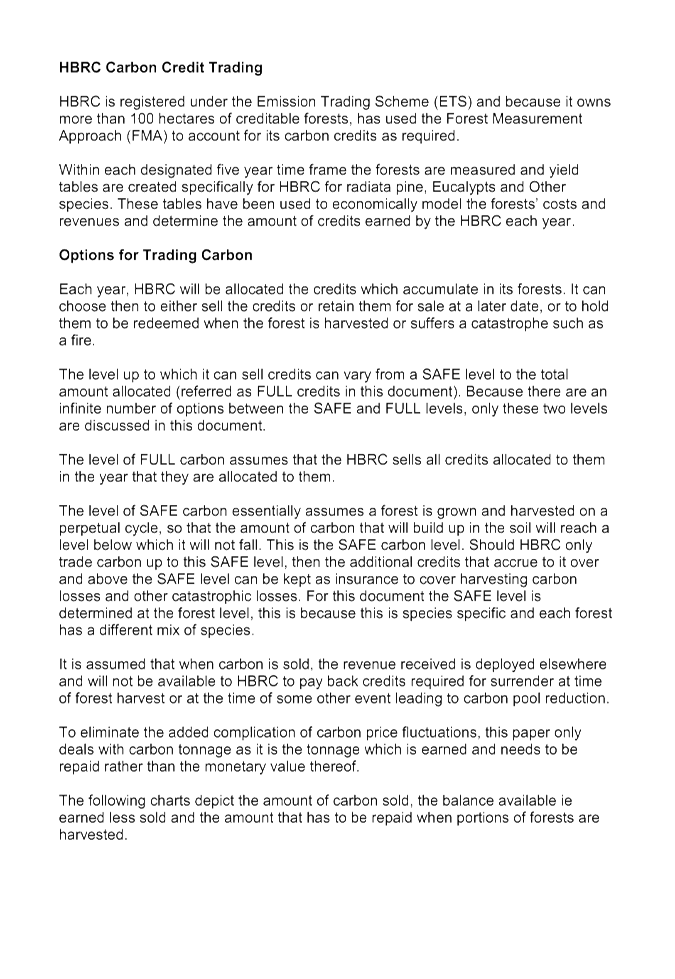

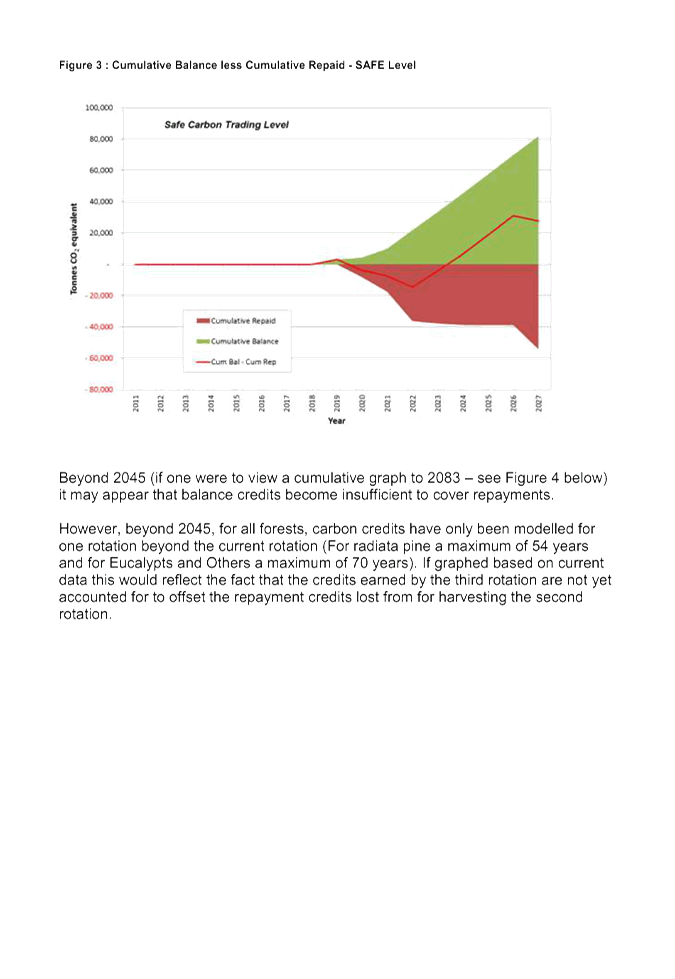

Date: Wednesday 23 September 2015

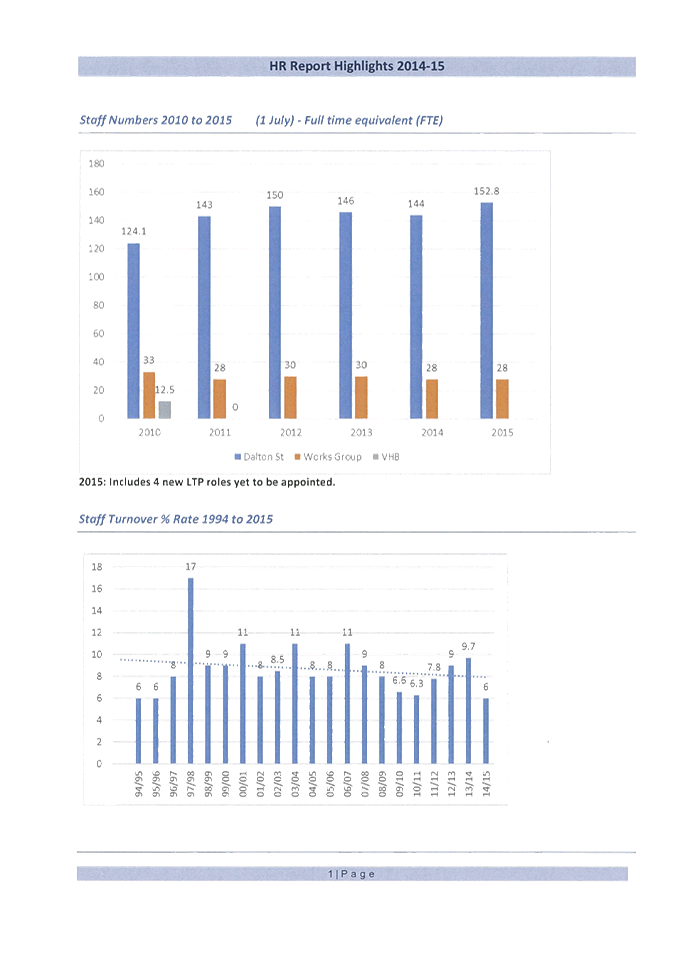

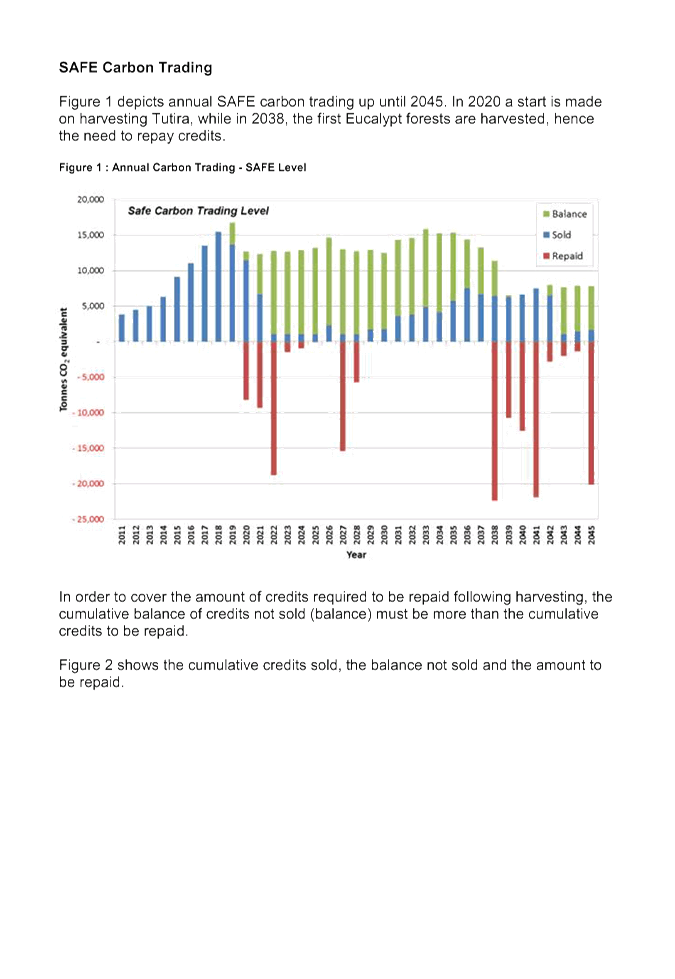

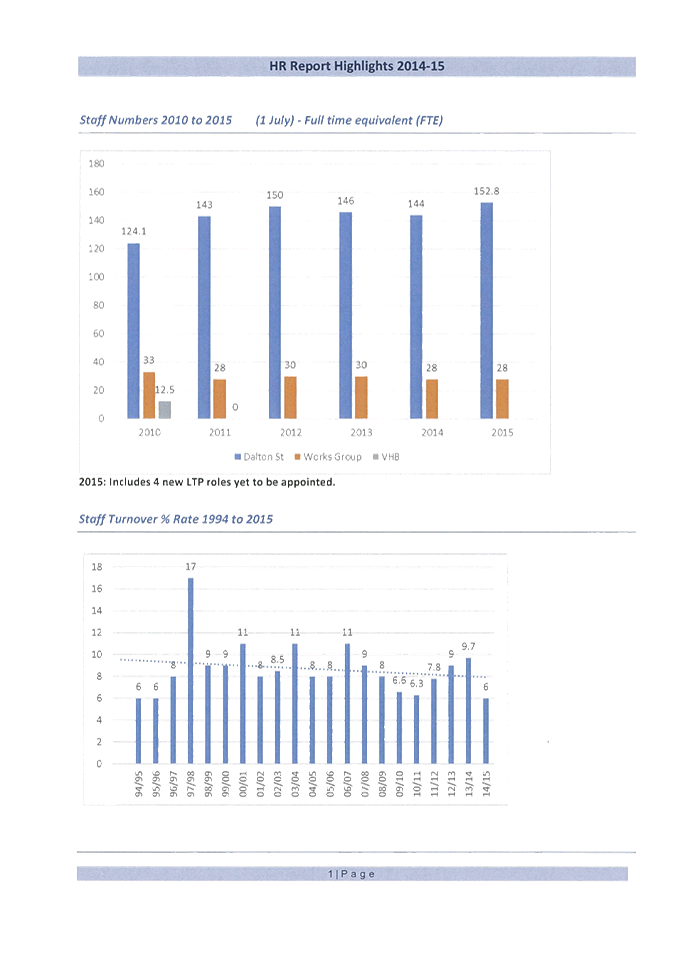

Time: 9.00 am

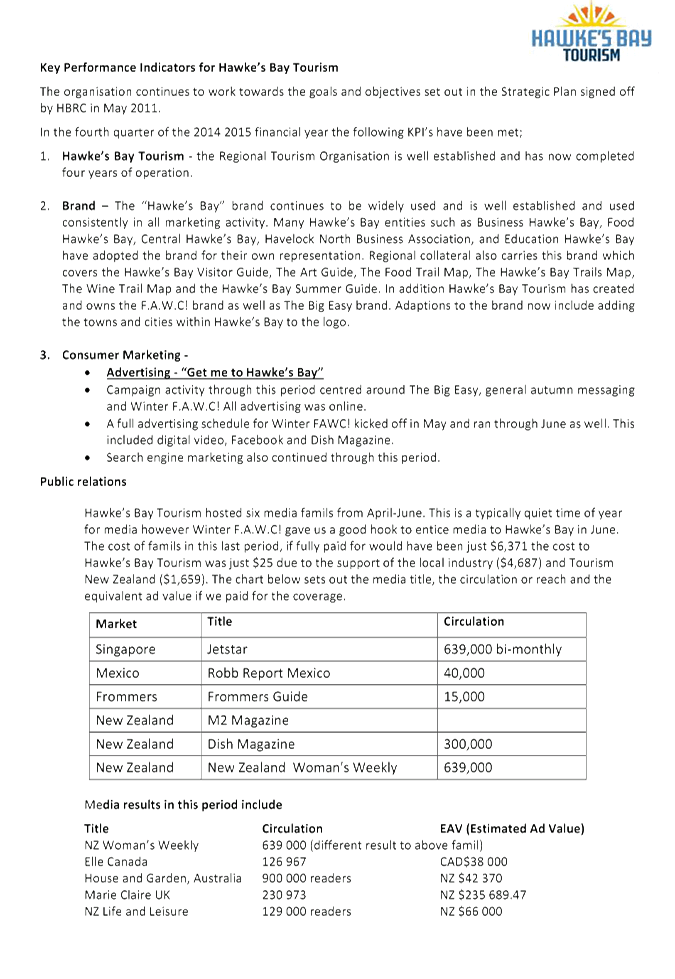

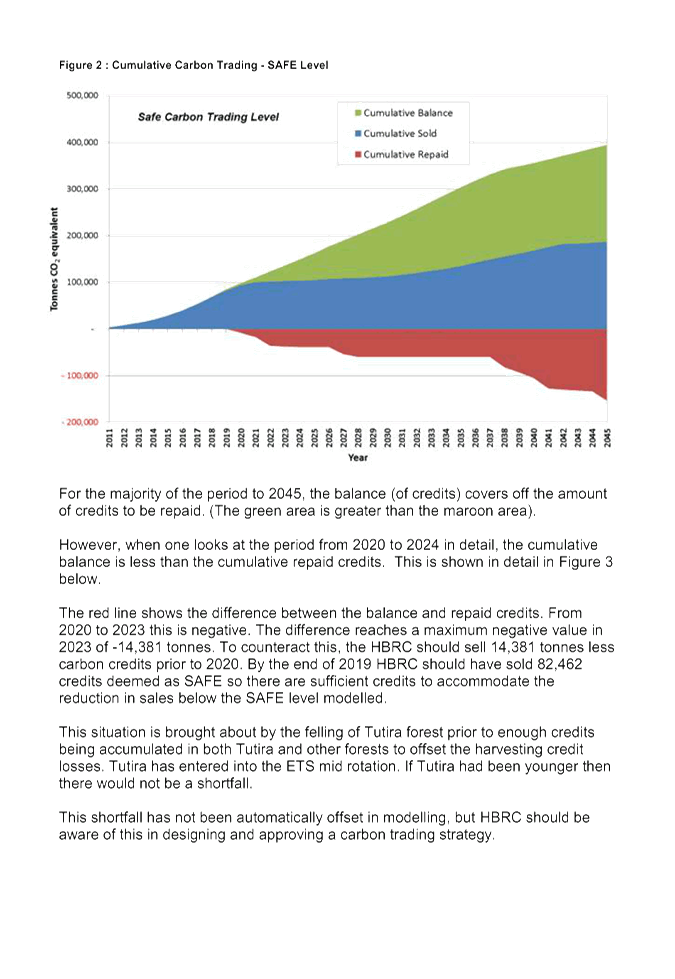

|

Venue:

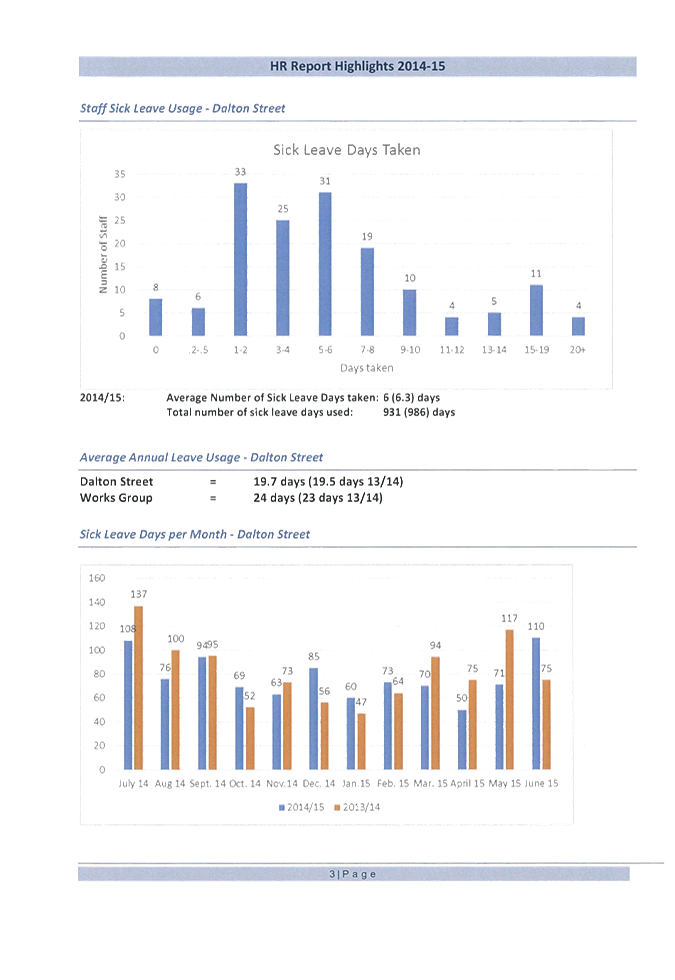

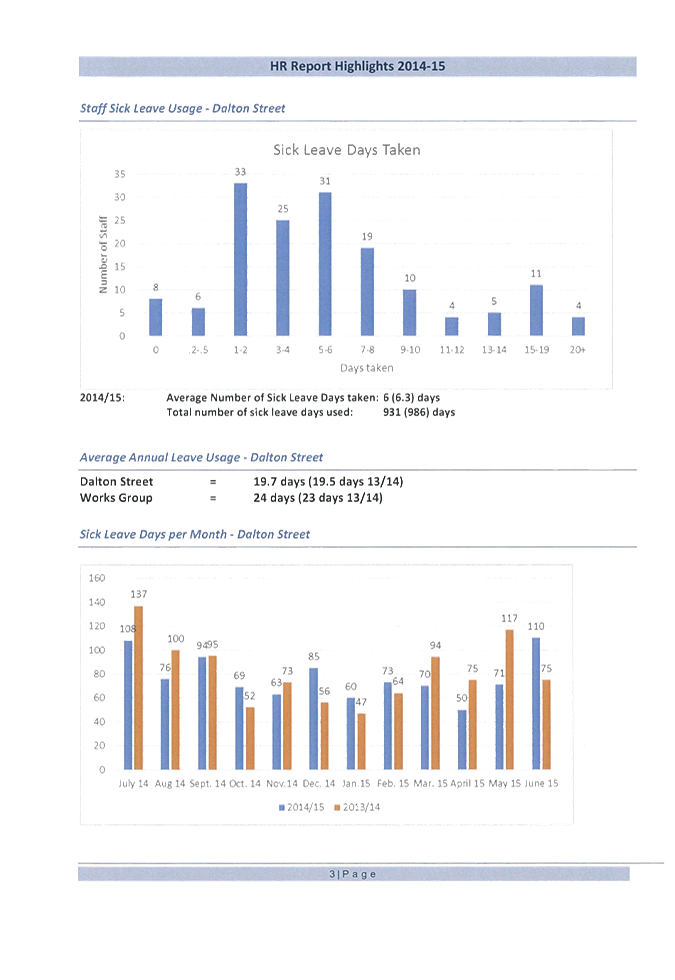

|

Council Chamber

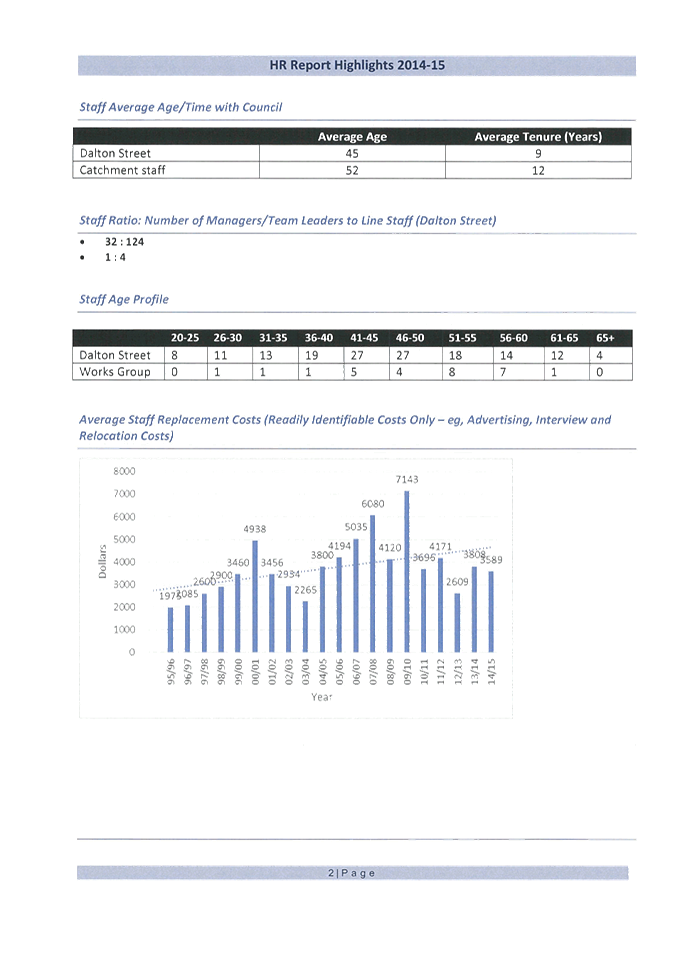

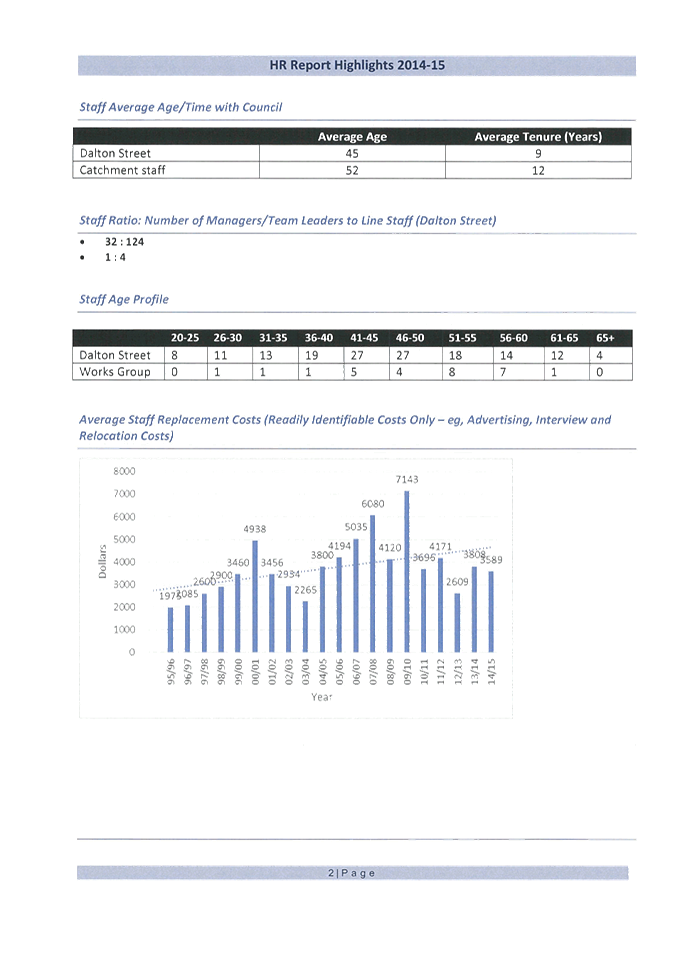

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

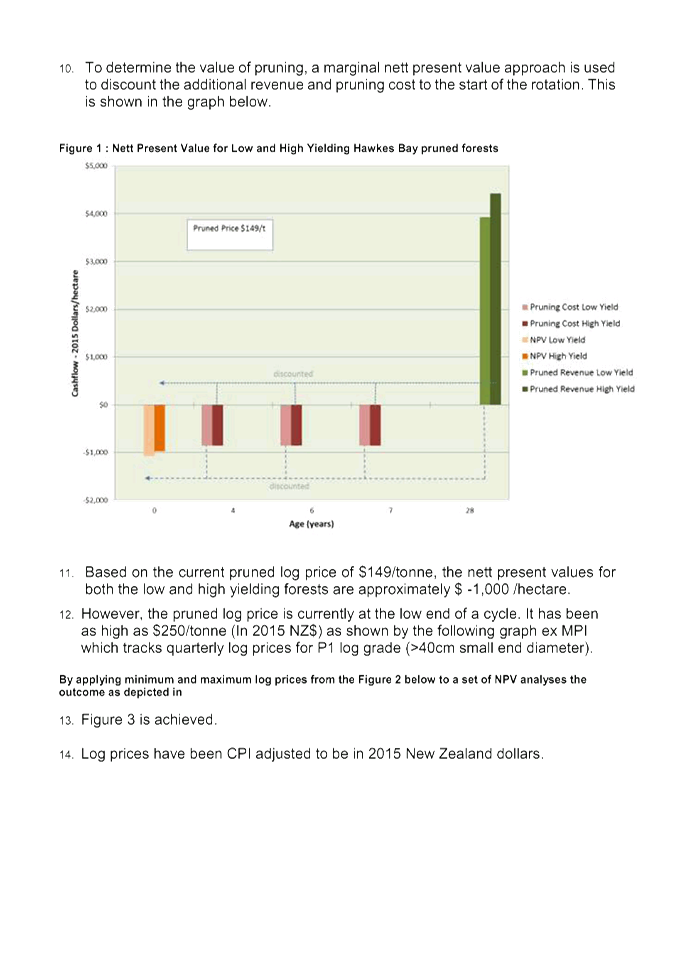

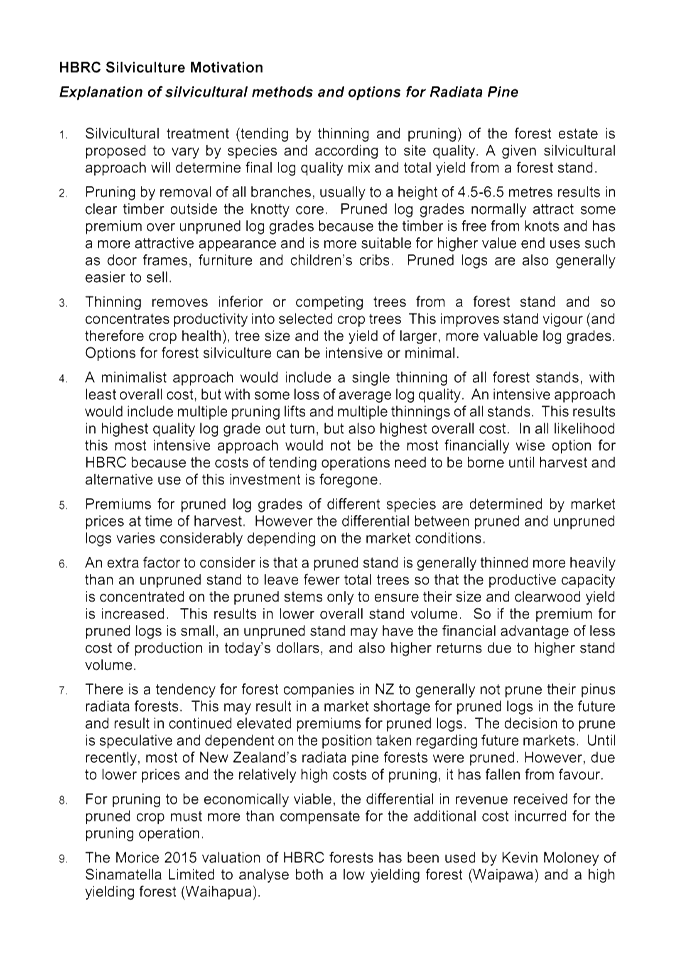

|

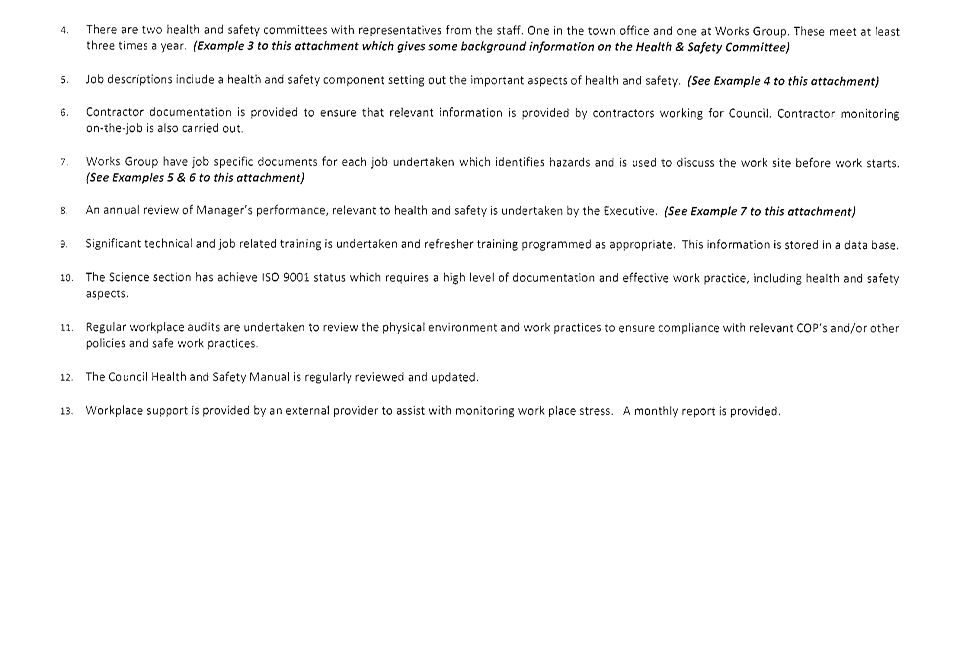

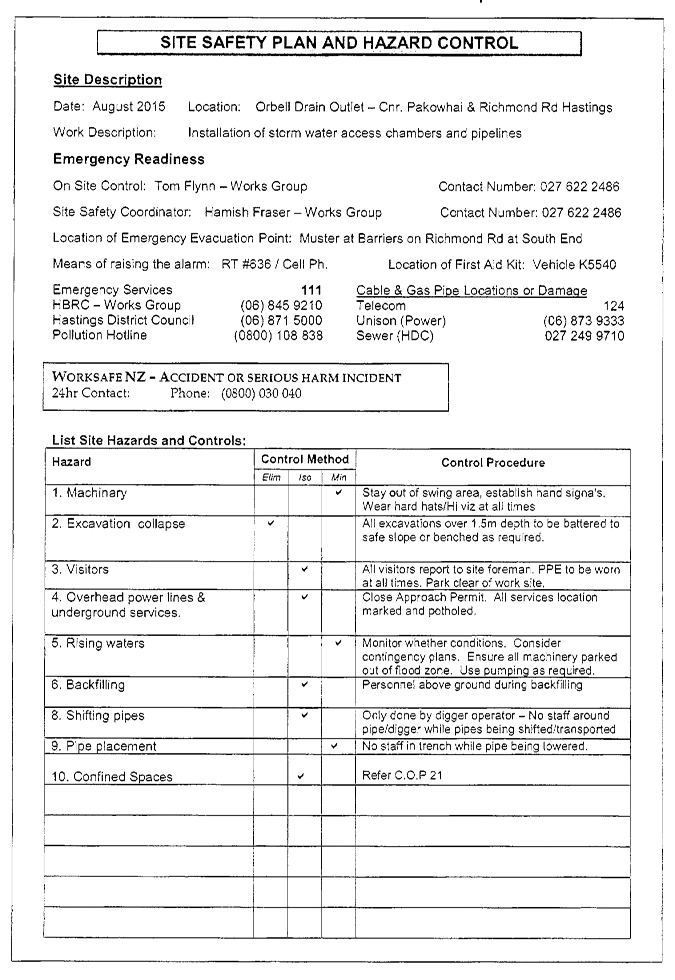

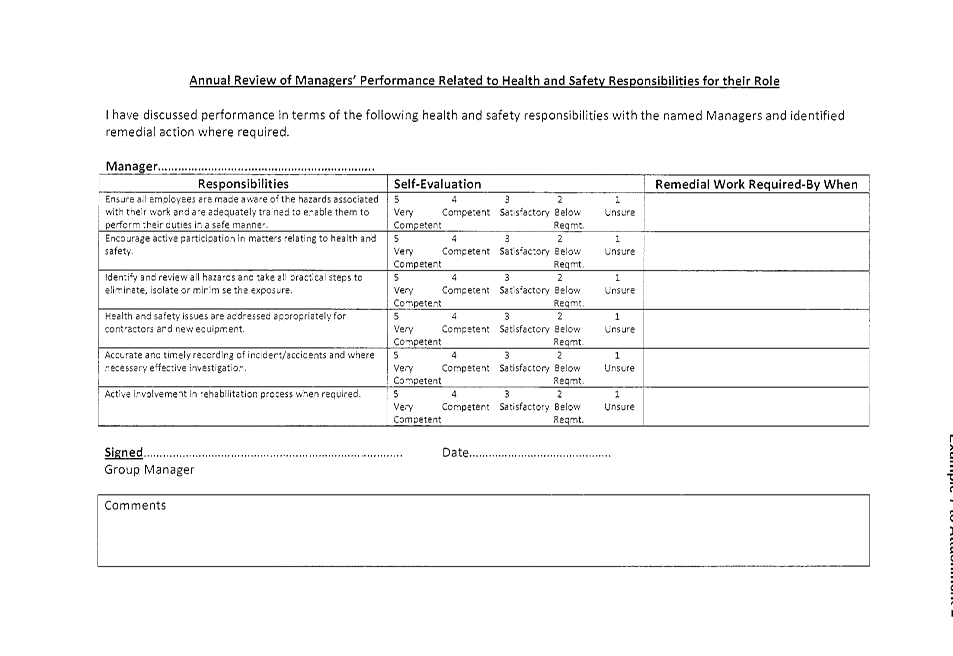

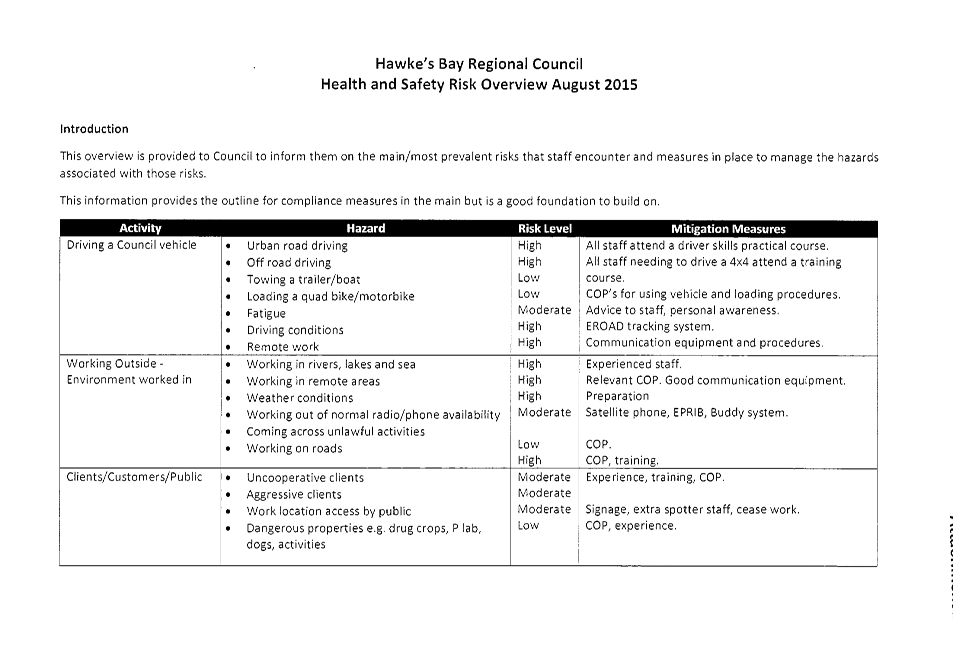

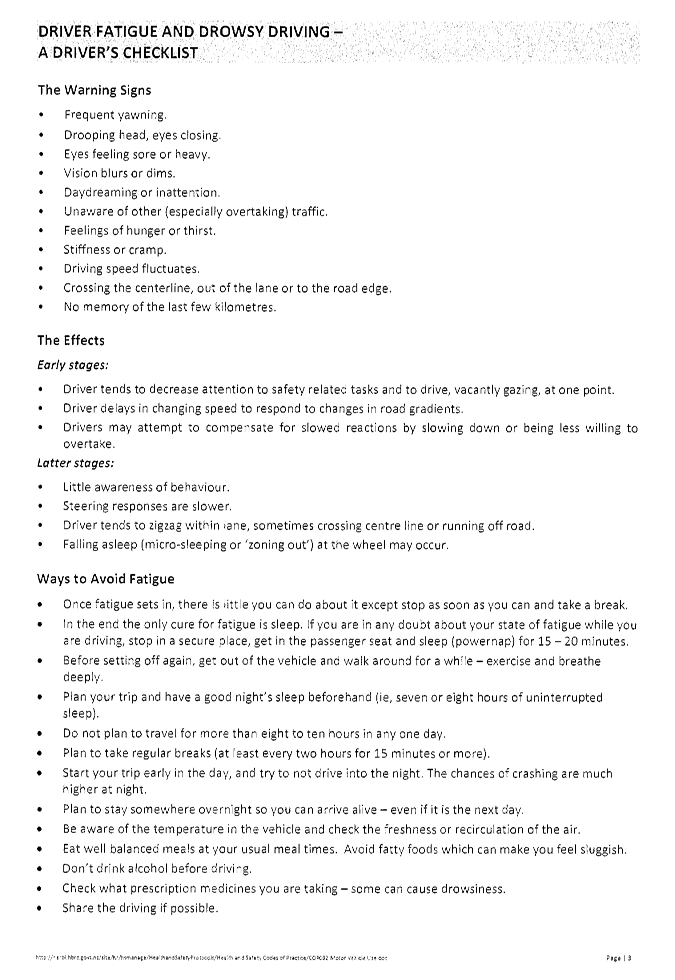

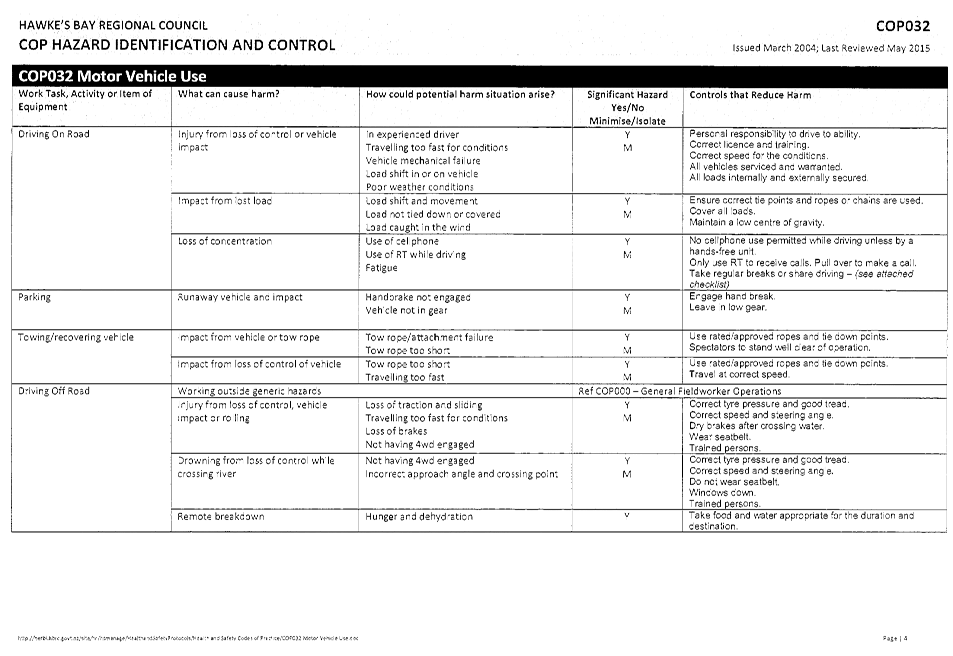

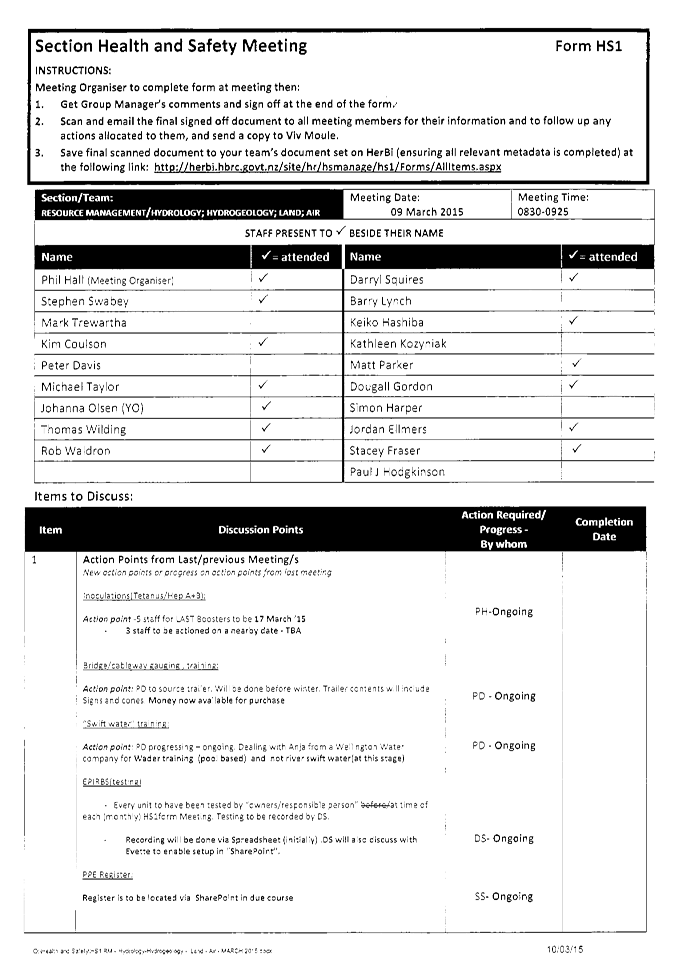

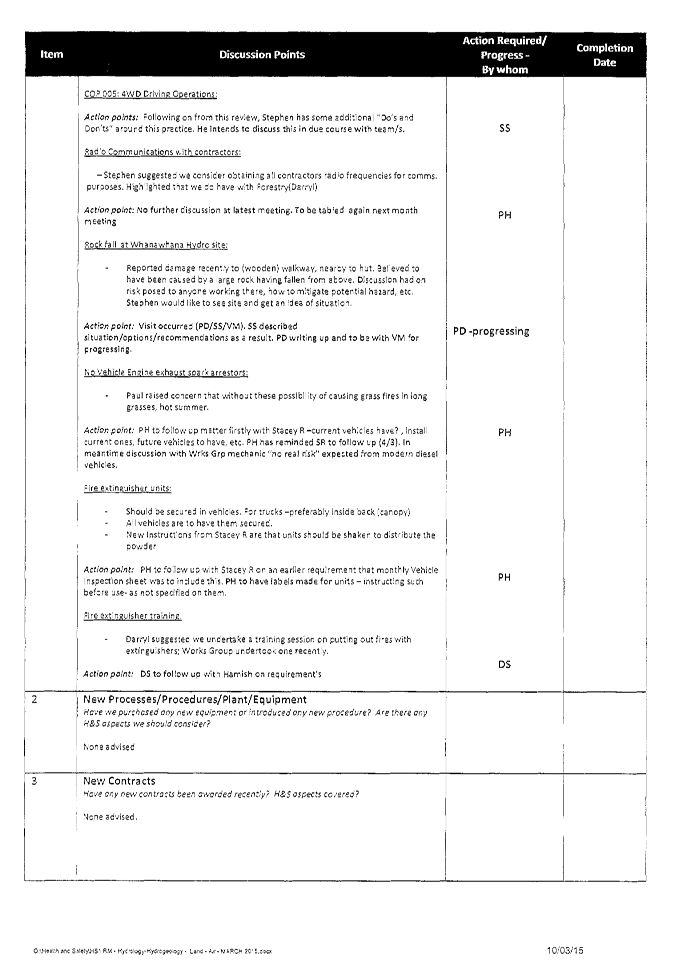

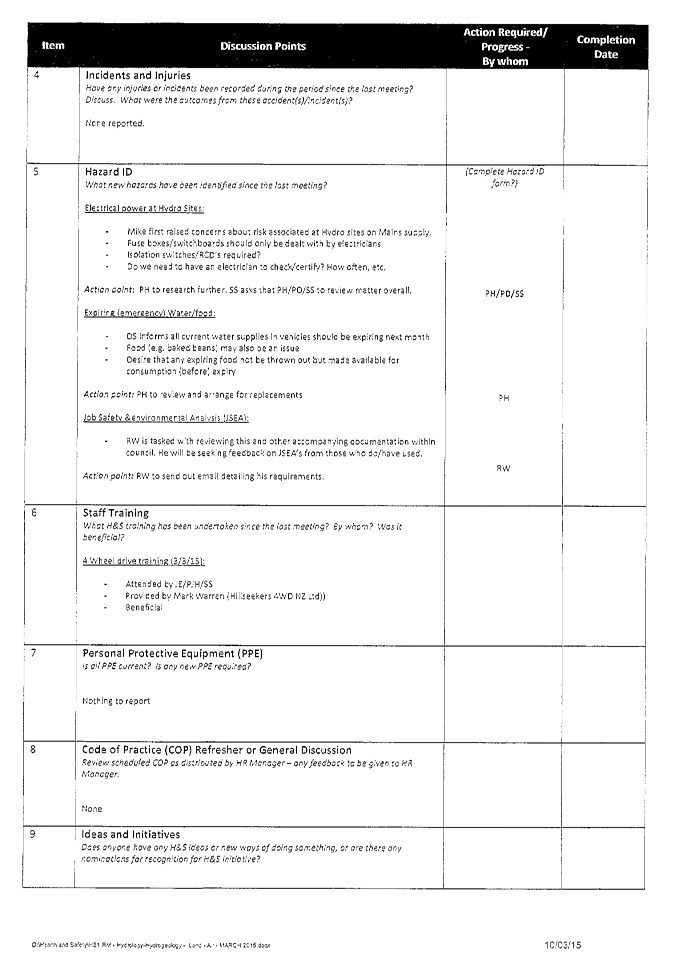

Agenda

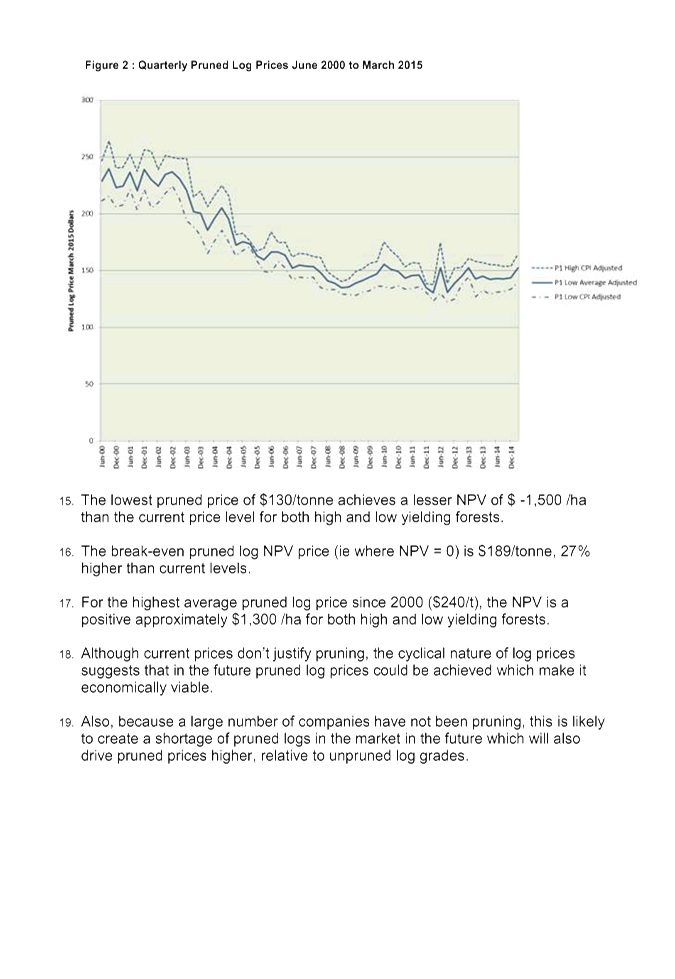

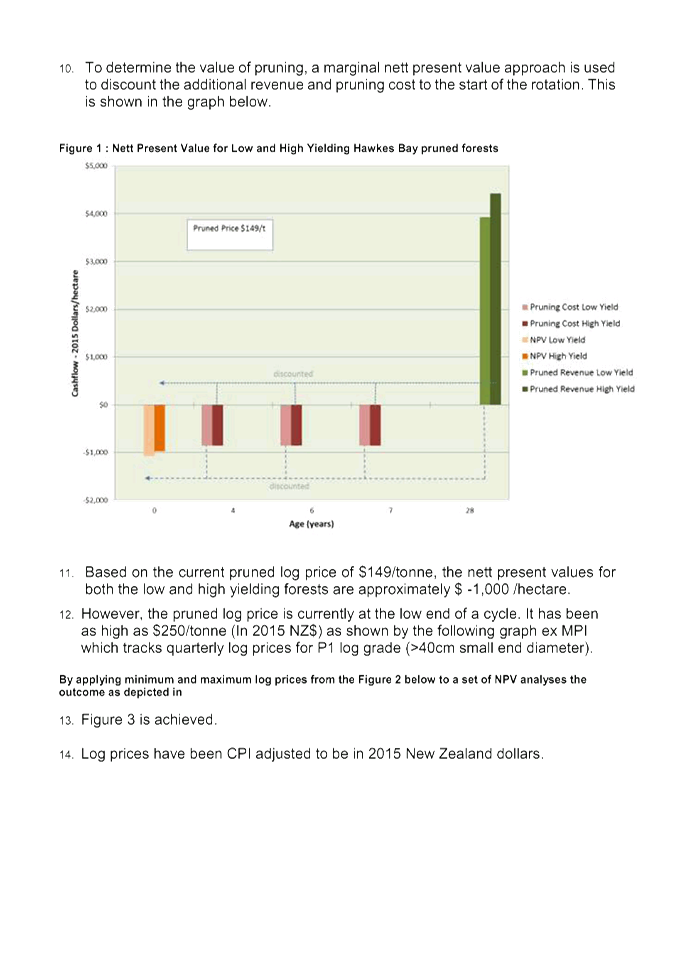

Item Subject Page

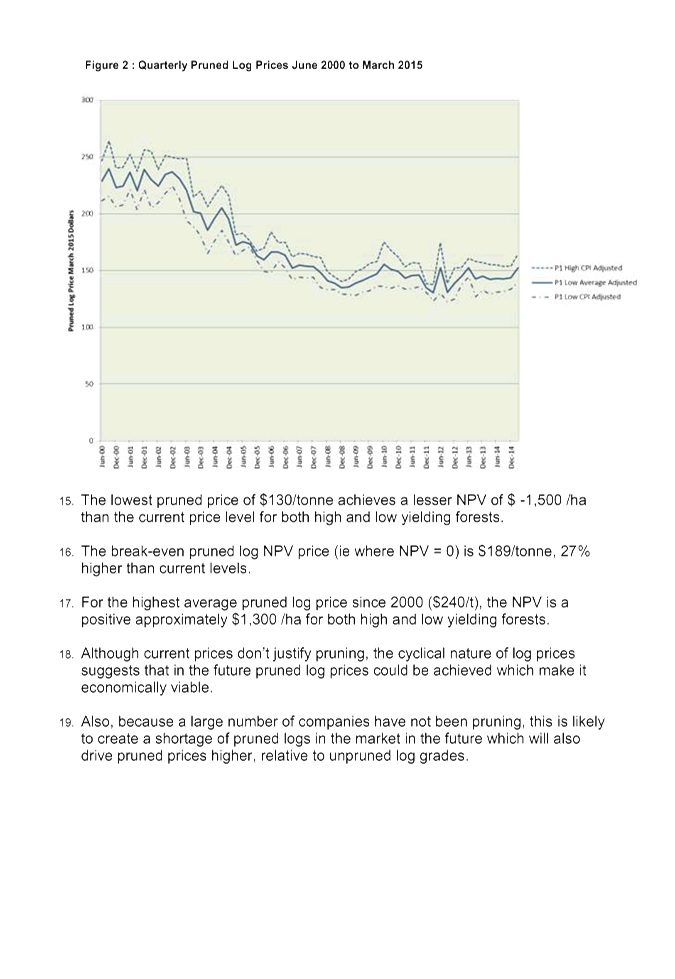

1. Welcome/Notices/Apologies

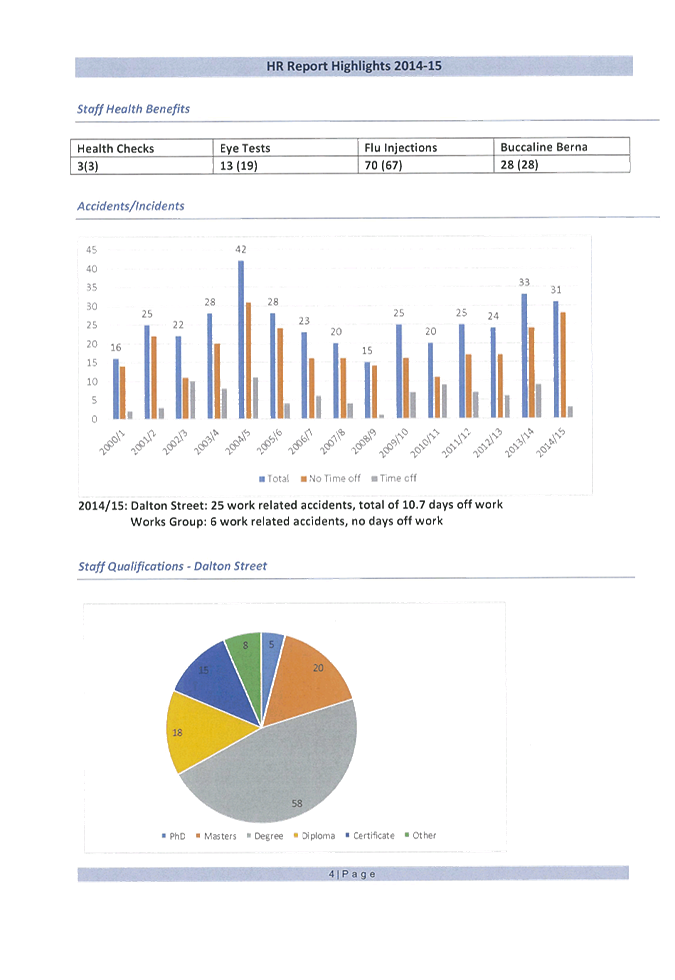

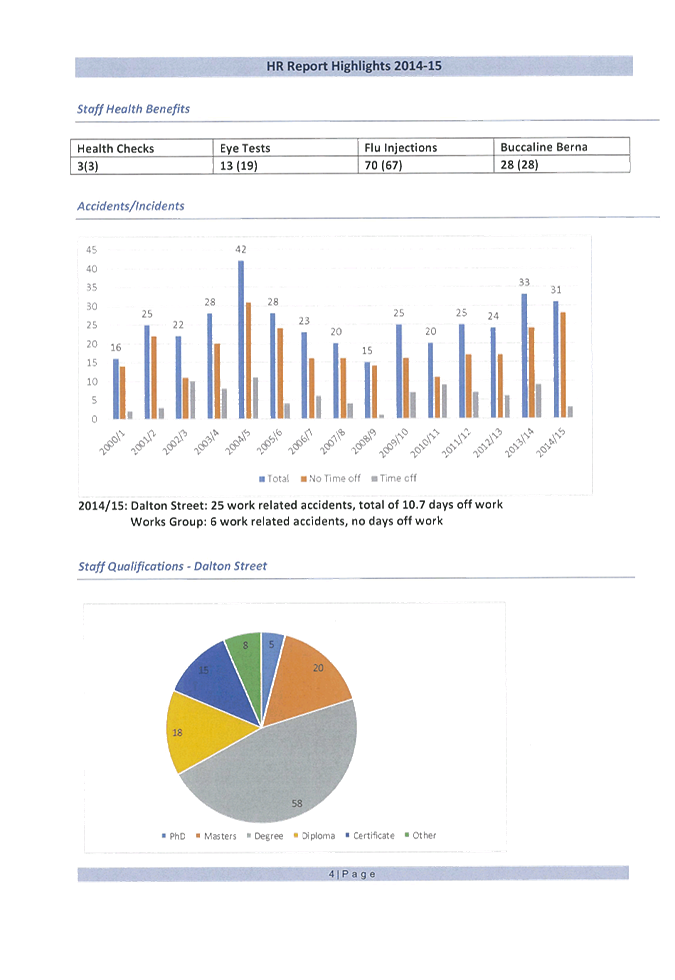

2. Conflict

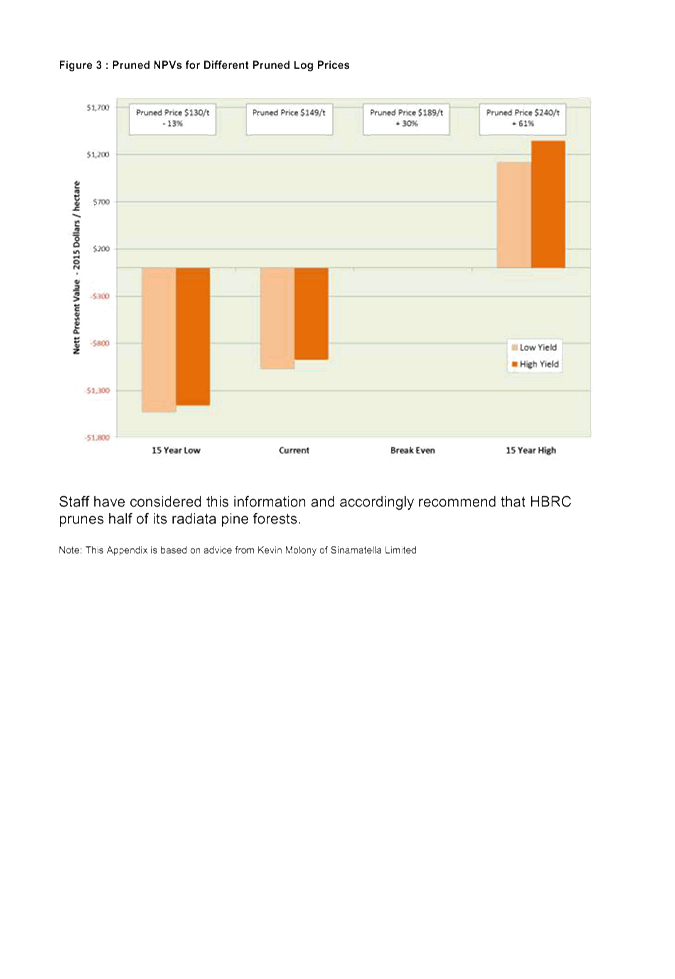

of Interest Declarations

3. Confirmation of

Minutes of the Corporate and Strategic Committee held on 22 April 2015

4. Matters Arising from

Minutes of the Corporate and Strategic Committee held on 22 April 2015

5. Follow-ups from

Previous Corporate and Strategic Committee meetings 3

6. Call for any Minor

Items not on the Agenda 7

Decision Items

7. 9.15am

HB Tourism 2014-15 Year-end Report and 2016-19 Proposed Key Performance

Indicators 9

8. Forestry

Investments 27

9. Recommendations

from the Finance Audit & Risk Sub-committee 47

Information or Performance Monitoring

10. 11am Implications of

New Health and Safety Legislation – Presentation by Nigel Formosa,

Assistant Health and Safety Inspector, WorkSafe

11. Human Resources 2014-15 Annual

Report 49

12. September 2015 Public

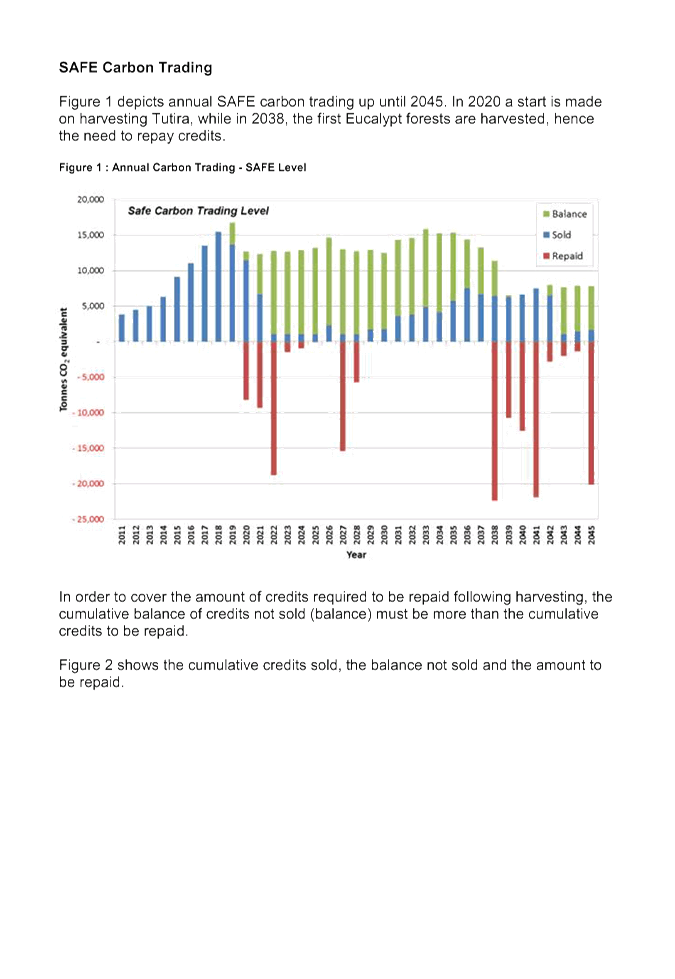

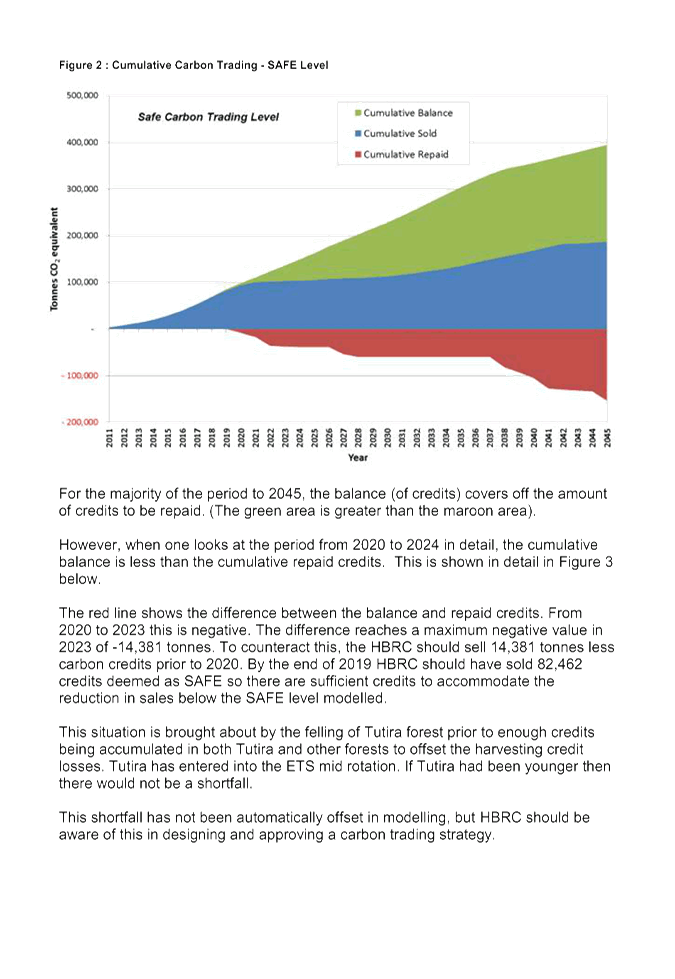

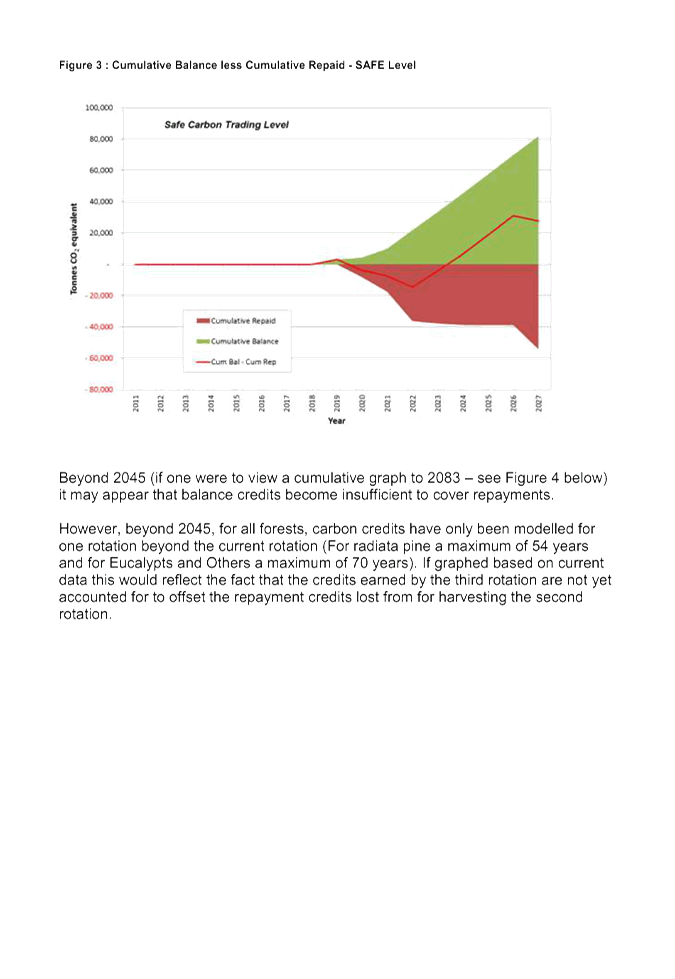

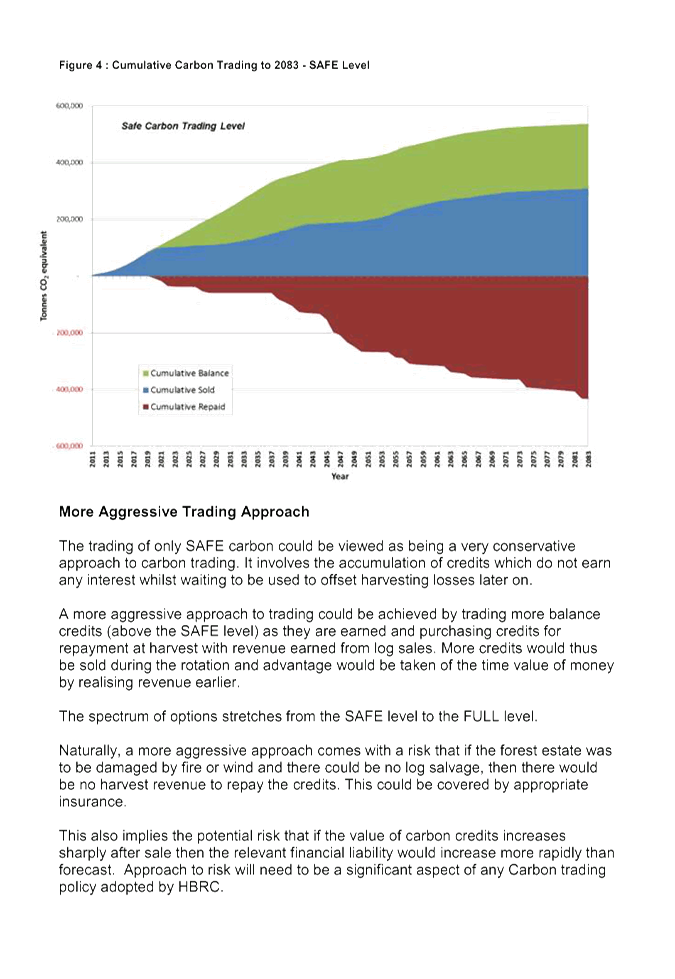

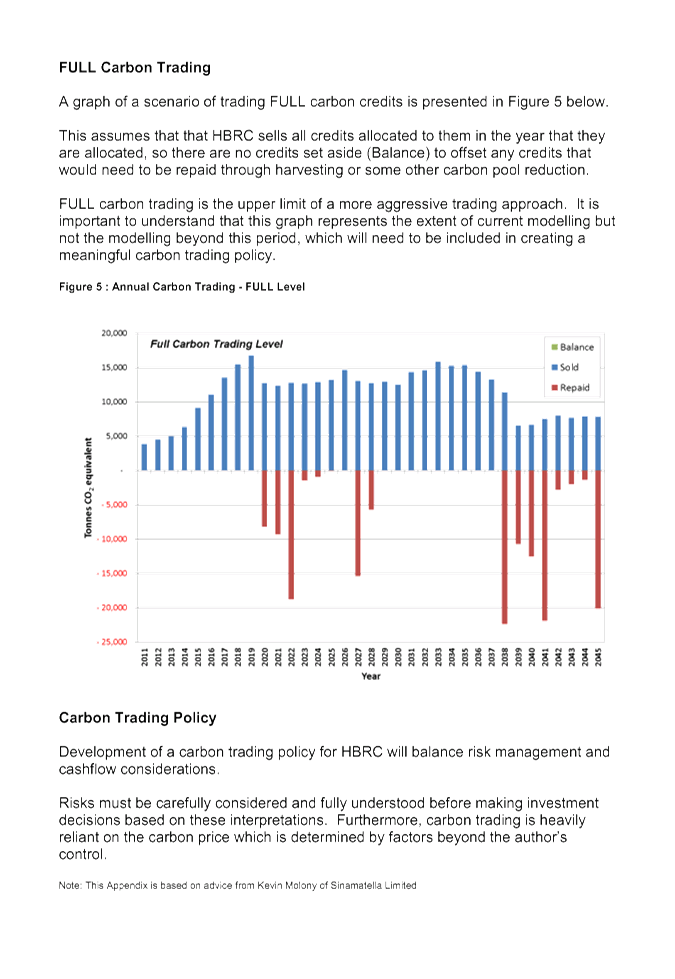

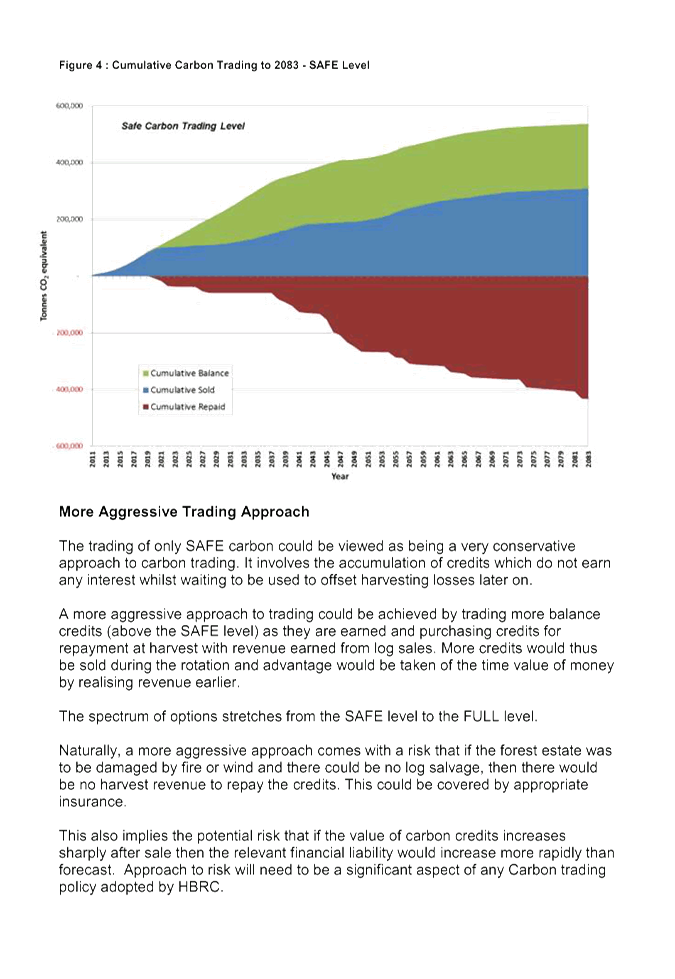

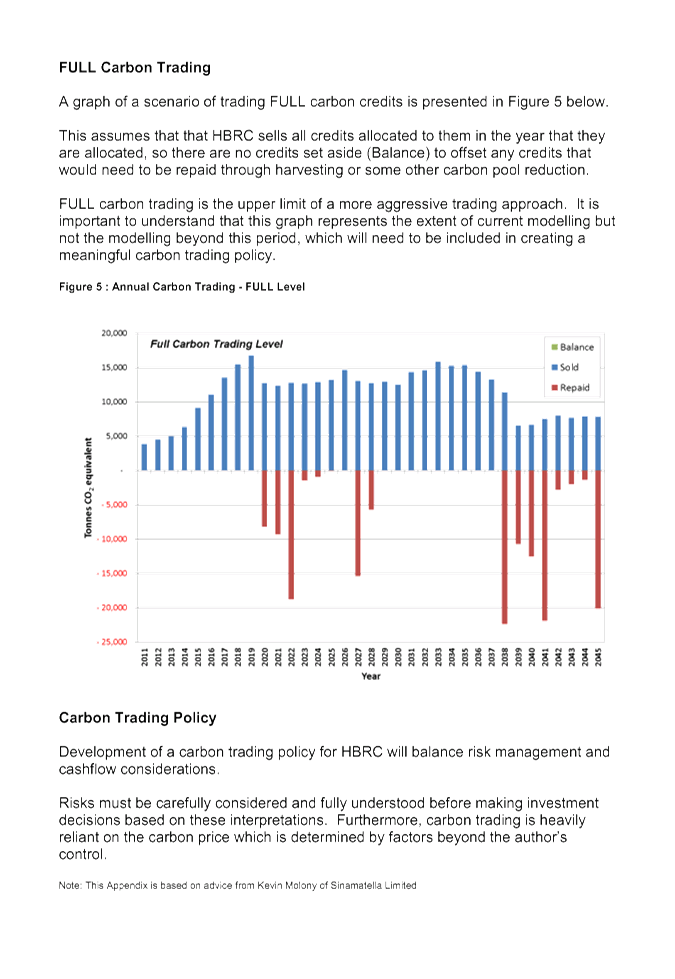

Transport Update 79

13. Gravel Resource Inventory and

Gravel Demand 83

14. Minor Items not on the Agenda 89

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 23 September 2015

SUBJECT: Follow-ups from Previous Corporate

and Strategic Committee meetings

Reason for Report

1. In order to track items raised at previous meetings that require

follow-up, a list of outstanding items is prepared for each meeting. All

follow-up items indicate who is responsible for each, when it is expected to be

completed and a brief status comment. Once the items have been completed and

reported to the Committee they will be removed from the list.

Decision

Making Process

2. Council is required to make a decision in

accordance with Part 6 Sub-Part 1, of the Local Government Act 2002 (the Act).

Staff have assessed the requirements contained within this section of the Act

in relation to this item and have concluded that as this report is for

information only and no decision is required in terms of the Local Government

Act’s provisions, the decision making procedures set out in the Act do

not apply.

|

Recommendation

1. That the Committee receives the report “Follow-ups

from Previous Corporate and Strategic Committee Meetings”.

|

|

Liz Lambert

Chief Executive

|

|

Attachment/s

|

1

|

Follow-ups

from Previous Corporate & Strategic Committee Meetings

|

|

|

|

Follow-ups

from Previous Corporate & Strategic Committee Meetings

|

Attachment 1

|

Follow-ups

from Corporate and Strategic Committee Meetings

22 April 2015

|

|

Agenda Item

|

Follow-up / Request

|

Person Responsible

|

Status Comment

|

|

1

|

Matters Arising

|

Napier-Gisborne rail

update on discussions with Napier Port, KiwiRail, HBRIC

|

Liz

|

Proposal submitted as

an alternative to the KiwiRail Tender, involving potential contract between

HBRIC and/or Napier Port and KiwiRail. Acceptance of this concept in

principle has yet to be received from KiwiRail and discussions have yet to

begin.

|

|

2

|

Minor items not on the

Agenda

|

Online voting –

put forward HBRC for trial

|

L Hooper

|

Email circulated to

councillors 22 April (following) advising HBRC doesn’t meet criteria

for inclusion

|

Ref follow-up item 2

From: Leeanne Hooper

Sent: Wednesday, 22 April 2015 4:37 p.m.

To: Alan Dick; Christine Scott (christine.scott@hbrc.govt.nz); Dave Pipe

(dave.pipe@hbrc.govt.nz); Debbie Hewitt; Fenton Wilson (chairman@hbrc.govt.nz);

mmohi@doc.govt.nz; Peter Beaven (peter.beaven@hbrc.govt.nz); Rex Graham; Rick

Barker; Tom Belford (tom@baybuzz.co.nz)

Cc: Liz Lambert; Paul Drury

Subject: online voting trials for 2016 elections

Good afternoon,

Following discussions with Raymond Horan at SOLGM and Mike Reid

at LGNZ, I have been advised that only territorial authorities will be

‘accepted’ for online voting trials, not regional councils.

Currently, Cabinet decisions in relation to detailed policy

settings and the regulatory framework are expected by the end of April.

Once those policies and criteria are set, potential providers

will be able to put estimates around the potential costs and LGNZ will

subsequently call for expressions of interest from local authorities.

LGNZ intends holding a ‘roundtable’ discussion on

Online Voting toward the end of May. Any council is welcome to send

representatives to this discussion so I will keep everyone posted with details

of this as they come to light.

Regards,

Leeanne

Hooper

Governance & Corporate Administration Manager

Hawke's Bay Regional

Council

159 Dalton Street | Private Bag 6006 | Napier 4142

P 06 833 8017 | F 06 835 3601

leeanne@hbrc.govt.nz | www.hbrc.govt.nz

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 23 September 2015

Subject: Call for any Minor

Items not on the Agenda

Reason

for Report

1. Under standing orders, SO 3.7.6:

“Where an item is not on the agenda

for a meeting,

(a) That item may be discussed

at that meeting if:

(i) that

item is a minor matter relating to the general business of the local authority;

and

(ii) the

presiding member explains at the beginning of the meeting, at a time when it is

open to the public, that the item will be discussed at the meeting; but

(b) No

resolution, decision, or recommendation may be made in respect of that item

except to refer that item to a subsequent meeting of the local authority for

further discussion.”

2. The Chairman will request any items Councillors

wish to be added for discussion at today’s meeting and these will be duly

noted, if accepted by the Chairman, for discussion as Agenda Item 14.

Recommendations

That

the Corporate and Strategic Committee accepts the following minor items not on

the agenda, for discussion as Item 14

|

Leeanne Hooper

GOVERNANCE & CORPORATE

ADMINISTRATION MANAGER

|

Liz Lambert

CHIEF EXECUTIVE

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 23 September 2015

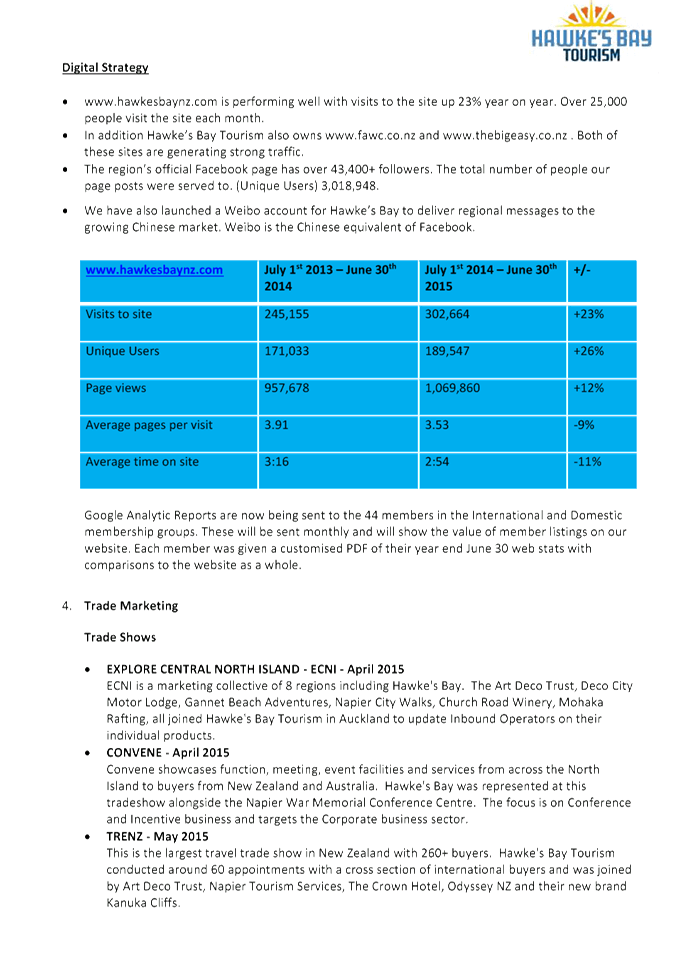

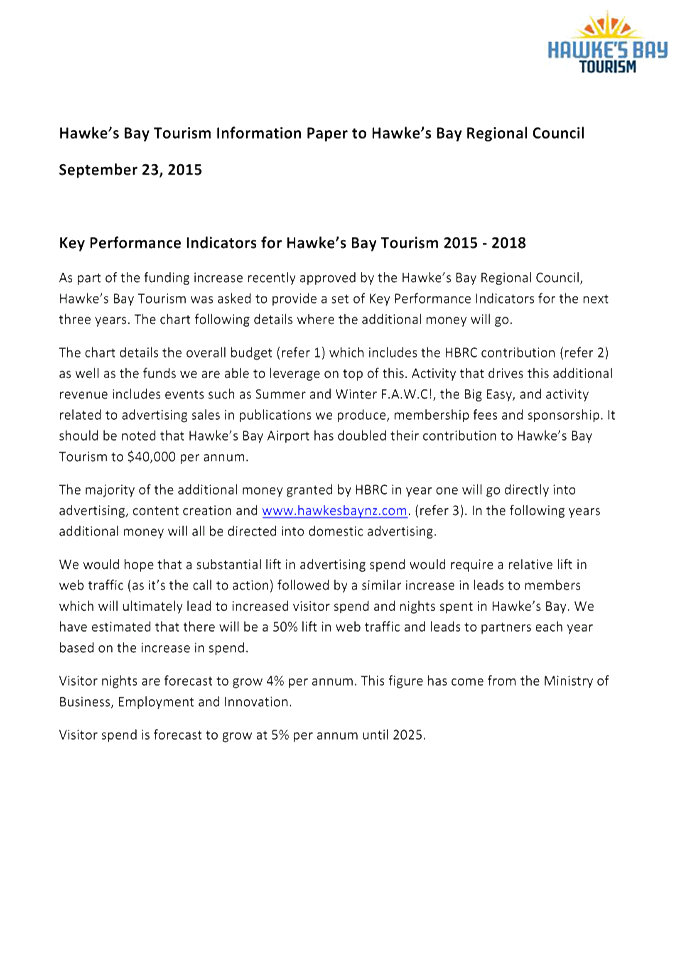

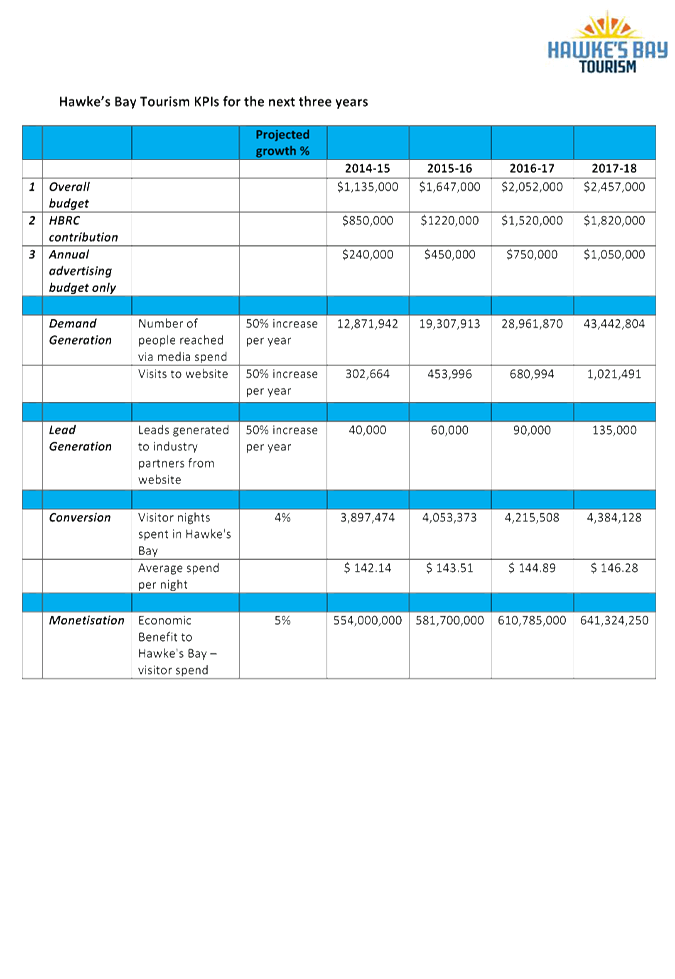

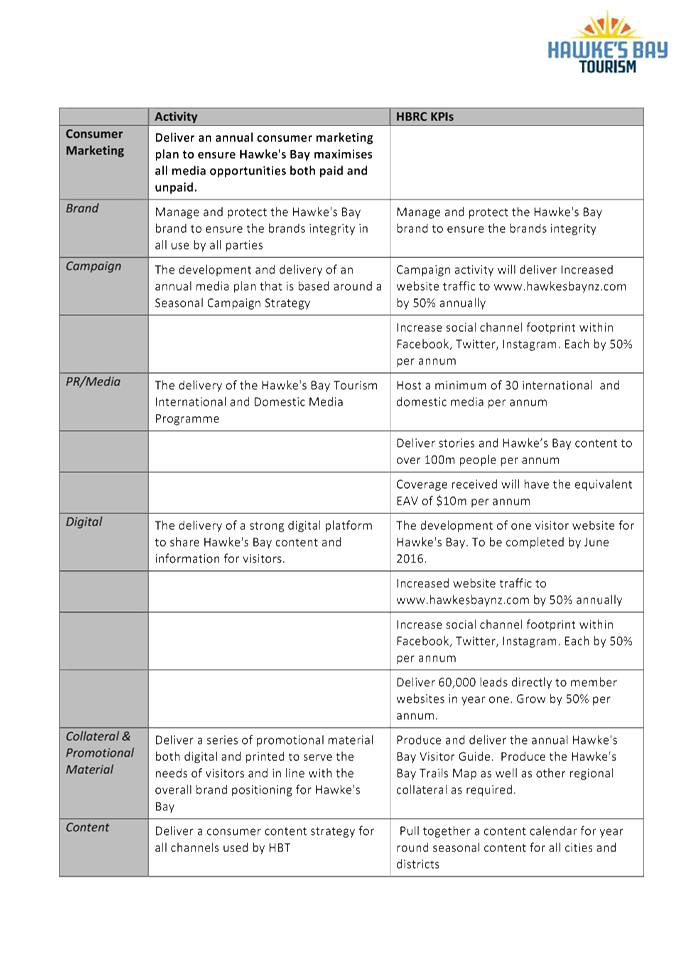

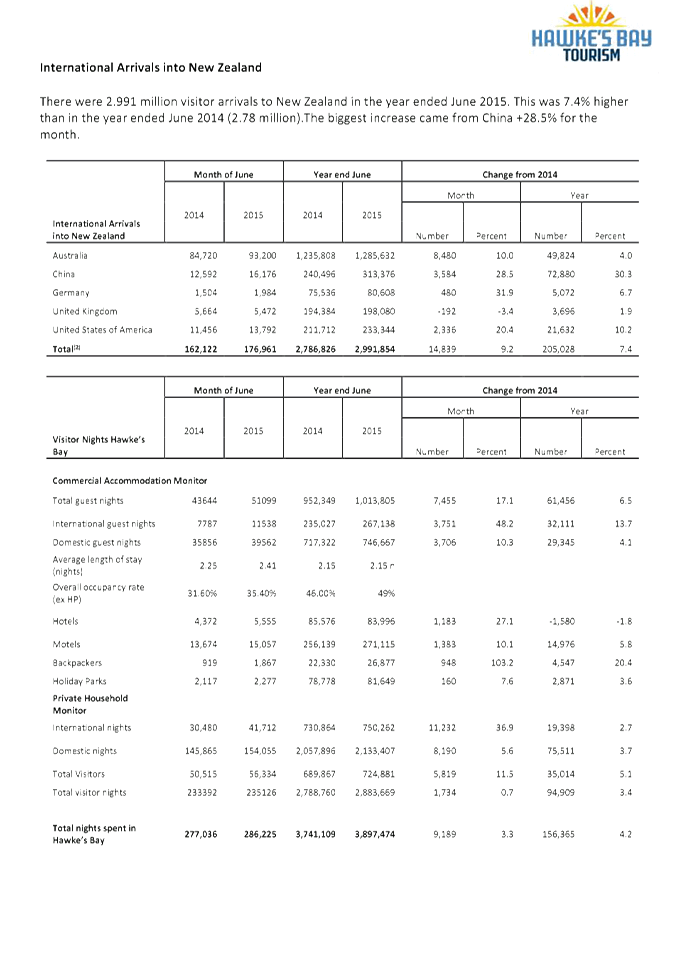

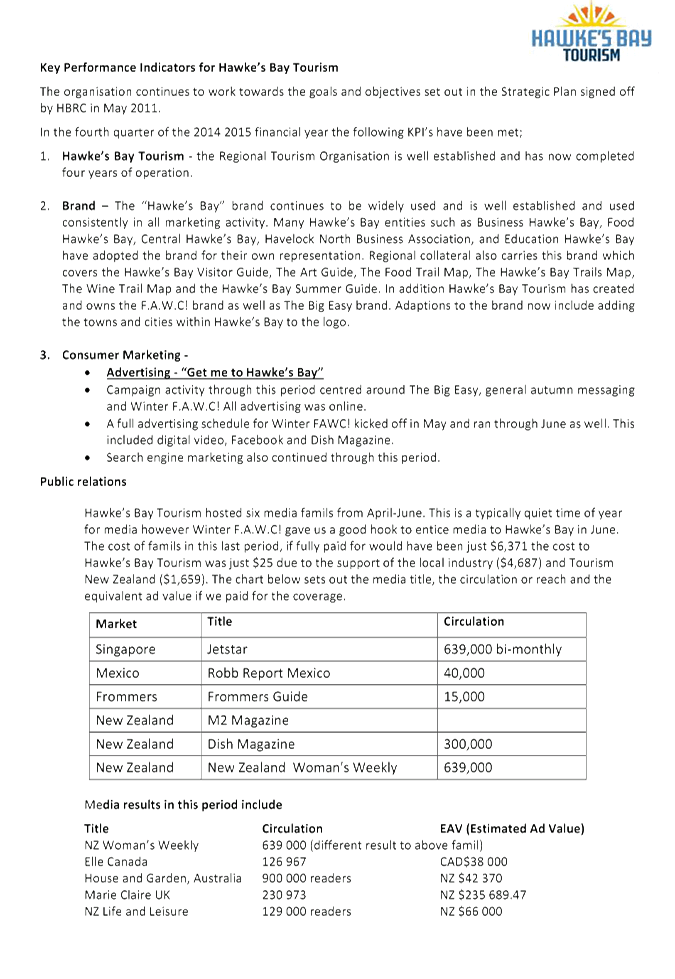

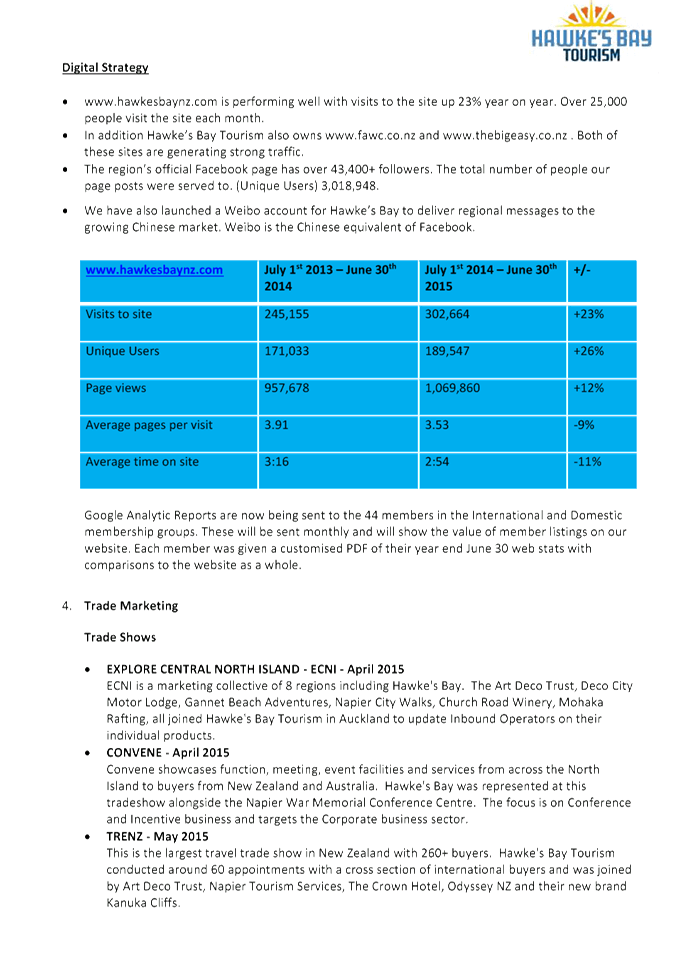

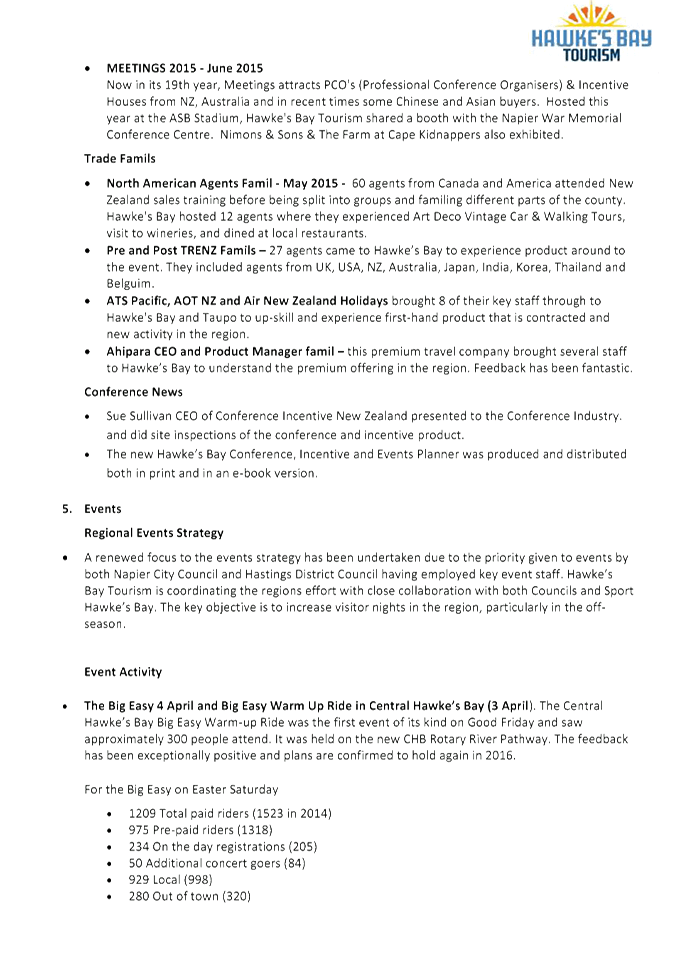

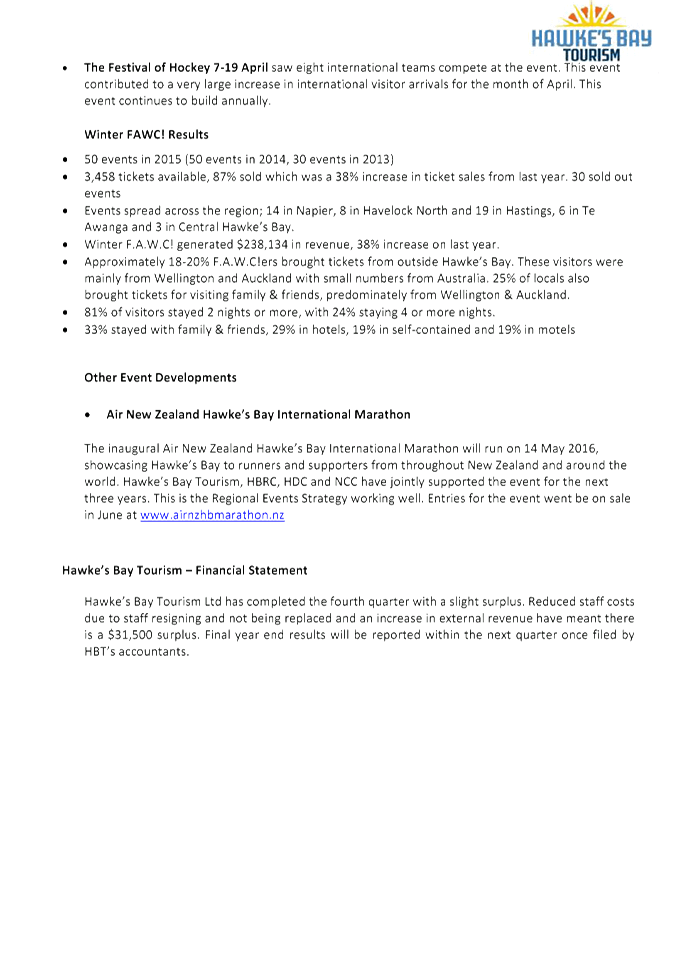

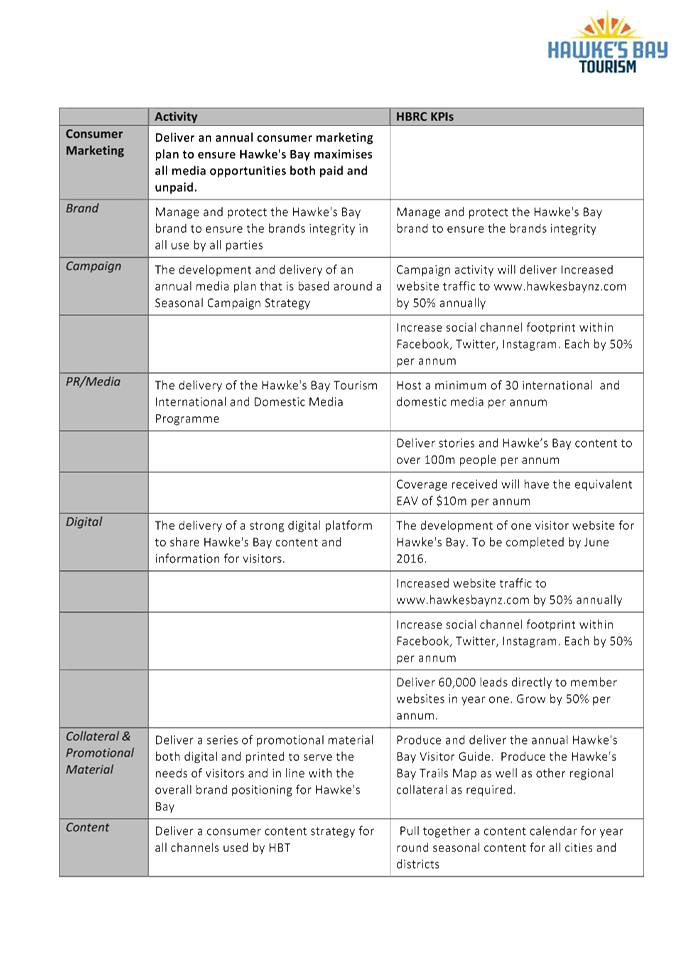

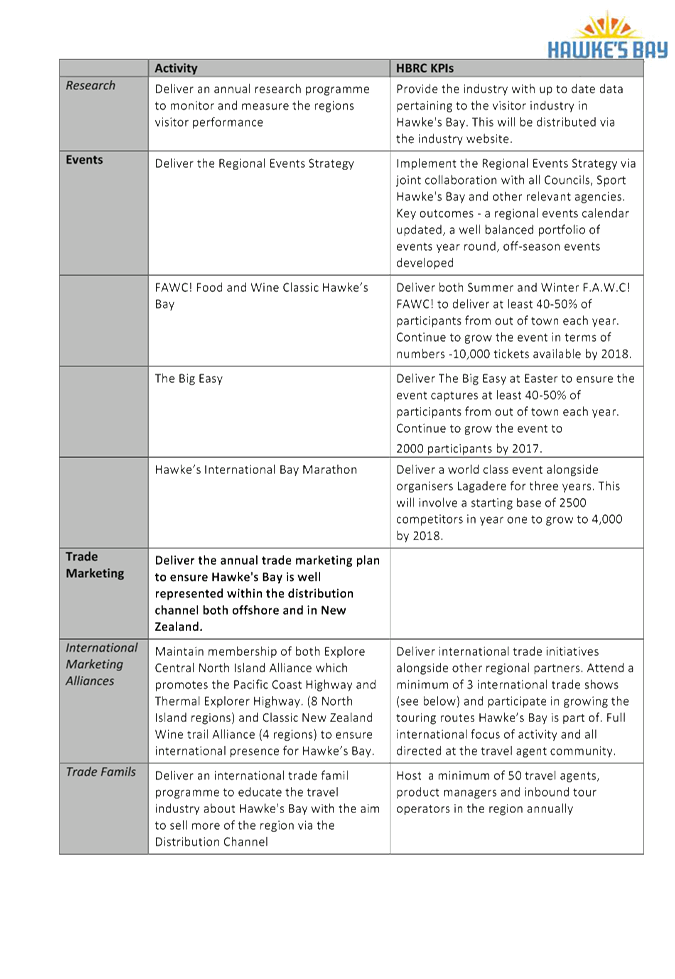

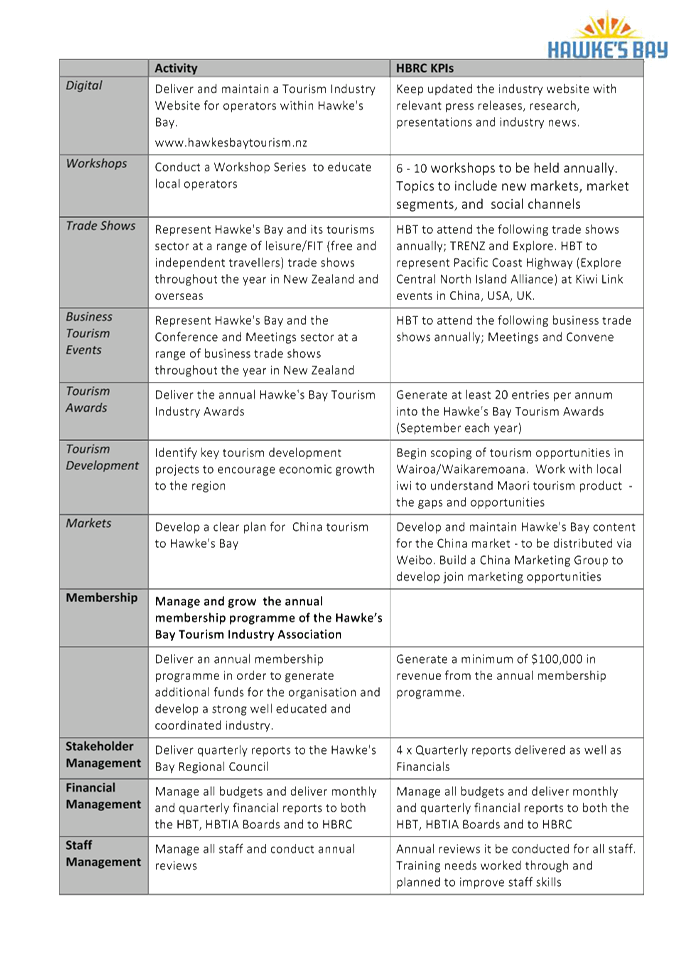

Subject: HB Tourism 2014-15

Year-end Report and 2016-19 Proposed Key Performance Indicators

Reason for Report

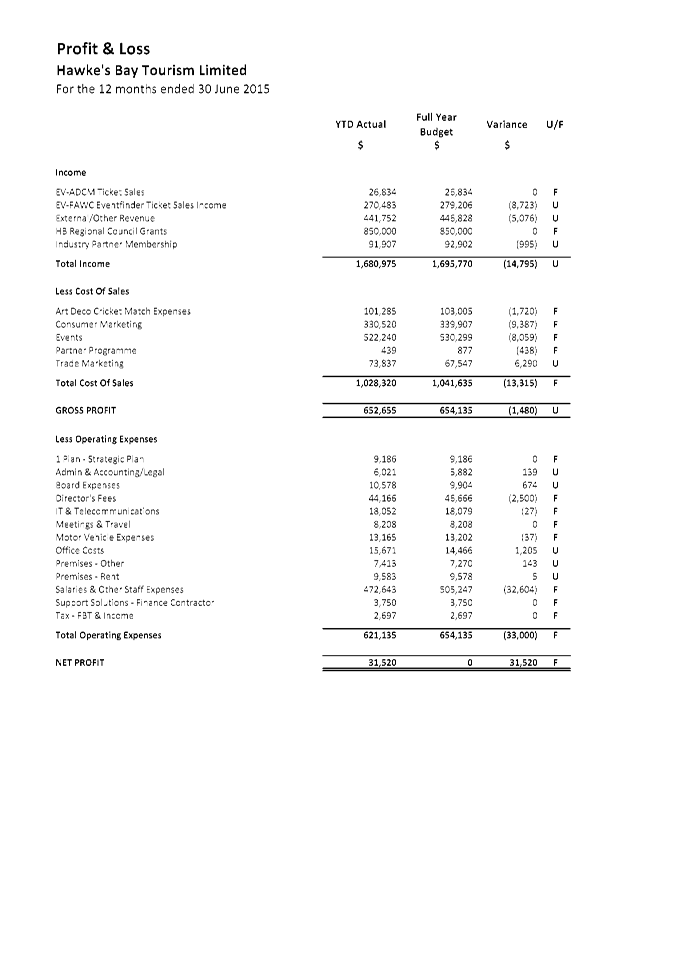

1. The purpose of this paper is to provide Council with Hawke’s

Bay Tourism Limited (HBTL) results for the 2014-15 financial year, and also

present the proposed Key Performance Indicators for 2016-19 under the new

funding agreement.

Background

2. A report from HBTL setting out achievements, progress towards the

key performance indicators as set out in the original 2012 funding agreement,

together with the Company’s financials, are attached to this paper.

Decision Making

Process

3. Council is required to make a decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements contained in Part 6 Sub Part 1 of the Act in relation

to this item and have concluded the following:

3.1. The decision does not significantly alter the service provision or

affect a strategic asset.

3.2. The use of the special consultative procedure is not prescribed by

legislation.

3.3. The decision does not fall within the definition of Council’s

policy on significance.

3.4. The decision is not inconsistent with an existing policy or plan.

|

Recommendations

1. That the Corporate and Strategic Committee receives and takes note

of the HB Tourism 2014-15 Annual Report.

The Corporate and Strategic Committee recommends that Council:

2. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted policy on significance and that

Council can exercise its discretion under Sections 79(1)(a) and 82(3) of the

Local Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

3. Approves the key performance indicators for Hawkes Bay Tourism Ltd

for 2015-16

|

|

Liz Lambert

Chief Executive

|

|

Attachment/s

|

1

|

HB Tourism

2014-15 Quarter 4 Report

|

|

|

|

2

|

HB Tourism 2014-15

Q4 Financial Results

|

|

|

|

3

|

HB Tourism

Proposed Key Performance Indicators

|

|

|

|

HB

Tourism 2014-15 Quarter 4 Report

|

Attachment 1

|

|

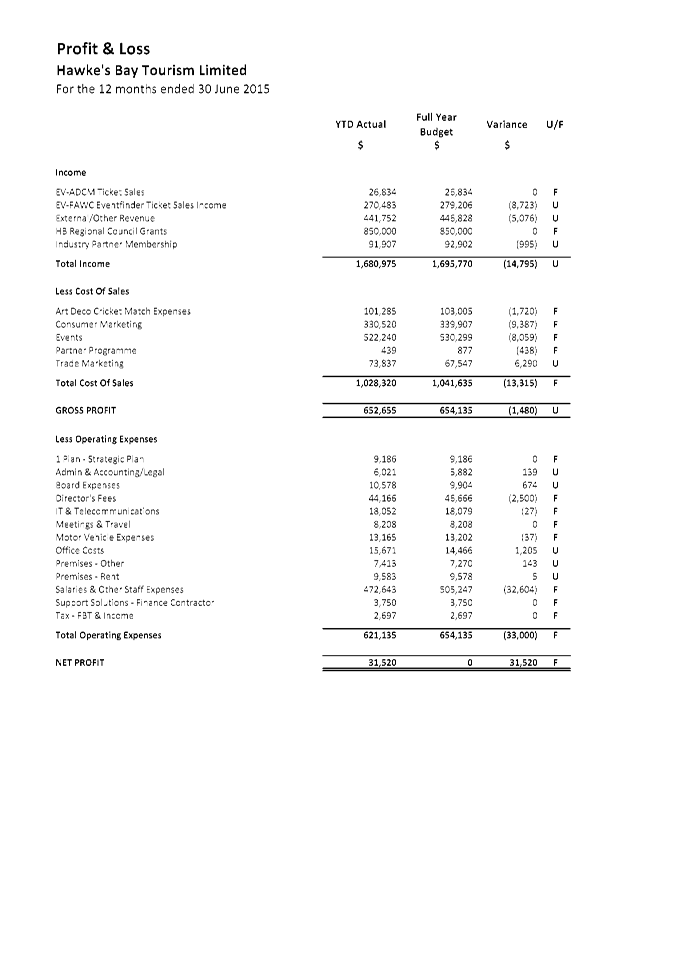

HB Tourism 2014-15 Q4

Financial Results

|

Attachment 2

|

|

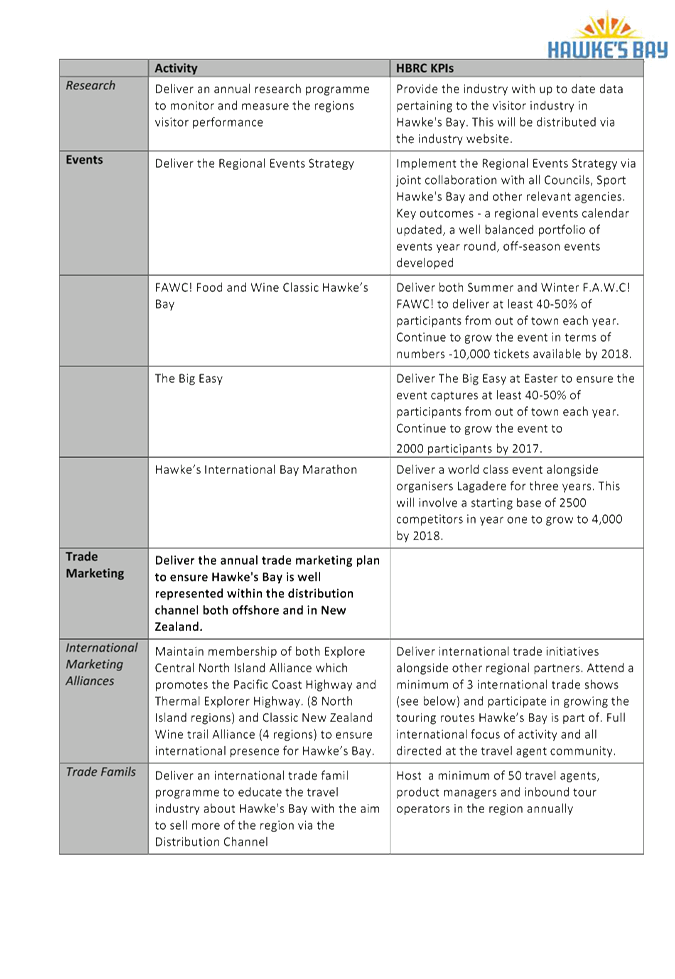

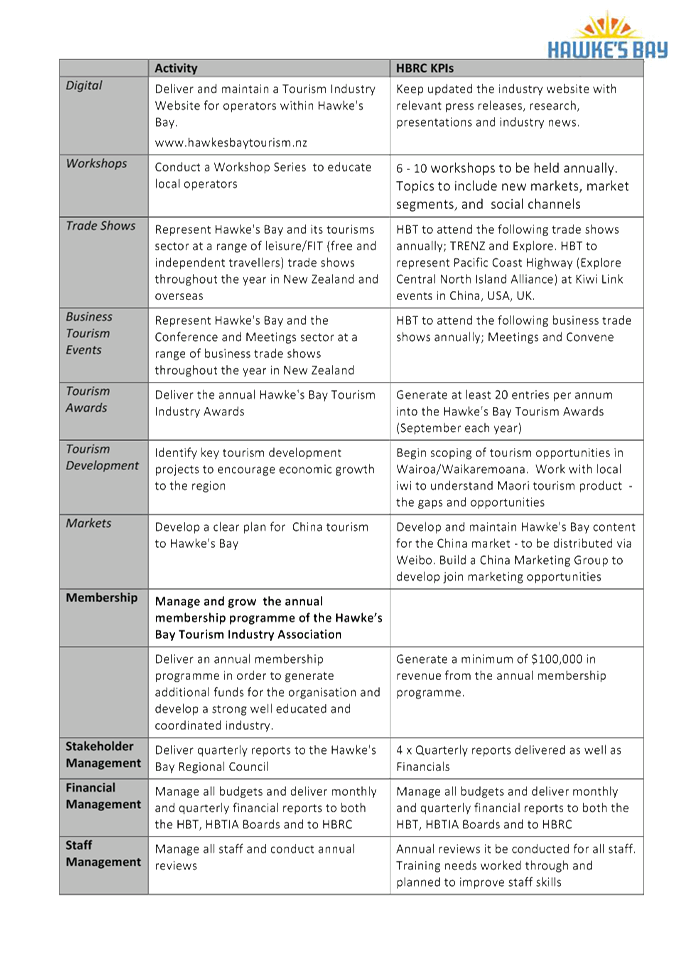

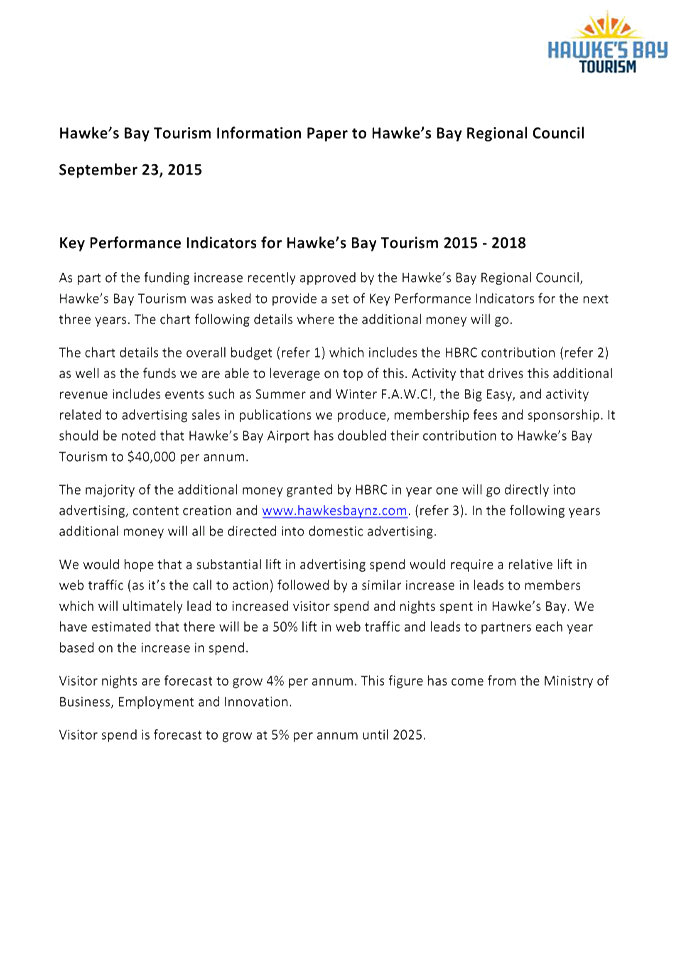

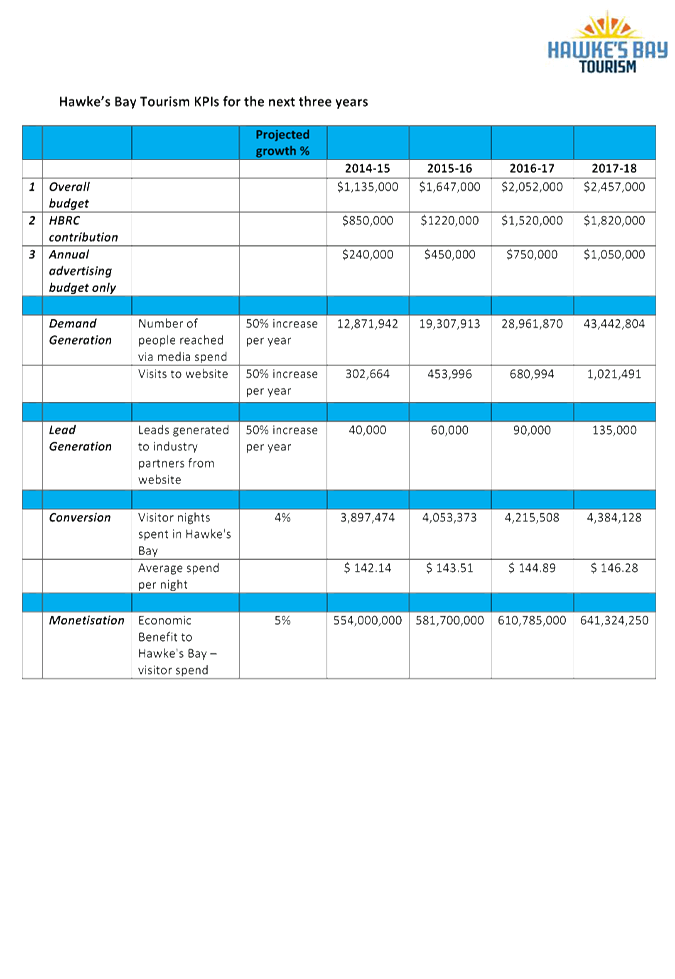

HB Tourism Proposed Key

Performance Indicators

|

Attachment 3

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 23 September 2015

Subject: Forestry Investments

Reason for Report

1. At its meeting on 12 November 2014, the Corporate and Strategic

Committee of Council considered a report on HBRC forest assets. The

Committee resolved to request a paper within the next year, “establishing

values other than commercial that demonstrate the justification for Council

maintaining this investment and projecting the ongoing forest management

programme beyond 10 years to cover the rotation period of the range of

species.”

2. This report covers the issues raised by the

Corporate and Strategic Committee.

Forest Assets –

What HBRC owns

3. Forest assets owned by HBRC are summarised in

the table below. These are set out by planted

area of species or tree type.

|

|

Mahia

Forest

|

Tutira

Reg. Park

|

Waihapua

|

Waipawa

|

Waipukurau

|

Grand Total

(hectares)

|

|

Cypress

|

|

|

17.2

|

|

|

17.2

|

|

Eucalyptus

fastigata

|

18.2

|

|

60

|

|

30.2

|

108.4

|

|

Eucalyptus

regnans

|

|

|

23.5

|

40.8

|

45.1

|

109.4

|

|

Other

Eucalypt

|

|

|

16.1

|

3.1

|

9.7

|

28.9

|

|

Manuka

|

|

130

|

2.8

|

|

|

132.8

|

|

Natives

|

|

16.8

|

7.6

|

1.2

|

1.1

|

26.7

|

|

Other

Softwoods

|

|

|

10.9

|

|

|

10.9

|

|

Radiata

pine

|

17.8

|

114.4

|

60

|

25.3

|

18.9

|

236.4

|

|

Redwood

|

|

|

28.4

|

|

|

28.4

|

|

Grand

Total

|

36

|

261.2

|

226.5

|

70.4

|

105

|

699.1

|

4. Note that in addition the above listed assets,

HBRC manages the Tangoio Soil Conservation Reserve on behalf of the

Crown. This responsibility was been vested in HBRC by the Crown in the

late 1980’s. Tangoio Soil Conservation Reserve will be the subject

of a separate report which is currently being developed in collaboration with

Maungaharuru Tangitu Trust. It is expected to be completed by 30 June 2016.

Purpose and objectives

of HBRC forest ownership

5. Each forest has a particular historic reason for

ownership, and each has its own profile for timber and non-timber benefits,

including carbon credit assets. Each forest has its own potential for

future development of these dependent on site character, location and

recreational potential.

6. The non-timber values of forestry is a growing

area of forest asset management. Sustainable land management in many

areas will include effective use of forestry as part of a suite of land uses,

particularly for East Coast hill country. In reality forests offer

massive community welfare and environmental enhancement, but these are poorly

understood and difficult to measure.

7. Various non timber benefits of forests are

outlined below in order that Council may consider its own priorities and

aspirations for these in more detail. This is also an opportunity for

Council to review how it wishes to improve the public view and understanding of

these benefits.

8. Non-timber benefits from HBRC ownership of

forests include:

|

Benefit

|

Explanation

|

|

Recreational opportunities through links to Regional Park

network, and other landowners such as DOC and Guthrie Smith Trust

|

Public benefit in terms of direct recreational use can be developed

through forest areas. The recent residents’ survey shows a high

level of value and satisfaction placed on open spaces assets provided by

HBRC. Forest ownership offers a number of opportunities to extend these

values considerably, given appropriate direction and resourcing.

A factor in Council’s decision to purchase Waihapua was

its strategic location between Tangoio Soil Conservation Reserve and

Tutira. Staff have worked with the Overseas Investment Office to secure

an easement to allow walking access from Waihapua to Guthrie Smith Trust

land. Staff have yet to develop any specific plans to utilise this in

conjunction with Guthrie Smith Trustees.

Waihapua Forest has spectacular vistas, a very diverse treescape

and established tracking, which offer potential for development of a walking

track network. This will require scoping and resourcing in order to be

developed as it is currently outside the existing Regional Park planning

process.

The local mountain bike club have expressed interest in developing

and using the Waipukurau forest as a mountain bike park.

|

|

Climate change mitigation

|

Trees sequester carbon, reversing the potential impact of the

greenhouse gas carbon dioxide which is released into the air though human

activity.

Current carbon trading models allow for a one-off credit of the

carbon fixing benefit of establishing a forest. Under this regime

subsequent rotations don't offer additional yield of financial benefit to the

forest owner.

|

|

Carbon credit revenue

|

Carbon credits represent carbon sequestered which accumulates as

forests grow. The current estimated value of carbon sequestered and

projections for the future are discussed in the financial section later in

this report.

|

|

Improved soil conservation and water quality

|

The Pakuratahi paired catchment study showed that water quality

is improved

and soil erosion reduced over the life cycle of a forest compared to pastoral

farming.

|

|

Waste water treatment

|

The application of waste water within the Mahia forest commenced

in late 2014. The Mahia forest is established in the upper reaches of

the Whangawehi catchment. The Whangawehi catchment management group and

its work enhancing the catchment has been a positive benefit resulting from

this project.

Central Hawke's Bay District Council has opted not to use the

CHB forests which were established in anticipation of use for wastewater

treatment. They remain available for this purpose should the current

approach to waste water treatment fail to meet consent conditions, or if

public pressure means it becomes less acceptable to discharge treated waste

water directly into waterways in the future.

|

|

Biodiversity (from native and exotic plantings, reserves and

connectivity)

|

Exotic forest plantings can provide connectivity for

biodiversity and provide habitat as a substitute for indigenous forests.

|

|

Educational opportunities

|

A key to improving public understanding of the benefits of

forests and land based careers is to host educational visits for school

groups and others. This is occurring as requested, but further

promotion of this may be beneficial.

|

|

Research and development for sustainable landuse

|

The HBRC forest estate offers far more diversity in terms of

planted species than typical industrial forests. Specific trials and

demonstration sites included within the estate, particularly Waihapua and

Tutira, are expected to demonstrate options for hill country restoration and

farm and community resilience.

Ongoing involvement with HB Branch of Farm Forestry Association,

Manuka Primary Growth Partnership (PGP), SCION and NZ Dryland Forests

Initiative are seen as keys to extending HBRC capability and maximising

community and industry benefits of HBRC hosted trial activity. Field events

are an ongoing aspect of this.

|

|

Honey and trees for bees research

|

The Tutira Manuka plantation and ‘trees for bees’

plantings offer significant scope for promoting industrial honey

plantations. A Manuka workshop (270 attendees) was held in HB in 2015

and included a visit to the Tutira plantation. The Trees for Bees conference

is to be held in HB in 2016 and will be hosted by HBRC.

The Tutira manuka forest is a key research site for the Primary

Growth Partnership for high performance manuka plantations. Research

outcomes from this project will be forthcoming over the next five

years. High UMF Manuka has potential to provide an alternative to

pastoral farming on steep erodible hill country.

|

|

Mauri enhancement

|

The mauri of land and river is degraded if they no longer have

the capacity to support traditional uses and values.

Manmade activities have the potential to degrade or extinguish

the mauri of a resource and as a result may offend the mana of those who hold

traditional rights and responsibilities with respect to that resource.

Known areas of significance to Maori within the estate have been excluded

from commercial planting.

|

|

Demonstrating the deliberate creation of resilient landscapes

|

The development of resilient landscapes, farms, enterprises and

communities and local economy can all be enhanced through smart application

of forest plantings in the landscape.

The HBRC forest estate is uniquely placed to demonstrate

multiple forest based options. These entail diverse values and

potential future income streams.

|

|

Potential for bioenergy in future

|

Current local opportunities for bioenergy are:

· Hog fuel at

Pan Pac cogeneration plant which generates power at the Whirinaki site.

This allows for cost neutral removal of forest wastes from some locations.

· A small

royalty for firewood is an option in some instances.

Challenges to bioenergy from forest wastes are currently; the

relatively low cost of alternative energy sources, transport and recovery

(harvest) costs, and low level of development of bioenergy plants, no ready

competitive market for alternative fuels.

Shifts in any of these factors may lead to greater interest in

bioenergy options. Until then it is proposed that no immediate action

be taken in regard to bioenergy.

|

Challenges in valuing

non-timber benefits from forests

9. The trend in NZ has been for the value of

ecosystem services and biodiversity and social benefits to be ignored.

These services and benefits can be significant and ideally should be part of

any assessment of land use options. Not appropriately accounting for

these benefits can favour land uses which provide limited ecosystem services,

and/or biodiversity benefits relative to forests.

10. Perversely, costs to forest owners can accrue

with policies to preserve benefits, such as the ETS. This has the

potential to lead to a negative value being placed on services which are

incredibly valuable for a successful society.

Specific issues to be

addressed

Waihapua Forest

11. Waihapua is located between Tangoio Soil

Conservation Reserve, which is administered by HBRC on behalf of the Crown, and

Tutira. An easement on a neighbouring property suitable for a walking track

link between Waihapua and the Guthrie Smith property has been negotiated with

the Overseas Investment Office. Staff have held a number of discussions

with groups about the possibility of developing a walking/mountain bike track

network within the property with the potential to link through Tangoio and to

Tutira.

12. Staff seek agreement from Council to progress

this vision into a concept plan in collaboration with interested groups and

neighbouring properties. Subject to Council agreement to proceed, this

work would be largely undertaken during the 2016 year, with a concept plan and

indicative cost estimate prepared for Council consideration late in 2016.

Waipukurau Forest

13. A group of Central Hawke’s Bay mountain

bike enthusiasts associated with the Rotary Rivers Pathway Trust have

approached Council seeking agreement to develop a mountain bike park on the

Waipukurau forest block. Discussions between Council staff and the group

have been on hold since late in 2014, because of the potential for the block to

be needed as part of a waste water treatment system for Waipukurau. The

Manager Resource Use has been providing regular updates on the performance of

the waste water treatment system installed for Waipukurau. The system is

now operating and its ongoing operation and maintenance within its consent

conditions is an issue for Central Hawke’s Bay District Council.

The current consent expires 30 September 2030.

14. A draft Agreement between HBRC and the mountain

bike group has been prepared. The group has prepared a concept design for

tracks through the block and estimates that they will need to invest in the

order of $100,000 to construct the tracks and associated infrastructure.

To provide certainty before making this investment the group seek a commitment

from HBRC for the use of the block for at least 10 years, and preferably 20

years. The current draft of the Agreement provides for HBRC to reimburse

the group the full cost of developing the track infrastructure if the land is

required for another purpose within 10 years of the signing of the Agreement,

and for the amount to be reimbursed to reduce year by year over the following

10 years.

15. This paper seeks agreement in principle from

Council to enter into an Agreement with a community group for the establishment

of a mountain bike park on the block for public recreation and enjoyment for a

period of at least 10 years.

Mahia Forest

16. Mahia – This 36 hectare (ha) forest was established 2011 for

waste water treatment, carbon sequestration and timber production. Mahia

beach waste water is being treated through irrigation onto the site.

17. There are no specific issues for Council to consider for this

forest.

Tutira Regional Park –

Pine Forest

18. The land and forest was purchased by HBRC during the late

1990’s. 114 ha of radiata pine was established by previous owners

from 1991-1998 for timber production and soil conservation.

19. Forest tending is complete for this rotation. The first

rotation harvest is due between 2018 and 2025 with estimated net harvest

revenues of approximately $2.8 million.

20. Specific issues for management of this forest:

20.1. Harvesting and the construction and maintenance of associated

infrastructure will need to be to a very high standard to address risks

relating to extreme erodibility of this site and the sensitive nature of the

Tutira catchment. Staff expect to develop a harvest and post-harvest plan

for Council consideration over the next 2 years.

20.2. Maungaharuru Tangitu hapu have a significant

interest in the area and harvest and replanting planning will need to take

their interests into account. Discussions with Maungaharuru Tangitu Trust

with regard to harvest planning have already commenced.

Tutira Regional Park - Manuka Forest

21. The plantation of 130 ha

of high performance manuka was established in 2011-2013 for manuka honey

production, carbon sequestration, soil conservation, forest restoration,

research, vista enhancement and amenity.

22. The area was chosen because the long term plan for the Regional Park

is for this area to regenerate into native species over time. The manuka

will act as a nurse crop and allow for native forest succession to occur.

The manuka trial provides potential proof of concept for high performance

manuka plantations as an alternative to pastoral farming and production

forestry in NZ hill country.

23. As part of the research driver for this property HBRC is a member of

the Primary Growth Partnership (PGP) for high performance manuka

plantations. This PGP aims to increase manuka honey export volume and

improved honey quality. Manuka honey harvest will phase in over the next

ten years. Ongoing monitoring of honey production is being undertaken

under the PGP, and it is expected that good data will be available by 2018 once

the manuka crop is fully established and flowering.

24. There

are no specific issues for Council to consider for this forest.

Silviculture

25. Background

information to consider regarding silviculture management is set out in

Attachment 1. Based on this information and advice received, staff

propose:

25.1. Up to 50% of the Pinus

radiata stands are pruned to about 5.5 metres to give the option of pruned logs

in the sales mix, but recognising the risk that the poor economics of pruning

under some price scenarios will be exacerbated on sites with poorer site

quality and/or lower rainfall.

25.2. Eucalyptus regnans and E.

fastigata and E. maidenii are managed with a low cost regime of thinning only,

to maintain stand vigour and health and to remove the worst formed trees to

allow for potential sawlog harvest in future, with some targeted pruning of

extremely productive areas to offer the option of higher grade sawlogs to

market at harvest.

25.3. 80-100% of species other

than Pinus radiata and Eucalyptus are pruned to 5-6 metres. Species offering

potential high quality timber will be pruned and thinned as part of

treatment. These species include redwoods, cedars and cypresses and

the ground durable eucalyptus trial area at Waihapua. Advice from Farm

Forestry Association members is that it is essential to prune the best areas of

these species so that pruned logs are available for sale on harvest.

Financial detail

Forestry Land Values

26. Table 1

below shows land values at 30 June 2014. Land was last revalued as at this

date. HBRC’s accounting policies require land to be revalued every three

years and accordingly the next revaluation will be as at 30 June 2017.

|

Forest

|

Valuation

1 July 2014

$’000

|

Purchase date (if since 2005)

|

Purchase price

$’000

|

|

Mahia

|

$71

|

2010

|

$450

|

|

Waihapua

|

$879

|

2009

|

$1,048

|

|

Waipawa

|

$291

|

2009

|

$753

|

|

Waipukurau

|

$406

|

2009

|

$1,615

|

|

Tutira

|

$326

|

|

|

27. With the

exception of Tutira Forestry, revaluations of land apply to the whole forest

area in each location, irrespective of whether it has some open space public

good use and other non-timber uses as outlined in Section 1 above. For Tutira

the cost and revaluation figures are for that part of the land used principally

for commercial forestry operations. Other parts of the Tutira Regional Park are

separately identified and recorded as infrastructure assets in HBRC’s

records.

Forestry Crop Values

28. Forestry Crops were revalued at 30 June 2015 in accordance with

international accounting standards. Table 2 below shows crop values as at

30 June 2015. Values increased during 2014/2015 due to improved log prices,

however the value of Manuka Honey crops fell. The new basis for Manuka

crop valuation is the longer term Comvita projection whereas the valuation for

previous years was based on the planting cost.

|

Forest

|

Area

(ha)

|

Valuation

30 June 2014

($000)

|

Valuation

30 June 2015

($000)

|

Valuation variance

($000)

|

Establishment cost

($000)

|

|

Mahia

|

36

|

37

|

48

|

11F

|

104

|

|

Waihapua

|

227

|

219

|

283

|

64F

|

834

|

|

CHB

|

175

|

219

|

250

|

31F

|

412

|

|

Tutira - manuka

|

130

|

332

|

277

|

55U

|

368

|

|

Tutira - pine

|

131

|

1,783

|

2,476

|

693F

|

|

29. In total

therefore, the HBRC owned forestry estate had a value at 30 June 2015 of

$5.307million in respect of both land and crops.

Financial Returns

30. The

forestry estate’s commercial operations are expected to generate positive

financial returns over the long term. Council’s LTP 2015-2025 relies on

returns from forestry, especially over 2019-2022 when the Tutira pine forest is

harvested. A financial model has been developed by Kevin Molony of Sinamatella

Limited, a specialist forestry consultant, including harvest yields, pricing

and sales of carbon credits (on a “safe” basis) to estimate

revenues, and expenditures and net cash flows over the period.

31. The

financial projection is that operating returns from the forest estate will

enable returns to reach around 6% - 7% across the portfolio (estimated internal

rate of return) for full forest rotations. This is consistent with

HBRC’s financial strategy which requires a 6% return from funds involved

in investment projects.

32. HBRC’s

2015-2025 LTP has included for all years of the Plan, a 6% return on forestry

investments as part of regional income and also includes approximately $2.5

million from the Tutira forestry harvest during the years 2018-19 to 2021-22,

these proceeds accruing from an end of term rotation of radiata pine.

33. The

following Table 3 details these currently modelled financial returns in terms

of cash flows based on the silviculture management approach outlined in above

and assuming current market prices for logs, honey and carbon credits continue

throughout the remainder of the LTP 2015-2025 period.

Table 3:

Projected Annual Returns from the Forest Estate 2016-2025

|

|

Projected Net Cash Flow for Financial years ending 30

June

|

|

Forest

|

2016

$

|

2017

$

|

2018

$

|

2019

$

|

2020

$

|

2021

$

|

2022

$

|

2023

$

|

2024

$

|

2025

$

|

|

Tutira - pine

|

18,375

|

16,155

|

18,925

|

19,951

|

819,905

|

636,646

|

1,012,282

|

-153,239

|

-110,591

|

-46,223

|

|

Waipawa

|

-8,005

|

3,637

|

-13,523

|

-19,361

|

6,314

|

-38,724

|

-7,134

|

-7,134

|

-7,134

|

-7,134

|

|

Waipukurau

|

-6,854

|

1,718

|

-22,890

|

-13,419

|

6,630

|

-54,259

|

-10,003

|

-10,003

|

-10,003

|

-10,003

|

|

Waihapua

|

-5,898

|

-7,396

|

-25,999

|

-13,755

|

9,547

|

-25,260

|

-33,251

|

-12,418

|

-12,418

|

-12,418

|

|

Mahia

|

-10,733

|

-8,666

|

3,663

|

-7,337

|

-25,677

|

3,245

|

-19,203

|

2,011

|

2,632

|

2,635

|

|

Tutira -

manuka

|

-13,304

|

3,895

|

33,271

|

53,386

|

53,386

|

58,386

|

58,386

|

58,386

|

58,386

|

58,386

|

|

Net

Operating revenue

|

-18,499

|

9,343

|

2,790

|

19,465

|

870,105

|

580,033

|

1,001,077

|

-122,397

|

-79,128

|

-14,757

|

|

Holding

interest

|

337,525

|

357,777

|

379,243

|

401,998

|

401,998

|

376,923

|

361,340

|

322,284

|

341,621

|

362,118

|

|

TOTALS

|

319,026

|

367,120

|

382,033

|

421,463

|

1,272,103

|

956,956

|

1,362,417

|

199.887

|

262,493

|

347,361

|

34. It is

important to note:

34.1. Volatile

Prices: Prices can be very volatile, as shown by

the movement in prices for carbon credits and logs over the last three

years. The modelling assumes no change in net prices of logs, carbon

credits, or honey over the period.

34.2. Sensitivity

to Price Fluctuations: The revenues assumed and

their net present value cash flows were represented by income from the sale of

logs (90%) and the accrual or sale of carbon credits (10%). Therefore

price variations on the model for log revenue has a greater impact than

variations in carbon prices.

34.2.1. For example, a 10% shift in log prices would give rise to a plus or

minus $300,000 adjustment in gross revenues whereas carbon prices would need to

fluctuate 64% (ie, a reduction from $7 to $2.50 per tonne or an increase from

$7 to $11.50 per tonne of carbon) in order to have the same effect of $300,000

on gross revenues.

34.2.2. Even with the income sensitivity adjustments referred to above, the

model would still provide a long term return on the rotation of approximately

6%.

34.3. Carbon

Credits: Carbon credits accumulate as the tree crop

grows and carbon is sequestered in the wood and bark of stem, branches and

roots and in foliage. After harvest the carbon in the stem is assumed not to

exist any longer and losses in carbon need to be paid back in the form of

credits. Residual carbon in roots and harvesting “slash” is assumed

to break down to zero over a ten year time frame. When a site is replanted, the

new crop will sequester new carbon which will offset the decaying carbon from

the previous crop. The point at which the increment from the new carbon first

exceeds the rate of decay from the previous crop is the level of

“safe” carbon. As long as a crop is being planted, harvested

and replanted in a perpetual cycle the carbon on site will never fall below

this safe level.

34.4. The

projections contained in Table 3 above assume a policy of selling no more than

the “safe” level so as to avoid any future liability as much as

possible. For a more detailed understanding of the need to establish a

carbon trading policy see Attachment 2.

34.5. Non-Timber

and Open Space Policy: Benefits from non-timber and

open space usage are not included in the modelling or the results shown in

Table 3 above. These benefits are over and above financial returns reported

above.

34.6. Manuka

Honey: Almost all establishment costs of the Manuka

Honey project were met by 30 June 2015. Only modest maintenance and land rental

costs are likely to be incurred in future as there is no further planned

investment. Returns from the venture with Comvita will show significant IRR over

its assessed life time.

34.7. Taxation

Issues: HBRC is not subject to income tax on the

income from the commercial operations on the forest estate while it continues

to directly own the land and crops. Should the land and/or crops be sold to a

company (such as HBRIC) the returns will become taxable income for that company

(even if it is wholly owned by HBRC) and reduce the net return to HBRC by

around 28% pa.

34.8. LTP

2015-2025: The LTP is predicated on use of

commercial forestry returns on the forest estate to support Council’s

continuing operations. Absence of these returns whether through their becoming

taxable or other reason could have a significant negative impact on the

Council’s financial performance. For example, around $2.6 million net is

expected harvesting forest on Tutira Forest between 2019 and 2022. Paying tax

on these receipts would cost the Council around $730,000 over this period.

Carbon Credits and

Strategy

35. At today's estimate the HBRC forest estate has sequestered 28,746 NZU of carbon.

This is based on projections from Kevin Molony who prepared the financial

analysis of the forest estate.

36. The first measurement event included only stands planted in

2010 or earlier. Younger stands were too small to economically measure

given their very small tree sizes and low volumes. Registered forests are

measured every 5 years.

37. At current prices of $7.00 per NZU of carbon HBRC’s

sequestered carbon has an estimated value of $201,221.

38. The next carbon measurement is due at end of next

commitment period and will include all HBRC planted sites. Forest plots are to

be measured by 30 June 2017, (then submitted by 30th June 2018).

39. Voluntary interim returns can be made based on current

growth curve, with unders and overs reconciled in mandatory returns based on

the latest data when this becomes available. Attachment 2 illustrates

options for the measurement and management of a carbon portfolio.

40. A carbon sales protocol and model is proposed to be

developed for HBRC to allow informed and timely carbon trading decisions

according to an agreed risk profile. This will allow sales or purchase

decisions to be signed off by the CE while making carbon revenue available to

HBRC.

41. Carbon credit sales create a potential liability at time of

forest harvest. This is because a proportion of relevant credits must be

surrendered (total carbon volume minus that carbon that will remain onsite and

be reabsorbed by following tree crop). If these credits have been sold

they need to be purchased at the price of the day for surrender.

42. Professional

advice will be sought to assist with drafting a suitable carbon strategy and

policy.

Decision Making Process

43. Council

is required to make a decision in accordance with the requirements of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained in Part 6 Sub Part 1 of the Act in relation to this item and have

concluded the following:

43.1. The

decision does not significantly alter the service provision or affect a

strategic asset.

43.2. The use

of the special consultative procedure is not prescribed by legislation.

43.3. The

decision does not fall within the definition of Council’s policy on

significance.

43.4. Options

to be considered are outlined in the paper.

43.5. The decision

is not inconsistent with an existing policy or plan.

|

Recommendations

The Corporate

and Strategic Committee recommends that Council:

1. Agrees that

the decisions to be made are not significant under the criteria contained in

Council’s adopted policy on significance and engagement and that

Council can exercise its discretion under Sections 79(1)(a) and 82(3) of the

Local Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and significance of the issue

to be considered and decided.

2. Agrees that staff should progress the

development of a concept for a walking/mountain bike track network within the

Waihapua property, with the potential to link through Tangoio and to Tutira,

in collaboration with interested groups and neighbouring properties.

3. Agrees that HBRC enter into an Agreement with

a community group for the establishment of a mountain bike park within the Waipukurau

Forest for public recreation and enjoyment for a period of at least 10 years,

and delegates authority to the Interim Chief Executive to determine the terms

and conditions of such an Agreement.

4. Agrees to the

proposed management approach for the HBRC forest estate being:

4.1. Pruning up to 50% of Pinus Radiata stands to

give the option of pruned logs in the sales mix.

4.2. Manage Eucalyptus regnans and E. fastigata and

E. maidenii with a low cost regime of thinning only, with some targeted pruning

of extremely productive areas to provide the option of higher grade saw logs

at harvest

4.3. Prune and thin between 80-100% of other

species to provide high quality timber.

5. Agrees to the development of a carbon sales protocol

to allow informed and timely carbon trading decisions according to an agreed

risk profile, and requests staff to progress its development for Council

consideration during 2016.

6. Notes the

significant returns projected for harvesting the Tutira pine forest between

2019 and 2022 and that these returns have been included in HBRC LTP 2015/25

financial forecasts.

7. Notes that on

average over a full rotation the estimated long term return on HBRC’s

investment in the forest estate is expected to be around 6-7% for full

rotations (subject to variations in prices and harvest yields). The returns

from Manuka honey are expected to be greater than 6% - 7% which reflects the

limited further expenditure required on these crops.

8. Notes

Council’s continued direct ownership of the forest estate will provide

the following benefits:

8.1. Continued integrated Council management of the open space policy

on these lands together with achieving a reasonable positive return from

their commercial operations

8.2. Significant financial returns over the long term; and

8.3. These financial returns will be received free of income tax whilst

the forest estate continues to be directly owned by the Council.

|

|

James Powrie

Land Services Advisor

|

Mike Adye

Group Manager

Asset Management

|

|

Paul Drury

Group Manager

Corporate Services

|

|

Attachment/s

|

1

|

HBRC

Silviculture Motivation

|

|

|

|

2

|

HBRC Carbon

Credit Trading

|

|

|

|

HBRC

Silviculture Motivation

|

Attachment 1

|

|

HBRC Carbon Credit Trading

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 23 September 2015

Subject: Recommendations from

the Finance Audit & Risk Sub-committee

Reason for Report

1. The following

matters will be considered by the Finance Audit & Risk Sub-committee on Tuesday 22 September 2015 and the recommendations from that

meeting will be tabled for the Committee’s consideration.

2. The

Sub-committee will consider HBRC Risk Management, the audit of Council’s

financial statements for the year ending 30 June 2015, areas of focus for the

internal audit programme, and appointment of an Independent Representative will

be considered in Public Excluded session.

Decision Making

Process

3. The items have

been specifically considered at the Sub-committee level.

|

Recommendations

That the

Corporate & Strategic Committee:

1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted policy on significance and that

Council can exercise its discretion under Sections 79(1)(a) and 82(3) of the

Local Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

HBRC Risk Management

2. to be

tabled

Internal Audit Programme

3. to be

tabled

Independent Representative on Finance Audit & Risk

Sub-committee

4. to be

tabled

|

|

Liz Lambert

Chief Executive

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 23 September 2015

Subject: Human Resources 2014-15

Annual Report

Reason for Report

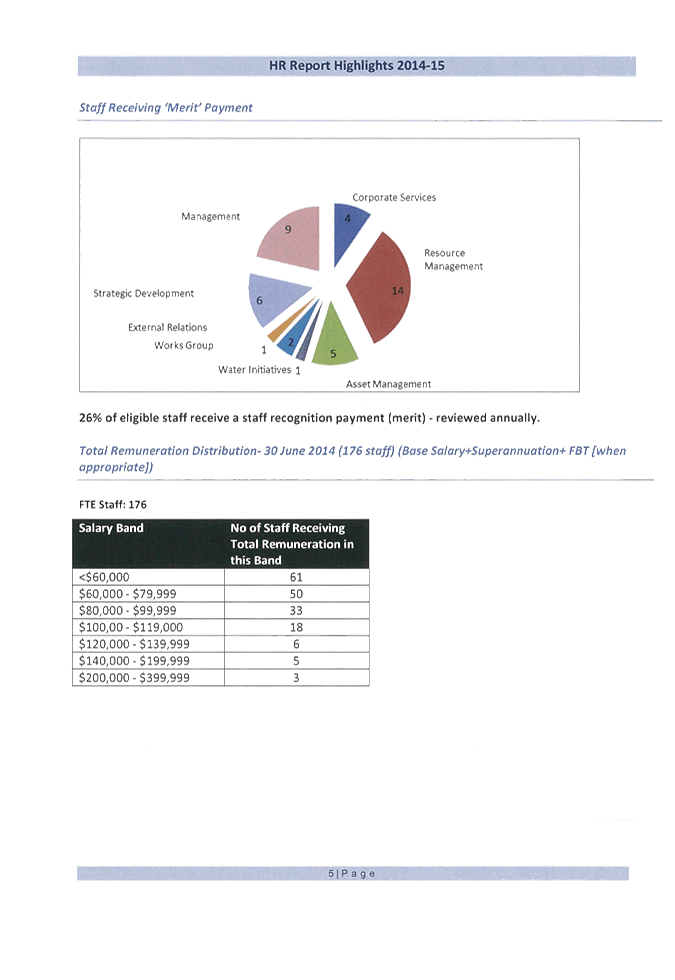

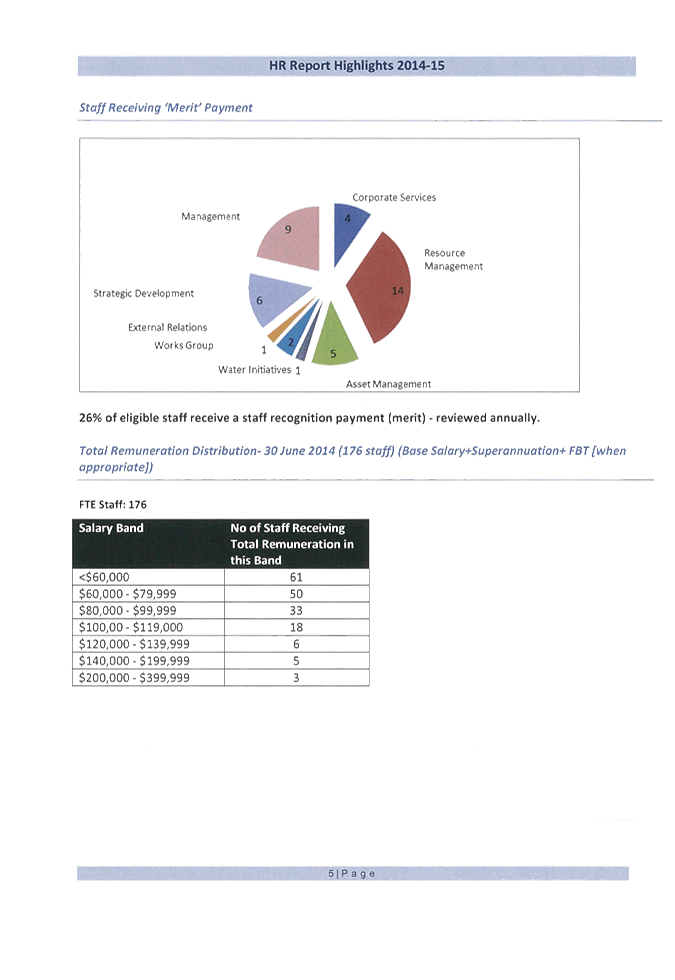

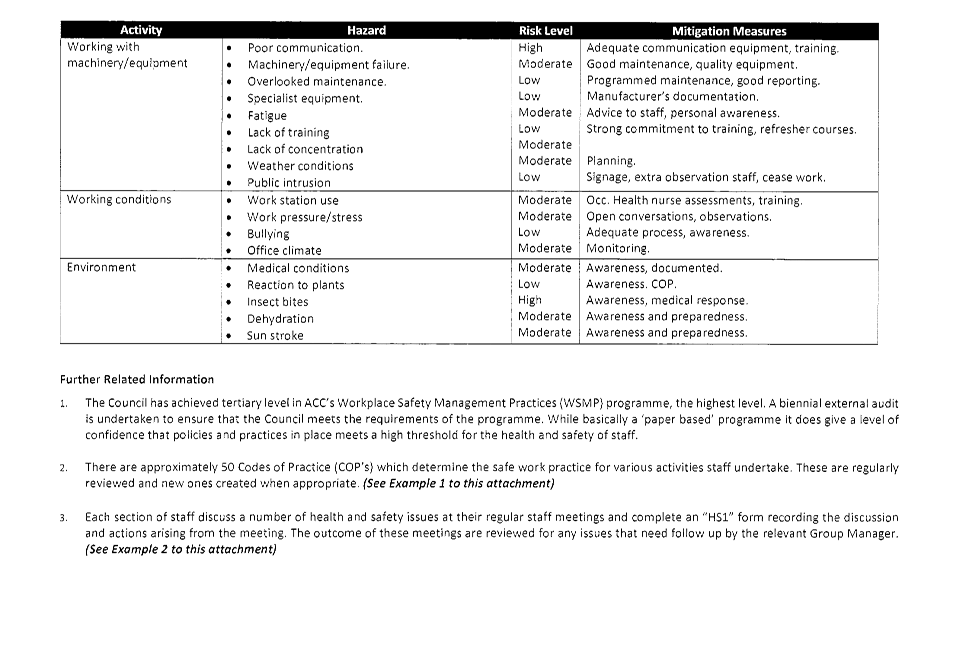

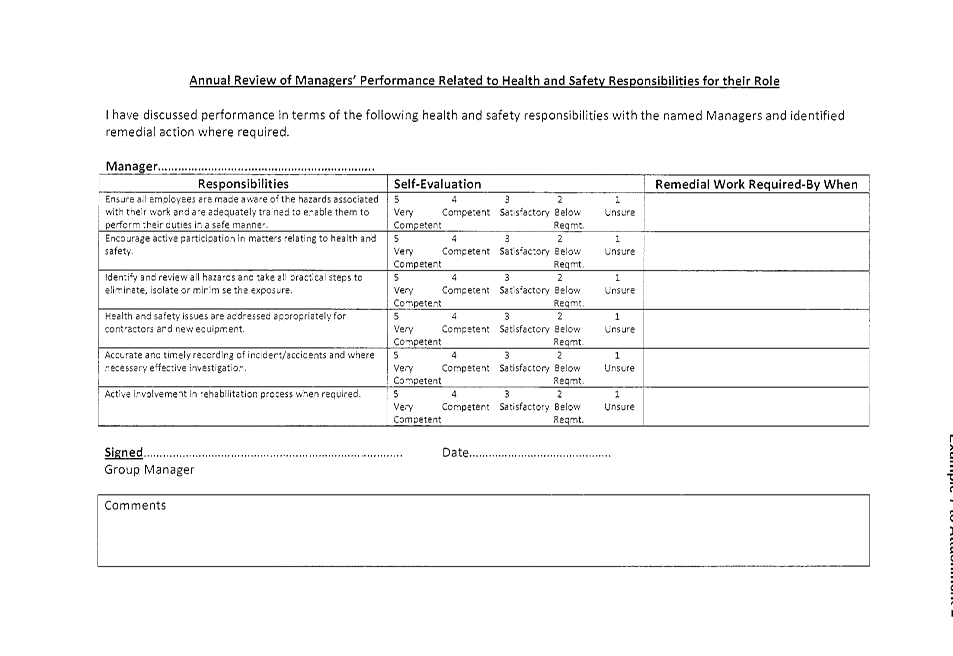

1. This agenda item is to provide Council with a brief overview of the

key human resource metrics recorded for the year 1 July 2014 to 1 July 2015. It

also covers, in more detail, the key aspects of Council’s health and

safety policies and practices so that councillors are aware of the steps

undertaken by management to provide a safe environment for all Council

staff. A copy of the HR Highlights document is appended as Attachment

1.

Key Metrics

Staff Numbers (Previous year in brackets)

2. As at 1 July 2015 180.8 FTE (172.22 FTE).

2.1. Dalton Street (including Waipukurau and Wairoa): 152.8 (144.2)

2.2. Works Group (Taradale and Waipukurau): 28 FTE (28)

3. Turnover for the year ending 30 June 2015 was 6% (2014 – 9%).

Twelve staff left during the year not including two redundancy situations. One

staff member was internally promoted to a new position during the year.

4. The Lawson Williams – HRINZ New Zealand Staff Turnover Survey

indicated an average turnover of 16.3% for contributing organisations in 2014.

For contributing local government organisations the average turnover was 12.4%.

Staff Leave Usage

5. The average number of sick days used was six, slightly down on last

year (6.3 days). There was a reduction in the total sick days used, 931 days

compared to 986 in 2014. The number of staff taking more than the annual

allocation (10 days) remained at 15%. This is only possible where they have

accumulated sick leave to use.

6. Annual leave usage remained constant at around an average of 19 days

per staff.

Average Age/Tenure

7. The average age of Dalton street staff was 45 and the average tenure

nine years.

8. For Works Group staff the average age was 52 and tenure 12 years.

9. Age Profile

|

|

20-25

|

26-30

|

31-35

|

36-40

|

41-45

|

46-50

|

51-55

|

56-60

|

61-65

|

65+

|

|

Dalton Street

|

8

|

11

|

13

|

19

|

27

|

27

|

18

|

14

|

12

|

4

|

|

Works Group

|

0

|

1

|

1

|

1

|

5

|

4

|

8

|

7

|

1

|

0

|

10. Succession

planning is an important ‘tool’ used to try and protect

institutional knowledge and in the next few years will be a key component of

workforce planning for Council.

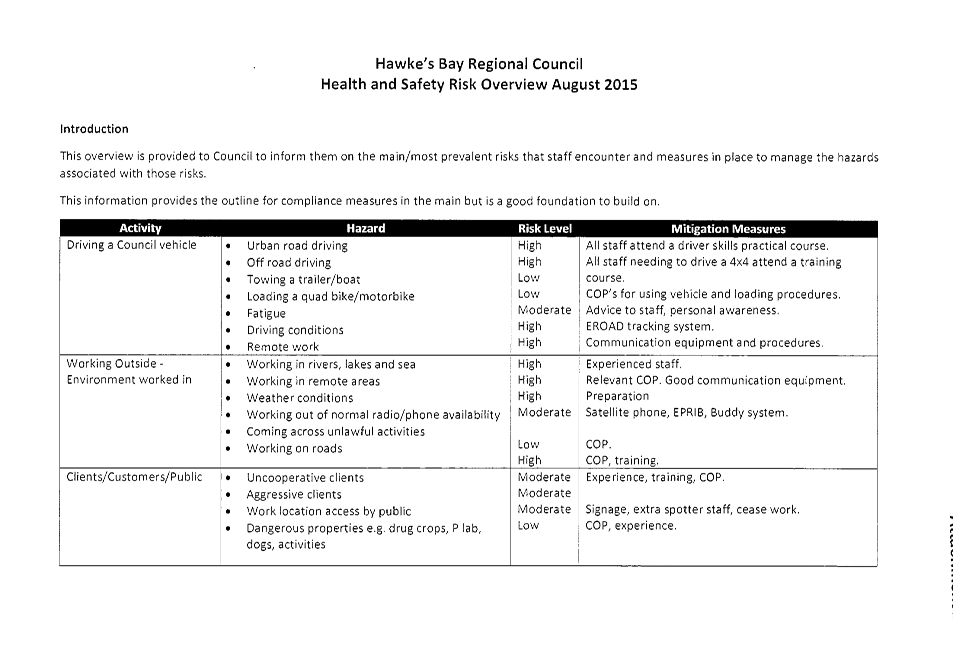

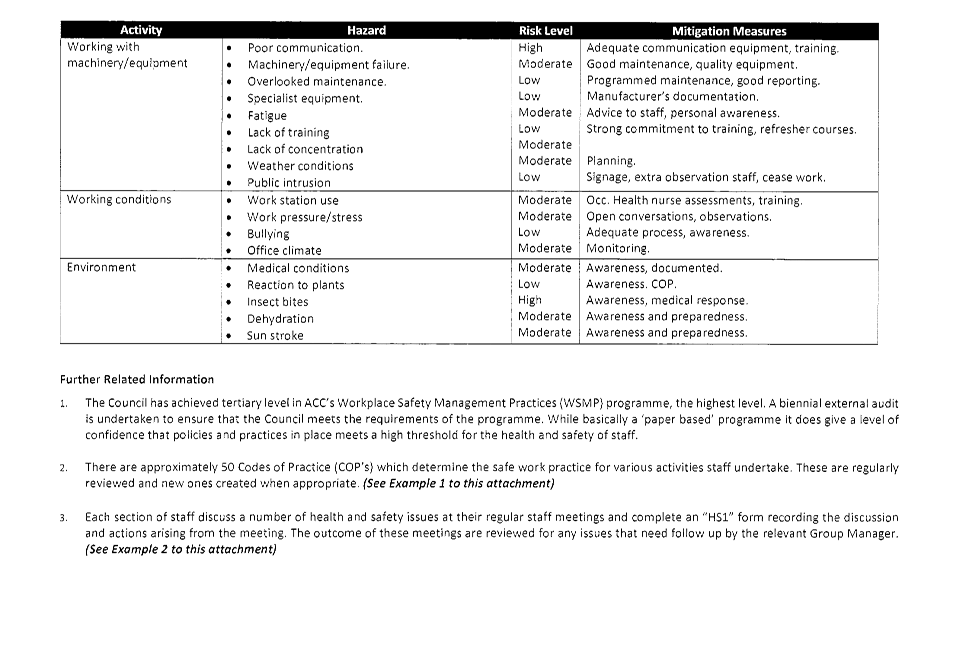

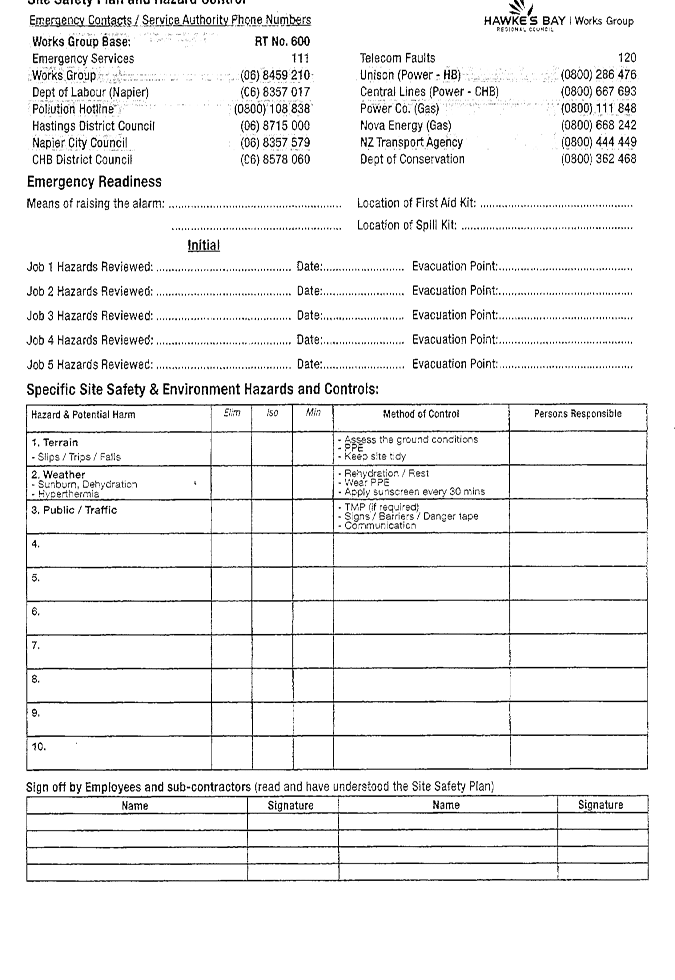

Health and Safety

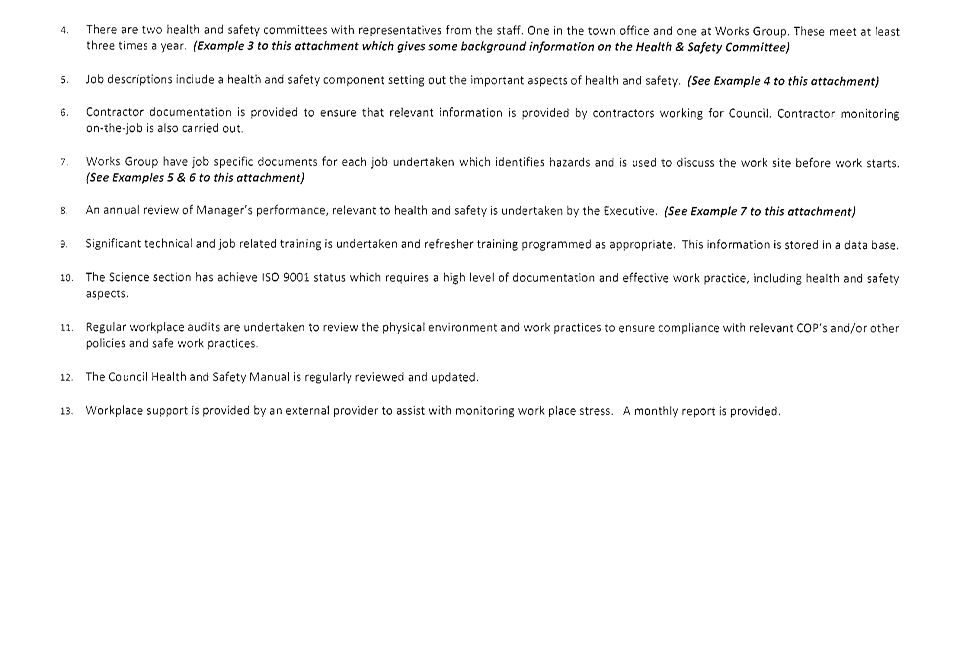

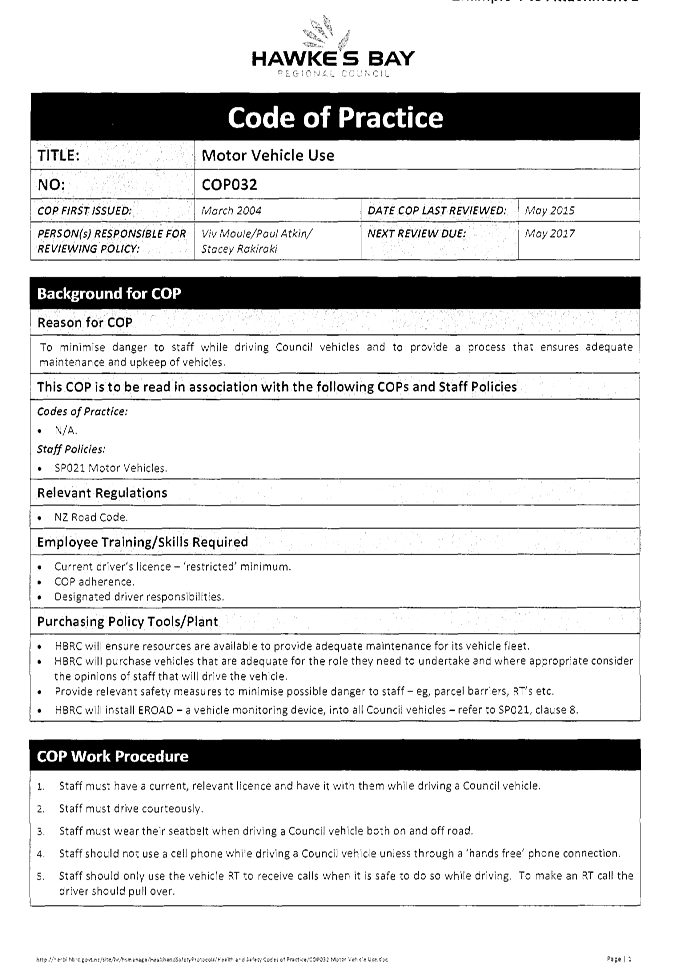

11. The move

to new legislation is a significant issue for all organisations and Council is

no different in that respect. Also included as Attachment 2 is an

outline of the aggregated key hazards and the tools used by Council management

to maintain a safe workplace.

12. The new

Health and Safety at Work Act will come into force from 4 April 2016.

13. All new

staff have a significant component of their induction programme aligned to health

and safety policies, practices and procedures.

14. There

were 31 work related incidents or accidents reported during the year, 25

involving Dalton Street staff with two of these resulting in a total of 10.7

days off work. Works Group had six accidents reported but with no time off work

– an excellent outcome particularly when the type of work undertaken is

considered. This result is considered a reflection of the

Works Group’s attention to health and safety and staff awareness and

commitment to safe work practices.

15. Of the 25

Dalton Street incidents/accidents, 15 were incidents where no harm happened.

The 10 accidents were: sprain/strain (4), minor cuts (2), falls/slips (3),

environmental (1) - poisonous plant.

16. There

were no serious harm incidents requiring a referral to WorkSafe NZ.

17. There

were four complaints from the public regarding staff driving and five speeding

fines.

18. Both

Works Group and Dalton Street have health and safety committees that have met

regularly during the year and played an active part in Council’s

commitment to good health and safety practices.

19. Staff

have recently completed a required self-assessment in terms of the requirements

of HBRC’s participation in the Workplace Safety Management Practices

programme (WSMP). Council achieved the tertiary level in the WSMP programme,

the highest level discount provided and has been at that level for the last

four years.

20. Vitae

continues to provide a workplace support service for Council. The number of

stress related referrals dropped over the last 12 months. Under the new

legislation issues around stress, particularly related to bullying, will be

able to be investigated by WorkSafe NZ as a health and safety issue.

21. Under the

new legislation councillors and the Chief Executive will be classed as the

“officers” of the PCBU (Council). Officers run the risk of

being personally liable over serious harm incidents if they haven’t been

carrying out due diligence. This can include, but is not restricted to, the new

Act’s role in dealing with staff stress claims that result in a serious

harm incident. Officers’ personal involvement in such claims would be

investigated by WorkSafe NZ and could lead to them being prosecuted.

22. Exit

interviews are held for all staff leaving the organisation and a review of

these surveys does not indicate any trends that are a cause for concern. Those

leaving had a range of reasons for doing so.

Staff Training and

Qualifications

23. The

training budget was 2% of the salary budget which is a reduction on last

year’s 2.3%.

24. The main

focus for training has continued to be the enhancement of leadership skills and

those participating have provided excellent feedback on the value of the

programme. Council also undertook staff training days which involved some

‘community services’ activities and an opportunity for staff who

would not normally work together to spend time with staff from across the

Council. The feedback from this initiative was extremely positive and has had

positive spin offs in the work place.

25. Specific

staff health and safety training has been updated as appropriate including

driving skills, water safety training and first aid, together with general

awareness training with the leadership team.

26. The

overall staff qualifications can be seen in the attached HR Highlights. Over 80

staff have a degree or above qualification, including five PhDs.

Industrial

27. All

supervising staff are employed under individual employment agreements.

28. There are

two current collective employment agreements, both are three year agreements

and expire in 2017. The Dalton Street Collective Agreement covers about half

the staff whose work is covered by this agreement; the other half have chosen

individual agreements.

Decision Making

Process

29. Council is required to

make a decision in accordance with Part 6 Sub-Part 1, of the Local Government

Act 2002 (the Act). Staff have assessed the requirements contained within

this section of the Act in relation to this item and have concluded that, as

this report is for information only and no decision is to be made, the decision

making provisions of the Local Government Act 2002 do not apply.

|

Recommendation

1. That the Corporate and Strategic Committee

receives the “Human Resources 2014-15

Annual Report”.

|

|

Viv Moule

Human Resources Manager

|

Liz Lambert

Chief Executive

|

Attachment/s

|

1

|

Human

Resources Report Highlights 2014-15

|

|

|

|

2

|

HBRC Health

and Safety Risk Overview August 2015

|

|

|

|

Human

Resources Report Highlights 2014-15

|

Attachment 1

|

|

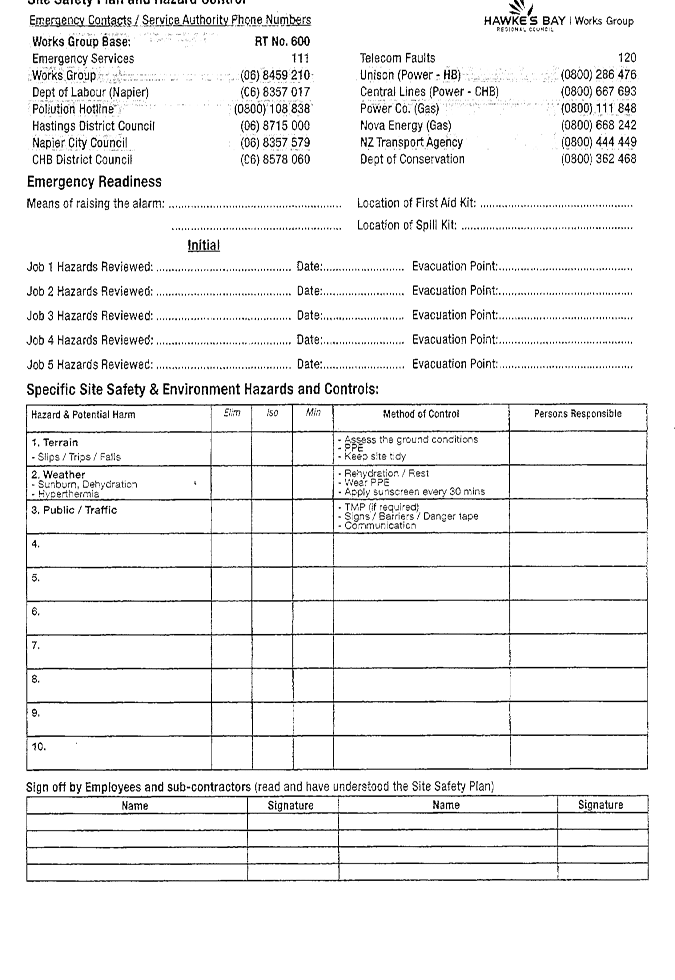

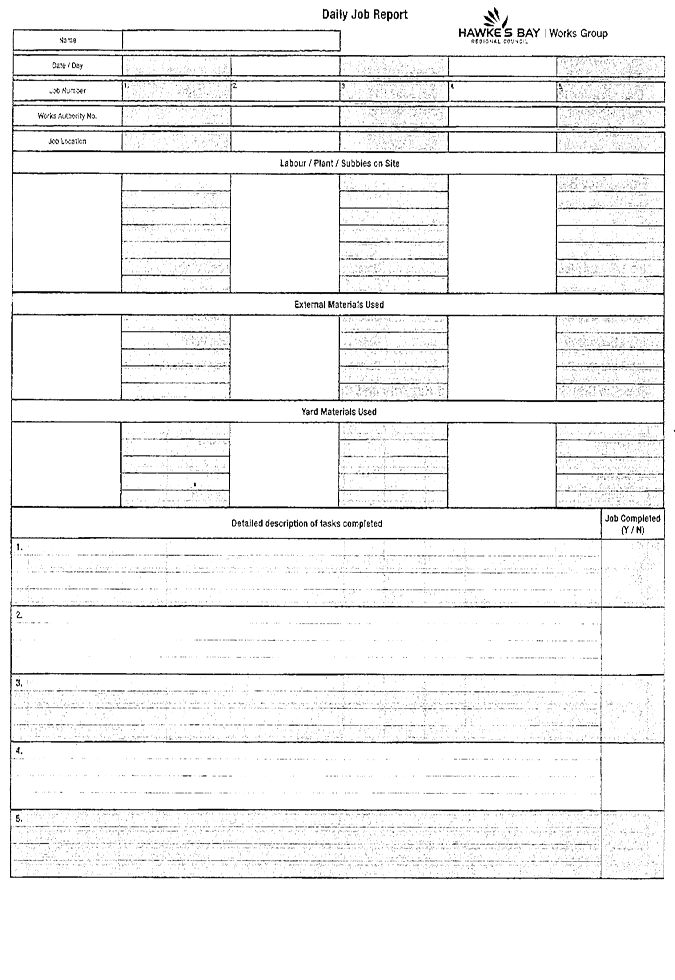

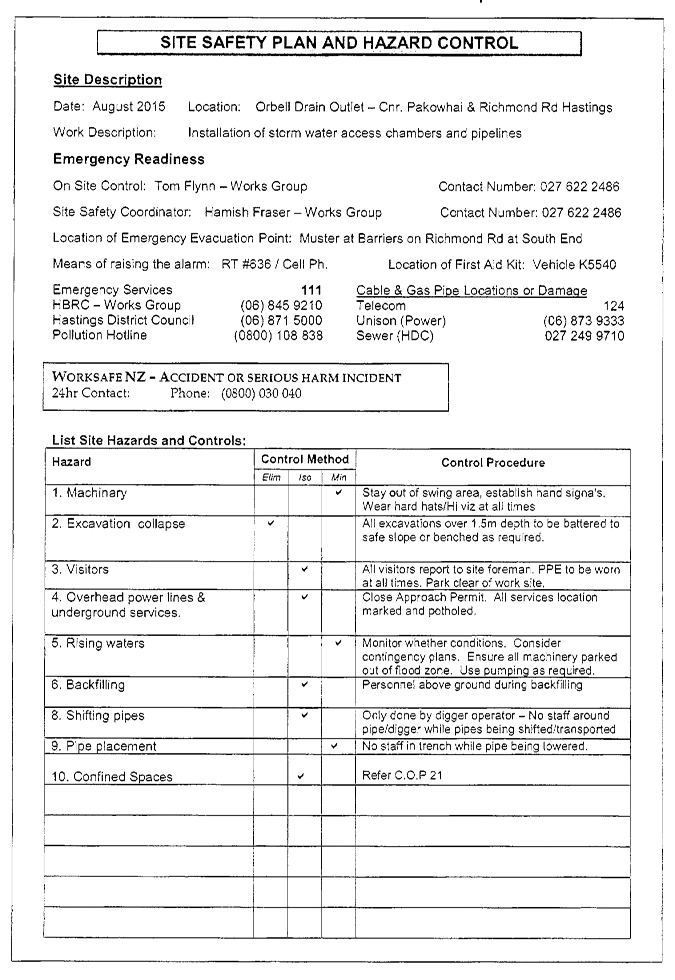

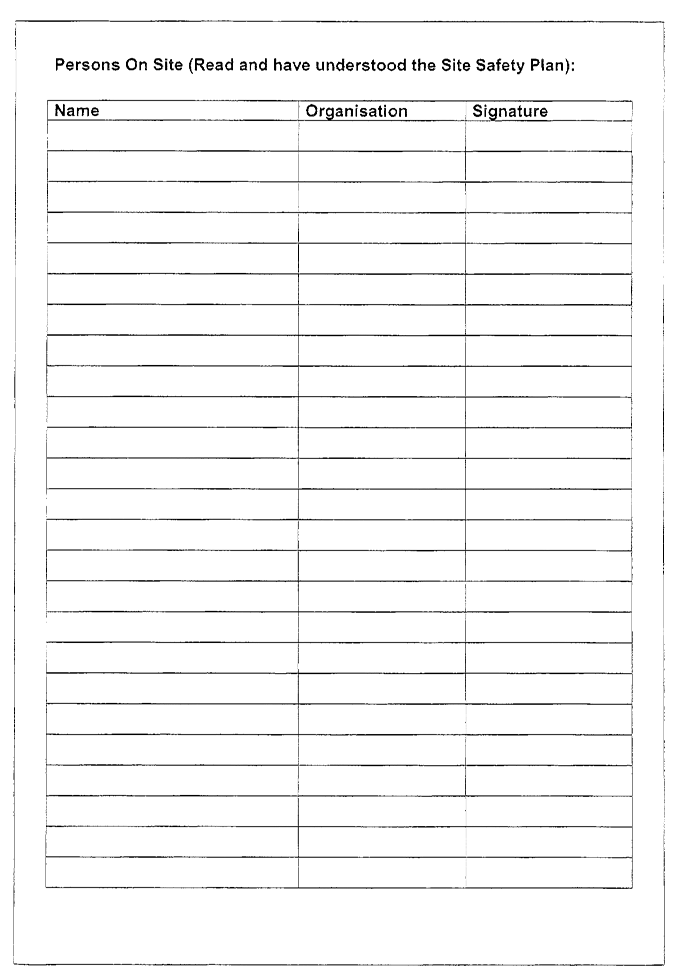

HBRC Health and Safety Risk

Overview August 2015

|

Attachment 2

|

|

HBRC

Health and Safety Risk Overview August 2015

|

Attachment 2

|

|

HBRC

Health and Safety Risk Overview August 2015

|

Attachment 2

|

|

HBRC

Health and Safety Risk Overview August 2015

|

Attachment 2

|

|

HBRC

Health and Safety Risk Overview August 2015

|

Attachment 2

|

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 23 September 2015

SUBJECT: September 2015 Public Transport

Update

Reason

for Report

1. This agenda item provides the Committee with an update on

Council’s public transport operations.

General

Information

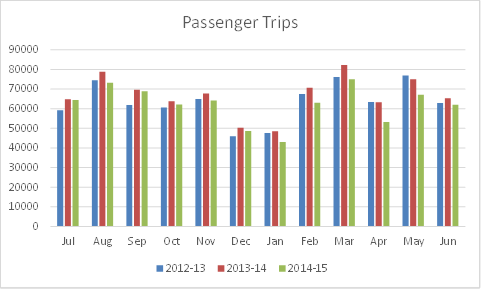

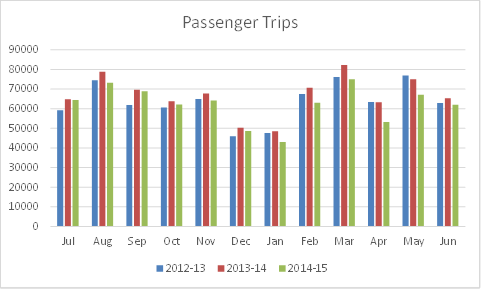

2. There were 6.9% fewer bus passenger trips in 2014-15 than 2013-14.

As previously reported, fluctuating petrol prices and private car running costs

are thought to have been the main contributing factors to this.

Bus Passenger Trips

3. The graph below shows total bus passenger trips during 2012-13,

2013-14 and 2014-15.

Diagram 1 – Passenger Trips –

2012-13, 2013-14, 2014-15

4. Average monthly patronage is shown in the table below.

Table 1 – Total Annual Passenger Trips and Monthly Averages

|

Year

|

Total Annual Trips

|

Monthly Average

|

|

2009-10

|

480,244

|

40,020

|

|

2010-11

|

554,647

|

46,220

|

|

2011-12

|

681,566

|

56,797

|

|

2012-13

|

761,392

|

63,449

|

|

2013-14

|

799,845

|

66,653

|

|

2014-15

|

744,692

|

62,057

|

5. Passenger

classes showing the largest drop in patronage when compared with 2013-14, are

shown in the following table.

Table 2

|

Passenger Class

|

% change between

2013-14 and 2014-15

|

|

Adult

|

-17%

|

|

Community Services card

|

-8%

|

|

District Health Board

patients

|

-6%

|

|

Senior

|

-3%

|

|

SuperGold card

|

-8%

|

|

Tertiary students

|

-5%

|

6. This pattern is

consistent with our theory that the drop in patronage has been largely caused

by a decrease in the cost of driving a car. Passengers paying adult fares are

those most likely to have access to a car. Many SuperGold passengers also

drive, but make more use of SuperGold free travel when the cost of driving is

high.

7. When passenger

numbers are analysed by route, the following patterns emerge.

Table 3

|

Route

|

% change between

2013-14 and 2014-15

|

|

Route

11 – Napier- Hastings via Clive

|

+22.7%

|

|

Route

12 Napier –Hastings via EIT

|

-5.1%

|

|

Route

13 Napier-Taradale via Tamatea

|

-4.6%

|

|

Route

14 Napier - Maraenui

|

-12.5%

|

|

Route

15 Napier - Ahuriri /Westshore

|

+16%

|

|

Route

16 A/B Hastings Camberley/Mahora

|

-15%

|

|

Route

17 Hastings Parkvale Akina

|

-24%

|

|

Route

20 Hastings Flaxmere

|

-11%

|

|

Route

21 Hastings Havelock North

|

-5.6%

|

Bus Stops

8. NCC

has initiated investigations with regard to a programme for formalising Napier

bus stops.

Realtime Passenger

Information

8. Investigations are ongoing into the ‘TrackABus’ passenger

information system. We have had initial discussions with our current service

provider with regard to its application to the Hawke’s Bay bus service.

Subject to a favourable outcome, we will seek approval of the council to

implement it, with the cost being met from within our existing bus contract

budget.

Bikes on Buses

9. There were 2721 bikes carried in 2014-15, which is 26.4% fewer than

2013-14. The growing network of cycle ways, cycle lanes and bike trails could

be a contributing factor to this, with fewer cyclists opting to take the bus.

Bus Service Costs

10. The

following table shows the net cost (after fares and excluding GST) of operating

the goBay bus service in 2012-13, 2013-14 and 2014-15. The costs include base

contract and quarterly incentive and indexation costs, which accounts for the

significant price fluctuations between months.

Table 4 – Net Cost of Bus Service – 2012-13, 2013-14,

2014-15

|

Year

|

Jul

|

Aug

|

Sep

|

Oct

|

Nov

|

Dec

|

Jan

|

Feb

|

Mar

|

Apr

|

May

|

Jun

|

Total

|

|

2012-13

|

$224,406

|

$206,395

|

$217,298

|

$229,967

|

$218,084

|

$246,304

|

$242,115

|

$237,799

|

$202,020

|

$231,333

|

$202,252

|

$237,765

|

$2,695,737

|

|

2013-14

|

$186,170

|

$278,969

|

$182,220

|

$187,613

|

$302,615

|

$207,605

|

$192,259

|

$162,473

|

$135,329

|

$189,097

|

$280,422

|

$160,101

|

$2,464,873

|

|

2014-15

|

$168,720

|

$157,262

|

$264,227

|

$174,153

|

$141,819

|

$255,647

|

$159,785

|

$141,269

|

$253,717

|

$160,004

|

$139,482

|

$247,509

|

$2,263,594

|

(50% of this cost is met by the New Zealand Transport Agency).

Bus Service Tender

11. The bus

service is currently being re-tendered for a period of nine years from 1 August

2016. The result of the re-tendering is expected within the next two weeks.

Total Mobility

12. The Total

Mobility Scheme, which is funded by regional council, local councils and the

NZTA, provides subsidised taxi transport for people who have a permanent

illness or disability which prevents them from using public transport.

13. The

following tables show the number of Total Mobility trips made during 2012-13,

2013-14 and 2014-15 and the corresponding cost (excl GST).

Table 5 – Total Mobility Trips – 2012-13, 2013-14, 2014-15

|

Year

|

Jul

|

Aug

|

Sep

|

Oct

|

Nov

|

Dec

|

Jan

|

Feb

|

Mar

|

Apr

|

May

|

Jun

|

Total

|

|

2012-13

|

6,753

|

6,839

|

6,471

|

7,256

|

6,925

|

6,447

|

6,022

|

6,320

|

6,614

|

6,850

|

7,106

|

6,382

|

79,985

|

|

2013-14

|

7,401

|

6,804

|

6,611

|

7,658

|

7,365

|

7,185

|

6,546

|

7,032

|

7,605

|

7,745

|

7,707

|

7,188

|

86,847

|

|

2014-15

|

8,320

|

7,950

|

7,677

|

8,267

|

7,701

|

7,948

|

6,354

|

6,901

|

8,245

|

7,328

|

7,737

|

7,852

|

92,280

|

Table 6 – Total Mobility cost ($, excl GST) – 2012-13,

2013-14, 2014-15

|

Year

|

Jul

|

Aug

|

Sep

|

Oct

|

Nov

|

Dec

|

Jan

|

Feb

|

Mar

|

Apr

|

May

|

Jun

|

TOTAL

|

|

2012-13

|

44,451

|

44,877

|

43,211

|

46,216

|

45,382

|

39,880

|

37,347

|

40,862

|

44,382

|

43,927

|

47,613

|

43,394

|

521,542

|

|

2013-14

|

49,274

|

46,153

|

43,965

|

50,189

|

47,744

|

46,968

|

39,581

|

46,567

|

52,047

|

50,715

|

51,078

|

49,348

|

573,629

|

|

2014-15

|

55,780

|

53,489

|

51,222

|

54,492

|

53,590

|

49,973

|

38,990

|

45,943

|

52,581

|

46,747

|

50,972

|

51,422

|

605,201

|

(60% of this

cost is met by the New Zealand Transport Agency).

Decision

Making Process

14. Council is required to

make a decision in accordance with Part 6 Sub-Part 1, of the Local Government

Act 2002 (the Act). Staff have assessed the requirements contained within

this section of the Act in relation to this item and have concluded that, as

this report is for information only and no decision is to be made, the decision

making provisions of the Local Government Act 2002 do not apply.

|

Recommendation

1. That the Corporate and Strategic Committee

receives the September 2015 Public Transport Update report.

|

|

Megan Welsby

Sustainable Transport Coordinator

|

Anne Redgrave

Transport Manager

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 23 September 2015

Subject: Gravel Resource

Inventory and Gravel Demand

Reason for Report

1. This report is

to inform the Committee of the findings of two recent investigations concerning

the region’s gravel supply and demand. This work is part of the Gravel

Resource Review being carried out under the Gravel Management Project (Project

369).

Background

2. In November

2010 Council approved a River Bed Gravel Review project to review the

management of the gravel resource in the region’s rivers. The significant

issues were grouped into 13 different study areas and a work program and budget

devised with the aim to complete the work in by the end of 2017.

3. The significant issues are:

|

Issue No.

|

Issue

|

Completion date

|

|

1

|

Hydrological review

|

2011-12

|

|

2

|

Gravel Supply and Transport

|

Begun and ongoing *

|

|

3

|

Gravel Resource Inventory

|

2015

|

|

4

|

Implications for Flood Protection

|

|

|

5

|

Gravel Demand and Forecast

|

2014

|

|

6

|

Gravel Monitoring & Determination of Resource

Availability

|

Begun 2015

|

|

7

|

Instream Ecological Effects

|

Underway, due 2015

|

|

8

|

Riverbed Birds and Flora

|

Underway, due 2015

|

|

9

|

Tangata Whenua Values

|

Ongoing

|

|

10

|

Effectiveness of Beach-raking

|

2013

|

|

11

|

RMA Issues

|

|

|

12

|

Allocation and Financial Mechanisms

|

|

|

13

|

Riverbed Gravel Management Plan

|

|

4. *Note: Since the start of the project staff have worked with NIWA on

more advanced geomorphological modelling of gravel transport to gain a much

greater understanding of the processes and the effects of different scenarios

(extraction rates, climate change, beach-raking, etc.). Staff are carrying out

the modelling and due to the complexity it is taking take more time than

initially considered at the start of the project. However the results are proving

of value and the work will help with questions relating to gravel supply to the

coast. Councillors have previously been given a presentation on this modelling

work relating to the Ngaruroro River.

5. The budget for the review is approximately $120,000 per year from

Project 369, Gravel Management Project. Gravel extraction rates were increased

by 20 cents/cubic metre to pay for the study. Gravel extractors have been

involved with the project from the start and support it. Meetings are held with

them each year to discuss progress and any other issues. However the demand for

gravel has reduced in recent years and the annual programme has had to be

curtailed because of reduced income.

6. Two significant issues were investigated last year and reports

provided. These were:

6.1. Gravel Demand and Forecast by Barry

Larsen (Consultant, principal author) and Murray Stevens

6.2. Gravel Resource Inventory by Murray

Stevens (Consulting Geologist, principal author) and Barry Larsen.

Gravel Demand and Forecast

7. The prime purpose of this report was to produce a river gravel

demand forecast together with a methodology for continuing with being able to

predict demand in the future. The report analyses past gravel demand from 2000

to 2013.

8. Meetings with key gravel extraction industry participants and

stakeholders were carried out along with industry research and other regional

research. HBRC recognises the benefits of working collaboratively with players

in the gravel extraction industry.

9. There are currently more than 50 companies or organisations with

river gravel extraction allocations covering the northern, central and southern

regions. The three largest extractors have extracted on average 60% of the

reported river gravel allocation (since 2000).

10. Other

sources of gravel are the coast (aiming to phase this out) and land based pits

used predominately to serve district council roading needs and forestry.

11. Historic

consumption (demand) has risen and fallen over the years since 2000 with some 8

million cubic metres extracted across the region during the period. This is an

average rate of 572,000 cubic metres per year. Since the peak of 2009 there was

a reduction in demand on average of 31% such that the average extraction across

the region as at 2013 was 400,000 cubic metres per year.

12. Note that

since the report was completed, as at 30 June 2015 the total extraction across

the region was 397,000 (including coastal). Of this amount 75% is taken from

the Ngaruroro River. Note that this figure differs from the annual plan

reporting in June 2015 because at that time not all the extraction data had

been returned.

13. In the

2000-2013 period the most significant reduction was 84% in the southern region

from an average of 121,000 cubic metres per year down to a mere 30,000 cubic

metres per year. As at 30 June 2015 the amount extracted was just 10,000 cubic

metres. This has serious implications for the Upper Tukituki Flood Protection

Scheme. Staff are currently working on methods to deal with this issue.

14. There are

a number of economic, demographic and industry drivers which contribute to

aggregate demand. Typically construction activity provides a good indicator of

demand and the Infometrics Ltd construction growth forecasts have

provided a forecast of the potential construction growth rates for the next 5

years (2014 to 2019). Staff propose to continue to update these forecasts in

future years. A sensitivity analysis was carried out by the author on low and

high growth rates.

15. Interestingly

the data indicates that the construction low is occurring now (2014 to 2015)

and is due to increase steadily out to 2019 with a growth rate of 6% to 8% per

annum on average for residential and non-residential sectors. The

infrastructure sector is lower showing only a 10% increase over the total

forecast period.

16. From this

data the increase in gravel demand can be forecast. By 2019 the demand is

expected to reach approximately 650,000 m3 an increase of 250,000 m3 on current

(June 2015) values.

17. The

impact from the Ruataniwha Dam on gravel demand was also examined. This was

just the impact from flow-on economic growth not the impact of gravel to be

used in construction of the dam which is all sourced on site. The impact of the

Ruataniwha Dam is short lived, with a maximum increase in demand of 250,000 m3

in the middle to latter part of the study period (2014 to 2019) and essentially

the same at the end of the period.

18. High, mid

and low growth forecast scenarios were reviewed to provide a range from which

decisions relating to demand can be made. This will be important when balancing

demand with the available supply from the region’s rivers. This is the

subject of the second report noted above.

19. The

report looked at export opportunities outside the region. Currently there is

around 14% of the river gravel extracted exported out of the region, especially

rounded pebble. There is potential for increased demand particularly to the

Auckland market.

20. An

important issue for gravel extractors and HBRC is that of longer term

allocations, beyond the annual allocation process currently operating. The

desire for some of the larger extractors is for more certainty over supply for

business planning and investment purposes. For HBRC the key issue, if

extractors were to request allocations for longer than 1 year, is that those

extractors would need to commit to the extraction of those volumes and not

merely ‘bank’ them. HBRC relies on extractors to help maintain

river channel capacity at a rate that is affordable and it is in everyone’s

interest to work together.

21. The

useable saleable product from gravel extraction is the yield. The actual yield

varies between extractors and local arrangements are made between companies to

help shift by-product. Regardless, stockpiles of by-product mount up over the

years as currently it cannot be returned to the river and there is little

demand for it. However there are options to be looked at in further studies

such as return to the river. Modelling can provide some answers to the effects

if this is carried out. Beach re-nourishment is another potential use, but the

pricing structure would need to be changed for this to be more acceptable.

Gravel Resource Inventory

22. The key

objectives for this study were:

22.1. The

identification of gravel resource locations and volumes

22.2. Identifying

the risks in gravel supply and quality

22.3. Determining

the sustainability of the river based gravel resource.

23. Gravel

source locations have been investigated and mapped in the report. Although

there is potentially a vast source of gravel, it still requires weather events

(floods) to transport the gravel naturally to populated areas where demand is

greatest or alternatively where channel capacity issues are paramount.

Transport costs become prohibitive if gravel needs to be sourced from sites

well away from the end use locations or alternatively if channel capacity needs

to be maintained by extraction to stockpile with no end use.

24. Using

data collected by HBRC and previous reports and investigations by HBRC a river