Meeting of the Hawke's Bay Regional Council

Date: Wednesday 29 October 2014

Time: 9.00am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Prayer/Apologies/Notices

2. Conflict

of Interest Declarations

3. Confirmation of

Minutes of the Regional Council Meeting held on 24 September 2014

4. Matters Arising

from Minutes of the Regional Council Meeting held on 24 September 2014

5. Maori Committee

Meeting held 28 October 2014

6. Follow-ups from

Previous Council Meetings 3

7. Call for any Minor

Items Not on the Agenda 9

8. Receipt of

Petition from Mr M Little

Decision Items

9. Affixing of Common

Seal 11

10. Recommendations from the

Environment and Services Committee 13

11. Ahuriri Estuary Committee 15

12. Napier Port Amended

Constitution 19

Information or Performance Monitoring

13. Hawke's Bay Tourism Quarterly

Report (9.10am) 27

14. Annual Plan Progress Report

for the First Three Months of the 2014-15 Financial Year 37

15. HBRIC Ltd Update 53

16. Monthly Work Plan Looking

Forward Through November 2014 61

17. Chairman's Monthly Report (to

be tabled)

18. Minor Items Not on the Agenda 69

Decision Items (Public Excluded)

19. PONL Board of Directors

Chairman Appointment 71

HAWKE’S BAY REGIONAL

COUNCIL

Wednesday 29 October 2014

SUBJECT: Follow-ups from Previous Council Meetings

Reason for Report

1. Attachment 1 lists items raised at previous meetings that require

follow-ups. All items indicate who is responsible for each, when it is expected

to be completed and a brief status comment. Once the items have been completed

and reported to Council they will be removed from the list.

Decision

Making Process

2. Council is required to make a decision in

accordance with Part 6 Sub-Part 1, of the Local Government Act 2002 (the Act).

Staff have assessed the requirements contained within this section of the Act

in relation to this item and have concluded that as this report is for

information only and no decision is required in terms of the Local Government

Act’s provisions, the decision making procedures set out in the Act do

not apply.

|

Recommendation

1. That Council receives the report

“Follow-ups from Previous Council Meetings”.

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

|

1

|

Follow-ups

from Previous Regional Council Meetings

|

|

|

|

Follow-ups

from Previous Regional Council Meetings

|

Attachment 1

|

Follow-ups

from previous Regional Council Meetings

Meeting Held 24 September 2014

|

|

Agenda Item

|

Action

|

Person Responsible

|

Status Comment

|

|

1

|

Napier Port

Amended constitution

|

Clarification

of clauses: 3.2, 10.4(b)

and 15.2(c), 15.6(e),

16.1(a), 17.1(b)

|

HBRIC Ltd

|

Refer

to 29 October Agenda item

|

|

Follow-ups

from Previous Regional Council Meetings

|

Attachment 1

|

LGOIMA Requests Received between 18 September and 20

October 2014

|

Request Status

|

DateReceived

|

Request ID

|

Requested By

|

Request Summary

|

|

Transferred

|

17/10/2014

|

OIR-14-076

|

Pauline Elliott on behalf of Transparent Hawke's Bay

|

Details of signed water user agreements, as they are signed,

including name of contracting party, volume of water contracted and date

signed, if any part of volume contracted at 10cents per cm3 (for users

transferring from deep groundwater & right to withdraw after 5 yrs)

|

|

Active

|

7/10/2014

|

OIR-14-075

|

Maddie Harris, NZ Taxpayers Union

|

Attendance record of every councillor since 2013

election.

(b) The portfolios and special responsibilities allocated to each

councillor/ board member.

(c) Whether any councillors/ board members also serve on any

other:

(i) Council;

(ii) Local Board;

(iii) Health Board;

(iv) District Licensing Agency.

(d) The year each councillor/ board member was first elected.

(e) The number of years each councillor has served on the Council.

|

|

Completed

|

23/09/2014

|

OIR-14-073

|

Jono Brown, New Zealand Taxpayers' Union Inc.

|

We request details of all vehicles owned by the Council

(including those covered in remuneration packages) as of todays date

including the:

* make,

* model;

* vehicle year

* whether the vehicle was purchased new or second hand;

* purchase price (including GST); and

* vehicle age (measured by total kilometres travelled –

rounded to the nearest 1,000).

|

HAWKE’S BAY REGIONAL COUNCIL

Environment

and Services Committee

Wednesday 29 October 2014

SUBJECT: Call for any Minor Items Not on the Agenda

Reason for Report

1. Under standing orders, SO 3.7.6:

“Where an

item is not on the agenda for a meeting,

(a) That item may be discussed at that

meeting if:

(i) that item is a minor matter relating to the

general business of the local authority; and

(ii) the presiding member explains at the beginning of

the meeting, at a time when it is open to the public, that the item will be

discussed at the meeting; but

(b) No resolution, decision, or

recommendation may be made in respect of that item except to refer that item to

a subsequent meeting of the local authority for further discussion.”

2. The Chairman will request any items councillors wish to be added for

discussion at today’s meeting and these will be duly noted, if accepted

by the Chairman, for discussion as Agenda Item 18.

Recommendations

That Council accepts the following minor items not on the agenda, for

discussion as item 18:

1.

|

Leeanne Hooper

Governance

& Corporate

Administration

Manager

|

Liz Lambert

Chief

Executive

|

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 29 October 2014

SUBJECT: Affixing of Common Seal

Reason for Report

1. The Common Seal of the Council has been affixed to the following

documents and signed by the Chairman or Deputy Chairman and Chief Executive or

a Group Manager.

|

|

|

Seal No.

|

Date

|

|

1.1

|

Leasehold

Land Sales

1.1.1 Lot 1

DP

4426

CT 55/97

- Transfer

1.1.2 Lot 49

DP 13039

CT E1/1227

- Agreement for Sale

and Purchase

1.1.3 Lot 14

DP 13691

CT F2/1251

- Agreement for Sale

and Purchase

1.1.4 Lot 16

DP 4488

CT 56/27

- Agreement for Sale

and Purchase

1.1.5 Lot 14

DP 13691

CT F2/1251

- Transfer

1.1.6 Lot 23

DP 6391

CT D4/1433

- Agreement for Sale

and Purchase

1.1.7 Lot 142

DP 13111

CT E3/562

- Agreement for Sale

and Purchase

1.1.8 Lot 587

DP 2497

CT 55/132

- Transfer

1.1.9 Lot 16

DP 4488

CT 56/27

- Transfer

|

3805

3805a

3807

3809

3810

3811

3812

3813

3814

|

20 September

2014

22 September

2014

30 September

2014

2 October 2014

9 October 2104

15 October 2014

15 October 2014

15 October 2014

21 October 2014

|

|

1.2

|

Memorandum of

Agreement

180 Ferry Road,

Clive

CT 91/34

(Boundary adjustment)

|

3803

|

19 September

2014

|

|

1.3

|

Esplanade

Strip

Lake Runanga

M1/1056

|

3804

|

19 September

2014

|

|

1.4

|

Staff

Warrants

1.2.1 J. Ellmers

(Delegations under Resource Management Act

1991; Soil Conservation and Rivers Control Act 1941; Land Drainage Act 1908

and Civil Defence Act 1983 (s.60-64); Civil Defence Emergency Management Act

2002 (s.86-91) and Local Government Act 2002 (s.174)

|

3806

|

25 September

2014

|

|

1.5

|

Proxy

Hawke’s

Bay Regional Investment Co Ltd

|

3808

|

30 September 2014

|

Decision Making Process

2. Council is required to make every decision in accordance with the

provisions of Sections 77, 78, 80, 81 and 82 of the Local Government Act 2002

(the Act). Staff have assessed the requirements contained within these sections

of the Act in relation to this item and have concluded the following:

2.1 Sections 97 and 88 of the Act do not apply;

2.2 Council can exercise its discretion under

Section 79(1)(a) and 82(3) of the Act and make a decision on this issue without

conferring directly with the community or others due to the nature and

significance of the issue to be considered and decided;

2.3 That the decision to

apply the Common Seal reflects previous policy or other decisions of Council

which (where applicable) will have been subject to the Act’s required

decision making process.

|

Recommendations

That Council:

1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted policy on significance and that

Council can exercise its discretion under Sections 79(1)(a) and 82(3) of the

Local Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and significance

of the issue to be considered and decided.

2. Confirms the action to affix the Common Seal.

|

|

Diane Wisely

Executive

Assistant

|

Liz Lambert

Chief

Executive

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 29 October 2014

SUBJECT: Recommendations from the Environment

and Services Committee

Reason for Report

1. The following

matters were considered by the Environment and Services Committee on 8 October 2014 and are now presented for consideration and

approval.

Decision Making

Process

2. These items

have been specifically considered at the Committee level.

|

Recommendations

The

Environment and Services Committee recommends that Council:

1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted policy on significance and that

Council can exercise its discretion under Sections 79(1)(a) and 82(3) of the

Local Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

Waipukurau Forestry Block

2. Agrees to allow the development of a bike park, for use by the general

public, by the Rotary Rivers Pathway Trust on the HBRC Waipukurau forestry

block on Mangatarata Road.

3. Delegates authority to the Interim Chief Executive to enter into a

legal agreement between the Rotary Rivers Pathway Trust and HBRC for an initial

period of 20 years which allows the Trust to develop and administer a bike

park on the Waipukurau forestry block.

Biodiversity Strategy Report

4. Endorses the Draft Hawke’s Bay Biodiversity Strategy.

5. Endorses the proposed community engagement on the Strategy via a

public symposium with written comments due by 16 December.

6. Instructs staff to present a summary of the comments to the

Environment and Services Committee for its consideration and further

feedback.

7. Endorses the Steering Group’s consideration of any written

comments and the subsequent finalisation of the Strategy.

Reports Received

8. Notes that the following reports were received at the Environment

and Services Committee meeting.

8.1. Follow-ups from Previous Committee Meetings

8.2. Nature Central

8.3. 2013-14 Open Spaces Report

8.4. 2013-14 Biosecurity Annual Report - Pest Animals and Plants

8.5. 2013-14 Flood & Drainage Operational Reports

8.6. Recreational Water Quality Report: Review of the 2013-14 Season

8.7. Update on PM10 Monitoring

8.8. 2014-15 Operational Report – Science

8.9. 2014-15 Operational Report - Client Services

8.10. 2014-15

Operational Report - Compliance and Consents

8.11. Statutory

Advocacy Update

|

|

Mike Adye

Group

Manager

Asset

Management

|

Iain Maxwell

Group

Manager

Resource

Management

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL

COUNCIL

Wednesday 29 October 2014

SUBJECT: Ahuriri Estuary Committee

Reason for Report

1. In November

2013 Council approved its commitment to engage with Mana Ahuriri, the Crown and

other parties in the development of the Ahuriri Estuary Committee (Te Komiti

Muriwai o Te Whanga) and delegated the Interim Chief Executive to represent the

Council on negotiations on the detailed development of the Committee.

2. The purpose of

this report is to update Council on the detailed development and to seek

Council approval of the draft clauses as negotiated.

Background

3. The Ahuriri Estuary (Te Muriwai O Te Whanganui ā Orotu) is a remnant of a 3,840 hectare area of water which, prior to 1931,

Europeans called the Napier Inner Harbour or the Ahuriri Lagoon. The lagoon was

separated from the sea by a narrow sand and shingle bank. Two main

rivers discharged into the lagoon, the Waiohinganga (Esk) and the Tutaekuri.

Periodically, the Ngaruroro and Tukituki Rivers flowed north to join the

Tutaekuri.

4. The earthquake of 3 February 1931 lifted the bed of the lagoon

between 1.5m and 3.4m and exposed about 1300 ha of the bed of the lagoon.

Various reclamations since 1931 have reduced the estuary by a further 1700ha to

its present size.

5. The Hāpu have a long-standing cultural connection with

Te Whanganui a Orotu (of which Ahuriri Estuary is a part) where they have

resided since well before European settlement. Historically this area was a

main source of food for the hapu. There are also a large number of wahi tapu in

the area.

6. The Hāpu of Mana Ahuriri wish to have their interests in

Te Whanganui a Orotu recognised through their Treaty settlement. Key to their

reaching a durable settlement will be the recognition of their mana in Te

Whanganui a Orotu, and, importantly, the Estuary. They are seeking to have

their kaitiaki status over the Estuary effectively recognised, and to ensure

that there is a coordinated and comprehensive approach to the Estuary’s

management involving all stakeholders with management responsibilities and

interests in the Estuary.

7. On 19 September 2013 these stakeholders met with representatives of

Mana Ahuriri and the Crown to discuss a Crown proposal for redress over the

Ahuriri Estuary as part of the Mana Ahuriri Treaty Settlement. In attendance at

the meeting were representatives from the Department of Conservation, the

Office of Treaty Settlements Napier City Council, Hastings District Council and

the Hawke’s Bay Regional Council.

8. Over the course

of 2014 discussions were held between the parties and the result is the

attached draft clauses for the establishment and operation of the Komiti (Attachment

1). The establishment of the Komiti is to be included in the Mana

Ahuriri settlement which is proposed to be signed mid to late March 2015. In

order to allow time for the Agreement to be prepared Council approval is sought

for the draft clauses and for further finalisation to be negotiated.

Draft

Clauses for Komiti

9. The key points

of the Draft Clauses are:

9.1. The Komiti

will be established as a permanent, stand-alone, multiparty, statutory body by

settlement legislation

9.2. The purpose

of the Komiti is to provide guidance and coordination in order to

promote the protection and enhancement of the environmental, economic, social,

spiritual, historical and cultural values of the Te Muriwai o Te Whanga for

present and future generations

9.3. Hawke’s

Bay Regional Council will have one representative on the Komiti (note that in

November 2013 Council noted that a separate paper will be brought back to

Council seeking a councillor appointment once the committee has been

finalised).

9.4. The functions

of the Komiti include (but are not limited to) identification of values,

vision, objectives and desired outcomes; advocacy; stakeholder engagement

and communication, promotion of support for the ongoing health and well being

of Te Muriwai o Te Whanga.

9.5. The Komiti is

also responsible for preparing and approving a management plan for Te Muriwai O

Te Whanga. The deed of settlement and legislation will provide the plan with a

statutory weighting of “have regard to” in relation to Council RMA

documents.

9.6. The

Management Plan will:

9.6.1. Identify

the significant issues for Te Muriwai O Te Whanga

9.6.2. Identify

management elements that may enhance the social, cultural and economic

wellbeing of people and communities

9.6.3. Consider

the integrated management of the water and lands of Te Whanganui a Orotu

for the benefit of the health and wellbeing of Te Muriwai o Te Whanga

9.6.4. Make

recommendations on the integration and coordination of Te Muriwai o Te Whanga

management

9.7. The onus for

preparation of the plan will fall on the local bodies (NCC, HDC and HBRC)

and the Department of Conservation

Financial and Resource Implications

10. The Komiti will not be

formally established as a statutory body until the settlement legislation

passes (which is currently estimated for early 2016). Preparation of the

Management Plan for Te Muriwai o Te Whanga must begin no later than three years

after Settlement Date. It is to be expected that both science and planning

staff may be required to contribute time to the preparation of the Plan.

Decision Making

Process

11. Council

is required to make a decision in accordance with the requirements of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained in Part 6 Sub Part 1 of the Act in relation to this item and have

concluded the following:

11.1. The decision does not

significantly alter the service provision or affect a strategic asset.

11.2. The use of the special

consultative procedure is not prescribed by legislation.

11.3. The decision does not

fall within the definition of Council’s policy on significance.

11.4. The decision is not

inconsistent with an existing policy or plan.

11.5. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others having an interest in the decision.

|

Recommendations

That Council:

1. Agrees that the

decisions to be made are not significant under the criteria contained in

Council’s adopted policy on significance and that Council can exercise

its discretion under Sections 79(1)(a) and 82(3) of the Local Government Act

2002 and make decisions on this issue without conferring directly with the

community and persons likely to be affected by or to have an interest in the decision due to the nature and significance of the issue to be considered

and decided.

2. Approves the Draft Clauses for the

Establishment and Operation of Te Komiti Muriwai O Te Whanga and advises the

Office of Treaty Settlements of this approval.

3. Authorizes the Interim Chief Executive to

represent the Council in negotiations on the final details for setting up the

Te Komiti Muriwai o Te Whanga.

4. Notes that the appointment of a councillor to

represent the Hawke’s Bay Regional Council on the Komiti will be made

once the Komiti is formally established, and further notes that an

appointment may be needed for the interim operation of the Komiti.

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

There are no

attachments for this report.

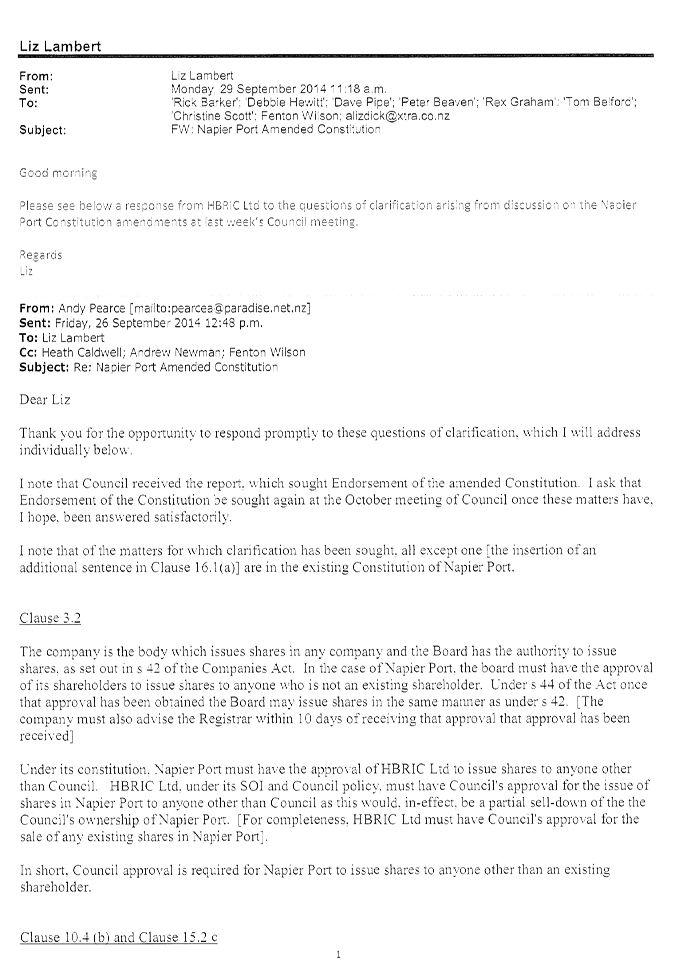

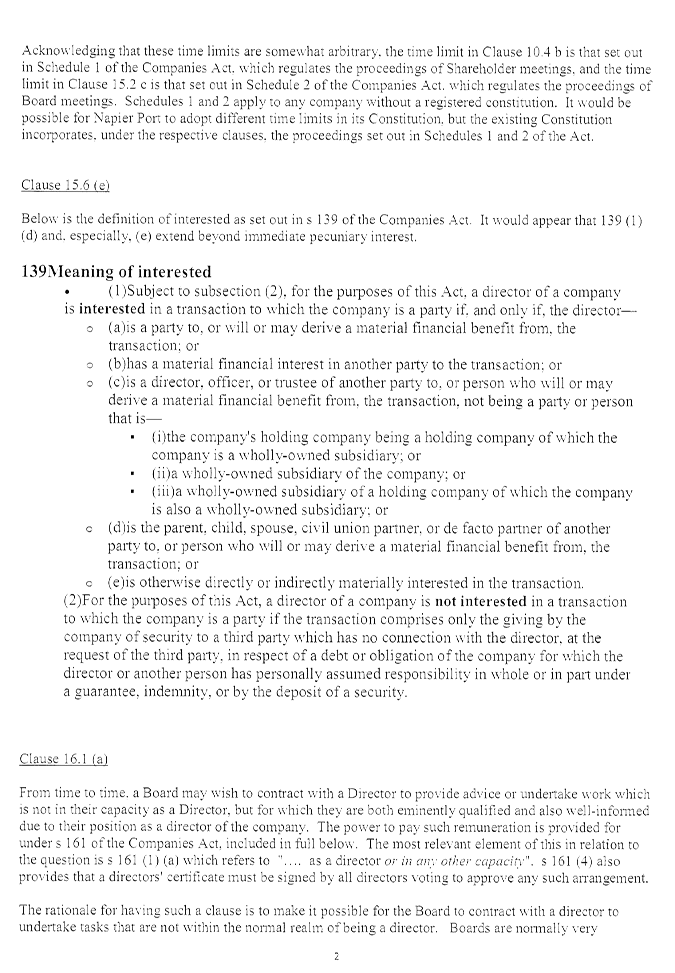

HAWKE’S BAY REGIONAL

COUNCIL

Wednesday 29 October 2014

SUBJECT: Napier Port Amended Constitution

Reason for Report

1. The purpose of

this report is to seek Council’s endorsement of the updated Constitution

of the Port of Napier Limited (Napier Port).

Summary

2. At the 24

September 2014 Regional Council meeting, Council received the updated

Constitution for the Port of Napier Limited and were asked to endorse the

changes that had been made following a legal review of the Constitution.

3. At that meeting

Council the view was expressed that the Constitution could not be endorsed

without clarification on several provisions. Council therefore received the

report but did not endorse it.

4. Clarification

was sought from HBRIC Ltd and provided by Chairman, Dr Andy Pearce. Dr Pearce’s

response was circulated to councillors via email on 29 September 2014. A copy

of the additional information circulated to councillors is appended as Attachment

1. No follow-up questions have been received.

5. Council’s

endorsement for the changes is now sought.

6. As the

shareholder it is Hawke’s Bay Regional Investment Company’s (HBRIC)

responsibility to approve the Port of Napier Constitution. Although it is

not Council’s role to approve the Constitution HBRIC does not want to

take Council’s support for the changes for granted and is therefore

seeking a positive endorsement for the changes.

7. The changes are

as present in the Council paper on 24 September 2014.

8. Napier Port

intends to adopt the revised Constitution in the form attached at its Annual

General Meeting in December 2014.

Decision Making

Process

9. Council is required to make a decision in accordance with the

requirements of the Local Government Act 2002 (the Act). Staff have

assessed the requirements contained in Part 6 Sub Part 1 of the Act in relation

to this item and have concluded the following:

9.1. The decision

does not significantly alter the service provision or affect a strategic asset.

9.2. The decision

does not fall within the definition of Council’s policy on significance.

9.3. The decision

is not inconsistent with an existing policy or plan.

9.4. Given the

nature and significance of the issue to be considered and decided, and also the

persons likely to be affected by, or have an interest in the decisions made,

Council can exercise its discretion and make a decision without consulting

directly with the community or others having an interest in the

decision.

|

Recommendations

That Council:

1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted policy on significance and that

Council can exercise its discretion under Sections 79(1)(a) and 82(3) of the

Local Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

2. Endorses the updated Port of Napier Limited Constitution.

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

|

1

|

Response to

questions of clarification

|

|

|

|

Response

to questions of clarification

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 29 October 2014

SUBJECT: Hawke's Bay Tourism Quarterly Report

Reason for Report

1. The purpose of this paper is to provide Council with Hawke’s

Bay Tourism Limited (HBTL) results for the three months to 30 September 2014.

Background

2. At the Council meeting on 26 February 2014, Council resolved that

Hawke’s Bay Tourism funding be extended for a further year to 30 June

2015 at the current assistance level of $850,000 per annum, noting that the

timing of any revisions in funding levels and extension of the term of funding

assistance would be considered in line with the 2015-25 LTP planning cycle.

3. A report from HBTL setting out achievements, progress towards the

key performance indicators as set out in the funding agreement, together with

the Company’s financials, are attached to this paper.

Decision Making

Process

4. Council is required to make a decision in accordance with Part 6

Sub-Part 1, of the Local Government Act 2002 (the Act). Staff have

assessed the requirements contained within this section of the Act in relation

to this item and have concluded that, as this report is for information only

and no decision is to be made, the decision making provisions of the Local

Government Act 2002 do not apply.

|

Recommendation

1. That Council receives the Hawke’s

Bay Tourism Quarterly Update report.

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

|

1

|

Hawke's Bay

Tourism Quarter 1 2014-15 Report

|

|

|

|

Hawke's

Bay Tourism Quarter 1 2014-15 Report

|

Attachment 1

|

Hawke’s Bay Tourism

Ltd – Quarter 1, 201

Prepared by Annie Dundas,

GM Hawke’s Bay Tourism

Overall

Hawke’s Bay Tourism Limited

was officially formed in July 2011 and began a three year strategy for

implementing visitor growth to the region supported by a three-year funding

commitment from the Hawke’s Bay Regional Council. This agreement has been

extended until the end of June 2015. The KPI’s developed in 2011 continue

to the form the basis of Hawke’s Bay Tourism activity. This report will

focus on the July - September 2014 period.

1. Visitor

Statistics

In an effort to take a broader

industry view of what is happening within Hawke’s Bay we will use the

following measures to record visitor arrivals and economic impact.

· Regional Tourism Estimates –

reflecting visitor spend. The

RTEs provide regional stakeholders with absolute dollar estimates of tourism

expenditure at a detailed regional level (i.e. by regional council, territorial

authority, visitors’ country of origin and industry). Dollars spent is measured by dollars

spent in accommodation, food and beverage services, retail sales, retail sales

fuel, other tourism products and other passenger transport.

· International Visitor Survey –

international visitor arrivals

· Commercial Accommodation Monitor

– hotels, motels, holiday parks and backpackers

· Private Household Monitor

– a measure of friends and family staying in Hawke’s Bay

Overall

both visitor spend and nights spent in the region by visitors are up in the

last twelve months.

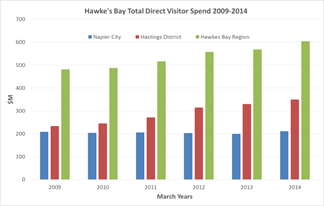

Spend

figures show international visitors spent $80m in the region year end March

2013 and domestic visitors spent $480m over the same period. (Source Regional

Tourism Estimates). Estimates by Economic Solutions have evaluated year end

March 2014 figures for Hawke’s Bay to be at $513m in domestic spend and

$91m in international. This represents a 6.3% increase overall.

Visitor arrival results for

Hawke’s Bay for the month of August 2014 combining Commercial

Accommodation and Private Household figures show a decline in nights of 2,898

guest nights in August 2014 compared to August 2013. Year- end figures indicate

that the region saw an increase in guest nights of 52,814 across the year.

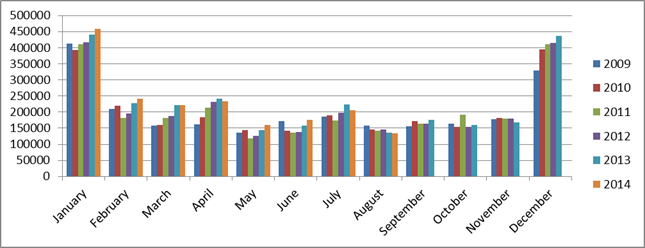

(graph below).

Commercial Accommodation

Hawke’s Bay

Commercial Accommodation Monitor for

August 2014 shows Hawke’s Bay guest nights down 2.2% compared to the same

period in August 2013. This equates to approximately 1,000 less nights spent in

commercial accommodation in the region in August. Hotels and Backpackers saw an

increase in August while Motels and Holiday Parks saw declines. August is

traditionally one of the quietest months across the year for visitors.

Private Household Monitor

The Private Household Monitor estimated 33,855 visitors to the

Hawke's Bay Region stayed

133,235

nights in private accommodation during August 2014. Note this excludes those

who stayed in holiday homes and baches, but includes children aged 15 or under.

The major reason for visiting Hawke's Bay were visiting friends or family

(73.0% of total nights stayed) and general holiday or leisure (10.7% of total

nights stayed). Visitors to the region stayed an average of 3.9 nights in

private accommodation. International visitors stayed on average 2.1 times as

long as domestic visitors (6.7 nights compared to 3.2 nights respectively).

International Arrivals into New

Zealand

Overall, international visitor

arrivals into New Zealand saw a decline in August of -0.2% (141,468

visitors). Australian arrivals made up much of the overall decline into

New Zealand with a -1.2% drop (45,008 less visitors) for August against August

last year. Continued month-on-month growth from the long-haul markets of the

USA (up 8.5%) and Germany (up 11.5%) was positive and China saw a good result

(up 12.2%) in August which is showing a return back to travel post the changes

to visas which discouraged controlled group tourism and commission shopping.

The UK saw a decline of -4.7% in August.

International Visitors to NZ

|

August 2014

|

Year end August 2014

|

|

Total

|

188,849

|

-0.2%

|

2,799,529

|

+5.3% (141,468)

|

|

Australia

|

98,784

|

-1.3%

|

1,238,528

|

+3.8% (45,008)

|

|

UK

|

7,088

|

-4.7%

|

193,680

|

+1.3% (2,480)

|

|

USA

|

9,584

|

+8.5%

|

212,432

|

+11.2% (21,392)

|

|

China

|

19,936

|

+12.2%

|

245,632

|

+7.2% (16,448)

|

Commercial Accommodation

|

August 2014

|

Year end August 2014

|

|

Hawke’s Bay

|

|

|

|

|

|

Total visitors

|

24,727

|

|

450,601

|

|

|

Total guest nights

|

45,251

|

-2.2%

|

946,263

|

-1.1%

|

|

International guest nights

|

8,376

|

+8.7%

|

234,872

|

-7.9%

|

|

Domestic guest nights

|

36,875

|

-4.4%

|

711,391

|

+1.3%

|

|

Average length of stay

|

1.83

|

Down from 1.91

|

2.14

|

Down from 2.16

|

|

Overall occupancy rate

|

21%

|

Down from 22.4%

|

33%

|

Up from 32.3%

|

|

Occupancy excl Holiday Parks

|

31.5%

|

|

46%

|

|

|

Hotels

|

9,421

|

+7.5%

|

142,329

|

-6.7%

|

|

Motels/Apartments

|

25,994

|

-5.8%

|

503,182

|

+3.9%

|

|

Backpackers

|

4,641

|

+8.1%

|

116,216

|

-0.1%

|

|

Holiday Parks

|

5,196

|

-7.2%

|

184,536

|

-9.4%

|

|

Other Regions Total Guest Nights

|

|

|

|

|

Coromandel

|

27,107

|

+28.6%

|

756,474

|

+5%

|

|

Bay of Plenty

|

58,939

|

+0.9%

|

1,097,906

|

+9%

|

|

Rotorua

|

117,394

|

+1.0%

|

1,821,580

|

+4%

|

|

Taupo

|

62,040

|

+3.1%

|

965,285

|

0%

|

|

Gisborne

|

17,197

|

+21.6%

|

342,550

|

+8%

|

|

Wellington

|

181,507

|

+5.9%

|

2,387,300

|

-2%

|

|

Nelson

|

41,822

|

-9.7%

|

1,239,270

|

+3%

|

|

Wanaka

|

56,900

|

-5.4%

|

639,706

|

-4%

|

|

Queenstown

|

278,620

|

-1.3%

|

2,936,051

|

+8%

|

|

Private Household Monitor

|

August 2014

|

Year end August 2014

|

|

Total Visitors

|

33,855

|

-6.9% (2344)

|

681,669

|

+7.3% (+46,880)

|

|

Total Visitor nights

|

133,235

|

-1.4% (1889)

|

2,767,604

|

+2.3% (+62,996)

|

Key Performance Indicators for

Hawke’s Bay Tourism

The organisation

continues to work towards the goals and objectives set out in the Strategic

Plan signed off by HBRC in May 2011.

In the first quarter of

the 2014 2015 financial year the following KPI’s have been met;

1. Hawke’s

Bay Tourism - the Regional Tourism Organisation is well established

and has now completed three years of operation.

2. Brand

– The “Hawke’s Bay” brand continues to be widely used

and is well established and used consistently in all marketing activity. Many

Hawke’s Bay entities such as Business Hawke’s Bay, Food Hawke’s

Bay, Central Hawke’s Bay, Havelock North Business Association, and

Education Hawke’s Bay have adopted the brand for their own

representation. Regional collateral also carries this brand which covers the

Hawke’s Bay Visitor Guide, The Art Guide, The Food Trail Map, The

Hawke’s Bay Trails Map, The Wine Trail Map and the Hawke’s Bay

Summer Guide. In addition Hawke’s Bay Tourism has created and owns the

F.A.W.C! brand as well as The Big Easy brand. Adaptions to the brand now

include adding the towns and cities within Hawke’s Bay to the logo.

3. Consumer Marketing -

· Advertising - “Get

me to Hawke’s Bay”

“Get me to Hawke’s Bay” is the

tagline used in all campaign activity.

Campaign activity has run through the first quarter

online and in print. Much of the advertising schedule through this period has

been dedicated to promoting Art Deco Weekend, Family Activity for the summer

holidays and Summer F.A.W.C! This has revolved around the release of new

video/digital footage as well as extensive activity within Facebook and other

online channels such as stuff.co.nz, nzherald.co.nz and eventfinda.

o A newly made 30 second Art Deco clip

has been made and there have been over 85,000 views via Facebook and Youtube. www.youtube.com/watch?v=DAZ8IkckLM8

o The

Summer F.A.W.C! 30 second video clip has been viewed by 5,000 people. www.youtube.com/watch?v=AkWURddv8VA

o The

Hawke's Bay facebook page has 32,500+ likes

Search

engine marketing also continues.

Public

relations

Hawke’s Bay Tourism has hosted the following

media in region between July – end September

· NZ Herald (Family focus)

· Getaway Australia (Cycling on the Hawke’s Bay

Trails) 1 million Australian viewers per week. This show will be aired in

Australia in November.

· House and Garden Australia - 995 000 readers per

issue

Media results include

· Annabel Langbein – Free Range Cook –

Through the Seasons has featured Hawke’s Bay in two episodes so far.

Viewership is approximately 500,000 per episode. Hawke’s Bay Tourism and

Hastings District Council supported her visit and filming in November 2013.

· NZ Herald

http://www.nzherald.co.nz/travel/news/article.cfm?c_id=7&objectid=11341711 http://www.nzherald.co.nz/travel/news/article.cfm?c_id=7&objectid=11336326

Digital

Strategy

www.hawkesbaynz.com

is performing well with unique visitation up over 11%. Over 21,000 people visit

the site each month. In addition Hawke’s Bay Tourism also owns

www.fawc.co.nz and www.thebigeasy.co.nz . Both of these sites are generating

strong traffic. The region’s official facebook page has 32,500 followers.

|

www.hawkesbaynz.com

|

1 Oct

2012 – 30 Sep 2013

|

1 Oct

2013 – 30 Sep 2014

|

+/-

|

|

Visits

to site

|

228,299

|

252,931

|

+10.79%

|

|

Unique

Users

|

166,572

|

185,215

|

+11.19%

|

|

Page

views

|

848,905

|

989,512

|

+16.56%

|

|

Average

pages per visit

|

3.72

|

3.91

|

|

|

Average

time on site

|

3.06

|

3:18

|

|

Research

A monthly one-page tourism monitor has been established

and is distributed to stakeholders and industry each month. See July attached.

4. Trade Marketing

In the first quarter we have

taken part in the following activity;

· RTONZ Regional Tourism

Organisations of New Zealand & Tourism New Zealand regional updates

· TRENZ – the largest

tourism event in New Zealand is confirmed to be hosted in Rotorua in May 2015

by Explore Central North Island of which Hawke’s Bay is a partner.

Extensive planning is underway to ensure the region leverages the opportunity.

· China – a revised

China manual has been developed for operators interested in growing their China

business.

· Film Hawke’s Bay

– assistance with Directors and Producers familiarisation to region

Conference Activity

· Quarterly C&I portfolio

meeting with industry leaders

· A range of bids and

presentations have been made for prospective conferences in the last three

months.

Trade Familiarisations

· China Southern Airlines

Golf Famil – 9 high-end agents visited for a golf itinerary in September

· Luxperience – 5

luxury agents visited Hawke’s Bay from the USA in September

· Thai Famil - 5

Jakarta based travel agents visited in August

· Hawke’s Bay Tourism

hosted the Tourism New Zealand Board in September for a famil and their Board meeting

which included a hosted dinner with a large number of the tourism industry.

· Touch of Spice a leading

luxury inbound operator was hosted principal on a famil of the region.

Workshops & Trade Events

· Monthly tourism sector

meetings continue. Representatives from the following sectors attend - motels,

hotels, B&B’s, attractions, councils and hospitality meet on the

first Friday of each month.

· Cruise New Zealand AGM

– 8 August 2014

· Tourism Awards –

Judging

· Tourism Awards Evening

5. Events

Regional Events Strategy

· A renewed focus to the events strategy has been

undertaken due to the priority given to events by both Napier City Council and

Hastings District Council having employed key event staff. Hawke’s Bay

Tourism is coordinating the regions effort with close collaboration with both

Councils and Sport Hawke’s Bay. The key objective is to increase visitor

nights in the region, particularly in the off-season. A revised events strategy

was presented to a number of event managers in Hawke’s Bay early October.

Event Activity

· An All Blacks Test Action Group was

formed for the All Black match on September 6. It included representatives from

all districts and associations as well as the HBRU. A range of activity was

delivered around the game under the theme of ‘The Great Match Hawke’s

Bay”. This includes a “what’s on” programme within

Hawke’s Bay Today, a series of activities within the Napier CBD prior to

the game, “blacking out” Havelock North. “Great Match”

collateral was displayed around the region and key areas such as West Quay,

renamed West Quay HQ. The All Blacks were involved in a number of local

activations within the Municipal Theatre and the Sound shell. Despite the

weather the region delivered a great result and hope this bodes well for

Hawke’s Bay hosting a Lions Game in 2017. Visitor numbers to the region

were estimated at approximately 6,000. An economic impact report will be

developed but early estimates would have the match generating anywhere between

$3-5m into the economy.

· Cricket World Cup 2015 –

Hawke’s Bay Tourism will lead the Community Engagement Strategy alongside

Councils, Cricket Associations and promotions groups. We have three matches in

Hawke's Bay and tickets are on sale now. Visiting teams include our very own

Black Caps, the West Indies, United Arab Emirates, Afghanistan and Pakistan.

The key event Hawke’s Bay Tourism is involved in is The Legends of

Cricket Art Deco Match on February 25th. This will be held at

Clifton Country Cricket Club.

· Summer F.A.W.C starts 31 October

– 9 November and ticket sales are well ahead of previous years with just

under 3,000 tickets sold so far. Revenue to date has exceeded $160,000. This

year over 60 events will make up the 10 day programme.

Big Events Coming Up

· F.A.W.C! Summer Series October 31

– November 9, 2014

· Air NZ Wine Awards

November 22, 2014

Hawke’s

Bay Tourism – Financial Statement

Hawke’s Bay Tourism Ltd is tracking well within

the first quarter of this financial year.

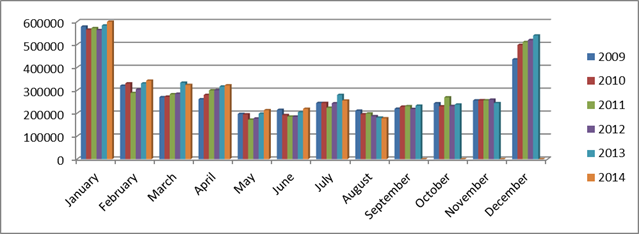

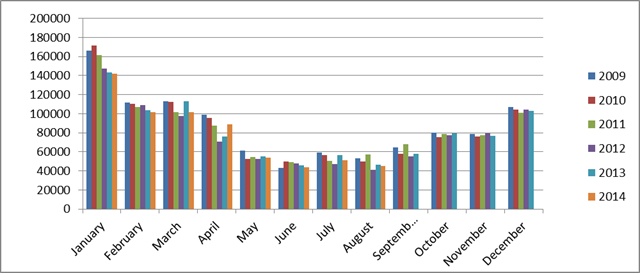

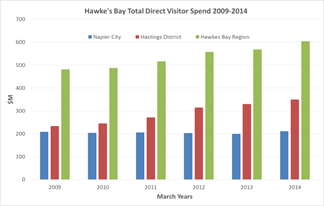

Key Hawke's Bay Tourism Results

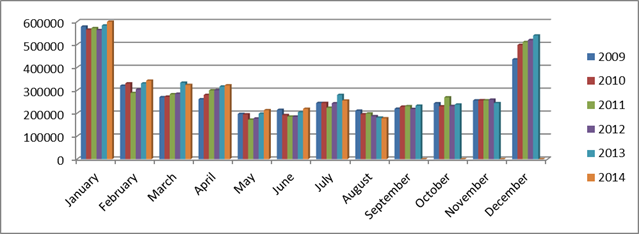

Year Ending July 2014 (please note figures in report are for August)

|

Total Direct Visitor Spend 1

|

Years

Ended July 2009-2014

|

|

Total Arrivals 2

|

Year Ended July 2014

|

|

|

|

|

July 2014

|

YE July 2014

|

Annual % Change

|

|

|

Hawke’s

Bay

|

74,788

|

1,126,575

|

4.8

|

|

|

Napier

City

|

36,254

|

536,887

|

5.1

|

|

|

Hastings

District

|

29,967

|

454,741

|

4.3

|

|

|

Commercial

Accommodation 3

|

26,158

|

442,562

|

0.3

|

|

|

VFR

Accommodation 3

|

48,630

|

684,013

|

7.9

|

|

|

Conventions

Activity Delegates 4

|

21,708

|

100,744

|

1.4

|

|

|

Cruise

Ship Visitors 5

|

-

|

85,437

|

-7.9

|

|

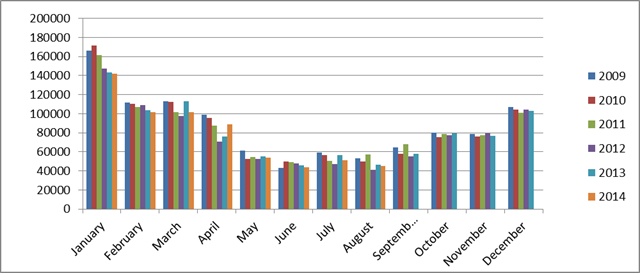

Total Night-Stays 2

|

Year Ended July 2014

|

|

Domestic Tourism 7

|

Year Ended July 2014

|

|

|

July 2014

|

YE July 2014

|

Annual % Change

|

|

|

July 2014

|

YE July 2014

|

Annual % Change

|

|

Hawke’s

Bay

|

255,994

|

3,716,765

|

1.3

|

|

Total

Arrivals

|

62,880

|

906,105

|

5.5

|

|

Napier

City

|

112,610

|

1,627,349

|

1.8

|

|

Total

Visitor Nights

|

205,171

|

2,758,598

|

1.1

|

|

Hastings

District

|

111,208

|

1,624,913

|

0.8

|

|

Average

Length of Stay (Nights)

|

3.26

|

3.04

|

-

|

|

Ave

Length of Stay (Nights)3

|

3.42

|

3.30

|

-

|

|

%

of All Nights

|

80.1

|

74.2

|

-

|

|

Commercial

Accommodation 3

|

51,252

|

947,272

|

-0.5

|

|

Commercial

Nights

|

43,310

|

713,071

|

2.3

|

|

VFR

Accommodation 3

|

204,742

|

2,769,493

|

2.0

|

|

VFR

Nights

|

161,861

|

2,045,527

|

0.8

|

|

Total

Commercial Occupancy Rate % 6

|

22.89

|

33.17

|

-

|

|

Key

Markets 8

|

Waikato,

Wellington, Auckland, Bay of Plenty, Manawatu-Wanganui.

|

|

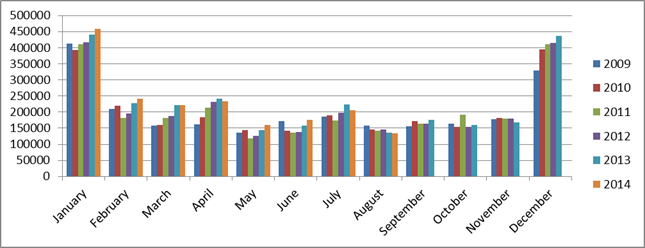

International Tourism 7

|

Year Ended July 2014

|

|

Economic Contribution of Tourism

|

Year Ended March 2014

|

|

|

July 2014

|

YE July 2014

|

Annual % Change

|

|

|

March 2014

|

YE March 2014

|

Annual % Change

|

|

Total

Arrivals

|

11,908

|

220,470

|

2.0

|

|

Domestic

Visitor Spend ($M) 8

|

38.2

|

513.0

|

6.2

|

|

Total

Visitor Nights

|

50,823

|

958,167

|

1.9

|

|

International

Visitor Spend ($M) 8

|

4.8

|

91.0

|

7.1

|

|

Average

Length of Stay (Nights)

|

4.27

|

4.35

|

-

|

|

Total

Visitor Spend ($M) 8

|

43.0

|

604.0

|

6.3

|

|

%

of All Nights

|

19.9

|

25.8

|

-

|

|

GDP

Contribution ($M) 9

|

37.6

|

527.8

|

6.3

|

|

Commercial

Nights

|

7,942

|

234,201

|

-7.9

|

|

Total

Direct Employment 9

|

-

|

4,213

|

6.3

|

|

VFR

Nights

|

42,881

|

723,966

|

5.6

|

|

Cruise

Tourism Spend ($M) 10

|

-

|

22.4

|

0.9

|

|

Key

Markets 8

|

Australia, Europe, UK, USA, Asia.

|

|

|

|

|

|

Notes:

|

1. Base

data sourced from Ministry of Business, Innovation & Employment (MBIE).

2. Includes

commercial and VFR overnight visitors. Commercial data sourced from

Statistics NZ and VFR (visiting friends and relations) data from HB Tourism.

3. Hawke's

Bay region only figures.

4. Data

sourced from MBIE quarterly conventions activity surveys.

|

5. Data

sourced from Port of Napier.

6. Data

sourced from Statistics NZ.

7. Hawke's

Bay region level results.

8. Based

on MBIE expenditure figures.

9. GDP

and Employment contributions calculated on basis of results of recent tourism

economic impact studies in HB.

10. ‘Cruise

NZ' forecast for 2013/14 cruise season.

|

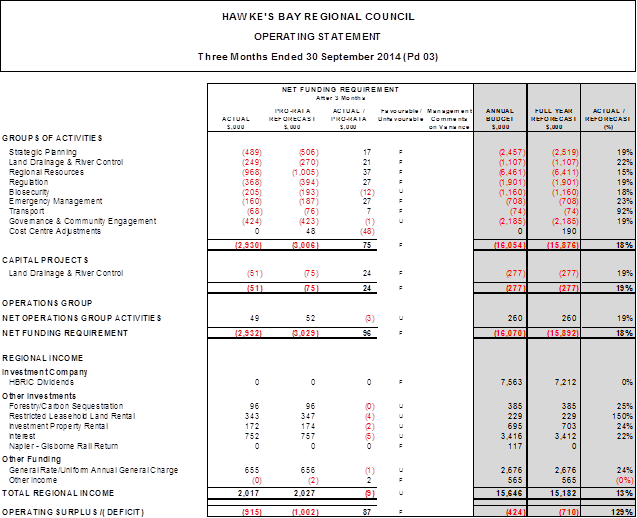

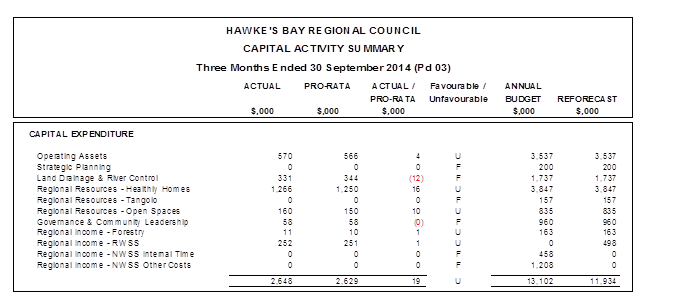

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 29 October 2014

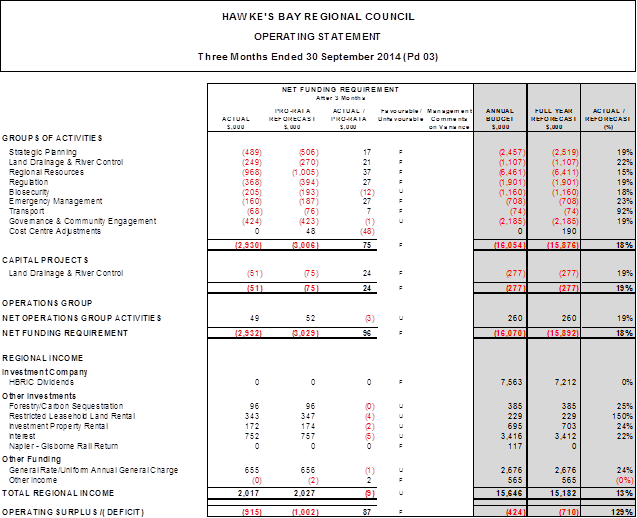

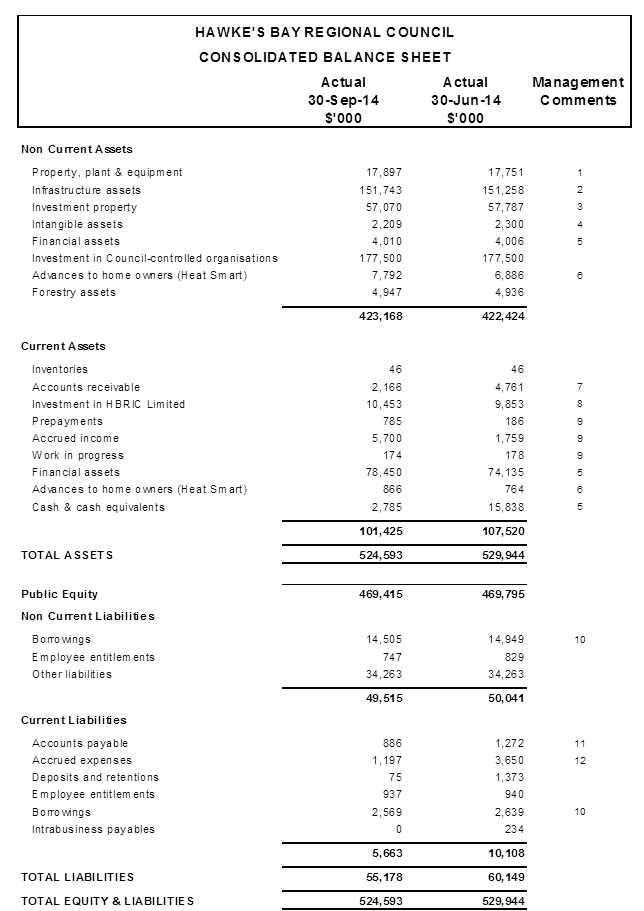

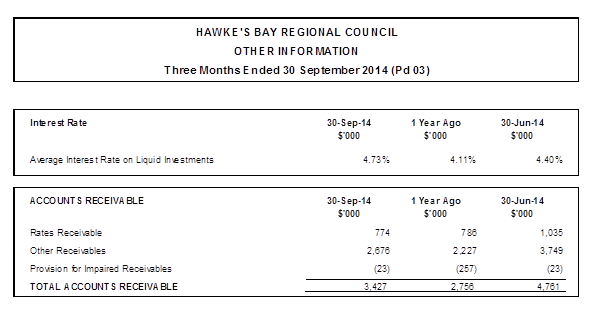

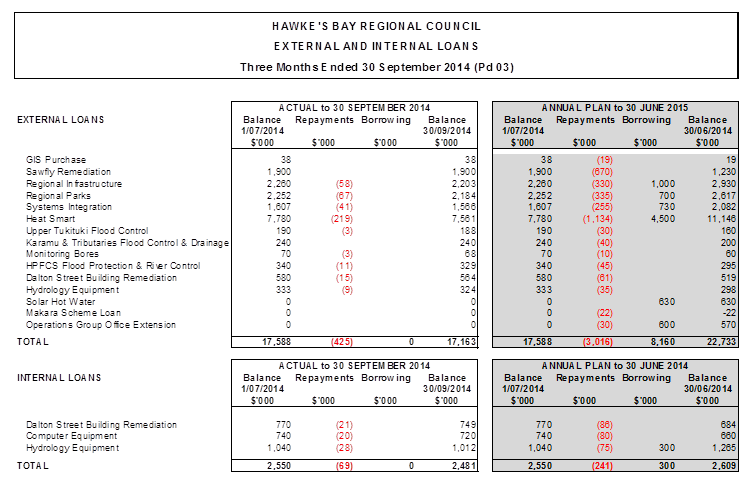

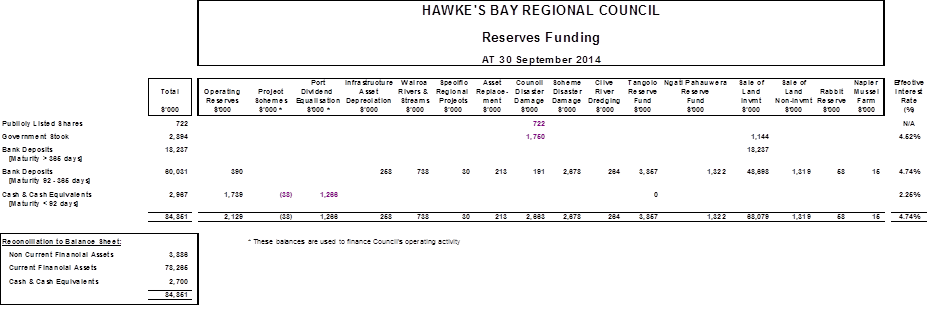

SUBJECT: Annual Plan Progress Report for the First Three Months of

the 2014-15 Financial Year

Reason for Report

1. This Annual

Plan Progress Report is an abridged report and covers the first three months of

the 2014-15 financial year. The report consists of commentary on financial

results to 30 September 2014 and various financial reports.

Summary of the Financial Position

to 30 September 2014

2. The actual

result covering the Council’s general funded operations for the first

three months of 2014-15 is a deficit of $915,000. This compares to the

pro-rata reforecast budget deficit of $1,002,000. The variation for the

three months is $87,000 favourable. The variations from pro-rata budgets

are covered in this report.

Pro-rata Budgets

3. In the past,

the financial reports included pro-rata budgets that were divided evenly

throughout the 12 months of each financial year. Earlier this year, Councillors

requested that, effective from the 2014-15 financial year, pro-rata budgets be

calculated more accurately to represent the fall of revenue and expenditure

during each month of the financial year. This exercise has been completed and

pro-rata figures included in the financial reporting have been confirmed by the

managers who are responsible for the projects.

Reforecasting Exercise

4. The

reforecasting is normally carried out by Council for the nine months ending

31 March 2014 and reported to Council at the April Council meeting. This

financial report sets out the results of an interim reforecasting exercise made

necessary due to:

4.1. The financial implications on

Council’s operating budget of the need to move the financial close for

the Ruataniwha Water Storage Scheme (RWSS) from 31 March 2014 (assumed date in

the Annual Plan 2014-15) to, at the earliest, 31 March 2015 (as advised to

Council at its meeting on 27 August 2014).

4.2. The Reserve Bank maintaining

the official cash rate (OCR) at 3.5% as set in July 2014. The

implications of this on interest rates offered by trading banks on term

deposits.

Comment on Financial Results for Three Months to 30

September 2014

5. The report is

provided in Attachment 1 which consists of:

5.1. Section A – Operating

Account

5.2. Section B – Balance Sheet

5.3. Section C – Cashflow

Statement

5.4. Section D – Capital

(including borrowing)

Decision Making Process

6. Council is

required to make a decision in accordance with Part 6 Sub-Part 1, of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained within this section of the Act in relation to this item and have

concluded that, as this report is for information only and no decision is to be

made, the decision making provisions of the Local Government Act 2002 do not

apply.

|

Recommendation

1. That Council receives the Annual Plan

Progress Report for the first three months of 2014-15 financial year.

|

|

Manton Collings

Corporate

Accountant

|

Paul Drury

Group

Manager

Corporate

Services

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

|

1

|

Summary of

Financial Position to 30 September 2014

|

|

|

|

Summary

of Financial Position to 30 September 2014

|

Attachment 1

|

Summary of Financial Position to 30

September 2014

SECTION A

Operating Position for Three Months

Ending 30 September 2014

1. This is the

first financial report for the 2014-15 Annual Plan year and is also the first

report to pro-rata estimates of expenditure revenue that reflect each project

manager’s assessment of the fall of expenditure and revenue during a

financial year.

2. This has

resulted in minimal variations for actual expenditure and revenue as against

the pro‑rata for the first three months, so accordingly the focus of this

financial report is to show the results of a high level reforecasting exercise

which was initiated due to:

2.1. The

recognition by Council in August 2014 that the financial close date for the

Ruataniwha Water Storage Scheme (RWSS) would need to be extended to 31 March

2015. The impact of this decision resulted in not only the cash flows

from Council to RWSS not now being required until at least nine months later

than set out in the Annual Plan, but also additional time would need to be

charged to the RWSS by Council staff.

2.2. The Reserve

Bank of New Zealand delaying further rises in the official cash rate (OCR) from

its last approved level of 3.5% per annum in July 2014. The Annual Plan

reflected the market expectation that rises in OCR would continue through the

2014/15 year to around 5% per annum by March 2015.

Coupled with slower increases in OCR is

also the Bank’s willingness/need to attract additional deposits due to

the slowing housing market and their reduced ability to on-lend.

Accordingly rates of 5.1% achieved on funds deposited in July 2014, can now

only be invested at between 4.7% - 4.8%. Again this has had an

unfavourable effect on Council’s regional income earned from interest on

deposits, especially considering the Council now has $70 million held on

deposit awaiting eventual drawdown to fund the RWSS if this project proceeds.

An analysis of the adjustments

proposed to be made to the Annual Plan to provide a reforecast deficit is as

follows.

Groups of

Activities

3. Strategic

Planning ($62,000 Unfavourable)

3.1. The paper

considered by Council on 27 August 2014 requested that Council notes that the

financial close for the RWSS would need to be extended to 31 March 2015. Also

included in the paper was a request for increased funding and including

additional budgeted provision to cover the commercial and legal costs to fund

the High Court Appeals currently underway. The proposal in that paper was

for Council to fund $62k as its share of costs relating to Plan Change 6 (PC6)

requirements as distinct from RWSS.

4. Regional

Resources ($50,000 Favourable)

4.1. The carry

forward of expenditure from 2013-14 to 2014-15 Annual Plan year included $400k

for consultancies in Council’s Science programmes. Subsequent to

Council’s approval on 4 June 2015, $50k of this carry forward request was

spent on consultancy in the 2013-14 year. This project has now been

adjusted and provides a $50k favourable variance against the published 2014-15

Annual Plan.

Cost Centre Adjustments

5. Internal

Staff Costs to RWSS ($118,000 Favourable)

5.1. As advised to

Council on 27 June 2014, the delay in financial close of the RWSS to

31 March 2015 would require additional input from Council staff which has

resulted in a further sum of $118k being debited to the RWSS capital project

and thus providing a favourable variance for Council’s operations.

6. Sick

Leave Provision ($72,000 Favourable)

6.1. Discussions

with Council’s auditors, Audit NZ, during the Annual Report for year end

30 June 2014, established that further work should be undertaken during

the 2014-15 financial year on the level of provision in Council’s balance

sheet to cover sick leave. Preliminary work has been carried out and this

provision in the balance sheet will need to be decreased by approximately $103k

which has a favourable impact on Council’s operations of $72k and on its

scheme reserves of $31k.

Regional Income

7. Hawke’s

Bay Regional Investment Company (HBRIC) Ltd Dividends ($351,000 Unfavourable)

7.1. The delay of

nine months for the financial close of the RWSS to 31 March 2015 has resulted

in the cashflows from Council to fund the RWSS not now being required until the

months subsequent to 31 March 2015. The interest at 6% on these advances

has been recalculated and this shows that the required dividend flows from

HBRIC Ltd as included in the Annual Plan now being reduced by $351k.

7.2. This reduced

dividend flow from HBRIC Ltd to Council will not result in Napier Port dividend

monies being retained by HBRIC Ltd. A paper to Council in April 2014

established that if the RWSS financial close was achieved on 30 June 2014 that

up to $22m of funding would be required by RWSS in 2014-15. Council

resolved that if HBRIC Ltd needed to undertake minimal borrowings in order to

provide a return on funds drawn down from Council, then Council would guarantee

these borrowings. Because of the delay by nine months for the financial

close of the RWSS, this borrowing by HBRIC Ltd will now not need to be

undertaken.

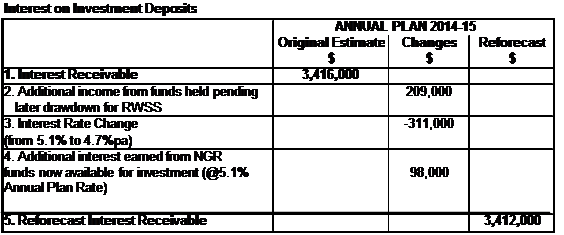

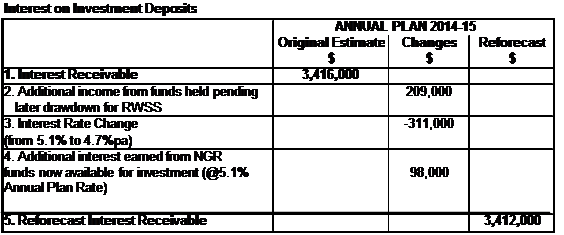

8. Interest

on Deposits ($4,000 Unfavourable)

There

are four major changes that need to be outlined for changes in interest earned

by Council on deposits.

8.1. The large

drawdowns of funds for RWSS have been deferred to the last quarter of 2014-15

and 2015-16. As a result, more funds will be on interest earning deposit over

the 2014-15 year. This deferral of payments to RWSS increases interest income

by around $209,000 in 2014‑15.

8.2. Interest

rates on deposits are running at around 4.7%pa rather than the 5.1% forecast in

the Annual Plan. This fall reduces income by around $311,000 in 2014-15.

Reduced interest rates arise from the RBNZ delaying further rises in the OCR

from its level of 3.50%pa in July 2014. Rises had been expected to continue

through 2014-15 to around 5.0%pa by March 2015. Current consensus views are for

the OCR to remain unchanged until at least the first quarter of 2015. As a

result bank deposit rates have levelled out at around 4.7% average, and are now

assumed to be maintained at this level for the remainder of 2014-15.

8.3. As noted

below it is now expected the $3.9 million funding for Napier Gisborne Rail

(NGR) provided for in 2014-15 will not be required until 2015-16 Financial

Year, which means these funds will be available for investment in bank

deposits, albeit at 4.7%, rather than at 6% in NGR as included in the Annual

Plan. This will improve investment interest income by around $98,000 in

2014-15.

These

changes are summarised in the following table.

9. NGR Interest

Funding ($117,000 Unfavourable)

9.1. Council provided

$3.9 million funding for NGR in 2014-15 in the Annual Plan. Progressing the NGR

proposal has slowed and it is now assumed this funding will not be required

until 2015-16 Financial Year, with the result $117k of interest on this

investment forecast in the Annual Plan will not now be received and the funds

will be held in HBRC’s cash investments for 2014-15.

Revised

Financial Position for the 2014-15 Year

10. The above interim

reforecasting of budgets included in the Annual Plan 2014-15 has resulted in a

reforecast operating deficit of $710k as compared to an Annual Plan operating

deficit of $424k. This shows an increased deficit of $286k.

11. It is useful to consider

the significance of this increased deficit when viewed against the total

expenditure on Council’s operating activities. The increase in

deficit of $286k represents 0.7% of the 2014-15 Annual Plan operating

expenditure of $41 million.

12. Staff are exploring three

avenues to address this increase in deficit and to restore the year end

position to more closely align with the Annual Plan.

12.1. Continued Monitoring

of Interest Rates Offered by Trading Banks

Staff will

continue to ensure that best rates are achieved on funds deposited with the

trading banks as any small increment in interest rates over 4.7% will have a

very positive effect on Council’s operating position given the large sums

currently being invested. The achievement of increased rates are

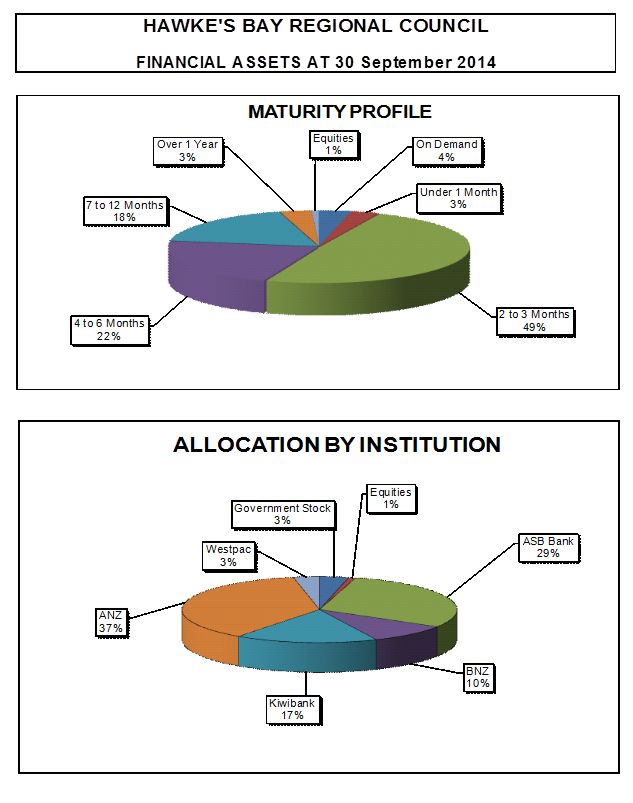

constrained due to Council’s revised investment policy requiring that no

more than 40% of Council’s funds are invested in any one trading bank,

and also the need to invest in short term, term deposits (6-12 months’

duration) pending the decision on financial close for RWSS on 31 March

2015. Every 0.1% increase in interest rates will provide additional

income of $70k.

12.2. Efficiency Reviews

for 2015-25 LTP

Council has already

been made aware of a review currently being undertaken by Council staff on ways

to achieve efficiencies/reductions in costs going into the 2015-25 LTP.

It is anticipated that some of those measures could well be implemented for the

remaining six months of the 2014-15 financial year and thus result in reducing

Council expenditure. Work is currently at an advanced stage in this

review and it is anticipated that a report will be presented to either the

November of December Council LTP workshop.

12.3. Provision

to Provide for future “Risk Pool” Insurance Claims

The New Zealand

Mutual Liability Risk Pool was established in 1997 to provide liability

insurance for local government. This Council, along with 77 other

councils are members of Risk Pool. This Council has the following

insurance cover with Risk Pool:

12.3.1. Public

liability.

12.3.2. Professional

indemnity.

12.3.3. Harbour

Board and marine wreck removal.

The reason for establishing the mutual

fund was to assist the placing of this type of cover which was becoming

difficult to obtain for the local government sector. The concept

underpinning the mutual fund is for all Councils to make an annual contribution

to each fund year and, with the support of reinsurers, provide cover in the

event of claims against its members. The trust deeds provide that in any year

if there is a shortfall whereby claims exceed the contributions of members and

insurance recoveries, then the Board of Risk Pool may make a call on the

members for that fund year. In November 2009 Risk Pool advised Council of the

impact of the leaky building issue. All councils with responsibilities

under the Building Act have, to varying extents, been impacted by the leaky

building issue. In November 2009 the Board of Risk Pool advised Council of

potential calls of $326k covering the fund years 2010, 2011 and part

2012. Council provided for the $326k and these monies have been paid to

Risk Pool.

On 6 March 2012 Risk Pool further advised

Council of the Risk Pool Board’s decision that, in addition to these

previous calls, further calls of $364k would need to be made on this Council

for the fund years 2012 (part payment), 2013 and 2014. These additional

calls came about because of a relatively large number of leaky building claims,

including large multi-unit claims moving through the litigation process.

The only payment made from this

additional provision of $364k was a payment of $88k which pertained to the 2012

year. Risk Pool have advised that no claims are necessary for 2013 and

2014, and have just advised that the claim for 2015-16 is estimated at $48k.

During the year end 30 June 2014 Annual

Report audit, Audit New Zealand discussed that the need for continuing with the

remaining $228k of reserve needed to be reviewed. Therefore it is intended

to discuss with Risk Pool the likelihood of any future calls being required,

and it is possible that the unexpended reserve of $228k will be able to be

reversed either in whole or in part in Council’s books – if so,

this will have a favourable impact on Council’s operating position of up

to $228k.

Heatsmart Progress Report

The programme has had an

excellent start to the year and anticipates that as we enter the summer months

the number of applications will reduce. Further it is expected that the

annual volumes will be achieved by the end of 2014-15.

Volumes

|

|

2014/15

|

2014/15

|

3 Months to 30 September 2014

|

|

Loan Type

|

Annual Plan Budget

Volumes

|

Reforecast Volumes

|

Pro-Rata Reforecast

Volumes

|

Actual Volumes

|

Actual over Budget

(Target 37.5%)

|

|

Insulation Loans

|

160

|

160

|

60

|

45

|

28%

|

|

Clean Heat Loans

|

625

|

625

|

234

|

276

|

44%

|

|

Clean Heat Grants

|

1,500

|

1,500

|

563

|

605

|

40%

|

|

TOTAL

|

2,285

|

2,285

|

857

|

926

|

41%

|

Expenditure (Excl GST)

|

|

2014/15

|

2014/15

|

3 Months to 30 September 2014

|

|

Loan Type

|

Annual Plan Budget

$’000

|

Reforecast $’000

|

Pro-Rata Reforecast

$’000

|

Actual $’000

|

Actual over Budget

(Target 37.5%)

|

|

Insulation Loans

|

336

|

336

|

126

|

96

|

29%

|

|

Clean Heat Loans

|

2,123

|

2,123

|

796

|

958

|

45%

|

|

Clean Heat Grants

|

912

|

912

|

342

|

368

|

40%

|

|

TOTAL

|

3,371

|

3,371

|

1,264

|

1,422

|

42%

|

|

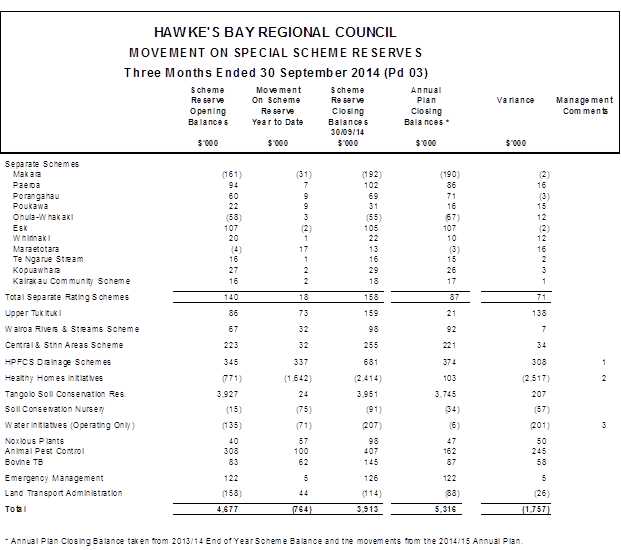

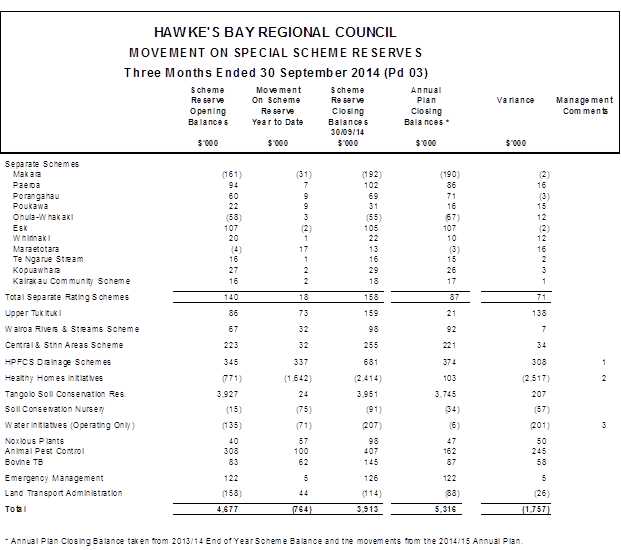

MANAGEMENT COMMENTS ON SCHEME

BALANCES

|

|

Note

Ref

|

Activity

|

Variation

from

Reforecast

$’000

(F)

or (U)

|

Management

Comment (major variances)

|

|

1

|

HPFCS

Drainage Schemes

|

308

(F)

|

The

majority of costs are scheduled to come to charge during the second half of

the year.

|

|

2

|

Healthy

Homes

|

2,517

(U)

|

As

set out in the Heatsmart progress report, the uptake for the first three

months to 30 September 2014 for clean heat loans and grants are much higher

in the winter months than in the summer months of each financial year.

Payments therefore reflect this increased activity and will be funded from

Council’s borrowing programme which is scheduled to be undertaken

during December 2014.

|

|

3

|

Water

Initiatives

|

201

(U)

|

Expenditure

for water initiatives which relate to the provision of telemetry services

show expenditure occurred evenly throughout the year, however revenue from

charges to consent holders are charged at the end of the financial

year. This scheme balance will therefore show a higher negative balance

in the earlier part of the year and will reverse by year end when section 36

charges are sent out to consent holders.

|

SECTION B

COMMENTS

ON BALANCE MOVEMENTS FROM FINANCIAL YEAR COMMENCEMENT

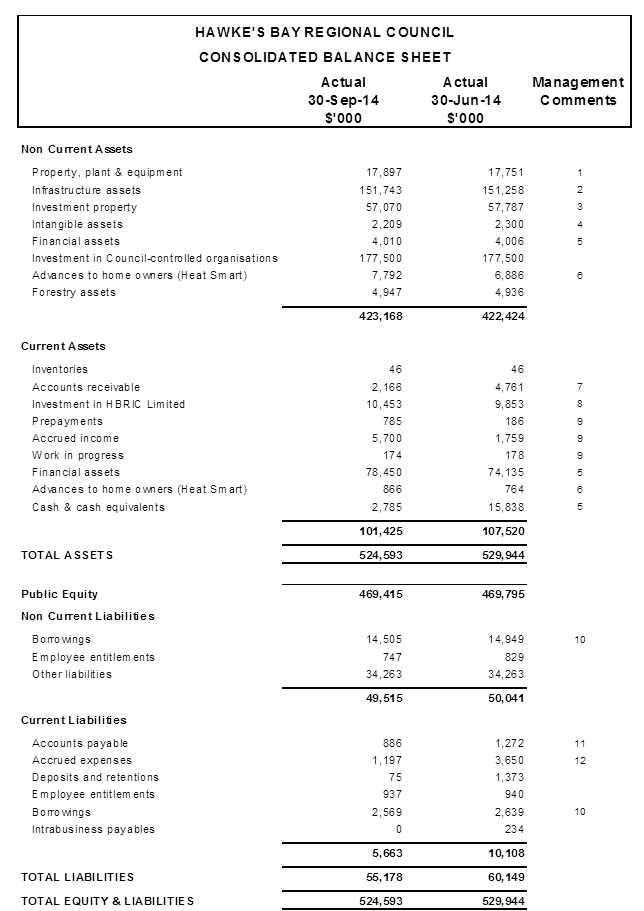

1. Property, plant

and equipment have increased by $146,000 due to the purchase of various assets

offset by depreciation.

2. Infrastructure

assets have increased by $485,000 since the beginning of the year reflecting

capital expenses made for the maintenance and improvement of infrastructure

assets offset by depreciation.

3. Investment

property has decreased by $717,000 reflecting the disposal of leasehold land

properties to the leaseholders for the financial year to date.

4. Intangible

assets have decreased by $91,000 due to the amortisation of computer software

for three months of the year.

5. Total cash,

cash equivalents and financial assets have decreased $8,734,000 since the

beginning of the year reflecting the second payment to ACC paid in July for

$2,838,000 and general operating expenses. Rates income was invoiced on

the 1st October 2014 and an influx of rates income will be received

in the next few months.

6. Advances to

Home Owners (Heat Smart) have increased by $1,008,000 reflecting the up take

from the public since the beginning of the year.

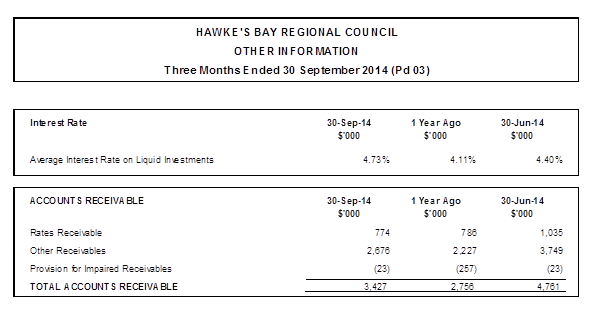

7. Accounts

receivable are $2,595,000 down on the balance at the beginning of the year as

the balance at the beginning on the year included compliance receivables which

are invoiced in June each year.

8. Advances to

HBRIC Ltd have increased by $600,000 since the beginning of the year reflecting

the contribution that HBRC have made to the RWSS this financial year.

9. Prepayments,

accrued income and work in progress have increased by $4,536,000 compared to

the beginning of the financial year. This is mainly due to $3,916,000 of

accrued income for three months of rates which get invoiced in October and

received over the next few months. Rates revenue is split evenly over the

year and an even portion is recognised as income every month.

10. Borrowings have decreased

by $514,000, being the repayments made for the year to date. New

borrowing is expected to be borrowed in December 2014.

11. Accounts payable have

decreased by $386,000 compared to the beginning of the financial year as there

more accruals done during the year end processing and have since been paid.

12. Accrued expenses shows a

decrease of $2,453,000 since the beginning of the year reflecting the payment

of the second instalment to ACC paid in July for $2,838,000.

|

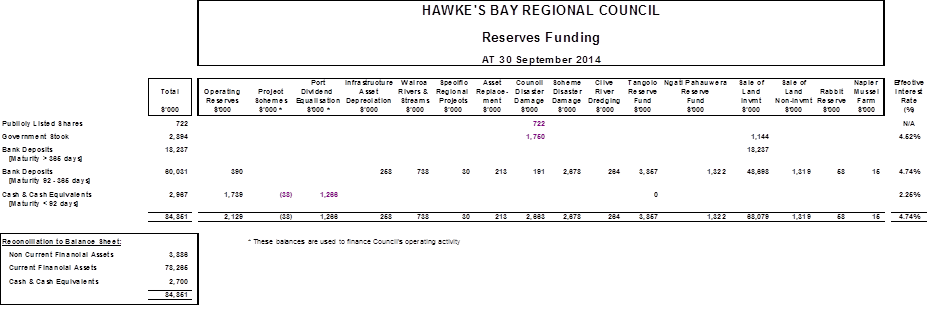

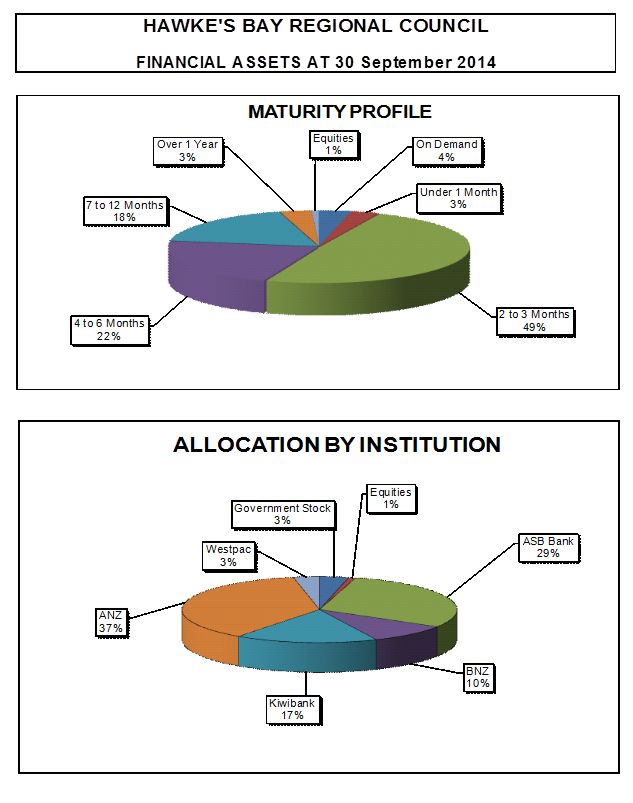

Summary

of Financial Position to 30 September 2014

|

Attachment 1

|

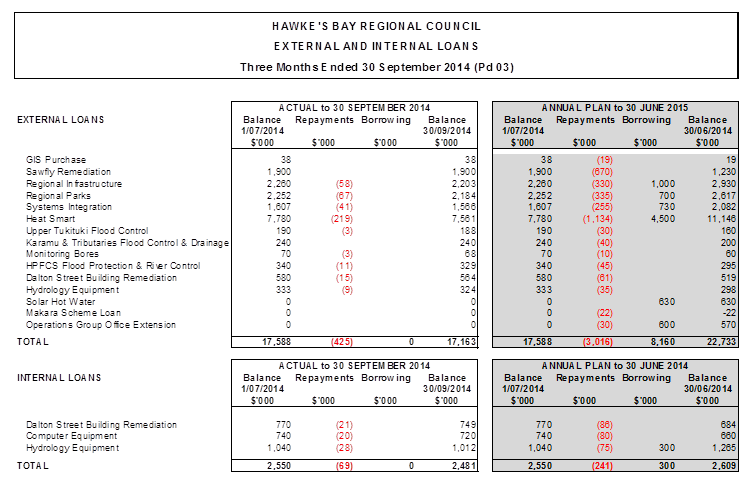

MANAGEMENT COMMENTS ON

BORROWINGS

1. The external loan

requirement for the 2014/15 financial year is due to be drawn down in December

2014.

2. The

amount that can be borrowed internally (as per HBRC liability management

policy) is limited to the funds held to cover the funding of replacement

operating property, plant and equipment and renewal of flood and drainage

scheme infrastructure. The current unallocated balance available for

internally borrowing is $258,000 for Infrastructure Asset Depreciation Reserve

and $213,000 for the Asset Replacement Reserve.

|

Summary

of Financial Position to 30 September 2014

|

Attachment 1

|

|

Summary

of Financial Position to 30 September 2014

|

Attachment 1

|

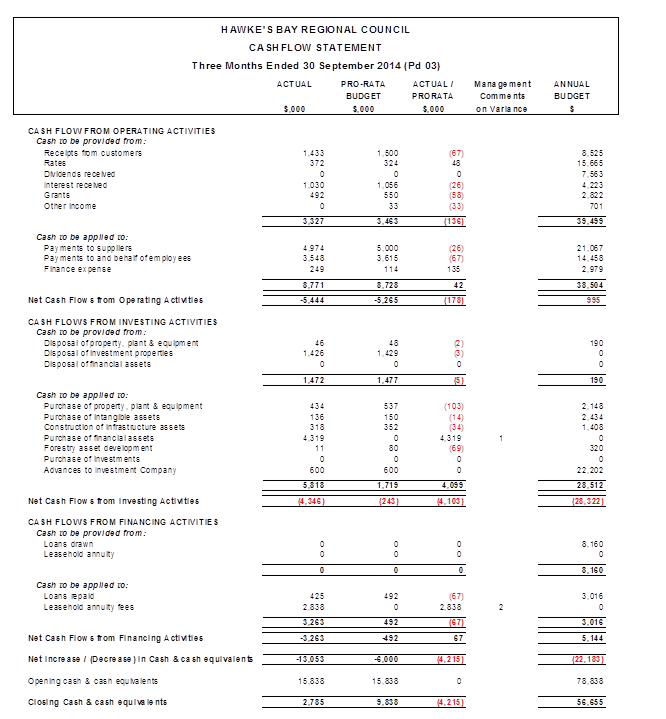

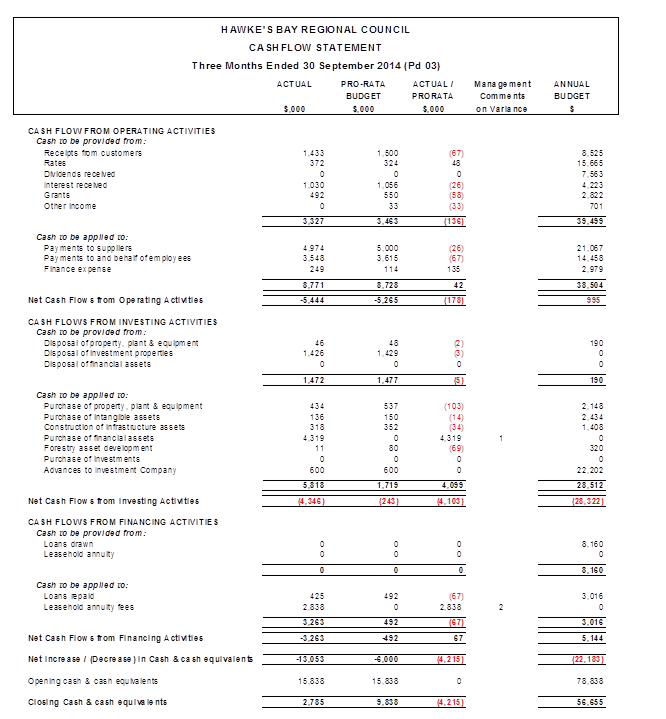

SECTION C

MANAGEMENT COMMENTS ON CASH

FLOWS

1. Financial

Assets have increased by $4,319,000 due to transfers from the current account

to fixed term deposits during the first three months of the year to attract

better interest rates.

2. Leasehold

annuity fees at the end of June 2014 were $2,838,000 but these were not paid

until July 2014.

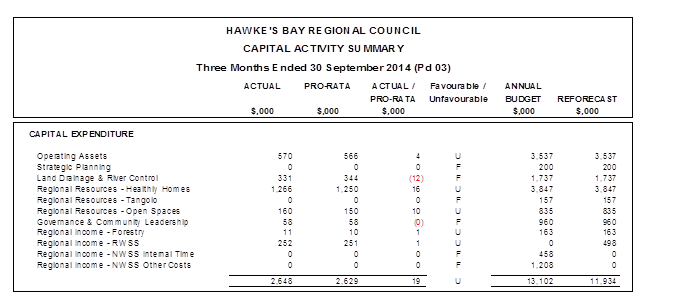

SECTION D

MANAGEMENT COMMENTS

There are no significant variances

from pro-rata that require any comment in this report.

The capital expenditure has been

reforecast, specifically in the area of costs for RWSS and Ngaruroro Water

Storage Scheme (NWSS). The Annual Plan provided $1.666 million for

funding of a portion of the feasibility for the NWSS, however due to the

financial close date for the RWSS being extended out to 31 March 2015, the

Ngaruroro feasibility is not anticipated to commence during the 2015-16 year.

As the RWSS financial close is to be

extended out to 31 March 2015, the reforecast capital budget of $498k reflects

the additional costs of Council staff time what will be required to be expensed

to this project during this period. The Annual Plan reflected a financial

close of 30 June 2014.

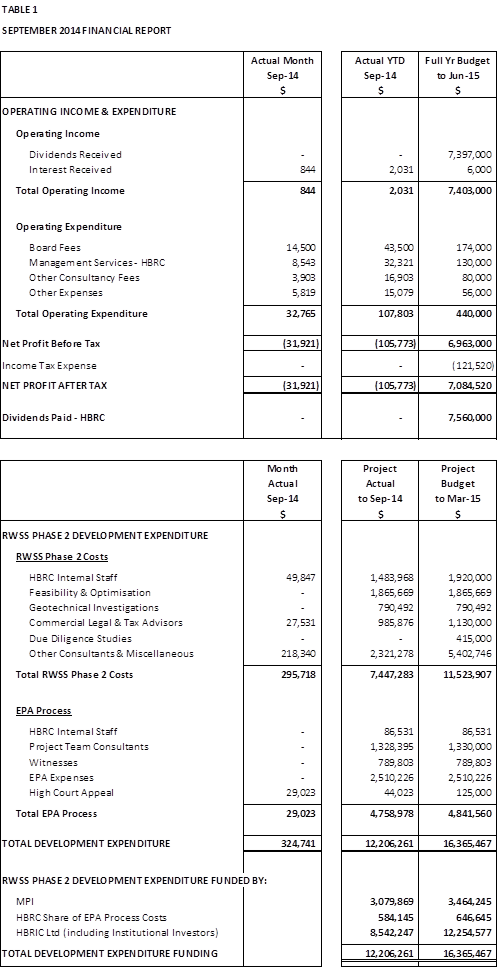

HAWKE’S BAY REGIONAL

COUNCIL

Wednesday 29 October 2014

SUBJECT: HBRIC Ltd Update

Reason for Report

1. Attached is the report of HBRIC Ltd to Council on its activities

over the last few weeks.

2. The HBRIC Ltd Chief Executive Andrew Newman, Company Manager Heath

Caldwell, and Board of Directors Chairman Dr Andy Pearce will be present at the

meeting to speak to the Update.

Decision Making

Process

3. Council is

required to make a decision in accordance with Part 6 Sub-Part 1, of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained within this section of the Act in relation to this item and have concluded

that, as this report is for information only and no decision is to be made, the

decision making provisions of the Local Government Act 2002 do not apply.

|

Recommendation

1. That Council receives

the “HBRIC Ltd and RWSS August 2014

Update” report.

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

|

1

|

HBRIC Ltd

Activities Update Report

|

|

|

|

HBRIC

Ltd Activities Update Report

|

Attachment 1

|

HAWKE’S BAY

REGIONAL INVESTMENT COMPANY LIMITED (HBRIC Ltd)

Report

to Hawke’s Bay Regional Council

29

October 2014

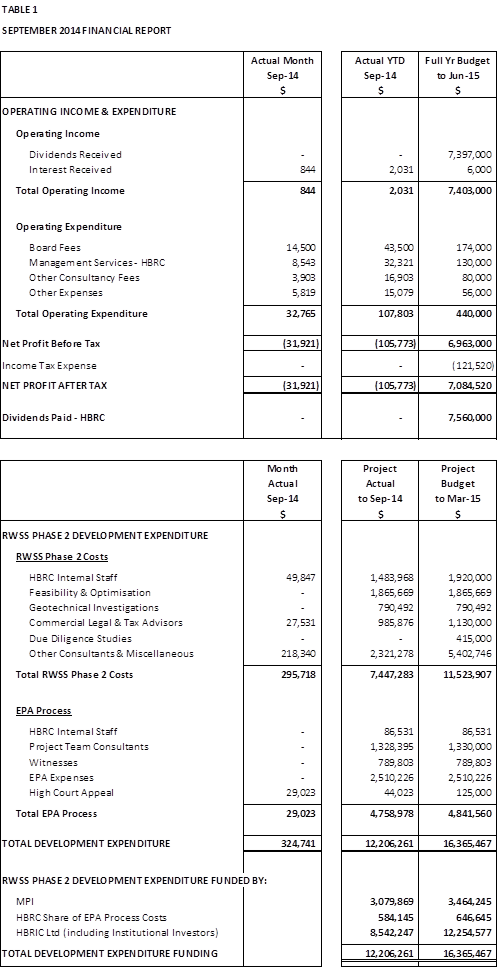

This report covers the following issues:

· HBRIC

Ltd’s initial suggestion for investment principles as per the development

of a Strategic plan as required in the Statement of Intent;

· RWSS

execution – Foundation Water User Agreement & conditionality;

· HBRIC

Ltd September 2014 Financial Report

· A

separate paper is provided on Napier Port Director appointments.

HBRIC

LTD STRATEGIC PLAN

It is recommended

that the following staged process for developing a Strategic Plan be put in

place for HBRIC Ltd:

1. Develop

investment principles for agreement with Council; then progressing to

2. Specific

potential opportunities to be discussed with Council to assess support; and

then

3. Proceed

to preliminary evaluation of the opportunities agreed with Council.

The first step is

to develop a set of principles for investment which we are seeking to test with

the Council.

The following