Meeting of the Finance Audit & Risk Sub-committee

Date: Wednesday 3 June 2015

Time: 9.00am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict

of Interest Declarations

Decision Items

3. Role and Functions

of the Finance, Audit & Risk Sub-committee 3

4. Members' Liability 7

5. Appointment of

Independent Member 17

6. HBRC Risk

Assessment and Management 19

7. External Audit 39

Information or Performance Monitoring

8. Work Programme

Going Forward 57

Decision Items (Public Excluded)

9. Internal Audit 59

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 03 June 2015

Subject: Role and Functions of

the Finance, Audit & Risk Sub-committee

Reason for Report

1. At its

inaugural meeting, the first order of business is to provide clarity to its

members on the role and functions of the Sub-committee which includes

confirming the Terms of References as adopted by the Regional Council and the

related delegations and reporting lines.

Terms of Reference (adopted 25 February

2015)

a) Purpose

The purpose of the Audit and Risk Committee

is to report to the Corporate and Strategic Committee on matters that will

assist the Council to fulfil its responsibilities for:

1. The robustness of risk management systems, processes and practices

2. The provision of appropriate controls to safeguard the

Council’s financial and non-financial assets, the integrity of internal

and external reporting and accountability arrangement

3. The independence and adequacy of internal and external audit

functions

4. Compliance with applicable laws, regulations, standards and best

practice guidelines

5. The review of Council’s expenditure policies and the

effectiveness of those policies.

b) Specific Responsibilities

The

Audit and Risk Committee shall have responsibility and authority to:

1. Consider the appropriateness of the Council’s existing

accounting policies and principles and any proposed changes

2. Enquire of internal and external auditors for any information that

affects the quality and clarity of the Council’s financial statements and

statements of service performance, and assess whether appropriate action has

been taken by management in response to this

3. Satisfy itself that the financial statements and statements of

service performance are supported by adequate management signoff and adequate

internal controls and recommend adoption of the Annual Report by Council

4. Confirm that processes are in place to ensure that financial

information included in Council’s Annual Report is consistent with the

signed financial statements

5. Review whether Council management has in place a current and

comprehensive risk management framework and associated procedures for effective

identification and management of the council’s significant risks

6. Undertake periodic monitoring of corporate risk assessment, and the

internal controls instituted in response to such risks

7. Undertake systematic reviews of Council operational activities

against Council stated criteria

8. Confirm the terms of appointment and engagement of external

auditors, including the nature and scope of the audit, timetable, and fees

9. Receive the external audit report(s) and review action to be taken

by management on significant issues and audit recommendations raised within the

report(s)

10. Conduct a

committee members-only session with external audit to discuss any matters that

the auditors wish to bring to the Committee’s attention and/or any issues

of independence

11. Review

the effectiveness of the system for monitoring the Council’s compliance

with laws (including governance legislation, regulations and associated

government policies), Council’s own standards, and best practice guidelines;

including health and safety.

c) Membership

· Four

members of Council, being:

Councillors

Debbie Hewitt, Rick Barker, Christine Scott and Fenton Wilson (elected by

Council on 25 March 2015)

· An external

appointee, being…..(to be determined at a subsequent meeting)

d) Chairman

A member of the Committee as elected by

the Council, being Councillor Debbie Hewitt (elected by Council on 25

March 2015)

e) Meeting

Frequency

The Committee shall meet quarterly, or as

required

j) Quorum

The quorum at any meeting of the

Committee shall be not less than 3 Councillor members of the Committee.

k) Accountability

The Finance, Audit and Risk sub-committee

is not delegated to make any decisions. All recommendations of the

sub-committee must be considered by the Corporate and Strategic Committee prior

to any decision of Council.

l) Officers

Responsible

· Chief Executive

· Group Manager Corporate Services

Reporting Through the HBRC Governance

Structure

2. The FA&R

sub-committee makes recommendations to the Corporate and Strategic Committee,

which then considers those recommendations in order to recommend decisions to

the Regional Council.

Decision Making

Process

3. Council is required to make a decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements contained in Part 6 Sub Part 1 of the Act in relation

to this item and have concluded the following:

3.1. The decision does not significantly alter the service provision or

affect a strategic asset.

3.2. The use of the special consultative procedure is not prescribed by

legislation.

3.3. The decision does not fall within the definition of Council’s

policy on significance.

3.4. The decision is not inconsistent with an existing policy or plan.

3.5. Given the nature and significance of the issue to be considered and

decided, and also the persons likely to be affected by, or have an interest in

the decisions made, Council can exercise its discretion and make a decision

without consulting directly with the community or others having an

interest in the decision.

|

Recommendations

That the

Finance, Audit and Risk Sub-committee:

1. Receives and reaffirms the Terms of Reference for the

sub-committee

2. Receives and confirms the Delegations made to it by the

Hawke’s Bay Regional Council

3. Receives and confirms the reporting lines for the sub-committee as

per the HBRC Governance structure.

|

|

Paul Drury

Group Manager

Corporate Services

|

Liz Lambert

Chief Executive

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 03 June 2015

Subject: Members' Liability

Reason for Report

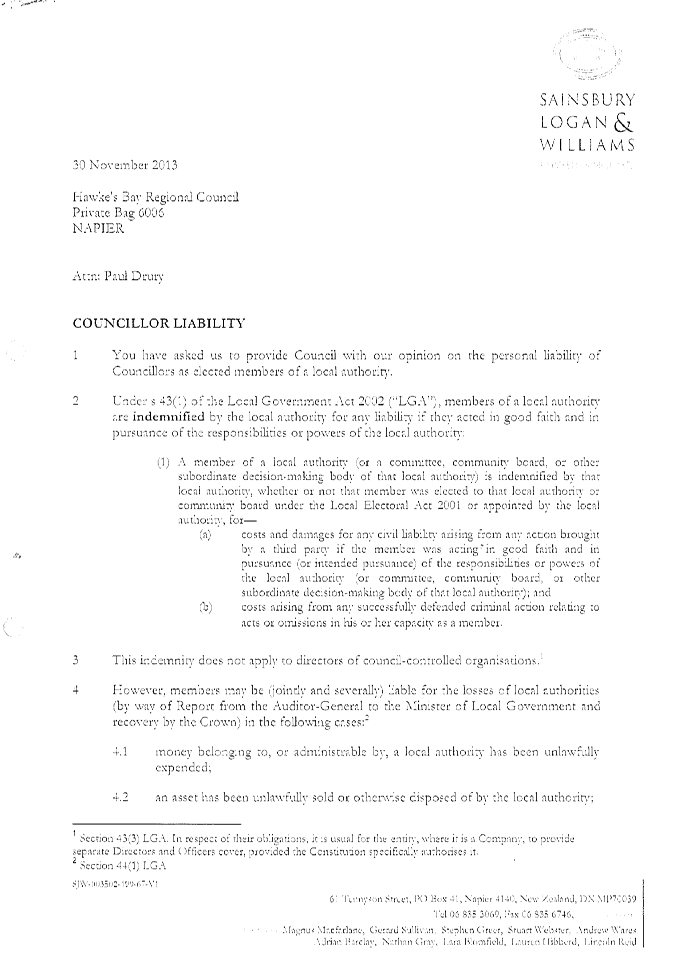

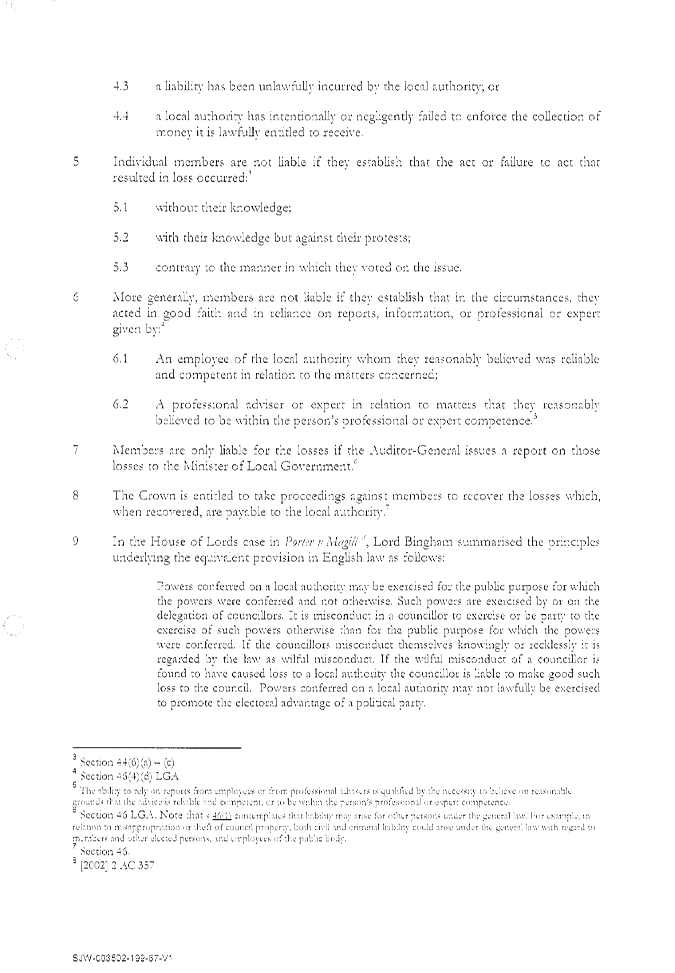

1. To provide clarification on the liability that members may be

exposed to in carrying out the duties of the Subcommittee and the insurance

cover that Council currently has in place to mitigate against such liability.

Background

2. As requested by the Chairperson of this Subcommittee, to review the

liability that members of the Subcommittee could be exposed to in making

decisions on papers considered by this Subcommittee, the following reports are

presented with this paper as Attachment 1.

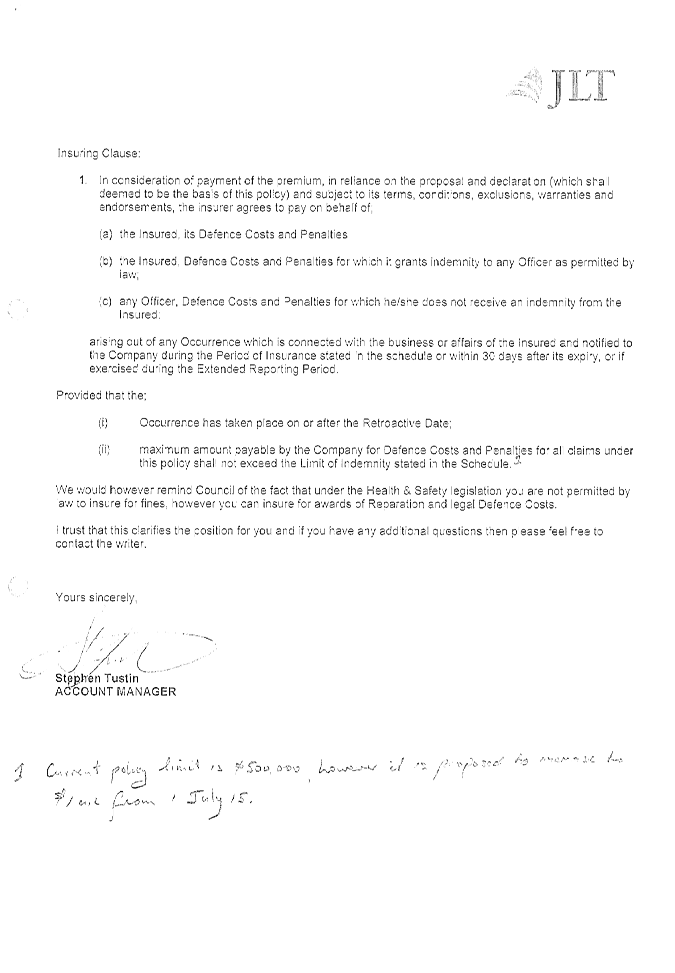

2.1. Two reports from Sainsbury Logan Williams, the first on

“Councillor Liability” and the second on “Health and

Safety” as relates to statute.

2.2. A letter from Council’s insurance brokers, Jardine Lloyd

Thompson Ltd (JLT) on the cover provided in Council’s insurance policies,

specifically professional indemnity, public liability and statutory liability

policies.

Lauren Hibberd from

Sainsbury Logan Williams will attend this meeting to present the material

included in the attachment, and also to provide additional clarification if

required.

3. The current insurance policy limits, cover and excess are as

follows.

|

Policies

|

Cover

|

Excess

|

|

Public Liability

|

$100 million

|

$2,000

|

|

Professional Indemnity

|

$100 million

|

$10,000

|

|

Statutory

Liability (part of employer’s liability policy)

|

$500,000

|

$5,000

|

4. It is proposed to increase the claim limit for the statutory

liability policy from $500,000 to $1 million effective from 1 July 2015.

JLT have advised Council that this increase in cover is prudent, in their

opinion, to reflect the additional liability due to the proposed changes in

Health and Safety legislation.

Decision Making

Process

5. Council is

required to make a decision in accordance with Part 6 Sub-Part 1, of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained within this section of the Act in relation to this item and have

concluded that, as this report is for information only and no decision is to be

made, the decision making provisions of the Local Government Act 2002 do not

apply.

|

Recommendation

1. That the Finance, Audit and Risk

Subcommittee receives the reports on “Members’ Liability”

from Sainsbury Logan Williams and from Jardine Lloyd Thompson insurance

brokers.

|

|

Paul Drury

Group Manager

Corporate Services

|

|

Attachment/s

|

1

|

Councillor

Liability Reports

|

|

|

|

Councillor

Liability Reports

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committeE

Wednesday 03 June 2015

Subject: Appointment of Independent

Member

Reason for Report

1. The Terms of

Reference for the sub-committee includes the appointment of an Independent

Member. In order to make an appointment, the sub-committee wishes to first

consider feedback from all Councillors on the issue.

Feedback Received to Date

2. Before we

consider the skill set for an independent member, I would prefer to have a

discussion about whether or not we need one. Further, I think this is a

discussion further down the track when we have thought through what it we are

setting out to achieve. At this point I think we would all have a better

appreciation of whether we need an independent member and should we decide yes,

at that point set out the skills and knowledge we were seeking.

3. I think the

skill set for the independent is extremely important - I think the independent

is extremely important - might be the only one with a skill set as unlike a

Board the only skill set that are pre requisite for being election is having

your name known. I also think the sooner appointed the better - the appointment

has been identified already by council resolution.

3.1. All A & R

committees need strong financial literacy. Therefore at the forefront of skills

is qualifications in finance, plus

3.1.1. experience

in risk framework identification

3.1.2. knowledge

(preferably experience) in audit

3.1.3. knowledge

of governance

3.1.4. knowledge

of local government - insight into different requirements under relevant acts

for local government

3.1.5. elected

members responsibilities vs Board members

3.2. I do know

that in seeking these skills in Hamilton CC and Napier CC they appointed a

suitably qualified and experienced accountant as Chairman - the only position

they would accept.

4. Proven ability

to focus on conformance. Chartered accountant.

5. Financially

literate. Local government understanding combined with private expertise.

Personality trait, has strong degree of independence. Not a local. Happy

to work in public / open meetings

Decision Making

Process

6. Council is required to make a decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements contained in Part 6 Sub Part 1 of the Act in relation

to this item and have concluded the following:

6.1. The decision does not significantly alter the service provision or

affect a strategic asset.

6.2. The use of the special consultative procedure is not prescribed by

legislation.

6.3. The decision does not fall within the definition of Council’s

policy on significance.

6.4. The decision is not inconsistent with an existing policy or plan.

6.5. Given the nature and significance of the issue to be considered and

decided, and also the persons likely to be affected by, or have an interest in

the decisions made, Council can exercise its discretion and make a decision

without consulting directly with the community or others having an

interest in the decision.

|

Recommendations

The Finance,

Audit and Risk Sub-committee recommends that the Corporate and Strategic

Committee:

1. Requests that the Chief Executive seeks Expressions of Interest

from …

or

2.

|

|

Paul Drury

Group Manager Corporate Services

|

Liz Lambert

Chief Executive

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 03 June 2015

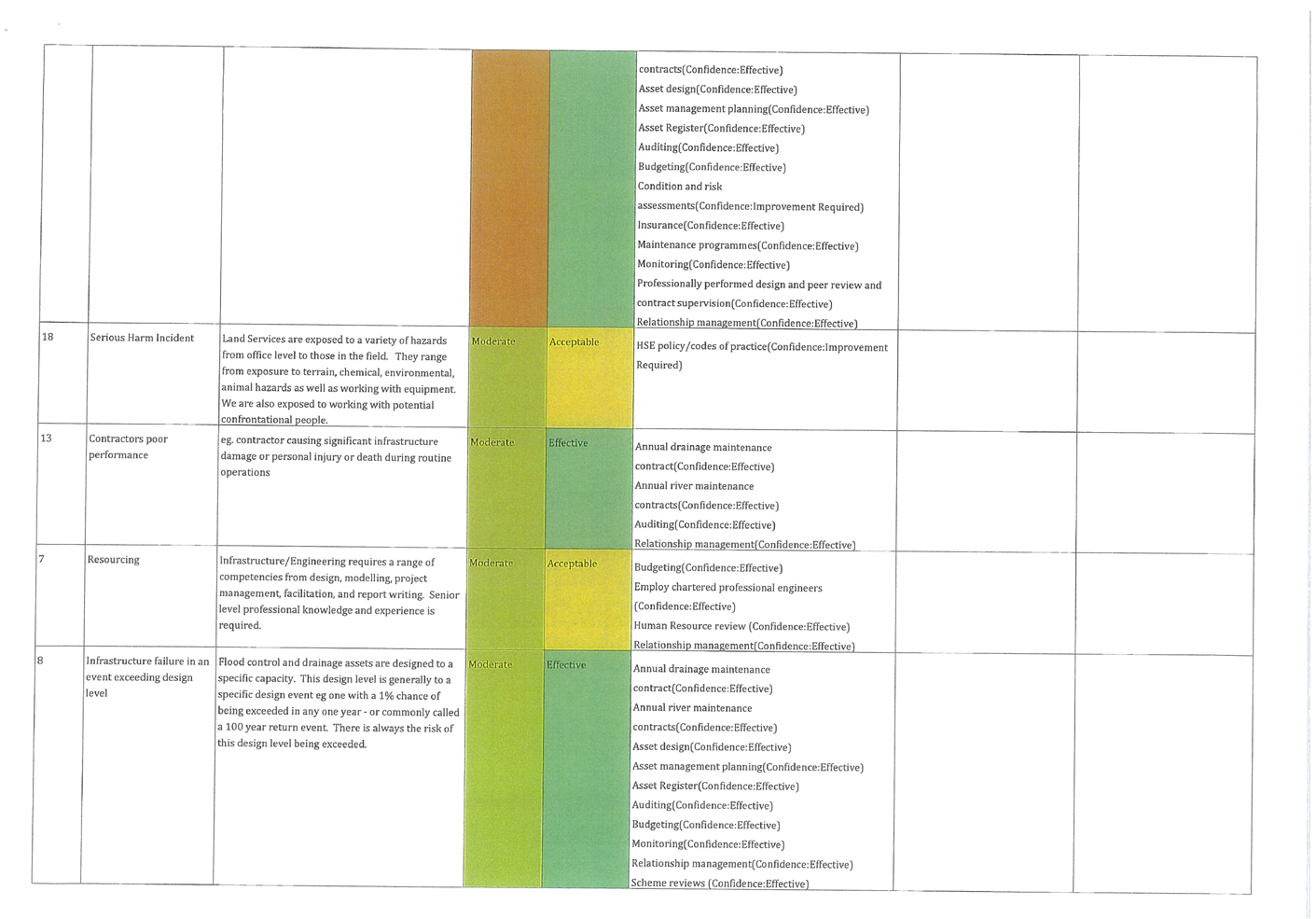

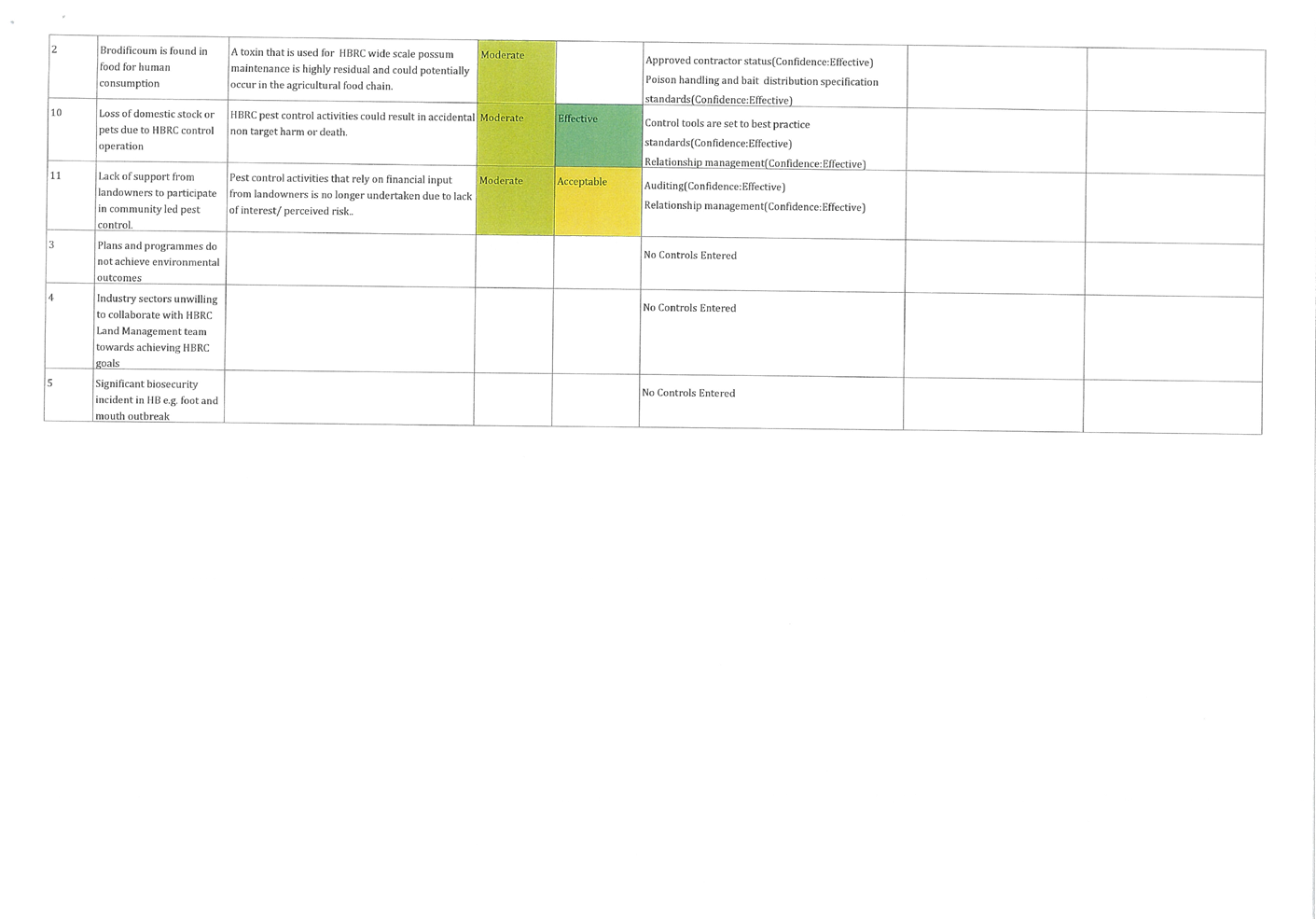

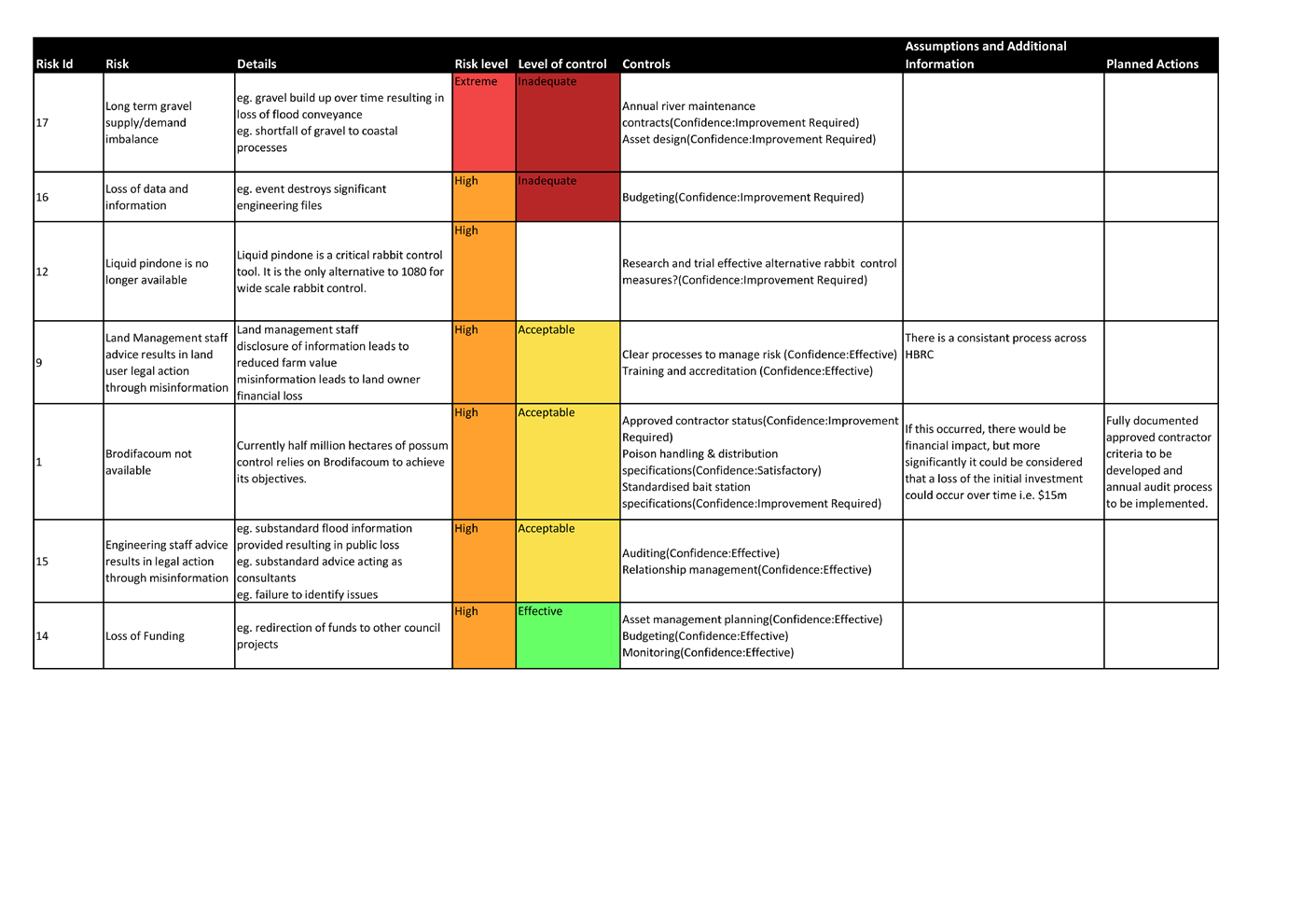

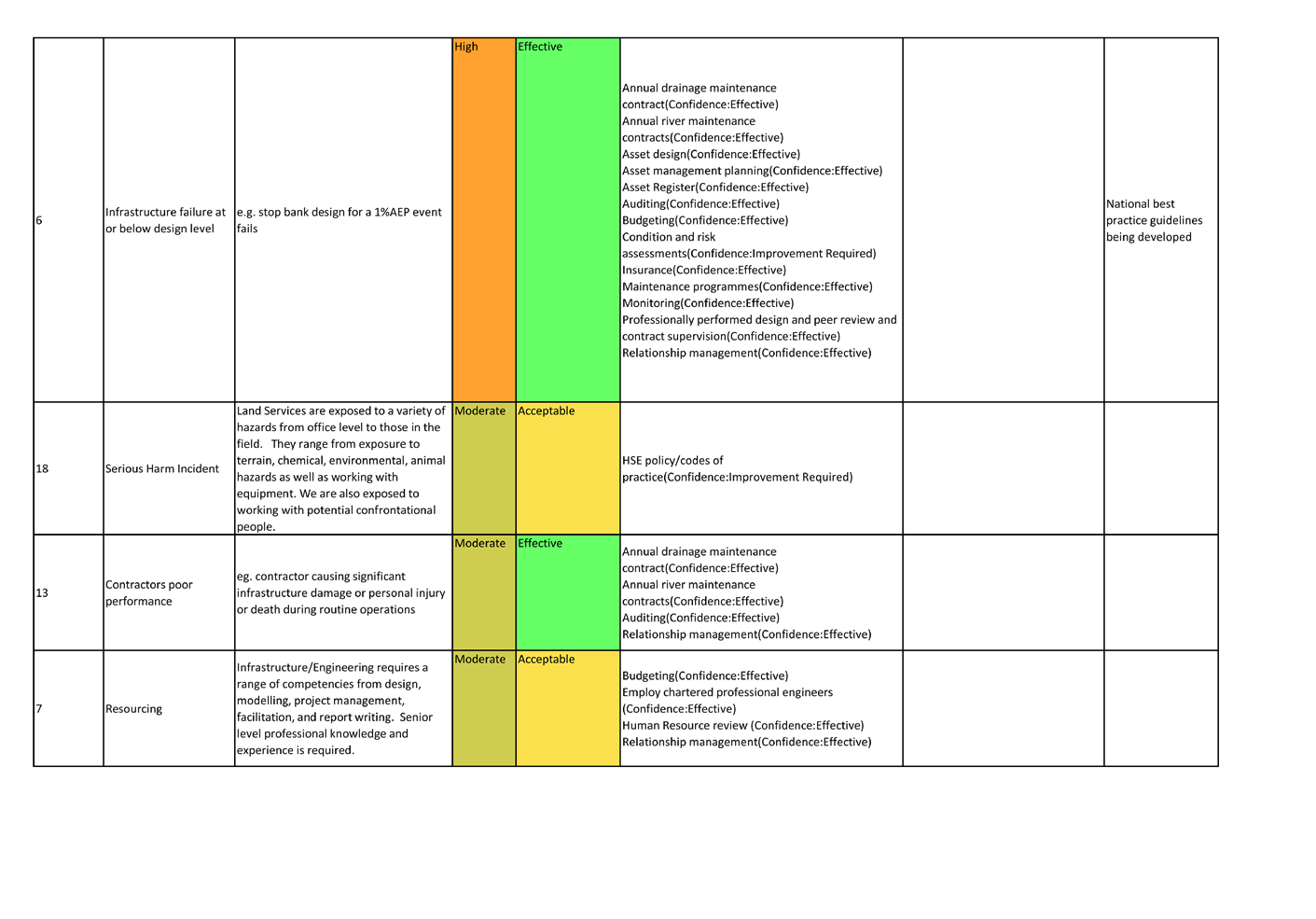

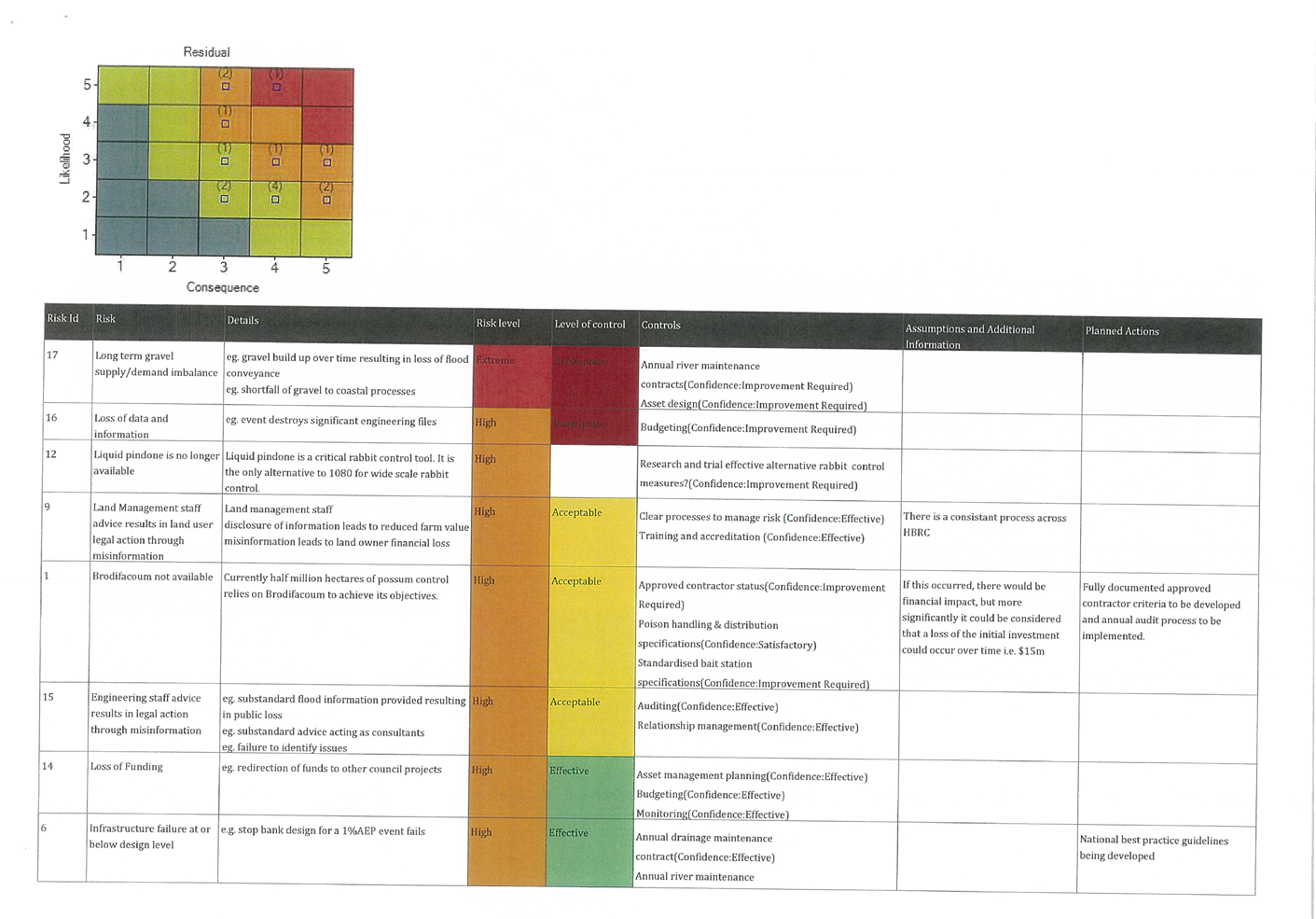

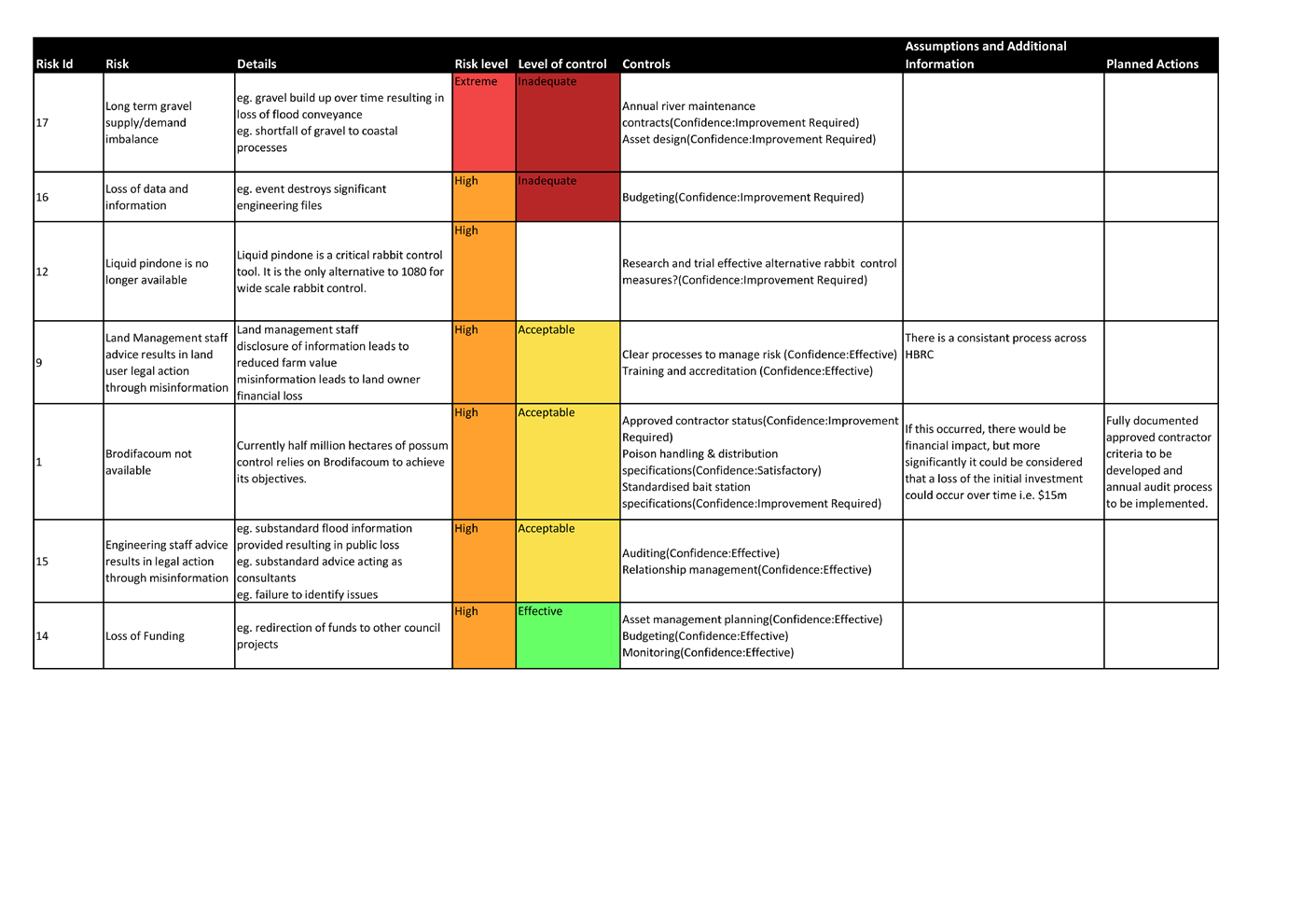

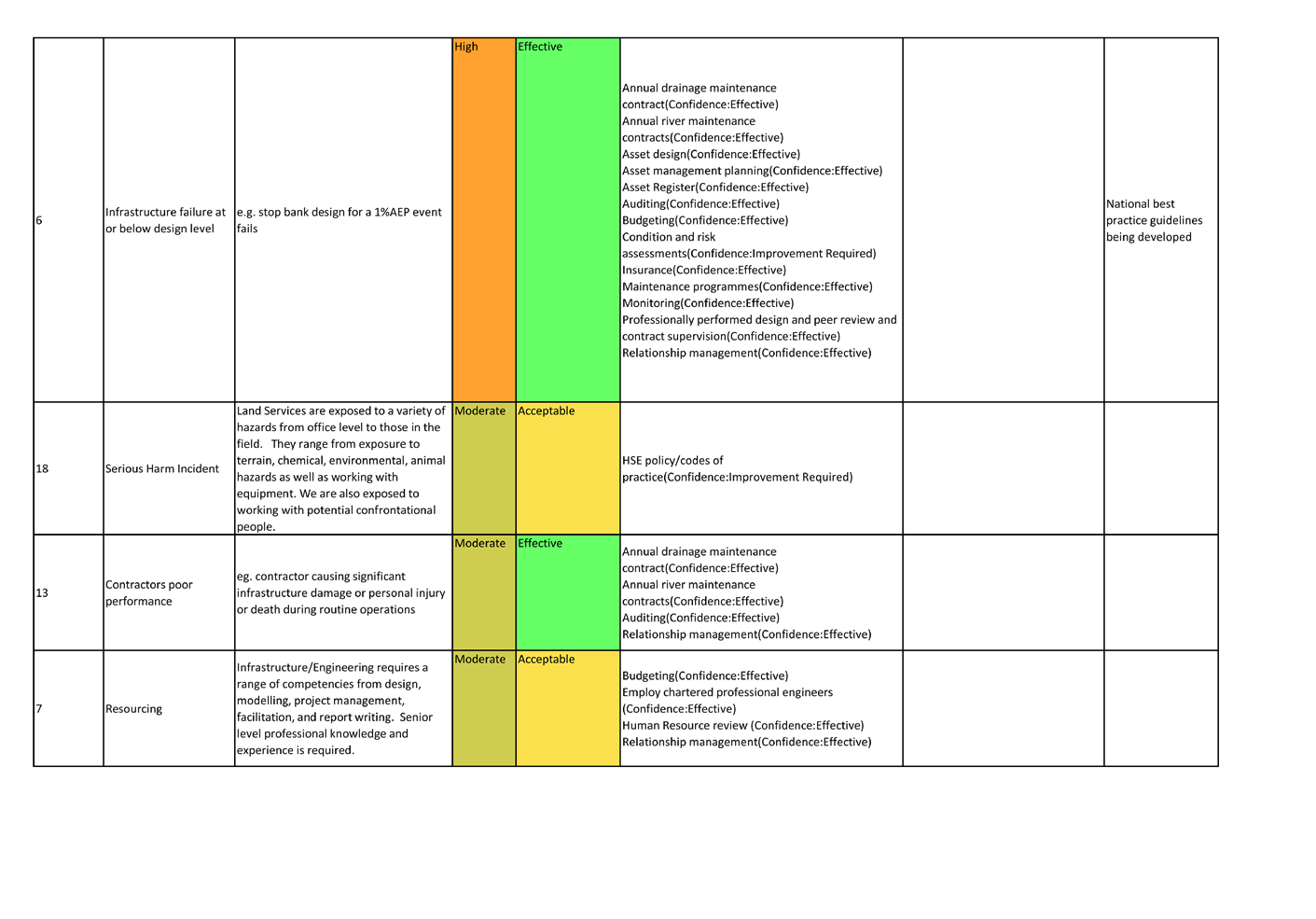

Subject: HBRC Risk Assessment

and Management

Reason for Report

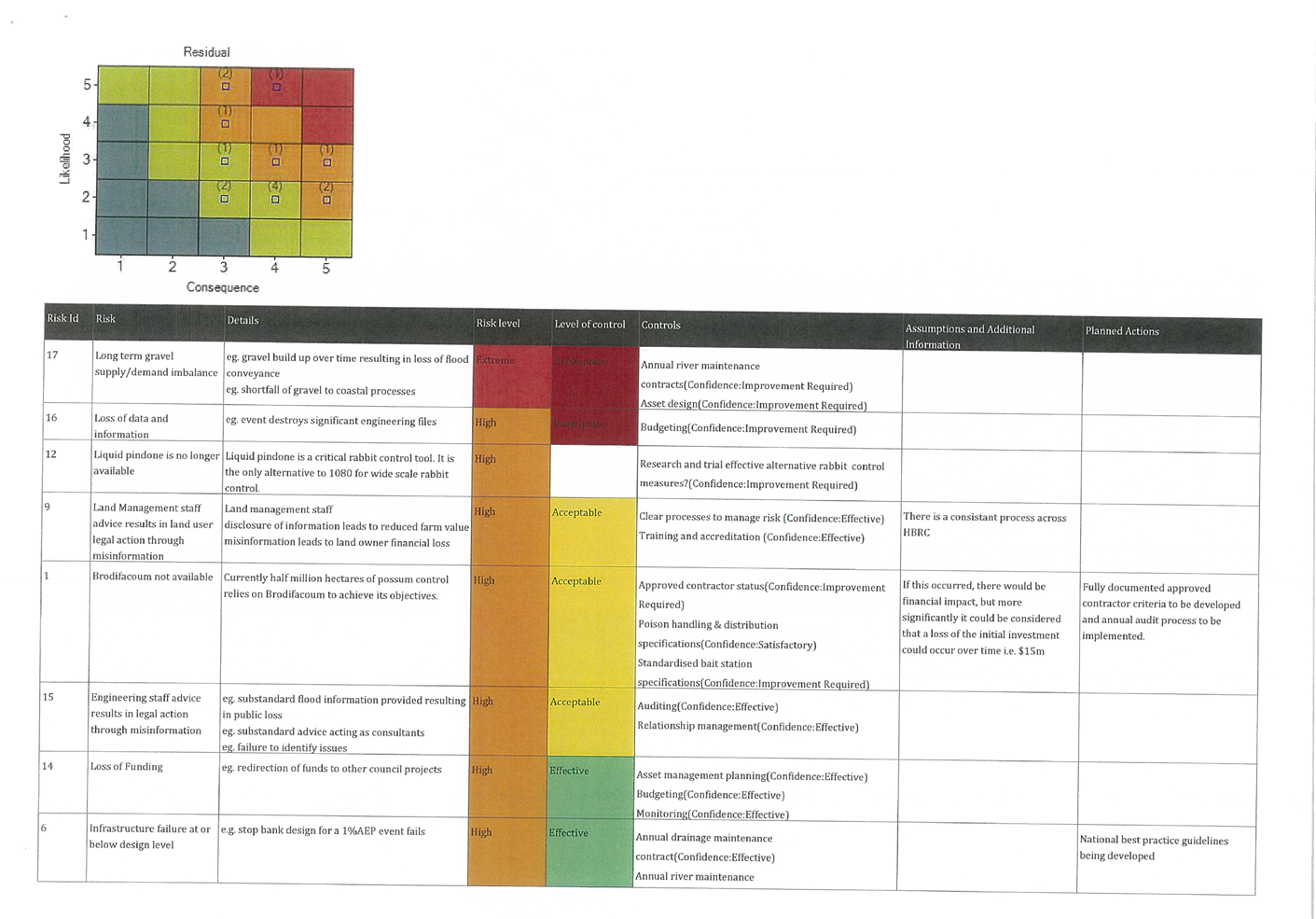

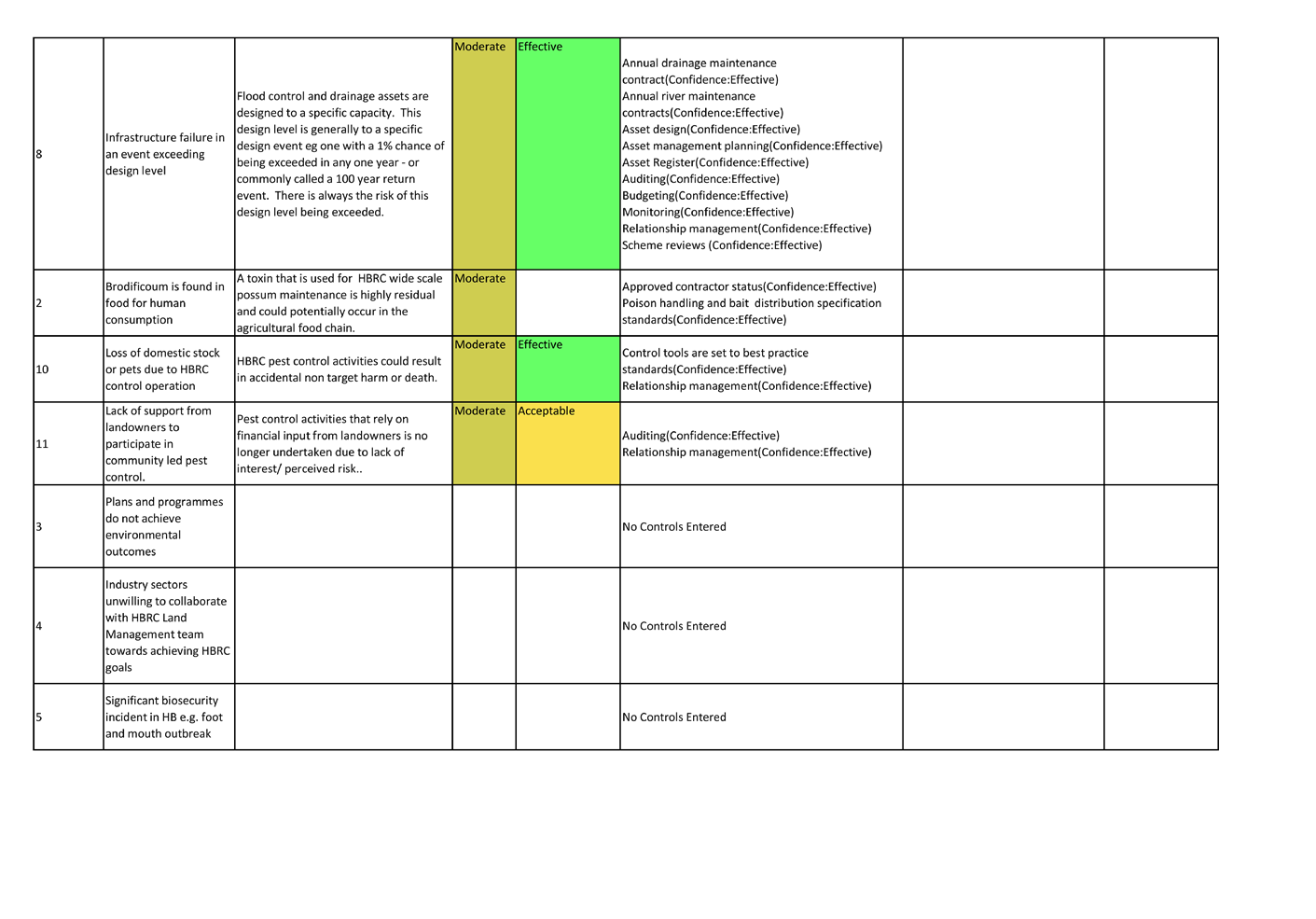

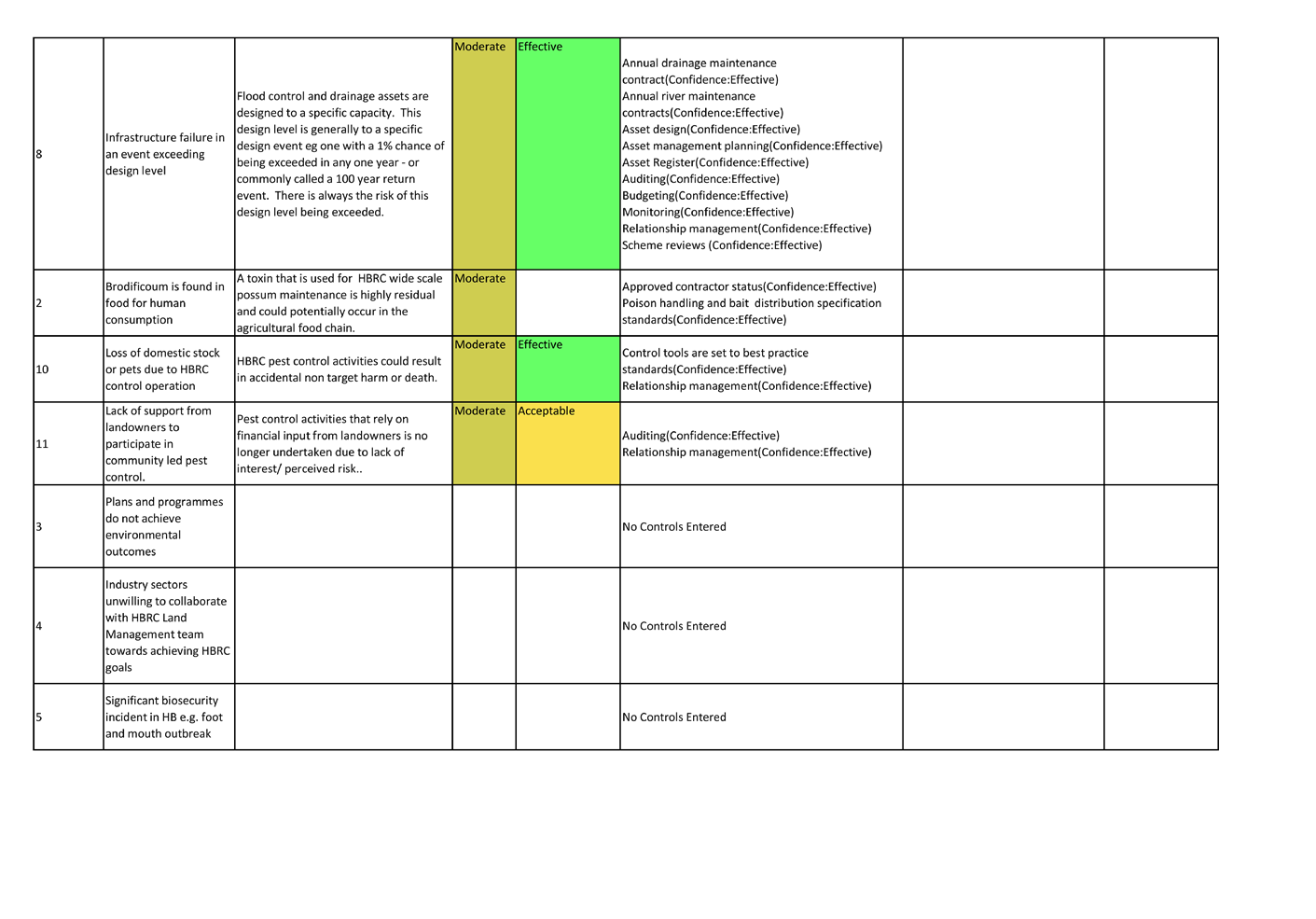

1. Staff have

developed a draft Audit and Risk Management Policy and Framework for the

organisation.

2. The draft is

attached for consideration by the Committee.

3. Also attached

are examples of risk assessments covering risks from two of Council’s

work areas. Risk assessments from all Council groups are in the process

of development. It is proposed that the top 10-20 risks for the

organisation identified from these group assessments are reported to the Audit

and Risk Committee in accordance with this policy, once it is adopted.

4. This paper

seeks comment on the content of this draft Risk Management Policy and

Framework, and the examples provided.

Current Framework

5. On a day-to-day

basis Council staff manage a large number of risks. Staff experience,

qualifications and professional judgement are critical to the mitigation of

many routine operational risks. The draft Policy and Framework is

designed to provide Council, as the governance body for the organisation, an

awareness of the major risks to which the organisation is exposed, and the

steps in place to manage or mitigate those risks.

6. Risk management

is an iterative process consisting of well-defined steps which, taken in

sequence, support better decision making by contributing a greater insight into

risks and their impacts. It requires a systematic, logical method of

identifying, analysing, evaluating, treating, monitoring and communicating risks

associated with any activity, function or process, and will enable Council to

better predict and respond to organisational risks.

7. Risk management

is recognised as an integral part of good management practice. To be most

effective risk management should be part of an organisation’s

culture. It is being integrated into HBRC’s philosophy, practices

and business plans.

8. HBRC’s

business landscape will continue to change and evolve. There is a need

for the organisation to continuously review and improve the ability to identify

and manage its risks. This policy and framework, once adopted, will set

the oversight, control and discipline to drive continuous improvement of

Council’s organisational risk management in a changing operating environment.

9. The framework

is based on three key areas where risk could impact on HBRC:

9.1. Financial

impact.

9.2. Reputation of

Council with its stakeholders.

9.3. Operational

capability.

10. All risks that have

potential impact on Council will be assessed by each Group Manager for their

respective Groups using this framework. A sample of the output from these

assessments is attached for Committee information.

11. The sample reports

highlight

11.1. The risks as they have

been assessed by staff,

11.2. The controls in place to

manage that risk and an assessment of the effectiveness of those controls.

12. It is important to

recognise that the failure of a mitigation method (risk control) may result in

the risk being greater than assessed. The management of risk control

mechanisms are essential to ensure that they continue to mitigate that risk.

13. The framework includes

clear parameters under which the risk likelihood and consequences have been

established. It is expected that these will be reviewed from time to time

as part of the ongoing improvement of Council’s risk management

processes.

14. If risk

management is to be effective, risks must be reviewed regularly. The

draft policy and framework provides for regular review and reporting.

15. Staff propose

to review the draft Policy and Framework based on the feedback received from

the Committee and to present it for adoption at the next meeting of the

Committee programmed for 22 September 2015.

Decision

Making Process

16. Council

is required to make a decision in accordance with the requirements of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained in Part 6 Sub Part 1 of the Act in relation to this item and have

concluded the following:

16.1. The decision

does not significantly alter the service provision or affect a strategic asset.

16.2. The use of

the special consultative procedure is not prescribed by legislation.

16.3. The decision

does not fall within the definition of Council’s policy on significance.

16.4. The decision

is not inconsistent with an existing policy or plan.

16.5. Given the

nature and significance of the issue to be considered and decided, and also the

persons likely to be affected by, or have an interest in the decisions made,

Council can exercise its discretion and make a decision without consulting

directly with the community or others having an interest in the

decision.

|

Recommendations

That the

Finance, Audit and Risk Sub-committee:

1. Receives the HBRC Risk Assessment and Management report

2. Provides comment on the draft Audit and Risk Management Policy and

Framework.

|

|

Mike Adye

Group Manager Asset Management

|

Liz Lambert

Chief Executive

|

Attachment/s

|

1

|

Draft Risk

Management Policy and Framework

|

|

|

|

2

|

Risk Table

|

|

|

|

3

|

Asset

Management Risk Report

|

|

|

|

4

|

Corporate

Services Risk Report

|

|

|

|

Draft

Risk Management Policy and Framework

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

AUDIT & RISK

MANAGEMENT

Draft POLICY AND

FRAMEWORK

June 2015

Definitions:

Council: means

the nine elected members as a governing body of Hawke’s Bay Regional

Council

HBRC: means

Hawke’s Bay Regional Council

Audit and Risk Committee means the Finance Audit and Risk Committee of Hawke’s

Bay Regional Council

Purpose of

this document;

1. This document :

a. Sets out HBRC’s risk management

policy and its approach to managing risk.

b. Sets out systems and processes HBRC

has in place to ensure the prudent stewardship and the efficient and effective

use of its resources.

c. Documents the roles and

responsibilities of the Council, the Audit and Risk Management Committee, the

Chief Executive and executive management team, and all staff.

d. Identifies reporting procedures.

2. The policy forms part of HBRC’s

audit and risk management and corporate governance arrangements.

Approach to

risk management and audit

1. The following key principles outline

HBRC’s approach to risk management and audit:

· HBRC’s risk is to be managed, monitored and reported, in

accordance with this policy adopted by Council.

· HBRC is a public organisation funded largely by money sourced from

the Hawke’s Bay community. It must use that money wisely and carry

out its duties cost effectively. HBRC must demonstrate it is a prudent

manager and user of public funds.

· The Chief Executive has responsibility for overseeing risk,

financial and operational management within the whole of HBRC and will report

to the Risk and Audit Committee on these issues in accordance with this policy.

· The Chief Executive and Executive management team supports, advises

and implements policies approved by Council, and is responsible for the

management of operational risks, and for reporting to Council all new and

emerging risks with the potential to significantly impact on Council.

· HBRC is conservative and prudent in its recognition and disclosure

of the financial and non-financial implications of risks

· Management staff are responsible for encouraging good risk

management practice within their groups and teams

Role of

Council

2. Council as the governance body for

HBRC has a fundamental governance role to play in financial and operational

management and the management of risk. Its role is to:

a. Set the tone and influence the culture

of risk management within HBRC. This includes:

· Understanding that there is risk in the activities undertaken to

achieve or support the desired organisational outcomes.

· Providing clarity on the level of risk that HBRC should be exposed

to in undertaking specific activities.

· Setting the standards and expectations of staff with respect to

conduct and probity.

b. Adopt an audit and risk management

policy and framework, monitor its effectiveness and review and revise this to

ensure it remains fit for purpose.

c. Appoint the Audit and Risk Committee and

continue to monitor its effectiveness.

d. Consider and monitor risks associated

with achievement of HBRC strategic outcomes.

e. Approve major decisions that may

affect HBRC’s risk profile or exposure.

Role of the

Finance Audit and Risk Management Committee

3. The Audit and Risk Management

Committee is set out in the Terms of Reference adopted by Council at its

meeting on 25 February 2015.

Role of the

Chief Executive and Executive Management Team

4. Key roles of the Chief Executive and

the executive management team relevant to Audit and Risk policy are to:

a. Implement policies on audit and risk

management and report on compliance and performance.

b. Identify, evaluate and manage

(excluding governance risks) the risks faced by the Organisation.

c. Provide adequate information in a

timely manner to Council and its committees on the status of significant risks

to which the Organisation is exposed and the controls to manage those risks.

Risk

management control system

5. The risk management control system

encompasses a number of elements that together facilitate an effective and

efficient risk assessment, enabling HBRC to consider a variety of strategic,

operational, financial, and commercial risks. These elements include:

a. Policies and procedures

Many of the organisational risks are managed through policies and

plans adopted by the Council. These include Regional Plans developed

according to relevant legislation, their associated implementation plans, and

policies or protocols specific to a particular issue. The policies

adopted by Council are implemented and communicated through the Chief Executive

to staff. Written procedures support the policies were appropriate.

b. Reporting

Comprehensive reporting is designed to communicate the monitoring of

key risks and their controls. Decisions to rectify problems are generally

made by staff, but may be at the direction of Council where a significant

potential risk is identified.

c. Annual and 10 year planning and

budgeting.

The annual and 10 year planning and budgeting processes are used to

set objectives, a performance framework through which to monitor progress

towards achieving those objectives, develop and communicate work programmes,

and allocate resources. A number of the work programmes are designed

specifically to mitigate strategic risks. Progress towards meeting annual

and 10 year plan objectives is monitored regularly.

d. Risk management framework

This framework helps to facilitate the identification, assessment

and ongoing monitoring of risks to which HBRC is exposed. The framework

is formally reviewed in accordance with the timelines set out in Table 1 below,

with all existing risks reviewed and new and emerging risks added.

e. Risk review programme.

The risk review programme is an important element of the risk

management process. Apart from its normal programme of work, each member

of the executive management team is responsible for the review of the

effectiveness of the risk management framework within HBRC as set out in Table

1 below.

f. Internal audit.

An internal review of risks may be requested by Council or

commissioned by the Chief Executive from time to time as they deem

appropriate. Such an external review may cover the risk framework and all

of the risks to which HBRC is exposed, or may be restricted to specific risks

or aspects of risk. This internal audit function may be contracted to an

external audit provider.

g Audit of HBRC’s Long Term Plans and

Annual Plans

These audits are carried out by Audit NZ on behalf of the Controller

and Auditor General.

Review of

effectiveness

6. The Chief Executive is responsible for

reviewing the effectiveness of HBRC’s risk controls. The frequency

and scope of such a review shall be dictated by the Audit and Risk Committee. The

review may be required for all or part of HBRC’s activities. The

outcome of such a review will be reported to the Audit and Risk Committee.

7. For each risk identified, the Chief

Executive will:

· Review the previous risk review and examine HBRC’s record on

risk assessment and control.

· Consider HBRC’s future risk profile and consider if current

risk control arrangements are being effectively implemented.

8. In making his decision the Chief

Executive will consider the following aspects:

a. Control environment:

· HBRC’s objectives and its financial and non-financial targets

· Organisational structure and caliber of the senior management team

· Culture, approach, and resources with respect to the management of

risk

· Delegation of authority

· Reporting to Council

b. On-going identification and evaluation

of risks:

· Timely identification and assessment of risks

· Prioritisation of risks and the allocation of resources to address

areas of high exposure.

c. Information and communication:

· Quality and timeliness of information on risks

· Time it takes for control breakdowns to be recognised or new risks

to be identified.

d. Monitoring and corrective action:

· Ability of the organisation to learn from its experiences

· Commitment and speed with which corrective actions are implemented.

|

Draft

Risk Management Policy and Framework

|

Attachment 1

|

TABLE

1

RISK MANAGEMENT FRAMEWORK

|

Responsible

Group

|

Decisions

areas

|

Frequency

of review/reporting

|

|

Council (through Audit and Risk

Committee)

|

· Organisation risk profile

· Top 10 residual risks

· Top 10 controls

· Significant new or emerging risks

· Governance risks

|

Annually

Annually

Annually

As they arise

Annually

|

|

|

|

|

|

Chief Executive (together with Exec

Managers)

|

· Review and monitoring Organisational risks including controls

· New and emerging risks reporting to Council

|

6 monthly

As they arise

|

|

|

|

|

|

Group Managers (together with 3rd tier

managers)

|

· Review and monitoring of:

- Risks associated

with Group’s risks including controls

- New and emerging

risks within group

|

6 monthly

As they arise

|

|

|

|

|

|

Staff

|

· Effective management of operational risks through implementation

of controls

· Reporting new or emerging risks as they arise

|

Ongoing

As they arise

|

|

Draft

Risk Management Policy and Framework

|

Attachment 1

|

Likelihood

Table

Name

|

Full

Description

|

Value

|

|

Almost Certain

|

Occurrence of

the event within this 10-yearly LTCCP may be credibly regarded as a

‘real possibility’ i.e. the probability of occurrence is greater

than non-occurrence. Documented and frequent incidents. Is likely

to occur more than once in this 10-year LTCCP period.

|

99

|

|

Likely

|

Occurrence of

the event within this 10-yearly LTCCP may be credibly regarded as a

‘real possibility’ i.e. the probability of occurrence is similar

to non-occurrence. Documented and regular incidents. Is likely to

occur once in this 10-year LTCCP period.

|

65

|

|

Unlikely

|

Occurrence of

the event within this 10-yearly LTCCP would be considered as having some

potential to occur – ie, a reasonable probability of occurrence over

time, but less than the probability of non- occurrence. Documented but

infrequent incidents. Has less than 50% chance of occurrence in this

10-year LTCCP period.

|

25

|

|

Highly Unlikely

|

Whilst possible,

occurrence of the event within this 10-yearly LTCCP would be regarded by most

people as unlikely i.e. the probability of non-occurrence is somewhat larger

than occurrence. Documented but few incidents. Has less than 10%

chance of occurrence in this 10-year LTCCP period.

|

12

|

|

Rare

|

It is not

expected that the event would occur within this 10-yearly LTCCP. Occurrence

of the event would probably be regarded as unusual - (the probability of

occurrence is quite small). Has less than 1% chance of occurrence in

this 10 year LTCCP period.

|

3

|

Consequence Tables

|

|

Financial

|

|

|

|

Name

|

Full

Description

|

|

|

Level 1

|

Value of investment(s) decreases by 30%.Loss of

cash flow/income or increase in unplanned expenditure of $5m over

Note: Language to be appropriate for all sections

of council

|

|

|

Level 2

|

Value of investment(s) decreases by 20%.Loss of

cash flow/income or increase in unplanned expenditure of $3m over

|

|

|

Level 3

|

Value of investment(s) decreases by 10%.Loss of

cash flow/income or increase in unplanned expenditure of $2m over

|

|

|

Level 4

|

Value of investment(s) decreases by 5%.Loss of

cash flow/income or increase in unplanned expenditure of $1m over

|

|

|

Level 5

|

Value of investment(s) decreases by 3%.Loss of

cash flow/income or increase in unplanned expenditure of $0.5m over

|

|

|

No Financial

Impact

|

No measurable financial impact

|

|

|

|

|

Stakeholders/Reputation

|

|

|

Name

|

Full

Description

|

|

|

Level 1

|

Extreme

dissatisfaction and loss of confidence. Central government

investigation and/or statutory management installed. Regulatory action

resulting in major prosecution and conviction of council (eg - fine of

>$100k).Note: ‘Stakeholder’ means clients, public, industry

groups (such as forestry/agriculture), local government bodies, lobby groups,

or Iwi.

|

|

|

Level 2

|

Major loss of

stakeholder confidence. Extensive stakeholder dissatisfaction expressed

through media resulting in a long period of negative coverage (>2

months). Widespread, unified, coordinated revolt by consent holders

and/or ratepayers against fees/conditions. Regulatory action resulting

in moderate prosecution and conviction of council (eg - $25-$100k)

|

|

|

Level 3

|

2-3 stakeholders

sectors dissatisfaction expressed through media resulting in a long period of

negative coverage (>2 months). Central Government impose statutory

sanctions. Regulatory action resulting in prosecution but no

conviction.

|

|

|

Level 4

|

Single

stakeholder sector express dissatisfaction through media for up to one

month. Central Government – CEO MFE directed by Minister to make

enquiries. Individual(s) express dissatisfaction through media or directly.

|

|

|

Level 5

|

Individual(s)

express dissatisfaction through media or directly. Individual(s) refuse

to pay fees/rates as a stand against council activities. No significant

impact on stakeholders or image

|

|

|

No Impact

|

No significant

impact on stakeholders or image

|

|

|

|

|

|

|

|

Operational

Capability

|

|

Name

|

Full

Description

|

|

|

Level 1

|

Event results in

management diversion from strategic objectives for a period of > 2

months. Delivery of LTCCP outcomes across work area significantly

affected for greater than six months. Critically detrimental effects on

stakeholders. Long term loss of capability (>2 months).Event results

in management diversion from strategic objectives for a period of <2

months.

|

|

|

Level 2

|

Event results in

management diversion from strategic objectives for a period of <2

months. Delivery of LTCCP outcomes across work area significantly

affected for up to six months. Moderate detrimental effects on

stakeholders. Event results in loss of operational capability for up to

2 months. Event results in management diversion from strategic

objectives for a period of a few days.

|

|

|

Level 3

|

Event results in

management diversion from strategic objectives for a period of a few

days. Delivery of LTCCP outcomes across work area significantly

affected for up to one month. Minor detrimental effects on

stakeholders. Event affects limited efficiency or effectiveness of

service. Managed internally.

|

|

|

Level 4

|

Event affects

limited efficiency or effectiveness of service. Managed

internally. Moderate staff morale problems resulting in some staff

resignations but managed through minor restructuring.

|

|

|

Level 5

|

Event causes

minor disruption felt by limited small group of stakeholders. Minor

staff morale impact resulting in minor dissention but managed over a short

period of time.

|

|

|

No impact

|

No impact on

operational capability

|

|

|

Asset

Management Risk Report

|

Attachment 3

|

|

Asset

Management Risk Report

|

Attachment 3

|

|

Asset

Management Risk Report

|

Attachment 3

|

|

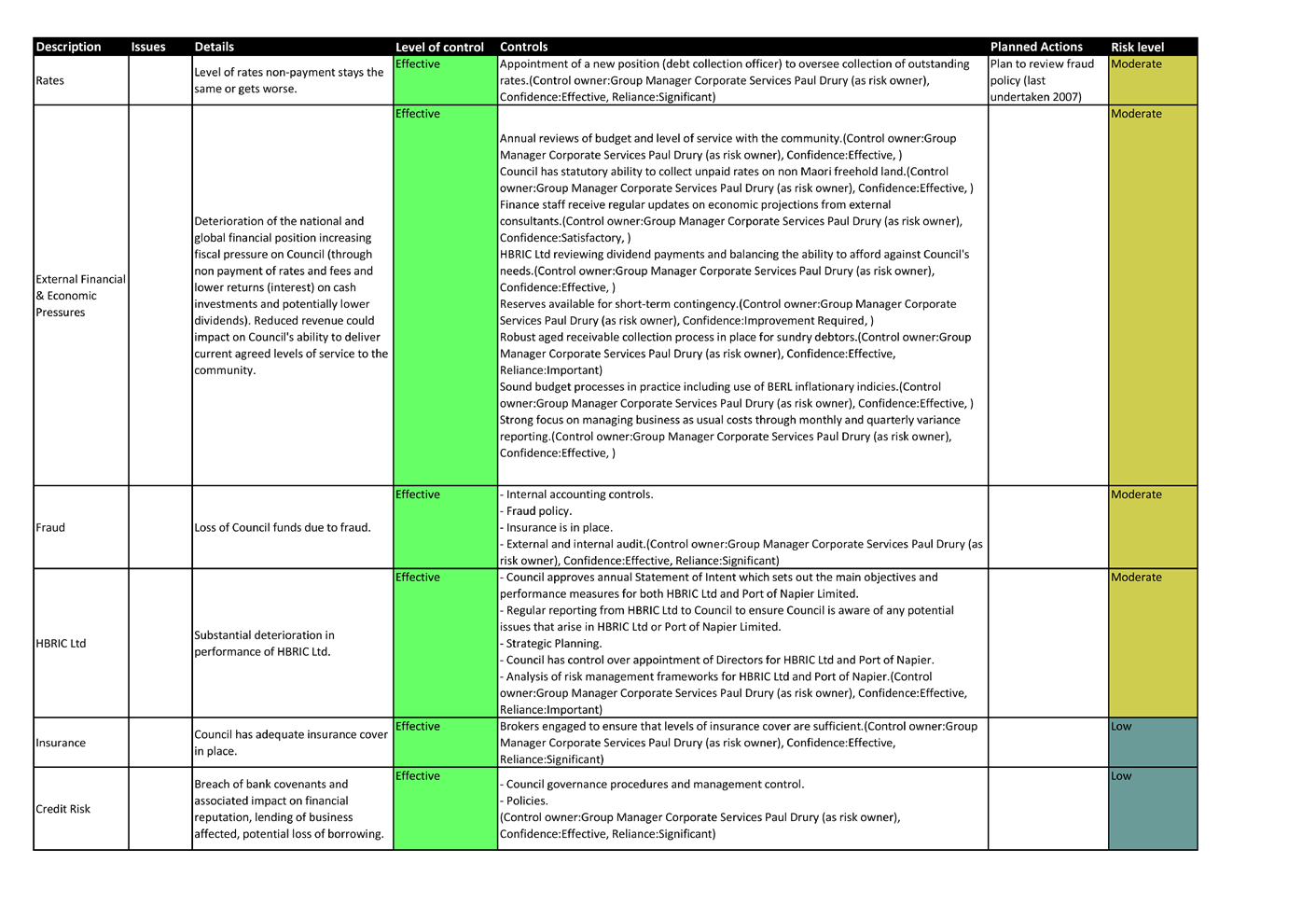

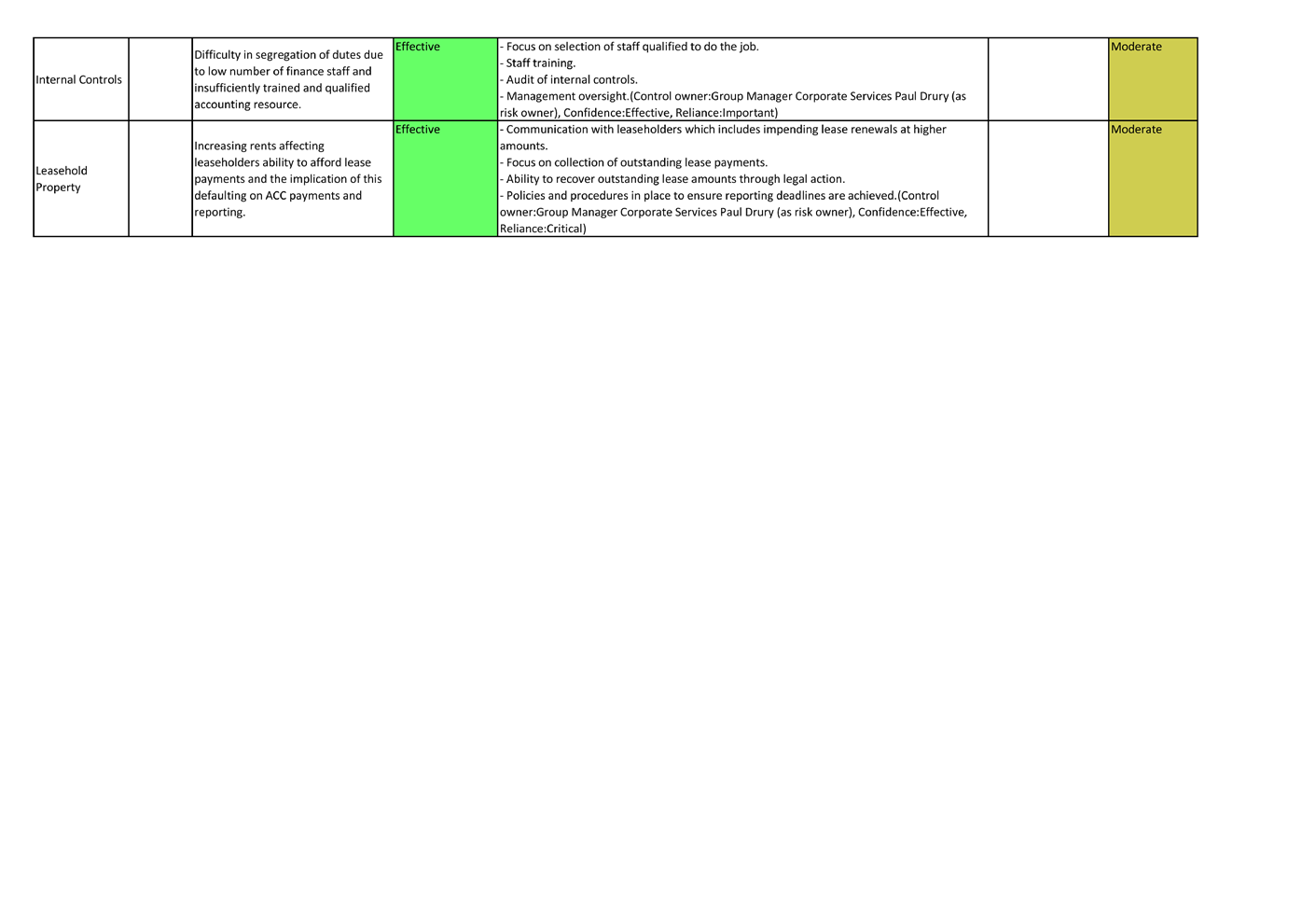

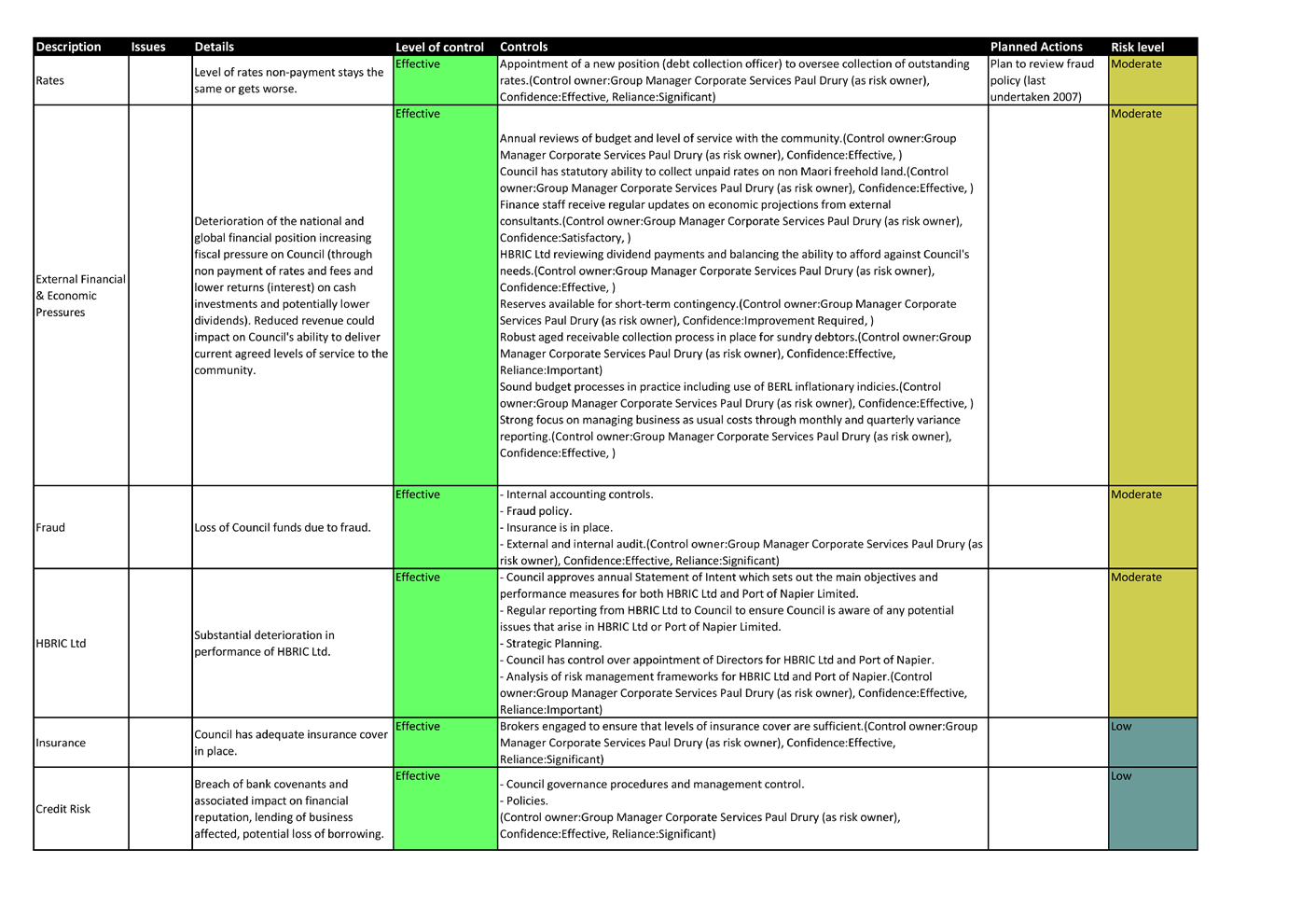

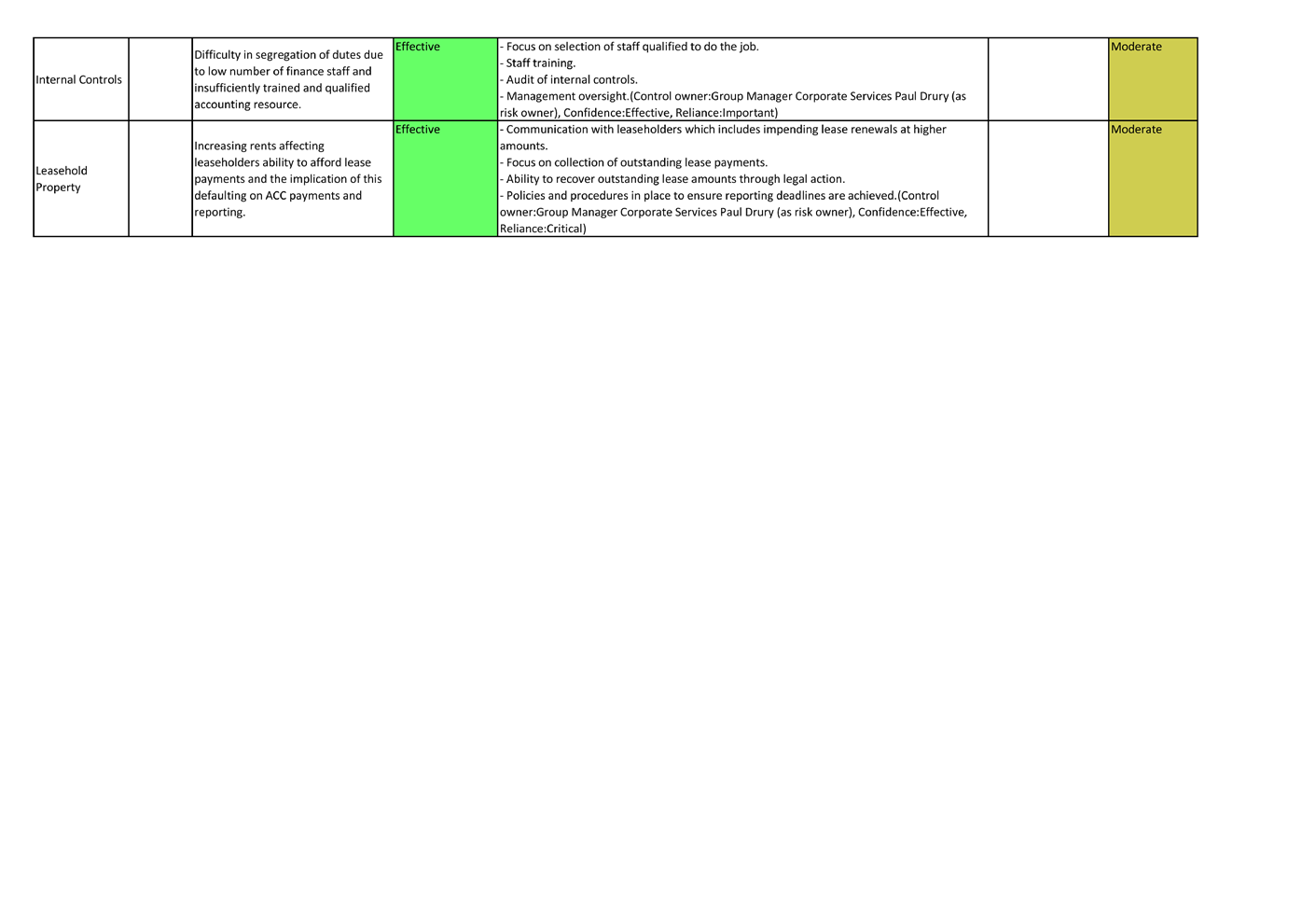

Corporate

Services Risk Report

|

Attachment 4

|

|

Corporate

Services Risk Report

|

Attachment 4

|

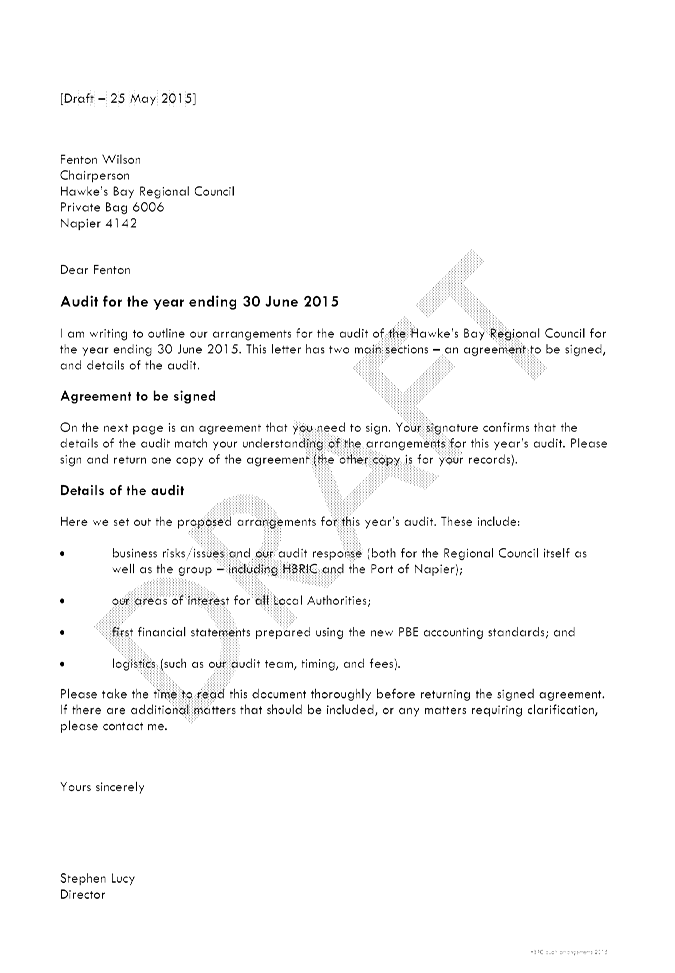

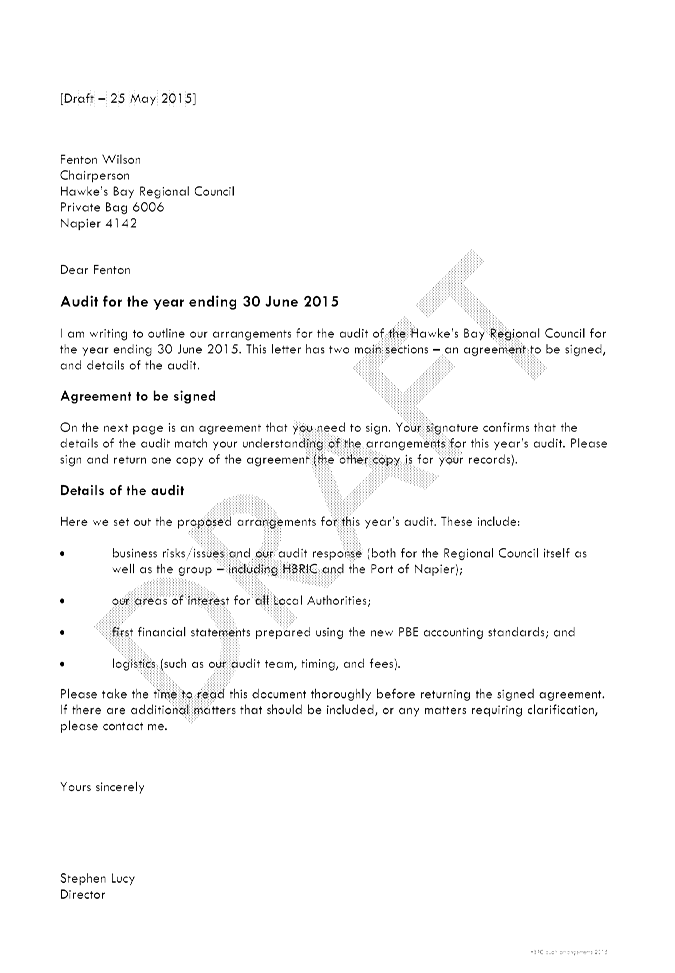

HAWKE’S BAY REGIONAL

COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 03 June 2015

Subject: External Audit

Reason for Report

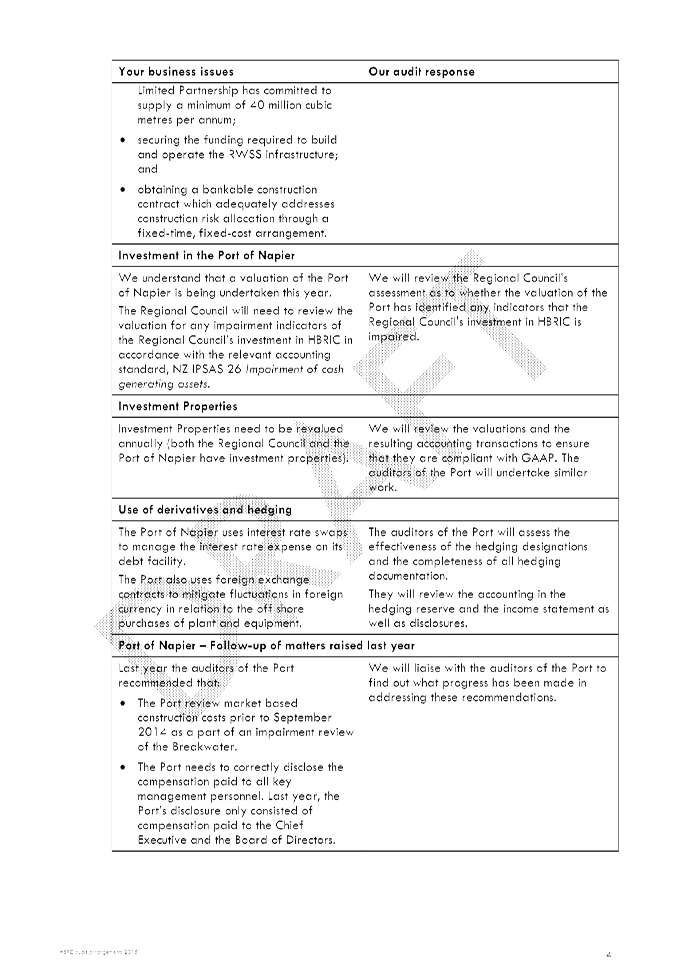

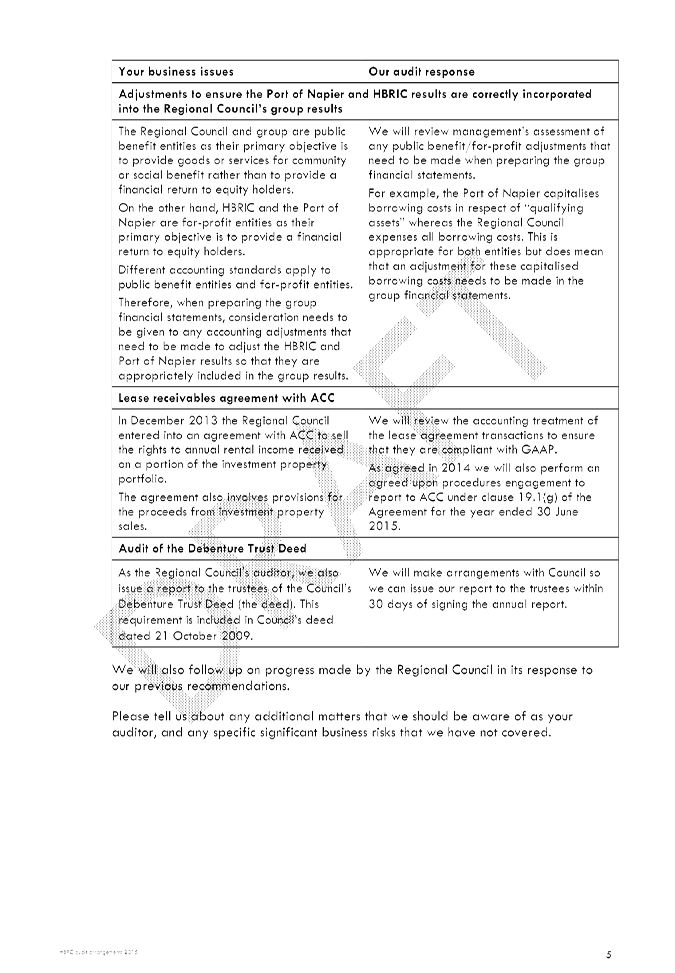

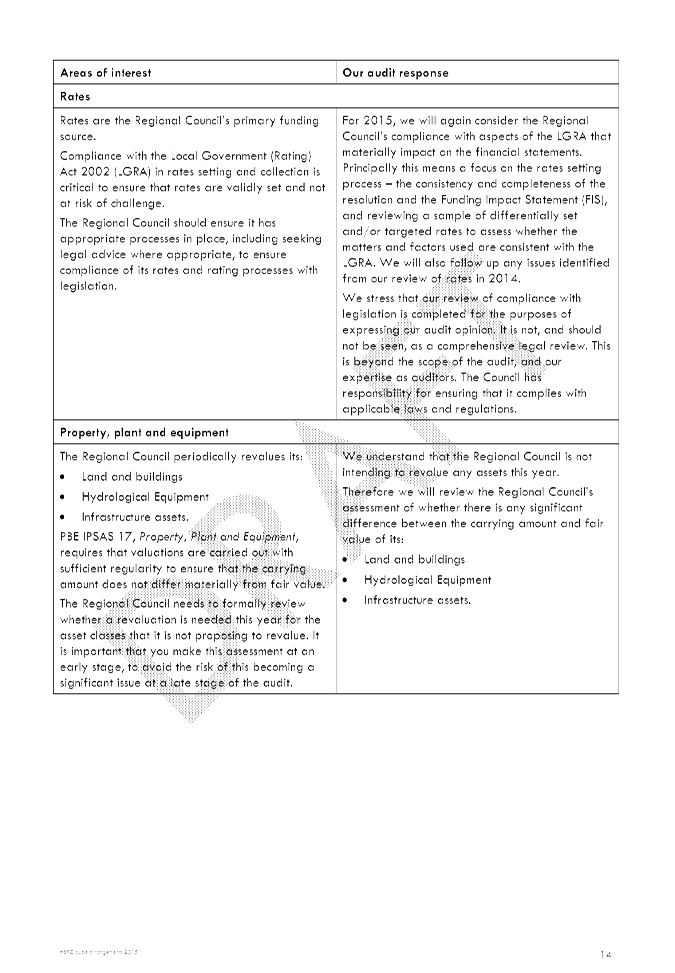

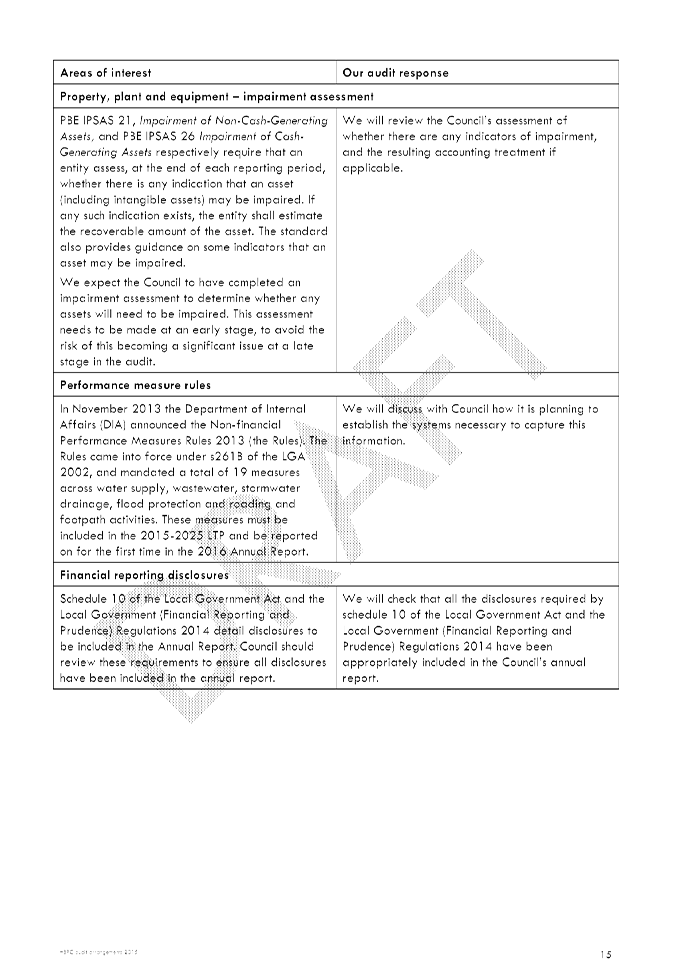

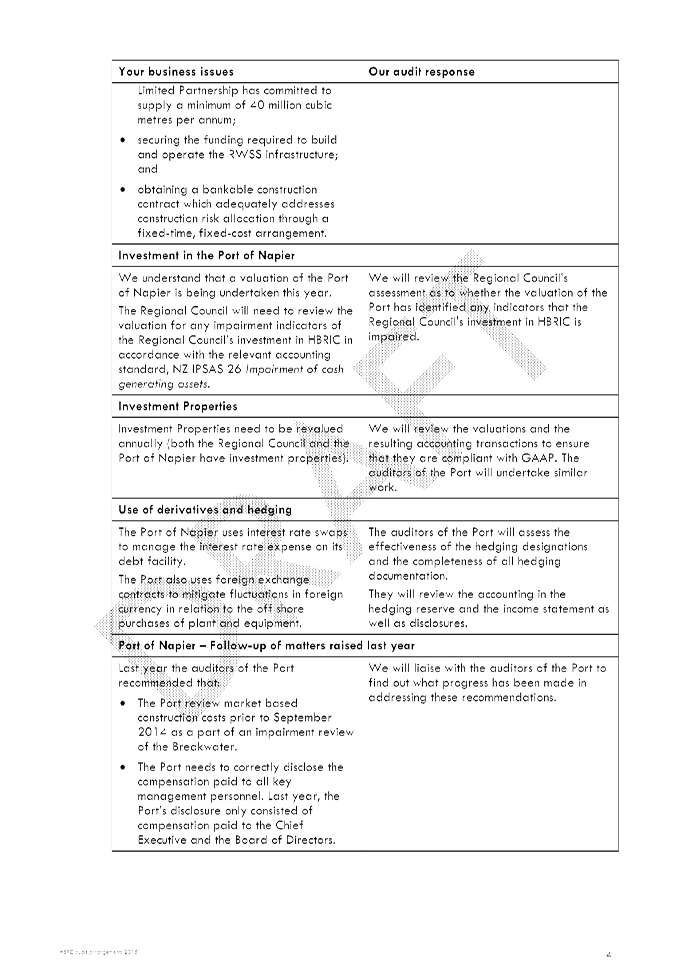

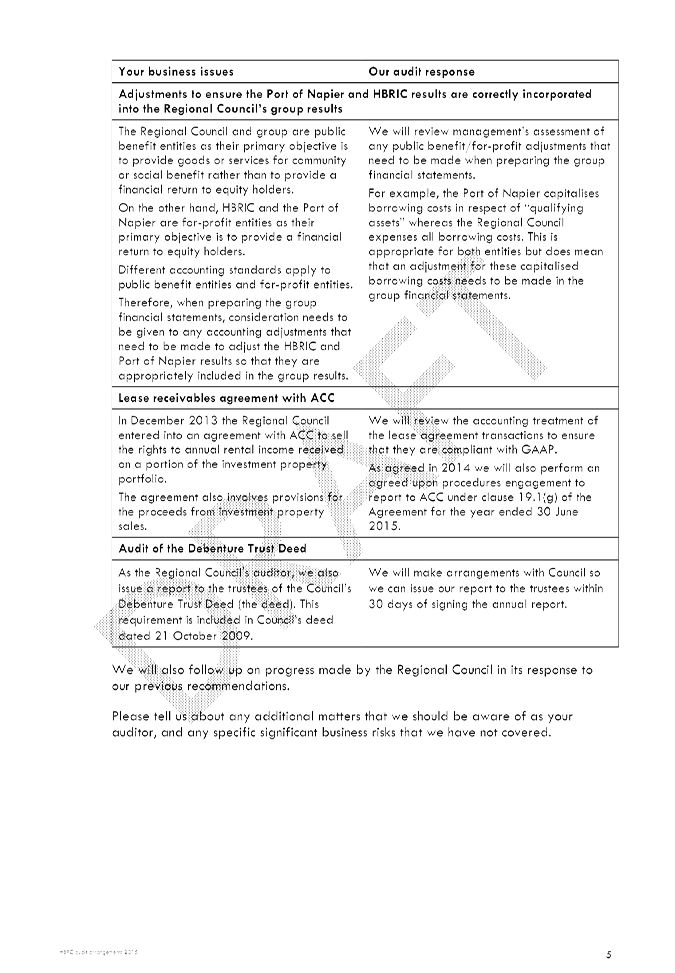

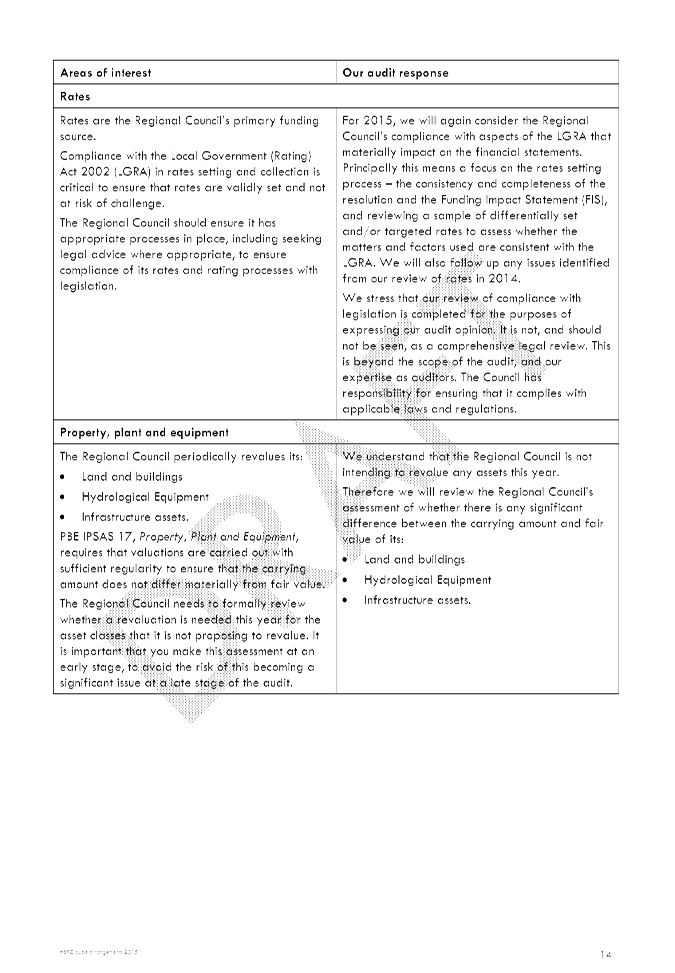

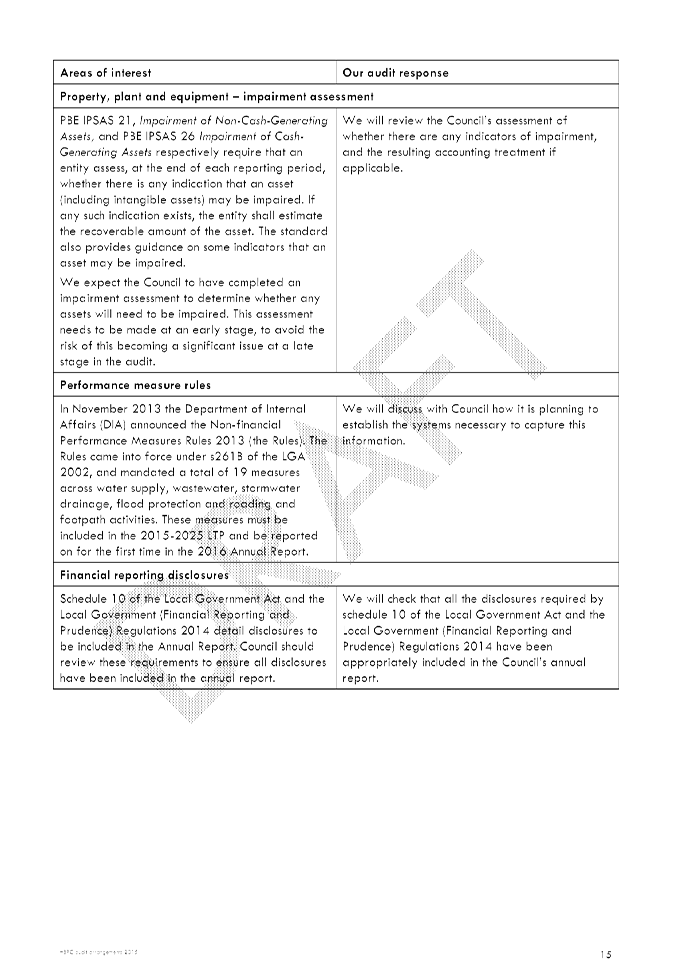

1. To cover the

draft arrangements letter for the external audit to be carried out by Audit NZ

on Council’s financial statements for the year ending 30 June 2015.

2. Included in

this sub-committee’s delegated terms of Reference is the responsibility

to confirm the terms of appointment and engagement of external auditors,

including the nature and scope of the audit, timetable and fees.

Background

3. Section 99 of

the Local Government Act 2002 refers to the Auditor General being responsible

to provide an audit report on Council’s Annual Reports. The Auditor

General has appointed Audit NZ to carry out this audit. Stephen Lucy is

the current Audit Director of Audit NZ who is responsible for this audit.

Stephen will be presenting the “draft arrangements letter” covering

the audit for the financial year to 30 June 2015 to Councillors at this

meeting, and will also cover off the future relationship between Audit NZ

and this subcommittee. Please refer to Attachment 1 for a copy of

the draft arrangements letter.

Decision Making

Process

4. The Audit of Council’s financial statements is a requirement

under the Local Government Act 2002.

|

Recommendations

1. That the Finance, Audit and Risk Sub-committee approves the draft

arrangements letter for the Audit NZ audit of Council’s financial

statements for year ending 30 June 2015.

|

|

Paul Drury

Group Manager Corporate Services

|

|

Attachment/s

|

1

|

Proposed

Audit Arrangements

|

|

|

|

Proposed

Audit Arrangements

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 03 June 2015

Subject: Work Programme Going

Forward

Reason for Report

1. In order to ensure the sub-committee’s ability to effectively

and efficiently fulfill its role and responsibilities, an overall suggested

work programme for the remainder of 2015 is provided following.

|

22 September

meeting

|

Presentation

of the Quantate model showing major risks to Council and action proposed to

be taken to mitigate against those risks

Insurance

programme (presentation by

Council’s insurance brokers – Jardine, Lloyd Thompson)

Health &

Safety – new legislative requirements and members’

accountability/liability – presentation by Worksafe

|

|

11 November

meeting

|

NZ Audit

report on HBRC 2014-15 Annual Report

Follow-up on

Health & Safety

Operational

review of a selected Council activity, i.e. budget vs actual and performance measures for

selected activity – in line with Committee’s objective to

undertake systematic reviews of Council operational activities

|

Decision Making

Process

2. As this report

is for information only and no decision is to be made, the decision making

provisions of the Local Government Act 2002 do not apply.

|

Recommendation

1. That the Finance, Audit and Risk

Sub-committee receives the “Work Programme Going Forward”

report.

|

|

Paul Drury

Group Manager Corporate Services

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Finance

Audit & Risk Sub-committee

Wednesday 03 June 2015

Subject: Internal Audit

That Council excludes the public

from this section of the meeting, being Agenda Item 9 Internal Audit with the

general subject of the item to be considered while the public is excluded; the

reasons for passing the resolution and the specific grounds under Section 48

(1) of the Local Government Official Information and Meetings Act 1987 for the

passing of this resolution being as follows:

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS

RESOLUTION

|

GROUNDS UNDER SECTION 48(1)

FOR THE PASSING OF THE RESOLUTION

|

|

Internal Audit

|

7(2)(i) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to enable

the local authority holding the information to carry out, without prejudice

or disadvantage, negotiations (including commercial and industrial

negotiations).

|

The Council is specified, in

the First Schedule to this Act, as a body to which the Act applies.

|

|

Paul Drury

Group Manager Corporate Services

|

Liz Lambert

Chief Executive

|