Meeting of the Corporate and Strategic Committee

Date: Wednesday 16 April 2014

Time: 9.00am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict of Interest Declarations

3. Confirmation of Minutes of the

Corporate and Strategic Committee held on 12 March 2014

4. Matters Arising from Minutes of the Corporate and

Strategic Committee held on 12 March 2014

5. Follow-ups from Previous Corporate and Strategic Committee

meetings

6. Environmental Protection Authority Board of Enquiry Draft

Decisions on Plan Change 6 and RWSS Consents

7. Call for any Minor Items Not on the Agenda

Decision Items

8. Primary Producer's Roundtable - Councillor Representative

9. RWSS Evaluation - Operating Position and Rates Impacts

10. Deloitte Peer Review of HBRIC Ltd RWSS Business Case -

Interim Report

11. Draft Ruataniwha Water Storage Scheme Investment Statement

of Proposal

12. Ruataniwha Water Storage Proposition Consultation

13. Review of Standing Orders

Information or Performance Monitoring

14. Minor Items Not on the Agenda

Decision Items (Public Excluded)

15. Deloitte Peer Review of HBRIC Ltd RWSS Business Case -

Interim Report

16. Confirmation of the Public Excluded Minutes of the

Corporate and Strategic Committee held on 12 March 2014

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 16 April 2014

SUBJECT: Follow-ups from Previous Corporate

and Strategic Committee meetings

Reason for Report

1. In order to track items raised at previous meetings that require

follow-up, a list of outstanding items is prepared for each meeting. All

follow-up items indicate who is responsible for each, when it is expected to be

completed and a brief status comment. Once the items have been completed and

reported to Council they will be removed from the list.

Decision

Making Process

2. Council is required to make a decision in

accordance with Part 6 Sub-Part 1, of the Local Government Act 2002 (the Act).

Staff have assessed the requirements contained within this section of the Act

in relation to this item and have concluded that as this report is for

information only and no decision is required in terms of the Local Government

Act’s provisions, the decision making procedures set out in the Act do not

apply.

|

Recommendation

1. That the Committee receives the report “Follow-ups

from Previous Corporate and Strategic Committee Meetings”.

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

|

1View

|

Follow-ups

from Previous Corporate & Strategic Committee meetings

|

|

|

|

Follow-ups from Previous Corporate

& Strategic Committee meetings

|

Attachment 1

|

Follow-ups from Corporate and Strategic Committee

Meetings

12 March 2014

|

|

Agenda Item

|

Follow-up / Request

|

Person Responsible

|

Due Date

|

Status Comment

|

|

1

|

Conflict of Interest

Declarations

|

Councillors to confirm

Declaration of Interests and return signed forms to the Chief Executive for

circulation to all councillors

|

Councillors &

E Lambert

|

Immed

|

|

|

2

|

Matters Arising from

11Dec minutes

|

HBRIC Ltd constitution

amendments

Advise

Councillors when completed and new Constitution in effect

|

E Lambert

|

|

|

|

3

|

Strategic Planning

Process for 2015-25 Long Term Plan

|

Updated Meeting Planner

to be confirmed and distributed to Councillors

|

L Hooper

|

Immed

|

Updated schedule posted

20 March

|

|

4

|

Strategic Planning

Process for 2015-25 Long Term Plan

|

Calendar of dates for

field trips to be circulated to Councillors for feedback as to which dates

suit and suggested destinations/ topics

|

M Adye

|

|

Memo with dates and

some suggested topics posted 2 April requesting Councillor feedback

|

|

5

|

Top 10 Corporate Risks

|

Review and amend to

reflect agreed updates from the meeting

|

M Adye

|

|

Updated Risk Issues

presented at 26 March Council meeting. Further amendment will be ongoing,

through continued monitoring and updating as well as through the LTP process

|

|

6

|

HBRC

Appointment and Remuneration of

Directors Policy

|

Councillors invited to

submit names of potential members of Appointments Committee to CE

|

Councillors &

E Lambert

|

Immed

|

No names submitted as

of 26 March Council meeting, so invitation re-extended to submit names

by 11 April to enable appointments at 30 April Council meeting

|

|

7

|

Nga Marae o Heretaunga

- Presentation

|

Further staff

engagement with Nga Marae o Heretaunga to assist development of a proposal

for Council’s consideration through 2014-15 Annual Plan process

|

E Lambert

|

|

|

|

8

|

Provisional Timelines –

RWSS Consultation

|

timelines for the

consultation, submissions and hearings processes leading to Council’s

decision to be included on updated Meeting Planner for distribution to

Councillors

|

L Hooper

|

|

Updated schedule posted

20 March

|

|

9

|

HBRC Health and Safety

|

Schedule of reporting

on H&S to Council to be developed and implemented

|

V Moule

|

|

|

|

10

|

HBRC Health and Safety

|

HBRC’s H&S policy

to be put on its website

|

V Moule

|

|

|

|

11

|

Local Governance

Statement

|

Maori Charter

Distribute to all

Councillors and Maori Committee members

Publish on HBRC website

|

L Hooper

A Gouder

|

Immed

|

Dropbox link provided

to Councillors 13 March and loaded onto HBRC website 14 March

Copies provided to

Maori Committee members at 25 February committee meeting

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 16 April 2014

SUBJECT: Call for any Minor Items Not on the Agenda

Reason for Report

1. Under standing orders,

SO 3.7.6:

“Where an item is not on the agenda for a

meeting,

(a) That item

may be discussed at that meeting if:

(i) that

item is a minor matter relating to the general business of the local authority;

and

(ii) the

presiding member explains at the beginning of the meeting, at a time when it is

open to the public, that the item will be discussed at the meeting; but

(b) No

resolution, decision, or recommendation may be made in respect of that item

except to refer that item to a subsequent meeting of the local authority for

further discussion.”

2. The Chairman will

request any items councillors wish to be added for discussion at today’s

meeting and these will be duly noted, if accepted by the Chairman, for

discussion as Agenda Item 14.

|

Recommendations

That

Corporate and Strategic Committee accepts the following minor items not on

the agenda, for discussion as item 14:

1.

|

|

Liz Lambert

Chief

Executive

|

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 16 April 2014

SUBJECT: Primary Producer's Roundtable - Councillor Representative

Reason for Report

1. The Hawke’s Bay Primary

Producer’s Round Table is a group that was inadvertently omitted from the list

of groups that Council considered at its meeting on 6 November 2013 with

respect to appointment of Councillors.

2. This paper asks the

Committee to consider the councillor appointment to this group.

Discussion

3. The group arose from a

request from the Heretaunga Plains primary sector groups during the 2009-19

Long Term Plan, to both the Hastings District Council and the Hawke’s Bay

Regional Council, to engage with the primary sector on the sustainable

development of the district’s productive land resources.

4. In response Hastings

District Council initiated the Hawke’s Bay Primary Producers Round Table and

provides administrative support to the group. It is chaired by Mayor Yule.

5. Both HBRC Councillors

and staff have been involved with meetings which are generally held quarterly.

Two councillors are to be appointed, one of which is the HBRC Chairman. From

staff, HBRC is usually represented by the Chief Executive and the Group Manager

Strategic Development.

6. It is a useful forum

for the primary sector to keep in touch with various planning processes, to

focus on strategic, long term issues impacting the primary sector and to get an

update of the current issues or state of the various primary sectors. It is not

recommended that HBRC should not be represented on this group.

7. There are no financial

or resource implications.

Decision Making

Process

8. Council is required to

make a decision in accordance with the requirements of the Local Government Act

2002 (the Act). Staff have assessed the requirements contained in Part 6 Sub

Part 1 of the Act in relation to this item and have concluded the following:

8.1. The decision does not

significantly alter the service provision or affect a strategic asset.

8.2. The use of the

special consultative procedure is not prescribed by legislation.

8.3. The decision does not

fall within the definition of Council’s policy on significance.

8.4. The persons affected

by this decision are all persons with an interest in the management of regional

resources.

8.5. Options that have

been considered include not making any appointment to the Hawke’s Bay Primary

Producers Round Table.

8.6. The decision is not

inconsistent with an existing policy or plan.

8.7. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others having an interest in the decision.

|

Recommendations

The Corporate

and Strategic Committee recommends that Council:

1. Agrees

that the decisions to be made are not significant under the criteria

contained in Council’s adopted policy on significance and that Council can

exercise its discretion under Sections 79(1)(a) and 82(3) of the Local

Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

2. Appoints

two Councillor representatives to the Hawke’s Bay Primary Producers Round

Table; being Councillors.....

|

|

Helen Codlin

Group

Manager

Strategic

Development

|

Liz Lambert

Chief

Executive

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 16 April 2014

SUBJECT: RWSS Evaluation - Operating Position and Rates Impacts

Reason for Report

1. The report to Hawke’s

Bay Regional Council (HBRC) on 18 December 2013 outlined a process for

evaluating a proposal from Hawke’s Bay Regional Investment Company Limited

(HBRIC Ltd) to HBRC to invest in the Ruataniwha Water Storage Scheme (RWSS).

2. As noted in Section

12.2 of the 18 December 2013 report, one element of the evaluation is

evaluating the potential impacts of the investment on HBRC’s future balance

sheet, operating position and rates.

3. This report contains

the required evaluation.

Background

4. There are three

elements to the evaluation, which are:

4.1. How the proposed

investment in RWSS impacts on HBRC’s future balance sheet

4.2. Whether and to what

extent the RWSS investment affects HBRC’s operating position as compared with

the forecasts of LTP2012-2022

4.3. Whether and to what

extent any affect on the operating position could require support from rates.

Initial HBRC Investment Funding

5. LTP2012-2022 assumed

HBRC would:

5.1. invest up to

$80million in RWSS comprising $55million of capital subscribed and advances to

the water storage operating entity (Waterco) and $25million of holding interest

over the term of the LTP

5.2. receive 6%pa return

on the investment during the period of LTP2012-2022, which was the expected

long term cash return assumed in the LTP

5.3. fund the investment

from the proceeds from sales of Napier leasehold land to lessees; capitalisation

of residual cash flows and use of cash held in bank deposits at the

commencement of the plan.

6. Subsequent to the

publication of LTP2012-2022 HBRC recognised that the $80million provided for

the RWSS investment in the water storage would need to be invested in the

operating entity itself and further, recognised that no interest or cash return

from the investment could be expected by HBRIC Ltd/HBRC until well after the

commencement of the operation of the scheme.

7. In the absence of any

other action these decisions would have caused a reduction in HBRC’s revenue of

around $4million in each of the 2016/2017 and later financial years compared

with LTP 2012-2022 forecasts. However Napier Port’s improved financial

performance and position has been such that it is able to pay higher dividends

(through HBRIC Ltd) over the period of LTP2012-2022 at levels sufficient to

offset this loss.

8. Consequently HBRC’s

operating position would be unaffected by changing the RWSS investments from

cash–generating investments to non-cash generating long term growth investment

in RWSS and no call for support from the rates take was therefore expected to

occur.

Current Situation

9. However HBRIC Ltd

recently brought forward the timing of draw downs of HBRC’s cash investments

for investment in RWSS from the levels assumed in February 2013 as shown in the

following table.

· * Majority of

draw down is within the first three months

· of the financial year.

10. The effect of these

proposed earlier draw downs is to reduce the interest revenue HBRC would have

received from its holdings of cash investments in the 2014/2015 financial year

of approximately $450,000 and $2.75million in the 2015/2016 financial year

(cumulatively $3.2million), with a consequential adverse impact on HBRC’s

operating position if not covered by HBRIC Ltd.

11. HBRIC Ltd holds the view

that these cash flow differences for HBRC in 2014-15 and 2015-16 cannot be

prudently met by HBRIC Ltd requiring a higher level of dividend than is

currently projected in Napier Port’s Statement of Corporate Intent,

particularly in 2015-16. In their opinion to do so would jeopardise Napier

Port’s ability to fund its business development expenditure, which is required

in order to grow the business and generate future cash flows and dividends for

its ultimate shareholder.

12. A letter dated 8 April

2014 has been received from HBRIC Ltd (refer attachment 1) which

proposes a solution for ensuring HBRC’s investment in the RWSS is cash

neutral. The proposal would require HBRC to borrow (or pay out of investment

reserves) $450,000 in 2014‑15 and a further $2,750,000 in the 2015-16

financial years to part fund HBRC’s required cost of funds for the draw downs

required for investment in RWSS. Under this proposal these funds would

constitute an advance to HBRIC Ltd, interest at market rates would be payable

on this advance as required by section 63 of the Local Government Act (interest

to be paid at market rates by a Council controlled trading organisation to the

local authority that advances the loan), and that the by the end of 2018-19

HBRIC Ltd would make a further distribution to enable the advance to be fully

repaid to HBRC. HBRIC Ltd has attached a spreadsheet to their letter which

establishes the proposed level of dividends from HBRIC Ltd to HBRC through the

remaining period of HBRC’s 2012-22 LTP to ensure that HBRC’s funding costs are

covered.

13. Therefore in the absence

of further information as to timing from HBRIC Ltd, at the present time it is

proposed HBRC advances approximately $3.2million to HBRIC Ltd to enable it to

fund additional dividend distributions to HBRC offsetting the losses of revenue

arising from HBRIC Ltd’s rescheduling of cash draw downs required for RWSS from

HBRC, provided the cost of funds of doing so, (market rate of interest as

required by the Local Government Act), is also met by HBRIC Ltd and repayment

is made by 2018/2019.

Commercial Feasibility and Associated

Risks

14. Commercial

feasibility (eg water uptake, investor commitment and returns etc) and the

impact (if any) on HBRC’s operating position, balance sheet and rates take are

being separately assessed by Deloitte in the course of their Peer Review of

HBRIC Ltd’s Business Case and will be separately reported to HBRC.

Conclusions

15. The proposals outlined

above remain consistent with the provisions contained in LTP2012‑2022 for

providing the total capital investment in RWSS will be no more than $80million.

This means their impact on HBRC’s balance sheet will not result in a materially

different financial position for HBRC from that forecast in LTP2012-2022,

namely reduction in cash held in bank deposits then invested through HBRIC Ltd

in RWSS infrastructure.

16. The

understanding/commitments now in place between Napier Port and HBRIC Ltd for

the payment of additional dividends from Napier Port and the proposed

arrangement for HBRC to advance approximately $3.2million to HBRIC Ltd, the

details of which have been outlined in this paper, will ensure HBRC’s operating

position remains unaffected for the proposed investment and equity in RWSS of

$71.5million, as set out in the RWSS business and investment case presented to

HBRC on 26 March 2014.

17. The proposal for HBRC to

advance $3.2million to HBRIC Ltd is subject to an opinion from Audit New

Zealand (HBRC and HBRIC Ltd’s auditors) and has been confirmed by legal opinion

dated 9 April 2014 (refer attachment 2).

Decision Making

Process

18. HBRC is required to make

a decision in accordance with Part 6 Sub-Part 1, of the Local Government Act

2002 (the Act). Staff have assessed the requirements contained within this

section of the Act in relation to this item and have concluded that, as this

report is for information only and no decision is to be made, the decision

making provisions of the Local Government Act 2002 do not apply.

|

Recommendation

That the Corporate and Strategic Committee

receives the report and notes that:

1. Understandings/commitments

by HBRIC Ltd, culminating in the letter of 8 April 2014 and financial

attachments, support the conclusion that the proposed investment in equity in

RWSS of $71.5m (as set out in the RWSS business and investment case presented

to HBRC on 26 March 2014), will be cost neutral to HBRC and, by

implication, the ratepayer.

2. This

position of cost neutrality to HBRC is made possible by an increase in

dividends from Napier Port which are proposed to increase substantially by

2016-17, and a proposed advance of approximately $3.2m from HBRC to HBRIC Ltd

to part fund the cost of funding required in RWSS for the years 2014-15 and

2015-16, as HBRIC Ltd has advised in the business case that shortfalls in

these years cannot be prudently met by further drawing on Napier Port.

3. The

proposal to provide an advance of $3.2m from HBRC to HBRIC Ltd, the increase

in HBRIC Ltd dividends during 2014-15 and 2015-16 of an equivalent amount,

the servicing of the advance and the repayment of this advance is subject to

a review from a legal perspective and also a review from Audit New Zealand

from an accounting/ legislative perspective.

4. Any

requirement for additional investment in RWSS over the currently proposed

figure of $71.5m in HBRIC Ltd equity, up to $80m as proposed in the LTP

2012-22, should only be made if HBRIC Ltd is able to meet the cost of funds

thus ensuring the investment in the RWSS is cash neutral for HBRC and will

not have an effect on HBRC’s level of rates.

5. HBRIC Ltd

has provided financial information and a commitment to pay interest at HBRC’s

cost of capital and repay, by 2018-19, the proposed advance of approximately

$3.2m from HBRC to HBRIC Ltd.

6. Deloitte

will report, as part of the review of the business and investment case, on

the potential impacts (if any) of any other commercial risk, specifically as

it relates to HBRC, as identified by them or included in the RWSS business

investment case.

|

|

Paul Drury

Group

Manager Corporate Services

|

Liz Lambert

Chief

Executive

|

Attachment/s

|

1View

|

HBRIC Ltd

Letter to HBRC dated 8 April 2014 confirming arrangements for temporary

funding.

|

|

|

|

2View

|

Legal opinion

on HBRIC Ltd funding proposal

|

|

|

|

HBRIC Ltd Letter to HBRC dated 8 April

2014 confirming arrangements for temporary funding.

|

Attachment 1

|

|

Legal opinion on HBRIC Ltd funding proposal

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 16 April 2014

SUBJECT: Deloitte Peer Review of HBRIC Ltd RWSS Business Case -

Interim Report

Reason for Report

1. Deloitte is some way

toward producing its final Business Case Peer Review report and will present

the interim findings from their report for Council’s consideration. Alan Dent

and David Morgan will make a verbal presentation on their review at the

meeting.

2. Where the presentation

and discussions relate to aspects of the financial case that remain, for now,

commercially sensitive these issues may need to be discussed in a public

excluded session. A separate paper has been developed to provide for this to

occur, should it be needed.

Background

3. To assist Council with

the decision making process surrounding the possible investment in the

Ruataniwha Water Storage Scheme, Deloitte was commissioned to perform an

independent peer review of the HBRIC Ltd RWSS Business Case.

4. The key issues for the

Council in evaluating HBRIC’s business case are:

4.1. Financial

feasibility – is the Council’s investment supported

by a sound business case? What are the strengths and weaknesses of the business

case?

4.2. Returns on

investment – what financial returns can the Council

expect from its investment and over what time period are these expected to occur?

4.3. Business Risks – what risks does the company face and how will these be managed or

mitigated?

5. These issues are

expected to be addressed by Deloitte reviewing the business case projections,

their underlying assumptions and its assessment of impacts of changes in a

range of market, management and financial variables, including:

5.1. Market demand,

including projected farmer take up and on farm profitability

5.2. Pricing of services

and sensitivity of revenue to price changes

5.3. Financial projections

including revenues, margins, expenses, operating position and free cash flow

5.4. Financial

position/balance sheet of the new company including the financing plan,

debt/equity structure and conditions (if any) required by shareholders that

will/may affect profitability and application of free cash flows

5.5. Risk identification,

evaluation, management and mitigation both in respect of the initial capital

investment and ongoing operations

5.6. Returns to

shareholders

5.7. Planned application

of free cash flows

5.8. Management model.

6. The Peer Review is in

the nature of an “audit” of the HBRIC prepared business case, but should

include assessment of the critical business case factors, including all

assumptions underlying it, and key elements such as the market for water

storage and distribution services, projected demand by farmers and others, the

resources required to establish and operate the business and the company’s

projected operating and financial performance and financial position over time.

7. It should include

review of the impacts and sensitivities (if any) of assumptions and information

available about:

7.1. Market Demand - Farmer/Irrigators

7.1.1. Projected farmer demand/take-up

7.1.2. Projected on-farm investment, future farm production, farmer

profitability and their ability to pay water distribution charges

7.1.3. Projected demand from other users and for other services (e.g. for

supply of hydro power)

7.1.4. Terms of sale of water storage and distribution services to farmers

(for 35 years or lesser periods).

7.2. Management Model

7.2.1. Proposed management structure

7.2.2. Proposed use of external advisors/consultants.

7.3. Governance Model

7.3.1. Size of Board

7.3.2. Board membership

7.3.3. Chairperson.

7.4. Financial projections

7.4.1. All revenues,

whether from distribution service charges or other sources, and operating

expenditures, including discussion of major issues of insurance, repairs &

maintenance and environmental controls

7.4.2. Gross margins and

gross profit and their sensitivity to service price changes

7.4.3. Operating surplus

7.4.4. Cost of funds

7.4.5. EBIT and EBITDA

7.4.6. Depreciation and amortisation

7.4.7. Income tax position

7.4.8. Net profit after tax

7.4.9. Capital expenditure

7.4.10. Free cash flow.

7.5. Funding model

7.5.1. How the invested funds are to be used

7.5.2. Funding Structure (equity & debt components)

7.5.3. Provision of working capital requirements for ongoing operations

7.5.4. Funding compensation

for acquisition of existing consent holders right to their consents (if any)

7.5.5. Sensitivity of

funding model to varying cash flows as a result of changes in farmer uptake and

water distribution price improving over time

7.5.6. Long term capital management plans

7.5.7. Provision (if any) for contingencies, especially during the

construction stage.

7.6. Investment Returns

7.6.1. Sustainability of returns over the long term

7.6.2. Projected distributions of net profits and proposed dividend policy.

7.7. Ownership Model

7.7.1. What implications

there may be for the operation of the business from the structure of the

shareholding partnership in the new company – who the partners are (CIIL, Ngai

Tahu Holdings, other private investors), what their class of investment and

respective rights to dividends (e.g. ordinary shareholders or preference

shareholders), fees, dividends and other payments are and what the

relationships will be (such as shareholder agreement on pre-emptive acquisition

rights, and board membership)?

7.7.2. What effect (if any)

will arise from pre-emptive acquisition rights in the new company planned for

customers and other stakeholders?

7.7.3. Relative returns to

shareholders and rationale/justification for any differences as between

shareholders

7.7.4. Impact of

shareholder’s planned exit requirements/strategies.

7.8. Business Case

Risks including risk identification and evaluation,

mitigation plans, and management and control plans arising from:

7.8.1. market demand and

famer uptake

7.8.2. project completion

7.8.3. business operation

7.8.4. variations in

farmers ability to pay water distribution prices over time

7.8.5. regional

environmental issues, especially from possible adverse effects on the

Ruataniwha Plains

7.8.6. funding and

financial structures, costs and obligations

7.8.7. uncompleted

contracts or agreements, including farmer’s contractual obligations to make

payments over the 35 years of water distribution contracts

7.8.8. external environment

(economy, legislative etc).

7.9. Non-business

financial issues

7.9.1. Significance of

recreational functions (if any) from using the reservoir

7.9.2. Costs to be incurred

by the new company (if any) for establishing and maintaining recreational

facilities and access to them.

8. The final Peer Review

report will be available for the Council meeting on 30 April.

Decision Making

Process

9. Council is required to

make a decision in accordance with Part 6 Sub-Part 1, of the Local Government

Act 2002 (the Act). Staff have assessed the requirements contained within this

section of the Act in relation to this item and have concluded that, as this

report is for information only and no decision is to be made, the decision

making provisions of the Local Government Act 2002 do not apply.

|

Recommendation

1. That the

Corporate and Strategic Committee receives the “Deloitte Peer Review of the

HBRIC Ltd RWSS Business Case” verbal interim report.

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 16 April 2014

SUBJECT: Draft Ruataniwha Water Storage Scheme Investment Statement

of Proposal

Reason for Report

1. The Council’s

evaluation of HBRIC Ltd’s proposal for Council to invest in the Ruataniwha

Water Storage Scheme is being carried out in five major steps which are:

1.1. Testing the

financial feasibility of the scheme by

commissioning an independent Peer Review of the RWSS Business Case (the

Deloitte report)

1.2. Evaluating the

potential impacts of the investment on Council’s

future balance sheet, operating position and rates (being considered as a

separate paper in this agenda).

1.3. Identifying, evaluating and comparing options for alternative investment

of the funds now held for the RWSS investment as required by the Local

Government Act 2002, including assessment of their economic and financial

benefits and costs (the Nimmo-Bell report, presented at the Environment and

Services Committee meeting of 9 April).

1.4. Strategic

Evaluation of investment in RWSS or alternatives

addressing matters such as fit with Council’s LTP objectives and economic

development strategy, equity between ratepayers and risk management (assessed

as part of the Statement of Proposal).

1.5. Public

Consultation on Council’s Provisional Decision

using a special consultative process as provided for by the Local Government

Act 2002 and final decision by Council following consideration of the

evaluation and results of the special consultative process (Statement of

Proposal).

2. This report initiates

nos. 1.4 and 1.5 through consideration of a draft Statement of Proposal (SoP).

A final version of the Statement of Proposal and the Summary of the Statement

of Proposal set out the information to be provided to the public as part of the

consultation on investment of up to $80 million in the Ruataniwha Water Storage

Scheme (RWSS).

3. The decision on

Council’s preferred option on investment is scheduled to be at the Council

meeting on 30 April. This paper provides a draft Statement of Proposal that

sets out the format and provisional contents of the document, and, in doing so,

identifies a preferred option as the basis for public consultation.

4. The reasoning for this

is:

4.1. It will allow for

double debate of the two options identified in the draft SoP – both at the

Committee meeting and again at the Council meeting.

4.2. If recommended, it

will allow for the preparation of a summary of proposal to be prepared for

adoption at the Council meeting.

4.3. The alternative

option is the status quo, which is not to invest, so no further consultation

would be required. In other words if Council’s decision is to not invest then

there will be no need to issue a Statement of Proposal.

4.4. The identification of

a preferred option at the draft stage allows for the finalisation of a more

complete Statement of Proposal for inclusion on the Council agenda.

4.5. The passing of a

recommendation at this meeting does not preclude a different outcome at the

Council meeting.

Special Consultative Procedure

5. At its meeting on 31

October 2012 Council resolved that if it decided to continue investing in the

RWSS project following a recommendation from HBRIC Ltd, then Council’s decision

would be subject to a further special consultative procedure.

6. The Special

Consultative Procedure (predominantly set out in sections 83 to 89 of the Local

Government Act 2002) consists of the following steps.

6.1. Prepare a statement

of proposal and a summary - Council must prepare a

description of the proposed decision or course of action. This should include

the problem or issue the proposal intends to address and a summary of options

considered. The statement of proposal must be included on an agenda for a

Council meeting. Council must also prepare a full and fair summary of the

proposal, which must be distributed as widely as it considers to be reasonably

practicable.

6.2. Public notification -

Council must publish a notice in one or more daily newspapers, or in other

newspapers of equivalent circulation, of the proposal and of the consultation

being undertaken. The statement must be available for distribution throughout the

community and must be available for inspection at the main Council office and

may be made available elsewhere, e.g. community libraries.

6.3. Receipt of

submissions - Council must acknowledge all written submissions and offer

submitters a reasonable opportunity to make an oral submission, i.e. to speak

in support of their written submission. Council must allow at least one month

(from the date of the notice) for people to make written submissions.

6.4. Public deliberation - All

meetings where Council deliberates on the proposal or hears submissions must be

open to the public, unless there is some reason to exclude the public under the

Local Government Official Information Meetings Act 1987. Similarly, all submissions

must be made available to the public unless there is reason to withhold them

under the Act.

7. The proposed

consultation programme for the final Statement of Proposal is presented in a

separate paper on this agenda.

Draft Statement of Proposal

8. The draft Statement of

Proposal has been prepared based on the following assumptions:

8.1. The Board of Inquiry

will issue the required resource consents for the RWSS;

8.2. The peer review final

report by Deloitte will confirm that the HBRIC business case meets satisfactory

outcomes in terms of financial feasibility, returns on investment and business

risks; and that the underlying business case projections and their assumptions

are confirmed.

9. The Draft SoP follows a

standard format for these types of documents. It covers:

9.1. Introduction –setting

out the background to the investment proposal

9.2. A summary of the

Proposal

9.3. Council’s objectives

for the investment

9.4. The nature and scope

of the activities proposed

9.5. Details of the

Proposal

9.6. An analysis of the

options considered

9.7. Conditions precedent

9.8. Preferred option

9.9. Reasons

9.10. Other information

10. The Draft Statement of

Proposal concludes with a preferred option to invest in the Ruataniwha Water

Storage Scheme and the reasons for this. The Summary Statement of Proposal

would be an abridged version of the final SoP, however copies of both documents

would be made available as part of the consultation process.

Decision Making

Process

11. The recommendations in

this paper cover the proposal to carry out a special consultative process for

the establishment of the proposed Investment Company. This special

consultative process is in accordance with the provisions of the Local

Government Act 2002.

|

Recommendations

The Corporate

and Strategic Committee recommends that Council:

1. Agrees

that the decisions to be made are not significant under the criteria

contained in Council’s adopted policy on significance and that Council can

exercise its discretion under Sections 79(1)(a) and 82(3) of the Local

Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

2. Approves

the content of the Statement of Proposal covering the proposed investment in

the Ruataniwha Water Storage Scheme, subject to receipt of a satisfactory

business case independent review report and subject to any additions and

amendments sought at the Corporate and Strategic Committee meeting.

|

|

Paul Drury

Group

Manager

Corporate

Services

|

Liz Lambert

Chief

Executive

|

Attachment/s

|

1View

|

Statement of

Proposal re Investing in RWSS

|

|

|

|

Statement of Proposal re Investing in

RWSS

|

Attachment 1

|

STATEMENT OF

PROPOSAL –

INVESTING

IN THE RUATANIWHA WATER STORAGE SCHEME

Hawke’s Bay Regional Investment

Company Limited (HBRIC Ltd) has developed a business plan to invest in the

Ruataniwha Water Storage Scheme (RWSS). It has recommended to its owner,

Hawke’s Bay Regional Council (HBRC) that HBRC invest up to $80 million in

accordance with its intention to do so as announced in its Long Term Plan

2012-2022 (LTP 2012-2022).

The RWSS involves:

· Constructing a reservoir and dam in

the Tukituki Catchment in Central Hawke’s Bay to collect and store water.

· Developing and implementing a system

to distribute water to farm gates and other supply points to irrigate land in

Central Hawkes Bay.

· Operating the distribution system to

deliver stored water to farmers and other users on a commercial basis (i.e.

customers pay a price for distribution that makes the system financially

viable).

Investment in RWSS should generate

both short and long term social, cultural and economic benefits for the Hawke’s

Bay region and improve long term returns from HBRC’s investment portfolio.

LTP 2012-2022 included a proposal

that HBRC invest up to $80 million in RWSS, (including its initial investment

in feasibility studies) in partnership with other public and private sector

investors and subject to full evaluation of the proposal.

Following public consultation on the

LTP 2012-2022 and the establishment of HBRIC Ltd, HBRC transferred its initial

investment in feasibility and other studies on the RWSS to HBRIC Ltd, assigning

it the task of taking the proposed investment through technical and financial

evaluation; applying for consents required under the RMA and managing the

consenting process; commissioning contractors to build the reservoir and dam

and distribution system and formulating a robust plan for funding the

investment in conjunction with iwi, interested investors, farmers, iwi and

others. HBRIC Ltd has completed these tasks and, supported by a Business Case,

sought HBRC’s approval for its investment proposition and funding sufficient to

enable HBRIC Ltd to acquire an approximately one-third share in the entity

owning the RWSS.

Public meetings to discuss the issue

of potentially investing in the RWSS were held as part of the LTP 2012‑2022

consultation process. Following this, and in the consideration of comments and

submissions received from the public, HBRC resolved to undertake a process of

special consultation under the Local Government Act with the intention of

enabling HBRC to hear submissions and make appropriate decisions in 2014.

The Special Consultative Procedure

(SCP) involves releasing a proposal for public comment. HBRC has now begun the

procedure by adopting this Statement of Proposal as a statement of its intent.

HBRC wishes to invest in RWSS and this Statement of Proposal provides an

evaluation of the proposed course of action.

The RWSS is a long-term

sustainable water storage infrastructure investment intended to help unlock

high value agricultural production in the Ruataniwha Plains by collecting,

storing and distributing water in an efficient and effective way to irrigate

around 25,000ha of agricultural land on the Ruataniwha Plains.

Invested funds will be used to

construct a dam and reservoir on the upper Makaroro River and an associated

distribution system to store high winter water flows for irrigation use during

summer when the pressure on water available in the Tukituki catchment is

highest, as well as generating hydro electricity.

As a consequence RWSS will help

mitigate environmental degradation of the Tukituki catchment, while providing

the opportunity to generate significant regional economic and social benefits

by providing a stable and reliable source of water through irrigation to enable

more productive and higher value farming on the Ruataniwha Plains.

HBRC, through HBRIC Ltd, will

establish and invest in the Ruataniwha Water Limited Partnership (RWLP) to own

and operate the RWSS. HBRC (through HBRIC Ltd) currently proposes to invest up

to $71.5 million (as required in HBRIC Ltd’s Business Case) to own

approximately one-third share of RWLP. HBRIC Ltd’s business case states that

the eventual investment required from HBRC could be up to $80 million. Other

shareholders who will own the remaining two-thirds of RWLP are expected to

include Ngai Tahu Holdings Limited, CHB farmers and other institutional and

interested infrastructure investors.

In addition Crown Irrigation

Investments Limited, a Crown-entity company under the Crown Entities Act 2004,

established by the Government to make bridging investments in development of

irrigation schemes (and other regional water infrastructure), is expected to

provide debt funding to RWLP on favourable terms, and any other financing

required will be borrowed on normal commercial terms.

The project cost is expected to be

in the vicinity of $275 million and construction of the dam, reservoir and

distribution system will take around three years from the date of receiving all

regulatory consents. Assuming approvals are received by mid 2014, it is

expected operations will commence in the third quarter of 2017.

2.1 Objectives

HBRC’s objectives for this

investment are to:

· Help achieve its strategic development objectives for

the Hawke’s Bay Region as a whole through establishing and managing a key

infrastructure resource to improve agricultural production and productivity

while enhancing environmental management of the Tukituki catchment;

· Encourage and enable increased private sector

investment in the region’s export oriented agricultural sector;

· Generate economic, social and cultural benefits in the

region;

· Help improve management and control of environmental

risks over the long term, especially those relating to water quantity and water

quality;

· Generate satisfactory tax paid returns to HBRC from the

financial performance of the invested assets;

· Ring-fence particular investment risks

2.2 Nature and Scope of Activities

The nature and scope of

RWLP’s activities will be to:

· Own and manage the

constructed dam and reservoir together with the land on which they are built,

the distribution pipelines, pumps and stations carrying water to farm gates and

any other supply points and all other assets and liabilities necessary to

operate the RWSS effectively and profitably;

· Raise funds for working capital and

development as required by selling bonds, mortgages, preference shares and

other debt instruments;

· Assist any subsidiary and associated

companies to increase shareholder value and regional prosperity through growth

and investment;

· Apply best practice governance

procedures within the RWLP and any subsidiaries and other investments it may

have now or in the future; and,

· Help achieve HBRC’s regional

strategic economic development objectives by investing in assets that will

benefit the Hawke’s Bay Region as a whole.

3. DETAILS

OF THE PROPOSAL

3.1 rwss

RWSS will consist of an 83 metre

high concrete dam on the Makaroro River in the Tukituki Catchment with a

reservoir having a maximum storage capacity of approximately 90 million m3,

which would be used to irrigate up to 25,000 hectares delivered through a mixed

and open canal and piped distribution system to farmers and other users in

Central Hawkes Bay. The dam and reservoir system will also include an

approximately 6.5kw hydro-electric power station.

As a result of a comprehensive

recruitment and selection process OHL/Hawkins joint venture was appointed the

preferred design and construction consortium for the RWSS. OHL is a listed

Spanish construction company with international operations and Hawkins

Infrastructure Limited is New Zealand’s largest privately owned construction

company.

It is intended RWSS will eventually

deliver approximately 104 million cubic metres of water each year to five zones

located across SH2 between Waipukurau in the south and Te Aute in the north.

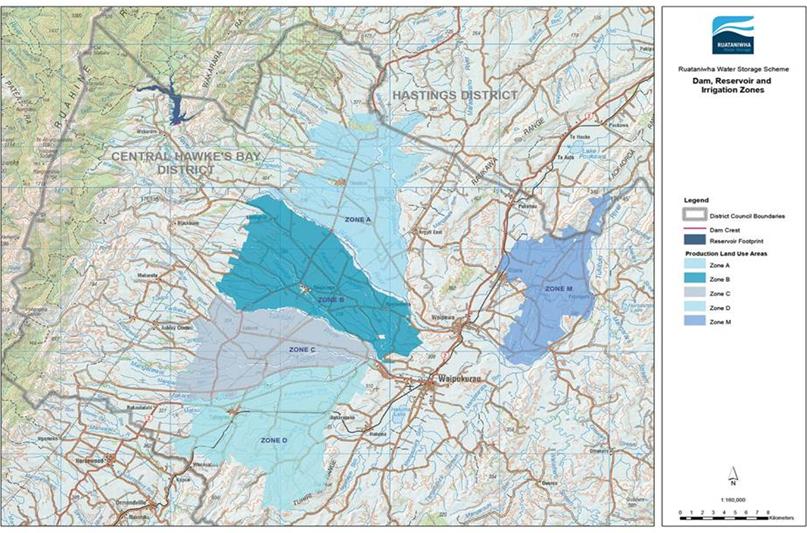

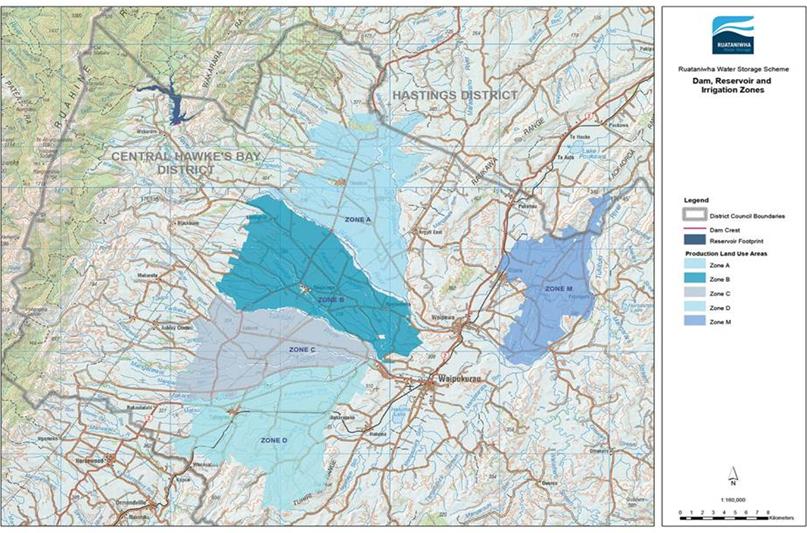

The following Figure 1 shows

the proposed location of the dam and reservoir for RWSS and production land use

areas (Zones A to M) that are expected to be able to utilise irrigation water

supplied by the Scheme.

|

Statement of Proposal re Investing in

RWSS

|

Attachment 1

|

Figure 1: RWSS Overview

Map

Source:

Hawke’s Bay Regional Council, March 2014

Note:

|

Statement of Proposal re Investing in

RWSS

|

Attachment 1

|

Project cost is expected to be

around $275 million and construction of the dam, reservoir and distribution

system will take around three years from the date of receiving all regulatory

consents and meeting all conditions precedent. Assuming approvals are received

by mid 2014, and construction starts in September 2014, it is expected

operations will commence in the third quarter of 2017.

Key steps in implementing RWSS

include:

· The EPA granting satisfactory resource consents for

RWSS infrastructure and operations which are workable for all parties –

scheduled to be finalised by 28 May 2014.

· Securing commitments from farmers to uptake a minimum

of 40 million cubic metres of water per annum from 1 October 2017.

· Obtaining funding from investors sufficient to

undertake and complete construction of the dam, reservoir and associated

distribution system on terms satisfactory to HBRIC Ltd and other investors;

· Execution of a fixed term fixed price design and

construction contract with preferred contractors OHL/Hawkins 50/50 joint

venture – scheduled to be executed by 30 June 2014. Construction of the dam and

associated distribution systems starting in September 2014 and finishing by

September 2017, on time and within budget.

· Construction of the allied hydro power station is

scheduled to commence in March 2015 and be completed by September 2017.

Most of these issues form part of

the conditions precedent (See Section 5 below) that must be achieved to the

satisfaction of the council before any investment can be made. If they are not

so achieved then HBRC will not invest and it is therefore likely RWSS would not

proceed in the proposed format at the present time.

3.2 PROPOSED

STRUCTURE

RWSS will be implemented as a Build

Own Operate Transfer (BOOT) arrangement, which means dam, reservoir and

distribution system will be designed, built, operated and owned by a limited

partnership of public and private sector interests - the Ruataniwha Water

Limited Partnership (RWLP). At the end of a 70 year concession period these

assets will be handed to HBRC (or HBRIC Ltd).

HBRC, through HBRIC Ltd, will

establish and invest up to $71.5 million to own approximately one-third of

RWLP. Other shareholders, who will own the remaining two-thirds of RWLP are

expected to include institutional and interested infrastructure investors.

In addition Crown Irrigation

Investments Limited, a Crown-entity company under the Crown Entities Act 2004,

established by the Government to make bridging investments in development of

irrigation schemes (and other regional water infrastructure), is expected to

provide debt funding to RWLP on favourable terms. Any other financing required

will be borrowed on normal commercial terms.

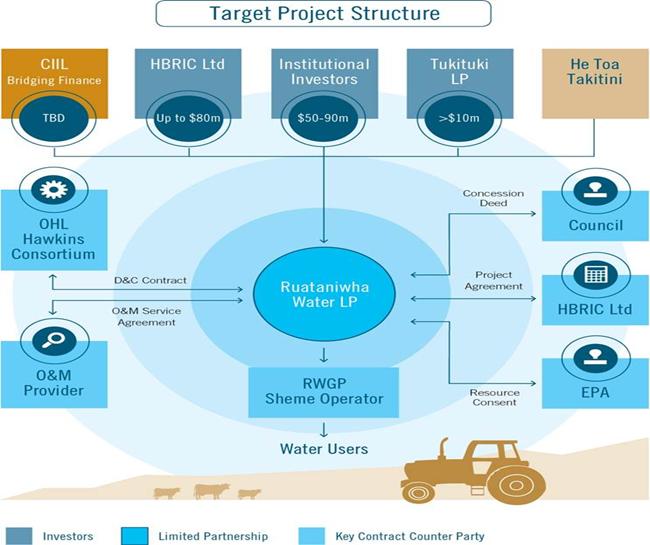

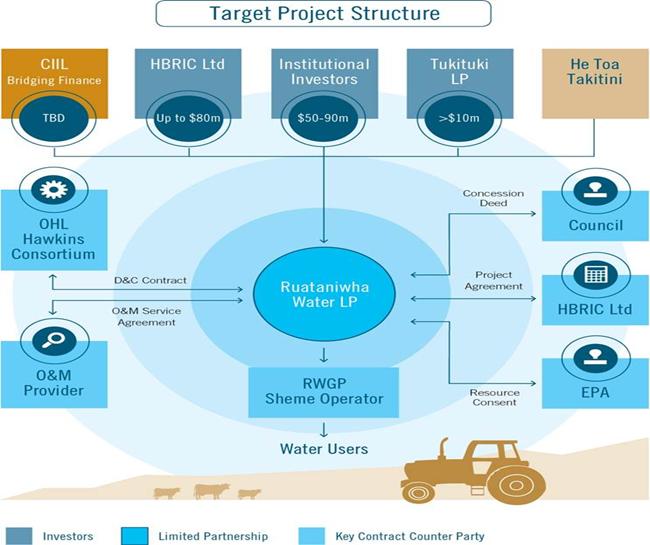

The following Figure 2

illustrates the proposed ownership and funding of RWLP.

|

Statement of Proposal re Investing in

RWSS

|

Attachment 1

|

Figure 2: RWLP Ownership

and funding of initial investment

Source:

Hawke’s Bay Regional Council, March 2014

|

Statement of Proposal re Investing in

RWSS

|

Attachment 1

|

It is important to note that without

HBRC’s investment, RWSS would not proceed. RWSS is a regional infrastructure

investment, initiated by HBRC and developed through HBRIC Ltd in partnership

with iwi, the private sector and central government agencies and crown

entities. The partnership and structure rests upon the participation of HBRC

through HBRIC Ltd.

Although the investment sought by

HBRIC Ltd at $71.5 million is less than the $80 million provided for under LTP

2012-2022, it is possible HBRC will be asked to eventually increase its funding

to the level proposed in LTP 2012-2022 (i.e. $80 million) to ensure completion

of RWSS.

3.3 GOVERNANCE

The RWLP Board will consist of five

or six directors, two of whom will be independent of the owners, and one of

those appointed will be Chairperson. Two directors will be appointed by HBRIC

Ltd and others appointed by the other shareholders in proportion to their

respective equity investments in RWSS.

3.4 Management

The RWLP will have its own operating

management, independent of any owner. The Chief Executive of RWLP will be

recruited and appointed by the Board of RWLP.

3.5 ANTICIPATED

Operating Performance

RWLP will derive revenues

principally from fees paid by users for the distribution of water to them. Its

resource consent caps the total amount of contracted water at 104 million cubic

metres per annum. In addition RWLP will enter into a concession deed with HBRC

to ensure reliability of supply is preserved. The majority of revenue will be

controlled by these requirements. RWLP will be contractually committed to

supply water volumes and quality to irrigators, and it should also earn some

revenue from the sale of electricity generated by a proposed hydro electric

power station.

3.6 risks

Like all investments, RWLP has

risks. In this case the risks include:

· Design and construction risks

· Establishment risks, such as:

o uptake by farmers

o response by investors

· Operational risks in course of

day-to-day business such as:

o environmental – weather

o regulatory

· External risks, such as:

o unforeseen changes in the

international and New Zealand economies, especially those affecting prices for

agricultural produce

o changes in the agricultural sector

o changes in government policies

o changes in New Zealand’s business

environment

HBRIC Ltd

has addressed these risks through a combination of conditions precedent and

HBRIC Ltd financial risk minimisation plans and environmental mitigation

programme and an Irrigation Management Plan (binding on farmers).

HBRC commissioned

Deloitte to undertake a peer review of the HBRIC Ltd Business Case and

associated business and financing risks.

A summary of

Deloitte findings will be included in this section

The options for achieving the

objectives outlined above were evaluated in reaching the conclusion that

investing in RWSS is the most efficient and effective way of achieving them.

These are:

· Invest in the RWSS as proposed; or,

· Status Quo: no investment in RWSS.

The advantages and disadvantages on

investing in RWSS as compared with not investing are summarised below.

4.1 ADVANTAGES

1. Economic

Benefits

Improving economic

benefits through development of agriculture is particularly important for

Hawke’s Bay region because its temperate climate and high sunshine hours give

it a key competitive advantage in diversity, quality and availability of

primary production and in processing food for export. Currently the region

contributes 3.4% of New Zealand’s national GDP, however its contribution to the

nation’s primary production and processing is 7%, more than double its

overall contribution, reflecting the benefit of its competitive edge. This

means the region gains relatively more form investment in primary production

than do other regions in New Zealand.

Economic benefits from

implementing the RWSS will occur as both one-off gains from the initial

development and construction phases, and subsequently, annually, from increased

production and productivity from farming operations. Independent assessment of

these benefits was undertaken by Butcher Partners Limited, an economics

research consultancy, and is summarised below.

Comment

on Deloitte assessment of this will be included in this section

a. One-off

construction and development benefits

Butcher Partners

estimated there will be a one-off increase in the regions GDP of around $410

million as a result of the investments made by farmers in on-farm systems

developed to use the water delivered by RWSS to their farm-gates and the

construction of the RWSS dam, reservoir and distribution system. These

investments are estimated to result in an addition of around $270 million to

household incomes and around 4,700 job years of work during construction.

b. Ongoing

annual benefits from farming and other operations

Benefits should arise

from increased processing that may arise from conversions from livestock

farming to fruit, vegetables and dairying. Although the extent of increased

processing is very uncertain, Butcher Partners estimate the total combined

increase in activity in the farming, processing and supporting industries could

raise Regional GDP by approximately $250 million per year, including an

additional $125 million per year in household income, and create a total

of 2,520 extra on-going jobs in the region.

The estimated annual

benefits are summarised in the following Table 5.

Table 5: Estimated

Economic Benefits at Full Development of RWSS

Sources:

Butcher Partners, Hawke’s Bay Regional Council, March 2014

These benefits would not

arise if RWSS was not implemented as a result of HBRC failing to invest in it.

2. Environmental

Benefits

Currently the Tukituki catchment

suffers from a nutrient imbalance when river flows are lowest in the summer

months. This results in excessive phosphorus in the water generating slime and

algae growth. This effect is compounded by further reduced water flows and

warming of the river as a result of draw off of water under current water

allocations to farmers, which exceed Regional Plan limits. These low flows

reduce habitat for trout and various taonga species and the slime and algae

growth impacts on the recreational value of the river.

HBRC has addressed these issues by

proposing Tukituki Plan Change 6 which will set minimum flow levels and set

appropriate nutrient levels which will improve environmental outcomes as a

result. However imposition of these requirements on their own will reduce

agriculture production and productivity and consequently impact adversely on

the region’s economy.

Commentary

on Board of Inquiry draft decision will be included in this section once

received.

Implementation of RWSS will enable

improvement of water quality (lower nutrient levels) and minimum flows while

off-setting the economic impacts of Plan Change 6.

Moreover RWSS will help the regional

economy offset the predicted effects of climate change. This is especially

important for Hawke’s Bay in the light of NIWA and other forecasts suggesting a

drying trend with more droughts in the future.

3. Social

Benefits

RWSS is expected to have

the following social benefits:

a. Short term boosts to the local,

district and regional economy during the construction phase, leading into long

term gains in employment relating to farming and farming services in

particular;

b. opportunities to change farming

practices and increase resilience to droughts;

c. reduced unemployment and

increased opportunities for youth, revive vitality amongst local communities,

and reduce dependency on welfare benefits;

d. improved career opportunities

for college and high school students;

e. water allocation rationalised;

f. new amenity values for

reservoir lake;

g. potential for enhanced

agricultural and horticultural training in support of land use changes;

h. improved

opportunities for technology development and transfer on farms as a result of

new farming systems and environmental management practices;

i. improved education, health,

sports and recreation and other services;

j. increased demand for farm

services based in Waipukurau and Waipawa as well as enhanced business activity

in retail and other areas;

k. improvements in quality of life

(housing, sports and community activity and services) as a result of flow-on

from increased employment, population and improved household incomes; and,

l. strengthening community groups

and organisations as a result of increased population and household incomes.

4. Cultural

Benefits

HBRC has a key ongoing

partnership with Maori in the Hawke’s Bay Region, who make up nearly 25%

(Census 2013) of the total Hawke’s Bay population. This relationship together

with the requirements of the RMA has resulted in HBRC and HBRIC Ltd including

tangata whenua representatives in all stages of the RWSS project development.

This has resulted in a number of benefits from RWSS as summarised below:

a. Execution

of memoranda by Ngati Kahungunu Iwi Authority, Te Taiwhenua o Tamatea, HBRC ,

HBRC and a number of Heretaunga hapu to cover cultural value monitoring,

preservation of native fish passage, base line and effects monitoring for the

Lower Tukituki river as well as new implementation policy in Plan Change 6

which includes cultural values monitoring as part of the wider HBRC Tukituki catchment

monitoring;

b. Agreement

between Te Taiwhenua o Tamatea and HBRIC Ltd formalising their relationship and

providing, amongst other matters:

i. First right of

refusal to Te Taiwhenua o Tamatea to contract for work arising from the

biodiversity mitigation package proposed to be implemented with RWSS;

ii. Active

pursuit of local and tangata whenua employment opportunities as part of the

RWSS Design and Construction programme; and,

iii. $50,000

annually will be set aside for education scholarships for tangata whenua with

links to the Ruataniwha district.

c. Establishment

of a “Kaitiaki Runanga”, whose role is to review, report and recommend in

relation to cultural and environmental monitoring during construction and the

initial stages of the project, as part of the RWSS resource conditions.

d. He

Toa Takitini (the Tamatea and Heretaunga Treaty Settlement Group) has expressed

interest in a potential equity stake in the scheme as part of its upcoming

settlement with the Crown (see Figure 2 above).

5. Security

of supply for users

RWSS provides users with

security of supply of water, irrespective of weather, climate and environment

conditions, that is not available without the RWSS.

6. Improved

Returns on HBRC’s investment portfolio

Over the long term the financial

return from investment in RWSS should be shown in both increased value of the

investment and an ongoing stream of dividends.

Although there is no guarantee of

returns, HBRC’s Long Term Plan 2012-2022 assumes that RWSS will eventually

generate dividends alone at the rate of at least 6% on its investment.

7. Impact

on rates

HBRC has structured its

proposed investment in RWSS of $71.5 million to be accomplished without

requiring any support from its rates income and therefore no rates increases should

occur in the future as a result of the investment in RWSS.

This will be achieved by

distributions from HBRIC Ltd derived from other investments meeting the cost of

funds of the RWSS investment.

Any requirement for

investment over the currently proposed figure of $71.5 million, up to $80

million, as proposed in lTP2012-2022, will only be made if HBRIC Ltd is able to

meet the cost of funds of the additional investment on the same terms as

already applies to the currently proposed investment of $71.5 million.

8. Monitoring

and Evaluation

This structure should

enhance monitoring and evaluation tools to assess the performance of the RWLP

against its objectives and HBRC’s strategic economic objectives while achieving

a satisfactory return on the portfolio as a whole. It will ensure:

a. Investments

can still be managed, monitored and evaluated on their own individual merits.

b. Any

cross-subsidies from one investment to another can be clearly identified and

evaluated.

c. Effects of

investment decisions made to assist HBRC’s strategic economic development

objectives can be identified, monitored and evaluated.

4.2 DISADVANTAGES

1. Environmental

Impacts

A very comprehensive

mitigation programme has been developed to offset a range of adverse

environmental effects that could result from implementation of RWSS unless

otherwise addressed. These adverse effects relate to terrestrial ecological

effects on the land flooded for the proposed reservoir and effects on the river

environment associated with the establishment and structure of the scheme and

its ongoing operation.

Although the programme of

six projects and implementation of an overall Irrigation Environment Management

Plan (“IEMP”), which is binding on farmers and their operations, are expected

to fully offset the projected impacts of RWSS and enable the implementation of

Plan Change 6 with minimal adverse impact on the regional economy, it is

possible the administration or effect of this programme may not deliver the

full benefits of mitigation all the time.

Nevertheless

the comprehensive nature of the mitigation programme and the IEMP should ensure

very little, if any, adverse environmental impact occurs as a result of RWSS.

2. Social

Costs

RWSS could also result in social

costs including:

a. some

loss in amenity values in the valley flooded to accommodate the reservoir;

b. increased health and safety

risks from intensified production from dairy and horticulture

c. increased traffic risks from

movement of heavy and other vehicles on local roads;

d. increased cost of maintaining

local roads;

e. possible values conflicts

between existing members of the communities and new entrants attracted by jobs

and opportunities; and

f. short term demand for rental

housing during the construction phase may put pressure on rents and

availability of housing for other renters.

3. Restricted

Access to HBRC’s Investment during its establishment phase

HBRC will be unable to

realise its investment in RWSS, should it wish to do so, until it is fully

established and operating profitably. In effect HBRC’s investment will be

“locked away” for at least 10 years.

The following conditions

precedent need to be satisfied before the HBRC provides any funding to HBRIC

Ltd:

1. The EPA granting

satisfactory resource consent conditions for RWSS infrastructure and

operations, which in turn are recommended as being workable by all investors;

2. Agreements to purchase a

minimum of 40 million cubic metres of water contracts (Water User Agreements);

3. Securing the funding

required to build and operate the RWSS infrastructure;

4. Obtaining a bankable

construction contract which adequately addresses construction risk allocation

through a fixed-time, fixed-cost arrangement.

In the event these conditions are

not met to the satisfaction of HBRC, no investment will be made in RWSS in this

form at this time.

HBRC believes investment as proposed

in the RWSS will realise significant long term social cultural, environmental

and economic benefits for the region, while also generating financial returns

to HBRC which will help sustain its services to the community in the future.

HBRC therefore recommends investment

in RWSS of up to $80 million proceed as outlined in this Statement of Proposal

for the following reasons outlined in “7” below.

Investment in RWSS is a

key initiative in helping to deliver HBRC’s strategic development objectives

which focus on active management of sustainable natural resources and

strengthening the regional economy. In particular:

· RWSS is part of HBRC’s

integrated approach to managing the Tukituki catchment with the consequential

environmental benefits of minimising the adverse economic impacts of Plan

Change 6 as a result of implementing minimum flow restrictions and setting limits

on nutrient discharge into the river;

· RWSS is expected to help

realise the significant agriculture potential of the Tukituki catchment by

providing a reliable supply of water for irrigation

· This should result in

significant additions to the regional economy in terms of additional jobs, and

add to regional household income and GDP once the scheme becomes fully

operational;

· It is a development

partnership of private and public sector parties, including HBRC (through HBRIC

Ltd), iwi, other Hawke’s Bay investors and central government investing in key

infrastructure to support the region and the nation over the long-term; and,

· It will achieve

commercial viability and generate value for its shareholders over time.

HBRC has chosen to follow

the special consultative procedure set out in the Local Government Act for the

investment in RWSS.

HBRC is releasing this proposal on 1

May 2014. Written submissions will be received until 3 June 2014.

HBRC will meet to consider submissions

on the proposal on 16 June 2014.

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 16 April 2014

SUBJECT: Ruataniwha Water Storage Proposition Consultation

Reason for Report

1. Council will

potentially embark on a Special Consultative Process for the Ruataniwha Water

Storage Investment Proposition on 1 May 2014.

2. The proposed

consultation period will run for a month from Thursday 1 May until Tuesday 3

June 2014.

3. This item outlines how

Council proposes to further inform people in the region about the scheme and

encourage their submissions, to assist Council’s decision on whether or not to

invest up to $80 million in the scheme.

4. The preparation of this

item is not intended to assume a particular outcome on 30 April, but it is

important that adequate preparations are made to enter a Special Consultative

Process on 1 May 2014, should Council agree to do so at its meeting on 30

April.

Background

5. HBRC has maintained a

steady public communication programme on the Ruataniwha Water Storage Scheme

(RWSS) since 2011. The process has previously included two rounds of public

consultation (both in 2012). Public also had the opportunity to submit during

the resource consent application stage led by the government’s Environmental Protection

Authority (in 2013).

6. Council wishes to

conduct a substantial consultation round, asking public to inform the

decision-making process, in advance of public hearings in June, and before

Council makes its final decision on investment in the scheme, tentatively

scheduled for Wednesday 25 June 2014.

Key Messages

7. If Council decides on

30 April that its preferred option for public consultation is to invest up to

$80M in the RWSS then the following will be the key messages:

7.1. Hawke’s Bay Regional

Council has a big decision to make on behalf of the regional community. We

believe that water storage means environmental and economic wins for Hawke’s

Bay. Simply put, the question we’re putting to the regional community is

whether or not to invest up to $80 million in the scheme.

7.2. Water storage will

allow HBRC to improve water quality and summer flows in the Tukituki River. It

can also unlock secure water supply to irrigate 25-30,000 hectares of land,

create around 2,500 new jobs and generate up to $250 million in year in ongoing

benefits for Hawke’s Bay.

7.3. The effects of a Plan

Change on the Tukituki River, without water storage, will mean higher minimum

flows for current and future water use, no ability to influence minimum and

flushing flows in dry periods, no contribution to regional economic

development, no related employment opportunities and no household income

benefits.

Better to Know

8. HBRC needs to present

information about RWSS in a non-partisan and non-emotional way. However the information

should be engaging – rather than overly technical – and allow people to draw

their own conclusions.

9. Book-ending

communications with ‘You need to know’ and ‘Better to know’ will reinforce the

delivery of information from which personal opinions can be formed.

10. www.bettertoknow.co.nz will lead to

new content embedded in HBRC’s website.

Consultation Outline

11. Consultation is based on

HBRC’s statement of proposal for investment in the Ruataniwha Water Storage

Scheme.

12. The objective is to

reach the widest possible audience in the region using a range of media, to

inform and encourage submissions.

13. Planned elements include

a personally addressed stakeholder letter, RWSS brochure, media releases,

press, print and radio advertisements, and consultation packs for the eight

libraries in the region and two main HBRC offices.

14. Additional planned

support will take the shape of a standardised PowerPoint presentation, video

case studies, associated with new online content at hbrc.govt.nz and accessible

via bettertoknow.co.nz.

15. Social media will also

be used to inform and encourage submissions in addition to GiggleTV (viewed in

fast food outlets, petrol stations, bars, gyms and retail outlets).

16. The RWSS Investment

Proposition will also be a key element of HBRC’s stand at the Better Home

and Living Expo. This occurs at Pettigrew Green Arena, from Friday 16 May

to Sunday 18 May 2014.

Public Meetings

17. Staff propose a significant round of public meetings to enable as

many people as possible to be informed and ask questions concerning HBRC’s

potential decision to invest. Where possible, a standard PowerPoint

presentation will be used to lead consultation.

|

14-May

|

12.30 pm

|

CHB Municipal Theatre

– Chambers, Waipawa

|

CHB

|

|

14-May

|

5.15 pm

|

Town Hall, Ongaonga

|

CHB

|

|

15-May

|

12.30 pm

|

Civic Theatre,

Waipukurau

|

CHB

|

|

15-May

|

5.15 pm

|

Town Hall, Takapau

|

CHB

|

|

20-May

|

TBC

|

Rakautatahi Marae,

Nancy Street, Takapau

|

CHB

|

|

22-May

|

5.30 pm

|

Duke of Edinburgh

Hotel, Porangahau

|

CHB

|

|

15-May

|

12.30 pm

|

Baptist Church,

Auditorium, Lyndon Road

|

Hastings

|

|

15-May

|

5.15 pm

|

Baptist Church,

Auditorium, Lyndon Road

|

Hastings

|

|

20-May

|

12.30 pm

|

Havelock Nth

Community Centre, Lantern Gallery

|

Hastings

|

|

20-May

|

5.15 pm

|

Havelock Nth Community

Centre, Lantern Gallery

|

Hastings

|

|

15-May

|

12.30 pm

|

War Memorial, Room 2,

Marine Parade

|

Napier

|

|

15-May

|

5.15 pm

|

Taradale Town Hall

|

Napier

|

|

15-May

|

12.30 pm

|