Meeting of the Corporate and Strategic Committee

Date: Wednesday 11 February 2015

Time: 9.00 am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict

of Interest Declarations

3. Confirmation of

Minutes of the Corporate and Strategic Committee held on 12 November 2014

4. Matters Arising

from Minutes of the Corporate and Strategic Committee held on 12 November 2014

5. Follow-ups from

Previous Corporate and Strategic Committee meetings 3

6. Call for any Minor

Items not on the Agenda 7

Decision Items

7. Establishment of

an Audit and Risk Committee 9

Information or Performance Monitoring

8. February 2015

Public Transport Update 17

9. Cranford

Foundation

10. HB Tourism Quarterly Update

Report 21

11. Business Hawke's Bay Six

Monthly Update 33

12. Minor Items not on the Agenda 35

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 11 February 2015

SUBJECT: Follow-ups from Previous Corporate

and Strategic Committee meetings

Reason for Report

1. In order to track items raised at previous meetings that require

follow-up, a list of outstanding items is prepared for each meeting. All

follow-up items indicate who is responsible for each, when it is expected to be

completed and a brief status comment. Once the items have been completed and

reported to the Committee they will be removed from the list.

Decision

Making Process

2. Council is required to make a decision in

accordance with Part 6 Sub-Part 1, of the Local Government Act 2002 (the Act).

Staff have assessed the requirements contained within this section of the Act

in relation to this item and have concluded that as this report is for

information only and no decision is required in terms of the Local Government

Act’s provisions, the decision making procedures set out in the Act do

not apply.

|

Recommendation

1. That the Committee receives the report “Follow-ups

from Previous Corporate and Strategic Committee Meetings”.

|

|

Liz Lambert

Chief Executive

|

|

Attachment/s

|

1

|

Follow-ups

from Previous Corporate & Strategic Committee Meetings

|

|

|

|

Follow-ups

from Previous Corporate & Strategic Committee Meetings

|

Attachment 1

|

Follow-ups

from Corporate and Strategic Committee Meetings

12 November 2014

|

|

Agenda Item

|

Follow-up / Request

|

Person Responsible

|

Status Comment

|

|

1

|

Follow-ups from

previous meetings

|

Follow-up re HPUDs

Implementation Committee re-activation

|

L Lambert/ H Codlin

|

|

|

2

|

Big 6 Feedback

|

Re-print full copies of

comments received and summary and distribute to Councillors

|

L Hooper

|

Distributed November

2014

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 11 February 2015

Subject: Call for any Minor

Items not on the Agenda

Reason

for Report

1. Under standing orders, SO 3.7.6:

“Where an item is not on the agenda

for a meeting,

(a) That item may be discussed

at that meeting if:

(i) that

item is a minor matter relating to the general business of the local authority;

and

(ii) the

presiding member explains at the beginning of the meeting, at a time when it is

open to the public, that the item will be discussed at the meeting; but

(b) No

resolution, decision, or recommendation may be made in respect of that item

except to refer that item to a subsequent meeting of the local authority for

further discussion.”

2. The Chairman will request any items Councillors

wish to be added for discussion at today’s meeting and these will be duly

noted, if accepted by the Chairman, for discussion as Agenda Item 12.

Recommendations

That the Corporate and Strategic Committee accepts the following

minor items not on the agenda, for discussion as Item 12:

-

|

Leeanne Hooper

GOVERNANCE & CORPORATE

ADMINISTRATION MANAGER

|

Liz Lambert

CHIEF EXECUTIVE

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 11 February 2015

Subject: Establishment of an

Audit and Risk Committee

Reason for Report

1. The purpose of

this report is to bring to Council options for consideration around the

Committee structure for the remainder of this term of Council, based on

previous discussions covering the establishment of an Audit and Risk Committee

(and how this would impact on the terms of references for existing committees).

Audit and Risk Committee

2. The Local Government

Act 2002 (LGA) requires a local authority to manage its revenues, expenses,

assets, liabilities, investments, and general financial dealings prudently and

in a manner that promotes the current and future interests of its community.

3. The role of elected

members is to set direction and context within which the administration can

operate, to exercise stewardship of the community’s assets for today and

in to the future, and to manage risk, promote transparency and strengthen

accountability.

4. In all actions

undertaken by local government to achieve its outcomes there are risks, either

financial or non-financial, or both. These risks must be identified, mitigated

and then managed. This is the role of Council’s management and occurs

through a range of processes developed over the years.

5. The role of

Council’s governance is to gain an assurance that there is a robust

process to manage risks appropriately. There is currently no comprehensive

mechanism in place at HBRC for governance to achieve that assurance. While

financial and non-financial reports are presented regularly to Council, and

statutory financial planning documents are verified by Audit New Zealand,

improvements can be made to processes to assure councillors that risks have

been identified and where possible have been mitigated.

6. It is

recommended that an audit and risk committee is the ideal structure to achieve

this.

Areas of focus for an audit and risk committee

7. A local

authority Audit and Risk Committee has four key areas of focus.

7.1. Financial

reporting, including:

7.1.1. Appropriateness

of accounting policies;

7.1.2. Annual

report.

7.2. Risk

management and the system of internal controls such as:

7.2.1. Managing

within the Council’s identified approach to risk

7.2.2. Understanding

the key risk areas including likelihood and consequences

7.2.3. Effectiveness

of internal controls

7.2.4. Fraud risk

and procurement risk.

7.3. External

Audit, including:

7.3.1. Relationship

with auditor

7.3.2. Understanding

scope and engagement

7.3.3. Review

significant audit findings/recommendations

7.3.4. Monitor

progress on recommendations.

7.4. Internal

audit, including:

7.4.1. Appointment

and relationship with internal auditor

7.4.2. Scope of

work

7.4.3. Responses

to internal audit recommendations.

Roles and responsibilities of an Audit and Risk Committee

8. Matters that

could be considered as part of the terms of reference for an Audit and Risk

Committee include:

8.1. Satisfying

itself about the existence and quality of cost-effective internal control and

risk management systems, and the proper application of processes

8.2. Monitoring

the Council’s external and internal audit process

8.3. Engaging with

the Council’s external auditors regarding the external audit work

programme and agreeing the terms and arrangements of the external audit

8.4. Monitoring

management responses to audit reports and the extent to which external audit

recommendations concerning internal audit controls and other matters are

implemented

8.5. Reviewing the

effectiveness of the risk assessment/management policies and processes

8.6. Monitoring

the delivery of the internal audit work programme

8.7. Review

components of the Long Term Plan that relate to risk (e.g. financial

assumptions, key financial policies).

Committee membership

9. The Audit and

Risk Committee is advisory-oriented, with particular emphasis to be placed on

performance management and associated risk management disciplines.

10. In many examples of Audit

and Risk committees throughout New Zealand external appointees are included on

the committees as they bring an independent view, together with other

experiences that may not be available from elected members. Such experiences

could, for example, include financial reporting knowledge, familiarity with

risk management disciplines, or the ability to explain technical matters in

their field to other committee members.

Formal establishment of an Audit and Risk Committee

11. If Council agrees that an

Audit and Risk Committee is a prudent next step to providing a formal mechanism

for ensuring effective financial and risk management controls are in place,

then a terms of Reference for the committee is required to be adopted.

12. Matters for consideration

in the Terms of Reference include:

12.1. Specific responsibilities

12.2. Membership of the committee

(including potential for external appointees).

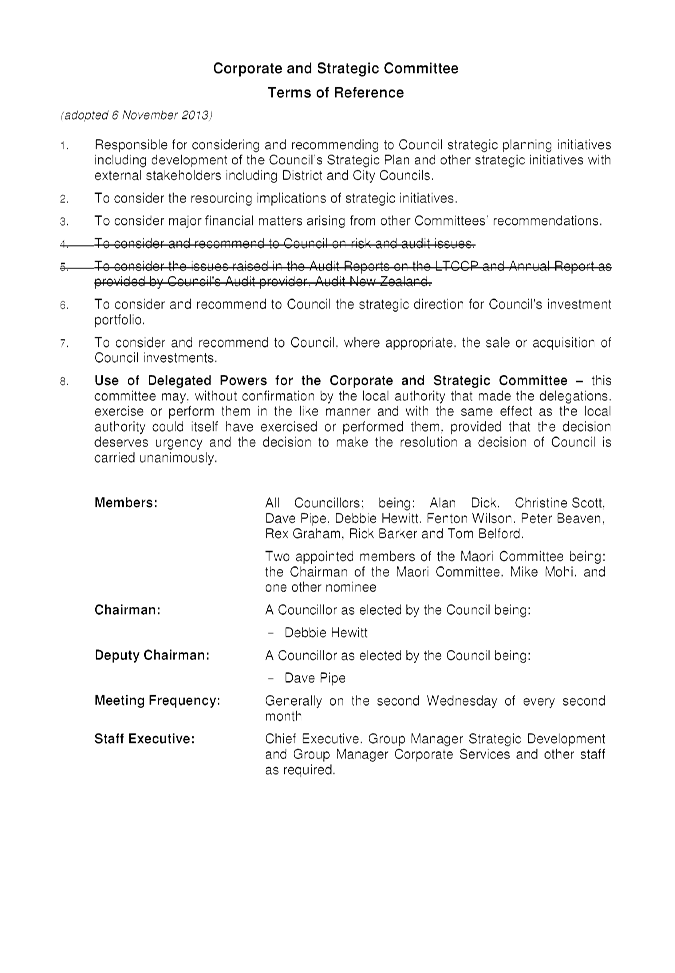

13. A draft Terms of Reference

is attached to this item for discussion. (Attachment 1). Consequential

amendments to the Terms of Reference for

the Corporate and Strategic Committee are also attached. (Attachment 2).

Decision Making Process

14. Council

is required to make a decision in accordance with the requirements of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained in Part 6 Sub Part 1 of the Act in relation to this item and have

concluded the following:

14.1. The decision

does not significantly alter the service provision or affect a strategic asset.

14.2. The use of

the special consultative procedure is not prescribed by legislation.

14.3. The decision

does not fall within the definition of Council’s policy on significance.

14.4. The persons affected by this

decision are the ratepayers for the region and the wider tangata whenua

community.

14.5. Options that

have been considered include retaining the existing committee structure,

however it is considered that greater efficiencies and improved governance will

occur as a result of the recommended changes to the committee structure.

14.6. The decision

is not inconsistent with an existing policy or plan.

14.7. Given the

nature and significance of the issue to be considered and decided, and also the

persons likely to be affected by, or have an interest in the decisions made,

Council can exercise its discretion and make a decision without consulting

directly with the community or others having an interest in the

decision.

|

Recommendations

The Corporate

and Strategic Committee recommends that Council:

1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted policy on significance and that

Council can exercise its discretion under Sections 79(1)(a) and 82(3) of the

Local Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

2. Makes the following changes to its committee structure:

2.1. Establishes an Audit and Risk Committee, and adopts the Terms of

Reference as amended at the Corporate and Strategic Committee, with the

appointees to be determined at the March Council meeting.

2.2. Amends the Terms of Reference for the Corporate and Strategic

Committee to delete the functions that will be carried out by the new Audit

and Risk Committee.

|

|

Liz Lambert

Chief Executive

|

|

Attachment/s

|

1

|

Draft Terms

of Reference Audit and Risk Committee

|

|

|

|

2

|

Proposed

Amendments to Corporate and Strategic Committee Terms of Reference

|

|

|

|

Draft

Terms of Reference Audit and Risk Committee

|

Attachment 1

|

Audit and Risk Committee

Terms of Reference

Draft for discussion 11 February 2015

a) Purpose

The purpose of the Audit and Risk

Committee is to assist the Council to fulfil its responsibilities for:

1. The

robustness of risk management systems, processes and practices;

2. The

provision of appropriate controls to safeguard the Council’s financial

and non-financial assets, the integrity of internal and external reporting and

accountability arrangement

3. The

independence and adequacy of internal and external audit functions

4. Compliance

with applicable laws, regulations, standards and best practice guidelines.

b) Specific

Responsibilities

The

Audit and Risk Committee shall have responsibility and authority to:

· Consider the

appropriateness of the Council’s existing accounting policies and

principles and any proposed changes;

· Enquire of

internal and external auditors for any information that affects the quality and

clarity of the Council’s financial statements and statements of service

performance, and assess whether appropriate action has been taken by management

in response to this;

· Satisfy itself

that the financial statements and statements of service performance are

supported by adequate management signoff and adequate internal controls and

recommend adoption of the Annual Report by Council;

· Confirm that

processes are in place to ensure that financial information included in

Council’s Annual Report is consistent with the signed financial

statements;

· Review whether

Council management has in place a current and comprehensive risk management

framework and associated procedures for effective identification and management

of the council’s significant risks;

· Undertake periodic

monitoring of corporate risk assessment, and the internal controls instituted

in response to such risks;

· Confirm the terms

of appointment and engagement of external auditors, including the nature and

scope of the audit, timetable, and fees;

· Receive the

external audit report(s) and review action to be taken by management on

significant issues and audit recommendations raised within the report(s);

· Conduct a

committee members-only session with external audit to discuss any matters that

the auditors wish to bring to the Committee’s attention and/or any issues

of independence;

· Review the

effectiveness of the system for monitoring the Council’s compliance with

laws (including governance legislation, regulations and associated government

policies), Council’s own standards, and best practice guidelines.

c) Membership

· Four members

of Council, being..... (to be determined at a subsequent meeting)

· An external appointee,

being…..(to be determined at a subsequent meeting)

d) Chairman

A member of the Committee as elected by

the Council, being….(to be determined at a subsequent meeting)

e) Meeting

Frequency

The Committee shall meet quarterly, or as

required

j) Quorum

The quorum at any meeting of the

Committee shall be not less than _____ members of the Committee.

k) Officers

Responsible

Chief

Executive

Group

Manager Corporate Services

|

Proposed Amendments to

Corporate and Strategic Committee Terms of Reference

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 11 February 2015

SUBJECT: February 2015 Public Transport Update

Reason

for Report

1. This agenda item provides the Committee with an update on

Council’s public transport operations.

General

Information

2. There were 3.5% fewer passenger trips in the first half of the

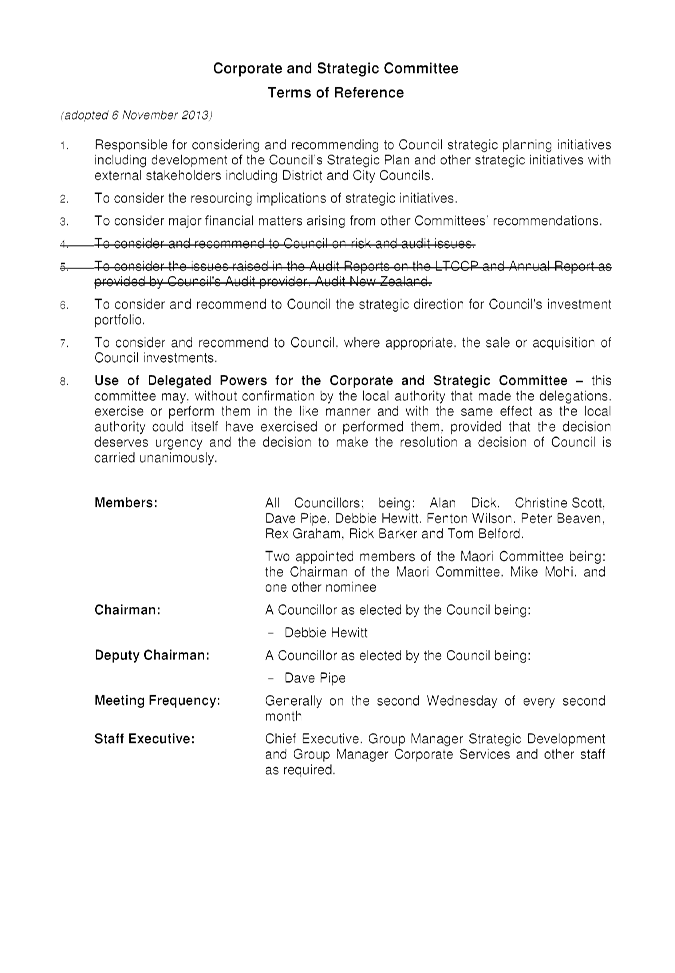

2014-15 year than the same period last year, with the most marked drop being

5770 trips in August, a 7% decline on the same month the previous year. While

especially wet weather probably contributed to the August decline, falling

petrol prices are thought to have been a contributing factor since then, with a

litre of 91 octane currently costing around $1.69 a litre, a fall of around 50

cents since October 2014.

Passenger Trips

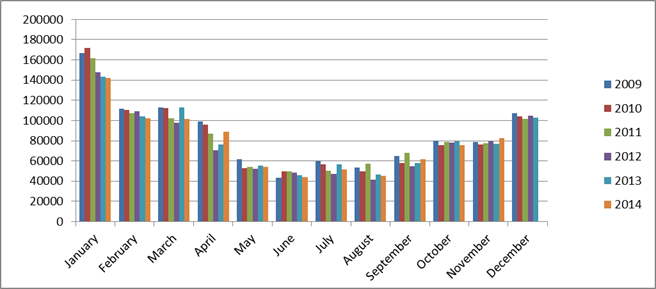

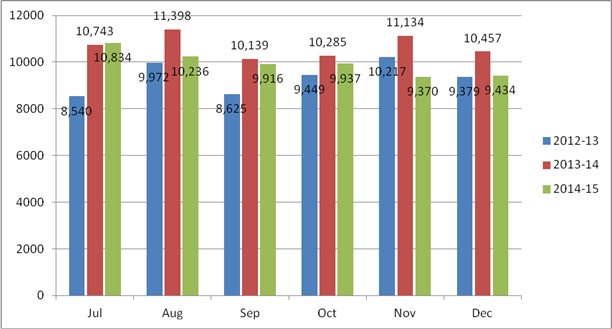

3. The graph below shows total passenger trips during the first six

months of 2012-13, 2013-14 and 2014-15.

Diagram 1 – Passenger Trips –

July to December – 2012-13, 2013-14, 2014-15

4. For the first time since 2009-10, the average monthly patronage has

decreased slightly, as shown in the table below.

Diagram 2 Annual Passenger Trips since 2009-10

|

Year

|

Total

Annual Trips

|

Monthly

Average

|

|

2009-10

|

480,244

|

40,020

|

|

2010-11

|

554,647

|

46,220

|

|

2011-12

|

681,566

|

56,797

|

|

2012-13

|

761,392

|

63,449

|

|

2013-14

|

799,845

|

66,653

|

|

2014-15

|

381,173

(YTD)

|

63,528

|

SuperGold Card Trips

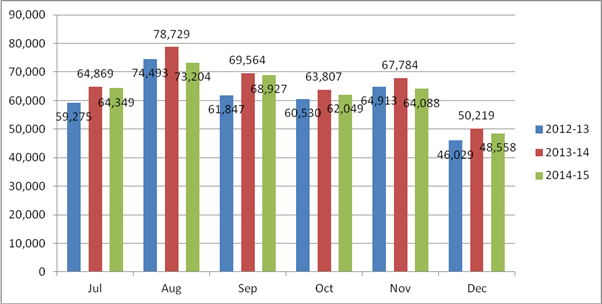

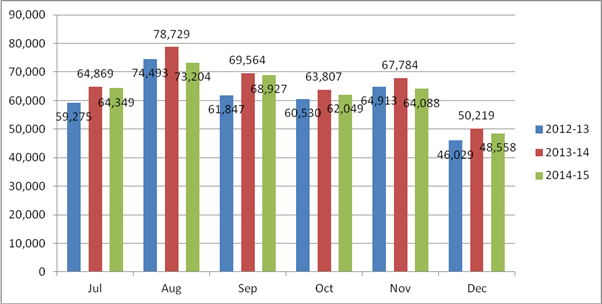

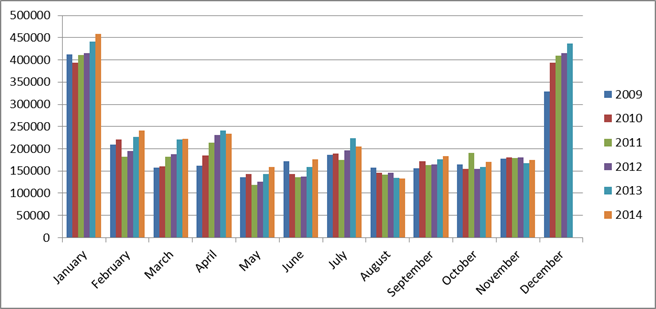

5. SuperGold Card trips are also slightly down for the year to

date, as seen in the graph below, which shows the number of SuperGold

cardholder trips made during the first six months of 2012-13, 2013-14 and

2014-15.

Diagram 3 – SuperGold Card Trips – July to December –

2012-13, 2013-14, 2014-15

Bus Stops

6. There has been no progress to date with regard to a programme for

formalising Napier bus stops.

Realtime Passenger Information

7. Investigations are currently underway for the introduction of ‘TrackABus’.

This is a NZ designed and supported low-cost, internet based, real-time

system, accessed through smartphone and desktop applications, which has in

other areas resulted in increased patronage of approx 5-10%.

8. The system works through the GPS facilities contained in modern

cellphones. It provides passengers with real time information about how far

away their next bus is, as well as having many benefits for operators and

regional councils. The system is much cheaper to install than conventional real

time systems which have displays at bus stops.

9. The service is in operation in Dunedin, Queenstown, Rotorua and

Gisborne. We are discussing the details of its application to the Hawke’s

Bay bus service with the company. Subject to a favourable outcome, we will seek

approval of the council to implement it here. The cost can be met from within

our existing bus contract budget.

Bikes on Buses

10. There

have been 1610 bikes carried on buses during the first six months of the

financial year, compared to 1615 during the same period last year.

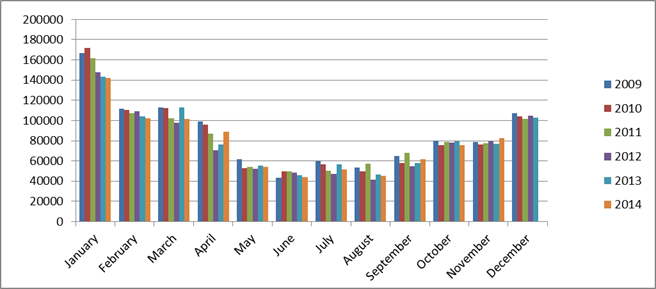

Bus Service Costs

11. The

following table shows the net cost (after fares and excluding GST) of operating

the goBay bus service during the first six months of 2012-13, 2013-14 and

2014-15. The costs include base contract costs plus two quarters’ cost

indexation, which accounts for the significant price fluctuations between

months.

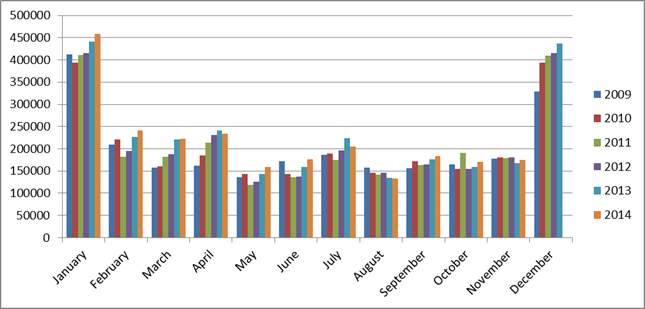

Diagram 4 – Net Cost of Bus Service – July to December

– 2012-13, 2013-14, 2014-15

|

Year

|

Jul

|

Aug

|

Sep

|

Oct

|

Nov

|

Dec

|

Total

|

|

2012-13

|

$224,406

|

$206,395

|

$217,298

|

$229,967

|

$218,084

|

$246,304

|

$1,342,454

|

|

2013-14

|

$186,170

|

$278,969

|

$182,220

|

$187,613

|

$302,615

|

$207,605

|

$1,345,192

|

|

2014-15

|

$168,720

|

$157,262

|

$264,227

|

$174,153

|

$141,819

|

$255,621

|

$1,161,802

|

(50% of this cost is

met by the New Zealand Transport Agency).

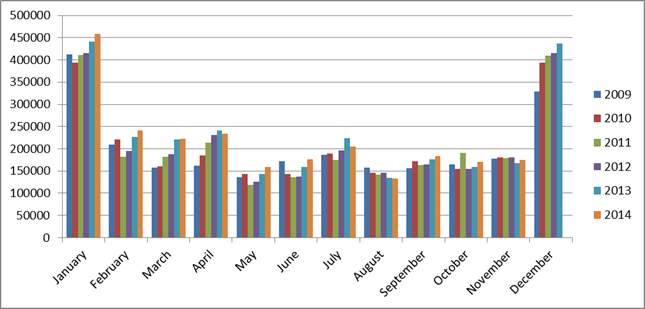

Total Mobility

12. The Total

Mobility Scheme, which is funded by regional council, local councils and the

NZTA, provides subsidised taxi transport for people who have a permanent

illness or disability which prevents them from using public transport.

13. The

following tables show the number of Total Mobility trips made during the first

six months of 2012-13, 2013-14 and 2014-15 and the corresponding cost (excl

GST).

Diagram 5 – Total Mobility Trips – July to December –

2012-13, 2013-14, 2014-15

|

Year

|

Jul

|

Aug

|

Sep

|

Oct

|

Nov

|

Dec

|

Total

|

|

2012-13

|

6,753

|

6,839

|

6,471

|

7,256

|

6,925

|

6,447

|

40,691

|

|

2013-14

|

7,401

|

6,804

|

6,611

|

7,658

|

7,365

|

7,185

|

43,024

|

|

2014-15

|

8,320

|

7,950

|

7,677

|

8,267

|

7,701

|

7,948

|

47,863

|

Diagram 6 – Total Mobility cost (excl GST) – July to

December – 2012-13, 2013-14, 2014-15

|

Year

|

July

|

Aug

|

Sep

|

Oct

|

Nov

|

Dec

|

Total

|

|

2012-13

|

$44,451

|

$44,877

|

$43,241

|

$46,216

|

$45,382

|

$39,880

|

$264,049

|

|

2013-14

|

$49,274

|

$46,153

|

$43,965

|

$50,189

|

$47,744

|

$46,968

|

$284,293

|

|

2014-15

|

$55,780

|

$53,489

|

$51,222

|

$54,492

|

$53,590

|

$49,973

|

$318,548

|

(60% of this cost is

met by the New Zealand Transport Agency).

Regional Public

Transport Plan

14. Submissions

on the Draft Regional Public Transport Plan 2015-25 closed on Friday

23 January, with 27 submissions received. Submissions will be heard on 13

February and a revised draft Plan will be considered by the Regional Transport

Committee on 6 March before the Plan goes to Council.

Decision

Making Process

15. Council is required to

make a decision in accordance with Part 6 Sub-Part 1, of the Local Government

Act 2002 (the Act). Staff have assessed the requirements contained within

this section of the Act in relation to this item and have concluded that, as

this report is for information only and no decision is to be made, the decision

making provisions of the Local Government Act 2002 do not apply.

|

Recommendation

1. That the Corporate and Strategic Committee

receives the February 2015 Public Transport Update report.

|

|

Megan Welsby

Sustainable Transport Coordinator

|

Anne Redgrave

Transport Manager

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 11 February 2015

Subject: HB Tourism Quarterly

Update Report

Reason for Report

1. The purpose of this paper is to provide Council with Hawke’s

Bay Tourism Limited (HBTL) results for the six months to 31 December 2014.

Background

2. At its meeting on 26 February 2014, Council resolved that

Hawke’s Bay Tourism funding be extended for a further year to 30 June

2015 at the current assistance level of $850,000 per annum, noting that the

timing of any revisions in funding levels and extension of the term of funding

assistance would be considered in line with the 2015-25 LTP planning cycle.

3. A report from HBTL setting out achievements, progress towards the

key performance indicators as set out in the funding agreement, together with

the Company’s financials, are attached to this paper.

Decision Making

Process

4. Council is

required to make a decision in accordance with Part 6 Sub-Part 1, of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained within this section of the Act in relation to this item and have

concluded that, as this report is for information only and no decision is to be

made, the decision making provisions of the Local Government Act 2002 do not

apply.

|

Recommendation

1. That Council receives the “HB

Tourism Quarterly Update’ report.

|

|

Paul Drury

Group Manager

Corporate Services

|

|

Attachment/s

|

1

|

HB Tourism

2014-15 Quarter 2 Report

|

|

|

|

2

|

HB Tourism

Quarter 2 Financials

|

|

|

|

HB

Tourism 2014-15 Quarter 2 Report

|

Attachment 1

|

Hawke’s

Bay Tourism Ltd – Quarter 2, 2014

Hawke’s

Bay Tourism Ltd – Quarter 2, 2014

Prepared by Annie Dundas,

GM Hawke’s Bay Tourism

Overall

Hawke’s Bay Tourism Limited was

officially formed in July 2011 and began a three year strategy for implementing

visitor growth to the region supported by a three-year funding commitment from

the Hawke’s Bay Regional Council. This agreement has been extended until

the end of June 2015. The KPI’s developed in 2011 continue to the form

the basis of Hawke’s Bay Tourism activity. This report will focus on the

October - December 2014 period.

1. Visitor

Statistics

In an effort to take a broader

industry view of what is happening within Hawke’s Bay we will use the

following measures to record visitor arrivals and economic impact.

· Regional Tourism Estimates –

reflecting visitor spend. The

RTEs provide regional stakeholders with absolute dollar estimates of tourism

expenditure at a detailed regional level (i.e. by regional council, territorial

authority, visitors’ country of origin and industry). Dollars spent is measured by dollars

spent in accommodation, food and beverage services, retail sales, retail sales

fuel, other tourism products and other passenger transport.

· International Visitor Survey –

international visitor arrivals

· Commercial Accommodation Monitor

– hotels, motels, holiday parks and backpackers

· Private Household Monitor

– a measure of friends and family staying in Hawke’s Bay

The Regional

Tourism Estimates have just been released for year end March 2014.

International visitor spend in Hawke’s Bay has increased by $20m over the

previous year and domestic spend has slightly decreased by $30m. The following

table shows how Hawke’s Bay is performing against other regions in terms

of visitor spend.

|

Regional Tourism Summary - Visitor Expenditure for Year

end March 2014

|

|

|

Domestic Spend

|

International Spend

|

Total Visitor Spend

|

|

Wellington

|

1,030,000,000

|

430,000,000

|

1,460,000,000

|

|

Queenstown

|

1,010,000,000

|

360,000,000

|

1,370,000,000

|

|

Waikato

|

800,000,000

|

210,000,000

|

1,010,000,000

|

|

Hawke's Bay

|

450,000,000

|

100,000,000

|

550,000,000

|

|

Bay of Plenty

|

390,000,000

|

110,000,000

|

500,000,000

|

|

Nelson

|

330,000,000

|

160,000,000

|

490,000,000

|

|

Rotorua

|

220,000,000

|

250,000,000

|

470,000,000

|

|

Dunedin

|

280,000,000

|

140,000,000

|

420,000,000

|

|

Lake Taupo

|

260,000,000

|

130,000,000

|

390,000,000

|

|

Coromandel

|

250,000,000

|

60,000,000

|

310,000,000

|

|

West Coast

|

120,000,000

|

190,000,000

|

310,000,000

|

|

Wanaka

|

130,000,000

|

120,000,000

|

250,000,000

|

|

Taranaki

|

180,000,000

|

60,000,000

|

240,000,000

|

|

Gisborne

|

80,000,000

|

20,000,000

|

100,000,000

|

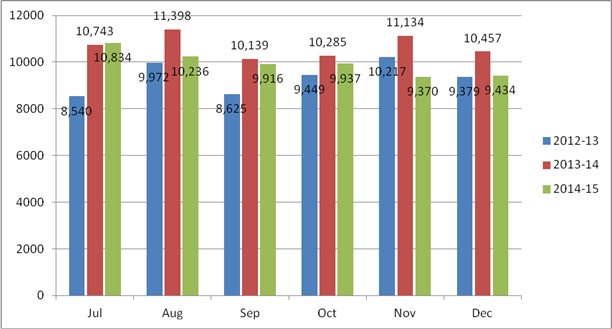

Visitor arrival results for

Hawke’s Bay for the month of November 2014 combining Commercial

Accommodation and Private Household figures show an increase in nights of

13,310 guest nights in November 2014 compared to November 2013. Year- end

figures indicate that the region saw an increase in guest nights of 79,811

across the year. (graph below).

Commercial Accommodation Hawke’s

Bay

Commercial Accommodation Monitor for

November 2014 shows Hawke’s Bay guest nights rose 7.3% compared to the

same period in November 2013. This equates to approximately 5,595 more nights

spent in commercial accommodation in the region in November. A number of major

events ran in November – Iron Maori, Summer F.A.W.C! and the Air New

Zealand Wine Awards.

Private Household Monitor

The

Private Household Survey revealed that an estimated 50,270 visitors to the

Hawke's Bay Region stayed 175,408 nights in private accommodation during

November 2014. Note this excludes those who stayed in holiday homes and baches,

but includes children aged 15 or under. The major reason for visiting Hawke's

Bay were visiting friends or family (82.2% of total nights stayed) and general

holiday or leisure (12.3% of total nights stayed). Visitors to the region

stayed an average of 3.5 nights in private accommodation. International

visitors stayed on average 1.5 times as long as domestic visitors (4.8 nights

compared to 3.2 nights respectively).

International Arrivals into New

Zealand

Overall, international visitor

arrivals into New Zealand saw an increase of +7.7% in November. China saw the

largest increase over the month and the USA was also strong in November.

International

Visitors to NZ

|

November

2014

|

Year

end November

2014

|

|

Total

|

270,408

|

+7.7%

|

2,836,774

|

+5.1%

(137,012)

|

|

Australia

|

102,688

|

+2.4%

|

1,246,320

|

+2.9%

(35,696)

|

|

UK

|

18,480

|

+0.1%

|

194,256

|

+1.8%

(3,440)

|

|

USA

|

24,464

|

+14.5%

|

218,848

|

+11.2%

(21,968)

|

|

China

|

27,184

|

+47.9%

|

257,584

|

+11.5%

(26,464)

|

Commercial

Accommodation

|

November

2014

|

Year

end November

2014

|

|

Hawke’s

Bay

|

|

|

|

|

|

Total

visitors

|

|

|

|

|

|

Total

guest nights

|

82,547

|

+7.3%

|

951,885

|

-0.8%

|

|

International

guest nights

|

27,606

|

+11.2%

|

237,702

|

-6.2%

|

|

Domestic

guest nights

|

54,940

|

+5.4%

|

714,183

|

+1.2%

|

|

Average

length of stay

|

2.03

|

|

2.12

|

|

|

Overall

occupancy rate

|

38.8%

|

|

33.2%

|

|

|

Occupancy

excl Holiday Parks

|

56%

|

|

46.2%

|

|

Commercial

Accommodation

|

November

2014

|

Year

end November

2014

|

|

Hawke’s

Bay cont’d

|

|

|

|

|

|

Hotels

|

12,204

|

-12.2%

|

139738

|

-10.1%

|

|

Motels/Apartments

|

41,379

|

+9.2%

|

506,312

|

+3.9%

|

|

Backpackers

|

15,563

|

+16.7%

|

120,354

|

+4.4%

|

|

Holiday

Parks

|

13,400

|

+13.3%

|

185,481

|

-7.7%

|

|

Private

Household Monitor

|

November

2014

|

Year

end November

2014

|

|

Total

Visitors

|

50,270

|

+2.8%

|

691,040

|

+7.7%

|

|

Total

Visitor nights

|

175,408

|

+4.6%

|

2,795,007

|

+3.2%

|

Key Performance Indicators for

Hawke’s Bay Tourism

The organisation continues

to work towards the goals and objectives set out in the Strategic Plan signed

off by HBRC in May 2011.

In the second quarter of

the 2014 2015 financial year the following KPI’s have been met;

1. Hawke’s

Bay Tourism - the Regional Tourism Organisation is well established

and has now completed three and half years of operation.

2. Brand

– The “Hawke’s Bay” brand continues to be widely used

and is well established and used consistently in all marketing activity. Many

Hawke’s Bay entities such as Business Hawke’s Bay, Food

Hawke’s Bay, Central Hawke’s Bay, Havelock North Business

Association, and Education Hawke’s Bay have adopted the brand for their

own representation. Regional collateral also carries this brand which covers

the Hawke’s Bay Visitor Guide, The Art Guide, The Food Trail Map, The

Hawke’s Bay Trails Map, The Wine Trail Map and the Hawke’s Bay

Summer Guide. In addition Hawke’s Bay Tourism has created and owns the

F.A.W.C! brand as well as The Big Easy brand. Adaptions to the brand now

include adding the towns and cities within Hawke’s Bay to the logo.

3. Consumer Marketing -

· Advertising - “Get me

to Hawke’s Bay”

Campaign activity has run through the second quarter

online and in print. “Get me to Hawke’s Bay” is the tagline

used in all campaign activity. Campaign activity continued to run in October

and November online and in print. Much of the advertising schedule through this

period was dedicated to promoting Art Deco Weekend 2015, Family Activity for

the summer holidays and Summer F.A.W.C! This includes double page spreads in

both Cuisine and Dish Magazine. Video/digital footage continues to be seeded

online and within Facebook and other online channels such as stuff.co.nz,

nzherald.co.nz and eventfinda.

The 2015 Visitor Guide was finished in October ready for

December distribution.

The Summer Guide was developed and distributed to 65,000

homes in the North Island in December.

Search engine marketing

also continues.

Public

relations

Hawke’s Bay Tourism has hosted the following media

in region between October - December

· Matthew Philp from Kia Ora Magazine

· Michael Hooper editor of Destinations Magazine.

FAWC! Media included the following;

· The New Zealand Herald

· Dish Magazine

· Decanter Magazine

· Australian Gourmet Traveller

· Wine + Wine & Spirits (US)

· Qantas Magazine,

· The Australian Way

· Travel Insider

· Food and Travel - Mexico

· Fohla de Sp Newspaper Brazil

· The Daily Mail & Photographer

· Toronto Sun

· Wine & Dine Singapore

· GQ China

· Travel & Leisure Magazine China

· Femina Hearst China

· Imoshan China - top food magazine in China (www.imoshan.com)

In addition HBT ran the

media programme for the Air New Zealand Wine Awards

Media results include

· Annabel Langbein – Free Range Cook – Through

the Seasons has featured Hawke’s Bay in four episodes. Viewership is

approximately 500,000 per episode. Hawke’s Bay Tourism and Hastings

District Council supported her visit and filming in November 2013.

· Mail Today from India - “Napier Way of

Life” – estimated ad value of $30k per page

·

Calgary

Sun - Ian Robertson http://www.calgarysun.com/2014/12/12/sip-savour-celebrate-new-zealand Unique Views Per Month:

447,508

Estimated Advertising Value $10k

·

An

additional result which Hawke’s Bay Winegrowers worked on and should be

mentioned is from Wine Enthusiast which voted Hawke’s Bay one of 10 wine

destinations to watch in 2015. Hawke’s bay made the cover of this title

which as a readership of over 750,000 in the USA. http://www.winemag.com/Web-2014/10-Best-Wine-Travel-Destinations-2015/index.php/cparticle/4

Digital

Strategy

·

www.hawkesbaynz.com

is performing well with unique visitation up over 14%. Over 22,500 people visit

the site each month. 270,854 visited the site year end December 2014.

·

In

addition Hawke’s Bay Tourism also owns www.fawc.co.nz and

www.thebigeasy.co.nz . Both of these sites are generating strong traffic.

·

The

region’s official Facebook page has over 35,000 followers.

4. Trade Marketing

In the second quarter we have

taken part in the following activity;

·

TRENZ

(Tourism Rendezvous) - extensive planning is underway, NCC, Odyssey,

Hawke’s Bay Tourism, The Crown, Art Deco Trust confirmed to attend TRENZ

in May 2015 – this is the largest international travel show for New

Zealand and Hawke’s Bay is a joint host in 2015.

· Kiwi Link China – HBT

attended as part of their involvement in the marketing alliance Explore Central

North Island. Over 80 agents were trained and introduced to Hawke’s Bay

product.

· HBT produced a new China

Trade Manual

· HBT attended a Tourism New

Zealand organized training of 250 Flight Centre Agents in Auckland

Trade Familiarisations -

Hawke’s Bay Tourism hosted the following agents -

· Flight Centre Australia

– 14 agents

· Flight Centre Canada

- 11 agents

· Down Under Answers USA

– 12 agents

Workshops/Events

The

December industry update was held on 17 December with over 80 operators in

attendance. HBT presented the Strategic Plan for Tourism. The response was

exceptionally positive.

Monthly

industry meetings continue involving a range of tourism sectors and Council

staff.

5. Events

Regional Events Strategy

· A renewed focus to the events strategy has been

undertaken due to the priority given to events by both Napier City Council and

Hastings District Council having employed key event staff. Hawke’s Bay

Tourism is coordinating the regions effort with close collaboration with both

Councils and Sport Hawke’s Bay. The key objective is to increase visitor

nights in the region, particularly in the off-season. A revised events strategy

was presented to a number of event managers in Hawke’s Bay early October.

Event Activity

· ICC Cricket World Cup 2015 –

Funding of

$75,000 has been received from New Zealand Cricket for the creation of the

Legends of Cricket Art Deco Match, team welcomes for Afghanistan and UAE and

match day activations. Hawke’s Bay Tourism will lead the Community

Engagement Strategy alongside Councils, Cricket Associations and promotions

groups. There is an enormous amount of activity planned from late February

– mid March when the Napier matches are to be held. We have three matches

in Hawke's Bay and tickets are on sale now. Visiting teams include our very own

Black Caps, the West Indies, United Arab Emirates, Afghanistan and Pakistan.

Game day activations are planned for the Napier CBD and theming for the event

will be evident from late January.

The

Legends of Cricket Art Deco Match on 25 February is progressing well. Tickets

are now on sale for the match – General admission for $10 or free with an

official ICC CWC 2015 ticket purchased and corporate tickets are also

available. www.artdecocricketmatch.co.nz is now live. Sir Ian

Botham has signed to be part of the action and NZ players include Ian Smith,

Mark Greatbatch, Jeremy Coney, Shane Thompson, Dion Nash, Chris Harris, Evan

Gray and Erv McSweeney. Marc Ellis and Shane Cortese have also been signed to

play.

· Summer F.A.W.C! - the third event

kicked off 31 October – 9 November.

· 62 events in 10 days. (68 events in 2013)

· 19 events in Napier, 25 in Hastings, 1 in Clive & 17

in Havelock North.

· 5652 tickets available Total 4942 tickets sold –

87%

(4397 available in 2013 with 3530 sold - 80%)

· 4702 tickets available through Eventfinda, 3218 sold

– 68%

(3897 available through Eventfinda in 2013 with 2286 sold - 58%)

· 35 sold out events. (36 events sold out in 2013)

· Ticket prices were set slightly lower than in 2013 with

30% under $50 (29% in 2013) and 69% events priced under $100 (66% in 2013).

· Approximately 30-40% of FAWCers were from outside

Hawke’s Bay.

· Of a total ticketing spend

of $178,475 gross (Eventfinda ticket sales only).

· 31% bought tickets for

visiting family and friends, particularly large group bookings.

· 47% spent between $100-300

on tickets.

· 74% of F.A.W.C!ers

indicated they would return to Summer F.A.W.C! 2015 and 58% for Winter F.A.W.C!

2015.

· 90% will recommend F.A.W.C!

to their family and friends

· 45 to 54 year olds bought

30% of tickets, followed by 55 to 64 year olds at 26% and 35 to 44 year olds at

21%

· 38% of visitors stayed with

friends or family, 23% in Self Contained, 23% in Motels and 15% in Hotels

· 42% of visitors stayed for

two nights, 30% stayed for four, 15% for one night and 11% for three nights.

· Air NZ Wine Awards November

22, 2014

· 600 attended the event and

HBT hosted 13 media over the weekend of the event.

Hawke’s

Bay Tourism – Financial Statement

Hawke’s Bay Tourism

Ltd is tracking well within the second quarter of this financial year. There is

an under spend in salaries due to a part time contract position being used to

cover the events position. This position will be filled within the next

quarter. Additional money will be diverted towards advertising of Hawke’s

Bay.

And

finally

With the recent demolition

of our current building we have decided to leave the builders to it and

relocate for a few months. So our physical address will be 91 Bridge

Street (the old Bonnie's Cupcakes premises just across the road from the Crown

Hotel).

|

HB Tourism Quarter 2

Financials

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 11 February 2015

Subject: Business Hawke's Bay

Six Monthly Update

Reason for Report

1. Business Hawke’s Bay (BHB) receives $100,000 annually from

HBRC under a three year funding agreement dated 18 September 2013. This

agreement provides:

1.1. Council will receive, as requested but no less than 6 monthly, a

formal briefing on activity delivered and to be delivered in association with

the Council’s Economic Development Manager, and

1.2. Council will receive, annually in July, a short written report

outlining progress against KPIs, changes to KPIs and changes in Business

Hawke’s Bay strategy.

2. BHB will brief the Council in respect of 1.1 above. It is noted that

BHB also receives funding from HDC, NCC and the private sector.

Background

3. BHB aims to facilitate collaborative planning and activity to foster

business development and business growth, seeking to retain, grow and attract

businesses in and into our region.

4. The 2011 Regional Economic Development Strategy (REDS) identifies

the following 4 themes.

Collaboration

4.1. Definition - Agree a regional model involving contributors to

economic development that provides direction and then delivers against regional

economic development strategy

4.2. Lead – BHB

4.3. Key Milestones– Establishment and management of Advisory

Group. Origination and establishment of the Business Hub, completion of annual

monitoring and report on REDS

Resilient Primary Sector Growth

4.4. Definition – Water security, sustainable land use, value added

products and processes, improved knowledge

4.5. Lead – HBRC

4.6. Key Milestones – Plan Change 6, RWSS, non-bovine milk project

(in conjunction with BHB) with an estimated 50% of funding via Callaghan

Research contract funding Food and Hort industries

Visitor Growth

4.7. Definition – Establish Hawke’s Bay Tourism, develop tourism

product and increase visitor nights and expenditure

4.8. Lead – Hawke’s Bay Tourism

4.9. Key Milestones – Noted that HBT regularly reports directly to

Council

Business, Investment, Skills and

Migrant Attraction

4.10. Definition

– Develop and implement an integrated, identified campaign to build on

our centres of excellence and target new innovative industries to diversify our

economic base

4.11. Lead

– BHB

4.12. Key

Milestones – to be reported at this meeting.

5. Accordingly, Council’s attention is primarily focused on

BHB’s performance in the following areas (with the Economic Development

Manager’s comments included).

Collaboration

5.1. BHB has continued to coordinate and lead the monthly Advisory Group

meeting made up of the region’s key economic development stakeholders.

5.2. BHB initiated the concept of the Business Hub, applied a significant

amount of time and energy to develop, promote and consult on the proposal and,

ultimately, has been successful in establishing a commercial model for the Hub

(due to open in Q1 2015). HBRC, NCC and HDC have financially supported directly

(as tenants) and indirectly (via a limited lease underwrite). It follows that

Council will be relying on BHB to ensure delivery of the Hub’s commercial

model.

5.3. BHB has recently concluded a region-wide consultation as part of its

requirement to monitor and report on REDS. BHB has provided the Intersectoral

Forum with a recommendation and proposal for a wide-ranging review of the

current REDS. As the proposal required significant resourcing from HBRC, NCC

and HDC the Forum has referred this proposal back to those organisations for review.

This process is currently underway.

Resilient Primary Sector Growth

5.4. BHB has appointed a Program Manager – Food and Beverage, who

is (among other things) leading the non-bovine milk project. BHB will provide

an update on this project at the meeting.

Business, Investment, Skills and

Migrant Attraction

5.5. BHB will provide an update on this at the meeting.

Decision Making

Process

6. Council is

required to make a decision in accordance with Part 6 Sub-Part 1, of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained within this section of the Act in relation to this item and have

concluded that, as this report is for information only and no decision is to be

made, the decision making provisions of the Local Government Act 2002 do not

apply.

|

Recommendation

1. That the Corporate and Strategic Committee receives the “Business

Hawke’s Bay Six Monthly Update” report.

|

|

Tom Skerman

Economic Development Manager

|

Helen Codlin

Group Manager

Strategic Development

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Corporate

and Strategic Committee

Wednesday 11 February 2015

Subject: Minor Items not on the

Agenda

Reason

for Report

This document has been

prepared to assist Councillors note the Minor Items Not on the Agenda to be

discussed as determined earlier in Agenda Item 6.

|

Item

|

Topic

|

Councillor

/ Staff

|

|

1.

|

|

|

|

2.

|

|

|

|

3.

|

|

|

|

4.

|

|

|

|

5.

|

|

|