Meeting of the Hawke's Bay Regional Council

Date: Wednesday 25 March 2015

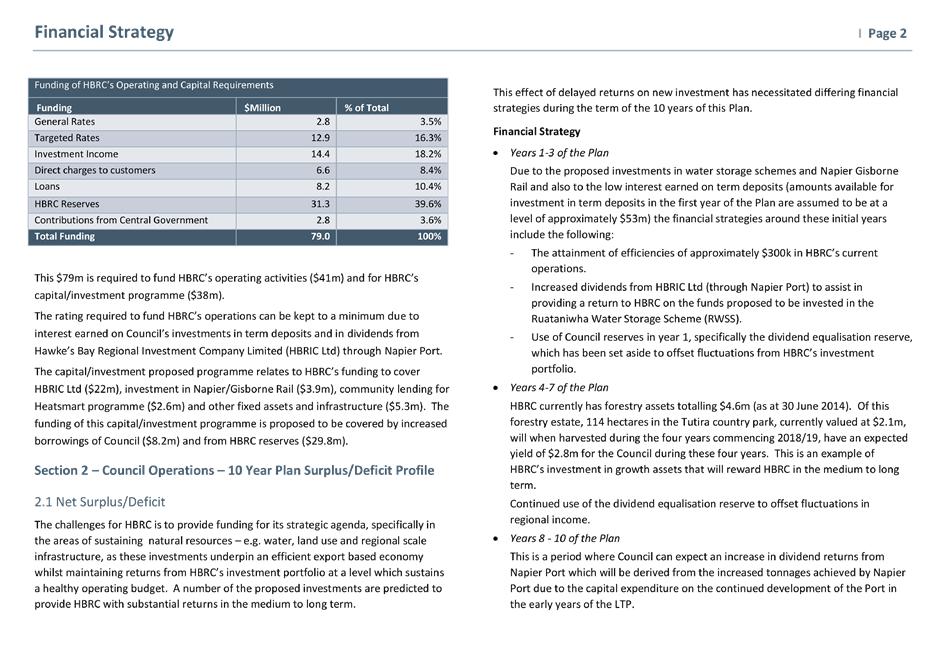

Time: 9.00 am

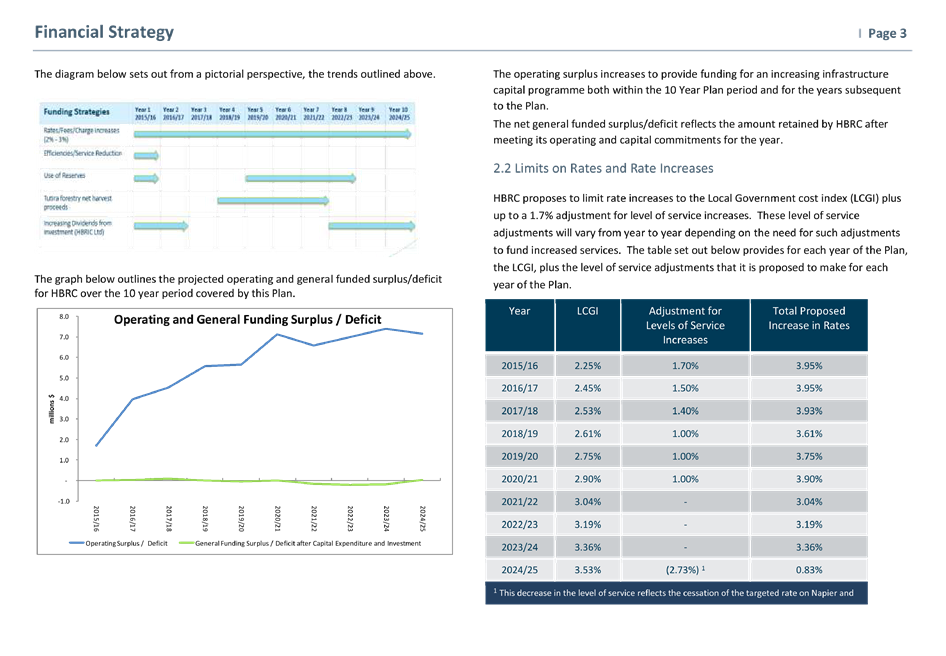

|

Venue:

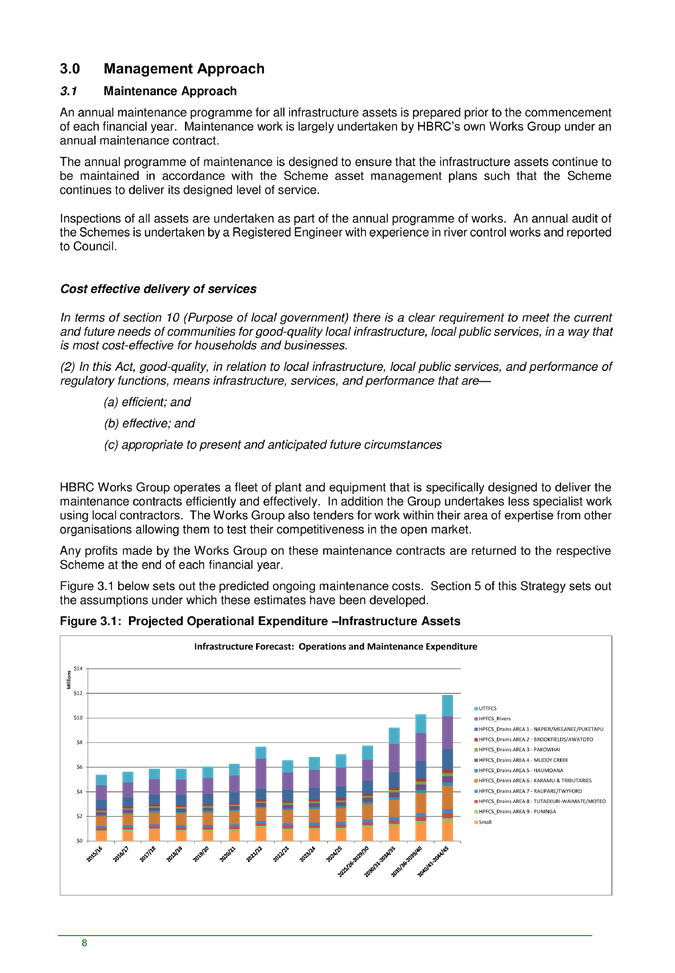

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Attachments

Excluded From Agenda

Provided to Councillors only in Hard Copy

form

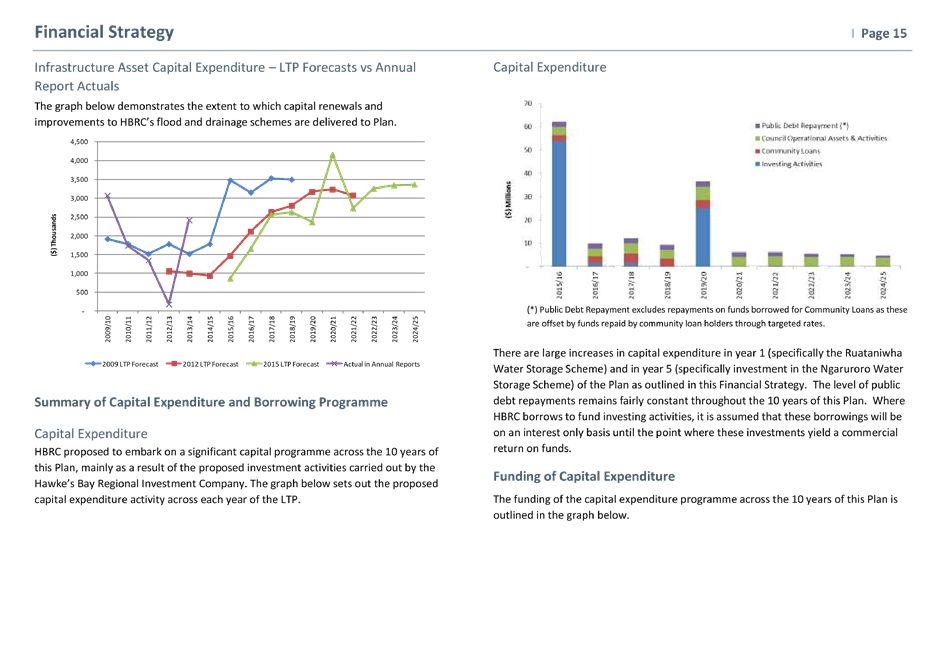

item subject page

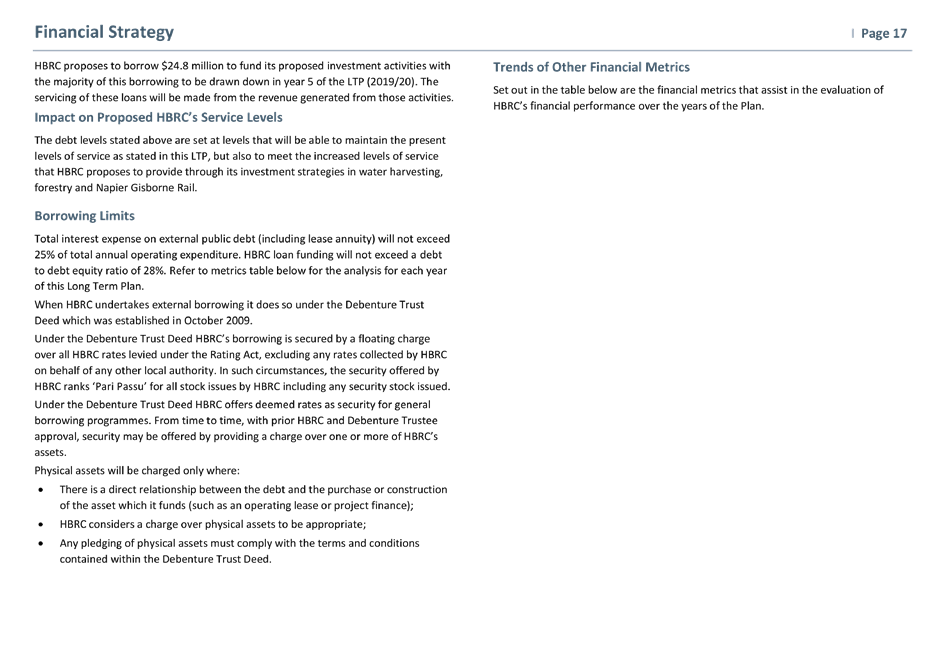

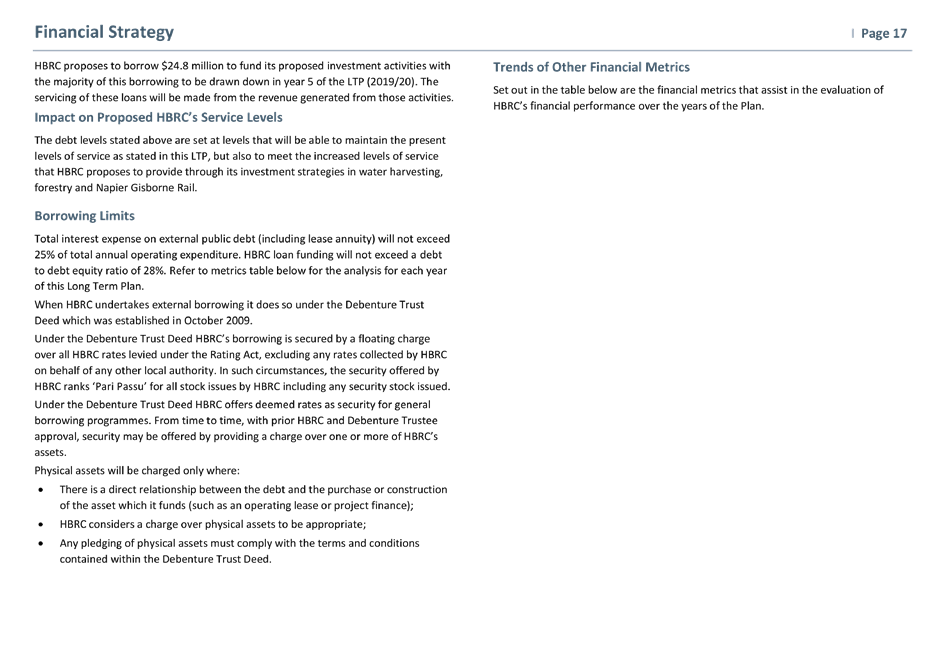

8. Adoption

of the Supporting Accountability Documents and Consultation Document for the

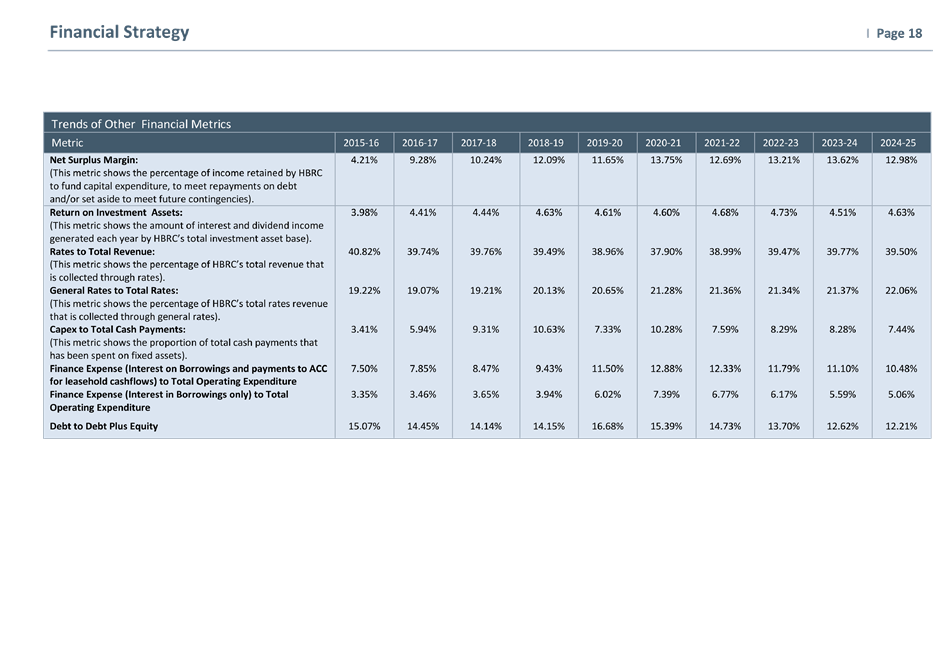

2015-25 Long Term Plan

Attachment 1: HBRC's

2015-25 Financial Strategy 2

Attachment 2: HBRC's

2015-45 30 Year Infrastructure Strategy 20

Attachment 3: HBRC's

Activities 40

Attachment 4: HBRC's

Financial Information 169

Attachment 5: HBRC's

2015-25 Policies 221

Attachment 6: HBRC's

Council Controlled Organisations Information 285

Attachment 7: Our

Plan - HBRC's Consultation Document 287

|

HBRC's

2015-25 Financial Strategy

|

Attachment 1

|

|

HBRC's 2015-45 30 Year

Infrastructure Strategy

|

Attachment 2

|

|

HBRC's Activities

|

Attachment 3

|

HBRC’s Activities

|

HBRC's

Activities

|

Attachment 3

|

Table of Contents

pg

HBRC’s Groups of

Activities

Introduction......................................................................... 1

HBRC’s Strategic Planning

Activities...................................................... 2

Introduction......................................................................... 2

Links to Strategic Outcomes.................................................. 2

Assumptions and Future Demand

Incorporated in this Plan... 2

Activity 1 Economic Development......................................... 6

Activity 2 Strategy and

Planning............................................. 9

Activity 3 Policy

Implementation.......................................... 14

Activity 4 State of the

Environment Reporting...................... 17

HBRC’s Land Drainage

& River Control Activities.................................. 19

Introduction....................................................................... 19

Links to Strategic Outcomes................................................ 19

Assumptions and Future Demand

Incorporated in this Plan.. 19

Activity 1 Flood Protection

& Drainage Schemes................... 21

Activity 2 Investigations &

Enquiries..................................... 27

Activity 3 Sundry Works....................................................... 29

pg

HBRC’s Regional Resources

Activities.................................................. 31

Introduction....................................................................... 31

Links to Strategic Outcomes................................................ 31

Assumptions and Future Demand

Incorporated in this Plan.. 31

Activity 1 Land Management............................................... 35

Activity 2 Air Management.................................................. 42

Activity 3 Water Management............................................. 45

Activity 4 Coastal Management........................................... 53

Activity 5 Gravel Management............................................ 57

Activity 6 Open Spaces........................................................ 60

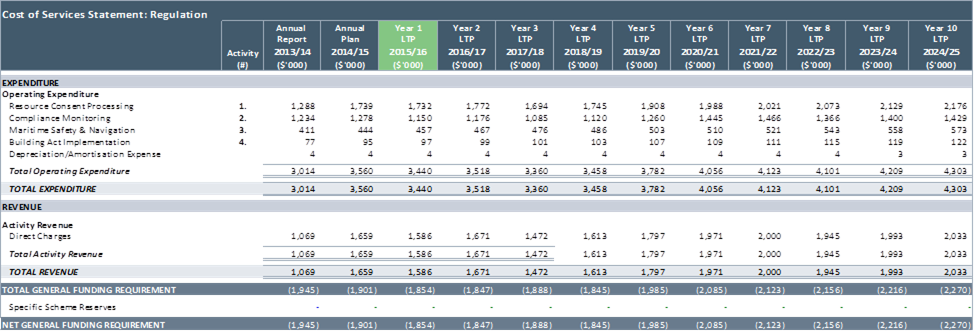

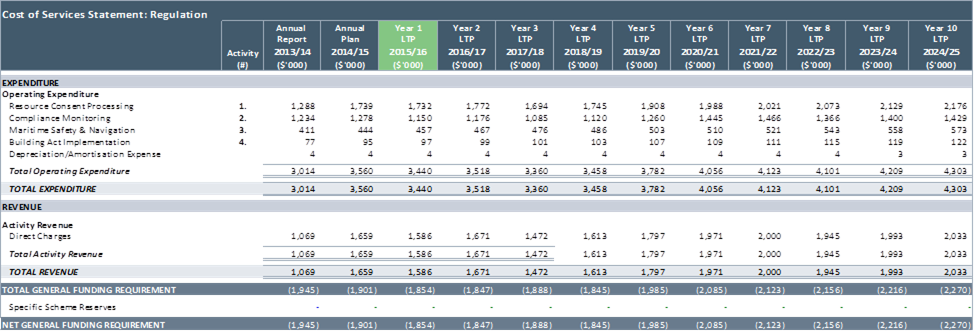

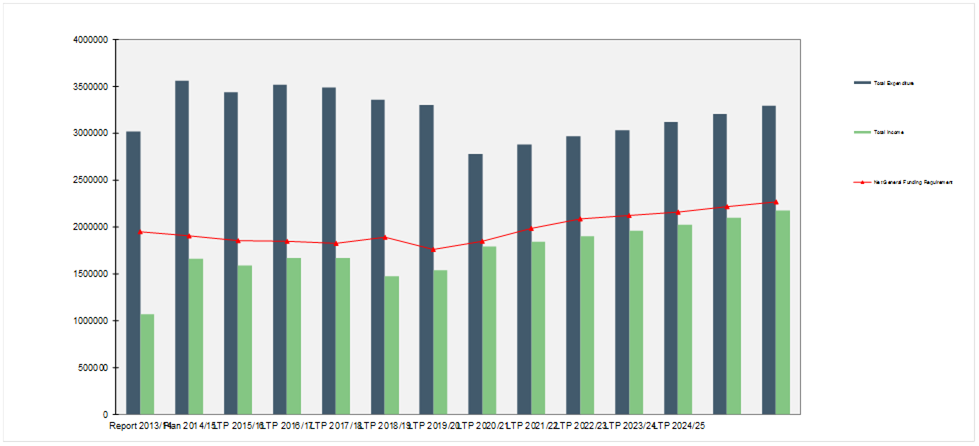

HBRC’s Regulation

Activities............................................................... 63

Introduction....................................................................... 63

Links to Strategic Outcomes................................................ 63

Assumptions and Future Demand

Incorporated in this Plan.. 63

Activity 1 Resource Consent

Processing............................... 66

Activity 2 Compliance

Monitoring........................................ 68

Activity 3 Maritime Safety

& Navigation............................... 70

Activity 4 Building Act

Implementation................................. 72

pg

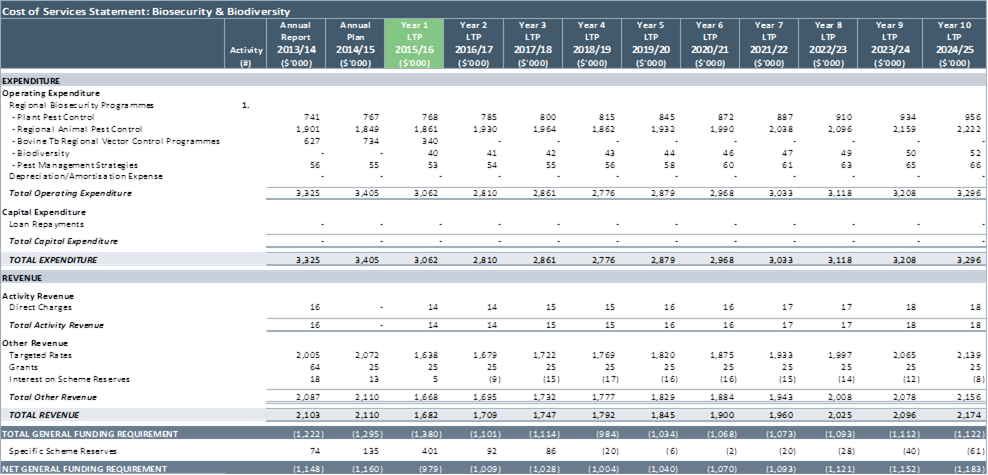

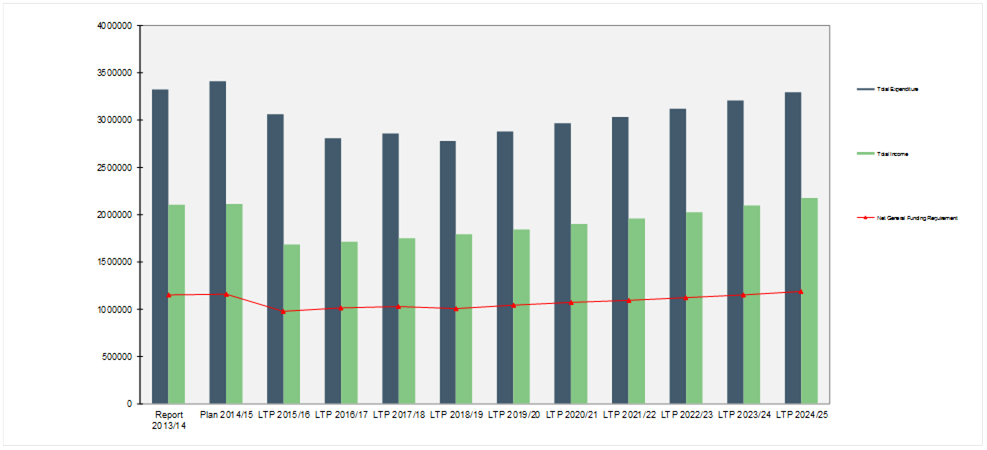

HBRC’s Biosecurity and

Biodiversity Activities..................................... 74

Introduction....................................................................... 74

Links to Strategic Outcomes................................................ 74

Assumptions and Future Demand

Incorporated in this Plan.. 74

Activity 1 Regional Biosecurity

Programmes......................... 77

Activity 2 Regional

Biodiversity............................................ 82

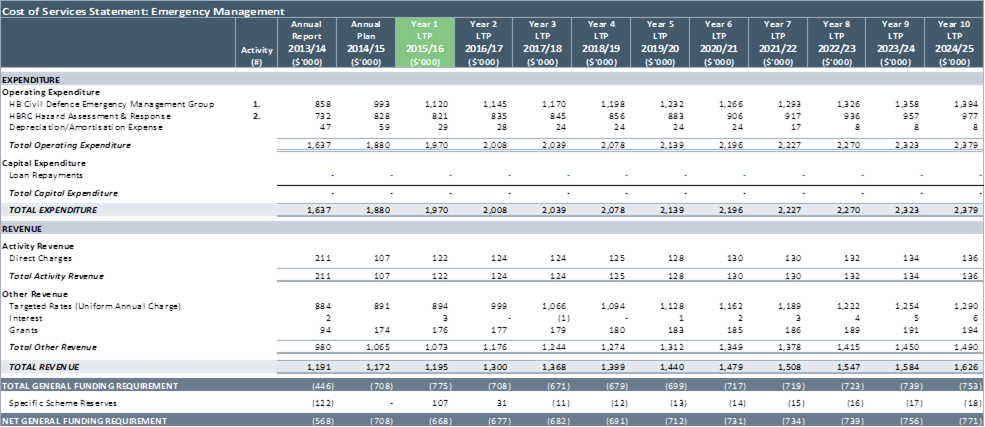

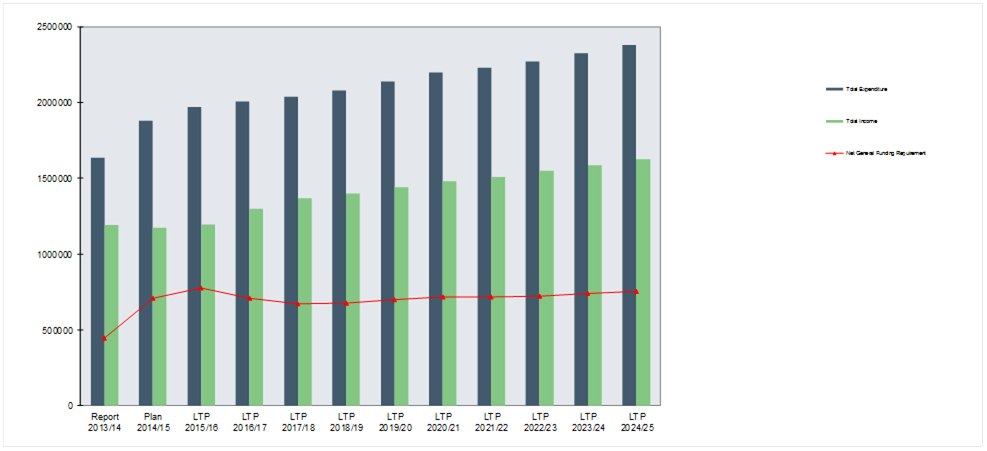

HBRC’s Emergency

Management Activities......................................... 84

Introduction....................................................................... 84

Links to Strategic Outcomes................................................ 84

Assumptions and Future Demand

Incorporated in this Plan.. 84

Activity 1 HB Civil Defence

Emergency Management Group. 87

Activity 2 Hazard Assessment

& HBRC Response.................. 94

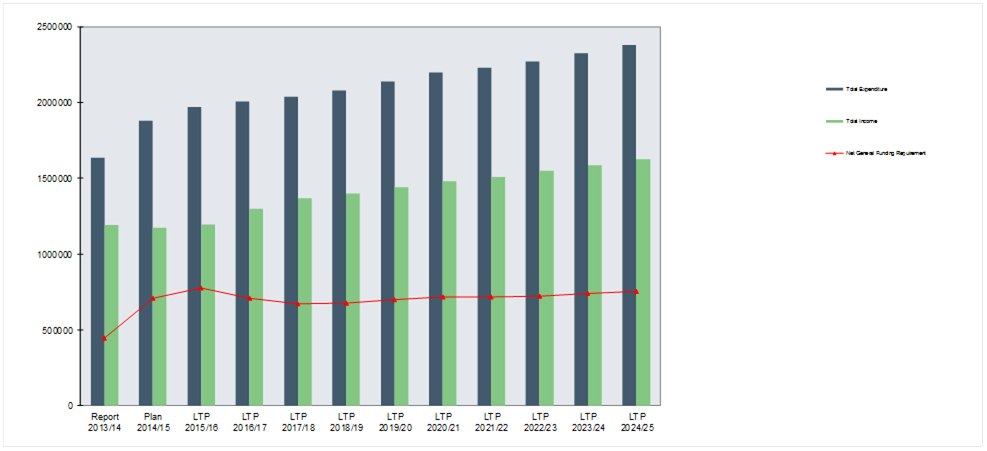

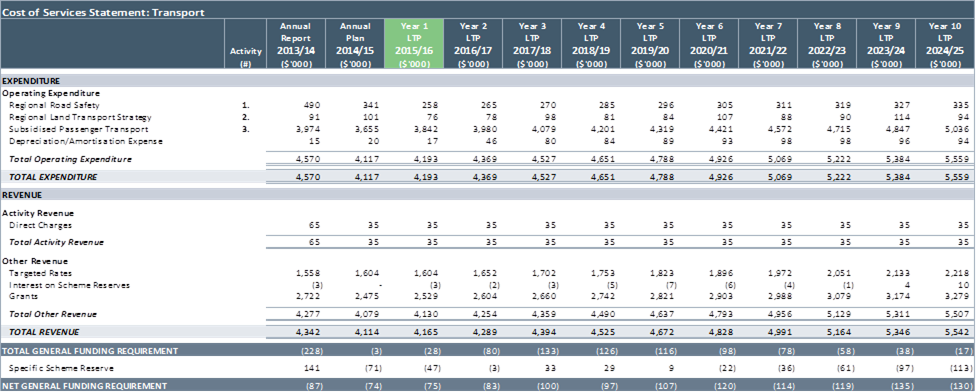

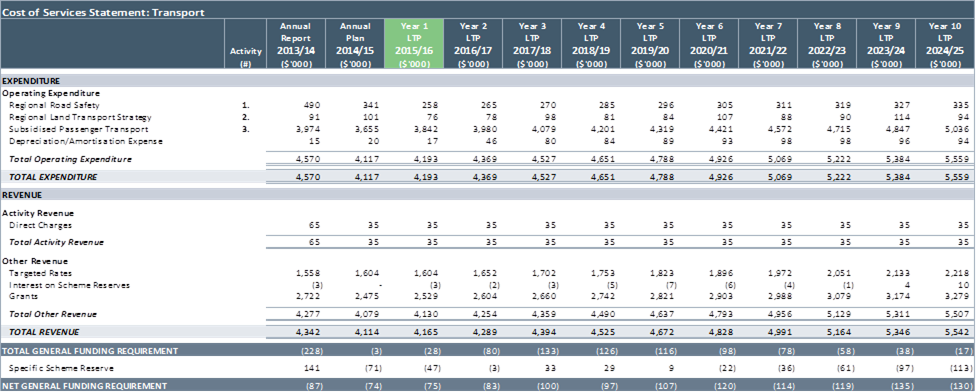

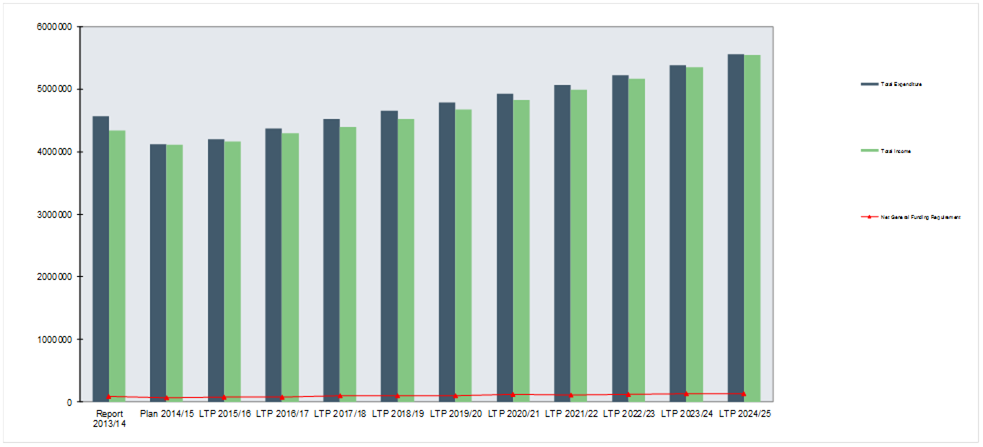

HBRC’s Transport

Activities................................................................. 98

Introduction....................................................................... 98

Links to Strategic Outcomes................................................ 98

Assumptions and Future Demand

Incorporated in this Plan.. 98

Activity 1 Regional Road Safety.......................................... 101

Activity 2 Regional Land

Transport Strategy........................ 103

Activity 3 Subsidised Passenger

Transport.......................... 105

pg

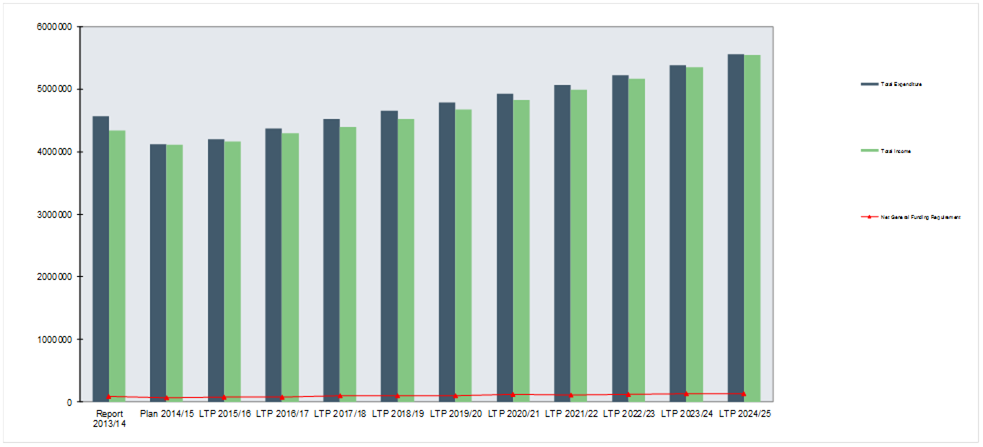

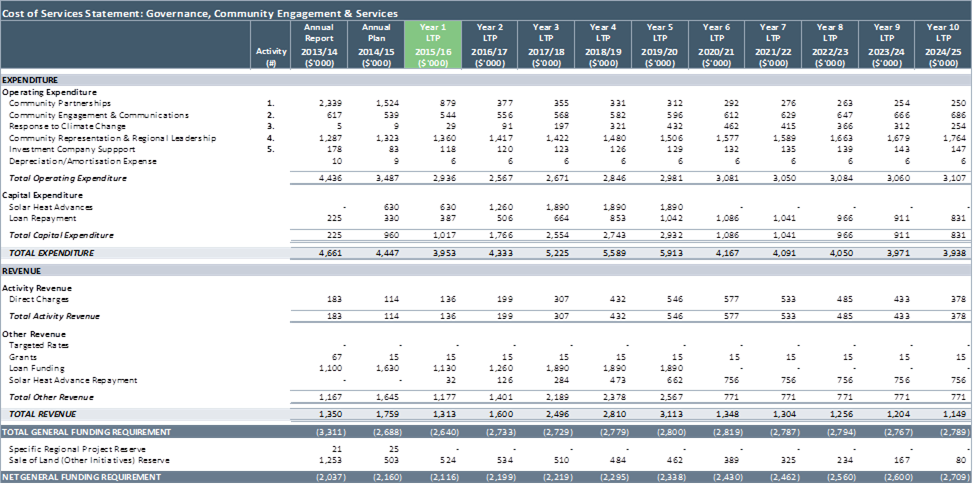

HBRC’s Governance,

Community Engagement & Services Activities... 109

Introduction...................................................................... 1109

Links to Strategic Outcomes................................................. 109

Assumptions and Future Demand

Incorporated in this Plan.. 109

Activity 1 Community

Partnerships....................................... 112

Activity 2 Community Engagement

& Communications......... 114

Activity 3 Community

Representation & Regional Leadership 117

Activity 4 Investment Company

Support.............................. 121

Acronyms Defined............................................................................. 123

|

HBRC's

Activities

|

Attachment 3

|

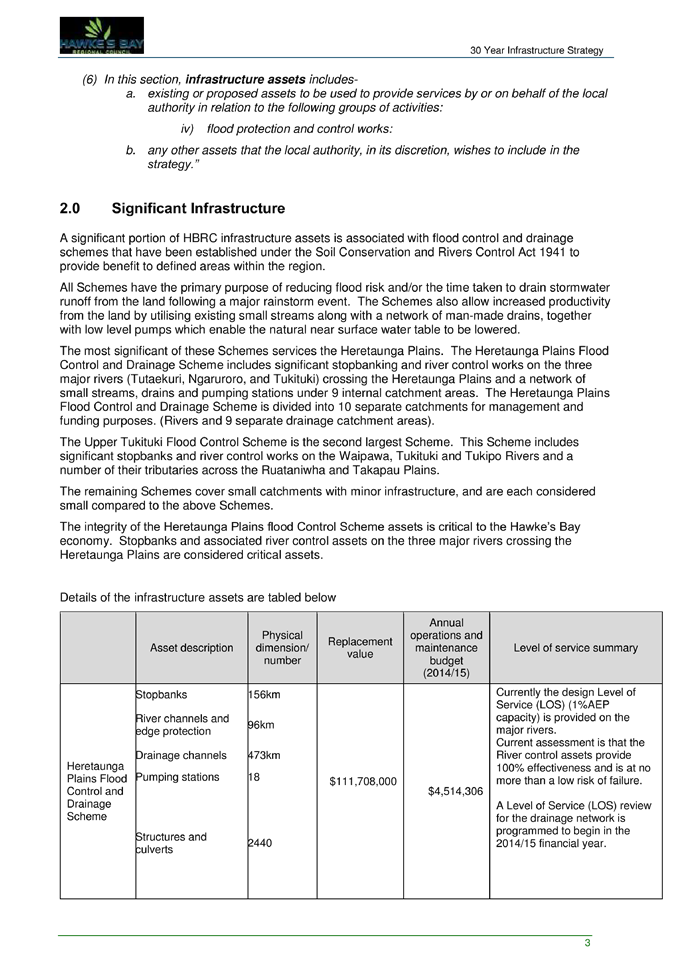

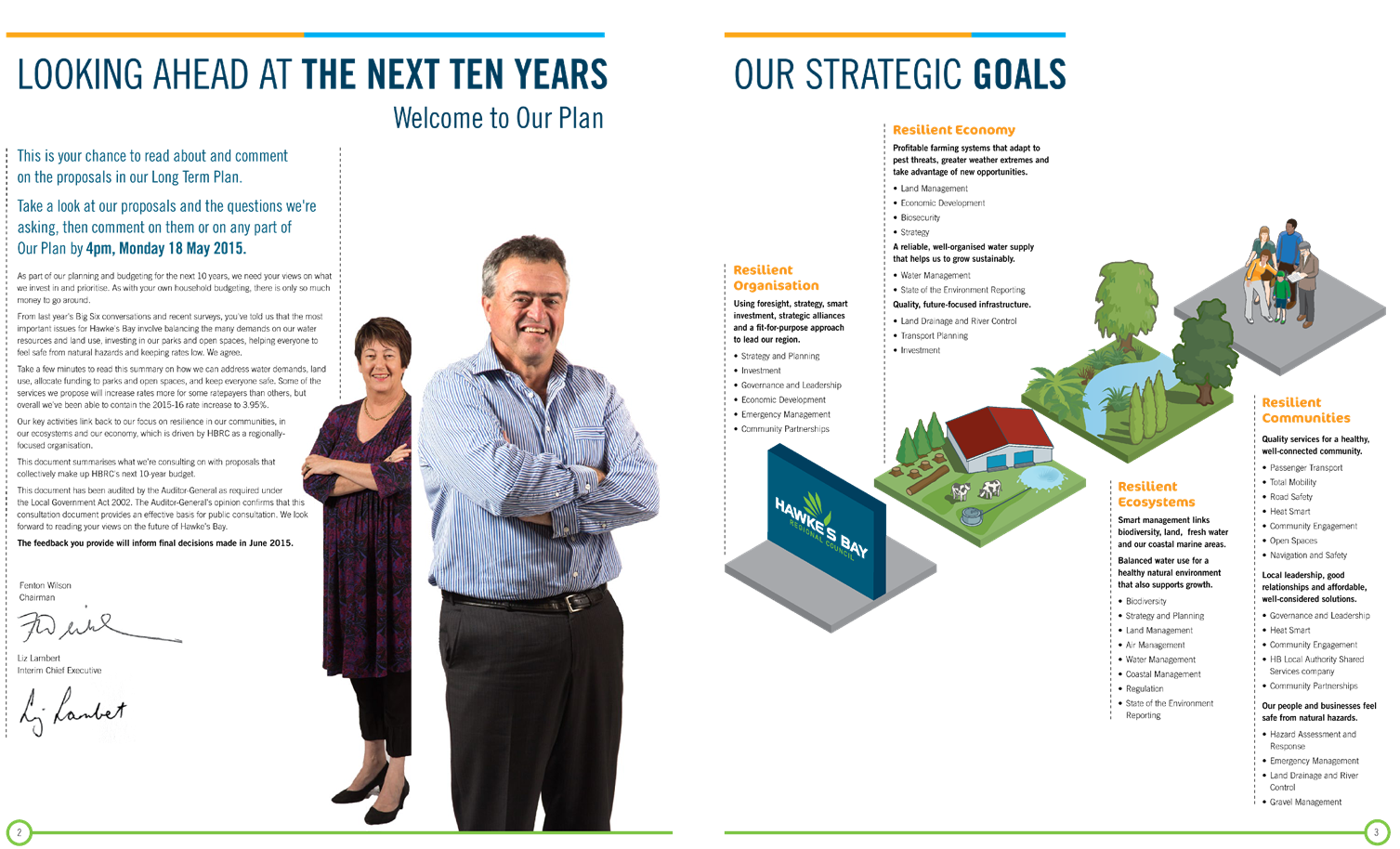

Introduction

This supporting document to

the Long Term Plan 2015-25 outlines the activities HBRC intends to carry out

over the next ten years and how they are linked to the strategic outcomes that

HBRC aims to achieve in meeting the current and future needs of communities for

good quality infrastructure, local public services, and performance of

regulatory functions.

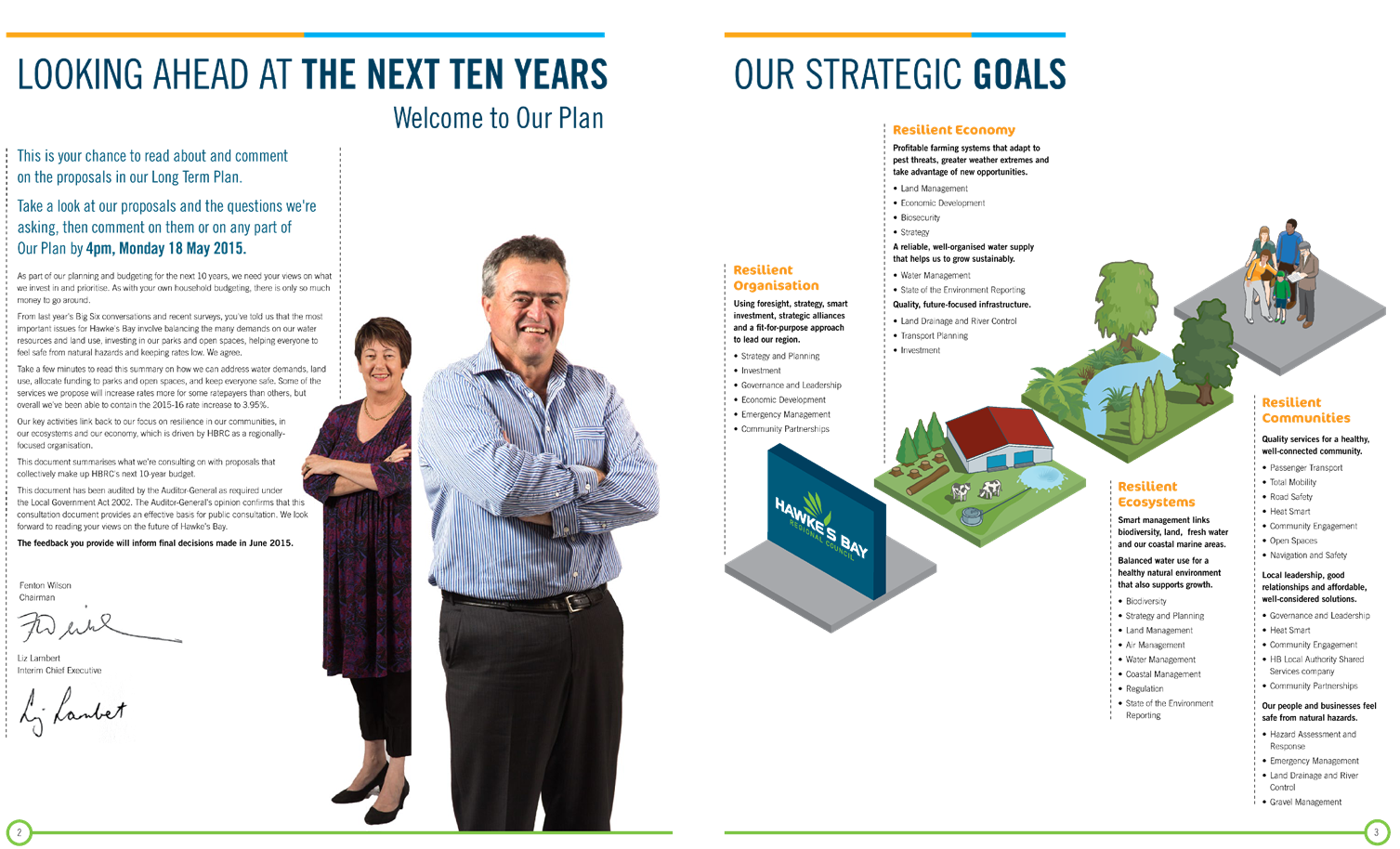

HBRC’s strategic

outcomes or aims have evolved from the 2011 Strategic Plan and through the

development of the Long Term Plan 2015-25.

The table below sets out the

Strategic Goals, the Outcome/Aim statements and the key activities that

contribute to achieving them.

|

Strategic Goals

|

Resilient Communities

|

Resilient Ecosystems

|

Resilient Economy

|

Resilient Organisation

|

|

Our Aims

|

Quality

services for a healthy, well-connected community

|

Local

leadership, good relationships and affordable, well-considered solutions

|

Our

people and businesses feel safe from natural hazards

|

Smart

management links biodiversity, land, fresh water and our coastal marine

areas

|

Balanced

water use for a healthy natural environment that also supports growth

|

Profitable

farming systems that adapt to pest threats, greater weather extremes and take

advantage of new opportunities

|

A

reliable, well-organised water supply that helps us to grow sustainably

|

Quality

future-focused infrastructure

|

Using

foresight, strategy, smart investment, strategic alliances and a

fit-for-purpose approach to lead our region

|

|

Key Activities

|

Passenger

Transport

Total

Mobility

Road

Safety

Heat

Smart

Community

Engagement

Open

Spaces

Navigation

and Safety

|

Governance

and Leadership

Heat

Smart

Community

Engagement

HB

Local Authority Shared Services company

Community

Partnerships

|

Hazard

Assessment and Response

Emergency

Management

Land

Drainage and River Control

Gravel

Management

|

Biodiversity

Strategy

and Planning

Land

Management

Air

Management

Water

Management

Coastal

Management

Regulation

State

of the Environment Reporting

|

Land

Management

Economic

Development

Biosecurity

Strategy

|

Water

Management

State

of the Environment Reporting

|

Land

Drainage and River Control

Transport

Planning

Investment

|

Strategy

and Planning

Investment

Governance

and Leadership

Economic

Development

Emergency

Management

Community

Partnerships

|

|

|

|

|

|

|

|

|

|

|

The Structure of the Groups of Activities Summaries

HBRC’s activities are arranged into eight groups

· Strategic

Planning

· Land

Drainage and River Control

· Regional

Resources

· Regulation

· Biosecurity

and Biodiversity

· Emergency

Management

· Transport

· Governance,

Community Engagement and Services.

The first section for each group provides:

· An

Introduction

· How

the Activities link to the Council’s Strategic Outcomes

· Assumptions

and Future Demand incorporated in this Plan

· Estimated

expenses for each activity and how it will be funded. It is important to note

that funding sources and the reason it was selected, is covered in detail in

the Revenue and Financing Policy.

· An

analysis of the forecast expenditure and income for the 10 years covered by

this Plan.

The second section is based on Activities

within each group and provides:

· The

significant issues addressed by each activity

· The

reason for HBRC involvement and the level of service that it expects deliver to

the community

· Any

Significant Negative Effects arising from its implementation

· How

HBRC will measure delivery of each service

· Current

performance

· Performance

targets for the next 10 years. These targets are the same for each year of the

Long Term Plan unless otherwise specified.

· Specific

work or projects that help ensure services can be delivered.

|

HBRC's

Activities

|

Attachment 3

|

Introduction

These activities pull

together Hawke’s Bay Regional Council’s (HBRC) strategic thinking

initiatives, economic development, investments and resource management policy

development. Together with State of the Environment reports, these provide

information for further strategic decisions.

Link to

Strategic Outcomes

This group of activities

contributes to HBRC’s strategic outcomes in the following ways.

Resilient communities

Local leadership, strong

relationships and affordable, well considered solutions –

by funding and undertaking activities which support economic development,

particularly those reliant on the region’s natural resources; maximising

the sustainable input of natural and physical resources into economic

activities, engaging the community in making decisions about the future of

their region.

Resilient ecosystems

- Active

management linking biodiversity, land, freshwater and our coastal marine areas –

by the development of catchment based regional plans, managing the

region’s natural and physical resources to ensure they are used

efficiently and effectively; and the State of the

Environment (SOE) project that will inform the community of environmental

change and the effectiveness of HBRC programmes.

- Balanced

water use for a healthy natural environment that also supports growth –

by setting water quantity allocation limits based on an understanding the

relationship between aquatic habitat requirements, river flows and economic

impacts.

Resilient Economy

Profitable farming systems

that can adapt to greater weather extremes, pest threats and take advantage of

new opportunities – by funding

and undertaking activities which support economic development, particularly

those reliant on the region’s hill country.

Resilient organisation

Using foresight, strategy,

smart investment, strategic alliances and a fit-for-purpose approach to lead

our region – by providing a mechanism to

coordinate regional initiatives through the Regional Economic Development

Strategy, and promoting integrated strategy and planning processes.

Assumptions

and Future Demand Incorporated in this Plan

The planning assumptions for

the following activities are:

- HBRC’s

economic development activity in Hawke’s Bay will be based on the

Regional Economic Development Strategy (REDS).

- Changes

to resource management legislation are expected by Central Government.

- There

will be sufficient funding from Year 4 to enable the resource management

planning activities to be delivered.

- Implementation

of the National Policy Statement for Freshwater Management is a priority.

|

HBRC's

Activities

|

Attachment 3

|

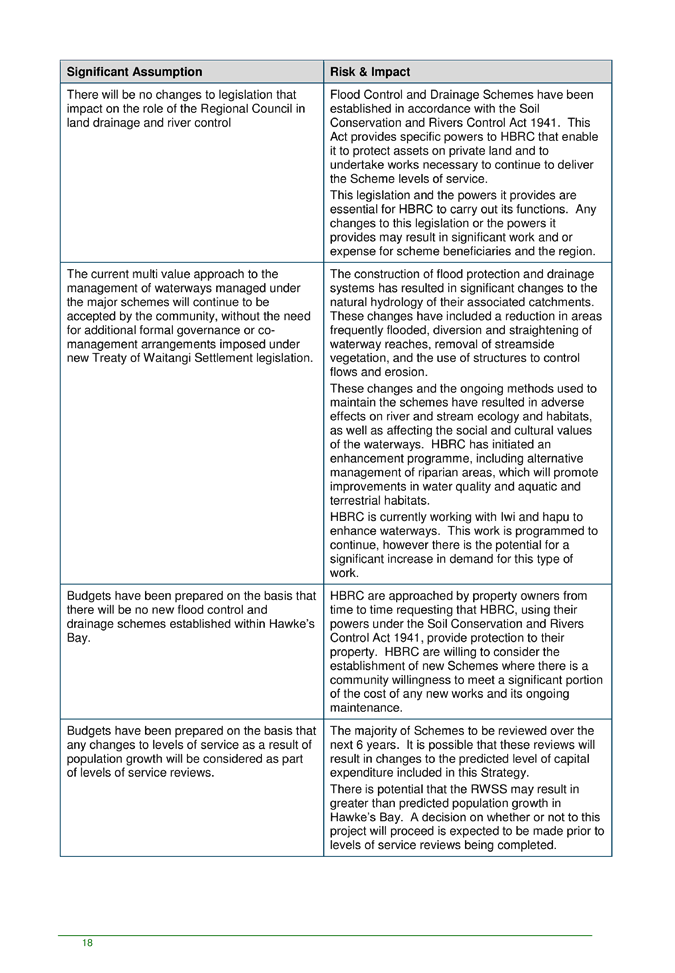

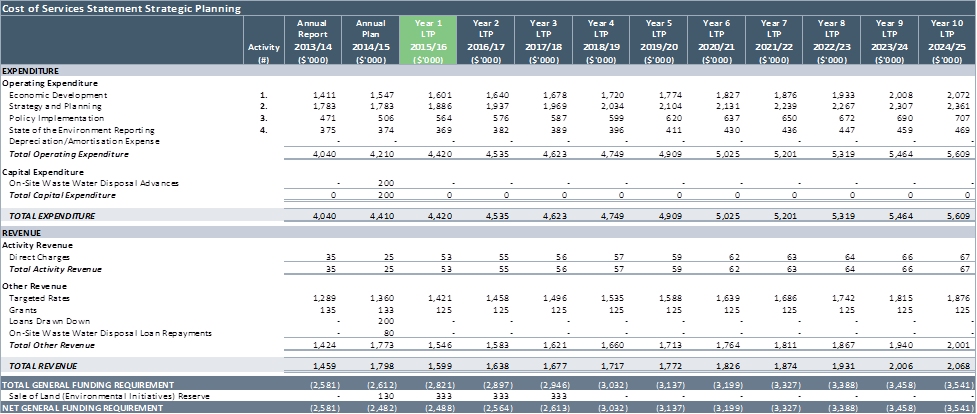

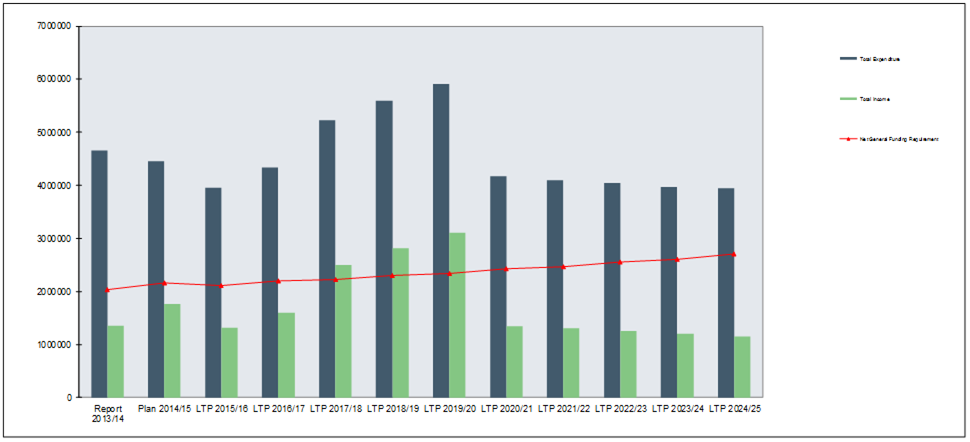

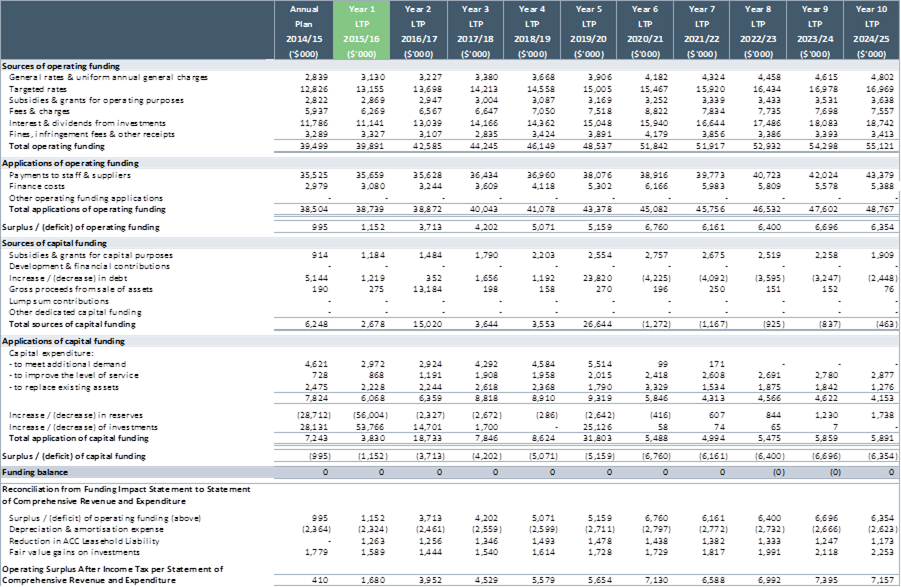

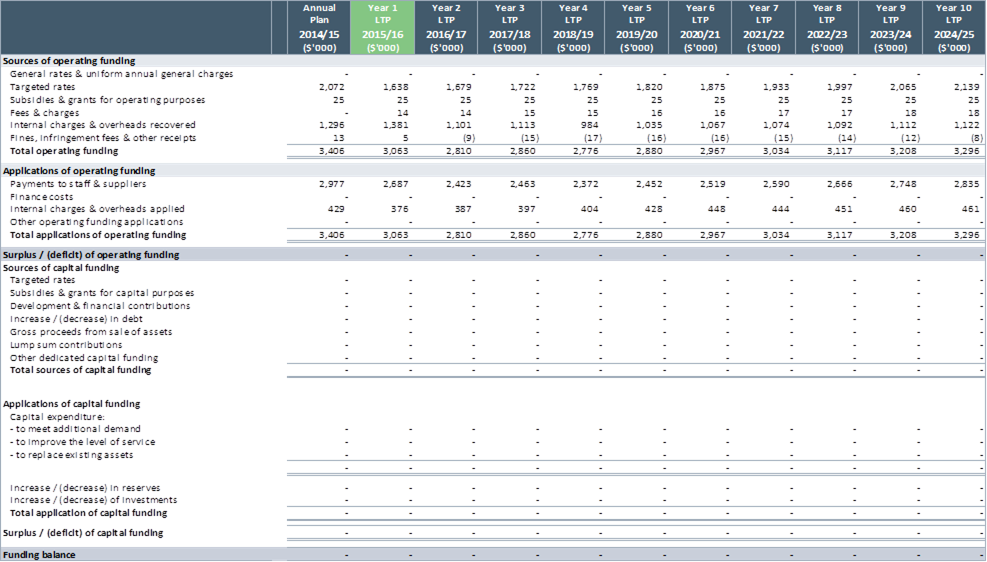

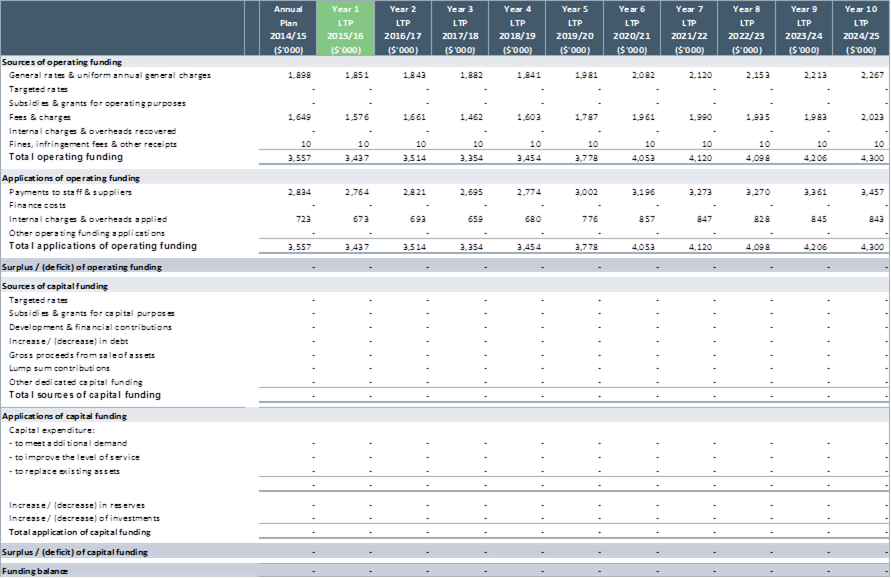

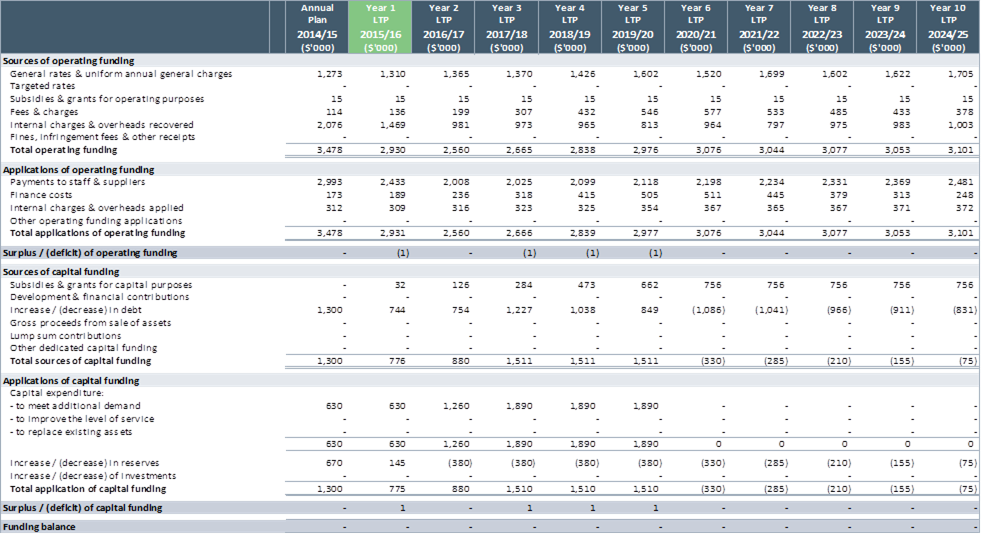

Net Funding Requirement – Strategic Planning

|

HBRC's

Activities

|

Attachment 3

|

Activity 1 – Economic Development

Significant

Issues

- The

future, in international, national and regional terms, remains complex and

uncertain. New ways of thinking about and planning for the future will be

required in order to understand the different social, economic, environmental

and political environments that might arise, and to develop strategies in

response.

- Key

primary production and manufacturing sectors which drive Hawke’s

Bay’s economy are high value and high volume industries, however they

have a low growth profile. A regional focus on productivity and innovation is

essential to lift the regional economic performance across these sectors.

- Post

Treaty Settlement Groups are also looking for ways to gain economic benefits

from their land and other assets.

- Each

territorial authority has its own economic objectives for its district. There

continues to be a need to maintain a co-ordinated approach to maximise direct

and indirect regional benefits through the Regional Economic Development

Strategy.

Rationale

A number of factors which

have the potential to impact on the region can be more efficiently addressed at

a regional level via a regional agency.

The Regional Economic

Development Strategy, which was initially developed jointly by HBRC,

territorial authorities and business agencies, articulates four key strategic

themes for the region and is currently being reviewed. HBRC plays a lead

role in the Resilient Primary Sector Growth theme, in recognition of its

function in natural resource knowledge and management, water security, and

provision of regional scale infrastructure, upon which the primary sector

relies. Via its targeted economic development rate, HBRC also supports Business

Growth and Visitor Growth for the region by funding Business Hawke’s Bay

and Tourism Hawke’s Bay respectively.

Significant

Negative Effects

No significant negative

effects will occur as a result of HBRC’s delivery of these activities.

Contributing projects include: 179

Economic Development and 185 Investment Strategies

|

HBRC's

Activities

|

Attachment 3

|

|

Service Levels and Performance Targets

Activity 1 – Economic Development

|

|

Level

of Service Statement

|

Level of Service Measure

|

Current Performance

|

Performance

Targets

2015-18 in detail; 2019-25 outline

|

Required Actions to Achieve

Performance

Targets

|

|

Regional Economic Development Strategy mission

statement: “To make Hawke’s Bay the best location in which to

visit, work, invest, live and grow”

|

Funding

contract with approved performance targets and reporting requirements

|

Funding

agreement in place for Hawke’s Bay Tourism Ltd with approved

performance targets and reporting requirements. Expires 30 June 2015

|

Yearly

Continue

quarterly reporting to Council on key performance indicators

|

Maintain

funding of Hawke’s Bay Tourism Ltd and review KPIs as part of funding

contract agreement

|

|

Long

term Regional Economic Development Strategy (REDS) and three year Action Plan

|

Being

reviewed 2014-15

|

Yearly

Annual report on Action Plan

2017-2018

Review the Regional Economic Development Strategy

|

Key

Performance Indicator (KPI) in Business Hawke’s Bay contract to monitor

and report on the Action Plan and review the Regional Economic Development

Strategy

|

|

Investment for research and development and business

development

|

In 2013

-14, a total of $1,1 million of grants came into the region via Ministry of

Science and Innovation

Underway in partnership with

Callaghan Innovation (Regional Partner Network)

|

2015-16 ongoing

At

least $800,000 per annum achieved for Research and Development investment

|

Implement Regional

Business Partner programme in partnership with Chamber of Commerce locally,

and New Zealand Trade & Enterprise and Callaghan Innovation nationally.

Remain proactive in

RFP process for next Regional Business Partner program which commences in

January 2016.

|

|

Implementation of HBRC led Initiatives to implement

REDS Action Plan – with a focus on primary sector resilience

|

Partnership

with Massey University for business growth

- Key

strategies and actions contained in Regional Economic Development Strategy -

|

Initiate and

progress initiatives as per the yearly REDS Action Plan – including

programmes associated with :

- Maori

Economic Development

- Wairoa

primary sector opportunities

- Supporting

the resilience of the region’s primary sector

Continue to engage

on Oil and Gas exploration / development with stakeholders

|

Implement REDS action plan as it relates to HBRC led

initiatives

|

|

HBRC's

Activities

|

Attachment 3

|

Activity 2

– Strategy and Planning

Significant Issues

- An

increasingly complex and uncertain future. It is essential to develop and

refine tools for new ways of thinking and planning to understand new social,

economic, environmental and political environments that might arise.

- The

need for high-level planning for infrastructure which enhances the

region’s economic and social potential.

- Integration

of economic development with the accessibility and capacity of natural

resources. Water is essential for the production of crops on the

Ruataniwha and Heretaunga Plains, which is an important part of the

region’s rural economy. Water also has intrinsic, recreational and

habitat values.

- The

implementation of the National Policy Statement for Freshwater Management

(NPSFM). This is a significant national driver and requires management

objectives to be set for freshwater bodies and associated ecosystems, water

quality and allocation limits. Land management practices will need to

continually improve to reduce impacts on water quality.

- A

new chapter into the Regional Policy Statement sets out the process for

integrating land and freshwater management at a catchment level.

- Establishing

freshwater objectives which require different and often competing values to be

identified. Collaborative processes with multiple stakeholders require

significant commitment of time and resources by all parties at the front end of

the process. It is hoped that this will result in fewer areas of contention at

the formal part of the plan development process.

- Better

integration of tangata whenua values and interests into planning documents and

enhancing the involvement of iwi/hapu into management and governance

arrangements.

Rationale

Strategy and Planning brings

together strategic thinking, strategy development and resource management

planning activities. The development of regional strategies can provide a

platform to develop resource management plans.

The management of the

region’s natural and physical resources is a key function of

Hawke’s Bay Regional Council (HBRC). Appropriate resource

management allows the region to maximise the economic and social benefits of

its resources while minimising detrimental environmental impacts.

Under the Resource

Management Act, HBRC is required to provide an overview of significant resource

management issues in the region and to provide guidance on the management of

these issues through the regional policy statement. Such issues may include

land, water, and air management, climate change, and energy. HBRC carries out

this role because it is able to provide an integrated overview of the entire

region. Territorial authorities are then required to implement the Regional

Policy Statement (RPS) through district plans.

The Regional Resource

Management Plan (which includes the RPS) became operative in August 2006. A

number of changes will be required to the Regional Resource Management Plan to

give effect to the National Policy Statement for Freshwater Management. HBRC is

required to implement the National Policy Statement for Freshwater Management

by 2025. HBRC will also need to commence its ten yearly review of the

Regional Resource Management Plan during this LTP period.

The Resource Management Act

requires HBRC to have a Regional Coastal Plan. HBRC has integrated management

of the land adjacent to the sea and the coastal marine area in a Regional

Coastal Environment Plan (RCEP). This Plan became operative in November 2014.

Significant

Negative Effects

Creating plans to implement

the National Policy Statement for Freshwater Management will be lengthy and

will involve significant costs. Implementing those plans will also involve

significant costs, particularly for rural land owners whose land use and land

management activities are being managed through the integrated land and

freshwater planning processes.

Contributing projects include: 191

Regional Coastal Plan and 192 Strategy & Planning.

|

HBRC's

Activities

|

Attachment 3

|

|

Service Levels and Performance Targets

Activity 2 –Strategy and Planning

|

|

Level

of Service Statement

|

Level of Service Measure

|

Current Performance

|

Performance

Targets

2015-18 in detail; 2019-25 outline

|

Required Actions to Achieve

Performance

Targets

|

|

HBRC

will help the community prepare for the future and increase community

resilience to climate change

|

Energy

Strategy prepared

Hawke’s

Bay Energy Initiative launched

|

Initial

studies undertaken to review other regional ‘energy future’

studies and to profile HB energy profile

|

2015-16

Develop

a Hawke’s Bay Energy Strategy with a Draft Strategy adopted by Council

by March 2016

Complete

report on the effectiveness of the Regional Resource Management Plan (RRMP)

and Regional Coastal Environment Plan (RCEP) in relation to managing the

effects of oil and gas exploration and development.

Community

Engagement Plan for potential Oil and Gas Exploration and Development in

Hawke’s Bay adopted by Council in August 2015.

2017-18

Investigate

potential energy efficiency initiatives for Council to consider.

|

Project

manage the development of the strategy, and report

|

|

East Coast Hill

Country Strategy

|

Initial

discussions have been held with the many central government, local

government, and industry sector groups.

|

2015-18

Develop and complete a strategy by July

2018 in preparation for policy development within the RRMP. Strategy

adopted by Council by July 2018.

|

Project

manage the development of the strategy

|

|

|

Number of sectors

through which HBRC promotes/influences reduction in carbon emissions and

adaptation to climate change

Number of Council

activities that contribute to climate change adaptation and reduction

|

HBRC

works with:

-

the primary production sector on sustainable farming and research initiatives

-

the urban community to reduce energy use, improve air quality and human

health through the ‘Heatsmart’ programme

A

Solar Hot Water Scheme initiative based on providing loan funding is pending

a viable business case

|

2015-18

Funding for an Approved Solar Hot Water

Scheme or an alternative Solar Initiative is available.

2016-17

Complete a report on the contribution of

Council activities make towards climate change adaption and mitigation, and

number of sectors that Council supports to promote or influence reductions in

carbon emissions and climate change adaptation.

|

Review

the business case for the Solar Hot Water Scheme as part of the Energy

Strategy initiative.

Proactively

seek initiatives through which HBRC is able to influence or promote a

reduction in regional carbon emissions.

Proactively

seek opportunities to make investments that provide a satisfactory return for

HBRC’s investment portfolio and result in sustainable use of the

region’s resources.

Project

manage the preparation of the Contribution to Climate Change Adaption.

Mitigation and Reduction report

|

|

HBRC

will integrate land and water and biodiversity management to deliver

environmental, economic, social and cultural outcomes

|

Progressive

Implementation Plan for 2014 National Policy Statement for Freshwater

Management (NPSFM)

|

NPSFM

Implementation Plan based on 2011 NPSFM

|

2015-16

Adopt

and notify Progressive Implementation Plan for 2014 NPSFM

Each Year

Prepare

report on implementation of National Policy Statement for Freshwater

Management

|

Report

on NPSFM Implementation Plan progress through the Annual Report

|

|

HBRC

will establish and maintain clear and appropriate policy in a responsive and

timely manner that will enable sustainable management of the region’s

natural and physical resources

|

Status of Resource

Management Plans and Policy Statements

No more than 2 years elapse from

notification of a plan change to decisions on submissions being issued

|

Policy under

development in following catchments

Taharua

and Mohaka

Heretaunga

Zone (Clive/Karamu, Ngaruroro, Tutaekuri, Ahuriri, Heretaunga Plains aquifer)

Policy recently completed

RPS

Change 5 Land and Freshwater Management

RRMP

Tukituki Plan Change 6

|

2015-16

Plan change for outstanding freshwater

bodies publicly notified July 2016

2017-18

- Plan change for Taharua /Upper Mohaka

adopted for public notification December 2017

- Plan change for Heretaunga Zone adopted for

public notification December 2017

(NB: Other freshwater-related plan changes

undertaken in accordance with the Implementation Plan for NPSFM).

2020-21

- Commence review of RRMP including RPS

- Commence policy development for remaining

catchment areas in the region to give effect to the NPSFM

|

Project manage the development of policy

for inclusion in the RRMP and RPS including:

Coordinate and integrate all the necessary

inputs into the planning processes

Coordinate and undertake the required

stakeholder community engagement before notification

|

Policy

recently completed |

Change 4 of RPS -

Built Environment gives effect to Heretaunga Plains Urban Development

Strategy

2015-2018

Participate in the implementation and

review of the Heretaunga Plains Urban Development Strategy

|

Participate in Technical Advisory Group

Support the Heretaunga Plains Urban

Development Strategy (HPUDS) Implementation Working Group

|

|

Operative Regional

Coastal Environment Plan

At all times there

is a regional plan in force for the HB coastal marine area

New Zealand Coastal

Policy Statement (NZCPS) put into action in accordance with statutory

requirements

|

Regional Coastal

Environment Plan and Plan Change 1- Geographical Coverage of Regional

Resource Management Plan became operative on 8 November 2014

|

2015-17

Prepare

and complete Coastal Hazard Management Strategy and Implementation Plans for

coastline between Tangoio and Clifton (see project 322)

Coastal

Hazard Management Strategy (Phase 1) to be adopted by Council by June 2016

2017-18

Commence

preparation of plan change(s) to give effect to Tangoio to Clifton coastal

hazard management strategy (if necessary)

2020-21

Commence

development of plan change(s) to give effect to 2010 NZCPS

|

Support and

participate in the development of the strategy through the Joint Coastal

Hazard Committee (refer Regional Resources, Activity 4, Coastal Management)

|

|

HBRC's

Activities

|

Attachment 3

|

Activity 3 – Policy Implementation

Significant Issues

- Ensuring

HBRC regional plans are implemented and then monitored and evaluated for

effectiveness.

- Ensuring

Hawke’s Bay Regional Council’s (HBRC) policies and responsibilities

are integrated into district planning decisions.

- Ensuring

HBRC’s activities and interests are provided for in Central

Government’s planning proposals and legislative reviews.

- Increasing

expectations that any contaminated land is dealt with promptly and efficiently,

particularly in relation to any identified high risk areas such as unused

timber treatment sites within the region.

- Implementation

of national policy statements and national environmental standards and the

costs associated with them.

Rationale

HBRC sets out the objectives

to achieve the desired environmental outcomes for the region through its

regional planning documents. Advocating these objectives and associated

policies to territorial authorities and key resource users is an important

element of implementing the plans.

Plan effectiveness

monitoring and reporting is also essential to evaluate whether the objectives

are being achieved.

Investigation of

contaminated land is HBRC’s responsibility under the Resource Management

Act, although both regional councils and territorial authorities have functions

in relation to how it is managed. Contaminated land requires specialised

knowledge and expertise and, given the potential environmental harm to water,

air, soil and people, it is a requirement that councils co-ordinate any

necessary investigations.

HBRC’s grants and

loans to homeowners for healthy homes/ clean air, sustainable land management

and community engagement initiatives are not required by legislation but are

important complementary methods for achieving the environmental objectives.

Significant

Negative Effects

As mentioned in Activity 2 -

Strategy and Planning, the implementation of those plans will also involve

significant costs, particularly for rural land owners whose land use and land

management activities are being managed through the integrated land and

freshwater planning processes. Advocating for the implementation of

Regional Policy Statement provisions may restrict some activities. Any

requirements for contaminated site clean-up will come at a cost to either the

landowner or the person or organisation who caused the contamination, the

clean-up how will be a positive effect.

Contributing projects include: 151 Hazardous

Waste/Substances Management, 192 Strategy & Planning and

196 Statutory Advocacy.

|

HBRC's

Activities

|

Attachment 3

|

|

Service Levels and Performance Targets

Activity 3 –Policy Implementation

|

|

Level of Service Statement

|

Level of Service Measure

|

Current Performance

|

Performance

Targets

2015-18 in detail; 2019-25 outline

|

Required Actions to Achieve

Performance

Targets

|

|

HBRC will promote integrated management and benefits of

collaboration by proactively communicating its policies and responsibilities

through dialogue and submissions on district plans, consent applications and

central government initiatives

|

Lodging

of submissions on district plans, district planning applications and central

government initiatives where there are relevant Regional Council policies

|

A report on

statutory advocacy activities:

Prepared

and presented at HBRC’s Environment & Services and Maori Committee

meetings

|

2015-25

Submissions made on

district plans, district planning applications and central government

initiatives reported to HBRC’s Environment and Services Committee.

Staff of HBRC and

territorial local authorities to meet at least twice a year to discuss

integration issues and steps to improve the regional and district plan are

identified and acted upon.

|

Continue to

receive, review and report on consent applications and plan development

activities

Facilitate the Hawke’s Bay Councils

Planners’ group

|

|

HBRC

will ensure resource management plans are implemented, monitored and

evaluated

|

Implementation

Plans in place for newly operative Plan Changes or Plan Reviews

|

Implementation Plan for Change 6 in preparation (at

time of writing)

|

Yearly

Annual Report on Implementation Plan for

Tukituki Catchment Plan Change 6)

2016-17

RRMP effectiveness

reporting

2018-19

RCEP effectiveness

reporting

2019-20

Tukituki

Plan Change effectiveness reporting

|

Project manage reporting on Implementation

Plan

|

|

HBRC

will investigate and manage contaminated sites to ensure public health and

safety and environmental protection

|

Maintain a database of potentially and confirmed contaminated

sites

|

Upgrading

of database to enable both public and territorial authority access

|

2015-25

To administer and maintain the database,

including checking of record details, site visits to GPS areas of

contamination, transfers to Territorial Local Authorities (TLA) as per agreed

protocol and advising landowners of the contaminated sites status of their

property.

To respond to queries and complaints

regarding potentially contaminated sites.

|

Review

database

Verification

of sites listed on database

Transfer protocols with TLAs

|

|

HBRC's

Activities

|

Attachment 3

|

Activity 4 – State of the Environment Reporting

Significant Issues

- Ensuring

people have access to and confidence in the environmental data collected to

assess the state of the region’s environment and the impacts of community

activities.

- Ensuring

environmental data is readily available in a relevant and easy to read format,

so that people can understand the state of the region’s environment and

the effectiveness of regional plans or policy.

Rationale

HBRC has a statutory

responsibility to monitor the State of the Environment. This is reported on

every 5 years, with annual updates. HBRC is also required to monitor the

suitability and effectiveness of policy statements and plans. This provides

important information that is of benefit to the region’s social,

cultural, environmental and economic wellbeing. Such information should

be easily accessible and available in a form that is meaningful and

understandable.

The research project

provides HBRC with the ability to leverage external investigations and research

funding and to undertake small research projects to fill unforeseen gaps in

knowledge.

The National Environmental

Monitoring Standards project is coordinated on behalf of other councils, NIWA

and power companies. The project aims to develop and standardise environmental

monitoring procedures in New Zealand. This project is funded externally by

grants and contributions from regions.

Significant

Negative Effects

No significant negative

effects will occur as a result of HBRC’s delivery of these activities.

Contributing projects include: 153

State of the Environment Reporting, 155 National Environmental Monitoring

Standards (NEMS) and 182 Unspecified Research & Grants

|

HBRC's

Activities

|

Attachment 3

|

|

Service Levels and Performance Targets

Activity 4 –State of the Environment

Reporting

|

|

Level of Service Statement

|

Level of Service Measure

|

Current Performance

|

Performance

Targets

2015-18 in detail; 2019-25 outline

|

Required Actions to Achieve Performance Targets

|

|

HBRC

will monitor and provide accurate information to the community so that it

understands the State of the Environment (SOE) for Hawke’s Bay

|

Data quality as assessed against HBRC’s quality

assurance system

Amount of State of the Environment monitoring data

available through HBRC’s website

|

HBRC’s

quality assurance system is based on nationally recognised standards and

guidelines. The Quality Management System that guides activities in the

Environmental Science sections was accredited in December 2012 in terms of

ISO9001:2008

Some

data for limited sites is available on HBRC’s website:

- Recreational

water quality

- Groundwater

quality

- Groundwater

levels

- River

flows

- Rainfall

- Air

quality

|

2015-25

Maintain

the current level of SOE data on HBRC’s website.

Continue

to make information from the following monitoring sites available through

HBRC’s website:

· All

telemetered river flow sites

· All

telemetered rainfall sites

· All

telemetered climate stations

- All

data collected, processed, analysed and stored in accordance with ISO requirements

- Maintain

ISO accreditation

|

- Update

quality assurance system requirements to maintain ISO accreditation

- Regular

auditing of the quality assurance system

- Take

corrective action as identified by internal and external audits

- Respond

to “areas of concern” and “opportunities for

improvement” identified by internal and external audits

- Maintain

monthly SoE reports on HBRC’s website

|

|

State of the Environment Monitoring Report

|

Five Yearly State of the Environment Report published

March 2015

|

2015-25

Annual Update State

of the Environment (SOE) Reports available by June each year

2019-20

Five yearly State

of the Environment Monitoring Report available by December 2019

|

Prepare annual update and five yearly reports

|

|

HBRC's

Activities

|

Attachment 3

|

Introduction

Historically, where frequent

flooding or poor drainage have been an issue for local land owners, the

Hawke’s Bay Regional Council (HBRC) or its predecessor organisation, the

Hawke’s Bay Catchment Board, have worked with them to establish a flood

control and/or drainage scheme to enable them to use their land with reduced

risk of flooding and associated improvements to drainage, provided they have

been willing to meet a significant portion of both the capital and ongoing

maintenance and operating cost. HBRC now administers 25 flood control and

drainage schemes throughout the region. The estimated replacement value

of these assets is $153,000,000.

This activity covers the

following inter-related programmes:

- Maintenance

and improvement of flood protection and drainage schemes

- Investigations

and enquiries associated with flood control and/or drainage issues.

- Sundry

works.

The empowering legislation

for this function of the Hawke’s Bay Regional Council (HBRC), is the Soil

Conservation and Rivers Control Act 1941, the Land Drainage Act 1908, the Local

Government Act 2002 and the Civil Defence Emergency Act 2002.

Link to

Strategic Outcomes

HBRC’s Land Drainage

and River Control activities contribute to Council’s strategic outcomes

in the following ways.

Resilient

Communities

- Our

people and businesses feel safe from natural hazards - by reducing the risk

of flooding to the community, our homes and productive land, and providing safe

waterway environments.

- Quality

services for a healthy, connected community – by providing for public

access to HBRC managed waterway environments for recreation and enjoyment and

enhancing amenity values where appropriate.

Resilient

Ecosystems

Active management linking biodiversity,

land, freshwater and our coastal marine area – by managing and enhancing

the river environment by mechanically opening river mouths; active river

control; enhancement of the waterways with a holistic management philosophy;

implementation of an environmental strategy and compliance with a code of

practice; and by ensuring activities are sustainable.

Resilient

Economy

Quality, future focused

infrastructure – by providing first class asset

management principles to the design, construction and maintenance of the flood

control and drainage schemes.

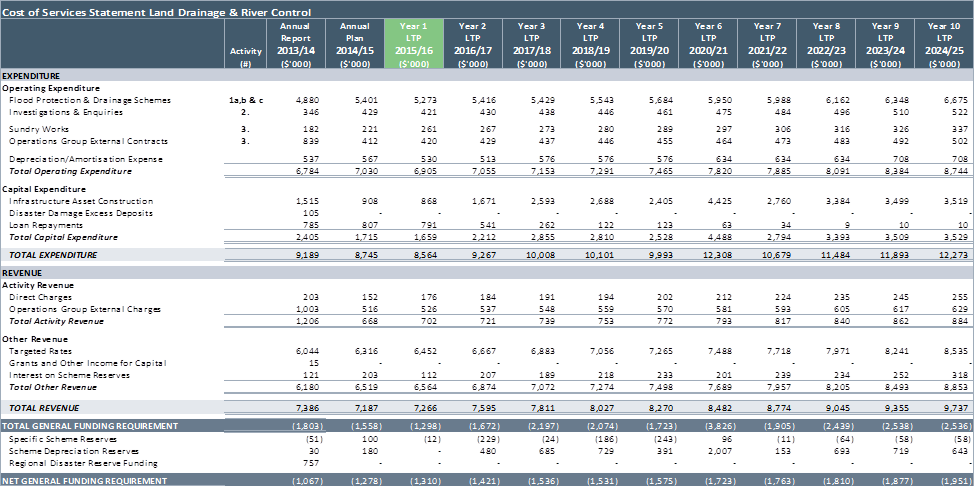

Assumptions

and Future Demand Incorporated in this Plan

The

planning assumptions for HBRC’s Land Drainage and River Control

activities are:

- Budgets

have been prepared on the basis that no flood events in the next 10 years that

could cause major damage to HBRC’s flood protection and drainage

assets. Should such an event occur, maintenance and improvement

programmes may be reviewed and budgets revised.

- Current

arrangements for gravel extraction will continue, with sufficient gravel

extraction by commercial extractors to maintain river bed levels at an ideal

grade. This is not currently the case for some Upper Tukituki rivers and

investigations are underway to determine options for addressing this.

- There

will be no changes to legislation that impact on the role of the Regional Council

in land drainage and river control.

- HBRC

maintains its current policy with regard to responsibility for funding of

existing and new flood protection and drainage works.

|

HBRC's

Activities

|

Attachment 3

|

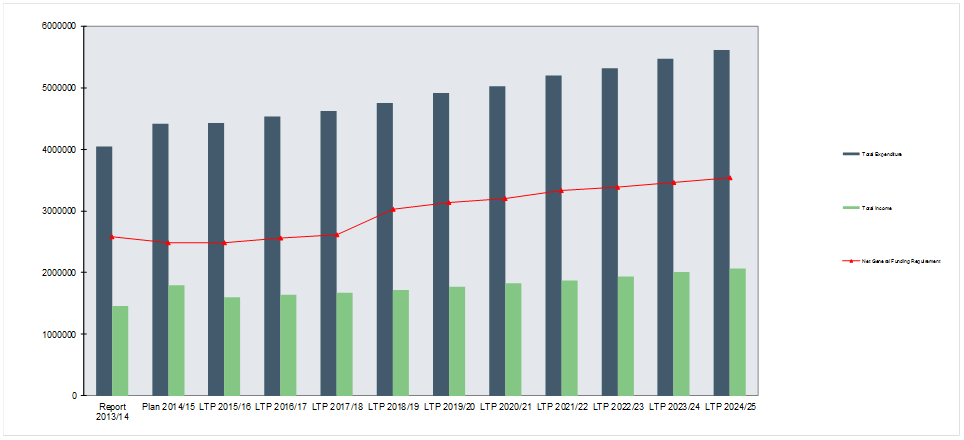

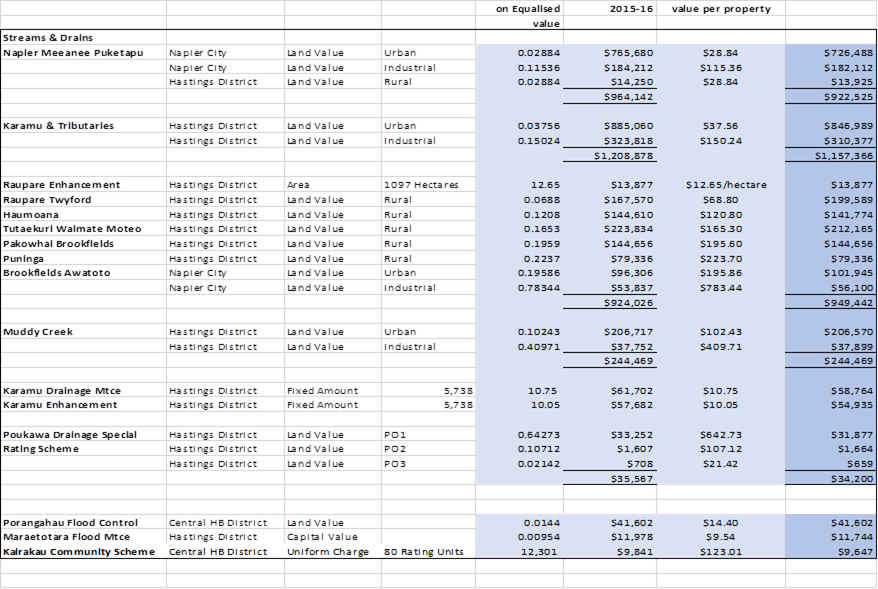

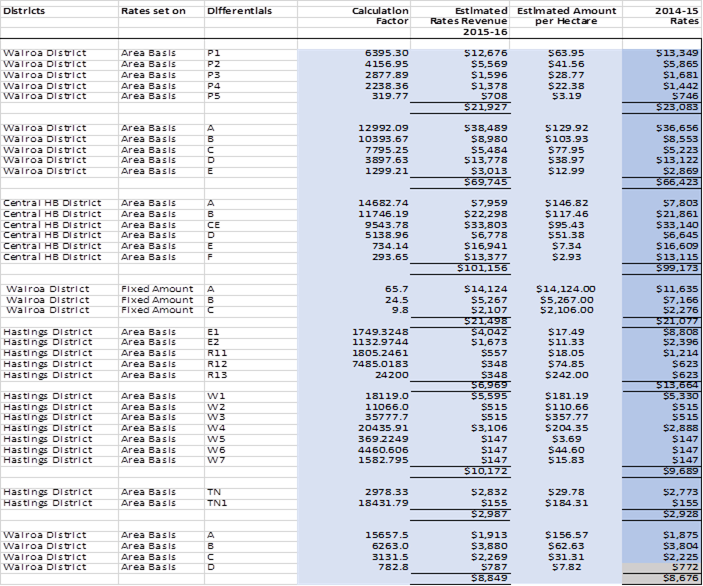

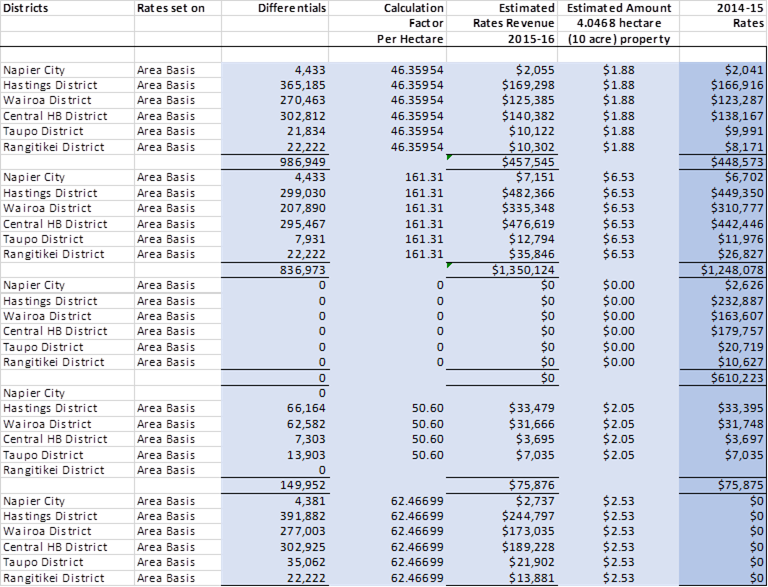

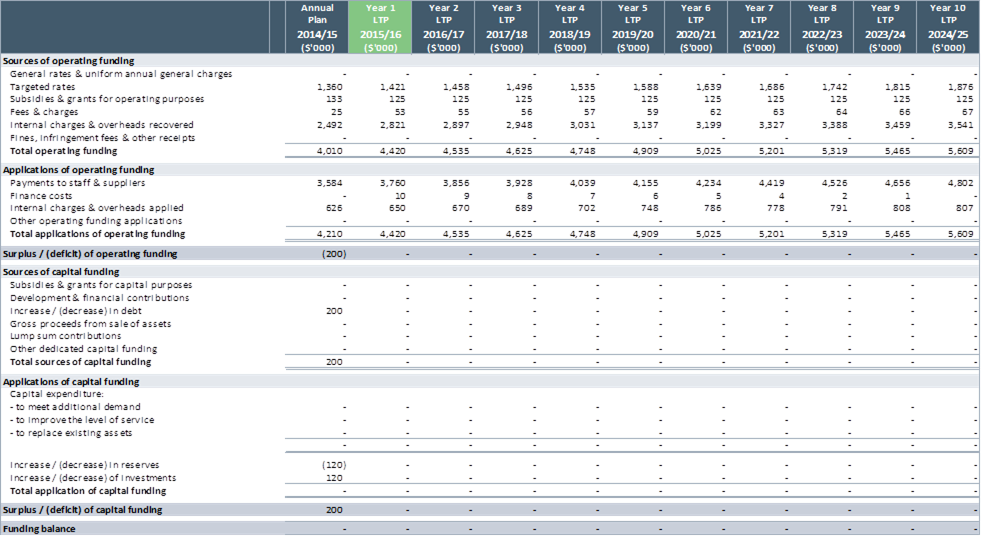

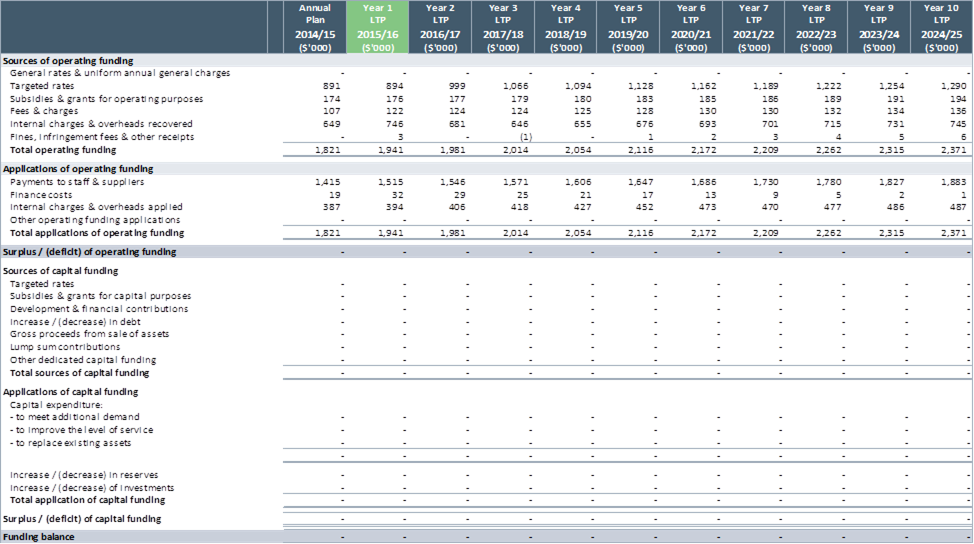

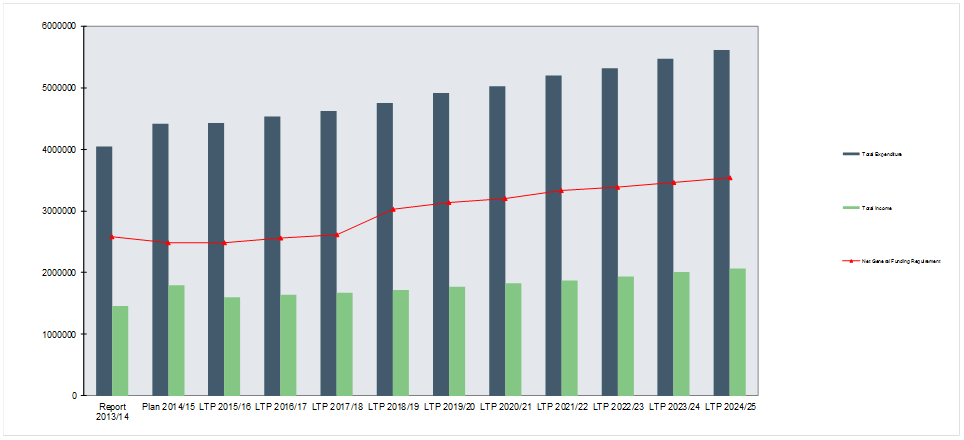

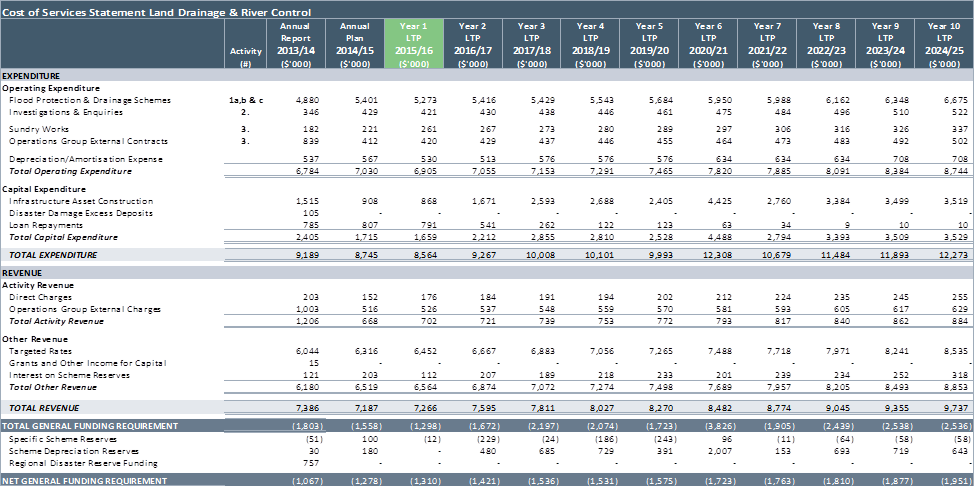

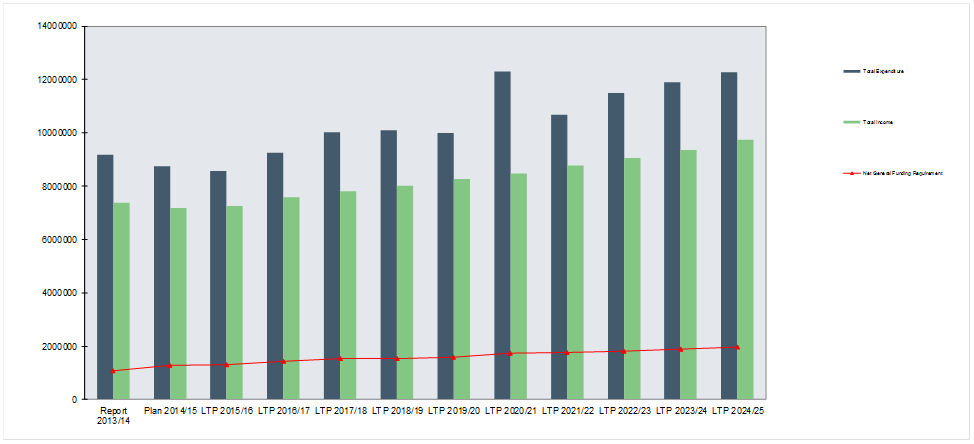

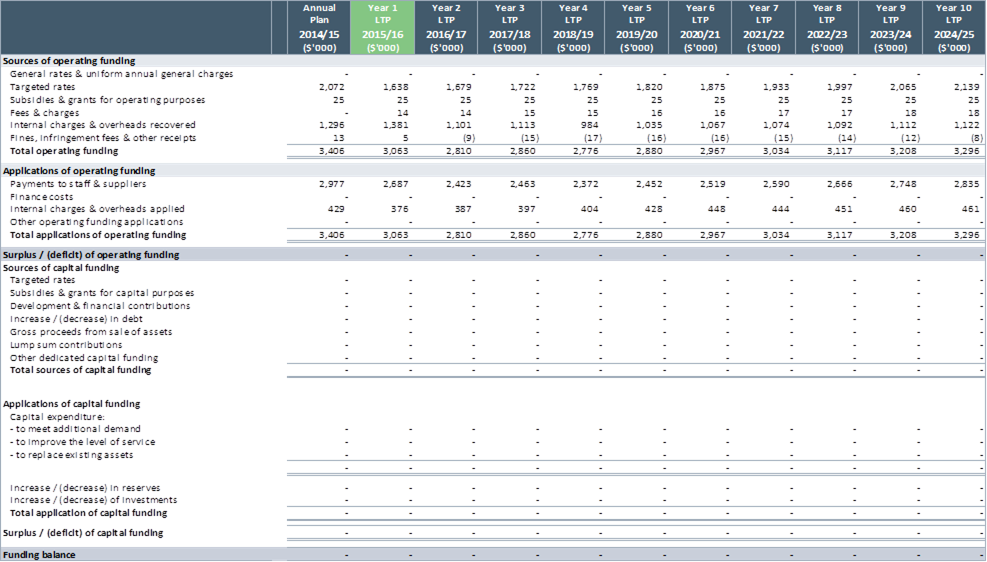

Net Funding Requirement – Land Drainage & River

Control

|

HBRC's

Activities

|

Attachment 3

|

Activity 1a,b,c – Flood Protection and Drainage Schemes

Significant Issues

- The

predicted impact of climate change is that Hawke’s Bay will become dryer

but with the potential for increased storminess. Severe storms are

predicted to bring greater rainfall which will result in increased flood

flows. Sea level rise will also have an impact

in the vicinity of the coast. These changes will result in increased

flood risk. HBRC will review all flood control and drainage

Schemes over time and investigate options for mitigating this impact.

- In

addition to climate change, the value of improvements on flood protected land

has increased significantly since construction of flood protection and drainage

schemes. The need for an increased level of service (ie protection) will be

explored as part of the programme of Scheme reviews.

- The

sustainable management of sediment within river systems is vital to the

scheme’s integrity, but there may be adverse impacts on river and coastal

areas. Research is underway to better understand the impacts of river sediment

management on sediment supplies; findings from this research may result in

changes to the way rivers are managed.

- The

Local Government Act 2002 requires that major flood protection and control

works are maintained, repaired, and renewed to the key standards defined in the

local authority’s relevant asset management plan and long term

plan. Performance targets for all Schemes in this Long term plan are

consistent with their respective asset management plans.

Rationale

Land drainage and river

control reduces the likelihood of damage from flooding on people and property.

The Heretaunga Plains and

Upper Tukituki Flood Control Schemes, as well as 14 other smaller schemes,

protect Hawke’s Bay communities from frequent flooding, allowing

landowners to optimise the productivity of their land.

HBRC carries out this role

under its legislative mandate and responsibility. It has the necessary skills,

historical understanding and regional overview required to integrate and manage

all land drainage and river control elements that make up the schemes.

Significant

Negative Effects

The construction of flood

protection and drainage systems has resulted in significant changes to the

natural hydrology of their associated catchments. These changes have

included a reduction in areas frequently flooded, diversion and straightening

of waterway reaches, removal of streamside vegetation, and the use of

structures to control flows and erosion.

These changes and the

ongoing methods used to maintain the schemes have resulted in adverse effects

on river and stream ecology and habitats, as well as affecting the social and

cultural values of the waterways. HBRC has initiated an enhancement programme,

including alternative management of riparian areas, which will promote

improvements in water quality and aquatic and terrestrial habitats.

|

HBRC's

Activities

|

Attachment 3

|

1a

– Heretaunga Plains Scheme

Contributing projects include: 286

Rivers Maintenance, 287 Rivers - Capital Projects, 288 Rivers - Special

Projects, 289 Sawfly Remediation loan repayments, 290 Maintenance of Drainage

& Pumping Assets, 291 Napier/Meeanee/Puketapu, 292 Brookfields/Awatoto, 293

Pakowhai, 294 Muddy Creek, 295 Haumoana, 296 Karamu, 297 Raupare/Twyford,

298 Tutaekuri/Moteo, 299 Puninga

|

Service Levels and Performance Targets

Activity 1a – Flood Protection

& Drainage Schemes: Heretaunga Plains Scheme

|

|

Level

of Service Statement

|

Level

of Service Measure

|

Current

Performance

|

Performance Targets

2015-18 in detail; 2019-25 outline

|

Required

Actions to Achieve

Performance

Targets

|

|

HBRC

will maintain an effective flood control network that provides protection

from frequent river flooding to communities and productive land within the

Heretaunga Plains Scheme.

All

flood protection and river control works associated with the Scheme shall be

maintained, repaired and renewed to the standards defined in the Scheme Asset

Management Plan.

The

level of protection in technical terms is to convey a flood discharge with a

1% probability of being exceeded in any one year (1%AEP) safely to the sea

progressively increasing to 0.2% AEP over the next 20 years

|

Communities

and productive land experience no flooding from rivers up to the design level

of protection

Work

planned through an annual programme of works is completed each year.

|

No land flooded

from the rivers within scheme areas

Modelling indicates

that the current flood control assets are capable of conveying a design flood

event

The

annual programme of works is completed, except where changes are made as a

result of flood damage or other unforeseen events

|

Ongoing

Prepare an annual programme of works prior

to the commencement of each financial year. Complete the annual

programme of work.

2015-18

Complete detailed design philosophy and

priorities for improved level of service

2016-25

Progress

implementation of improved levels of service in accordance with work

programme

|

Ongoing

Prepare

an annual maintenance schedule prior to the commencement of each financial

year.

Maintenance and

gravel extraction to maintain the channel capacity and integrity of the flood

protection assets

Monitoring of flood

events in accordance with the Flood Manual

Sawfly damage monitoring and

alternative species planting

Annual asset audit

by a chartered professional engineer, and full assessment of each of the

major rivers every 12 years

|

|

The

level of service will be reported as kilometres and percentage of floodway

that provide the design level of service

|

Audits

in past year indicate the following levels of service:

Tutaekuri 100% (23.6km

of river channel)

Ngaruroro 100%

(39km of river channel)

Lower Tukituki 100% (10.2km of river

channel)

|

2015-25

Tutaekuri, Ngaruroro & Lower Tukituki

Audits: No change

|

|

HBRC

will maintain an effective drainage network that provides drainage outlet for

rainfall runoff of 32mm in 24 hours from smaller watercourses to communities

and productive land within the Heretaunga Plains Scheme

|

Frequent

out of channel flooding lasting more than 24 hours does not occur for the

design rainfall runoff and lesser events.

|

The

drainage network coped with the design runoff with no flooding.

|

2015-21

Complete reviews of the level of service

provided within the nine scheme areas covering the drainage network across

the Heretaunga Plains and determine new level of service measures and

targets.

2019-onwards

Implement

outcome of reviews.

|

2015-18

Commence review of individual catchment

areas and complete at least 3 per year.

Ongoing

Monitoring,

operation and maintenance of the drainage network.

Annual asset audit by a chartered

professional engineer

|

|

HBRC

will protect and enhance the scheme’s riparian land and associated

waterways administered by the Regional Council for public enjoyment and

increased biodiversity

|

Stream

Ecological Valuations.

Ecological

Enhancement Plans

|

Stream ecological valuations (SEV) have

been completed for Napier urban streams. Hastings urban streams are in

progress

River ecological management plans completed

for the Ngaruroro River, practically complete for the Tutaekuri River and

begun on the Tukituki River

|

2017-18

Stream

Ecological Valuations show no decline and/or show an increase in ecological

function of urban streams

Rolling review

On the rivers, increased native planting as

measured six yearly based on the River Ecological Enhancement Plans

|

2015-18

Complete the Hastings urban streams SEV.

Complete River Ecological Management and Enhancement Plans (EMEP) for

enhancement of ecological values for the Scheme rivers

Ongoing

- Continue riparian

planting and waterway enhancement

- Implement an annual

enhancement programme from the EMEP.

- Re-evaluate EMEP

every 6 years to confirm implementation approach

|

1b – Upper

Tukituki Scheme

Contributing projects include: 265

Upper Tukituki Scheme

|

Service Levels and Performance Targets

Activity 1b – Flood Protection

& Drainage Schemes: Upper Tukituki Scheme

|

|

Level

of Service Statement

|

Level of Service Measure

|

Current Performance

|

Performance

Targets

2015-18 in detail; 2019-25 outline

|

Required Actions to Achieve

Performance

Targets

|

|

HBRC

will maintain an effective flood control network that provides protection

from frequent river flooding to communities and productive land within the

Upper Tukituki Scheme area.

All

flood protection and river control works associated with the Scheme shall be

maintained, repaired and renewed to the standards defined in the Scheme Asset

Management Plan.

The

level of protection in technical terms is to convey a flood discharge with a

1% probability of being exceeded in any one year (1%AEP) safely to the sea.

|

Communities

and productive land experience no flooding from rivers up to the design level

of protection

Rates

fairly reflect the degree of benefit received by the flood protection

provided.

Work

planned through an annual programme of works is completed each year.

The

level of service will be reported as kilometres and percentage of floodway

that provide the design level of service

|

Flooding was

experienced in Onga Onga from a flood greater than the design flood in

November 2013

River bed levels are rising as a result of

reduced gravel extraction. This is resulting in more frequent flooding

on some land and elevated ground water levels in some areas

Ratepayers have advised that they do not

believe that the method of allocation of targeted rates for Scheme works is

fair

The annual programme of works is completed,

except where changes are made as a result of flood damage or other unforeseen

events

|

2015-16

Complete review of

river bed gravel resource (ref gravel management) and identify most cost

effective approach to sustainable gravel management within scheme area

2015-18

Complete a review

of the method of allocating to ratepayers the cost of maintaining and

improving the flood protection scheme

Ongoing

Prepare an annual programme of works prior

to the commencement of each financial year. Complete the annual

programme of work.

|

2015-16

Complete a review

of the rate allocation system and implement a new system if the existing one

is deemed to be unfair

Ongoing

Prepare

an annual maintenance schedule prior to the commencement of each financial

year.

Continue

maintenance and gravel extraction to maintain the channel capacity and

integrity of the flood protection assets

Monitoring of flood

events in accordance with the Flood Manual

Annual asset audit

by a chartered professional engineer, and full assessment of each of the

major rivers every 12 years

|

|

|

Past

audits indicate levels of service of:

Upper Tukituki

34.4km, 95%

Waipawa 26.5km, 95%

|

2019-25

Review

the level of protection provided by the Scheme (including allowing for the

impacts of climate change) and develop a long term improvement plan to

implement outcomes from the review

|

|

HBRC

will protect and enhance the scheme’s riparian land and associated

waterways administered by the Regional Council for public enjoyment and

increased biodiversity

|

Ecological

Management and Enhancement Plans

|

The

development of a River

Ecological Management and Enhancement Plans (EMEP) has commenced for

the Tukituki River

|

2015-18

- Complete Rivers Ecological Management and Enhancement

Plans for enhancement of ecological values for the Scheme rivers

- On the rivers increased native planting as

measured six yearly based on the river Ecological Management and Enhancement

Plans (EMEP)

|

Ongoing

- Continue riparian planting

and waterway enhancement

- Implement annual programme from the EMEP

- Re-evaluate EMEP every 6 years to confirm

implementation approach

|

1c –

Other Schemes

Contributing projects include: 240

Makara Flood Control Scheme, 241 Paeroa Drainage Scheme, 242 Porangahau Flood

Control Scheme, 243 Poukawa Drainage Scheme, 244 Ohuia – Whakaki Drainage

Scheme, 245 Esk River Control Scheme, 246 Whirinaki Drainage Scheme, 247

Maraetotara River Control Scheme, 248 Te Ngarue River Control Scheme, 249

Kopuawhara River Control Scheme, 276 Kairakau Community Scheme, 277 Wairoa

Rivers & Streams Scheme, 278 Central & Southern Area Rivers &

Streams Scheme

|

Service Levels and Performance Targets

Activity 1c – Flood Protection

& Drainage Schemes: Other Schemes

|

|

Level of Service Statement

|

Level of Service Measure

|

Current Performance

|

Performance

Targets

2015-18 in detail; 2019-25 outline

|

Required Actions to Achieve

Performance

Targets

|

|

HBRC

will maintain an effective flood control and drainage network that provides

protection from frequent flooding to communities and productive land within

designated Scheme areas, including:

Makara Flood

Control

Paeroa Drainage

Porangahau Flood

Control

Ohuia –

Whakaki Drainage

Esk River

Whirinaki Drainage

Maraetotara

Te Ngarue

Kopuawhara Flood

Control

Poukawa Drainage

Kairakau

Waimarama

(proposed)

|

A

full assessment of the capacity and integrity of flood control works is

completed every 12 years by a chartered professional engineer with interim

audits undertaken annually

The

level of service will be reported as percentage of assets that provide the

design level of service

|

Estimated

at 95% for all Schemes other than Waimarama. No Scheme currently in place for

Waimarama

|

2015-18

Waimarama Flood Protection Scheme accepted

by community and operation phase begun

Develop a programme of Scheme reviews and

commence review process with at least 2 Schemes

Ongoing

Continue with review process and quantify

level of service provided by Schemes where this in unknown

|

Ongoing

Maintenance to

preserve channel capacity and integrity of flood protection and drainage

assets

Monitoring of flood

events in accordance with the Flood Manual

Complete annual

asset audit by a chartered professional engineer of selected areas of

Schemes, and a full assessment of each of the scheme areas every 12 years

2015-18

Consult with

Waimarama community regarding the possibility of establishing a flood control

scheme to fund improved management of the waterways and flood channels

flowing through the community

|

|

HBRC's

Activities

|

Attachment 3

|

Activity 2 – Investigations and Enquiries

Significant Issues

- The

assessment of flood risk requires expert judgement and understanding of

hydrology and hydraulics. Simplifying flood risk information for easy

communication is difficult.

- River

engineering expertise and experience is difficult to find on the employment

market. An arrangement to provide river engineering advice to Gisborne

District Council helps HBRC to recruit more full-time engineers with relevant

knowledge and skills

Rationale

HBRC responds to many

enquiries about coastal erosion, flood risk and drainage related issues.

Depending on the issue, HBRC is able to help through:

- Provision

of flooding and drainage advice

- Provision

of advice relating to riverbed land and other HBRC administered land

- Provision

of advice on coastal erosion and flood risk

- Technical

and financial assistance for approved ‘public good’ projects

- A

consultancy service that is fully cost recoverable.

In addition, HBRC provides

consultancy services to other councils. It currently has an agreement to

provide one full time equivalent of engineering input to Gisborne District

Council. HBRC does this because it has the skills, historical understanding and

regional overview required to understand and provide advice on these issues.

Significant

Negative Effects

There are no significant

negative effects arising from the delivery of these activities.

Contributing projects include: 250

Investigations & Enquiries, 251 Subsidised Investigations & Minor

Projects, 255 Consultancy Services

|

HBRC's

Activities

|

Attachment 3

|

|

Service Levels and Performance Targets

Activity 2 –Investigations and

Enquiries

|

|

Level of Service Statement

|

Level of Service Measure

|

Current Performance

|

Performance

Targets

2015-18 in detail; 2019-25 outline

|

Required Actions to Achieve

Performance

Targets

|

|

HBRC

staff will provide expert advice on drainage, flooding, and coastal erosion

issues.

|

All

queries are dealt with by appropriate qualified and experienced staff

|

HBRC

employs two chartered professional engineers with experience in flood

management, river control and coastal issues

|

Ongoing

HBRC

retains two chartered professional engineers with experience in flood

management, river control and coastal issues on staff

|

Ongoing

Manage and provide for succession of key

staff

Recruit graduates and promote of Local

Government careers to ensure staffing capacity for the future

|

|

HBRC will provide up to a 30% subsidy for river control

and flood protection where the criteria set out in the Regional

Council’s guidelines for technical and financial assistance are met

|

Value of subsidies provided annually

|

Subsidies valued at $40,000

|

Ongoing

$40,000 plus inflation of subsidy money is

provided each year at a subsidy rate of 30%

|

Ongoing

Continue to promote

the HBRC subsidy programme

|

|

HBRC will provide a consultancy service for drainage,

flooding, and coastal erosion issues according to individual project

agreements on a full cost recovery basis

|

- Cost

recovery

- Satisfaction

with Service

|

- Costs

are recovered

- Not

specifically measured

|

Ongoing

Full

costs of any consultancy work are recovered

Major

clients are satisfied with service provided

|

Ongoing

Effectively and

efficiently complete consultancy projects

|

|

HBRC's

Activities

|

Attachment 3

|

Activity 3 –Sundry Works

Significant

Issues

- Identifying

a sustainable, easily accessible and affordable source of material for coastal

erosion protection at Westshore Beach to continue.

- The

effects of climate change and rises in sea level on this works.

- The

impact of river mouths naturally closing and the effect of climate change and

rises in sea level on their frequency.

Rationale

Land Drainage and River

Control provides for protection of property at risk from erosion or flooding

by:

- Management

of river mouths to reduce unnecessary flooding

- Gravel

renourishment of Westshore Beach so that erosion is managed seaward of the 1986

erosion line.

Hawke’s Bay Regional

Council (HBRC) carries out this role because it has the necessary skills,

historical understanding and regional overview required to integrate and manage

all land drainage and river control elements that make up the schemes, and

balance conflicts between river users and flood protection requirements.

Significant

Negative Effects

There are no significant

negative effects arising from the delivery of these activities.

Contributing projects include: 261

River & Lagoon Opening, 264 Westshore Coastal Works

|

HBRC's

Activities

|

Attachment 3

|

|

Service Levels and Performance Targets

Activity 3–Sundry Works

|

|

Level of Service Statement

|

Level of Service Measure

|

Current Performance

|

Performance

Targets

2015-18 in detail; 2019-25 outline

|

Required Actions to Achieve

Performance

Targets

|

|

HBRC will ensure that the beach at Westshore has

erosion checked to 1986 erosion line

(The 1986 line was the extent of erosion

before beach renourishment began, and is identified on a series of posts

along the foreshore)

|

The comparison of annual beach cross section surveys to

the 1986 erosion

|

The erosion remains seaward of the 1986 line

The resource consent for extraction of gravel from

Pacific beach expires in 2017. A renewal of this consent will not be

sought

|

Ongoing

Erosion does not extend landward of the 1986 line by

more than 10% of the beach length in any 12 month period

2015-18

- An alternative source of gravel or

sand for renourishment will be sought

- The current approach to erosion

mitigation at Westshore will be reviewed as part of the Coastal Hazard

Management Strategy

|

Ongoing

Regular monitoring and renourishment is completed

annually

2015-18

Review to be completed. New source of

renourishment material to be found

|

|

HBRC will maintain river mouths so that they do not

flood private land above a specified contour subject to suitable river, sea

and weather conditions that will allow a safe and successful opening to be

made

|

Incidences of flooding of private land above levels as

specified in the River Opening Protocol

|

No incidences. Some properties in Te Awanga at

risk of flooding in moderate events

|

Ongoing

Private land above a specified contour is not flooded

as a result of a river mouth being closed

|

Ongoing

River mouths and lagoon outlets are inspected regularly

and opened when required, and when river, sea and weather conditions allow

|

|

HBRC's

Activities

|

Attachment 3

|

Introduction

Regional Resources addresses

the region’s public shared resources (air, water, coast, gravel), its

land resource (in private ownership) and Hawke’s Bay Regional Council

(HBRC) owned property managed as a regional resource.

In relation to public shared

resources, these activities include the gathering of information about them to

improve their sustainable management, and efficient use.

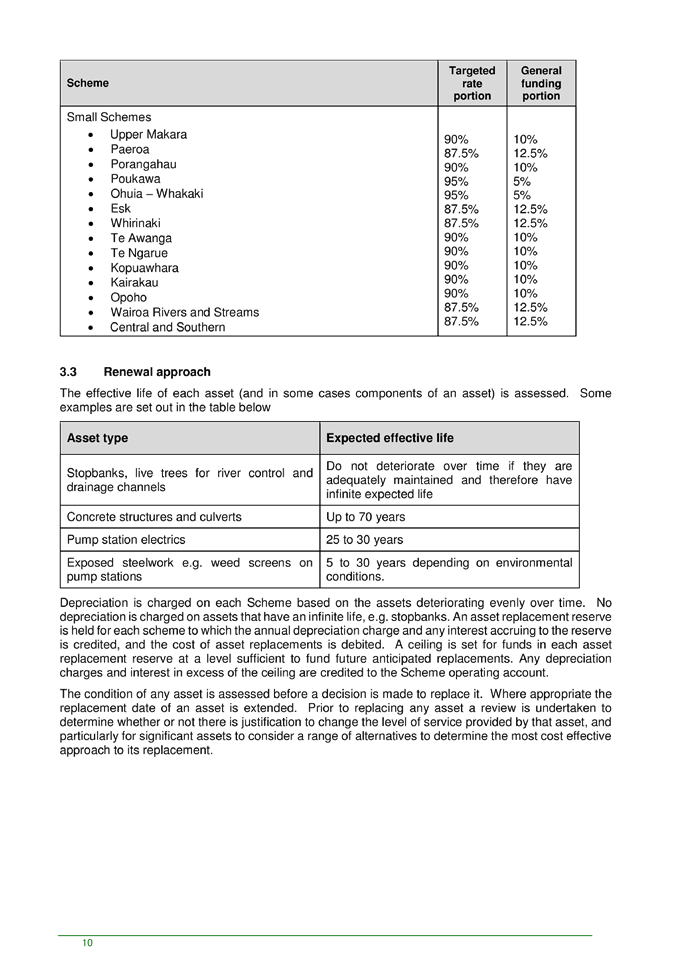

In relation to the land

resource, HBRC promotes sustainable land management and enhanced economic and

environmental performance. HBRC also leverages government funding to support

these initiatives.

In relation to Council-owned

land, all activities aim to improve public access to these areas.

Link to

Strategic Outcomes

This group of activities

contributes to Council’s strategic outcomes in the following ways.

Resilient

Communities

- Quality

services for a healthy, connected community - by providing access to the

coast, open space and safe off road pathways/cycleway opportunities for

recreational enjoyment, protecting sites of cultural significance within open

space areas and, where appropriate, identifying and valuing them for public

education and interest, protecting the natural environment particularly fresh

and coastal swimming water quality, improving air quality and reducing

respiratory disease through the Heat Smart and home insulation programme.

- Local

leadership, strong relationships and affordable, well-considered solutions

– by enabling community-led water user groups to develop ways to

efficiently use the region’s water allocations, through actions such as

audited self management.

Resilient

Ecosystems

Active management linking

biodiversity, land, freshwater and our coastal marine areas

–by understanding that the region’s natural and physical resources

are being managed to ensure they are used efficiently and sustainably;

identifying and promoting sustainable land management practices; improving air

quality; sustainably managing rivers, coast and the gravel resource; and

providing opportunities for access to open space areas.

Resilient

Economy

Profitable farming systems

that can adapt to greater weather extremes, pest threats and take advantage of

new opportunities – by working closely

on-farm with the regions land holders to understand their needs, working with

the primary sector in joint research and extension initiatives and facilitating

collaborative approaches to adaptive governance and management that consider

holistically the impact of decision making in the landscape on social,

cultural, environmental and economic objectives, for example as proposed in the

East Coast Hill Country Resilience Proposal.

Assumptions

and Future Demand Incorporated in this Plan

The

planning assumptions for the following activities are:

- Science

investigations will not be delayed as a result of unsuitable climatic

conditions.

- Funding

policies for water management reflect more targeted cost recovery, improving

the alignment of costs to those who benefit.

- The

funding policies applied to most of these activities will remain constant over

the life of the plan. However new funding sources will be evaluated and

utilised, as appropriate, for resource investigations and monitoring relating

to land, air and the coast.

- HBRC

will continue to own and manage Tutira Country Park, Pakowhai Country Park, and

Pekapeka Wetland. HBRC will also continue to manage the Tangoio Soil

Conservation Reserve and operate the Soil Conservation Nursery.

- Open

Space projects that have been approved by the Council (and therefore comply

with HBRC’s Open Space Policy and Evaluation criteria) are to be financed

through loan funding of up to $7.5 million. The servicing of any drawdown against

this loan will be funded from the Council’s Sale of Land (non investment)

Reserve.

Significant

Negative Effects

There are no significant

negative impacts relating to the collection of information about regional

resources, unless the information raises more questions than answers and

results in delays in decision-making.

In relation to sustainable

land management, the Ministry for Primary Industries also has a role to meet

New Zealand’s Kyoto Protocol obligations. Therefore there is a risk of

landowners being confused by having two agencies engaging with them on the same

issue. It is important that HBRC and MAF work together to avoid duplication.

|

HBRC's

Activities

|

Attachment 3

|

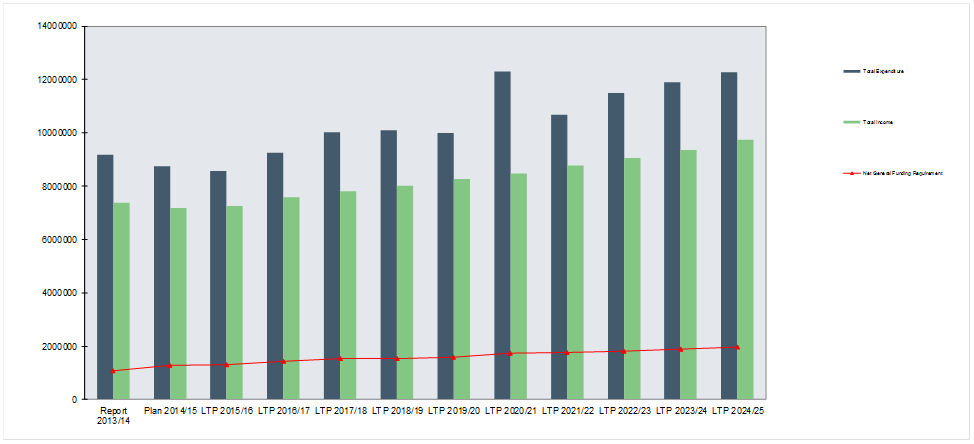

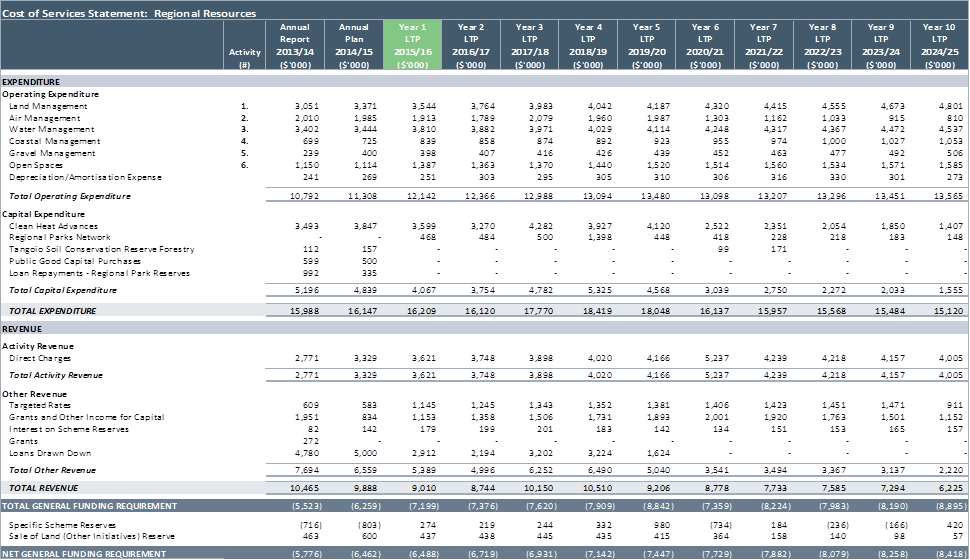

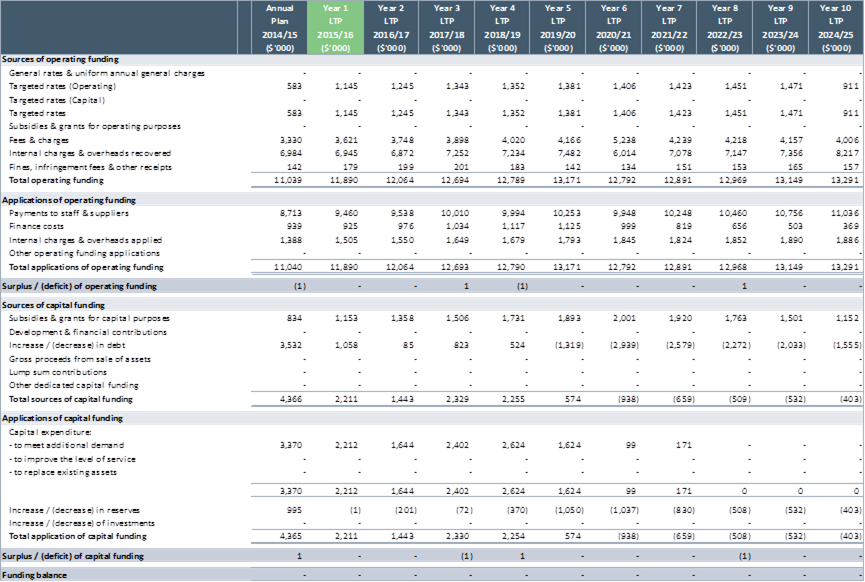

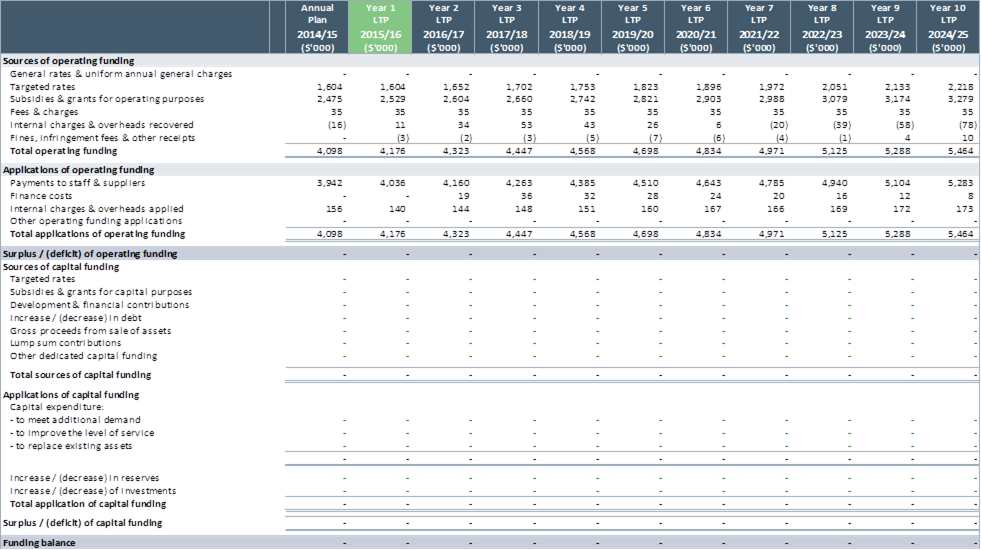

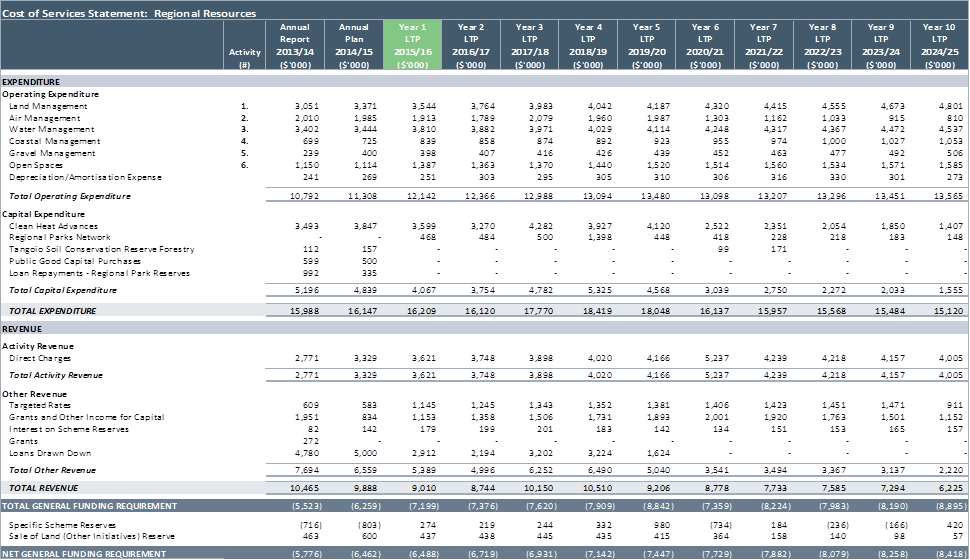

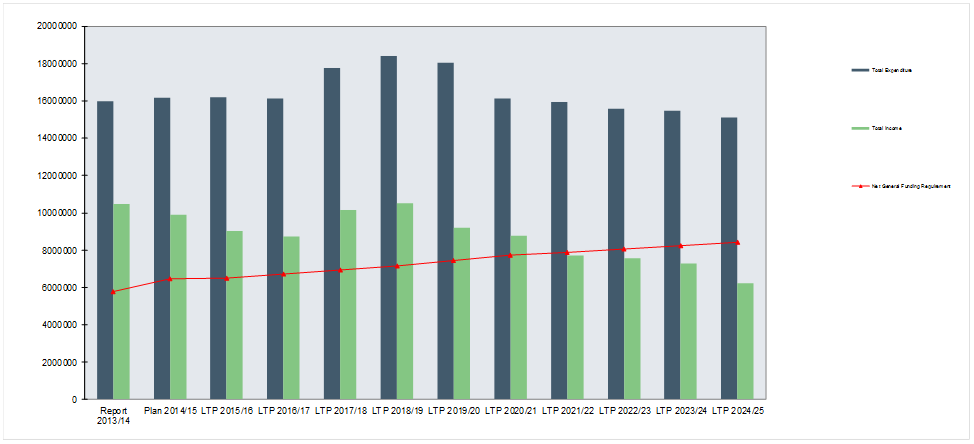

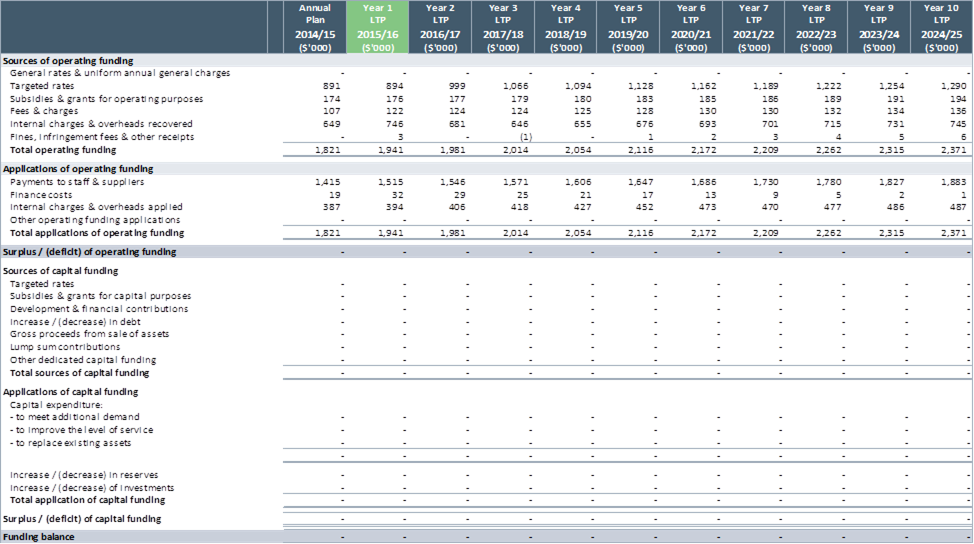

Net Funding Requirement – Regional Resources

|

HBRC's

Activities

|

Attachment 3

|

Activity 1 – Land Management

Significant

Issues

- 64%

(about 900,000 ha) of the region’s rural land is classed as erodible to

highly erodible hill country; of that about 150,000 ha is in land use that is

likely to exceed the sustainable capacity of the soil.

- Climate

change is predicted to result in more intensive rain events and increased

temperatures, leading to increased risk of erosion and droughts.

- There

is a trend toward more intensive land uses that rely on increasing inputs of

water, energy and fertilisers. Without the use of good farming practices,

this intensification could lead to the degradation of soil quality, soil

quantity, water quality, and terrestrial and aquatic ecosystems.

- High

quality soils are a limited resource in Hawke’s Bay and represent one of

our most vital natural assets. Preserving both the availability and quality of

these soils into the future is critical to our primary sector based provincial

economy.

- Our

regions biodiversity is critical to a resilient landscape. In order to

make productive use of the land 75% of the regions indigenous vegetation has

been cleared and only 2% of our original wetlands remain. A bio-diverse

ecosystem plays a critical role in the provision of ecosystems services and

what remains of our taonga requires our considered support and management.

Background

Our landscape provides a

range of ecosystem services that benefit everyone including, storing water that

helps mitigate flooding, the decomposition of wastes and pollutants, the

filtering and cycling of nutrients, the provision of food, fuel and fibre, the