Meeting of the Hawke's Bay Regional Council

Date: Wednesday 18 December 2013

Time: 9.00 am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Prayer/Apologies/Notices

2. Conflict of Interest Declarations

3. Confirmation of Minutes of the

Regional Council Meeting held on 28 November 2013

4. Matters Arising from Minutes of the Regional Council

Meeting held on 28 November 2013

5. Follow-ups from Previous Council Meetings

6. Call for any Minor Items Not on the Agenda

Decision Items

7. Affixing of Common Seal

8. HBRIC Ltd and Ruataniwha Water Storage Scheme Monthly

Update

9. Ruataniwha Water Storage Scheme Investment - Proposed

Evaluation Process

10. HBRIC Ltd Board of Directors Membership and Constitution

11. Recommendations from the Maori Committee

12. Recommendations from the Corporate and Strategic Committee

13. Reformatting of Financial Reporting for Council

Information or Performance Monitoring

14. 11.00am Hawke's Bay Tourism Ltd Quarterly Report and

Presentation

15. Monthy Work Plan Looking Forward Through January 2014

16. Minor Items Not on the Agenda

Public Excluded

17. Confirmation

of the Public Excluded Minutes of the Regional Council Meeting held on 28 November

2013

18. Matters

Arising from the Public Excluded Minutes of the Regional Council Meeting held

on 28 November 2013

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 18 December 2013

SUBJECT: Follow-ups from Previous Council Meetings

Reason for Report

1. Attachment

1 lists items raised at previous meetings that require follow-ups.

All items indicate who is responsible for each, when it is expected to be

completed and a brief status comment. Once the items have been completed and

reported to Council they will be removed from the list.

Decision

Making Process

2. Council is required to make a decision in accordance with

Part 6 Sub-Part 1, of the Local Government Act 2002 (the Act). Staff have

assessed the requirements contained within this section of the Act in relation

to this item and have concluded that as this report is for information only and

no decision is required in terms of the Local Government Act’s provisions, the

decision making procedures set out in the Act do not apply.

|

Recommendation

1. That Council receives the report “Follow-ups

from Previous Council Meetings”.

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

|

1View

|

Follow-ups

from Previous Regional Council Meetings

|

|

|

|

Follow-ups from Previous Regional

Council Meetings

|

Attachment 1

|

Follow-ups from previous Regional Council Meetings

Meeting Held 28 November 2013

|

|

Agenda Item

|

Action

|

Responsible

|

Due Date

|

Status Comment

|

|

1

|

Follow-ups from

previous meetings

|

LGOIMA statistics – how

many requests for costs, and is this a barrier to requests

|

L Hooper

|

|

Email

sent to Councillors 2/12/13 and appended

|

|

2

|

Follow-ups from

previous meetings

|

Request Council

receives a full briefing on the state of RWS and how project is progressing

before the end of the year.

Suggest the region’s

mayors be invited to such a briefing.

|

E Lambert

|

|

Region’s

mayors invited to attend 18 December Regional Council meeting in order to

hear the latest HBRIC Ltd / RWSS update on the status and progress of the

RWSS

|

|

3

|

Proposed

2014 Schedule of meetings

|

Add a strategy workshop

in some time in March

Add field trips to

Wairoa, CHB, Taranaki & Horizons

Add LTP strategy

workshop in September

RWSS special

consultative process dates to be added when confirmed

|

E Lambert /

L Hooper

|

|

Updated

schedule to be distributed to Councillors as additional dates confirmed.

|

|

4

|

Annual Plan

Progress Report

|

Amendments to financial

reporting to Council

|

P Drury

|

Feb14

|

Paper

to 18 December RC meeting to seek agreement to proposed amendments to take

effect for February 2014 (7 mos end 31/1/14) next progress report

|

|

5

|

Annual Plan

Progress Report

|

Session for new

councillors on Council accounts and how they operate

|

P Drury

|

|

|

|

6

|

Annual Plan

Progress Report

|

Briefing on progress of

the development of a regional and lower North Island spatial planning

framework

|

H Codlin

|

|

|

|

7

|

Annual Plan

Progress Report

|

Investigate – during

Annual Plan process – whether the fund set up to help TLA led upgrading of

community wastewater systems in unsewered communities can be re-allocated or

whether there are potential opportunities where it might actually be used.

|

H Codlin /

E Lambert

|

April 14

|

|

|

8

|

Annual Plan

Progress Report

|

For each of the HBRC

flood & drainage schemes: Riparian enhancement – how much potential in

the Region; how much has been done previously; how much still to go

- a map showing completed, underway, potential future work

|

M Adye

|

Feb 14

|

To

be included and responded to as part of action list for the next E&S

Committee meeting 12 February 2014.

|

|

9

|

Annual Plan

Progress Report

|

Where is the grass

forage trial (establish economic impacts of rabbits on pastoral farming)

being carried out?

|

C Leckie

|

|

The forage trial was

carried out on Opouahi station, (Maungaharuru/Tutira area). The report is

being written by Landcare research and is expected to be completed February

2014.

|

|

10

|

Minor Items

not on the Agenda

|

Provide

costs associated with building on-farm water storage dams – including

engineering, consents, construction etc

|

I Maxwell

|

|

A

paper will be developed and brought to the first E&S meeting in 2014.

|

Reference

Follow-up item #1

From: Leeanne Hooper

Sent: Monday, 2 December 2013 4:15 p.m.

To: Alan Dick; Christine Scott; Dave Pipe; Debbie Hewitt; Fenton Wilson;

mmohi@doc.govt.nz; Peter Beaven; Rex Graham; Rick Barker; Tom Belford

Subject: LGOIMA information requested

Good afternoon Councillors,

Following is the information

requested in relation to LGOIMA requests and those requests assessed for costs

(s13) where substantial collation of information is required.

In the period 19 June 2012

through 28 November 2013, HBRC received 140 LGOIMA requests. Of those, 8

involved considerable staff time for the collation of substantial information

and were therefore assessed for costs (lowest estimated $200, and highest

$27,000). Of the requests for costs – (a deposit to be paid in advance)

the results were:

o 4 - no response by deadline advised, therefore

information not provided in line with letter, which states:

“Please note that Council will consider the request closed should this

payment not be made by the due date and no further correspondence is received.”

o 1 requestor clarified/specified information requested,

costs were withdrawn & information provided

o 1 withdrew the request after receiving the cost

estimate

o 2 paid the assessed amount and information

subsequently provided

As per the HBRC Annual Plan:

Charges for

the Provision of Information

The Regional

Council (HBRC) shall charge for the provision of any information including the

Regional Policy Statement, regional plans and resource consents as follows.

· The

first hour of time spent actioning a request for information on each or any

occasion relating to the same general matter shall be provided free of charge.

· HBRC

reserves its rights under section 13 of the Local Government Official

Information and Meetings Act 1987 (LGOIMA) to charge for the provision of

information above one hour. HBRC delegates the decision for treating requests

made by the same person and in quick succession as one request, to the Chief

Executive.

· Staff

time spent actioning any request over and above the time provided free of

charge shall be charged at the rates set out in Table 6. HBRC may also choose

to require payment in advance.

· The

first 20 pages of black and white photocopying on standard A4 or A3 paper shall

be provided free of charge.

· Where

the total number of pages of photocopying is in excess of 20 then the rates set

out in Table 6 will apply.

· In

alignment with the LGOIMA, HBRC does not consider requests for explanations in

its definition of information requests.

|

Table 6: Charge rates (excl GST) for the purpose of calculating actual costs per hour

|

|

Item

|

Per Hour

|

|

Executive

|

$121.83

|

|

Asset Management

|

$96.27

|

|

Environmental Science

|

$89.75

|

|

Strategic Direction

|

$93.18

|

|

Environmental Regulation

Resource consent processing

Resource consent administration

Management input into resource consent processing

including attendance at hearings and during deliberations

Compliance/impact monitoring of consents and

Approving, monitoring & auditing of Tier 1 Marine Oil Spill Contingency

Plans, and monitoring of Resource Management Act regulations

All other tasks, consent processing

All other tasks, compliance monitoring

|

$118.45

$80.75

$123.85

$104.00

$79.33

$81.90

|

|

Environmental Information

|

$68.46

|

|

Land Management

|

$83.82

|

|

Disbursement costs shall be charged at the rates of:

Accommodation

Public notification

Photocopying

External laboratory testing

Consultant fees

|

$120 a night per person

Actual advertising costs

20c per A4 page B&W

40c per A4 page colour

30c per A3 page B&W

70c per A2 page B&W

actual cost

actual cost

|

Regards,

Leeanne

Hooper

Governance & Corporate Administration Manager

|

Follow-ups from Previous Regional

Council Meetings

|

Attachment 1

|

LGOIMA Requests Received

between 21 November and 11 December 2013

HAWKE’S BAY REGIONAL COUNCIL

Environment

and Services Committee

Wednesday 18 December 2013

SUBJECT: Call for any Minor Items Not on the Agenda

Reason for Report

1. Under standing orders,

SO 3.7.6:

“Where an item is not on the agenda for a

meeting,

(a) That item

may be discussed at that meeting if:

(i) that

item is a minor matter relating to the general business of the local authority;

and

(ii) the

presiding member explains at the beginning of the meeting, at a time when it is

open to the public, that the item will be discussed at the meeting; but

(b) No

resolution, decision, or recommendation may be made in respect of that item

except to refer that item to a subsequent meeting of the local authority for

further discussion.”

2. The Chairman will

request any items councillors wish to be added for discussion at today’s

meeting and these will be duly noted, if accepted by the Chairman, for

discussion as Agenda Item 16x.

|

Recommendations

That Council accepts

the following minor items not on the agenda, for discussion as item 16:

1.

|

|

Leeanne Hooper

Governance & Corporate

Administration Manager

|

Liz Lambert

Chief Executive

|

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 18 December 2013

SUBJECT: Affixing of Common Seal

Reason for Report

1. The Common Seal of the

Council has been affixed to the following documents and signed by the Chairman

or Deputy Chairman and Chief Executive or a Group Manager.

|

|

|

Seal No.

|

Date

|

|

1.1

|

Leasehold

Land Sales

1.1.1 Lot 581

DP 2497

CT 55/126

- Transfer

1.1.2 Lot 4

DP 7422

CT C4/323

- Agreement for Sale and Purchase

- Transfer

1.1.3 Lot 39

DP 6391

CT E2/1453

- Agreement for Sale and Purchase

1.1.4 Lot 10

DP 4488

CT 56/282

- Agreement for Sale and Purchase

- Transfer

1.1.5 Lot 98

DP 13378

CT F1/568

- Transfer

|

3739

3741

3747

3742

3744

3745

3746

|

22 November 2013

28 November 2013

9 December 2013

28 November 2013

6 December 2013

6 December 2013

6 December 2013

|

|

1.2

|

Deed of

Variation

Local

Authority Environmental Monitoring Group Production of EMS for freshwater

data

|

3740

|

25 November 2013

|

|

1.3

|

Change 4 of

Regional Resource Management Plan

Adopted at

Council meeting 28 November 2013

|

3743

|

5 December 2013

|

Decision Making Process

2. Council is required to

make every decision in accordance with the provisions of Sections 77, 78, 80,

81 and 82 of the Local Government Act 2002 (the Act). Staff have assessed the

requirements contained within these sections of the Act in relation to this

item and have concluded the following:

2.1 Sections 97 and 88 of the Act do not apply;

2.2 Council can exercise its discretion under Section

79(1)(a) and 82(3) of the Act and make a decision on this issue without

conferring directly with the community or others due to the nature and

significance of the issue to be considered and decided;

2.3 That the decision to apply the

Common Seal reflects previous policy or other decisions of Council which (where

applicable) will have been subject to the Act’s required decision making

process.

|

Recommendations

That Council:

1. Agrees

that the decisions to be made are not significant under the criteria

contained in Council’s adopted policy on significance and that Council can

exercise its discretion under Sections 79(1)(a) and 82(3) of the Local

Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

2. Confirms

the action to affix the Common Seal.

|

|

Diane Wisely

Executive

Assistant

|

Liz Lambert

General

Manager (Operations)

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 18 December 2013

SUBJECT: HBRIC Ltd and Ruataniwha Water Storage Scheme Monthly

Update

Reason for Report

1. Attached is the report

of HBRIC Ltd to Council on its activities during the October- December 2013

period.

2. The HBRIC Ltd Managing

Director, Andrew Newman, and Company Manager, Heath Caldwell, will be present

at the meeting to speak to the update.

Decision Making

Process

3. Council is required to

make a decision in accordance with Part 6 Sub-Part 1, of the Local Government

Act 2002 (the Act). Staff have assessed the requirements contained within this

section of the Act in relation to this item and have concluded that, as this

report is for information only and no decision is to be made, the decision

making provisions of the Local Government Act 2002 do not apply.

|

Recommendation

1. That

Council receives the “HBRIC Ltd and Ruataniwha

Water Storage Scheme Monthly Update” report.

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

|

1View

|

HBRIC Ltd and

RWSS Monthly Update Report

|

|

|

|

HBRIC Ltd and RWSS Monthly Update

Report

|

Attachment 1

|

HAWKE’S

BAY REGIONAL INVESTMENT COMPANY LTD (HBRIC Ltd)

Report

to Hawke’s Bay Regional Council

18

December 2013

This

report covers developments over the October - November 2013 period for the

following:

· HBRIC Ltd

· RWSS

Execution

Key operational

activities undertaken by the HBRIC Ltd Board in October - November 2013

included:

· Appointment of one non-executive Director to the Board

of Napier Port as approved by Council.

Critical

Deadlines

It

is important to note that the following deadlines are critical from this point

onwards.

Investment

Recommendation to HBRC

Ÿ Subject

to draft consent conditions, finalisation of Design & Construction

(D&C) terms, consolidation of the financial base case, and investor

positions, HBRIC Ltd is considering tabling the business case and with

appropriate recommendations to HBRC by late February 2014.

EPA

and consenting

Ÿ The

Tukituki proposal is well advanced with the likelihood that there will be some

hearing days early in the New Year. Draft consent conditions could potentially

be available mid/late February 2014 with final consent conditions

expected 6 April 2014.

Design

& Construction

Ÿ Finalisation

of contractual costs and terms finalised by 14 February 2014. Contract end

of March 2014.

Water

uptake

Ÿ Farmer

Investment Memorandum targeted release in late January 2014.

Ÿ Water

contract and refined price by late January 2014 – this will depend on

material progress with Crown Irrigation Investments Ltd (CII) and D&C negotiations.

Financing

Ÿ Formation

of the investor consortium – next Investor Representative Committee meeting was

scheduled for 12 December 2013.

Ÿ CII

terms sheet to be developed in January 2014.

Ÿ Draft Concession

Deed terms sheet developed. Depending on the timing of other critical deadlines

this could be available to Council in late January 2014.

Ÿ Limited

partnership formation - post D&C Decision and depending on Crown position –

possibly March 2014.

Design

and Construction

Overview

Ÿ Submissions

from the 2 shortlisted D&C consortia, Bouygues and OHL-Hawkins were

received on 19th August 2013. Since that time a formal evaluation process was

undertaken culminating in the production of a D&C RFP Evaluation Report

which provided a recommendation for HBRIC Ltd and Investor Representative

Committee approval.

Ÿ The

D&C RFP Evaluation report and process was described and presented to the

Investor Representative Committee on 30th October 2013. Through this process

and on recommendation from the Project Evaluation team it was resolved to

accept the recommendation to move to a Preferred Respondent position with

OHL-Hawkins and a Reserved Respondent position with Bouygues, as part of moving

to the next phase of negotiations.

Ÿ Further

negotiations are currently being undertaken with OHL-Hawkins on costs and contractual

terms which are expected to be confirmed by mid February 2014.

Risks

|

Risk

|

Rating

|

Mitigation

|

|

Construction

price driving above 22-25c per m3

|

Medium - high

|

D&C

process – minimising interface risk – cost and price

optimisation

– costs and revenue

|

|

Extra

site and geotech issues identify fatal flaw

|

Medium –

trending lower

|

Additional

GNS final seismic completed. Provision in D&C capex build budget for further

geotech investigations as part of final design phase.

|

|

Landowner

objections

|

Medium,

if not proactively managed

|

Sales and

purchase options agreements work strand continuing

|

Investors

· Investor discussions are making good

progress with the Investor Representative Committee now established and all

aspects of the project being discussed in this forum.

· Crown negotiations are ongoing with more

details to be available in January 2014.

Risks

|

Risk

|

Rating

|

Mitigation

|

|

Failure

to secure adequate public investment

|

Medium

|

Leveraged

deal HBRIC Ltd/Crown

Meeting

the Crown’s investment criteria

|

|

Failure

to secure adequate private investment

|

Medium

Risk

increases with less uptake

|

Iwi and

farmer equity and intergenerational equity

Financial

model and uptake

|

Uptake

· There are currently 103 EOI’s signed

for a total of 42.5M m3 of water covering 12,900ha of land. A breakdown of

these EOI’s by land use will be presented to Council at the meeting.

· Information Memorandum work stream is

currently underway with a targeted release at the beginning of 2014.

· Refinement of the water price to be

completed once the D&C work assessment has been completed.

Risks

|

Risk

|

Rating

|

Mitigation

|

|

Rate of

uptake varies from base case

|

Medium

|

Education

Incentives

Sales

team

|

|

Price

escalation

|

Low

|

Price

tagged to CPI or similar indice adjustment in deed

|

|

Water

user agreement – take or pay – volumetric charge versus capex charge

disincentivises uptake

|

Medium

|

Contractual

form needs careful pitch towards the end of a sale process

Intergenerational

equity and option to invest

|

|

Distribution

and commissioning

|

Medium

|

Optimisation

with D&C process

User groups

|

EPA

Consent application and plan change & related matters

· The EPA Board of Inquiry is into its

fifth week. After three weeks of hearings in Hastings it moved to Waipawa Town

Hall last Monday (9 Dec) where it will sit for two weeks hearing a range of

submitters including Fish & Game, other environmental groups, local

farmers, and Irrigation New Zealand.

· HBRC & HBRIC Ltd’s case was

presented over the first nine days of the hearing and outlined the RWSS

process, Maori consultation, the science behind Plan Change 6 and the TRIM

conceptual models of the Tukituki Catchment, developed for RWSS to predict

nitrogen and phosphorus concentrations in streams.

· In week three the focus moved to

verbal submissions. There was plenty of discussion around the methodology used

to determine seasonal allocations and the proposed maximum groundwater

allocation. Horticultural interests say their only outstanding matter is the

minimum flow increase from 4,300 litres per second to 5,200 litres per second

in 2023.

· Further informal expert conferencing

continues to discuss outstanding issues in Plan Change 6.

· Environmental groups have raised

concerns about the effects of RWSS on water quality through land use

intensification, aquatic ecology, terrestrial ecology and recreation.

· The hearing will adjourn for the year

on 20 December 2013 and resume on 15 January 2014 at Hawke’s Bay Opera House.

It is anticipated the hearing will finish on 20 January 2014.

Risks

|

Risk

|

Mitigation

|

|

Not

obtaining required resource consents

|

Draft

consent conditions and strategic partner support – Iwi, DoC, Pan sector

|

|

Nutrient

management regime and limits made more stringent through BoI/EPA

|

Leading

science on:

Nitrate

toxicity and Tukituki in-stream management model

Provision

of periphyton freshes – flow optimisation

|

|

Dam

design envelop constrained removing innovation and optimisation

|

|

|

Consent

granted is less than 35 years, or other constraints imposed e.g. smaller dam

|

|

Communications

· The Communications Activity Plan for

HBRIC Ltd is outlined below.

COMMUNICATION

ACTIVITY PLAN – November 2013 Update

|

TO WHOM

|

WHAT

|

OWNER

|

DATE ACTND

|

|

Farmers

CHB Community

General Public

Media & Public

Business

General

|

November

2013

§ Quarterly

Farmer Update

§ Central

HB A & P Show – 8-9 Nov (TBC)

§ Our

Place – RWSS story

§ Media

Release – Preferred D & C consortia named

§ Article

in Hawke’s Bay Chamber of Commerce bi-monthly newsletter

§ Daily

summaries from Tukituki Catchment Proposal EPA Board of Inquiry

|

Helen

Andrew/Graeme

Helen

Helen

Helen

Helen

|

Mid-Nov

8-9 Nov

Mid-Nov

Completed

Completed

18-29

Nov

|

|

|

|

|

|

|

General Public

Media & Public

Media & Public

Media & Public

General

|

December 2013

§ RWSS

Newsletter Update

§ Media

Release - Concession Deed

§ Media

Release – D&C announcement

§ Media

Release – Confirm water price after D& C announcement

§ Daily

summaries from Tukituki Catchment Proposal EPA Board of Inquiry

|

Helen

|

Early Dec

TBC

TBC

TBC

2-20 Dec

|

|

|

|

|

|

|

General Public

General Public

General Public

Business

Leaders

General Public

General Public

General Public

|

January 2014 – May 2014

§ Communications

Campaign (TBC)

§ Library

display – rotating to HB libraries

§ Community

forums/Roadshow

§ Leaders

Briefing – Feb 2014

§ Article

in Hawke’s Bay Chamber of Commerce bi-monthly newsletter

§ RWSS

Newsletter – Feb/March 2014

§ RWSS

Newsletter – April/May 2014

§ Public

consultation – April/May 2014

|

Helen

|

TBC

TBC

TBC

Feb 2014

Feb 2014

TBC

TBC

TBC

|

Table 1 sets out the

November 2013 Financial Report for HBRIC Ltd.

The report sets out

the actual costs incurred for both the month and the year to date against the

full year budget to 30 June 2014 (operating) and full project budget to April

2014 (capital).

A summary of the key elements outlined in

the report for the month of November is as follows:

Operating Income

and Expenditure

· There was a total of $39,940 of operating expenditure

in the month of November with a breakdown of these costs set out as follows:

- $9,500 for Board Fees for the Chairman and two

non-executive Directors.

- $13,016 for Management Services provided by HBRC staff.

- $13,040 for Consultancy Fees which includes taxation

services in relation to the preparation of the 2013 income tax return as well

as fees for the three independent RWS Board Committee members for the month of

November.

- $4,384 for other miscellaneous expenditure.

RWS Phase 2 Costs ($374,676)

· The $31,949 of HBRC internal staff time for November

covers a number of work streams including:

- Ongoing landowner liaison meetings with dam, reservoir

and Zone M landowners, including headrace canal and pipe landowners within the

distribution network.

- Attendance and presentation at the Board of Inquiry

hearing.

- Ongoing negotiations with Investor Representative

Committee including meeting with Crown Irrigation Company.

- Ongoing project management.

· The $214,172 of Other Consultants costs covers off a

number of pieces of work including:

- Completion of D&C evaluation tender process,

including D&C evaluation report.

- Commence further evaluation and negotiation with

preferred D&C candidate (OHL-Hawkins).

- Water contract and sales advisory costs.

- Completion of updated demand forecast model.

- Various landowner meetings and negotiations for

November.

· $128,555 for Commercial Legal & Tax Advisory

services for November.

EPA Process Costs ($530,031)

· $10,194 of HBRC internal

staff time for November covering project management for the Board of Inquiry

hearing and witness evidence preparation.

· The $149,039 of costs for

Project Team Consultants for November covers a number of work streams

including:

- DOC land exchange consultations.

- Finalising preparation of 42 statements of rebuttal

evidence for Board of Inquiry hearing.

- Preparation for and attendances at Board of Inquiry

hearing commencing on 18 November 2013.

- Ongoing project

management.

· $131,447 of costs for

witnesses covering off the finalisation of rebuttal evidence, and preparation

for and attendances at Board of Inquiry hearing commencing on 18 November 2013.

· The $239,351 of EPA

Expenses relates to the costs incurred by the Environmental Protection

Authority for November.

Project Reforecast

· A process is currently

being undertaken to identify additional budget requirements for the RWSS

through to financial close. The key areas where there additional budget are

likely to be required are:

- HBRC internal staff time

- D&C evaluation costs

- Consents

- EPA Expenses

· Once completed this

reforecast will be assessed by the Investor Representative Committee, including

the Ministry for Primary Industries, with finalisation and approval of this reforecast

scheduled for January 2014.

· It is important to note

that all development costs incurred by HBRIC Ltd prior to financial close will

form part of its total investment quantum in the RWSS.

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 18 December 2013

SUBJECT: Ruataniwha Water Storage Scheme Investment - Proposed

Evaluation Process

Reason for Report

1. Hawke’s Bay Regional

Investment Company Limited (HBRIC Ltd), HBRC’s wholly owned investment company,

is developing a proposal to invest up to $80 million in equity as a minority

shareholder in a company to be formed to implement and operate the Ruataniwha

Water Storage Scheme (RWSS).

2. The size and nature of

the proposed investment is likely to have a substantial impact on the structure

and performance of the Council’s investment portfolio and potentially on its

operating position over a considerable period. Council will therefore conduct

its own independent evaluation of the proposal to inform its decision making

about any investment.

3. This report outlines

the evaluation process in relation to the proposal to invest, for Council to

consider in order to prepare a Statement of Proposal for a Special Public

Consultative Process and final decision. Also set out are the key issues to be

addressed by the proposed independent peer review of the RWSS business case.

Background

4. The new company will be

responsible for designing, constructing and operating a dam and reservoir and

distribution system to collect and store water from the Makaroro River in

Central Hawke’s Bay and supply it to farmers and other stakeholders on the

Ruataniwha Plains. It will charge users for its services and is intended to

become commercially viable and generate financial returns to its investors over

time. At the same time the scheme is expected to boost economic development of

the region and add to its regional GDP.

5. Design and construction

of the infrastructure, development of the business case for investment in the

scheme and establishing funding for it is the responsibility of and is managed

by HBRIC Ltd. Council and HBRIC Ltd are jointly seeking the appropriate resource

management plan changes and resource consents required to enable the scheme to

be implemented, through the Environmental Protection Authority (EPA).

6. HBRIC Ltd has already

secured investor interest, and both Ngai Tahu Holdings and Trustpower Limited

have joined with HBRIC Ltd to form an investor group in which all three parties

are contributing funds towards the costs of design and consenting processes.

7. In addition, Crown

Irrigation Investments Limited (CIIL), a state owned enterprise, has formally

notified its interest in investing in the scheme and is working with HBRIC Ltd

and the investor group to progress its interest to a final decision whether or

not to invest and the level of this investment.

8. Financial provision for

the proposed investment estimated at $80m has been presented and consulted on

in the LTP 2012-2022 and included in HBRC’s Annual Plans for 2012/2013 and

2013/2014. In addition Council is committed to undertaking a Special Public

Consultative Process on the proposed investment once its terms have been

finalised and all conditions satisfied.

Evaluation

Process

9. HBRC assumes HBRIC Ltd’s

expert advisers will have resolved all design and construction matters and the Environmental

Protection Agency (EPA) Board of Inquiry consent process will resolve

environmental and social and cultural matters. HBRC will therefore only be

called upon to consider strategic, financial and economic issues and any

legislative requirements in making its decision about its own investment in the

RWSS.

10. It is expected HBRIC Ltd

will initiate the key steps in the evaluation process by submitting a

comprehensive proposal to HBRC containing its outline of the development of the

appropriate infrastructure, its costs and proposed funding, corporate structure

and business case and estimated economic benefits and costs of the project for

the Hawke’s Bay region and New Zealand as a whole.

11. The Council’s evaluation

of HBRIC Ltd’s proposal is expected to be carried out in five major steps which

are:

11.1. Testing the financial

feasibility of the scheme by commissioning an

independent Peer Review of the RWSS Business Case.

11.2. Evaluating the

potential impacts of the investment on Council’s

future balance sheet, operating position and rates.

11.3. Identifying, evaluating and comparing options for alternative investment

of the funds now held for the RWSS investment as required by the Local

Government Act 2002, including assessment of their economic and financial

benefits and costs.

11.4. Strategic Evaluation

of investment in RWSS or alternatives addressing

matters such as fit with Council’s LTP objectives and economic development

strategy, equity between ratepayers and risk management.

11.5. Public Consultation

on Council’s Provisional Decision using a special

consultative process as provided for by the Local Government Act 2002 and final

decision by Council following consideration of the evaluation and results

of the special consultative process.

Crown Irrigation Investments

12. As noted in paragraph 7

above Crown Irrigation Investments Limited, the Government’s company tasked

with implementing government policy to increase irrigated land in New Zealand

by co-investing in off-farm irrigation schemes, is considering investment in

the new company. It too will follow its own evaluation process to guide its final

decision about this proposed investment.

13. HBRC officers met with

CIIL’s officers to discuss our respective approaches to evaluating investment

in RWSS. This meeting revealed similar views between HBRC and CIIL about

requiring an independent peer review of the RWSS business case and a

willingness to consider jointly undertaking it with HBRC and sharing costs

correspondingly. The Terms of Reference for the independent peer review of the

Business Case and the process of selection and appointment of an appropriate

consultant is proposed to be jointly agreed and managed by HBRC and CIIL.

14. This plan is subject to

further discussions with CIIL as both parties fully determine their

requirements for evaluation.

Next Steps

15. On receipt of HBRIC Ltd’s

recommendation the assessment proposed to be undertaken by Council includes:

|

Item

|

Estimated

Time Required

|

|

An

independent peer review of the RWSS business case

|

3 – 4 weeks

|

|

Assessment

of potential impacts of Council’s investment in RWSS on rates, its operating

position and balance sheet

|

|

Identification

and evaluation of alternative options in terms of economic and financial

returns for investing Council’s funds – (this study will take place in the

first few months of the 2014 calendar year).

|

|

Preparation

of a summary paper for HBRC covering the HBRIC Ltd proposal and the

subsequent advice and evaluation undertaken as outlined in the three points

above, and making recommendations about investing in the RWSS.

|

1 week

|

|

Councillors

receiving and reading papers.

|

1 week

|

|

Preparation,

approval and issue of a Statement of Proposal for the Special Public

Consultative Process already announced

|

1 week

|

|

A Special

Public Consultative Process period of at least four weeks

|

4 weeks

|

|

Receipt of

submissions and staff review and reporting of them

|

2 weeks

|

|

Councillors

receiving and reading submissions/staff responses

|

1 week

|

|

Council’s

hearing of public submissions

|

0.3 weeks

|

|

Council’s

final decision on the proposed investment and summary paper to Council.

|

1 week

|

16. HBRC will obtain

independent advice on the proposal from consultants who have not been employed

by HBRIC Ltd or parties associated with the preparation of its proposal. The

timeline assumes the appointed consultants will be able to complete their

contracted tasks by the completion dates specified (3 – 4 weeks allowed for

this assessment), however these dates may change depending upon the

availability of consultants and the issues they may find during the course of

their work.

17. In order to make the

evaluation process as quick and efficient as possible it is proposed to

determine the Terms of Reference for reviews to be done by independent external

advisors (as suggested in 11.1-11.3 above) and identify, recruit and appoint

appropriate advisers over the December 2013 to February 2014 period so that

they are in position to start their work as soon as the HBRIC Ltd final

proposal is available.

18. It is proposed to

prepare Terms of Reference for the independent peer review of the business case

(11.1 above), and agree it with CIIL in December 2013 if the work is to be

jointly commissioned.

19. Terms of Reference for

the identification and evaluation of alternative investments called for in 11.3

above will also be developed over a similar period. This step is an HBRC only

requirement (in accordance with the provisions of the Local Government Act

2002).

20. It is important the key

issues addressed by any Terms of Reference are the ones Council wants to

consider. We have therefore drafted an initial outline of these in 21.1 through

21.3 below for review and comment by Council. Comments will be fed into the

final version of the terms of reference. Also it is the intention for draft

terms of reference for the business case as well as the terms of reference

covering the evaluation on alternative investments to be distributed at this

Council meeting.

Terms of Reference for Peer Review of

Business Case – Key Issues

21. The

key issues for HBRC in evaluating HBRIC Ltd’s business case are:

21.1. Financial feasibility –

is HBRC’s investment supported by a sound business case?

21.2. Returns on investment –

what financial returns can HBRC expect from its investment and over what time

period are these expected to occur?

21.3. Business Risks – what

risks does the company face and how will these be managed or mitigated?

22. These issues are

expected to be addressed by the independent peer reviewer by reviewing the

business case projections and assessing impacts of changes in a range of

market, management and financial variables.

Decision Making

Process

23. Council is required to

make a decision in accordance with Part 6 Sub-Part 1, of the Local Government

Act 2002 (the Act). Staff have assessed the requirements contained within this

section of the Act in relation to this item and have concluded the following:

23.1. Sections 97 and 98 of

the Act do not apply as these relate to decisions that significantly alter the

service provision or affect a strategic asset.

23.2. Sections 83 and 84

covering special consultative procedure do not apply.

23.3. The decision does not

fall within the definition of HBRC’s policy on significance.

23.4. The persons affected by

this decision are those members in the community who want clarity on the issues

and timeframe for HBRC’s RWSS review.

23.5. No options have been considered

as the requirements of a special consultative process are covered by the Local Government

Act 2002.

23.6. Section 80 of the Act

covering decisions that are inconsistent with an existing policy or plan does

not apply.

23.7. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others having an interest in the decision.

|

Recommendations

That Council:

1. Agrees that

the decisions to be made are not significant under the criteria contained in

Council’s adopted policy on significance and that Council can exercise its

discretion under Sections 79(1)(a) and 82(3) of the Local Government Act 2002

and make decisions on this issue without conferring directly with the

community and persons likely to be affected by or to have an interest in the

decision due to the nature and significance of the

issue to be considered and decided.

2. Notes this

Evaluation Process for the proposed Ruataniwha Water Storage Scheme

investment is limited to consideration of strategic, economic and financial

issues and that other external processes and HBRIC Ltd’s own implementation

process will resolve design, construction, environmental and social and

cultural issues to the satisfaction of Council.

3. Notes the

proposed joint management of the independent peer review process with Crown

Irrigation Investments Limited is in the process of negotiation.

4. Delegates

authority to Council’s Chief Executive to undertake the identification,

recruitment and appointment of an independent peer reviewer following the

procurement process outlined in the timeline and, if possible, to conclude an

agreement with Crown Irrigation Investments Limited to jointly conduct the proposed

peer review of the HBRIC Ltd business case on terms satisfactory to Council

by the end of January 2014.

|

|

Paul Drury

Group

Manager

Corporate

Services

|

Liz Lambert

Chief

Executive

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 18 December 2013

SUBJECT: HBRIC Ltd Board of Directors Membership and Constitution

Reason for Report

1. The following

recommendations were made by the Corporate and Strategic Committee to Council.

|

Recommendations

The Corporate

and Strategic Committee recommends that Council:

1. Agrees that the

decisions to be made are not significant under the criteria contained in

Council’s adopted policy on significance and that Council can exercise its

discretion under Sections 79(1)(a) and 82(3) of the Local Government Act 2002

and make decisions on this issue without conferring directly with the community

and persons likely to be affected by or to have an interest in the decision

due to the nature and significance of the issue to be considered and decided.

2. Confirms that it has

considered the potential solutions for the perceived conflict of interest, and

resolves to appoint Danelle Dinsdale and David Faulkner as Directors to

replace the three Councillor Directors on the Transition Board of Hawke’s Bay

Regional Investment Company Limited for the period to 30 June 2014, noting

that the number of Directors will be reduced from seven to six.

3. Agrees that Clauses

8.1 and 8.3(a) of the Constitution be amended to:

“8.1 Minimum

and maximum numbers: The minimum number of Directors shall be three (3)

and the maximum number of Directors shall be seven (7).

8.3 Appointment

of Directors and Chairperson:

a. HBRC shall

appoint at least three (3) and up to seven (7) Directors to the Board of the

company (including the right to appoint and remove and nominate alternates)

in accordance with HBRC’s Policy concerning Director appointments of existing

Council Members (Councillor Directors), and Directors who are independent of

the Council (Independent Directors). HBRC shall appoint a Chairperson from

amongst the Directors so appointed;”

4. Agrees that Clause

2.4 of Schedule 2 of the Constitution be amended to:

“2.4 Chairperson:

In accordance with clause 8.3 of the Constitution, HBRC shall appoint a

Chairperson of the Board from amongst the Directors.”

5. Notes that a policy

on the appointment and remuneration of Directors is to be developed and

presented to the next (12 March 2014) Corporate and Strategic Committee

meeting.

|

2. At the Corporate and Strategic Committee

meeting during discussions on Board membership an issue was noted around the

timing of the changes to the Constitution of HBRIC Ltd set out in

Recommendation 3 and it was also noted that a consequential change of the

removal of Councillor Directors to the Transition Board would need to be a

change to the quorum provision.

Additional

Recommendations and Changes to Constitution

3. The change to Clause 8.1 could take

effect immediately upon adoption of the recommendations by Council.

4. The changes to Clause 8.3 could take

effect immediately upon the adoption of a policy concerning Director

appointments. This would allow for confirmation of the appointment of Ms

Dinsdale and Mr Faulkner. Following the Corporate and Strategic Committee, and

upon the advice of legal counsel, it is proposed that an Interim Policy

be put to Council for consideration and adoption at this meeting, to be in place

for a period of 3-4 months until the full Policy is considered by Council in

March 2014. The proposed Interim Policy is as follows.

Proposed Interim Director

Appointment Policy

Purpose: The purpose of this policy is to set out Council’s

intentions for the appointment of directors to the Board of the HBRIC for the

period from 18 December 2013 until 30 June 2014.

Appointment of Directors

The Hawke’s Bay Regional Council

shall not appoint any of its members (Councillor Directors) to the Board

The Hawke’s Bay Regional Council

shall appoint up to seven Directors who are independent of the Council to the

Board (Independent Directors)

If the need arises, in addition to

those already appointed, directors will be appointed based on merit.

Managing

Director Role

5. For the purpose of clarification, the

Managing Director will no longer be a formal Board member of HBRIC Ltd but will

continue to provide oversight of the execution of HBRIC Ltd strategy and issues

related to its activities.

Quorum

6. An amendment is required to Clause 2.2

of Schedule 2 of the Constitution “Proceedings of Board Members” to address the

anomaly of the quorum where there are no councillor directors.

7. The recommended amendment is:

7.1. “A quorum for a meeting of the of the

Board, other than an adjourned meeting, is a majority of the Directors who are

entitled to vote at that meeting to include not less than two (2) Councillor

Directors three (3) Directors.”

Conclusion

8. In addition to the recommendations

passed by the Corporate and Strategic Committee meeting in respect of HBRIC Ltd

Board membership there are two additional recommendations in this paper, these

being:

8.1. A Proposed Interim Policy on the

Appointment of Directors; and

8.2. An amendment to the meeting quorum

provision in the Constitution.

9. These are recommendations 4 and 5 below.

Decision Making

Process

10. Council is required to

make a decision in accordance with the requirements of the Local Government Act

2002 (the Act). Staff have assessed the requirements contained in Part 6 Sub

Part 1 of the Act in relation to this item and have concluded the following:

10.1. The decision does not

significantly alter the service provision or affect a strategic asset.

10.2. The use of the special

consultative procedure is not prescribed by legislation.

10.3. The decision does not

fall within the definition of Council’s policy on significance.

10.4. The persons affected by

this decision are the members of the HBRIC Ltd Board of Directors.

10.5. Options that have been

considered are discussed in the related briefing papers.

10.6. The decision is not

inconsistent with an existing policy or plan.

10.7. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others having an interest in the decision.

|

Recommendations

That Council:

1. Agrees that the decisions to be made

are not significant under the criteria contained in Council’s adopted policy

on significance and that Council can exercise its discretion under Sections

79(1)(a) and 82(3) of the Local Government Act 2002 and make decisions on

this issue without conferring directly with the community and persons likely

to be affected by or to have an interest in the decision due to the nature

and significance of the issue to be considered and decided.

2. Confirms that it has considered the

potential solutions for the perceived conflict of interest, and resolves to

appoint Danelle Dinsdale and David Faulkner as Directors to replace the three

Councillor Directors on the Transition Board of Hawke’s Bay Regional

Investment Company Limited for the period to 30 June 2014, noting that the

number of Directors will be reduced from seven to six.

3. Agrees that Clause 8.1 of the HBRIC Ltd

Constitution be amended, for immediate effect, to:

“8.1 Minimum

and maximum numbers: The minimum number of Directors shall be three (3) and

the maximum number of Directors shall be seven (7).”

4. Adopts the interim

policy on the appointment and remuneration of Directors as follows.

Hawke’s Bay Regional Council

Interim Policy on Appointment of

Directors

[Adopted 18 December 2013]

Purpose

The purpose of this policy is to set out Council’s intentions for

the appointment of directors to the Board of the HBRIC for the period from 18 December

2013 until 30 June 2014.

Appointment of Directors

1. The Hawke’s Bay Regional Council shall not

appoint any of its members (“Councillor Directors”) to the Board

2. The Hawke’s Bay Regional Council shall

appoint up to seven Directors who are independent of the Council to the Board

(“Independent Directors” )

3. If the need arises, in addition to those

already appointed, directors will be appointed based on merit

5. Notes that the final HBRC Appointment

and Remuneration of Directors Policy is under development and will be

presented to the 12 March 2014 Corporate and Strategic Committee meeting for

consideration, and for adoption at the 26 March 2014 Regional Council

meeting.

6. Agrees that Clause

8.3(a) of the HBRIC Ltd Constitution be amended to:

“8.3 Appointment of Directors

and Chairperson:”

a. HBRC

shall appoint at least three (3) and up to seven (7) Directors to the Board

of the company (including the right to appoint and remove and nominate

alternates) in accordance with HBRC’s Policy concerning Director appointments

of existing Council Members (Councillor Directors), and Directors who are

independent of the Council (Independent Directors). HBRC shall appoint a

Chairperson from amongst the Directors so appointed;”

7. Agrees that Clause 2.4

of Schedule 2 of the HBRIC Ltd Constitution be amended to:

“2.4 Chairperson:

In accordance with clause 8.3 of the Constitution, HBRC shall appoint a

Chairperson of the Board from amongst the Directors.”

8 Agrees that Clause 2.2

of Schedule 2 of the HBRIC Ltd Constitution be amended to:

“2.2 Quorum: A

quorum for a meeting of the Board, other than an adjourned meeting, is a

majority of the Directors who are entitled to vote at that meeting to include

not less than three (3) Directors.”

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 18 December 2013

SUBJECT: Recommendations from the Maori Committee

Reason for Report

1. The following matters were

considered by the Māori

Committee on Tuesday 3 December 2013 and are now presented for

consideration and approval.

Decision Making

Process

2. These items have been

specifically considered at the Committee level.

|

Recommendations

That Council:

1. Agrees that

the decisions to be made are not significant under the criteria contained in

Council’s adopted policy on significance and that Council can exercise its

discretion under Sections 79(1)(a) and 82(3) of the Local Government Act 2002

and make decisions on this issue without conferring directly with the

community and persons likely to be affected by or to have an interest in the

decision due to the nature and significance of the

issue to be considered and decided.

Appointment of Tangata Whenua

Representatives to the Maori Committee

2. Appoints Fred

McRoberts, Shaun Haraki and Adrian Manuel representing the Wairoa area; Piri

Prentice, Joinella Maihi-Carroll and Beverley Kemp-Harmer representing the

Ahuriri area; Haami Hilton, Michael Paku and Marei Apatu, representing the

Heretaunga area; Roger Maaka, Mike Mohi and Brian Gregory, representing the

Tamatea area, as members of the Māori Committee of the Hawke's Bay

Regional Council.

2. Appoints Bill

Blake (Wairoa), Rangi Puna (Ahuriri) and Marge Hape (Tamatea) as short term

replacement members of the Māori Committee of the Hawke's Bay Regional

Council.

Election of

Chairman and Deputy Chairman of the Maori Committee

3. Confirms the appointment of Mr Mike Mohi

as Chairman of the Māori Committee, as elected

by the members of that Committee.

4. Confirms the appointment of Mr S Haraki

as Deputy Chairman of the Maori Committee, as elected

by the members of that Committee.

Membership

of Council Committees by Tangata Whenua Nominated Members of the Maori

Committee

5. Appoints Mrs Joinella Maihi-Carroll

and Mr Brian Gregory as members of the Environment and Services

Committee.

6. Appoints Mr Piri Prentice

and Mr Shane Haraki as members of the Corporate and Strategic

Committee.

7. Appoints Mr

Brian Gregory as a member of the Regional

Transport Committee.

|

|

Viv Moule

Human

Resources Manager

|

Liz Lambert

Chief

Executive

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 18 December 2013

SUBJECT: Recommendations from the Corporate and Strategic Committee

Reason for Report

1. The following matters

were considered by the Corporate and Strategic Committee on 11 December

2013 and are now presented to Council for consideration and approval.

Decision Making

Process

2. These items have all

been specifically considered at the Committee level.

|

Recommendations

That Council:

1. Agrees

that the decisions to be made are not significant under the criteria

contained in Council’s adopted policy on significance and that Council can

exercise its discretion under Sections 79(1)(a) and 82(3) of the Local

Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

HBRC Staff Accommodation - Guppy Road Operations and Wairoa

2. Agrees to

proceed with refurbishments to the office accommodation building at HBRC’s

Guppy Road site as outlined below, at an estimated cost of $410,000 plus GST.

2.1 Renewal of the main roof and guttering, added insulation,

replacement of cracked exterior panels, removal of damaged ceiling panels,

fitting of a plasterboard ceiling, provision of appropriate access for

disabled persons including widening all corridors and enlarging existing

toilet, and the creation of a ramp leading into the entrance of the building.

2.2 Extension to the rear of

the building to increase the size of the existing store room, creation of a

meeting room, extension of the reception area, and additional toilet block

and shower facilities.

3. Does not proceed with

improvements of the HBRC Wairoa office.

Hawke's Bay Local Government Reorganisation Draft Proposal

4. Decides to

lodge a submission to the Local Government Commission on its Draft proposal

for the reorganisation of local government in Hawkes Bay, based upon

reinforcing the need for any local government structure within Hawke’s Bay to

have a specific focus on the management of natural resources in recognition

of the region’s strong linkages to its primary production sector.

5. Requests

that a draft submission is brought to the 12 February 2014 Environment and

Services Committee and the 25 February 2014 Maori Committee meetings for

consideration and input prior to the final submission being presented at the 26

February 2014 Regional Council meeting for adoption.

Oil and Gas Exploration Policy Development

6. Endorses,

in-principle, the draft public engagement proposal for oil, gas and energy

policy development.

7. Notes that

staff will present a further report to the Corporate and Strategic Committee

meeting on 12 March 2014 (including a revised memorandum of understanding;

revised terms of reference for multi-stakeholder group; stakeholder group

composition; and details of resourcing and budget implications) about a

public engagement proposal for oil, gas and energy policy development in

Hawke’s Bay.

Appointment to the HB Tourism Board

8. Appoints a

representative to the Board of Hawke’s Bay Tourism; being Councillor Dave

Pipe.

9. Notes that the

following reports were received at the Corporate and Strategic Committee

meeting.

9.1 Follow-ups From

Previous Corporate and Strategic Committee Meetings

9.2 Approach/Timelines

For Annual Plan 2014/15

9.3 Public Transport

Update

|

|

Mike Adye

Group

Manager

Asset

Management

|

Liz Lambert

Chief

Executive

|

Attachment/s

There are no

attachments for this report.

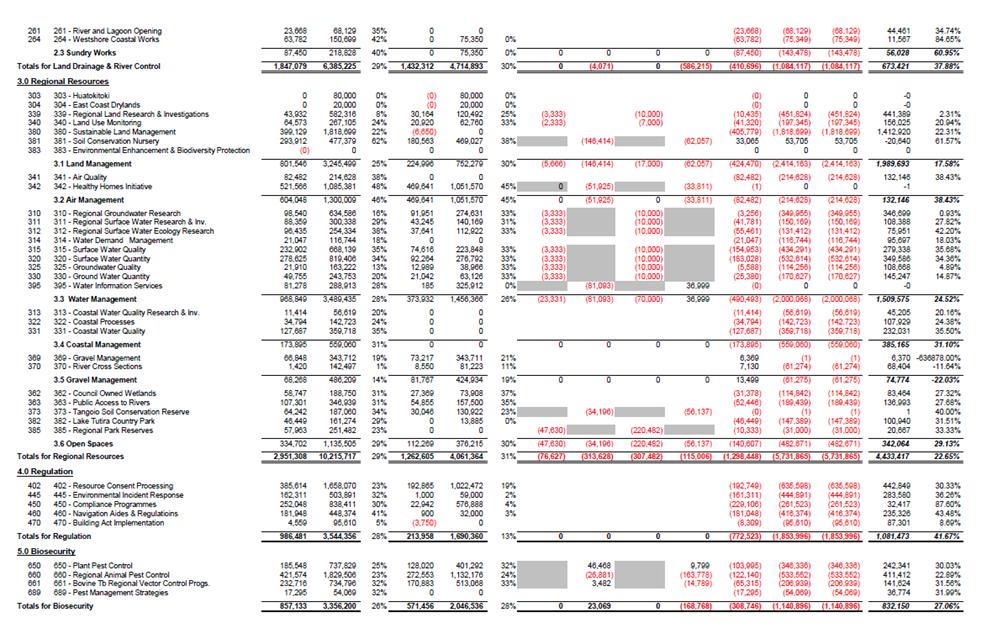

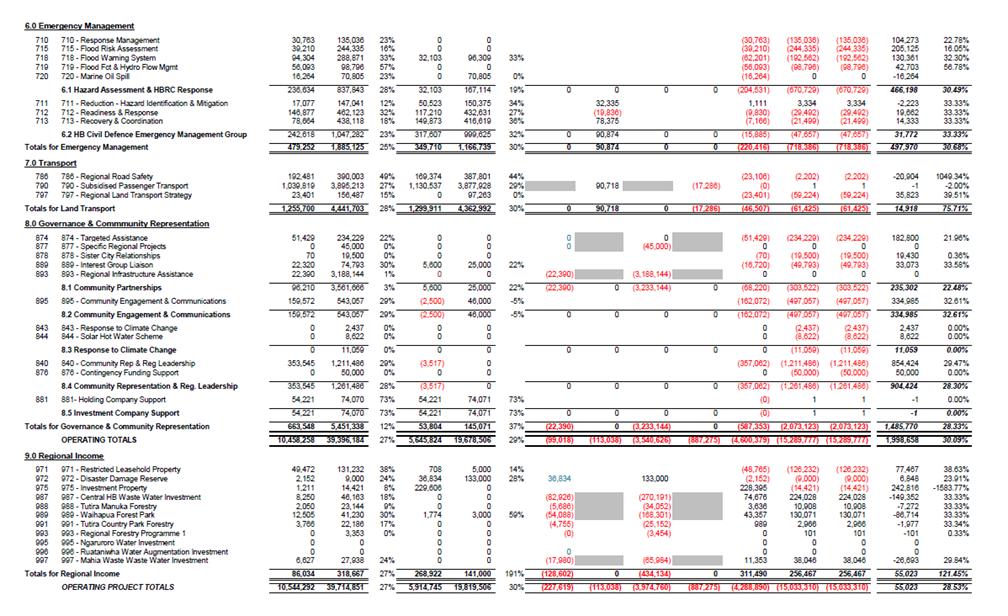

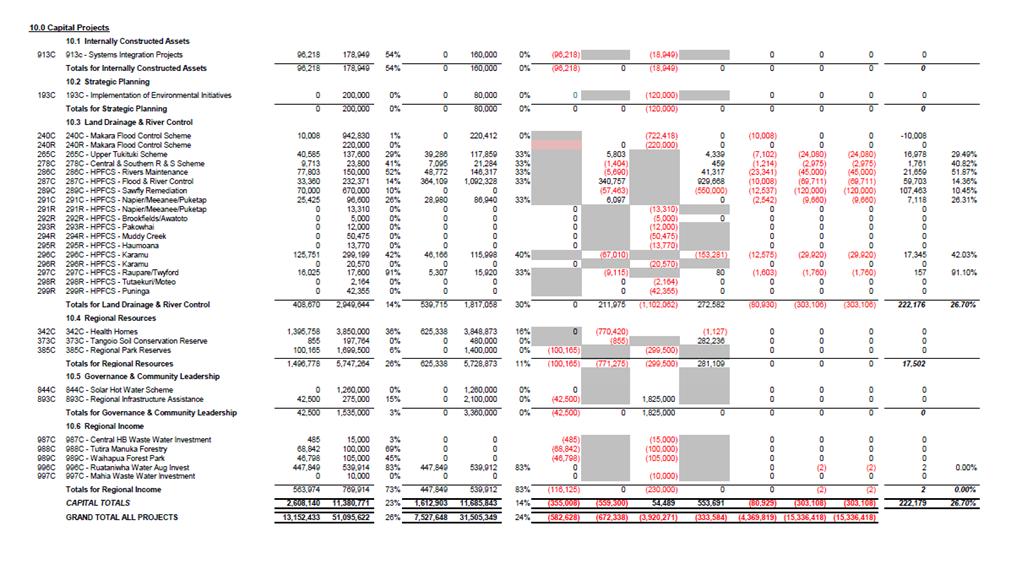

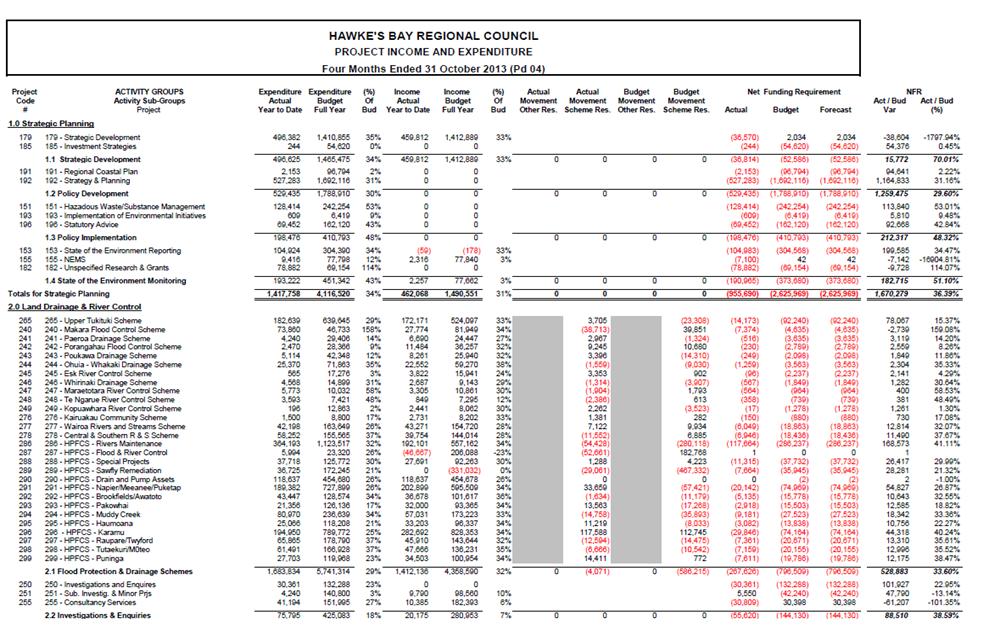

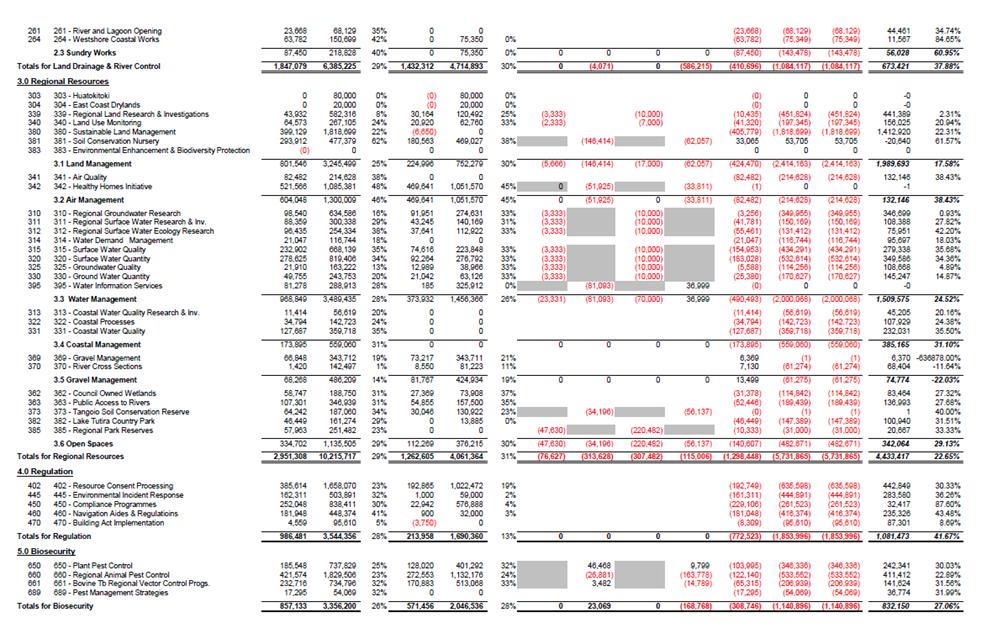

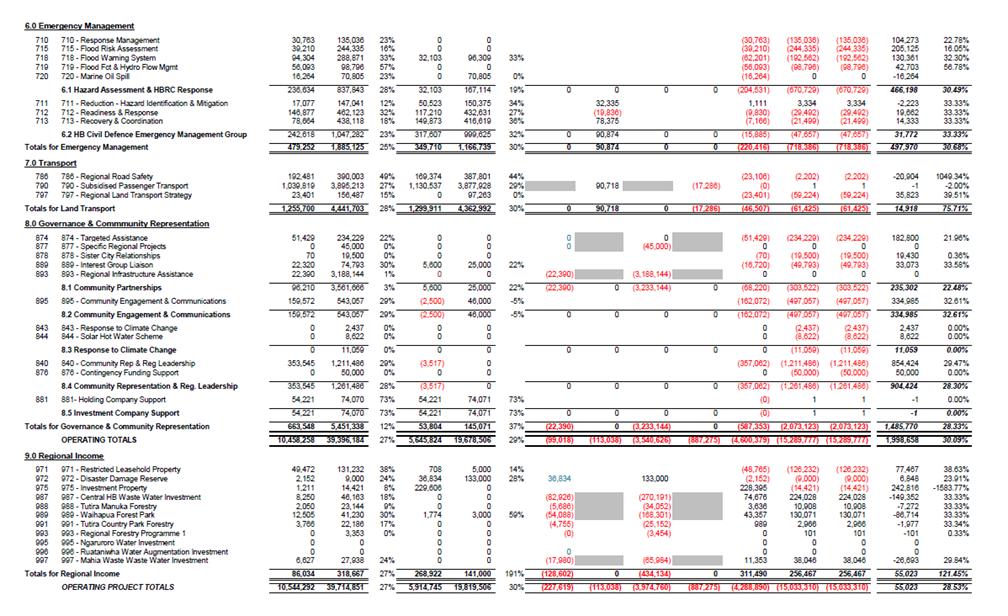

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 18 December 2013

SUBJECT: Reformatting of Financial Reporting for Council

Reason for Report

1. At the Council meeting

on 28 November 2013 when the financial report for the four months ending 31

October 2013 was discussed, Council requested that consideration be given to a

reformat of the financial information provided to Council with an increased

emphasis on provision of management information on trends and variations from

budget. This report sets out a reformatted financial report for Council’s

consideration which, if adopted, will take effect for the next financial report

to Council in February 2014.

Objectives of Improved Financial Reporting

Content and Format

2. The content of the

financial report as covered in this paper has been reformatted to achieve the

following objectives:

2.1. More focus on

management comment on variances from budget in the operating statement.

2.2. Fewer figures

provided and more narrative.

2.3. Management comments

more closely aligned to the financial statements being commented on.

2.4. Improved projections

of pro-rata for expenditure/revenue to be assessed and to be used in financial

reporting:

2.4.1. For 2013/14

continue with the pro-rata budgets being based on equal monthly split.

2.4.2. For 2014/15

pro-rata budgets to be based on management assessment of when

expenditure/revenue will occur in each month during the financial year.

2.5. Provision of cashflow information with

pro-rata budgeted cashflows and management comment on variations.

Proposed Format of

Revised Financial Reporting to Council

3. Section A – Operating Account

3.1. Summary operating statement.

3.2. Management comment on variances from

pro-rata budgets.

3.3. Heatsmart report and report on

non-recoverable costs covering appeals/ referrals direct to Environment Court.

3.4. Movement on special scheme reserves.

3.5. Management comments on variances from

projected scheme closing balances.

3.6. Projected income and expenditure.

4. Section B – Balance Sheet

4.1. Summary balance sheet.

4.2. Consolidated balance sheet.

4.3. Comments on balance sheet movements

from the financial year commencement.

4.4. External and internal borrowing.

4.5. Comments on borrowing.

4.6. Reserve funding.

4.7. Financial assets – maturity profile

and allocation by institution.

5. Section C – Cashflow

5.1. Cashflow statement.

5.2. Comments on variations from pro-rata

budgets.

6. Section D – Capital

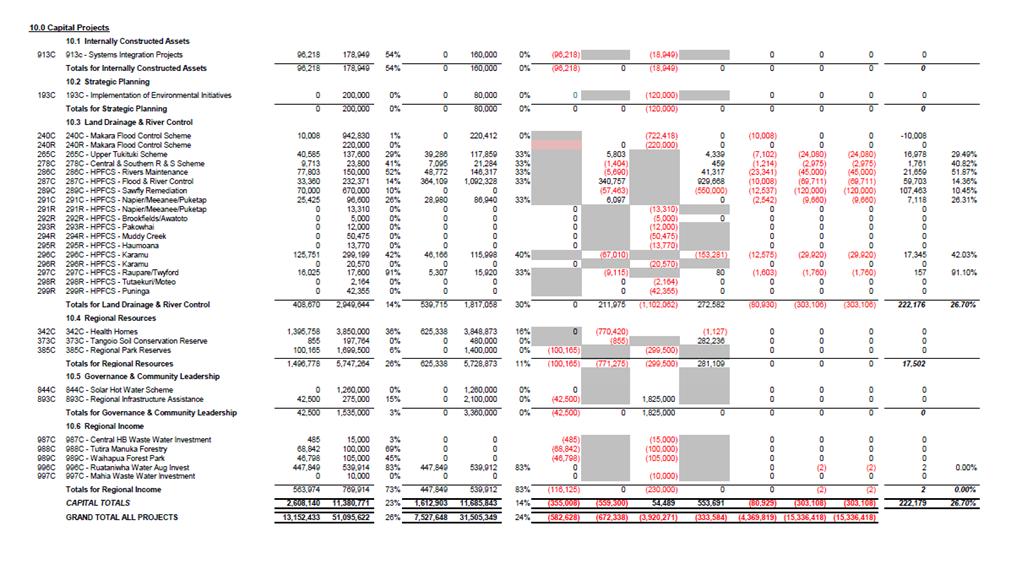

6.1. Capital activity summary.

6.2. Comments on variations from pro-rata

budgets.

7. A specimen report based

on the four months to 31 October 2013 is appended as Attachment 1 for

clarification. Please note that the non-financial portion of the 31 October

2013 report has not been included.

Decision Making

Process

8. Council is required to

make a decision in accordance with the requirements of the Local Government Act

2002 (the Act). Staff have assessed the requirements contained in Part 6 Sub

Part 1 of the Act in relation to this item and have concluded the following:

8.1. The decision does not

significantly alter the service provision or affect a strategic asset.

8.2. The use of the

special consultative procedure is not prescribed by legislation.

8.3. The decision does not

fall within the definition of Council’s policy on significance.

8.4. The persons affected

by this decision are all persons in the community that have an interest in

clarity on financial information presented to Council.

8.5. Options that have

been considered include the status quo and the proposed format changes.

8.6. The decision is not

inconsistent with an existing policy or plan.

8.7. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others having an interest in the decision.

|

Recommendations

That Council:

1. Agrees

that the decisions to be made are not significant under the criteria

contained in Council’s adopted policy on significance and that Council can

exercise its discretion under Sections 79(1)(a) and 82(3) of the Local

Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

2. Approves

the changes made to the financial reporting format and content to be provided

to Council, noting that this revised format will be effective for reporting

on the seven months to 31 January 2014 which will be presented to Council on

26 February 2014.

|

|

Paul Drury

Group

Manager

Corporate

Services

|

Liz Lambert

Chief

Executive

|

Attachment/s

|

1View

|

Reformatting

of Financial Reporting for Council

|

|

|

|

Reformatting of Financial Reporting

for Council

|

Attachment 1

|

HAWKE’S BAY REGIONAL COUNCIL

Thursday 28 November 2013

SUBJECT: ANNUAL PLAN PROGRESS REPORT FOR

THE FIRST FOUR MONTHS OF 2013/14

Reason for Report

1. This Annual Plan

Progress Report is a full report and covers the first four months of the 2013/14

financial year, and consists of commentary on financial results to 31 October

2013 and various other reports.

Summary of Financial Position to 31 October 2013

2. The actual result

covering the Council’s general funded operations for the first four months of

2013/14 is a surplus of $181,000. This is compared to the pro-rata budget

deficit of $282,000. The variation for the four months is $463,000

favourable. The variations from pro-rata budgets are covered in this report.

Comment on Financial Results for Four Months to 31 October 2013

3. This report is provided in the following format:

Attachment 1: Financial Reports for the

Four Months to 31 October 2013 -

3.1. Section A – Operating Account

3.2. Section B – Balance Sheet

3.3. Section C – Cashflow Statement

3.4. Section D – Capital (includes borrowings)

Attachments

2 – 9: Group of Activities Summary of Service

Levels and Performance Targets

Decision Making Process

4. Council is required to make a decision

in accordance with Part 6 Sub-Part 1, of the Local Government Act 2002 (the

Act). Staff have assessed the requirements contained within this section of the

Act in relation to this item and have concluded that, as this report is for

information only and no decision is to be made, the decision making provisions of the Local Government Act 2002 do not apply.

Recommendation

1. That Council receives

the Annual Plan Progress Report for the first four months of the 2013/14

financial year.

|

Manton

Collings

CORPORATE

ACCOUNTANT

|

Paul Drury

GROUP

MANAGER CORPORATE SERVICES

|

Attachment/s

1 Financial Reports for the Four

Months to 31 October 2013

2 Strategic Planning Group of

Activities Summary of Service Levels and Performance Targets

3 Land Drainage & River Control

Group of Activities Summary of Service Levels and Performance Targets

4 Regional Resources Group of

Activities Summary of Service Levels and Performance Targets

5 Regulation Group of Activities

Summary of Service Levels and Performance Targets

6 Biosecurity Group of Activities

Summary of Service Levels and Performance Targets

7 Emergency Management Group of

Activities Summary of Service Levels and Performance Targets

8 Transport Group of Activities

Summary of Service Levels and Performance Targets

9 Governance & Community

Engagement Group of Activities Summary of Service Levels and Performance

Targets

SECTION A

|

Reformatting of Financial Reporting

for Council

|

Attachment 1

|

NB: Red text – example information only

|

Management

Comments on Variances from Pro-Rata Budgets

|

|

Note

Ref

|

Activity/Revenue

|

Variation from Pro-Rata

$000

(F) or (U)

|

Management Comment (variances over

$50,000)

|

|

1

|

Strategic Planning

|

$80 (U)

|

Manager of Strategic

Planning to complete the explanation

|

|

2

|

Land Drainage &

River Control

|

$49 (U)

|

Manager of Land

Drainage & River Control to complete the explanation

|

|

3

|

Regional Resources

|

$612 (F)

|

Manager of Regional

Resources to complete the explanation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heatsmart Progress Report

1. The following is an

update on progress made in the allocation of Clean Heat grants and loans, and

loans for insulation as part of the Heatsmart programme.

2. The first four

months for the year reflect the last of the winter activity peak.

3. The demand for Clean

Heat and insulation support is expected to reduce over the summer months and

increase again in the last quarter of the year.

|

VOLUMES

|

|

|

|

|

|

Loan Type

|

2013/14

|

4 Months to 31 October 2013

|

|

Ann Plan

|

Pro Rata

|

|

Actual

|

|

Budget

|

Budget

|

Actual

|

Over Budget

|

|

Volumes

|

Volumes

|

Volumes

|

Target 33%

|

|

Insulation Loans

|

735

|

245

|

277

|

38%

|

|

Clean Heat Loans

|

600

|

200

|

220

|

37%

|

|

Clean Heat Grants

|

660

|

220

|

486

|

74%

|

|

TOTAL

|

1,995

|

665

|

983

|

|

|

EXPENDITURE (EXCL GST)

|

|

|

|

|

|

Loan Type

|

2013/14

|

4 Months to 31 October 2013

|

|

Ann Plan

|

Pro Rata

|

|

Actual

|

|

Budget

|

Budget

|

Actual

|

Over Budget

|

|

$000

|

$000

|

$000

|

Target 33%

|

|

Insulation Loans

|

1,558

|

519

|

611

|

39%

|

|

Clean Heat Loans

|

1,771

|

590

|

672

|

38%

|

|

Clean Heat Grants

|

402

|

134

|

307

|

76%

|

|

TOTAL

|

3,731

|

1,244

|

1,590

|

|

Non recoverable costs re appeals and referrals direct to the

Environment Court

4. The reason for

providing information on the non-recoverable costs of appeal is because in

previous financial years HBRC has been exposed to costs (which are not

controllable by HBRC) that have substantially exceeded budget. For the 2013/14

financial year external cost of $21,372 have been incurred. This is 40% of the

budget provided of $53,000. The following details are provided for information

only to clarify the status of ongoing appeals.

5. For the current

financial year to date (to 31 October 2013), costs for appeals to the

Environment Court have amounted to $23,002. This covers staff time and external

costs and includes a write-off of $16,500 settled via an appeal to the

Environment Court.

6. There is only one

current appeal. This is the appeal of Mahanga E Tu vs HBRC and WDC. This is

against decisions granting consent to Mexted, Williams and Malherbe. Issues