Meeting of the Hawke's Bay Regional Council

Date: Wednesday 26 March 2014

Time: 9.00 am

|

Venue:

|

Council Chamber

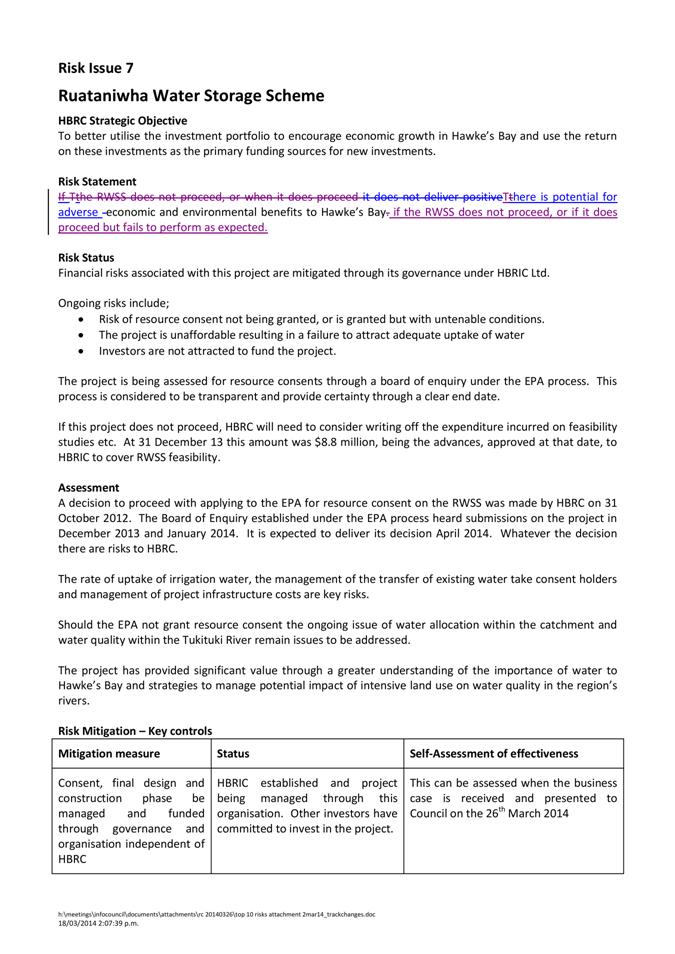

Hawke's Bay Regional Council

159 Dalton Street

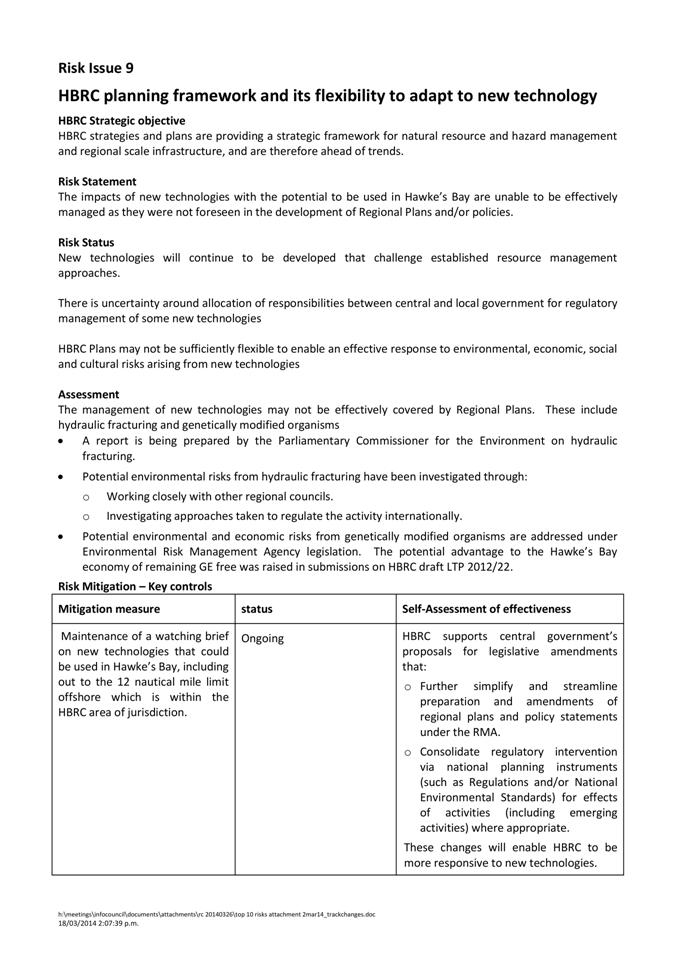

NAPIER

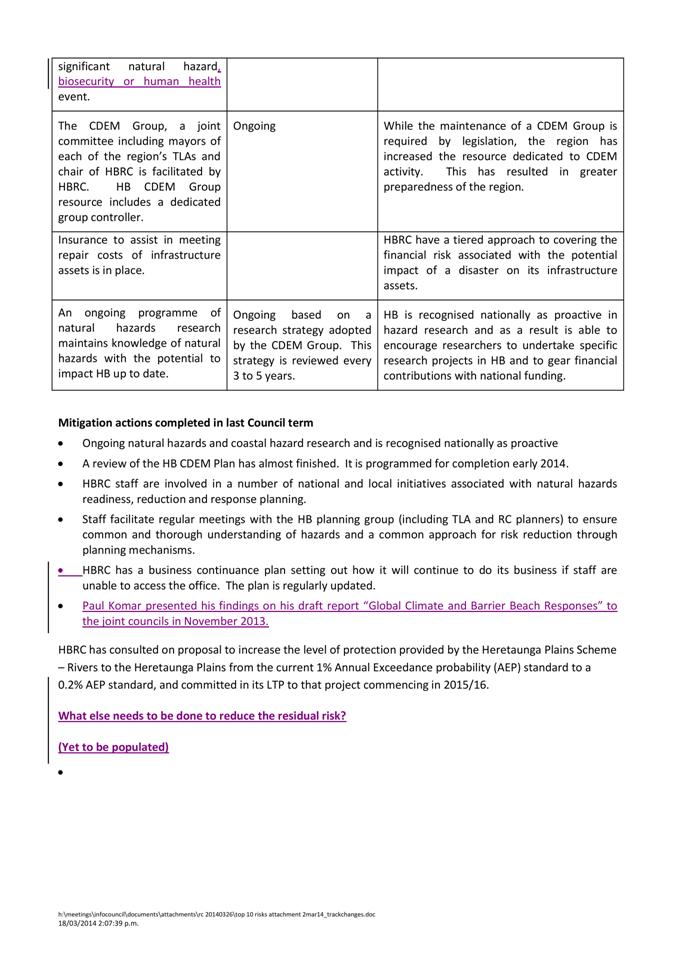

|

Agenda

Item Subject Page

1. Welcome/Prayer/Apologies/Notices

2. Conflict of Interest Declarations

3. Confirmation of Minutes of the

Regional Council Meeting held on 26 February 2014

4. Matters Arising from Minutes of the Regional Council

Meeting held on 26 February 2014

5. Follow-ups from Previous Council Meetings

6. Call for any Minor Items Not on the Agenda

Decision Items

7. Hawke's Bay Regional Investment Company Ltd (HBRIC Ltd)

Business and Investment Case for the Ruataniwha Water Storage Scheme

8. Affixing of Common Seal

9. Recommendations from the Corporate and Strategic Committee

10. Adoption of the Draft 2014/15 Annual Plan

11. Communications Strategy for the Draft Annual Plan 2014/15

12. HBRC Submission on Transport Funding Assistance Rates Review

13. Public Transport - Update and Route 12 Capacity Issues

Information or Performance Monitoring

14. Monthly Work Plan Looking Forward Through April 2014

15. Minor Items Not on the Agenda

16. Chairman's Monthly Report (to be tabled)

Decision Items (Public Excluded)

17. Port of Napier Ltd (Napier Port) Director Appointment

18. Confirmation

of Public Excluded Minutes of the Regional Council Meeting held on 26 February

2014

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 26 March 2014

SUBJECT: Follow-ups from Previous Council Meetings

Reason for Report

1. Attachment

1 lists items raised at previous meetings that require follow-ups.

All items indicate who is responsible for each, when it is expected to be

completed and a brief status comment. Once the items have been completed and

reported to Council they will be removed from the list.

Decision Making Process

2. Council is required to make a decision in accordance with

Part 6 Sub-Part 1, of the Local Government Act 2002 (the Act). Staff have

assessed the requirements contained within this section of the Act in relation

to this item and have concluded that as this report is for information only and

no decision is required in terms of the Local Government Act’s provisions, the

decision making procedures set out in the Act do not apply.

|

Recommendation

1. That Council receives the report “Follow-ups

from Previous Council meetings”.

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

|

1View

|

Follow-ups

from Previous Regional Council Meetings

|

|

|

|

Follow-ups from Previous Regional

Council Meetings

|

Attachment 1

|

Follow-ups from previous Regional Council Meetings

Meeting Held 26 January 2014

|

|

Agenda Item

|

Action

|

Responsible

|

Due Date

|

Status Comment

|

|

1

|

Minor Items

not on the Agenda

|

Provide

copies of the “Maori Charter” to all councillors and Maori Committee members

|

L Hooper

|

Immed

|

Current

Charter provided to Maori Committee members on 25/2/14 and to Councillors via

Dropbox on 13/3/14.

Also

available on the HBRC website on the Council & Committees Structure page.

|

|

Follow-ups from Previous Regional

Council Meetings

|

Attachment 1

|

LGOIMA Requests Received

between 20 February and 18 March 2014

|

Request Status

|

Date

Received

|

Response Due

|

Requested By

|

Request Summary

|

Group Manager Responsible

|

|

Active

|

10/03/14

|

4/04/14

|

P Brian Webby

|

2-3060 Paeria Drainage Class B

What is this levy or scheme for? What area in Wairoa does it cover?

Summary of the total levy collected for this scheme?

List of what work if any Council has paid for under this levy in recent time?

|

Mike Adye

|

|

Complete

|

6/03/14

|

1/04/14

|

Pauline Doyle

|

Seeking a more recent map showing the full permit area which

apparently encroaches right down into Napier City

|

IM, Drew Broadley

|

|

Complete

|

5/03/14

|

2/04/14

|

Julianna Dawson (NCIF Wairoa)

|

The results of recent PM10 monitoring at Tiaho School in Wairoa

|

Iain Maxwell

|

|

Active

|

4/03/14

|

2/04/14

|

Luke Stewart

|

1. How much has

Hawke’s Bay Regional Council spent on:

- the resource consents associated with the Ruataniwha Water Storage scheme

proposal? - the Ruataniwha Water Storage scheme proposal?

- the Tukituki Plan Change proposal? - the Tukituki Catchment proposal? -

resource consents associated with the Ruataniwha Water Storage scheme

proposal? - the Ruataniwha Water Storage scheme proposal? - the board of

inquiry process associated with the Tukituki Catchment Proposal, Tukituki

Plan Change and Ruataniwha Water Storage Scheme?

2. How much has

Hawke’s Bay Regional Investment Company spent on:

- the Tukituki Plan Change proposal? - the Tukituki Catchment

proposal? - the board of inquiry process associated with the Tukituki

Catchment Proposal, Tukituki Plan Change and Ruataniwha Water Storage Scheme?

|

Helen Codlin

Andrew Newman

|

|

Complete

|

3/03/14

|

31/03/14

|

David Noakes

|

How many Incident response officers HBRC have and on average

(per month and annually) how many incident reports HBRC has

|

Iain Maxwell

|

|

Active

|

27/02/14

|

|

Luke Stewart - Green Party

|

Titles & Dates of any economic reports relating to RWSS

HBRC contribution to Irrigation NZ conference

|

Andrew Newman & Graeme Hansen

|

|

Complete

|

24/02/14

|

24/03/14

|

Rex Graham Also on behalf of councillors Barker, Belford and

Bevan

|

The release of HBRIC ltd CEO Salary increase

|

Liz Lambert

|

HAWKE’S BAY REGIONAL COUNCIL

Environment

and Services Committee

Wednesday 26 March 2014

SUBJECT: Call for any Minor Items Not on the Agenda

Reason for Report

1. Under standing orders,

SO 3.7.6:

“Where an item is not on the agenda for a

meeting,

(a) That item

may be discussed at that meeting if:

(i) that

item is a minor matter relating to the general business of the local authority;

and

(ii) the

presiding member explains at the beginning of the meeting, at a time when it is

open to the public, that the item will be discussed at the meeting; but

(b) No

resolution, decision, or recommendation may be made in respect of that item

except to refer that item to a subsequent meeting of the local authority for

further discussion.”

2. The Chairman will

request any items councillors wish to be added for discussion at today’s

meeting and these will be duly noted, if accepted by the Chairman, for

discussion as Agenda Item 15.

|

Recommendations

That Council

accepts the following minor items not on the agenda, for discussion as item 15:

1.

|

|

Leeanne Hooper

Governance & Corporate

Administration Manager

|

Liz Lambert

Chief Executive

|

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 26 March 2014

SUBJECT: Hawke's Bay Regional Investment Company Ltd (HBRIC Ltd)

Business and Investment Case for the Ruataniwha Water Storage Scheme

Reason for Report

1. Following consideration

of a full feasibility study in October 2012 the Hawke’s Bay Regional Council

(Council) resolved to transfer the responsibilities for progressing the

Ruataniwha Water Storage project to the conclusion of the resource consent

application phase to Hawke’s Bay Regional Investment Company (HBRIC Ltd),

including those responsibilities as the applicant for the required resource

consents.

2. As part of that

transfer of responsibilities HBRIC Ltd undertook to report back to Council at

the end of the consent process with a recommendation on whether or not Council

should proceed to invest further in the Ruataniwha Water Storage project and,

if so, under what terms and conditions further investment should be made.

Council decided that if, at this point, it was to continue investing in this

project then its decision would be subject to a special consultative process.

3. HBRIC Ltd has now

progressed its investigations to the point of delivering a business case as the

basis for Council to consider its preferred option as part of the special

consultative process.

4. A copy of the business

case is circulated under separate cover.

5. The Chairman and

members of the Board of HBRIC Ltd will present the business case to Council.

Background

6. The Tukituki catchment

is subject to low flow events in both major tributaries of the main stem of the

river on a regular basis through the summer period. Significant irrigation

utilising both surface and ground water resources takes place during the times

of the year when the water has highest value for the environment, river ecology

and recreational users. This has resulted in all values being compromised.

7. Water storage has been

considered as part of the potential framework for overall water management in

Hawke’s Bay for generations; however the drought years of 2006-2009, and the

pressure of both current irrigation and demand for more, brought the issue to a

head in 2008.

8. In 2008, Council

initiated a number of projects in parallel, including substantial investment in

the water resource science area, establishment of water user groups and water

demand management, establishment of significant community engagement process

both at a regional and catchment scale, and investment in water storage

pre-feasibility and feasibility processes in two catchments.

9. The clear intention of

Council from the outset has been to seek to deliver both environmental and

economic wins for the catchment, its residents, and for the region.

10. In the case of the

Tukituki Catchment, the prefeasibility study was undertaken between 2008 and 2009.

The results of this high level assessment suggested a storage scheme was worth

progressing to a further feasibility stage. Subsequently in December 2009,

Council with initial support from the Sustainable Farming Fund, committed to an

advanced prefeasibility phase with the initial stage of that project being to

assess in detail the storage sites.

11. Of significance at the

completion of that process was that storage at the scale identified in

prefeasibility (multiple off-river storage dams) was problematic from a

geotechnical and energy cost perspective. The highly fragmented nature of the

foundation material throughout the area and the need to pump water into storage

sites called into question the immediate and long-term economic viability of

that project configuration. Commencing in January 2010, two in-tributary sites

were then investigated through the full feasibility phase, with one being

discounted on the basis of foundation geotechnical issues.

12. The full feasibility

study was then referred on to HBRIC Ltd as the basis for the development of the

business case which is now presented to Council. Council has previously

appointed Deloitte to peer review the business case and their findings will be

reported back to Council in April.

Decision Making Process

13. Council is required to

make a decision in accordance with Part 6 Sub-Part 1, of the Local Government

Act 2002 (the Act). Staff have assessed the requirements contained within this

section of the Act in relation to this item and have concluded that as this

report is for information only and no decision is required in terms of the

Local Government Act’s provisions, the decision making procedures set out in

the Act do not apply.

|

Recommendations

That Council:

1. Receives

the Hawke’s Bay Regional Investment Company Ltd (HBRIC Ltd) report entitled

“Business and Investment Case for the Ruataniwha Water Storage Scheme”.

2. Notes that

Deloitte is undertaking an independent per review of the HBRIC Ltd Business

and Investment case and will report back to Council in April.

3. Notes that

investment by Council, via HBRIC Ltd, in the RWSS to a quantum of up to $80

million is essential, together with a large level of Crown Irrigation

Investment Ltd (CII) debt funding, in order for the project to set a water

price that is financially viable for both water users and investors.

4. Notes that

the RWSS will make an important contribution to achieving Council’s strategic

environmental objectives for the Tukituki river and catchment as set out in

Land Water Us 2050 and Proposed Plan Change 6, by:

4.1. ensuring

a sustained minimum flow on the Makaroro River below the dam of

1.23 cumecs, which will sustain more than 20% of the 7-Day Mean Annual

Flow of the Tukituki at Red Bridge;

4.2. providing

for up to four flushing flows per year of up to one million cubic metres each

to assist Council to manage and mitigate periphyton build-up in the lower

Tukituki in particular, thus enhancing the ecological and recreational status

of the river;

4.3. providing

water to sustain minimum flows set for the Waipawa River at the RDS gauging

site and Tukituki River at Tapairau Rd (also ensuring that current consent

holders linked to those flows are not adversely affected by the scheme);

4.4. enabling

existing water users supplied by run-of-river and connected groundwater takes

(which negatively affect the low flows of Waipawa and Tukituki rivers) to be

supplied with stored water as an alternative; and

4.5. there

are six substantial environmental management, mitigation and offset projects

included in the RWSS project ranging from the catchment headwater to the

lower estuary.

5. Notes that

the RWSS Consents will require, at their own cost, Ruataniwha Water Limited

Partnership (RWLP) and Ruataniwha Water GP Ltd (RWGP) as the entities,

respectively, owning and operating the Scheme, to undertake comprehensive

water quality monitoring of 15 variables monthly and two variables annually

at 16 sites throughout the catchment, commencing 24 months before any water

is supplied, and that the data from these measurements will be integrated

with Council’s own environmental monitoring programmes.

6. Notes that

the proposed Production Land Use Conditions of the RWSS consents:

6.1. requires

that production land water users being supplied by the RWSS must prepare Farm

Environmental Monitoring Plans (FEMP) which must be regularly audited;

6.2. ensures

the limits for nitrogen/nitrate management set in Proposed Plan Change 6

(which are based on site-specific toxicity guidelines developed by NIWA) and

phosphorus emissions (no net increase in emissions at a sub-catchment level)

are met;

6.3. requires

E coli levels in surface and groundwater, and a range of other

environmental monitoring and management requirements that are, individually

and collectively, at least as stringent and generally more stringent than are

applied to irrigated land use elsewhere in New Zealand;

6.4. requires

that stock are excluded from all lakes, wetlands, permanently or

intermittently flowing rivers on any property supplied by the RWSS.

7. Notes that

the RWSS will make substantial contributions to Council’s strategic regional

economic development objectives, and that:

7.1. the RWSS

is projected to generate $250 million per year of ongoing value-added (i.e.

not gross) economic benefits in total, and the one-off benefit of the

construction project is estimated as being $410 million over the construction

period;

7.2. the

value added on-farm is projected to be $73 million/year; the value added to

farm support and services industries is projected to be $63 million/year; and

the value added to processing and processing support industries is projected

to be $120 million/year;

7.3. the

regional economic multiplier of the value added on-farm is 3.4, and thus the

added-value economic benefits of the RWSS are distributed through the wider

regional economy, consistent with the findings of ex-post studies of

the economic benefits of the Opuha water storage dam; and

7.4. the

ongoing economic impact of value added from the RWSS is estimated to have a

Net Present Value of $3.7 billion, discounted at 5% over 70 years.

8. Notes that

the RWSS is projected to have substantial employment and social benefits, and

is projected:

8.1. to

generate more than 2,500 full-time equivalent jobs, widely distributed over

the agriculture, manufacturing, wholesale and retail trade, transport and

communications, rural contracting, utilities and construction, and other

services employment sectors; and

8.2. to

generate ongoing household income of $60 million/year in farming and

farm-support industries (likely to be significantly concentrated in Central

Hawkes Bay) and $67 million/year in processing and processing support

industries (likely to be more widely distributed throughout the region).

9. Notes

that, in relation to engagement and agreements with mana whenua and kaitiaki:

9.1. HBRIC

Ltd has entered into an agreement with Te Taiwhenua o Tamatea (Tamatea) that

provides for ongoing close engagement between RWLP, the intended owner of the

RWSS, and Tamatea through the life of the RWSS and that both the Concession

Deed between Council and RWLP and the Project Agreement between HBRIC Ltd and

RWLP require acknowledgement of and adherence to this agreement;

9.2. Council

and HBRIC Ltd have entered into two Joint Memoranda with Ngati Kahangunu Iwi Incorporated

(NKII) and Te Taiwhenau o Heretaunga with Te Taiwhenua o Tamatea (ToHTT) a

party to the first and confirming their agreement to the second, which, inter

alia, provides for engagement of all the Memoranda parties in a Kaitiaki

Runganga (expanding the membership of the Mana Whenua Working Group of the

Tamatea Agreement) and for additional monitoring activities in the lower

Tukituki, both of which have been added to the proposed RWSS Consent

Conditions presented to the Board of Inquiry (BoI); and

9.3. the

Joint Memoranda noted in 9.2 above are also acknowledged in the Concession

Deed and the Project Agreement documents in the same manner as the Tamatea

Agreement, requiring adherence to what is agreed in the Memoranda.

10. Notes that,

in regard to Council’s Proposed Plan Change 6:

10.1. the BoI

must decide on Plan Change 6 first, then decide whether the Resource Consents

sought for the RWSS are in conformance with its decisions on Plan Change 6;

10.2. the key

decision to be made by the BoI that could affect the RWSS is likely to be

between what Council has proposed as nitrate limits for the Tukituki which

are based on nitrate toxicity to fish, OR much lower nitrate limits as sought

by a range of submitters (15% to 20% of Council’s proposal); and

10.3. if the

BoI decides to impose lower nitrate limits than proposed by Council there

would be significant consequences for the RWSS in regard to whether, and how,

it could manage nitrate emissions within a lower set of limits.

11. Notes that,

in regard to the consents sought for the RWSS via the BoI process:

11.1. no expert

engineering evidence was submitted that contested the design, location,

foundation conditions, engineering geology and seismology in regard to the

dam and related infrastructure or the proposed operation of that

infrastructure;

11.2. no expert

engineering evidence was submitted that contested the design, location or

proposed operation of the distribution system and its infrastructure such as

canals, pipelines, outfalls etc.

12. Notes that,

in relation to the Environmental Protection Authority (EPA) decision-making

process:

12.1. a Draft

Decision on Proposed Plan Change 6 and the RWSS Consents is expected on 15

April 2014; and

12.2. a Final

Decision must be made by 28 May 2014.

13. Notes that

HBRIC Ltd and co-investors in the intended RWLP, are finalising a Design and

Construction contract that is, to the maximum extent practicable, on a fixed

cost fixed time basis for the Dam and Distribution infrastructure, which:

13.1. will be

subject to expert panel oversight in the final design stage prior to

application for building consent from Waikato Regional Council;

13.2. is able

to deliver an increased volume of 104 million cubic metres of water per year

(a significant increase from the 91 million cubic metres projected at

Feasibility stage) without affecting the residual or flushing or other

environmental flows required in the RWSS Consents;

13.3. provides

water to all users on piped distribution at a pressure of 3.5 bars at the

farm gate (a significant improvement on nil pressure and supply up to 2km

from farm gate projected at Feasibility stage); and

13.4. enables a

contracted water price of 23 c/cubic metre plus a variable charge for

pressurization of up to 3 c/cubic metre (in the mid range of 22-25 c/cubic

metre projected at Feasibility stage).

14. Notes that:

14.1. HBRIC Ltd

has received Expressions of Interest (EoI) for 47 million cubic metres of

water/year to be purchased, and that HBRIC Ltd is now engaged on a process of

seeking confirmed contracts for purchase under a standard Water User

Agreement that requires compliance with all Land Use Conditions of the RWSS

Consents submitted to the BoI process; and

14.2. achieving

a target level of 40 milllion cubic metres/year of contracted water, or such

other volume as is agreed by the parties investing in RWLP, is a Condition

Precedent for Financial Close

15. Notes that:

15.1. the RWSS

is intended to be owned and operated as a modified Build, Own, Operate and

Transfer project over a 70-year Concession Period, governed by a Concession

Deed between Council and RWLP, the intended Owner of the RWSS Assets and

Infrastructure during the Concession Period, and also by a Project Agreement

between HBRIC Ltd and RWLP;

15.2. Ruataniwha

Water GP Ltd, the General Partner of the RWLP, will be the Operator of the

RWSS Assets and Infrastructure during the Concession Period;

15.3. investors

in RWLP will hold shares in RWGP in the same proportions as their ownership

in RWLP;

15.4. local

eligible investors, including farmers who have contracted for water from the

RWSS, will have their investment aggregated by another Limited Partnership

(Tukituki Investment LP) which will invest the aggregated amount in RWLP. It

is also expected that, to the extent that there is local iwi investment in

the RWSS, a similar separate LP (or LPs) will make any local iwi investment

in RWLP;

15.5. at the

end of the Concession Period ownership of the RWSS Assets and Infrastructure

will be handed back to Council/HBRIC Ltd or successor, except that, to the

proportional extent of ownership of the RWLP by local investors LP, and any

local iwi LP, such owners will have continuing proportional ownership of the

Assets and Infrastructure, or of the entity succeeding RWLP that owns the

Assets and Infrastructure.

16. Notes that

in regard to the capital structure and capital raising process:

16.1. equity

ownership in RWLP is expected to be subscribed for, at Financial Close, by a

combination of HBRIC Ltd, a number of institutional investors, Tukituki

Investment Limited Partner (TILP), and possibly by an Iwi LP;

16.2. the

capital raising process will continue until Financial Close and will not be

confirmed until all Conditions Precedent are satisfied and/or waived by

agreement of the investor parties;

16.3. it is

expected that HBRIC Ltd will subscribe for up to $80 million of equity in

RWLP, with a current likely investment amount of $72 million, of which $63

million will be in cash and $9 million of already expended development

expenditure and intellectual property which will be recognized by the

allocation of equity interests;

16.4. it is

expected that CII will provide debt financing to the RWLP subject to their

investment terms being met, the conditions precedent being met and

shareholder approval;

16.5. the different

equity investors will have different terms reflecting, inter alia,

their different target rates of return, priority for cash-flows generated

from water sales, and whether they have interests terminating at the end of

the Concession Period or have ongoing equity interest beyond the Concession

Period;

16.6. the terms

negotiated and agreed between the investor parties, at Financial Close, have

been (or will have been) negotiated and agreed between the parties on an

arms-length, commercial basis.

17. Notes that

in relation to the terms under which HBRIC Ltd proposes to invest in RWLP:

17.1. HBRIC Ltd

will accept a low priority for cash-flows during the uptake period before the

exit of CII, in order to ensure an acceptable water price and to encourage uptake;

17.2. during

the uptake period, HBRIC Ltd will make a lower rate of return (base-case

modelled at 5% post-tax internal rate of return (IRR), from both cash yield

and incremental increase in value of interests) than institutional investors

over that period;

17.3. after the

uptake period, for the remainder of the Concession Period, HBRIC Ltd will

make the same return as all other investors (base-case modelled as 10%

post-tax IRR) – a good rate of return for a “brownfields” infrastructure

investment);

17.4. the lower

rate of return and slower rate to profitability that HBRIC Ltd proposes to

accept on its investment in RWSS/RWLP are consistent with the provisions of

its Statement of Intent (SoI) with Council, when the investment is intended

to “Help achieve Council’s regional strategic economic development objectives

by investing in assets that will benefit the Hawke’s Bay Region as a whole.”

(Pages 3 and 4 2013/2014 SoI)

17.5. As noted

in 7 above, the RWSS is projected to make substantial contributions to

Council’s regional strategic economic development objectives.

18. Notes that

the Directors of HBRIC Ltd have given detailed consideration to extensive

negotiations with counterparties in regard to investment quantum, risk and

return, and have exercised their judgment, in particular, on the following

key points:

18.1. the

quantum proposed of up to $80 million to be invested by HBRIC Ltd (depending

in part on the amount of capital raised via TILP) is appropriate and

necessary (together with the large amount of CII funding) to achieve a water

price that is viable for users, that will encourage uptake, and will also

make the project viable for commercial investors;

18.2. the 5%

post-tax IRR on HBRIC Ltd’s investment that is modelled in the base case over

the uptake period is necessary (together with the low interest rate on CII

debt) both to set an appropriate water price and to enable early cash-flows

to be prioritised to institutional investors (delaying these cash-flows would

be more expensive for the project and for HBRIC Ltd overall);

18.3. the HBRIC

Ltd rate of return during the uptake period is less than a commercial rate of

return, but this is acceptable under HBRIC Ltd’s Statement of Intent in order

to achieve regional economic development;

18.4. the HBRIC

Ltd rate of return during the uptake period being less than a commercial rate

of return also reflects environmental contributions noted in 4 above;

18.5. the 10%

post-tax IRR return that is modelled in the base case for HBRIC Ltd (and all

investors) after the uptake period and CII has exited the project is an

appropriate and good commercial rate of return on the investment;

18.6. HBRIC

Ltd’s low rate of return during uptake and commercial rate of return post the

uptake period mean that HBRIC Ltd should be a long-term investor in the

project, at least until significantly more than halfway through the first

consent period;

18.7. there is

some level of risk that, under a slow uptake scenario, a significant fraction

of the CII debt will have to be repaid as a lump sum under a “hard exit” by

CII, after about year 15 of the project. In such a situation, which is

considered unlikely, HBRIC Ltd could be required to fund in the order of

$12-24 million of that payback. HBRIC Ltd has a number of options to fund such

a payment, if that eventuates, or to avoid making its contribution by

allowing other local investors to take up or expand their equity interests in

RWLP; and

18.8. the level

of governance representation that HBRIC Ltd will have in the Ruataniwha Water General Partner Ltd (which will operate the project) is

considered appropriate for the proportion of equity interests held by HBRIC

Ltd.

19. Notes that

discussions have been held between HBRIC Ltd and Council management regarding

the level of dividends HBRIC Ltd can forecast in comparison with reduced cash

flows to Council from interest and other cash yields from its current

investments, and:

19.1. Council's

cash investment into HBRIC Ltd is projected to be in two tranches –

circa $22 million in 2014/15 and circa $41 million in 2015/16;

19.2. Discussions

to date indicate that in the years after 2015/16 there is unlikely to be

significantly less cash-flow from HBRIC Ltd to Council's operating budget

than would be received by Council if the current investments were maintained;

19.3. In

2014/15 there may be a shortfall of circa $400,000 between forecast dividend

payments and the reduction in Council's cash-flow from its existing

investments as a consequence of withdrawing $22 million from cash-generating

investments, and a shortfall of circa $2,750,000 in 2015/16 as a consequence

of withdrawing a further $41 million from cash-generating investments;

19.4. HBRIC Ltd

holds the view that these cash-flow differences for Council in 2014/15 and

2015/16 cannot be prudently met by HBRIC Ltd requiring a higher level of

dividend from Napier Port than is currently projected in Napier Port's

Statement of Corporate Intent, particularly in 2015/16; and

19.5. Council

and HBRIC Ltd management will continue to discuss how to mitigate the impact

on Council's cash flows of changing $63 million of Council's investment

portfolio from cash-generating investments to growth investments from which

cash-flow can not be expected for a period of time.

19.6. HBRIC

Ltd’s cash distributions from the RWSS become more reliable after the three

to five year period post-construction, and increase significantly after the

uptake period which will enable HBRIC Ltd to meet shareholder dividend

requirements.

20. Notes the following Conditions Precedent that must be either satisfied

or waived by agreement before Financial Close:

20.1. Granting

of resource consent for RWSS, which in turn is recommended as being workable

by all investors;

20.2. Subscription

of a minimum of 40 million cubic metres (m3) of water contracts

(Water User Agreements);

20.3. Securing

the private and public funding required to build Scheme infrastructure;

20.4. A

bankable construction contract with construction risk allocation adequately

addressed through a fixed-time, fixed-cost arrangement;

21. Notes, in the counter-factual situation where the RWSS does not

proceed either because of BoI decisions or because Council declines to make

the investment proposed in the RWSS, that:

21.1. Plan

Change 6, in whatever form is decided by the BoI, will become effective,

without the RWSS, including increased minimum flows, water allocation limits,

nutrient management limits etc.

21.2. the

environmental minimum and flushing flows set out in 4.1 to 4.3 will not be

provided;

21.3. existing

water users linked to minimum flows on Waipawa at the RDS gauging site and

Tukituki at Tapairau Rd will not be shielded from the increased minimum flows

set out in Proposed Plan Change 6;

21.4. existing

water users supplied by run-of-river and connected groundwater takes will

suffer economic impacts from the increased minimum flows in the catchment set

out in Proposed Plan Change 6;

21.5. the

contributions to strategic regional economic development , amounting to more

than $4 billion, set out in 7.1 to 7.4 will not be generated; and

21.6. the

employment (>2,500 jobs) and household income benefits (>$125

million/year) set out in 8.1 and 8.2 will not be generated.

22. HBRC

advises HBRIC Ltd that subject to:

22.1. having

received and being satisfied with its own legal advice on the RWWS documents

and all related legal matters;

22.2. having

received and being satisfied with its advice from the RWSS Business Case

Assessment process and advisers;

22.3. having

received and being satisfied with its advice from the Alternative Investments

Analysis process and advisers;

22.4. having

received the Draft and Final Decisions of EPA Board of Inquiry processes on

Plan Change 6 and the RWSS Resource Consents and being satisfied that the

RWSS can proceed as proposed under the decisions made;

22.5. having

undertaken a Special Consultative Procedure of public consultation regarding

whether or not to invest in the RWSS via HBRIC Ltd, and having made its

determination to make such an investment; and

22.6. receiving

confirmation from HBRIC Ltd that all Conditions Precedent to Financial Close

of the investment by all investing parties in the RWLP have been either

satisfied or waived by agreement of the parties;

it

will confirm to HBRIC Ltd its decision to invest up to $80 million (projected

level of $72 million) of new equity in HBRIC Ltd

by subscription for additional shares at one share per $1 invested, for the

purpose of HBRIC Ltd subscribing for up to $80 million (projected level of

$72 million) of interests in Ruataniwha Water Limited Partnership and

matching shares in Ruataniwha Water GP Ltd to implement the Ruataniwha Water

Storage Scheme.

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

|

1

|

HBRIC Ltd

RWSS Business Case

|

|

Under

Separate Cover

|

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 26 March 2014

SUBJECT: Affixing of Common Seal

Reason for Report

1. The Common Seal of the

Council has been affixed to the following documents and signed by the Chairman

or Deputy Chairman and Chief Executive or a Group Manager.

|

|

|

Seal No.

|

Date

|

|

1.1

|

Leasehold Land

Sales

1.1.1 Lot 1

DP 11041

CT P1/826

- Transfer

1.1.2 Lot 2

DP 5296

CT 56/144

- Agreement for Sale and Purchase

- Transfer

1.1.3 Lot 318

DP 11329

CT B3/130

- Transfer

1.1.4 Lot 868

DP 7201

CT B4/942

- Transfer

1.1.5 Lot 31

DP 12692

CT E1/53

- Agreement

for Sale and Purchase

|

3762

3763

3766

3764

3765

3768

|

24 February 2014

24 February 2014

10 March 2014

25 February 2014

4 March 2014

18 March 2014

|

|

1.2

|

Deed of Grant

of Easement

Lot 3 DP 4063

CT 86/188

(Pedestrian and

cycleway – SH50 in Fernhill)

|

3767

|

17 March 2014

|

Decision Making Process

2. Council is required to

make every decision in accordance with the provisions of Sections 77, 78, 80,

81 and 82 of the Local Government Act 2002 (the Act). Staff have assessed the

requirements contained within these sections of the Act in relation to this

item and have concluded the following:

2.1 Sections 97 and 88 of the Act do not apply;

2.2 Council can exercise its discretion under Section

79(1)(a) and 82(3) of the Act and make a decision on this issue without

conferring directly with the community or others due to the nature and

significance of the issue to be considered and decided;

2.3 That the decision to apply the

Common Seal reflects previous policy or other decisions of Council which (where

applicable) will have been subject to the Act’s required decision making

process.

|

Recommendations

That Council:

1. Agrees

that the decisions to be made are not significant under the criteria

contained in Council’s adopted policy on significance and that Council can

exercise its discretion under Sections 79(1)(a) and 82(3) of the Local

Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

2. Confirms

the action to affix the Common Seal.

|

|

Diane Wisely

Executive

Assistant

|

Liz Lambert

Chief

Executive

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 26 March 2014

SUBJECT: Recommendations from the Corporate and Strategic Committee

Reason for Report

1. The following matters

were considered by the Corporate and Strategic Committee on 12 March 2014

and are now presented to Council for consideration and approval, with

additional information provided to assist Council on the two topics set out

below.

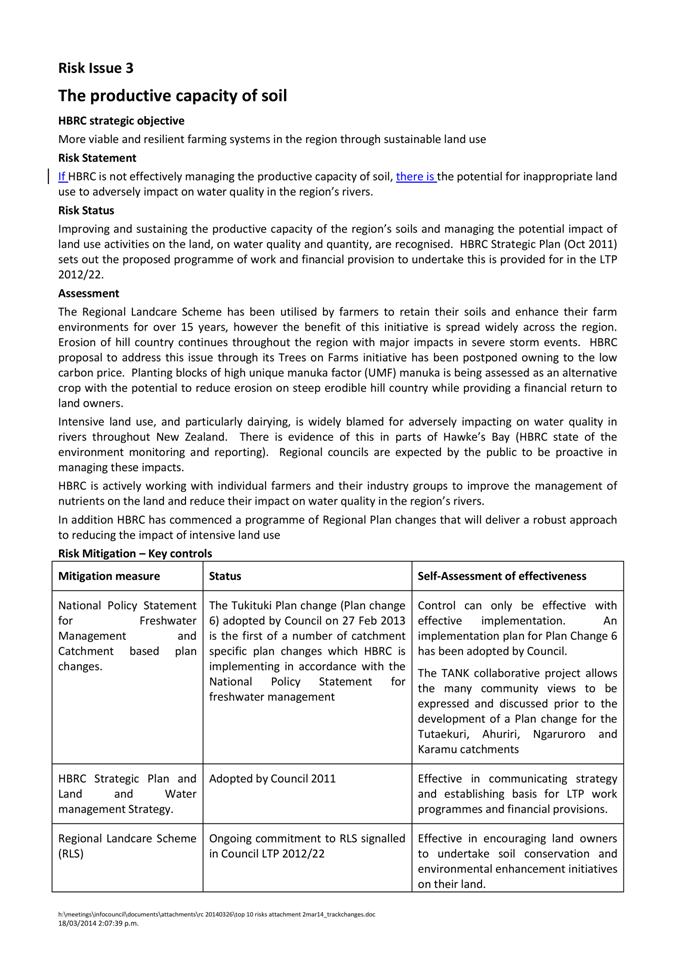

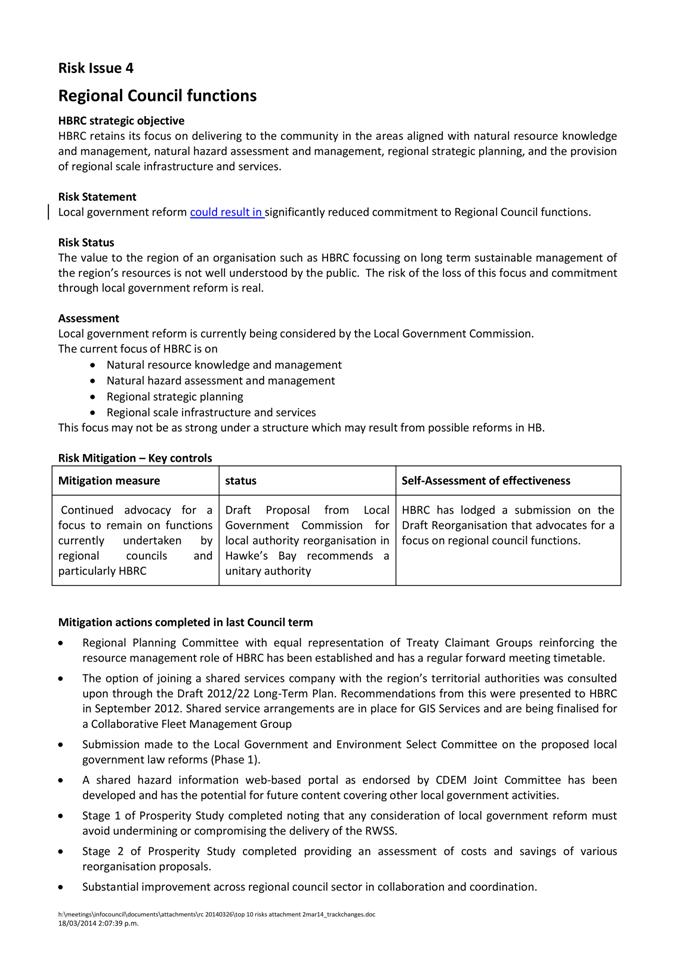

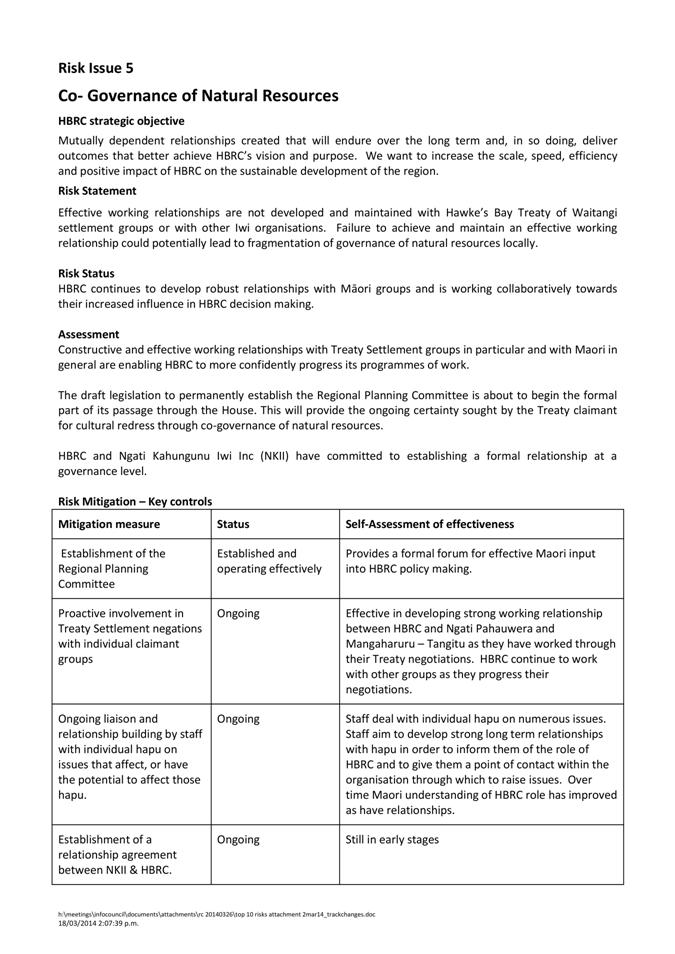

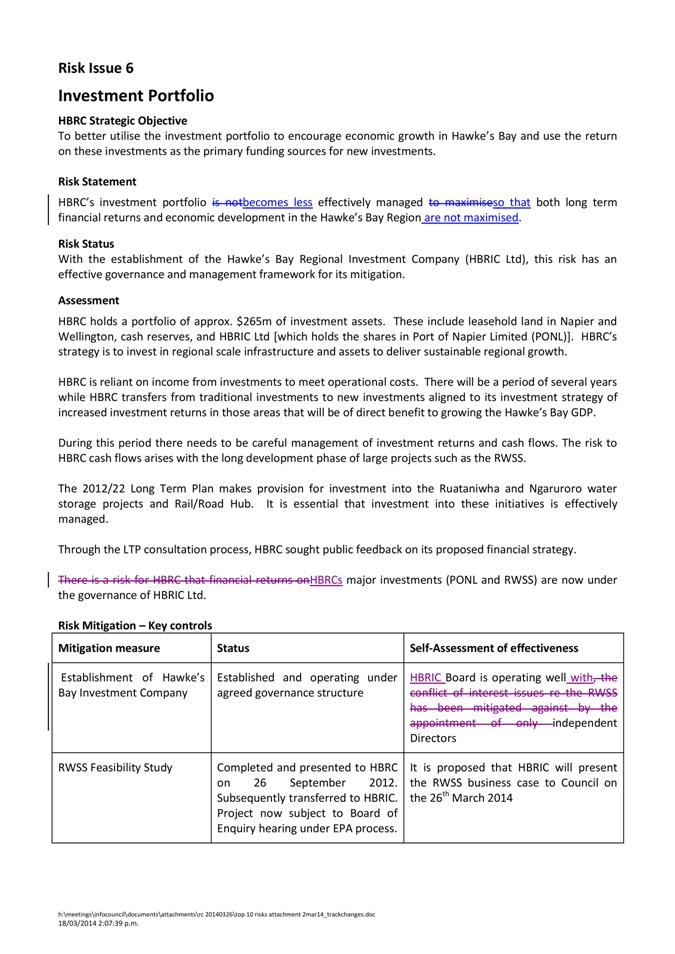

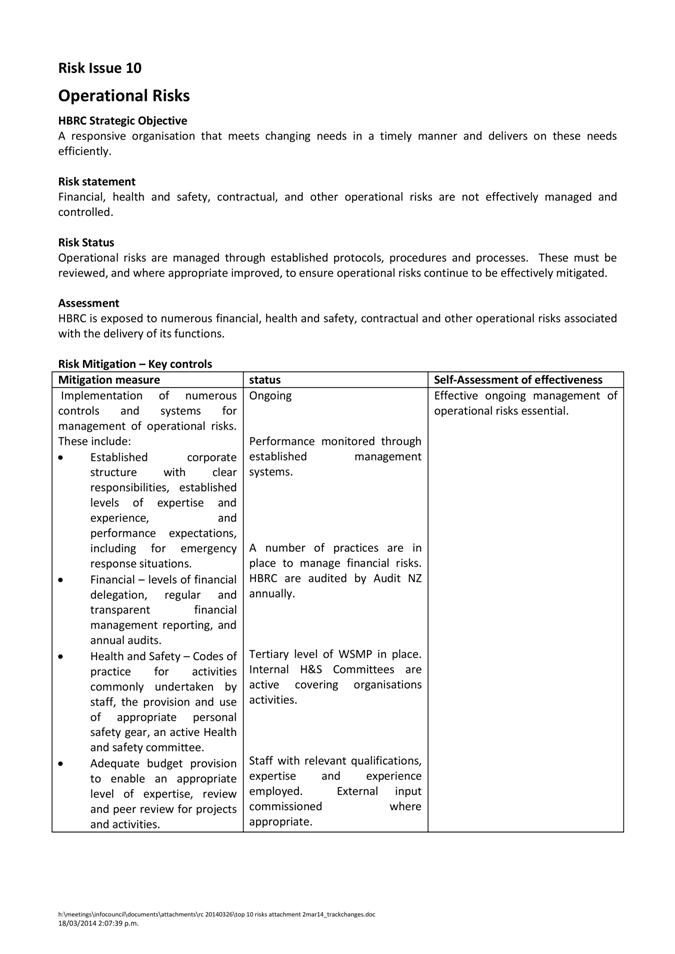

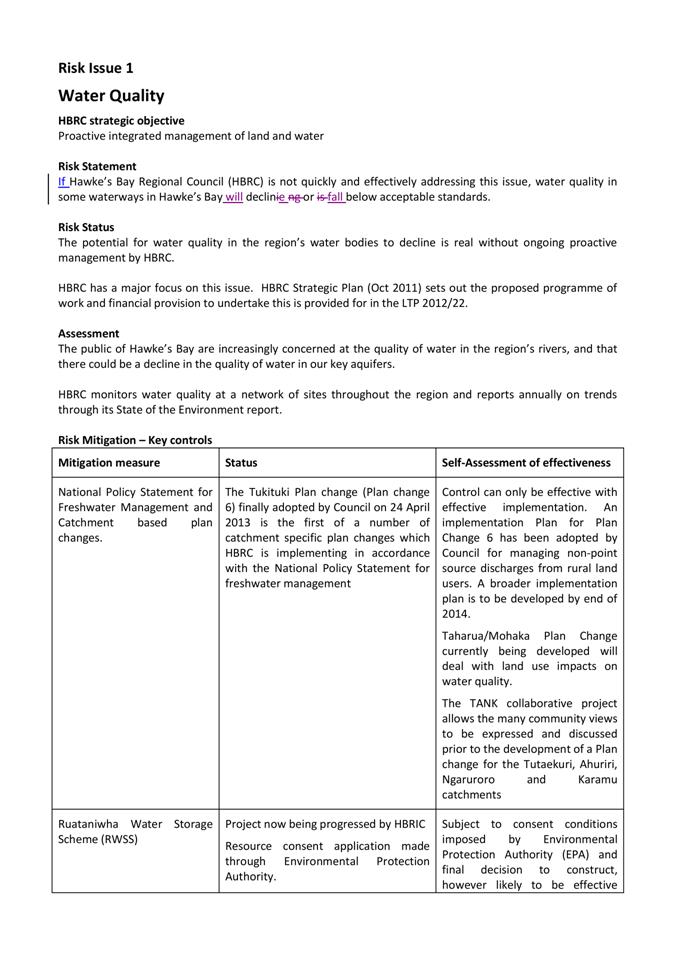

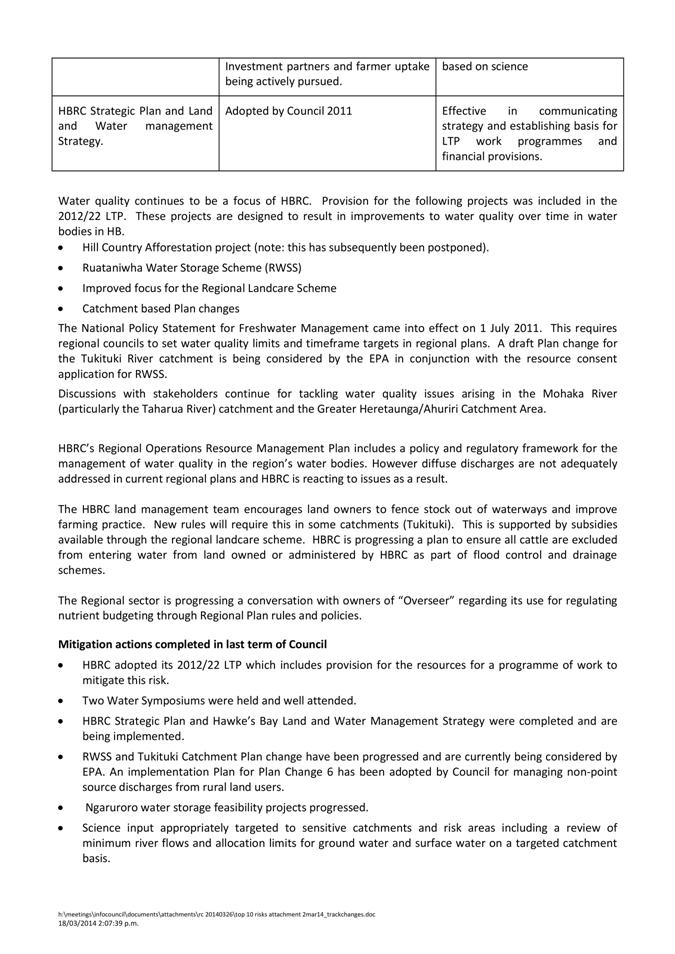

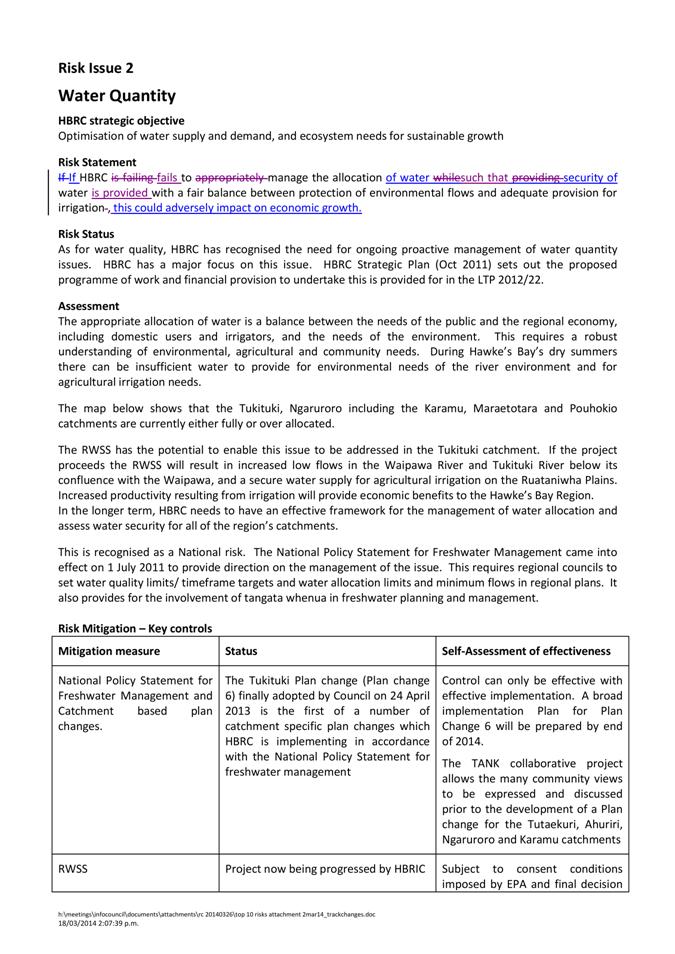

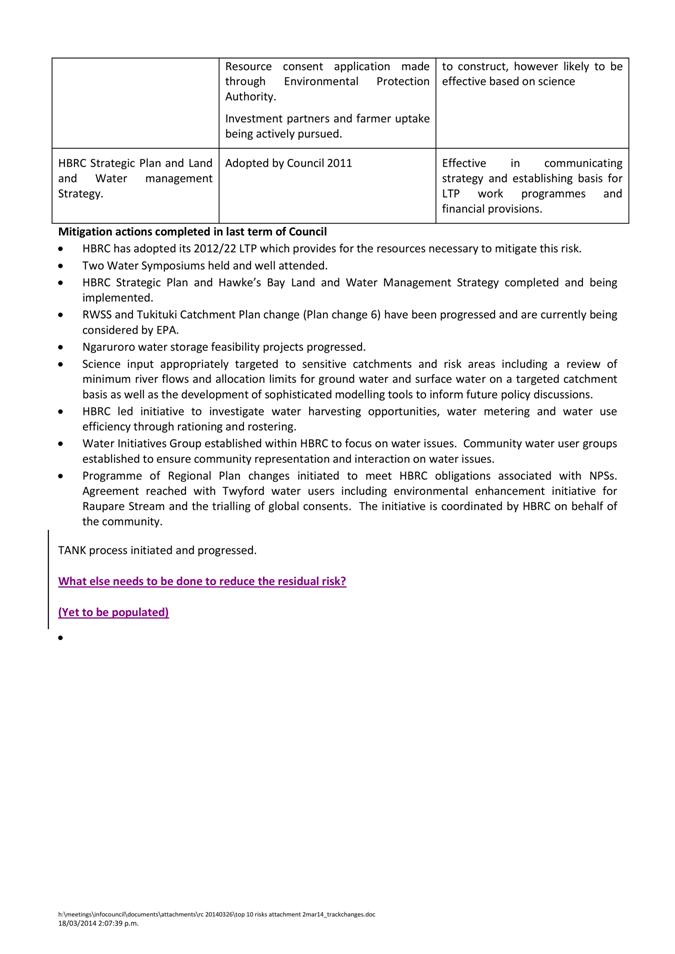

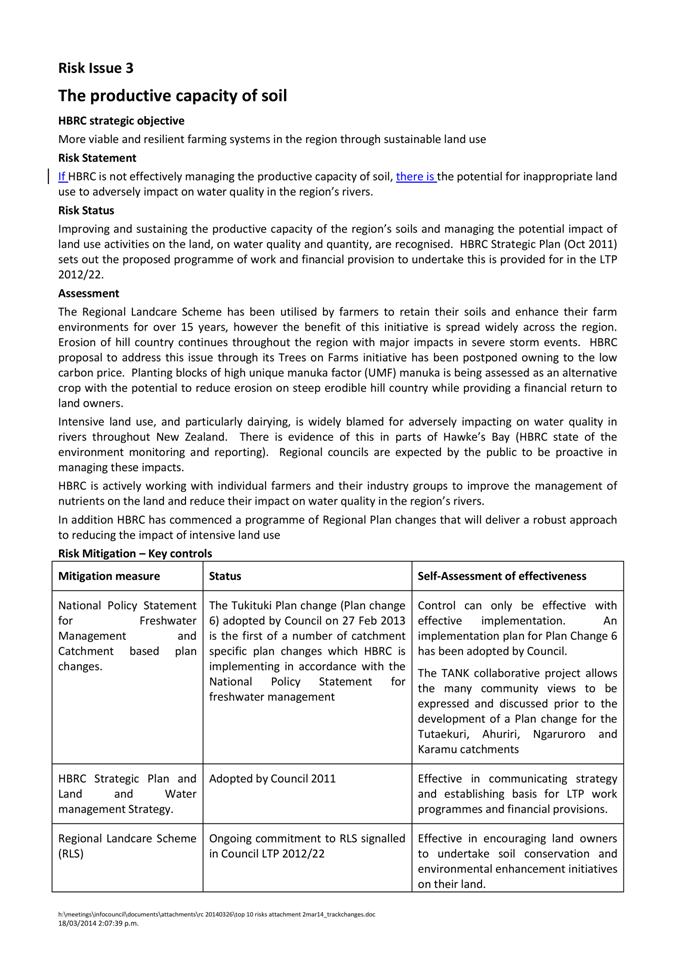

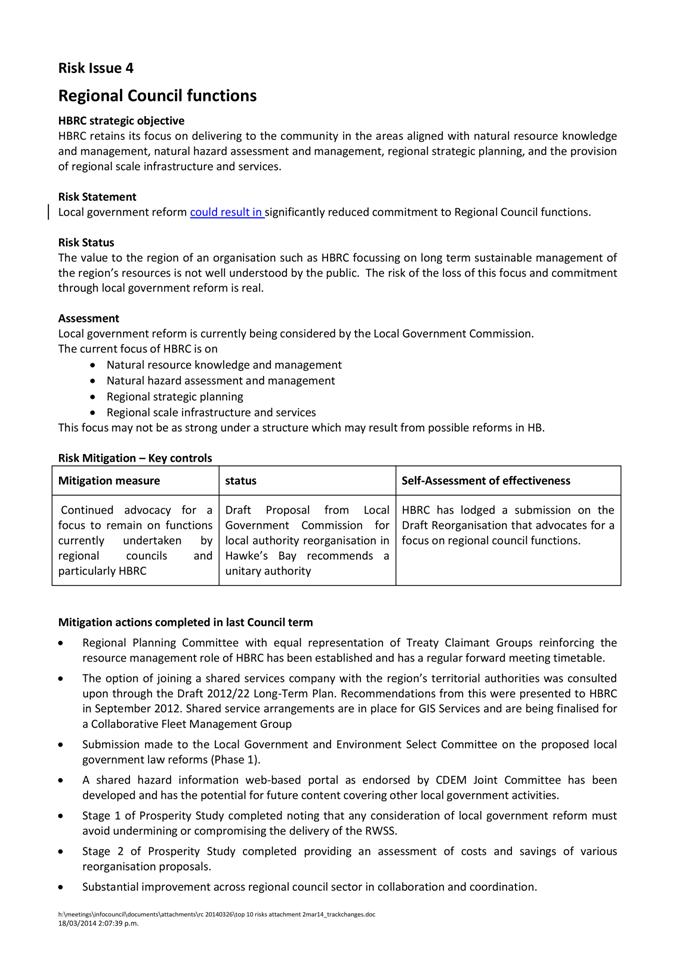

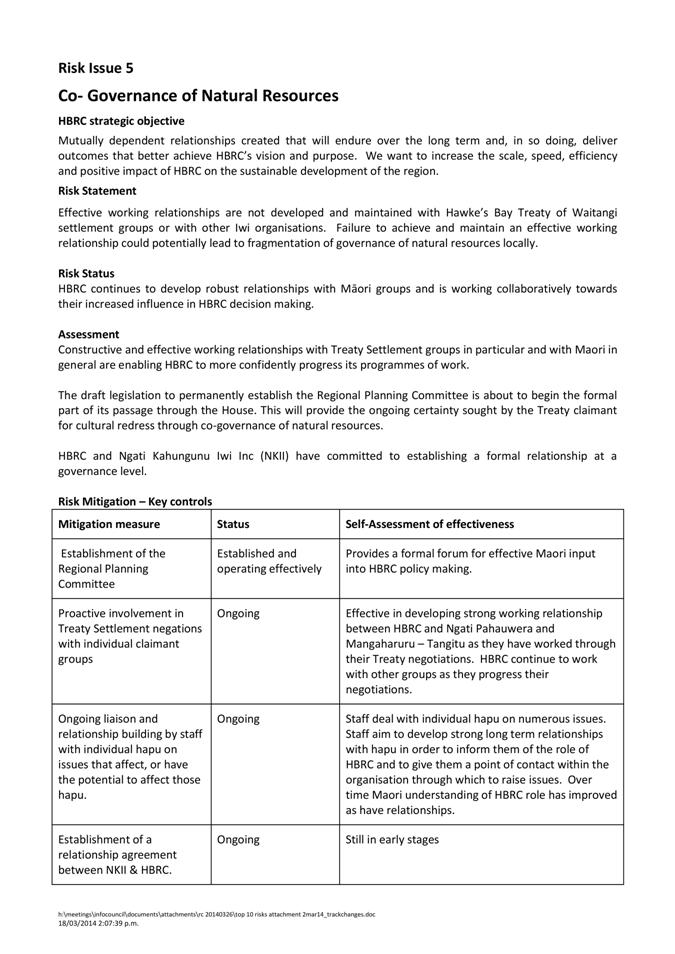

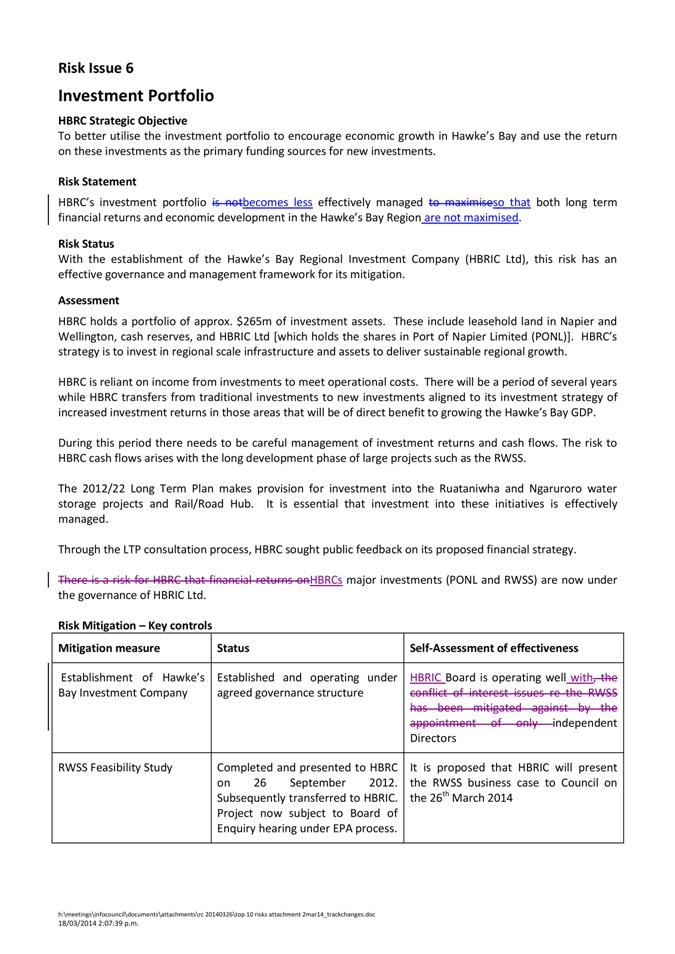

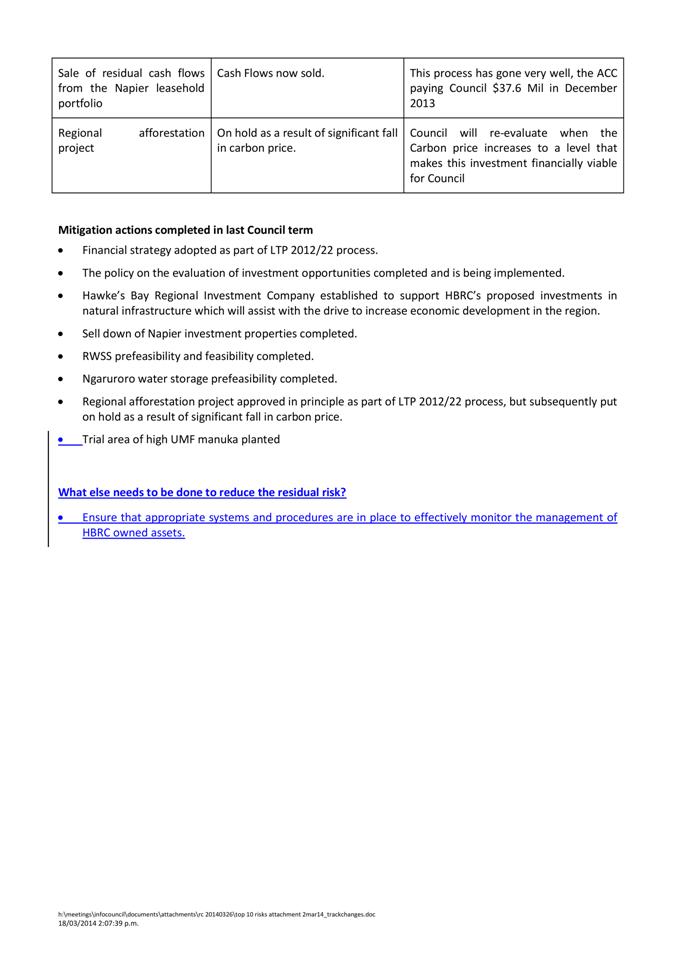

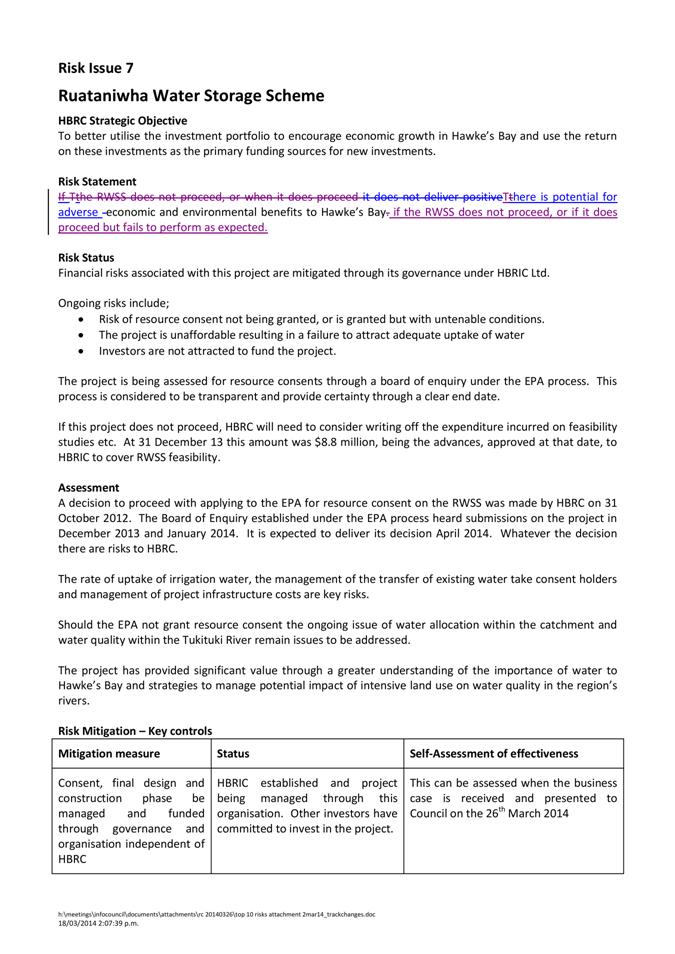

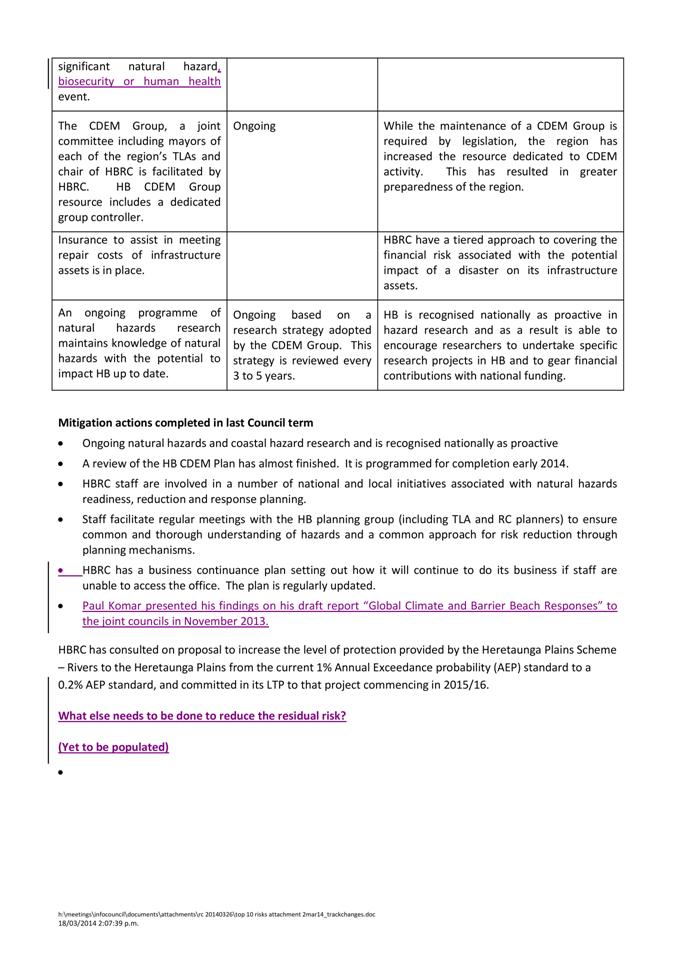

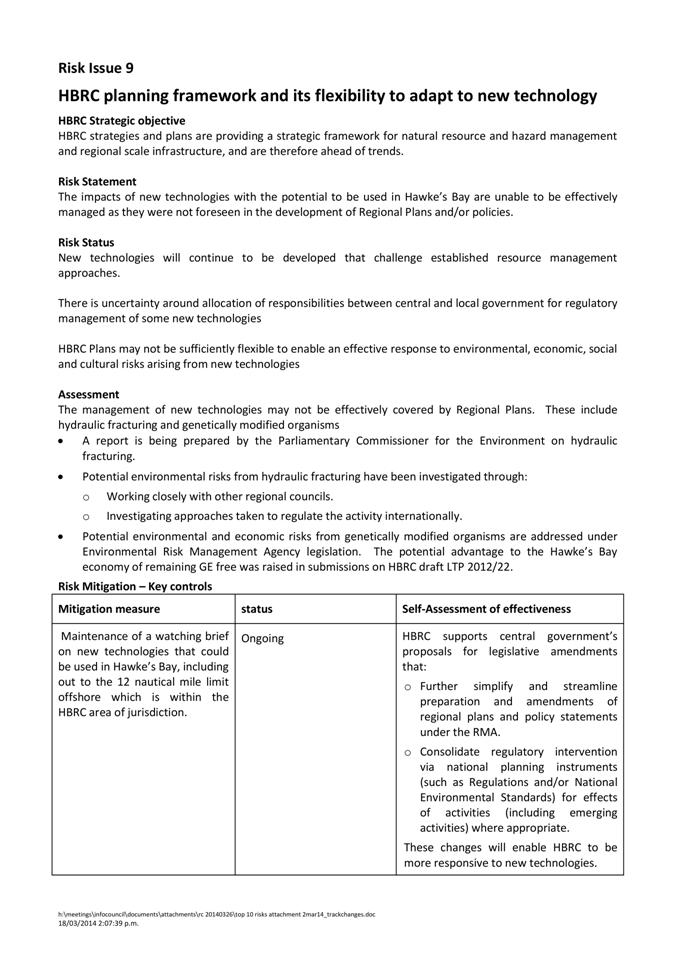

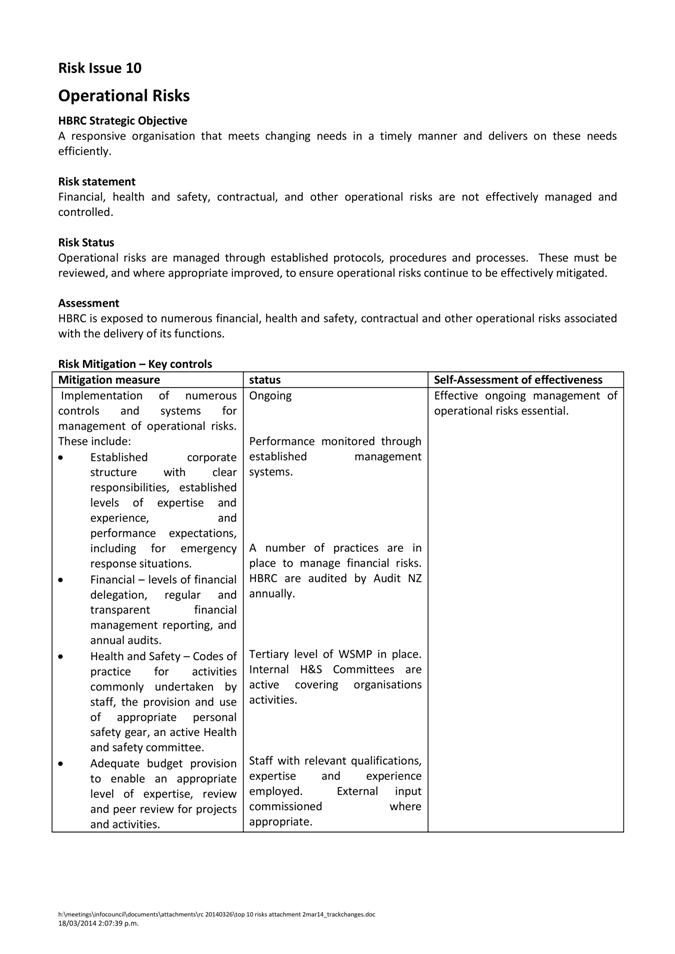

Top 10 Corporate Risks Assessment

2. Various amendments were

agreed at the 12 March Corporate and Strategic Committee meeting. These have

been incorporated in updated documentation attached.

HBRC Appointments Committee

3. At the Corporate and

Strategic Committee it was recommended that Council determines the membership

of an Appointments Committee to recommend the appointment of directors to the

permanent Board of HBRIC Ltd effective from 1 July 2014.

4. The Appointments Policy

suggests that this Appointments Committee should, where possible, comprise the

Chairman of HBRIC Ltd, a current councillor, a recently retired councillor, and

an external experienced director. The current chair of HBRIC Ltd is ineligible

to be part of the Committee so two external experienced directors have been

sought.

5. The following persons

are recommended to form the Appointments Committee: Cr Alan Dick (current

councillor); Mr Neil Kirton (recently retired councillor), Mr John Newland and

Mr Neville Smith (experienced independent directors).

6. The expectation is that

the Appointments Committee will inform the Council of its recommendations for

HBRIC Board membership by 28 May 2014.

Decision Making

Process

7. Council is required to

make a decision in accordance with the requirements of the Local Government Act

2002 (the Act). Staff have assessed the requirements contained in Part 6 Sub

Part 1 of the Act in relation to this item and have concluded the following:

7.1. The decision does not

significantly alter the service provision or affect a strategic asset.

7.2. The decision does not

fall within the definition of Council’s policy on significance.

7.3. The decision is not

inconsistent with an existing policy or plan.

7.4. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others having an interest in the decision.

|

Recommendations

That Council:

1. Agrees

that the decisions to be made are not significant under the criteria

contained in Council’s adopted policy on significance and that Council can

exercise its discretion under Sections 79(1)(a) and 82(3) of the Local

Government Act 2002 and make decisions on this issue without conferring directly

with the community and persons likely to be affected by or to have an

interest in the decision due to the nature and

significance of the issue to be considered and decided.

Strategic Planning Process for 2015-25 Long Term Plan

2. Adopts the

Proposed Strategic Planning Programme for the development of the Long Term

Plan; being:

|

Phase

|

Period

|

Method/output

|

|

What will

HB look and feel like in 2050?

Identification

/ review of key issues

Review

purpose, vision and values, strategic framework

|

April to June

|

Council /

staff workshops

7-8 May

12-13 June

|

|

Produce a

branded document for public engagement (i.e. Embracing Futures Thinking

yellow book, Strategic Plan discussion document)

|

July

|

Document

adopted at 16 July 2014 C&S meeting, then Council

|

|

Informal

engagement – Councillor / community level

|

August - October

|

Stakeholder

meetings

Speaker

series?

|

|

Finalise

Preferred Strategic Direction

|

November

|

C&S

Comm / Council paper

|

|

Adopt

Draft Long Term Plan

|

March 2015

|

Draft Long

Term Plan

|

|

Consultation

|

April-May

|

Engagement

Strategy

|

|

Hearings

|

Early June 2015

|

Officers

Reports and recommendations

|

|

Adopt Long

Term Plan

|

June 2015

|

Council

paper / LTP

|

Top 10 Corporate Risks Assessment

3. Adopts the

Hawke’s Bay Regional Council Risk Management Policy and Framework, March 2014.

4. Approves

the risk mitigation approach to each of the ten risk issues.

Oil and Gas Exploration Policy Development

5. Defers

formation of a multi stakeholder group (and its associated tasks) and

incorporates a proposal for preparation of a “Regional Oil and Gas

Exploration and Renewable Energy Strategy” into the 2015-25 Long Term Plan

development process.

HBRC Appointment and Remuneration of Directors Policy

6. Adopts a

final Policy subject to the inclusion of any amendments agreed at the

Corporate and Strategic Committee meeting (the final version with amendments

is attached)

7. Determines

the membership of the Council Appointments Committee which will recommend to

Council the appointment of Directors to the permanent Board of HBRIC Ltd in

accordance with the Policy; that being:

“The Council will establish a Council Appointments

Committee after the triennial Council election to recommend to the Council

the appointment of Council and independent directors to HBRIC Ltd. This

committee will be comprised of four members who are not seeking appointment

to the HBRIC Ltd Board. Where possible the committee members will include the

current chair of HBRIC Ltd, a Councillor, a recently retired Councillor and

an external experienced director.”

8. Appoints the following persons to the Appointments

Committee: Messrs Alan Dick, Neil Kirton, John Newland and Neville Smith.

Local Governance Statement 2013-15

9. Adopts the Local Governance Statement as amended in response to

feedback provided and agreed at the Corporate and Strategic Committee

meeting, and notes that the Statement will be made available to the public by

11 April 2014.

HBRC Wairoa Office

10. Agrees to

proceed with improvements of the HBRC Wairoa office at an estimated cost of

$225,000, with construction work not committed to until HBRC has a long term

lease with Department of Conservation for them to share the property,

including office accommodation and storage.

11. Notes that the

following reports were received at the Corporate and Strategic Committee meeting:

11.1 Follow-ups

From Previous Corporate and Strategic Committee Meetings

11.2 Nga Marae o

Heretaunga – Presentation

11.3 HBRC Health

and Safety

11.4 HB LASS Half Yearly Report

11.5 Provisional Timeline - RWSS

Consultation.

|

|

Mike Adye

Group

Manager

Asset

Management

|

Liz Lambert

Chief

Executive

|

Attachment/s

|

1View

|

Updated Top

10 Risk Issues

|

|

|

|

2View

|

Final Policy

- HBRC Appointment and Remuneration of Directors

|

|

|

|

Updated Top 10 Risk Issues

|

Attachment 1

|

|

Final Policy - HBRC Appointment and Remuneration of Directors

|

Attachment 2

|

HAWKES

BAY REGIONAL COUNCIL

Policy

on appointment and remuneration of directors

FOR

ADOPTION 26 MARCH 2014

Purpose

1. The purpose

of this policy is to set out, in accordance with Section 57(1) of the Local

Government Act 2002 (“the Act”), an objective and transparent process for:

(a) The

identification and consideration of the skills, knowledge and experience

required of directors of a Council organisation.

(b) The

appointment of directors to a Council organisation.

(c) The

remuneration of directors of a Council organisation.

Principles

2. The following principles underlie this policy:

(a) Appointments

will be made on the basis of merit.

(b) The

Council will follow corporate governance best practice.

(c) Directors

of Council-controlled trading organisations will be appointed on the basis of

the contribution they can make to the organisation, and not on the basis of

representation.

(e) All

Council appointed directors must comply with the Council’s Code of Conduct for

Directors.

(f) Where

organisations are subsidiaries of the Hawke’s Bay Regional

Investment Company Ltd (HBRIC Ltd) or companies directly owned by HBRC, then

HBRIC Ltd will act as the interface and monitoring body between the Council and

those subsidiaries.

(g) All appointments of

directors to the Board of HBRIC Ltd and to any Council

Controlled Trading Organisation must be ratified by the Hawke’s Bay

Regional Council.

Definitions

3. The term “Council organisation” (“CO”) is used as

defined in Section 6 of the Act.

4. The Act also

creates two sub-categories of COs – “Council-controlled organisations” (“CCOs”)

and “Council-controlled trading organisations” (“CCTOs”).

5. The Council

has interests that fall in each of these 2 sub-categories.

6. The

following statements used in this Policy are provided for guidance purposes

only. Fuller definitions are provided in Section 6 of the Act.

Meaning

of “Council organisation”

7. In broad terms, a CO is an organisation in which the

Council has a voting interest or the right to appoint a director, trustee or

manager (however described). This is a wide-ranging definition, covering a

large number of bodies.

Meaning

of “Council-controlled organisation”

8. A CCO is a

CO in which one or more local authorities control, directly or indirectly, 50%

or more of the votes or have the right, directly or indirectly, to appoint 50%

or more of the directors, trustees or managers (however described).

Meaning

of “Council-controlled trading organisation”

9. A CCTO is a CCO that operates a trading undertaking for

the purpose of making a profit.

10. For the

purpose of this document only:

(a) Hawkes’ Bay Regional

Investment Company Ltd (HBRIC Ltd) is excluded from the definition of a CCTO

(there is a separate section in this Policy (page 3) for the appointment and

remunerations of directors to HBRIC Ltd).

(b)

Napier Port (Port of Napier Limited) is considered for the purpose of this

Policy only to be a CCTO, notwithstanding specific exemptions for port

companies under Section 6 of the Act.

(c) All

associate and subsidiary companies of HBRIC Ltd are consdired to be CCTOs

irrespective of whether HBRIC Ltd has a controlling interest in the company.

11. Pages 3- 6

sets out the policy for the appointment and remuneration of directors to the

Board of the Hawke’s Bay Regional Investment Company Ltd.

12. Pages 7-11 contains the

policy for other Council Controlled Organisations, including CCO’s and CCTO’s

currently subject to this Policy. These CCOs are listed in Appendix 1. Any new

Council organisations in which the Council will have a voting interest or the

right to appoint a director, trustee or manager will be subject to this Policy.

13. On page 12 is

the policy for Council Organisations, that are not Council Controlled

Organisations, that are currently subject to this Policy. These COs are

listed in Appendix 2. Any new Council Organisation will be subject to this

Policy.

14. On pages

13-14 is the HBRIC Ltd Chairperson Succession Planning Policy.

HAWKES

BAY REGIONAL INVESTMENT COMPANY LTD

Introduction

15. HBRIC

Ltd is 100% owned by the Council, and holds shares in the Council’s CCTOs. It

monitors the performance of all CCTOs, whether owned directly by HBRIC Ltd or

the Council, and recommends new director appointments for these organisations

for the Council’s approval.

HBRIC

Ltd Director appointment process and Identification of required skills,

knowledge and experience

16. The HBRIC Ltd constitution provides for a maximum of

seven directors and it is intended that it comprises a mix of Council and

independent directors. It is critical to the success of this board that it has

a composition which is capable of maintaining the confidence of both the

Council and the subsidiary companies.

17. The Council

will establish a Council Appointments Committee after the triennial Council

election to recommend to the Council the appointment of Council and independent

Directors to HBRIC Ltd. This committee will be comprised of four members who

are not seeking appointment to the HBRIC Ltd Board. Where possible the

committee members will include the current chair of HBRIC Ltd, a Councillor, a

recently retired Councillor and an external experienced director.

18. In the

process of selecting Council and independent directors the Council Appointments

Committee will first determine the required skills, knowledge and experience

which is necessary for an effective board. In general terms, the committee

will apply similar criteria to potential candidates to those used by HBRIC Ltd

in its assessment of candidates for other CCTOs. However, where necessary the

committee will also take into account a candidate’s potential to quickly

acquire business and financial skills, as well as his or her existing skills

and experience. The candidates’ skills must be relevant to the requirements of

HBRIC Ltd in terms of its governance and provide as far as possible that there

is a suitable cross- section of skills available at the board table which is

capable of meeting the normal criteria of good governance.

19. The committee

may use the services of a specialist consultant in making an assessment of the

suitability of candidates for a Council Director position.

Council Directors of HBRIC Ltd

20. The HBRIC Ltd constitution provides that Council

directors must resign on a date specified by the Council being no later than

three months after the triennial Council elections, although they may offer

themselves for re-appointment. The date selected will be chosen to allow time

to select Council directors for appointment as replacement directors in

accordance with this policy.

21. Only a

Councillor may be appointed as a Council Director of HBRIC Ltd.

22. The Council

Appointments Committee will, after the triennial Council elections, interview

all Councillors expressing an interest in appointment to the HBRIC Ltd Board.

This includes existing HBRIC Ltd Council directors retiring and offering

themselves for re-appointment.

23. Following the

interviews, the Committee will make its final recommendations in a report to

the Council. This report will be considered in the public part of the agenda.

The Council will consider the report and make its decision.

24. Public

announcement of the appointments will be made as soon as practicable after the

Council has made its decision.

25. It is important that the selected Council directors

will be able to gain the confidence of the Council and the subsidiary company

boards, given the confidential and commercially sensitive nature of much of the

business being considered.

Independent directors of HBRIC Ltd

26. The HBRIC Ltd constitution provides that the

independent directors will retire by rotation with at least one retiring each

year.

27. The HBRIC Ltd

governance committee or full board (excluding any retiring director) will give

consideration to whether a retiring independent director should be reappointed

by rotation and make a recommendation to the Council regarding reappointment

where the term of that director will be within the policy for tenure for CCTO

directors as provided in this policy.

28. In the case

of a vacancy for an independent director appointment, whether it be a casual

vacancy or arising from the non reappointment of a retiring independent

director, the same procedures will be followed as applies to the appointment of

a director to a CCTO.

29. Independent

directors will be selected according to the same criteria as used by HBRIC Ltd

in its assessment of candidates for other CCTOs. In making appointments every

endeavour will be made to ensure that a range of good governance skills will be

available to the HBRIC Ltd board as a whole.

30. An

independent Director of HBRIC Ltd may be a person who is neither a Councillor

nor an employee of the Council.

Chairperson

31. The Council shall nominate who will be the chair of the

HBRIC Ltd board and take account of the experience and appropriate skills of

the existing board. This nomination will be made in accordance with the

policy adopted by Council on 26 March 2014 regarding HBRIC Ltd Chairperson

succession. The policy is to ensure that there can be continuity of

knowledgeable and capable leadership of the HBRIC Ltd Board. The policy

envisages that work commences to identify a successor to the chairperson at

least a year before the planned retirement of the incumbent and that in making

any replacement board appointments that consideration be given to whether there

is sufficient potential on the board for a replacement chairperson should that

be needed unexpectedly.

32. The Council

Appointments Committee is responsible to make a recommendation to the Council

on the nomination of the HBRIC Ltd Chairperson.

All

directors of HBRIC Ltd

33. It

is expected that all appointees to the HBRIC Ltd Board will undergo, or already

have undergone, formal corporate governance training, or have the requisite

experience in this area. HBRIC Ltd will generally pay for at least part of any

such training.

Length

of tenure

34. Independent

directors will normally be appointed for periods of three years. Subject to a

review of the director’s performance after each three year period, the normal

tenure for a director will be six years. Following six years of service, a

director may be re-appointed for a further three years as decided by Council.

Remuneration

of HBRIC Ltd directors

35. Periodically, normally every three years but more

frequently if considered appropriate, HBRIC Ltd will review the level of

remuneration being paid to the boards of the CCTOs.

36. As part of

this function, HBRIC Ltd an independent panel will

also review the levels of fees considered appropriate for the HBRIC Ltd board

after the triennial Council elections.

37. The fees for HBRIC Ltd directors

will be assessed using the same methodology that is used for other CCTOs, with

no distinction made between independent and Council directors. It is expected

that an element of public service should be reflected in the final agreed

fees.

38. HBRIC Ltd

will then report to the Council with a recommendation with regard to the level

of fees for the HBRIC Ltd board. When the Council considers this issue, those

Councillors who are directors of HBRIC Ltd or any other CCTO may not take part

in discussions or vote on the issue except where a declaration permitting

Councillors to discuss and vote on the issue has been granted by the

Auditor-General.

39. HBRIC Ltd

will arrange and pay for directors’ liability insurance, and indemnify each of

the directors.

Removal

of a director

40. The

HBRIC Ltd Constitution provides that any director of HBRIC Ltd may be removed

from office at any time by notice in writing from the majority shareholder

(Council).

41. Without

limiting the right of the Council in the constitution, the likely reasons which

would justify removal of a director would be where a director:

(a) No

longer has the confidence of the board or the Council

(b) Has

breached ethical standards and this reflects badly on the board and/or Council

(c) Does

not act in the best interests of the company

(d) Breaches

the confidence of the board in any way including speaking publicly on board

issues without the authority of the board

(e) Does

not act in accordance with the principles of collective responsibility.

42. Where the

HBRIC Ltd board has concerns regarding the behaviour of one of its directors it

shall be considered first by the board and where necessary the board may

recommend the removal of the director to the Council.

43. HBRIC Ltd may

remove a director from any of its subsidiaries for similar reasons as set out

above

without reference to the Council. following referral to, and

approval by, the Council.

Council Controlled Trading Organisations

Introduction

44. The Council has significant shareholdings, direct and

indirect, in a variety of CCTOs. These all operate at arm’s length from the Council

on a commercial basis.

45. The Council

may establish further CCTO’S during the life of the Policy.

46. HBRIC Ltd has

been charged by the Council with monitoring and recommending new director

appointments for Council approval in respect of the CCTO’s in which HBRIC Ltd

directly holds shares.

47. CCTOs in

which HBRIC Ltd hold shares directly are empowered under this policy to appoint

directors to their own subsidiaries or associates in accordance with their own

policies.

48. No directors

will be appointed to CCTO boards other than through the process described in

this policy.

Identification

of required skills, knowledge and experience of CCTO directors

49. The required

skills, knowledge and experience for director appointments to a CCTO board are

assessed in the first instance by the Governance, Appointment and Remuneration

Committee of HBRIC Ltd, in consultation with the Chairperson of the relevant

CCTO. Reference is made to current governance best practice in this area, as

encapsulated in the Institute of Directors’ Principles of Best Practice for New

Zealand Directors and other relevant material. External assistance may be used

by HBRIC Ltd in some cases.

50. The mix of

skills and experience on the CCTO board will be taken into account, and

consideration given to complementing and reinforcing existing skills and

reducing known weaknesses where necessary.

51. In general

terms, the following qualities are sought in directors of CCTOs:

(a) Intellectual

ability.

(b) Commercial

experience.

(c) Understanding

of governance issues.

(d) Sound

judgement.

(e) High

standard of personal integrity.

(f) Commitment

to the principles of good corporate citizenship.

(g) Understanding

of the wider interests of the publicly-accountable shareholder.

52. As a general

principle, the Council would seek to appoint a person who, while meeting all of

the above criteria, has particular strengths in terms of attribute g).

53. It is

expected that all appointees to CCTO boards will undergo, or already have

undergone, formal corporate governance training, or have the requisite

experience in this area.

Appointment

process for CCTO directors

54. When a vacancy arises in any CCTO, the HBRIC Ltd

Governance, Appointment and Remuneration Committee, having identified the

skills, knowledge and experience required for the position (in consultation

with the CCTO Chairperson), will then follow the process set out below:

Search

(a) HBRIC

Ltd will maintain a database of potential candidates for appointment to CCTO

boards. This will be updated on a regular basis, utilising contacts with the

business community and other relevant sources. The database and its detail

will be confidential to the Board of HBRIC Ltd. A Councillor is eligible to be

included in this database on merit.

(b) The

database will be the first point of reference in the search process. However,

in most cases, a specialist consultant will also be contracted to assist with

the provision of names of possible candidates and the initial evaluation. In

most cases, the vacant CCTO board position will not be advertised, as this

would not normally be expected to add any significant value to the process.

(c) In

some circumstances, HBRIC Ltd may wish to appoint one of its own directors for

a particular purpose.

(d) If the HBRIC Ltd

Governance, Appointment and Remuneration Committee, after consultation with the

chairperson of a particular CCTO board, determines that there is a need for a

Councillor on the board of that CCTO to bring the specific skills and

relationships of a Councillor Director to the board, then the process of

selection of candidates will be varied in the following manner:

i. The

HBRIC Ltd Governance, Appointment and Remuneration Committee, assisted by a

specialist consultant, will call for nominations from all interested

Councillors and will interview all Councillors expressing an interest in an

appointment to the CCTO and make an appointment in a manner which is consistent

with this policy in all other respects.

ii. If

the term of appointment for a Councillor who is appointed under this clause is

due for reconsideration in terms of the constitution of the CCTO they may be

considered for reappointment by HBRIC Ltd without further consultation with

Council under a process consistent with clauses 52 to 55.

iii. Appointments

of any Councillor appointed under this clause by HBRIC Ltd shall expire 31

March in the year following a triennial election.

iv. If

following the triennial local government election the appointee is not re-elected

as a Councillor HBRIC Ltd will commence a process for selection of a new

appointee to the board, which may or may not be a Councillor.

v. HBRIC

Ltd will re-assess in consultation with the CCTO at no less than three yearly

intervals whether there remains a need for a person to be appointed to the

board who is specifically an elected Councillor.

vi. If

the HBRIC Ltd Governance, Appointments and Remuneration Committee determines

there is an ongoing need for a Councillor on the board of that CCTO, the

committee shall carry out a process consistent with paragraphs 15 – 22 of this

policy to recommend the appointment of a Councillor to the CCTO.

vii. This

clause does not apply to appointments where a Councillor is appointed other

than in accordance with this sub-clause.

Interview

(a) Following the search process, the HBRIC Ltd

Governance, Appointments and Remuneration Committee will draw up a short list

of candidates.

(b) Where

appropriate the committee will co-operate with other shareholders in the

selection process.

(c) Each

candidate will be interviewed by the committee. The committee will then decide

its preferred candidate, check all references and report back to the full HBRIC

Ltd Board for ratification.

Appointment

(a) The

HBRIC Ltd Board will then make a recommendation to the Council. The report

will be “public excluded” in order to protect the privacy of the individual

concerned. The Council will consider the report from HBRIC Ltd and make its

decision.

(b) Public

announcement of the appointment will be made as soon as practicable after the

Council has made its decision.

Reappointment

55. Where a director’s term of appointment has expired and

he or she is offering him/herself for reappointment, a representative of the

HBRIC Ltd Board (normally the Chairperson) will consult on a confidential basis

with the Chairperson of the CCTO with regard to:

(a) Whether

the skills of the incumbent add value to the work of the board.

(b) Whether

there are other skills which the board needs.

(c) Succession

issues.

56. The HBRIC Ltd

Governance, Appointments and Remuneration Committee will consider the

information obtained and, taking into account the director’s length of tenure

(see below), form a view on the appropriateness of reappointment or making a

replacement appointment.

57. Where

reappointment is considered appropriate then the HBRIC Ltd Board is authorised

to approve it without further reference to the Council.

58. Where it is

not intended to reappoint the existing incumbent, the appointment process

outlined above will apply.

Length

of tenure

59. CCTO

directors will normally be appointed for periods of three years. Subject to a

review of the director’s performance after each three year period, the normal

tenure for a director will be six to nine years. Following nine years of

service, a director may be re-appointed for a further three years in special

circumstances.

Chairpersons

of CCTOs

60. It is the responsibility of the board of each CCTO to

appoint its own Chairperson. However, normally the CCTO board will consult

with HBRIC Ltd on the person to be so appointed, and where HBRIC Ltd considers

it appropriate, it will give its view on who it considers to be the appropriate

person to fill the Chairperson's position.

Napier

Port

61. For the purposes of this policy only, Napier Port is

defined as a CCTO notwithstanding anything in the Local Government Act or the

Port Companies Act.

Remuneration

of CCTO directors

62. HBRIC Ltd has been charged with monitoring and, where

appropriate, recommending to Council for approval changes in remuneration

levels for the boards of CCTOs.

63. Periodically

HBRIC Ltd will review the level of remuneration made available to the boards of

the CCTOs for distribution amongst directors on each board.

64. The fees will

be reviewed on an overall basis for each CCTO, leaving the board of that CCTO

to apportion the fee between board members as it sees fit. Under exceptional

circumstances, HBRIC Ltd may approve an application from a CCTO for additional

fees, for a special project.

65. In performing

its review of remuneration, HBRIC Ltd will take account of the following

factors:

(a) The

need to attract and retain appropriately qualified directors.

(b) The

levels of remuneration paid to comparable companies in New Zealand.

(c) The

performance of the CCTO and any changes in the nature of its business.

(d) Any

other relevant factors.

66. In general,

it is intended that boards of CCTOs will receive a level of remuneration that

is competitive with the general market, while recognising that there will be

differences from time to time, particularly in the period between reviews.

Professional advice will be sought where necessary.

67. In the event

of a Council or HBRIC Ltd staff member being appointed to a CCTO board, the

fees for that appointee shall either not be paid or be paid to the Council or

HBRIC Ltd, unless there are special circumstances. This reflects the employee

being appointed as part of their existing position.

68. The Council

also supports the payment by CCTOs of directors’ liability insurance and the

indemnification of all directors.

Council-Controlled Organisations

Introduction

69. The Council has an interest in CCOs which are not

trading organisation. These CCO’s are Hawke’s Bay Local Authority Shared

Services and. These are not-for-profit bodies and, in contrast with the

section that deals with CCTOs, Hawke’s Bay Regional Investment Company Ltd has

no involvement in monitoring or the director/trustee appointment process.

70. Appointments

to a CCO are generally for a three year term, and are made after the triennial

Council elections.

Identification

of required skills, knowledge and experience of CCO directors, and appointment

71. The Council will determine the required skills,

knowledge and experience for each appointment to these Council Controlled

Organisations and make its appointments accordingly.

72. In general,

the attributes required for directors of CCTOs will be applicable, but the

weightings given to each attribute may vary according to the nature of the

appointment.

73. In most

cases, Councillors will be the appointees, but there may be instances where it

is appropriate to appoint external directors or Council staff.

.

Remuneration

of CCO directors

74. After each triennial Council election, the Council will

determine whether there are any CCOs that may more properly be classified as

CCTOs for the purposes of determining an appropriate level of remuneration. If

any CCOs are so classified, the remuneration of their boards will be determined

by HBRIC Ltd in accordance with the policy for CCTOs set out on page 6.

75. In all other

cases, CO directors appointed by the Council will receive the remuneration (if any) offered by that

body. Council staff members appointed to

such bodies will not accept any remuneration.

Council Organisations

Introduction

77. The

Council has non-controlling interests in numerous COs. These are

not-for-profit bodies and, in contrast with CCTOs, Hawke’s Bay Regional

Investment Company Ltd has no involvement in monitoring or the director/trustee

appointment process.

78. Appointments

to COs are made for a number of reasons. These include:

(a) To

provide a means of monitoring where the Council has made a grant to that body.

(b) To

enable Council involvement where the CO’s activity is relevant to the Council.

(c) To

satisfy a request from the CO that the Council appoint a representative.

(d) Statutory

requirements.

79. Appointments

to a CO are generally for a three year term, and are made after the triennial

Council elections.

80. The Council

will endeavour to minimise the number of appointments where the benefit to the

Council of such an appointment is minimal.

Identification

of required skills, knowledge and experience of CO directors, and appointment

81. The

range of reasons for the appointment of Council representatives to COs results

in a wider range of desired attributes for appointees to these bodies.

82. The Council

will determine the required skills, knowledge and experience for each

appointment. Candidates are not restricted to Councillors – in some cases, it

may be more appropriate to appoint Council staff or external people with

affiliations to the Council.

Remuneration

of CO directors

83. CO

directors appointed by the Council will receive the remuneration (if any)

offered by that body. Council staff members appointed to such bodies will not

accept any remuneration.

HAWKE’S

BAY REGIONAL INVESTMENT COMPANY LIMITED

CHAIRPERSON

SUCCESSION PLANNING POLICY

(This policy is

specifically for the HBRIC Ltd Board Chair)

ADOPTED 26 MARCH 2014

Introduction

In

line with best practice, and in conjunction with the development of the policy

on the appointment and remuneration of directors, this policy has been

developed and is presented to Council for consideration and adoption.

Rationale for a succession plan:

To provide for:

· Smooth

transition through a planned approach

· Knowledgeable

leadership of the board in the event of planned or unexpected retirement of the

incumbent Chairperson

· Recognition

that the term of any chairperson in that role is limited

· A

Chairperson’s desire to step down at any time, knowing that there is a person

who is prepared to take over the role

· Appointment

of a new Chairperson who should generally have knowledge of the Company.

.

Principles:

·

Directors would generally not be appointed for more than two (3 year) terms on

a board

· A

person appointed as Chair in their second term may be appointed for a maximum

of six years as Chairperson unless in exceptional circumstances as agreed by

the Council.

· Council

and HBRIC Ltd will generally consider the need for a potential successor as