Meeting of the Corporate and Strategic Committee

Date: Wednesday 25 January 2012

Time: 9.00 am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Notices/Apologies

2. Conflict of Interest Declarations

3. Confirmation of Minutes of the

Corporate and Strategic Committee held on 9 November 2011

4. Matters Arising from Minutes of the Corporate and

Strategic Committee held on 9 November 2011

5. Action Items from Previous Corporate and Strategic

Committee meetings

6. Call for General Business Items

Decision Items

7. A Study on Improving the Social and Economic Performance

of Hawke's Bay

Information or Performance Monitoring

8. Hawke's Bay Tourism Six Monthly Update (9.15am)

9. Public Transport Update

10. Apache Oil Exploration Project Briefing (1.00pm)

11. General Business

Decision Items (Public Excluded)

12. Appointment of Independent Members of the Investment Company

Transition Board of Directors

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 25 January 2012

Subject: Action Items From Previous Corporate and Strategic Committee

Meetings

Introduction

1. Attachment

1 lists items raised at previous meetings that require actions or

follow-ups. All action items indicate who is responsible for each action, when

it is expected to be completed and a brief status comment. Once the items have

been completed and reported to Council they will be removed from the list.

Decision

Making Process

2. Council is required to make a decision in accordance with

Part 6 Sub-Part 1, of the Local Government Act 2002 (the Act). Staff have

assessed the requirements contained within this section of the Act in relation

to this item and have concluded that as this report is for information only and

no decision is required in terms of the Local Government Act’s provisions, the

decision making procedures set out in the Act do not apply.

|

Recommendation

1. That the Committee receives the report “Action

Items from Previous Corporate and Strategic Committee Meetings”.

|

|

Andrew Newman

Chief

Executive

|

|

Attachment/s

|

1View

|

Items from

Previous Corporate and Strategic Committee Meetings

|

|

|

|

Items from Previous Corporate and

Strategic Committee Meetings

|

Attachment 1

|

Actions from Corporate and Strategic Committee

Meetings

9 November 2011

|

Agenda Item

|

Action

|

Person Responsible

|

Due Date

|

Status Comment

|

|

4. Matters arising from

the meeting held 14 September

|

Councillors to be

provided with information on how the Council’s goals and objectives are

leveraged by and through the Environment Action Awards and Balance Awards

categories and judging criteria.

|

EAL

|

|

Paper to March

Corporate & Strategic Committee meeting

|

|

4. Matters arising from

the meeting held 14 September

|

Determine whether

majority of Councillors wish to invite Peter Winder to speak to his Shared

Services report, and if the result is yes then invite Mr Winder to do so.

|

EAL/AN

|

|

Councillors to provide

indication at 25 Jan Committee meeting as to preference for Mr Winder to

speak to his report or not

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 25 January 2012

Subject: A Study on Improving the Social and Economic Performance of

Hawke's Bay

Reason for Report

1. Annexed as attachment 1

is the draft Terms of Reference for this proposed study.

2. The Mayors, Chair and CEs of each of the

respective councils have met twice to work through Terms of Reference for a

study on improving the social and economic performance of Hawke’s Bay and have

agreed on the version as attached, subject to each Council’s ratification.

3. Currently some $40,000 is potentially,

at least in part, available for this study.

4. Our suggestion is that options for the

person to lead this study are considered by the joint group and that the

successful consultant is asked to provide a budget estimate for the study which

will the enable the Council to determine more accurately what funds it needs to

make available over the balance of this financial year and the 2012-13 year.

Decision Making

Process

5. Council is required to

make a decision in accordance with the requirements of the Local Government Act

2002 (the Act). Staff have assessed the requirements contained in Part 6 Sub

Part 1 of the Act in relation to this item and have concluded the following:

5.1. The decision does not

significantly alter the service provision or affect a strategic asset.

5.2. The use of the special

consultative procedure is not prescribed by legislation.

5.3. The decision does not fall

within the definition of Council’s policy on significance.

5.4. The persons affected by

this decision are all ratepayers in the region

5.5. The decision is not

inconsistent with an existing policy or plan.

5.6. Given the nature and

significance of the issue to be considered and decided, and also the persons

likely to be affected by, or have an interest in the decisions made, Council

can exercise its discretion and make a decision without consulting directly

with the community or others having an interest in the decision.

|

Recommendations

The Committee

recommends that Council:

1. Agrees

that the decisions to be made are not significant under the criteria

contained in Council’s adopted policy on significance and that Council can

exercise its discretion under Sections 79(1)(a) and 82(3) of the Local

Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

2. Adopts the

terms of reference for a study on improving the social and economic

performance of Hawke’s Bay.

3. Obtains a

budget estimate for the study from the lead consultant once appointed.

4. Funding

for the balance of the 2011-12 financial year be drawn for the project

provision for Local Government efficiency studies and that if required

additional provision be made for the 2012-13 financial year.

|

|

Andrew Newman

Chief

Executive

|

|

Attachment/s

|

1View

|

Draft Terms

of Reference for a Study on Improving the Social and Economic Performance of

Hawke's Bay

|

|

|

|

Draft Terms of Reference for a Study

on Improving the Social and Economic Performance of Hawke's Bay

|

Attachment 1

|

A

STUDY ON IMPROVING THE SOCIAL AND ECONOMIC PERFORMANCE OF HAWKE'S BAY

(Version 3 – following discussions from Mayors/Chairman

and CEs group – 5 December 2011)

TERMS OF REFERENCE

The

communities of Hawke's Bay seek a prosperous future based on strong social and

economic performance. They want advice on actions and steps that can be taken

to add value to the region and its people to improve social and economic

performance.

The

Councils of Hawke's Bay have decided to commission a study on improving the

social and economic performance of the Hawke's Bay region. The Councils seek a

highly qualified, respected, independent person to lead the study and assemble

a suitably qualified team to assist them.

While

the study leader will have some scope to shape content, the study should

comprise two main parts:

1. Situation

analysis and problem identification

This part should include (but not be

limited to):

· an analysis of

historic and current economic and social performance.

· an analysis of

demographic, economic and social performance trends and what they might deliver

Hawke's Bay and the current policy and intervention settings.

· an analysis of

current policies, priorities, interventions, legislative requirements and

structural settings in or affecting Hawke's Bay and any apparent gaps,

inconsistencies or policy clashes.

· an identification

and analysis of significant inhibitors to prosperity that affect Hawke's Bay.

Significant inhibitors include barriers to success or opportunities not being

fully capitalised on at the present time (for example our current failure as a

community to unleash to full potential of a significant proportion of our young

people).

2. Solutions –

How should prosperity inhibitors be addressed to ensure a prosperous future?

This part should include an

identification of changes, initiatives and priorities that should be pursued in

order to improve the future social and economic performance of the Hawke's Bay

region. The scope of the study is not proscribed from looking at particular

sectors or solutions. The study should include relevant comparative analysis of

the efforts of other provincial regions (nationally, and internationally where

relevant) to be competitive in the modern and future global economic

environments.

It is expected that recommendations

will be made that will affect and need to be considered by government, the

business and not-for-profit/community sectors, iwi and hapu groups and local

government. Recommended solutions should be accompanied by an analysis of the

likely benefits, with evidence to support them, and an assessment of the costs

and negative impacts of change.

The

study is commissioned on behalf of the Councils of Hawke's Bay by a joint group

of the Mayors, Chairman of the Regional Council and the chief executives of the

five Councils (the Joint Group). The study leader will report to this joint

group.

It is

intended that the study leader will report in two phases: a report on problem

identification summarising the work done in part one, and a second report

setting out solutions and recommendations summarising the work done in part

two. It is intended that the first phase should be reported to the Joint Group

for input and further scoping for phase two.

The joint group

seeks a proposal from a prospective study leader on how they would go about

fulfilling the requirements of these terms of reference. In particular advice

is sought on the following aspects:

· Support resources

and personnel required.

· suggested time

required (ideally the study group would like the study completed by 30 November

2012.

· Estimated cost.

· Recommended

methodology for the inclusion of community views on aspects of the study.

Joint Group

Councils of Hawke's Bay

December 2011

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 25 January 2012

Subject: Hawke's Bay Tourism Six Monthly Update

Reason for Report

1. The purpose of this

paper is to provide Council with Hawke’s Bay Tourism Limited (HBTL) results for

the six months to 31 December 2011.

Background

2. At its meeting on 25

May 2011 Council resolved to approve the funding agreement between the Hawke’s

Bay Regional Council and HBTL. Section 11 of this funding agreement provided

for a quarterly and annual report to be presented to Council to enable Council

to monitor the outputs/outcomes being achieved and the financial progress

against budget given the commitment by Council to fund HBTL, through a payment

of $850,000 each year for three years commencing 2011/12.

3. A report from HBTL

setting out achievements, progress towards the key performance indicators as

set out in the funding agreement, together with the Company’s financials, is

attached to this paper.

4. The Chairman, George

Hickton, Annie Dundas, General Manager, and Sam Orton, Director, of HBTL will

be presenting this report to Council.

Decision Making

Process

5. Council is required to

make a decision in accordance with Part 6 Sub-Part 1, of the Local Government

Act 2002 (the Act). Staff have assessed the requirements contained within this

section of the Act in relation to this item and have concluded that, as this

report is for information only and no decision is to be made, the decision

making provisions of the Local Government Act 2002 do not apply.

|

Recommendation

1. That

Council receives the report from Hawke’s Bay Tourism

Limited for the six months ending 31 December 2011.

|

|

Paul Drury

Group

Manager

Corporate

Services

|

Andrew Newman

Chief

Executive

|

Attachment/s

|

1View

|

Second

Quarter Report, October - December 2011

|

|

|

|

2View

|

Hawke's Bay

Tourism Six Month Financials

|

|

|

|

Second Quarter Report, October -

December 2011

|

Attachment 1

|

Hawke’s

Bay Tourism Ltd – Second Quarter Report, October - December 2011

Prepared

by Annie Dundas, GM Hawke’s Bay Tourism

Overall

Hawke’s Bay Tourism Limited has now

completed six months of operation and continues to be well supported by the

local tourism industry and all councils. To date 142 tourism businesses have

signed up to the new partnership programme of Hawke’s Bay Tourism Ltd and

additional marketing funds have been secured from Hastings District Council

within this period. Hawke’s Bay Tourism is on track to achieve the key

performance targets set by The Hawke’s Bay Regional Council for the first year.

Good progress continues with domestic advertising, partnership advertising in

Australia alongside Wellington, media hosted and website development. Please

see the detail within the KPI report.

Hawke’s Bay Tourism has also

embarked upon developing a strategy to future proof tourism growth in Hawke’s

Bay. The

Hawke’s Bay Regional Council envisages that in 2050 “Hawke’s Bay is well

connected to the rest of the world, and the world is well connected to us”.

Furthermore, the scenario that the Regional Council paints includes the vision

that “the region’s uniquely Hawke’s Bay branding became the foundation for our

social, cultural and economic prosperity”, and “the tourism industry is

thriving”.

Hawke’s Bay Tourism

believes that sustainable tourism growth will play an integral role in

achieving this picture of the future. Tourism is one of the largest and

fastest growing industries in the world, and by its nature a key enabler of

domestic and international connectivity. Tourism is also an important means to

achieving the sense of place desired by local residents.

With the endorsement of

the Hawke’s Bay Regional Council we plan to lead the region in developing a

strategic vision for tourism in Hawke’s Bay. A corresponding paper follows.

Arrival figures

In the first 4 months of Hawke’s Bay

Tourism officially operating, visitor arrivals into the region July – October

2011 are +2.6% on the same period in 2010. This equates to an additional 24,000

guest nights spent in the region over this period. The main contributor to this

growth was Rugby World Cup travel. Commercial accommodation figures for the key

Rugby World Cup months of September and October show international visitor

arrivals to Hawke’s Bay up 121.8% and 60.2%.

In general domestic travel within New Zealand is

down due to the high dollar and an increase in New Zealanders travelling

overseas. Hawke’s Bay figures reflect the decline with domestic visitors down 3.5% and 9.2% in

September and October. Domestic tourism was expected to slow during Rugby World

Cup as Kiwis stayed home and spent discretionary funds on match tickets.

Hawke’s Bay

Tourism, 19 Waghorne Street, Ahuriri, Napier. PO Box 12009, Ahuriri, Napier

4144, New Zealand

WEB: www.hawkesbaynz.com TWITTER:

www.twitter.com/visitorHB

FACEBOOK: www.facebook.com/hawkesbaynz

|

Guest nights year end

October 2011

Commercial

Accommodation

Private Accommodation

|

Total 3,484,386

+1.5%

Total

996,405 -2.1%

International

266,826 +12.4%

Domestic

729,579 -6.5%

Total

2,487,980 +3%

|

|

Commercial

Accommodation

Hotels

Motels/Apartments

Backpackers

Holiday Parks

|

Guest nights – year

end Oct

143,692

+2.6%

481,453

-2.5%

130,089

+6.5%

241,170

-8.0%

|

|

International Visitor Arrivals to

NZ

Total

Australia

UK

USA

China

|

October 2011

215,902 16.8%

98,448 21.2%

17,648 18.8%

13,600 1.9%

10,624 22.8%

|

Year end October 2011

2,579,098 2.6% (64,889)

1,139,842 2.2 % (24,557)

232,939 -3.4% (-8,313)

185,522 -3.1% (-5,998)

137,604 +18.2% (21,194)

|

The Rugby World Cup continued to

have a strong impact on international arrivals into New Zealand, particularly

from Australia, the UK and USA for September which was expected. Australia has

been propped up by Rugby World figures as have smaller markets such as France

(+146%), South Africa (+417%) and Argentina (+63.6%). The overall annual

result of 2.6% growth shows the Rugby World Cup affect and the continued

strength of China and smaller south Asian markets such as Malaysia (+141.1%)

and Singapore (+99%). This growth is directly attributable to increased air

capacity from their respective gateways.

Key

Performance Indicators for Hawke’s Bay Tourism

The organisation has been

working towards the goals and objectives set out in the Strategic Plan signed

off by HBRC in May 2011.

In six months of

operation the following KPI’s have been met;

1. Hawke’s Bay Tourism -

Establishment of a new Regional Tourism Organisation achieved July 1, 2011.

Hawke’s Bay Tourism Ltd has successfully brought together the previous tourism

team of Venture Hawke’s Bay and staff from Wine Country Tourism Association.

All now operate under Hawke’s Bay Tourism Ltd.

2. Brand - Establishment

of a “Hawke’s Bay” brand and communication tagline. The brand “Hawke’s Bay” and

tagline “Get me to Hawke’s Bay” are well established and are being used in all

communication produced by HBT. Since September the revised Hawke’s Bay Trails

(cycleways) map has been published, as well as the Hawke’s Bay Art Guide, The

Visitor Guide, the Food & Wine Trail Guide and outdoor signage at the Port

of Napier welcoming cruise passengers has been developed. This means we are now

delivering a consistent message for Hawke’s Bay across all channels.

3. Consumer Marketing - HBT has developed an

annual domestic media schedule which includes the promotion of Hawke’s Bay in

print, online and via social networks from November – June 2012. There is also

a strong Search Engine Optimisation (SEO) campaign aligning to this campaign

and all HBT work throughout the year. Full page print ads have already appeared

in Sunday Magazine, Canvas, Kia Ora, and the Dominion Post. Hastings District

Council continues to utilise the new creative within their own advertising

budget so Splash Planet has been using the “Get Me to Hawke’s Bay” tagline at

no cost to HBT.

The Australian consumer campaign is being driven in

partnership with Absolutely Positively Wellington (PWT). As mentioned in the

previous report Hawke’s Bay is part of a $3m campaign promoting Wellington as

the gateway for Australian visitors on Air New Zealand (ANZ). ANZ and PWT are

each putting in $1m to promote the 60,000 additional seats on the Tasman

between Sydney/Melbourne and Wellington. Hawke’s Bay will be featured as an

add-on to the urban Wellington scene. HBT’s contribution is $100k. Activity to

date has included WLG - a pop-up restaurant in Melbourne showcasing Hawke’s Bay

produce and wine. Up to 175 Australians each day over 2 weeks experienced food

from 5 top chefs including Terry Lowe from Black Barn Bistro. Every diner on

the opening night received a return trip to Wellington with Air New Zealand.

The desire is for Hawke’s Bay to be recognized alongside Wellington as part of

a preferred Australian itinerary to New Zealand.

Media – PR - HBT has hosted 57 media

in the second quarter. This result is well above target and reflects a great

relationship with Tourism New Zealand who see us as one of the “go to” regions

for showcasing New Zealand to international media.

New Zealand

· AA Directions

· North & South

Australia

· 11 media as part of the Australian Society of Travel

Writers.

· Not Quite Nigella – a food blogger

with 140,000 followers

· Grazia Magazine

· Sarah Wilson-Opinion Leader (ex host

of Masterchef, 80 000 blog followers, 12 000 Twitter fans, Sunday magazine

column + Foxtel show)

· Alana Lowes, food writer and 3rd

runner up in Masterchef Australia writing for Ok Magazine and Sydney Magazine

· Melbourne Age-Food Supplement

USA & Canada

· 31 American media as part of the

Society of American Travel Writers, including Frommers, Smarter Travel (Trip

Advisor), All Things Cruise.com, Time Out Chicago, Daily Herald Chicago and

Cruise Critic.com.

UK/Germany

· Dagmar Kluthe-Editor Vogue Germany.

· 5 x German Media + Air NZ and TNZ PR

escorts. Linked with Air NZ Wine Awards Famil.

· ITV from the UK

India

· BBC Good Food and Conde Nast

Traveler India

Digital

Strategy

– For the second quarter hawkesbaynz.com has delivered the

following;

· 59,736

visits +9% and 10% increase in page views (291,606)

· 3.30

mins average time on site (3.41)

Content on third party sites is on-going with the focus

on increasing Hawke’s Bay content on www.newzealand.com, the national tourism

site that receives over 1m users a month.

The refreshed www.hawkesbaynz.com is under construction

and will be completed in February. There is a live booking function available

on the site and this will transfer to the new site in 2012.

Search activity generated 5,904 visits to the website

in November with 63.50% of this traffic being new. These search results are

very positive at this early stage.

Research – the quarterly visitor performance

monitor has been established to accurately report on all aspects of tourism for

Hawke’s Bay, this is communicated to industry quarterly.

4. Trade Marketing –

HBT

hosted 17 key travel sellers in the second quarter. 11 German Product Managers

stayed in region for two nights and experienced a range of tourism product.

Companies included Kiwi Tours, Gebeco, Travel Plus, FTI, Studiosus Reisen and

best of Travel Group. A further six UK

Frontline Travel Agents stayed in the region one night. UK companies included

Travel Bag, Thomas Cook, Flight Centre and Austravel.

Currently

17 cruise ships have visited Port of Napier, with a maximum passenger capacity

of 28,604 visitors and 11,233 crew – assuming 70% disembark then this is 20,022

visitors and 7,863 crew. New cruise product includes a range of cycling

options for cruise passengers along the Hawke’s Bay Trails as well as

Supertrike Tours.

5. Product development - The Hawke’s Bay Trails revised

map has been produced detailing the three national cycle-ways. 15,000 maps have

already been distributed this summer with exceptionally positive feedback from

visitors. The Hawke’s Bay Trails are being promoted as a linking mechanism in

connecting tourism attractions and services throughout the region.

HBT

has been working closely with cruise inbound operators to broaden the tourism

product offered to cruise passengers. However with ships in port for shorter

periods, developing new products is proving difficult this season.

The

second HBT workshop for industry members was held with over 50 members taking

part in an Online Workshop to up-skill members on the basics of Google, Trip

Advisor, Bookit and www.newzealand.com.

6. Events – Hawke’s Bay Tourism started

recruitment for a Regional Events Manager in the second quarter. The role will

officially begin the third quarter of the year.

Hawke’s

Bay Tourism – Comment on Financial Statement

Hawke’s Bay Tourism Ltd

has recognised a need to reforecast its budget after the first 6 months of

operation.

Revenue and income

projections have been reforecast.

· HBTIA Funding Pledges - Initially budgeted at receiving

160k, the budget has been reforecast to reflect a reduction in 25k of pledge

money. This money was expected from the Infinity Trust but has been declined in

2012. Several small tourism businesses who initially pledged money have changed

ownership or been sold.

· Industry Partner Membership – while currently at 142

members, HBT is not expecting to reach our target of 250 full-fee paying

members. Adjustments to fees paid by members were made based on previous

contributions to VHB and this has meant a reduction in revenue overall as well.

Projected partnership revenue was $137,500, it is now expected to be $80,000, a

reduction of $57,500.

· External Revenue – this was over-budgeted by $41,000

based on assumptions made through the RTO’s transition period before July 2011.

It relates to two projects which were assumed to be self-funding but in fact

were not. This error has now been picked up and won’t occur in future budgets.

This budget is now $100,000.

Direct marketing costs

· Consumer marketing – this budget has been reforecast

from $468k to 390k. Activity that won’t occur as a result related to the

development of social and mobile applications and this will happen in the new

financial year.

· Trade Marketing – this budget has been reforecast from

$89k to 73k. Trade budgets have been reforecast to reflect a reduction in

activity, mainly around hosting key travel trade. This activity will be

deferred to the new financial year.

· Events – budget has been reduced overall due to a delay

in the appointment of the contract position.

· Partner Programme costs – these have been revised based

on the first six months of activity and less budget required.

Hawke’s Bay Tourism Ltd

is managing its budget closely and has therefore recognised a need to

reforecast its budget, and make appropriate adjustments to planned activity.

This will enable it to still deliver on its KPI’s and deliver a balanced budget

year end June 2012.

|

Hawke's Bay Tourism Six Month Financials

|

Attachment 2

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 25 January 2012

Subject: Public Transport Update

Reason for

Report

1. This agenda item

provides the Committee with an update on Council’s public transport services,

including trends since the previous update in November 2011. The report contains

patronage and revenue graphs which are updated each month and provided to this

Committee and the Regional Transport Committee.

General Information

2. The overall performance

of the bus service still continues to be positive with good passenger growth

and fare recovery levels.

Total Passenger Trips

3. The following graph

shows total passenger trips from February 2009 to December 2011.

Diagram 1 –

Passenger Numbers – February 2009 - December 2011

4. Since 2009 the total

number of trips per year and monthly average have steadily trended upwards, as

follows:

Total

Yearly Trips Monthly Average

2009 434,231 36,186

2010 512,657 42,721

2011 616,198 51,350

Patronage

and Financial Trends

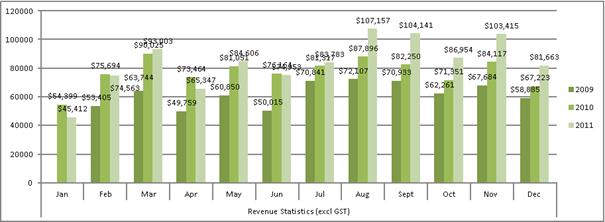

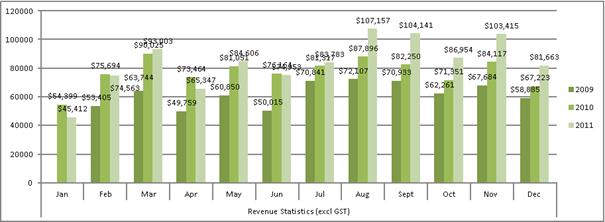

5. The following graph

shows a comparison of fare revenue (excluding GST) from February 2009 to

December 2011.

Diagram 2 – Total Revenue – February 2009 - December 2011

Farebox

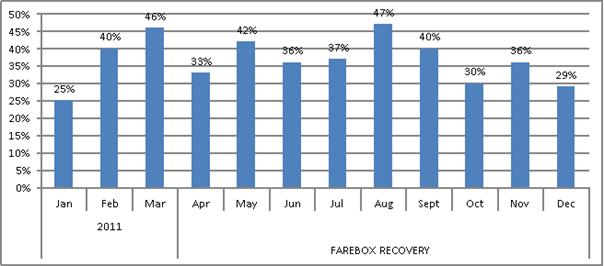

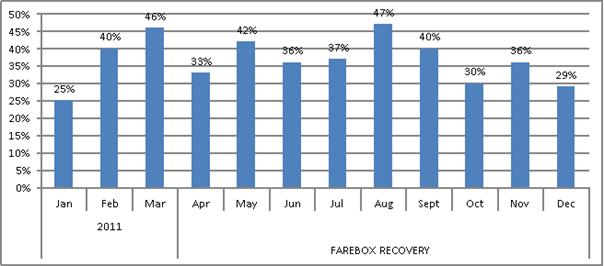

Recovery (total fares as a percentage)

6. The following graph

shows the farebox recovery trend (i.e. the total amount of fares as a

percentage), from January to December 2011. The average farebox recovery for

this period was 37%.

Diagram 3 – Farebox

Recovery – January - December 2011

Capacity

7. This graph shows the

seat capacity utilised on a monthly basis from January to December 2011. The average

utilised capacity for this period was 44%.

Diagram 4 –

Capacity – January - December 2011

SuperGold

Card Trips

8. The following graph

shows the number of SuperGold cardholder trips made from January to December

2011. SuperGold cardholders continue to make very good use of this scheme.

Diagram 5 –

Number of SuperGold Card Trips – January - December 2011

Improvements

to Bus Services

9. The increased services

on Route 12 are proving successful and providing a high level of service to

passengers. Services operate every 15 minutes in peak times and every 30

minutes off-peak. The increased frequencies make public transport a viable mode

of transport for a greater number of people.

10. The six month trial of

the Napier-Ahuriri-Westshore-Ahuriri-Napier continues to prove popular with

local residents and visitors. Staff are currently analysing the passenger

statistics, feedback from passengers and relevant information about the route

and current timetable, to bring to Council before the end of the six month

trial to enable Council to make a decision on whether to retain this as a

permanent service. Below is a graph showing the monthly statistics for this

service.

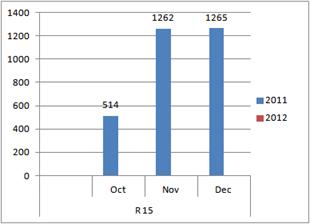

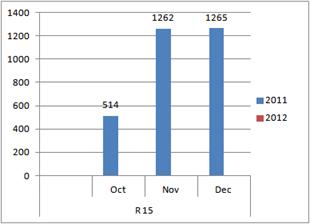

Diagram 6 –

Total Passenger Numbers for Route 15 – October - December 2011

Infrastructure

Bus Stops

11. All Hastings services

now travel via “The Park” shopping centre (formerly Nelson Park). New bus stops

have been installed outside the Environment Centre on Russell Street, outside

Mitre 10 at the Park and outside Video Ezy on Karamu Road. Services no longer

turn into the K-Mart complex. This change has brought about extra costs as each

service travels on average about 1.3km more, a total of 890kms per week.

12. The new cycle shelter on

Dalton Street, installed by Napier City Council, makes ‘bike and ride’ a

practical option for many cyclists who can cycle into the Napier terminus from

the suburbs, secure their bikes in the cycle shelter and travel across to

Hastings on the Route 12 service.

13. Staff have been in

contact with Hastings District Council to see whether there are any plans to

install a similar bike shelter near the Hastings terminus on Eastbourne Street,

as was indicated in earlier i-Way reports. The i-Way Coordinator advised there

are plans to install bike racks near some bus stops in the first half of 2012;

however locations have yet to be decided.

14. Bike shelters at both the

Napier and Hastings termini will make public transport a more realistic option

for a larger number of people. Transport planners generally accept that public

transport ridership falls off dramatically when the nearest bus stop is more

than 400 metres away from homes/workplaces. Therefore cycling to the bus

terminal, being able to park a bike securely, coupled with including active and

sustainable components into the journey will be an attractive option for many

people. (The February ‘It’s all go’ column in the community newspapers will

focus on the new bike shelter in Napier).

15. Staff are currently

investigating stage 1 of a project to install goBay signage at all bus stops

with an existing bus stop pole. All bus stops have been numbered and the design

of the signage has been approved by NZTA. Stage 2 of the project would see bus

stop poles and signage installed at all bus stops, in line with the

adopted hierarchy of bus stops outlined in the Regional Public Transport Plan.

16. Staff are also

investigating a ‘text-a-bus’ service. This is a relatively low-cost service

that would enable passengers to text through the number of a bus stop and

receive a quick response, via a text message, advising the scheduled time of

the next bus. This information would be based on the scheduled timetable and

not ‘real-time’. In order for this to proceed staff are seeking agreement from

Napier City Council and Hastings District Council to the goBay signage

(outlined above) being installed, which would show the bus stop number.

Other

17. Although there have been

some delays, the bus stop map is now very close to completion. However the

on-line version may not be available until the HBRC website re-design has been

approved and finalised. The bus stop map, bus stop signage and text-a-bus would

make public transport much more easily accessible to Napier and Hastings

residents and visitors.

18. The annual goBay

passenger survey was carried out in November, with 630 responses (compared to

220 last year). The results will be available in early February, but early

indications suggest a high level of satisfaction with services. Interesting

responses include one from a lady who has been travelling on the bus in Napier

for all her life - 82 years. Another from a lady in Pirimai, who had not

visited Ahuriri/Westshore for 20 years and was stunned and thrilled by her trip

on the Hopper.

Travel Plans

19. ‘Walk Once a Week’ days

proved to be very successful at St Mary’s School Hastings and Lucknow School

Havelock North in 2011. Both schools are investigating a ‘kiss’n’drop zone’ to

help alleviate congestion and improve safety at the school gate.

20. Letters were sent to all

Napier and Hastings primary schools at the end of 2011 inviting them to take

part in the School Travel Plan programme.

21. The HBRC travel plan

team continue to encourage more staff to use active modes of transport on their

journey to and from work, with an emphasis on public transport.

Total

Mobility Update

22. Below is a table showing

details of Total Mobility client numbers and expenditure to date for the

2011/12 financial year.

Diagram 7 –

Total Mobility Statistics - June 2011 to December 2011

Decision

Making Process

23. Council is required to

make a decision in accordance with Part 6 Sub-Part 1, of the Local Government

Act 2002 (the Act). Staff have assessed the requirements contained within this

section of the Act in relation to this item and have concluded that, as this

report is for information only and no decision is to be made, the decision

making provisions of the Local Government Act 2002 do not apply.

|

Recommendation

1. That the

Corporate and Strategic Committee receives the Public

Transport Update.

|

|

Megan Welsby

Sustainable

Transport Coordinator

|

Carol Gilbertson

Transport

Manager

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 25 January 2012

Subject: Apache Oil Exploration Project Briefing

Reason for Report

1. To introduce to Council

Mr Alex Ferguson, (Manager Regulatory Affairs for Apache Corporation) who will

lead the project going forward. This also provides Mr Ferguson with an

opportunity to explain the process proposed for the petrochemical exploration

activity in the region.

Background

2. Two companies, Apache

Corporation (Apache) and TAG Oil (TAG) have formed a joint venture for this

exploration project. In this venture Apache are the lead and have agreed to pay

for the right to explore TAG’s permit holdings.

3. TAG owns the rights to

three permits for the East Coast of the North Island. These rights are in the

Gisborne District and extend south of the Hawke’s Bay to be partly in the

Horizon’s region.

4. Apache is represented

by its Canadian affiliate, Apache Canada and this office will be the lead for

the project going forward. Mr Fergusson from Apache will be joined by

Alexandra Johansen from TAG to discuss the proposal with Council

Decision

Making Process

5. Council is required to

make a decision in accordance with Part 6 Sub-Part 1, of the Local Government

Act 2002 (the Act). Staff have assessed the requirements contained within this

section of the Act in relation to this item and have concluded that, as this

report is for information only and no decision is to be made, the decision

making provisions of the Local Government Act 2002 do not apply.

|

Recommendation

1. That the Corporate and Strategic Committee

receives the verbal report on the Apache Oil Exploration project from Mr Alex

Ferguson and Alexandra Johansen.

|

|

Bryce Lawrence

Manager

Compliance

and Harbours

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 25 January 2012

Subject: General Business

Introduction

This

document has been prepared to assist Councillors note the General Business to

be discussed as determined earlier in Agenda Item 6.

|

Item

|

Topic

|

Councillor

/ Staff

|

|

1.

|

|

|

|

2.

|

|

|

|

3.

|

|

|

|

4.

|

|

|

|

5.

|

|

|

|

6.

|

|

|

|

7.

|

|

|

|

8.

|

|

|

|

9.

|

|

|

|

10.

|

|

|

HAWKE’S BAY REGIONAL COUNCIL

Corporate

and Strategic Committee

Wednesday 25 January 2012

Subject: Appointment of Independent Members of the Investment Company

Transition Board of Directors

That Council excludes the public

from this section of the meeting, being Agenda Item 12 Appointment of

Independent Members of the Investment Company Transition Board of Directors

with the general subject of the item to be considered while the public is

excluded; the reasons for passing the resolution and the specific grounds under

Section 48 (1) of the Local Government Official Information and Meetings Act

1987 for the passing of this resolution being as follows:

|

GENERAL SUBJECT OF THE ITEM TO BE

CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION

|

GROUNDS UNDER SECTION 48(1)

FOR THE PASSING OF THE RESOLUTION

|

|

Appointment of Independent Members of the Investment

Company Transition Board of Directors

|

7(2)(a) That the public

conduct of this agenda item would be likely to result in the disclosure of

information where the withholding of the information is necessary to protect

the privacy of natural persons.

|

The Council is specified, in

the First Schedule to this Act, as a body to which the Act applies.

|

|

Andrew Newman

Chief

Executive

|

Fenton Wilson

Chairman

|