Meeting of the Hawke's Bay Regional Council

Date: Wednesday 28 May 2014

Time: 9.00am

|

Venue:

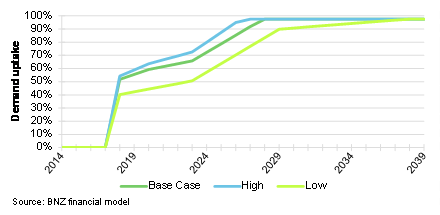

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Prayer/Apologies/Notices

2. Conflict

of Interest Declarations

3. Confirmation of

Minutes of the Regional Council Meeting held on 30 April 2014

4. Matters Arising

from Minutes of the Regional Council Meeting held on 30 Apri 2014

5. Follow-ups from

Previous Council Meetings 3

6. Call for Minor

Items Not on the Agenda

7. Napier Port

Presentation (9.30am)

Decision Items

8. Deloitte Peer

Review of HBRIC Ltd RWSS Business Case (10.45am) 11

9. Affixing of Common

Seal 93

10. Register of Members' Interests 95

11. Amendment of Council's

Investment Policy 99

12. HBRIC Ltd 2014-15 Statement of

Intent 105

13. Recommendations from the Maori

Committee 123

Information or Performance Monitoring

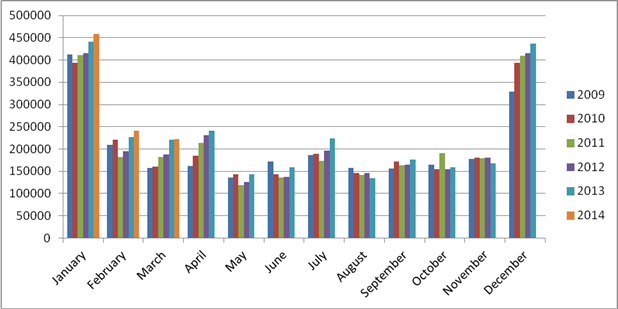

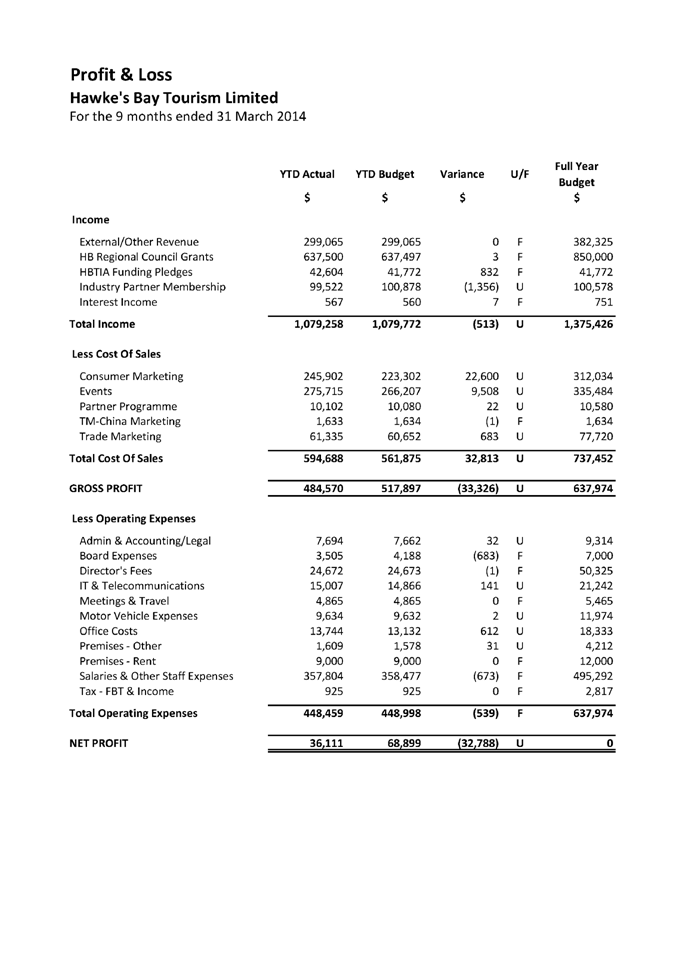

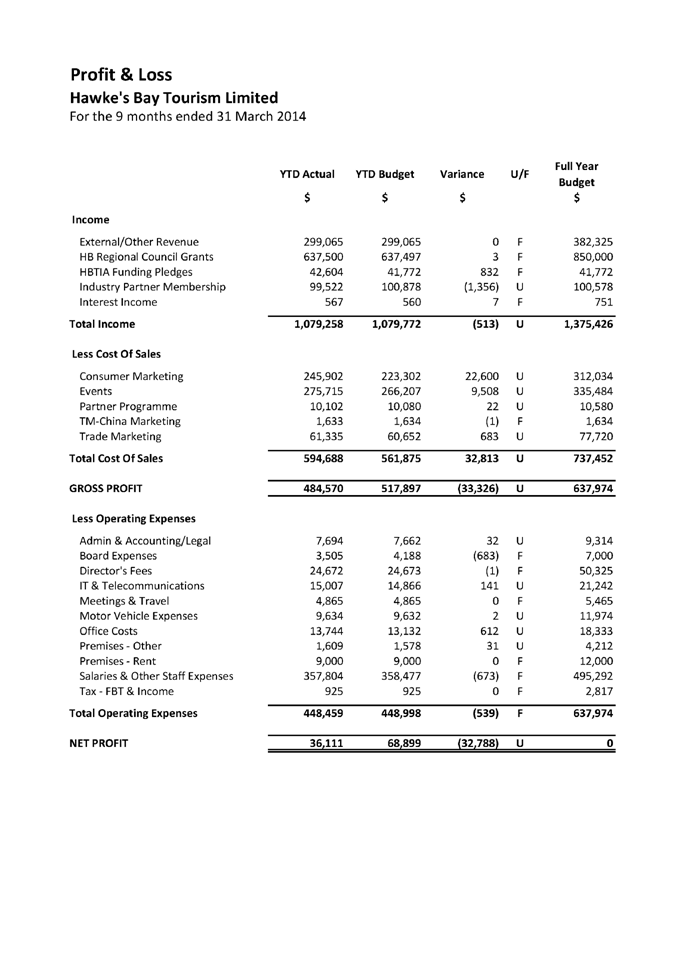

14. Hawke's Bay Tourism Quarterly

Report (9.05am) 125

15. Monthly Work Plan Looking

Forward Through June 2014 139

16. Chairman's Monthly Report (to

be tabled)

17. Minor Items Not on the Agenda 145

18. HBRIC

Ltd Discussion of Plan Change 6 (approx 1pm)

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 28 May 2014

SUBJECT: Follow-ups from Previous Council Meetings

Reason for Report

1. Attachment 1 lists items raised at previous meetings that require

follow-ups. All items indicate who is responsible for each, when it is expected

to be completed and a brief status comment. Once the items have been completed

and reported to Council they will be removed from the list.

Decision Making Process

2. Council is required to make a decision in

accordance with Part 6 Sub-Part 1, of the Local Government Act 2002 (the Act).

Staff have assessed the requirements contained within this section of the Act

in relation to this item and have concluded that as this report is for

information only and no decision is required in terms of the Local Government

Act’s provisions, the decision making procedures set out in the Act do

not apply.

|

Recommendation

1. That Council receives the report

“Follow-ups from Previous Council Meetings”.

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

|

1

|

Follow-ups

from Previous Regional Council Meetings

|

|

|

|

Follow-ups

from Previous Regional Council Meetings

|

Attachment 1

|

Follow-ups

from previous Regional Council Meetings

Meeting Held 30 April 2014

|

|

Agenda Item

|

Action

|

Responsible

|

Due Date

|

Status Comment

|

|

1

|

Conflict of

Interest Declarations

|

Threshold

for declaration of shareholdings and clarification of non-pecuniary interest

|

L Hooper

|

Immed

|

Email

(attached following) sent 1/5/2014

|

|

2

|

Affixing

Common Seal

|

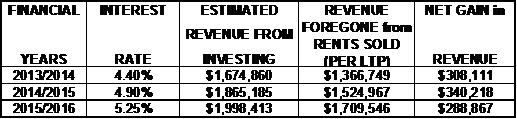

Explanation

of how freeholding of leasehold properties affects ACC cashflow payments

|

E Lambert

|

Immed

|

Email

(attached following) sent 1/5/2014

|

|

3

|

|

|

|

|

|

From: Leeanne Hooper

Sent: Thursday, 1 May 2014 12:21 p.m.

To: Alan Dick; Christine Scott; Dave Pipe; Debbie Hewitt; Fenton Wilson;

mmohi@doc.govt.nz; Peter Beaven; Rex

Graham; Rick Barker; Tom Belford

Cc: Liz Lambert

Subject: Follow-ups from Meeting yesterday

Good morning,

Some follow-up information from yesterday’s meeting

for you …

Members’ Interests (Guidance from Auditor General)

http://www.oag.govt.nz/2010/lamia/docs/local-authorities-members-interests-act.pdf

From Part 3 re shareholdings:

Interest

in a company

3.24

If either you or your spouse or partner is involved in a company that has

a pecuniary interest in a matter before the authority, you are deemed

for the purposes of the Act to have the same interest (as the company) only if:

•

you or your spouse or partner, singly or together, own 10% or more of the

shares in:

–

the company; or

–

another company that controls it; or

•

either you or your spouse or partner is a shareholder of the company, or

another company that controls it; and either of you is the managing director or

general manager (by whatever name you are actually called) of the company or

the controlling company; or

•

either you or your spouse or partner is the managing director or general

manager (by whatever name you or they are actually called) of the company, and

either of you is a shareholder of another company that controls it.

Part 5: Other conflict of interest issues states:

“5.1 Having a pecuniary interest in a matter before

the local authority, as discussed in Part 3, is one type of conflict of

interest. However, quite apart from the Act, there are legal rules about

conflicts of interest more generally, which apply to both pecuniary and

non-pecuniary conflicts of interest.

Conflicts

of interest generally

5.5

A conflict of interest exists where two different interests intersect –

in other words, where your responsibilities as a member of the local authority

could be affected by some other separate interest or duty that you may have in

relation to a particular matter. That other interest or duty might exist

because of:

•

your own financial affairs;

•

a relationship or role that you have; or

•

something you have said or done.

Situations

where a risk of bias may exist

5.18

The most common risks of non-pecuniary bias are where:

•

your statements or conduct indicate that you have predetermined the matter

before hearing all relevant information; or

•

you have a close relationship or involvement with an individual or organisation

affected by the matter.

What

is predetermination?

5.26

You could also create a legal risk to the authority’s decision if you

participate in the authority’s consideration of a matter and you have

made a formal submission to the authority in your personal capacity to support

or oppose a particular proposal as part of a public submissions process. There

may be rare situations where you may still be able to consider such matters.

However, as a potential decision-maker, to avoid creating legal risk for the

authority’s decision, it is advisable to avoid making submissions on

matters that will come before your authority for decision – doing so will

usually compromise your ability to participate in the decision making

process.”

Bias, Predetermination,

Relationship with other persons or organisations (including membership of other

organisations) and ‘What to do?’ are all covered in Part 5 –

available via the link provided above

ACC & Leasehold Cashflows (excerpts from 14

August 2013 Regional Council public excluded agenda item 7)

I realise that this paper was considered by the previous

Council, so if any of you want a full copy of it let me know and I will send a

‘red paper’ version to you.

1. In the event a leaseholder purchases the freehold of his/her/their

property from HBRC during the fifty year period, the purchase price paid by the

leaseholder to HBRC will be allocated as follows:

1.1. First, to pay to ACC the net present value of the expected future

rents which would have been received by HBRC if the sale of the freehold had

not proceeded, calculated at the same discount rate as used in the purchase

price paid by ACC, and,

1.2. Second to share any difference between the price paid by the

leaseholder and the net present value of potential future rents between ACC and

HBRC.

Benefits and Costs

2. The benefits of the final proposed deal are outlined below:

2.1. HBRC receives a single lump sum of $xx for investment in key

regional initiatives that cannot be achieved from any other way of dealing with

these assets because of the constraints of the HBELEA.

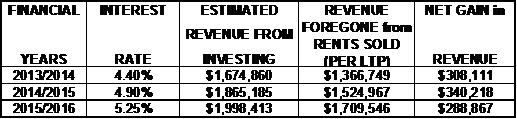

2.2. As a result of the sale, HBRC’s revenue is estimated to

improve to the extent that the sales proceeds can be invested and earn interest

in excess of the leasehold rentals. These improvements in revenue are

around $310,000pa for the 2013/2014 financial year $340,000 in the 2014/2015

financial year and $290,000 in the 2015/2016 financial prior to reinvestment.

The following table illustrates these calculations using current market

interest rates.

2.3. The HBRC will share, along with ACC, in the potential upside to

future rents which increase at a greater rate than 1.5% pa projected for the

cash flows sold. This means where rents do increase beyond projected levels in

future HBRC will receive a share of the higher rents which will in turn

increase its operating revenues.

2.4. HBRC continues to own the underlying properties, and will continue

to manage them in accordance with existing lease terms between HBRC and

leaseholders.

2.5. Leaseholder’s rights and obligations in terms of their leases

and the HBELEA are unaffected.

2.6. At the end of the fifty year term (i.e. in 2063), all cash flows

derived from rentals paid by then leaseholders will return to HBRC in full.

2.7. Management costs will be funded for HBRC by deduction from gross

rents before net rents are transferred to the investors. The effect of this

arrangement is to reduce HBRC’s operating costs correspondingly.

3. If the cash flows are not sold and the funds needed for RWSS are

borrowed at current market rates, the cumulative additional cost to the HBRC

over the period of the LTP will be around $3.9m.

If you have any further questions or this email hasn’t

answered the questions properly, as expected, please let me know J

Cheers,

Leeanne

Hooper

Governance & Corporate Administration Manager

|

Follow-ups

from Previous Regional Council Meetings

|

Attachment 1

|

LGOIMA Requests Received between 23 April and 21 May

2014

|

Request Status

|

Date

Received

|

Requested By

|

Request Summary

|

Group Manager Responsible for Response

|

|

Active

|

19/05/2014

|

Ian McIntosh

|

? within your "delegated authority" in making a

submission to the EPA Board of Inquiry on their Interim decision.

Answers to the following questions under the Official Information Act: 1. Did

you believe you were acting under your "delegated authority" as

'Acting Chief Executive' when you submitted the 7th May material to the EPA?

2. Did the Regional Council vote at any time on whether such a submission

should be made and, if so, when?

|

Liz Lambert

|

|

Active

|

20/05/2014

|

Rick Barker

|

1. A copy of the submission HBRC made in response to the interim

decision of the Board of Inquiry re Plan Change 6.

2. Why was the HBRC's submission not forwarded to Councillors as a matter of

course.

3. A description and the timing sequence for the planning that was considered

by the leadership team for the consultation process as a lead up the expected

necessity for making submissions to the BoI in response to its interim

decision.

4. Outline of the process of consultation actually undertaken for the

development and conclusion of HBRC response.

5. List of the people, other than HBRC staff who provided input,

comments or advice on the development of HBRC's response - including Regional

Councillors, the Board of HBRIC, staff seconded to HBRIC, iwi and their reps,

local government, non governmental organisations, commercial entities and

individuals.

6. Description of the process of engagement with Councillors in the

development of the response by HBRC to the interim decision and how you

arrived at the view that this was both adequate and appropriate.

|

Liz Lambert

|

|

Active

|

7/05/2014

|

A Better Hawke's Bay

|

HBRC financial info, being: 1. current level of external

borrowings 2. current level of internal borrowings 3. proportion of rates

revenue charged to service debt for of last 5 rating years and 4. relative $

amounts 5. interest rate used to calculate debt servicing content of rates

charged 6. actual interest rate paid on external borrowings for each year 7.

total amount of interest paid on external borrowings for each of last 5 years

8. projected level of borrowings from each external & internal source for

next 5 years

|

Paul Drury

|

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 28 May 2014

SUBJECT: Deloitte Peer Review of HBRIC Ltd RWSS Business Case

Reason for Report

1. Deloitte has completed its Business Case Peer Review report and this

report will be presented at this Council meeting by Alan Dent and David Morgan

from Deloitte’s.

Background

2. To assist Council with the decision making process surrounding the

possible investment in the Ruataniwha Water Storage Scheme, Deloitte was

appointed by HBRC in January 2014 to undertake an independent peer review of

the Business and Investment Case presented by HBRIC Ltd to HBRC.

3. The independent

peer review of the business case is an important part of the overall assessment

process for HBRC and has relevance for the assessment of:

3.1. Financial

feasibility – is the Council’s investment supported by a sound

business case? What are the strengths and weaknesses of the business case?

3.2. Returns on investment – what

financial returns can the Council expect from its investment and over what time

period are these expected to occur?

3.3. Business

Risks – what risks does the company face and how will these be

managed or mitigated?

4. The Peer Review is in the nature of an “audit” of the

HBRIC Ltd prepared business case and Deloitte was tasked, in particular,

with addressing:

4.1. Whether HBRC

can have comfort that its exposure to calls on capital can be limited to its

current funding envelope of $60-80million

4.2. The

circumstances under which HBRC may be required to contribute additional capital

and where possible the quantity of those potential calls and the risks that

such calls could eventuate

4.3. The extent to

which HBRC can have comfort that the projected returns on its investment have

been accurately calculated and are based on reasonable assumptions

4.4. How

investment returns could vary under different scenarios

4.5. Any other

matters that Deloitte considers ought to be brought to HBRC’s attention

in connection with its assessment of the business case.

Deloitte Interim Report

5. In its interim

report presented to Council’s Corporate and Strategic Committee meeting

on 16 April 2014, Deloitte identified the key interlocking components of the

business case from a financial perspective as being:

5.1. The up-front

capital investment in the physical infrastructure of the RWSS

5.2. The business

model which drives the operating cash flows necessary to provide the investor

returns

5.3. The ownership

model and related investment structure that allocates capital, risk and return

to the different investor

5.4. Fundamentally

however the critical factor is demand – how long it takes to get to full

uptake and the profile of this uptake.

6. In

assessing these factors as the core building blocks of the project, Deloitte

satisfied itself as to the reasonableness of the assumptions supporting these

building blocks and the way the financial model has been constructed and

returns calculated within the HBRIC Ltd business case. They then used the model

to:

6.1. Assess the

overall return on capital from the project under different uptake scenarios

6.2. Demonstrate

how the internal rate of returns have been calculated

6.3. Use

sensitivity analysis to identify which assumptions matter and which are

immaterial in terms of the financial case

6.4. Identify the

implications for HBRC capital requirements and returns under different

scenarios.

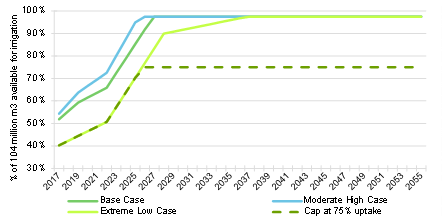

7. The key risk to the project as identified by Deloitte is how long

the project takes to get to full uptake of water. This is important for two

reasons:

7.1. If the level and pace of uptake are lower and slower respectively

than the base case then there is a risk that HBRC will be called upon for

additional capital (together with all other investors)

7.2. There is a risk that HBRC’s rate of return may be lower than

that estimated in the business case e.g. the business case assumes a rate of

return of 6.9% at full uptake, but this could range between 6.4% and 7.4%

depending on the level and speed of uptake.

8. Deloitte is confident that the risks from any overruns in capital

costs during construction are well covered by the fixed price, fixed time

contract and will not impact upon HBRC.

Final Report and Findings

9. Attachment 1

to this paper is the final report of the review of the HBRIC Business Case from

Deloitte’s. Their conclusion is part of the executive summary of

this report which considers the base scenario presented in the Business Case.

10. Deloitte notes that

the three major moving parts of the proposal, namely the construction contract,

the required level of initial contracted water and the capital structure, have

yet to be finalised. They also state that is it not unusual for projects

of this nature to have a degree of uncertainty right up to the point of

financial close. Given this situation it would be appropriate for Council

to retain their services to undertake a final assessment of the proposal should

there be any material change between the base case and the situation at financial

close.

Decision Making

Process

11. Council

is required to make a decision in accordance with the requirements of the Local

Government Act 2002 (the Act). Staff have assessed the requirements

contained in Part 6 Sub Part 1 of the Act in relation to this item and have

concluded the following:

11.1. The decision

does not significantly alter the service provision or affect a strategic asset.

11.2. The use of

the special consultative procedure is not prescribed by legislation.

11.3. The decision

does not fall within the definition of Council’s policy on significance.

11.4. The persons affected by this

decision are the public of Hawke’s Bay

11.5. Options that

have been considered include not receiving the report, although Council

specifically commissioned Deloitte to undertake an independent per review.

11.6. The decision

is not inconsistent with an existing policy or plan.

11.7. Given the

nature and significance of the issue to be considered and decided, and also the

persons likely to be affected by, or have an interest in the decisions made,

Council can exercise its discretion and make a decision without consulting

directly with the community or others having an interest in this

specific decision as public consultation is occurring on the overall investment

proposition.

|

Recommendations

That Council:

1. Agrees that the decisions to be made are not significant under the

criteria contained in Council’s adopted policy on significance and that

Council can exercise its discretion under Sections 79(1)(a) and 82(3) of the

Local Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

2. Receives the report titled “Peer Review of the

Ruataniwha Water Storage Scheme Business Case” prepared by

Deloitte; and

3. Notes that a further report will be required from Deloitte when

the final RWSS business case, including the capital structure, has been

finalised by HBRIC Ltd.

|

|

Paul Drury

Group

Manager

Corporate

Services

|

Liz Lambert

Chief

Executive

|

Attachment/s

|

1

|

Peer Review

of the Ruataniwha Water Storage Scheme Business Case

|

|

|

|

Peer

Review of the Ruataniwha Water Storage Scheme Business Case

|

Attachment 1

|

Table of Contents

1. Executive Summary 20

2. Introduction and Scope 28

3. Approach 30

4. Investment Proposition 32

5. Capital Investment 35

6. Business Model 41

7. Ownership Model and Investment Structure 50

8. Financial Projections 56

9. Other Benefits 75

10. Other Matters 79

Appendix 1

– Terms of Reference 81

Appendix 2

– Documents Reviewed 86

Appendix 3

– RWSS Overview Map 87

Appendix 4

– Construction Risk Register 88

Appendix 5

– MacFarlane Product Price Assumptions 89

Appendix 6

– Sensitivity Analysis 90

|

Peer Review of the Ruataniwha Water

Storage Scheme Business Case

|

Attachment 1

|

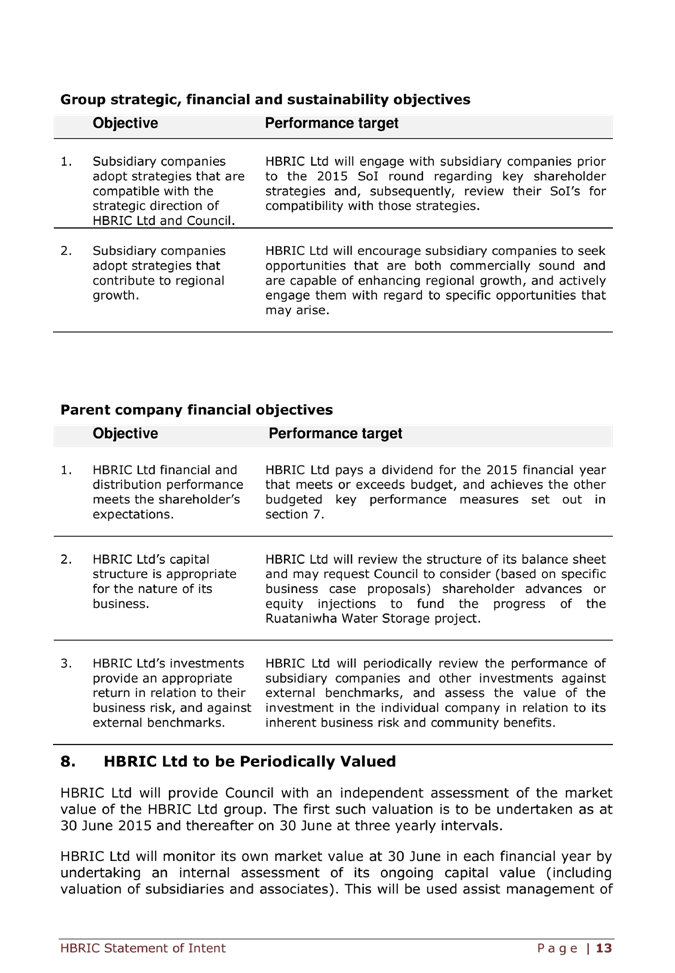

Table of Figures

Figure

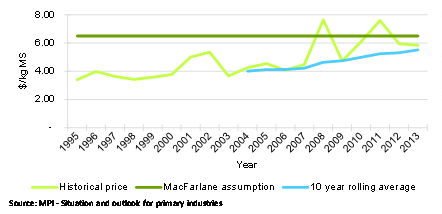

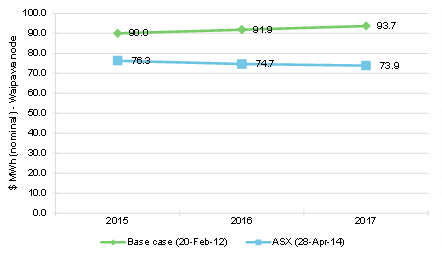

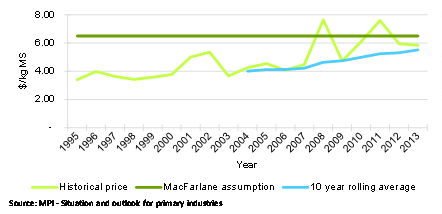

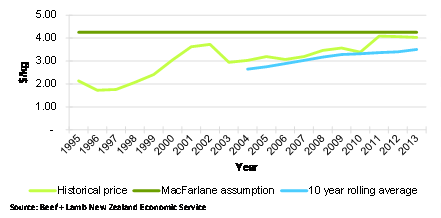

1: Milk Price ($/kgMS) 43

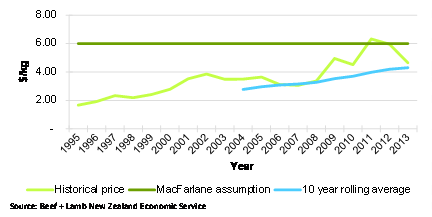

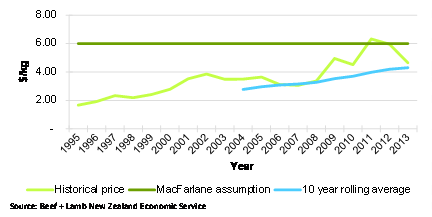

Figure 2: Lamb Price ($/kg) 43

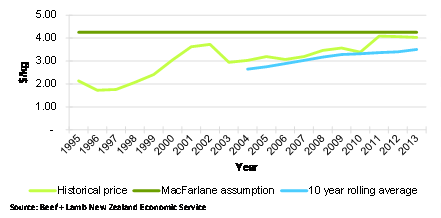

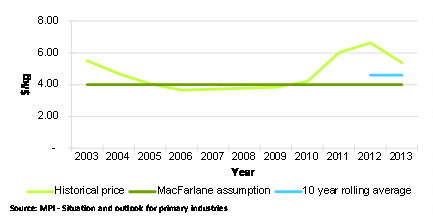

Figure 3: Beef Price ($/kg) 44

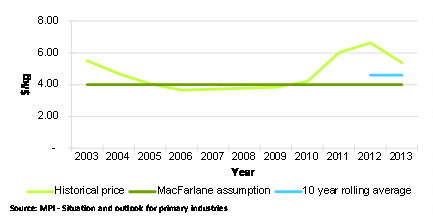

Figure 4: Wool Price ($/kg) 44

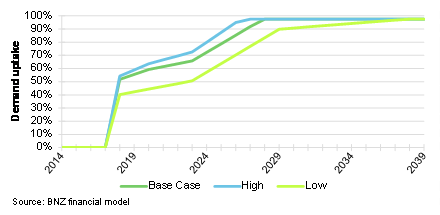

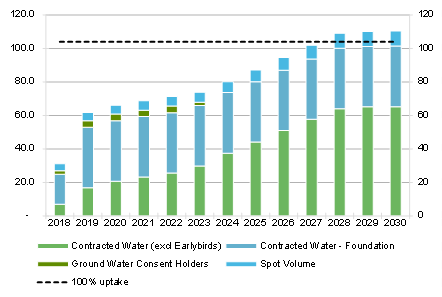

Figure 5: Projected Demand

Uptake 45

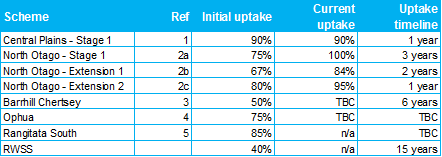

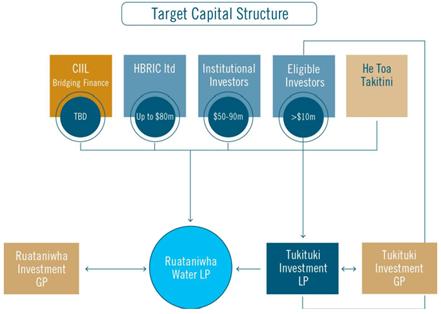

Figure 6: Existing and

Anticipated Land Use 46

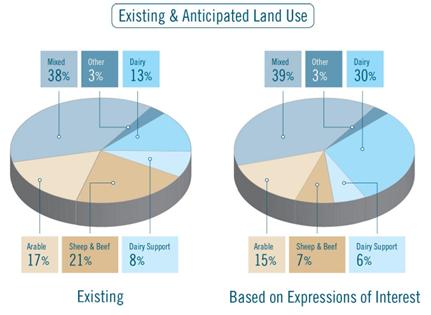

Figure 7: Business Case Capital

Structure 51

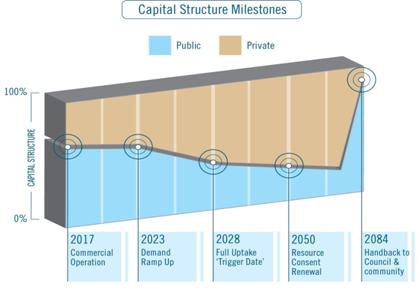

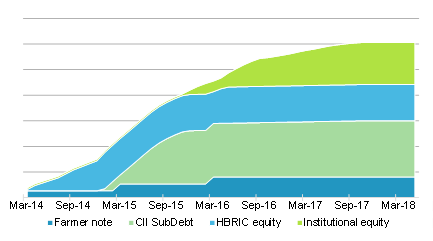

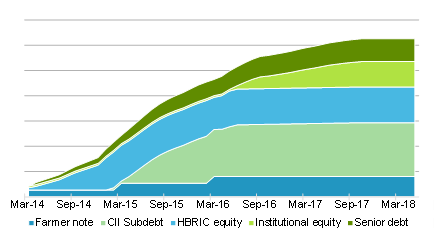

Figure 8: Changes to RWSS

Capital Structure through 70 Year Concession Period 51

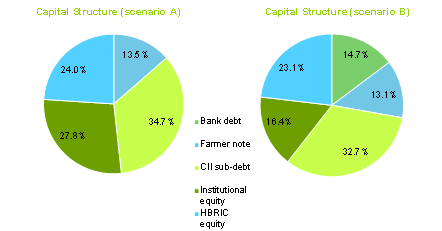

Figure 9: Capital Structure

Scenarios 56

Figure 10: Construction Funding

Mix (Capital Structure A) 57

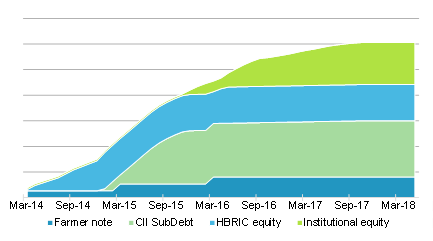

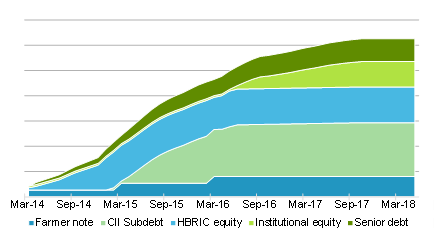

Figure 11: Construction Funding

Mix (Capital Structure B) 57

Figure 12: Base Case Water

Volumes (Million m3) 59

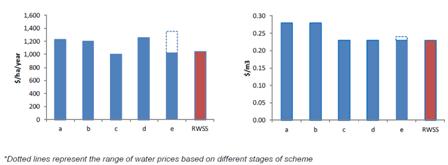

Figure 13: Comparison of INZ

Selected Schemes to RWSS 61

Figure 14: Electricity Price

Path 62

Figure 15: Projected Revenue

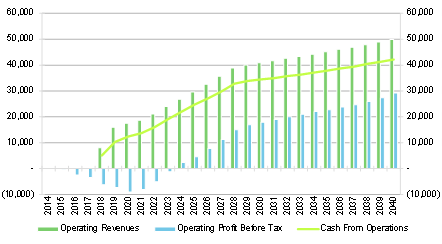

and Operating Profit 66

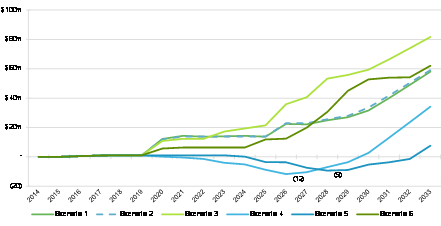

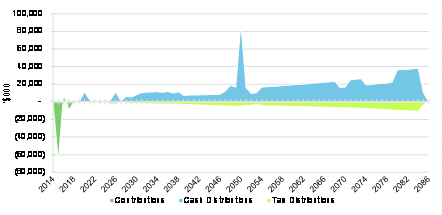

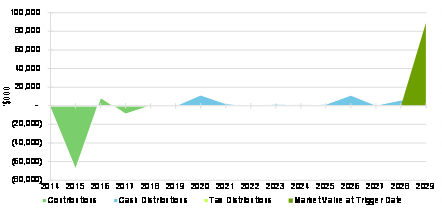

Figure 16: HBRIC Cash Flow -

Whole Concession 69

Figure 17: HBRIC Cash Flow -

Pre Trigger Date 69

Figure 18: HBRIC Cash Flow -

Post Trigger Date 69

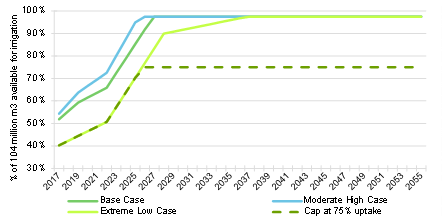

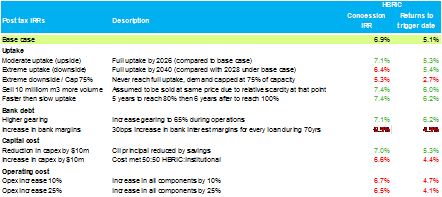

Figure 19: Projected Demand

Uptake 71

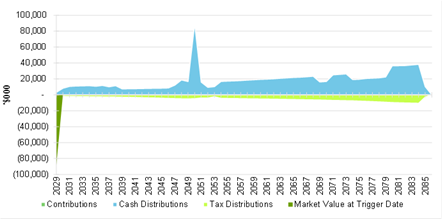

Figure 20: Cumulative Post Tax

Distributions to HBRIC 73

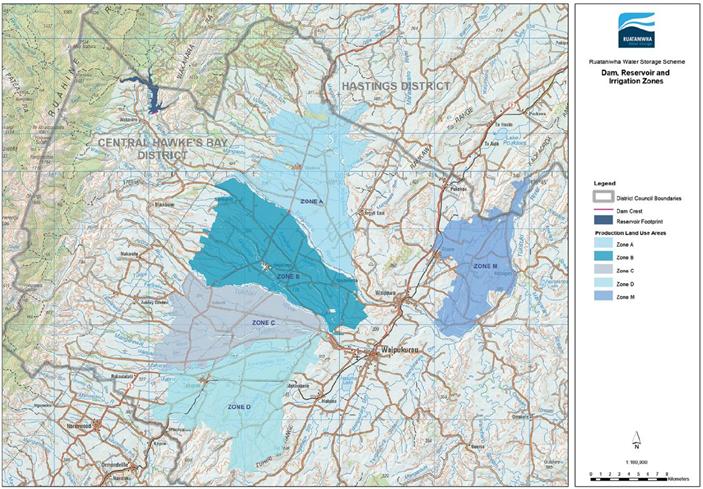

Figure 21: RWSS Overview Map 87

|

Peer

Review of the Ruataniwha Water Storage Scheme Business Case

|

Attachment 1

|

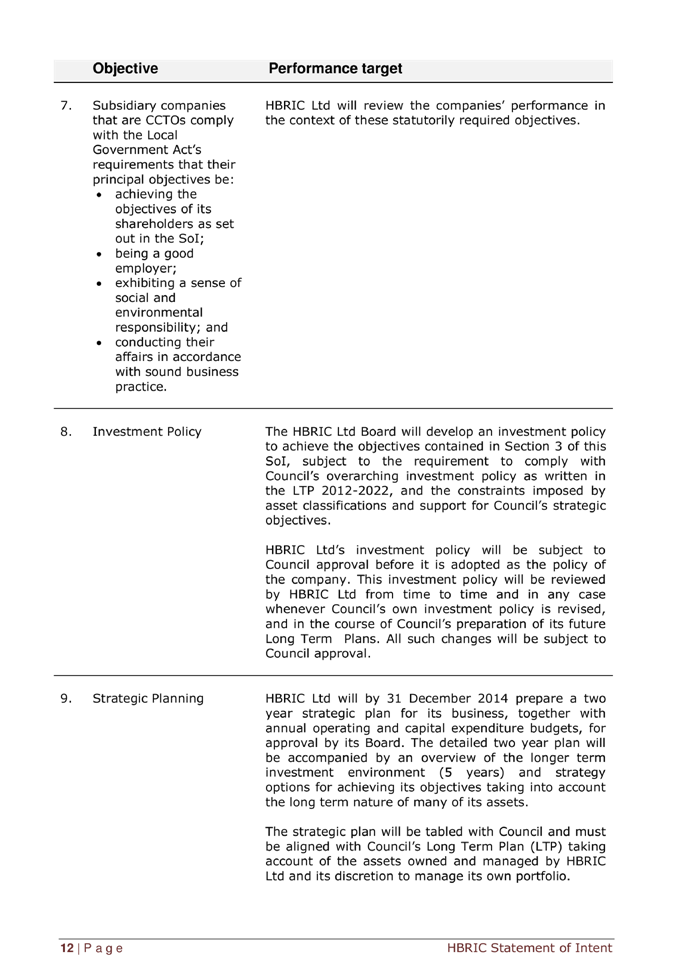

Table of Tables

Table

1: Contract Price Structure 22

Table 2: Other Up-front

Investment Costs 22

Table 3: Base Case Capital

Structure 24

Table 4: RWSS Capital Cost 33

Table 5: Contract Price

Structure 37

Table 6: MacFarlane Rural

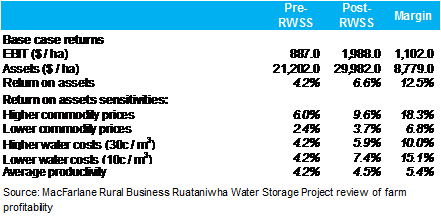

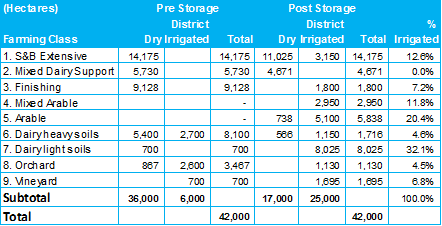

Business RWSS Farm Profitability Analysis 42

Table 7: Macfarlane Land Use

Assumptions 43

Table 8: Irrigation Scheme

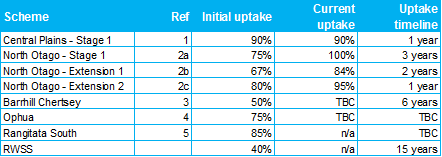

Uptake Timeline 46

Table 9: Base Case Capital

Structure 50

Table 10: Breakdown of Capital

Costs 58

Table 11: Construction

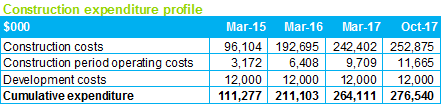

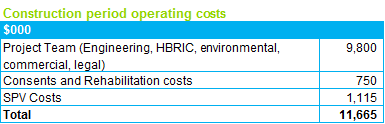

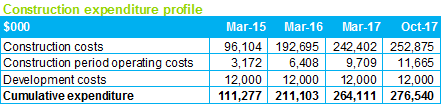

Expenditure Profile 58

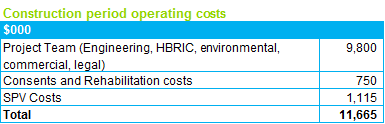

Table 12: Construction Period

Operating Costs 58

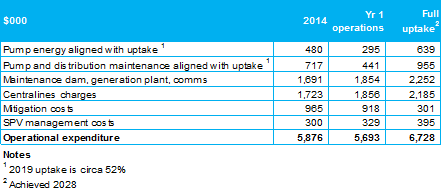

Table 13: RWSS Operational

Expenses 63

Table 14: Depreciation Rates

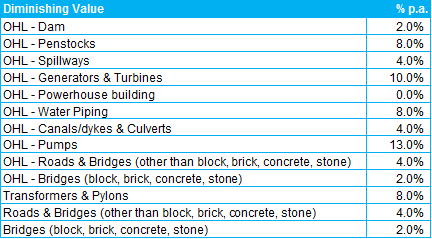

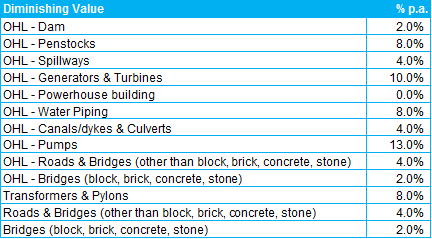

for Construction Components 64

Table 15: Operating Profit

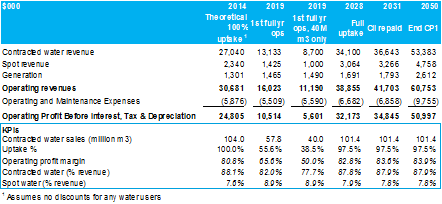

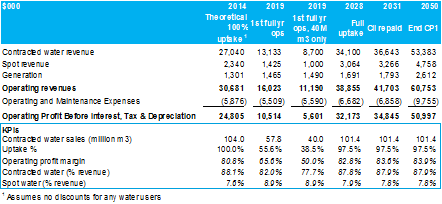

(Base Case) 65

Table 16: Investment Returns 71

Table 17: One Off Construction

Impacts Estimated by Butcher 76

Table 18: On-going Impacts From

Increased Farm Production Estimated by Butcher 76

Table 19: Construction Risk

Register 88

Table 20: MacFarlane Product

Price Assumptions 89

Table 21: Investment Returns 90

|

Peer

Review of the Ruataniwha Water Storage Scheme Business Case

|

Attachment 1

|

Glossary

|

Abbreviation

|

Definition

|

|

|

|

|

ACoT

|

Avoided Cost of

Transmission

|

|

INZ

|

Irrigation New Zealand

|

|

ASX

|

Australian Securities

Exchange

|

|

IRR

|

Internal Rate of Return

|

|

BNZ Advisory

|

An independent division

of Bank of New Zealand, a subsidiary of National Australia Bank

|

|

Macfarlane

|

Macfarlane Rural

Business Limited

|

|

BOI

|

The Board of Inquiry

process under the management of the Environmental Protection Agency

|

|

$m

|

Millions of dollars

|

|

BOOT

|

Build Own Operate

Transfer

|

|

M3

|

1 cubic metre of water

|

|

Butcher

|

Butcher Partners

Limited

|

|

M m3

|

1 million cubic metres

of water

|

|

Castalia

|

Castalia Limited

|

|

MW

|

Megawatt

|

|

CIIL

|

Crown Irrigation

Investments Limited

|

|

O&M

|

Operations and

Maintenance

|

|

Concession Period

|

The 70 year period from

the beginning of construction to the transfer back to the Community of the

Scheme

|

|

PWC

|

PricewaterhouseCoopers

|

|

D&C

|

Design and Construct

|

|

RFP

|

Request for Proposal

|

|

DSRA

|

Debt service reserve

account

|

|

ROA

|

Return on Assets

|

|

EOI

|

Expressions of Interest

|

|

RPA

|

Ramp-up proceeds

account

|

|

EPA

|

Environmental

Protection Agency

|

|

RWSS / Scheme

|

Ruataniwha Water

Storage Scheme

|

|

FEMP

|

Farm Environmental

Management Plan

|

|

RWSS LP

|

Ruataniwha Water

Limited Partnership

|

|

FY

|

Financial year

|

|

SMEC

|

SMEC Holdings Limited

(formerly Snowy Mountain Engineering Company)

|

|

GDP

|

Gross Domestic Product

|

|

SPV

|

Special Purpose Vehicle

|

|

HBRC

|

Hawke’s Bay

Regional Council

|

|

Trigger date

|

The point at which

there is full uptake

|

|

HBRIC

|

Hawke’s Bay

Regional Investment Company Limited

|

|

WUA

|

Water User Agreement

|

|

Peer

Review of the Ruataniwha Water Storage Scheme Business Case

|

Attachment 1

|

1. Executive

Summary

Introduction

Hawke’s Bay Regional

Council (“HBRC”) is considering investing up to $80 million the

Ruataniwha Water Storage Scheme (“RWSS”, the “Scheme”).

HBRC’s subsidiary company, Hawke’s Bay Regional Investment Company

Limited (“HBRIC”), has prepared a business case in support of this

investment. Deloitte

has been engaged to peer

review this business case.

The RWSS is a proposed

long-term sustainable water storage solution for the Tukituki catchment in

Hawkes Bay. Through the construction of a dam on the upper Makaroro River

and associated distribution system the RWSS will store high winter flows for

irrigation use during summer when pressure on the water resource in the

Tukituki catchment is greatest. The motivation behind the Scheme is the

capturing of environmental, economic and social value.

A new company will be established

to build and own the dam and reservoir to be used to collect, store and

distribute water to farmers and other stakeholders on the Ruataniwha Plains on

commercial terms. It is important to note that the proposed procurement

structure is under a build, own, operate and transfer (“BOOT”)

structure which will see ownership transfer back to HBRIC[1] at the end of a 70

year[2]

concession period.

The scale of the RWSS and

the multiple objectives make this a far more complex investment proposition

than has been the case with other large scale irrigation schemes which have

primarily been commercially motivated, subject to compliance with environmental

and other regulatory constraints. In the case of the RWSS environmental and

wider economic development and social considerations are major drivers of the

case for investment and the reason why the Scheme cannot be funded on a wholly

commercial basis from the outset.

The RWSS will comprise an 83

m high dam capable of managing outflows of approximately 200 million cubic

metres (“M m3”) per year on average and a primary (canal

and pipeline) and secondary distribution network (pipelines, pumps and

property-off-takes). The costed Scheme Design is based on a hypothetical

secondary distribution layout which:

· Provides for full uptake of 104 M m3

of water per annum;

· Provides full workable pressure to 35 m

head; and

· Accounts for approximately 44 M m3

of water as signed up in irrigator expressions of interest

(“EOI’s”).

Based on the forecast

water volumes and distribution layout the RWSS has the potential to increase

farm productivity and allow higher value farming through irrigating

approximately 25,000[3]

hectares (and an additional 17,000 hectare direct area of influence giving a

total influence area of circa 42,000 hectares) on the Ruataniwha Plains and

down through the Tukituki catchment. In addition to the 104 M m3 of

water available to be contracted for irrigation purposes a further 43.3 M m3

of water will be available for environmental purposes (residual flows and

flushing flows) and 52.3 M m3 for other purposes including being

sold as spot water and providing an additional buffer of water available for

managing environmental conditions.

In undertaking our peer

review we have directed our work at addressing the following matters in

particular:

· Whether HBRC can have comfort that its

exposure to calls on capital can be limited to its current funding envelope of

up to $80 million;

· The circumstances under which HBRC may be

required to contribute additional capital and where possible the quantity of

those potential calls and the risks that such calls could eventuate;

· The extent to which HBRC can have comfort

that the projected returns on its investment have been accurately calculated

and are based on reasonable assumptions;

· How investment returns could vary under

different scenarios; and

· Those other matters that we consider ought

to be brought to HBRC’s attention in connection with its assessment of

the business case.

In undertaking our peer review we have

identified the key interlocking components of the business case from a

financial perspective as being:

· The up-front capital investment in the

physical infrastructure of the RWSS;

· The business model which drives the

operating cash flows necessary to provide the investor returns; and

· The ownership model and related investment

structure that allocates capital, risk and return to the different investor

categories.

The interplay between these

three components underpins the financial case for the RWSS.

Design & Construction

HBRIC has run a competitive

process for the selection of its preferred construction contractor. The process

was structured as a request for expressions of interest followed by a

shortlisting and request for proposal. The HBRIC process attracted a number of

quality bidding consortia. Following a shortlisting to two consortia a full

Request for Proposal (“RFP”) process was undertaken. At the

conclusion of this process OHL-Hawkins was selected as the preferred bidder.

The bid was requested as a

fixed price for design and construct (“D&C”). This is normal

practice where the required performance and scope of the project can be

adequately specified. It also eliminates the interface between designer and

constructor which, if managed as separate contracts by the investor or owner, can

create additional risk through unclear accountability in the event of problems

with the project or its eventual performance.

One of the difficulties

with the Scheme is that the full extent of initial irrigation water uptake and

the location of the offtake points are currently unknown. The location of the

initial offtake points is likely to be spread throughout the total area to be

irrigated and it is extremely difficult to design a distribution system which

meets only this initial demand and can be readily expanded in stages as demand

grows. In order to deal with this challenge the project team has negotiated a

contract price structured as follows:

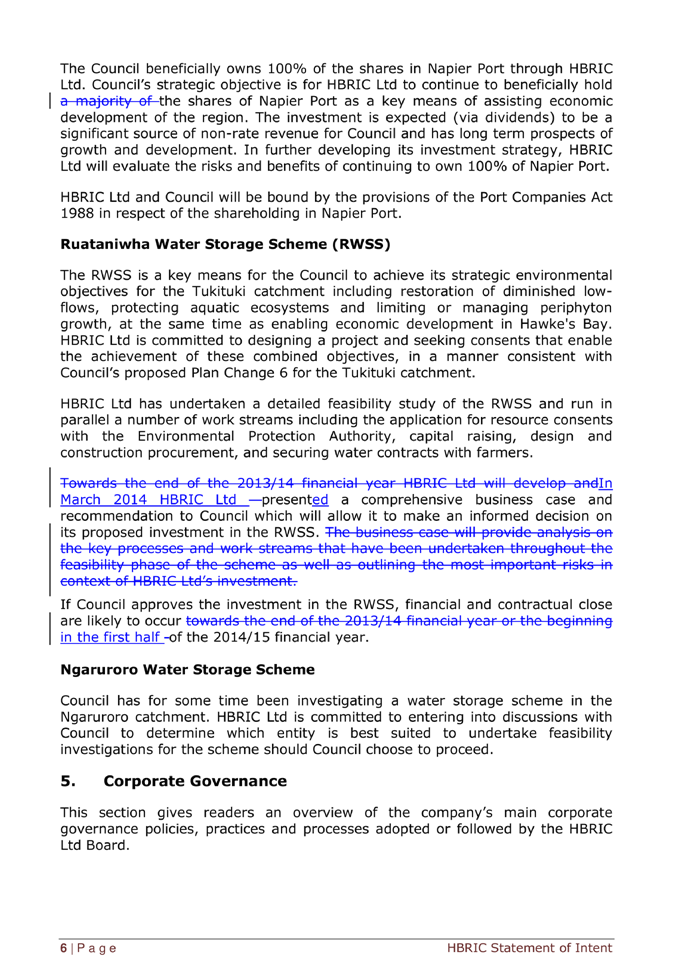

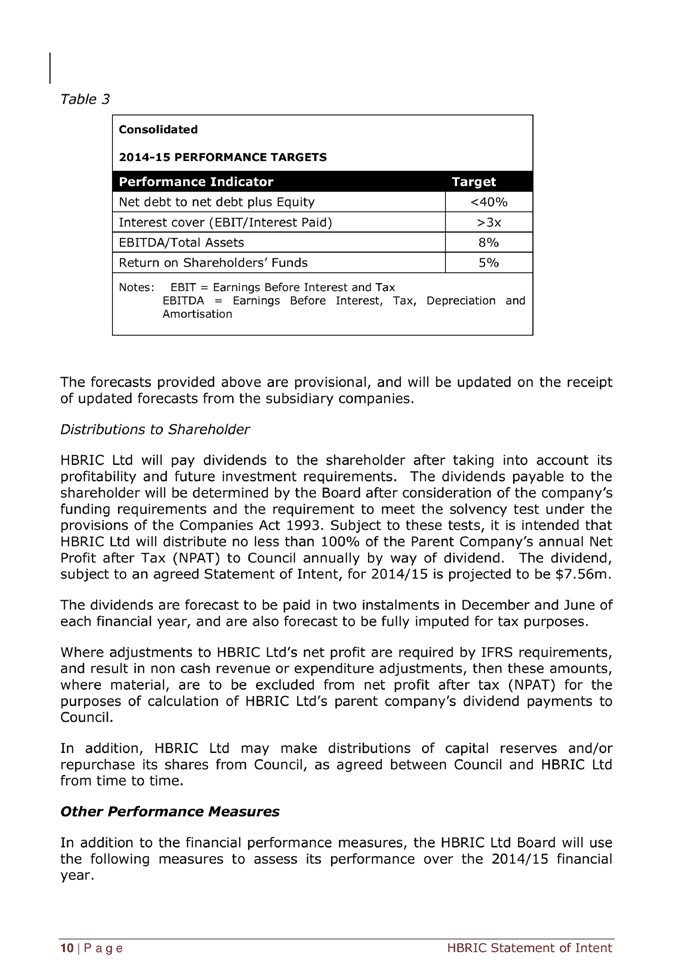

Table 1: Contract Price Structure

|

Price

Element

|

Price

|

Pricing

basis

|

|

Dam and electricity

generation

|

$120.6 million

|

Fixed price and scope

|

|

Primary distribution

|

$63.0 million

|

Measure and value

allowing flexibility to build less or a different layout[4]

|

|

Secondary distribution

|

$59.4 million

|

Measure and value

allowing flexibility to build less or a different layout

|

|

Total OHL-Hawkins

contract

|

$243.0 million

|

Fixed price and scope

(absolute cap on price assuming full scheme is built)

|

The combination of a fixed

price and scope pricing for the dam and electricity generation elements of the

Scheme and a measure and value approach for the primary and secondary

distribution elements significantly reduces the risk of the equity investors

being required to fund material capital cost overruns. The risk to the

investors arising from delays in Scheme completion or Scheme performance issues

are limited by damages provisions in the contract.

In addition to costs

associated with the build of the physical infrastructure additional other costs

also need to be funded as part of the up-front investment in the Scheme. These

are:

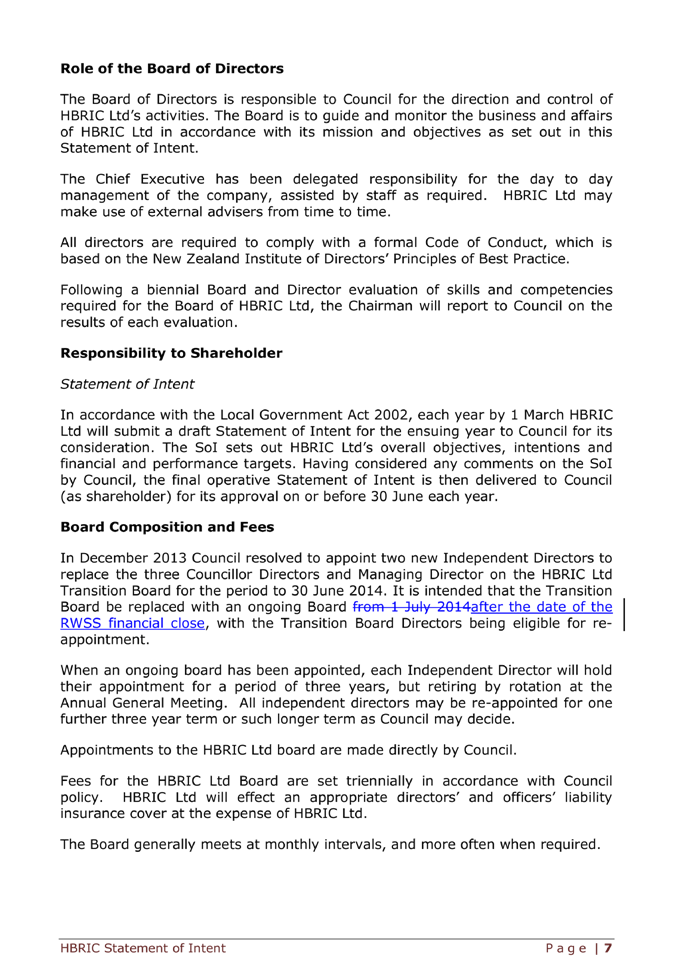

Table 2: Other Up-front Investment Costs

|

Construction

Component

|

Price

|

Party

responsible

|

|

OHL-Hawkins (dam,

generation, distribution)

|

$243.0 million

|

OHL-Hawkins

|

|

Construction period

operating costs

|

$11.7 million

|

RWSS Partnership

|

|

Development costs, Land,

Ancillary Roading & Surveying

|

$21.8 million

|

Incurred or negotiated

prior to FC

|

|

Total capital cost

|

$276.5 million

|

|

Business

Model

The business model for the

RWSS is based on users (farmers) contracting for water on a take or pay basis

for a period aligned with the first 35 year resource consent period. Unlike

other similar schemes RWSS is not being structured as a farmer co-operative.

Therefore, while farmers have an opportunity to invest in the RWSS this is not

a requirement of their accessing water. As a consequence the financial

viability of the RWSS is fundamentally dependent on farmers being willing to

contract for water. The validity of assumptions made in this regard is

therefore critical to any financial case for investment. A primary factor in

determining the proposed ownership structure, with HBRIC and Crown Irrigation

Investments Limited (“CIIL”) as being cornerstone funders, is the

positive economic and environmental externalities. If the Scheme was being

undertaken solely for the benefit of irrigators it would be reasonable to

assume the majority of the funding would be provided from a co-operative

structure but it would be very unlikely the same scale of project would be

achievable.

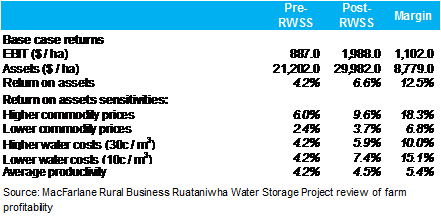

The economic assumptions

underpinning the business model are supported by an independent farm

profitability study undertaken in September 2012 by agribusiness consultant

Macfarlane Rural Business Limited (“Macfarlane”), an independent

demand and uptake analysis undertaken by infrastructure advisor, Castalia Limited

(“Castalia”), and also an internal process undertaken by HBRIC and

its legal and financial advisors to collate EOIs.

Demand for irrigation water

is premised on the assumption that irrigation will facilitate increased farming

profitability and reduced weather risk. The Macfarlane study provided an

analysis of the direct financial benefits that may result from the RWSS. This

study informed the Castalia demand study, originally completed in September

2012 and updated in November 2013, which sought to forecast the phased uptake

profile for irrigation water. The EOI process undertaken in 2013, which ran

from early March until the end of August, has provided further confirmatory

analysis and broadly reinforced the findings of the Macfarlane farm

profitability and the Castalia demand studies.

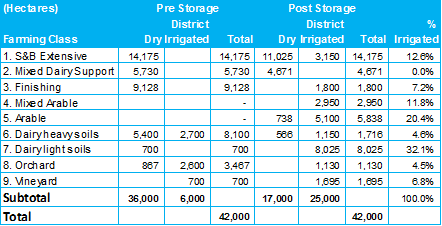

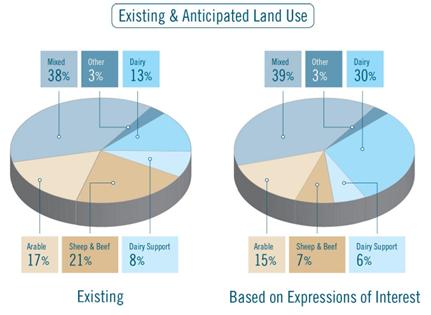

Macfarlane consider that

land use under irrigation will change towards more intensive and profitable

farming systems. A high proportion is assumed to be dairying and arable farming

depending on soil type. Land use will be determined by relative profitability

and soil type, moderated by the farmers own preference. Macfarlane consider

that farm productivity for farms who take up water after the Scheme is

commissioned will trend toward the top 20% for reasons of modern irrigation

technology, higher debt servicing, greater motivation and improved technical

skills. More fundamentally reliable irrigation water provides farmers

with the confidence to increase stocking and planting levels without the

concern that dry conditions may impact on their investment.

Effectively, the Macfarlane

farm profitability study provided an ‘end state’ or rational basis

for utilising irrigation to intensify farming systems as a means of increasing

profitability. The forecast rate of uptake was based on an assessment of farmer

sentiment and other modelled factors related to the decision making processes

of incumbent and new entrant farmers. Fundamentally this will involve farmers

weighing up the capital costs necessary to effect a change in land use against

long run expected returns on this marginal capital. While capital costs can be

estimated with a high degree of precision long run returns on capital are

harder to predict and will be fundamentally be determined by commodity prices

and productivity improvements. While long run trends in commodity prices can be

estimated these are not certain. Further, in the short term prices can be

volatile relative to this long run trend and this volatility can influence

investment decision making.

Castalia undertook a

survey to gauge farmer views in relation to irrigation uptake and also the

likely impact on land sale (turnover rates). The survey, conducted anomalously,

(online, by phone and also in written form) had a response rate of around 50%

of the RWSS catchment land area. The Survey responses covered a wide range of

farming types, soil types and farmer demographics. Survey information was used

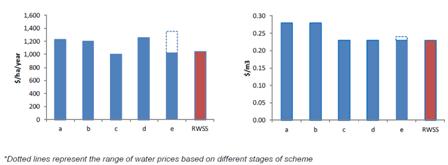

as a key input in a demand model, which also included amongst other parameters,

milk pay-out, the cost of water and the rate at which land turned over.

HBRIC has advised that a

condition precedent for financial close for the Scheme is to have 40 M m3

or 38.5% of water contracted by 30 June 2014. This has now been pushed out to

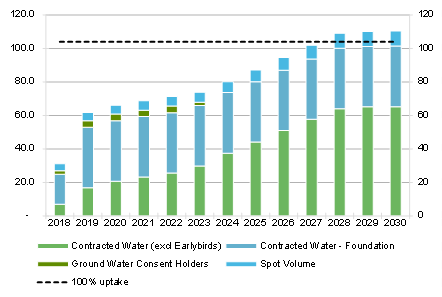

30 September 2014. The Base Case financial projections for RWSS assume 52% of

contracted water by the time construction is completed which assumes additional

13.5 M m3 of water users sign up over the 3.5 years construction

period. We had considered a timeline requiring nearly 40% of water to be

contracted by 30 June to be extremely tight given the material contractual

commitment that farmers are being required to enter into, the extension to 30

September should give some headroom.

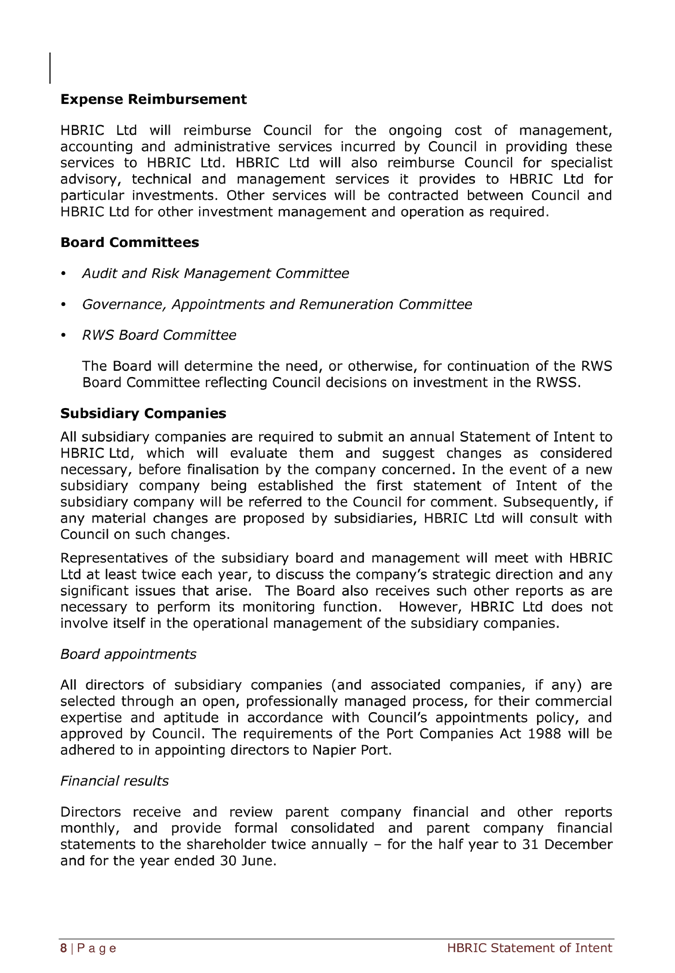

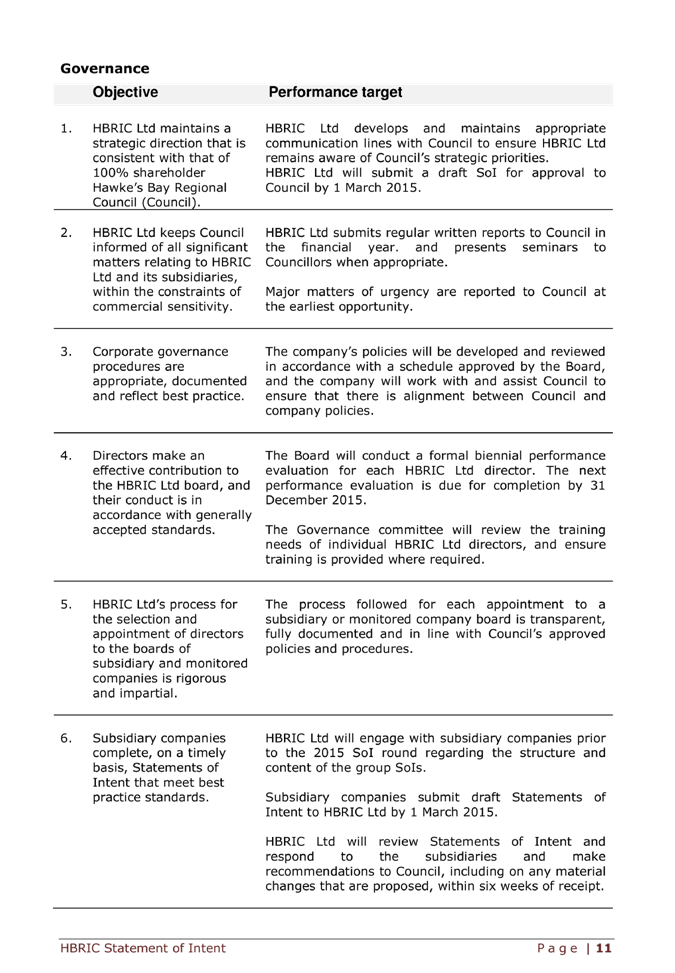

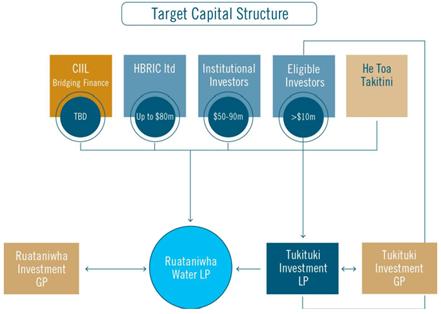

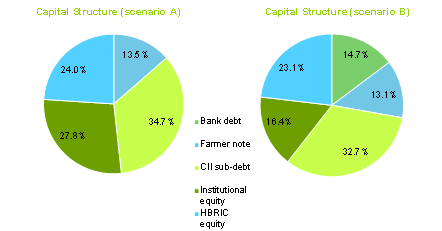

Capital Structure

The final capital structure

is yet to be locked down but is expected to be provided from a combination of

arm’s length sources (institutional investors and bank debt), related

parties (farmers, local investors and local Iwi) and discounted capital (CIIL

and HBRIC). The Base Case financial projections assume the following capital

structure:

Table 3: Base Case Capital Structure

|

Financing

Sources

|

Indicative

Investment

|

|

HBRIC Ltd

|

Up to $80m

|

|

Institutional

Investors

|

>$50

million

|

|

Crown

Irrigation Investments Ltd

|

TBD

|

|

Tukituki

Investments LP / He Toa Takitini

|

> $10 million

|

|

Total

funding sources

|

$276

million

|

Current projections assume that HBRIC

achieves a less than commercial return on its investment until the point at

which full uptake is achieved at which time it will receive the same returns as

other equity investors. The cost of CIIL funding is heavily discounted, but

this capital is required to be refinanced as farmer uptake ramps up.

In our view, in the absence of subsidised

capital from HBRIC and CIIL the RWSS is not viable under the current uptake

scenario. However, the Scheme is also critically dependent on capital from

parties seeking a commercial return on this investment. We note that if full

uptake (or at least a significant portion of uptake) was contracted at

financial close we would expect a reasonable proportion of the funding to be

provided by bank debt. This is the case with the more recent co-operative

schemes in the South Island and large scale infrastructure projects where a

significant portion of the revenue is contracted.

We asked BNZ Advisory to

consider a scenario which had 100% uptake at day 1 of operations. Under this

scenario a reasonable commercial capital structure is considered to be 75% bank

debt gearing via project finance and the balance funded by institutional

investors solely (that is, no public funding).

This scenario results in an

institutional investor IRR that would be within an acceptable range of returns

for institutional investors for such a project (70 year concession with no

uptake risk).

The requirement to balance the needs of

commercial investors and the providers of subsidised capital adds significant

complexity to the capital structure both in terms of the quantum of capital

needed from the different sources and how the terms of such investment are

balanced out to make sure that the objectives of each party are met and

aligned. While the inclusion of different investor classes in the capital

structure adds complexity there are benefits also. In particular the

involvement of institutional investors brings additional scrutiny and financial

and governance disciplines. In addition such investors can also bring

additional technical competencies. In this regard we note that while Trustpower

has recently decided not to invest in the RWSS it did play a significant role

in the process for selecting the preferred construction partner and in

validating key assumptions that have been incorporated in the financial models

developed by BNZ Advisory for the purposes of the RWSS business case.

The capital structure for

RWSS requires operating cash flows to be shared between investors on quite

different bases. We have undertaken extensive scenario analysis to satisfy

ourselves that there are no circumstances whereby HBRIC is required to commit

additional capital to fund the payment of returns to other equity investors.

However, we note that the final capital structure and who the investors will be

have yet to be finalised. Similarly, the terms under which funds will be

provided are still subject to negotiation and the agreement of final terms and

these could vary from what is currently being modelled.

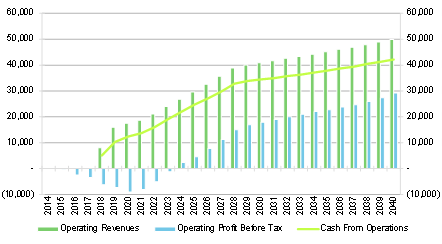

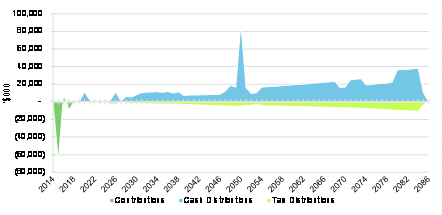

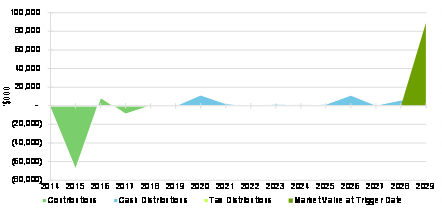

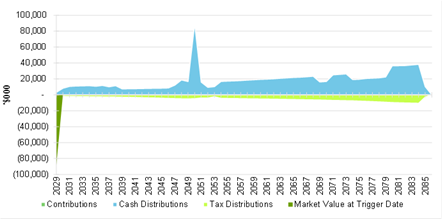

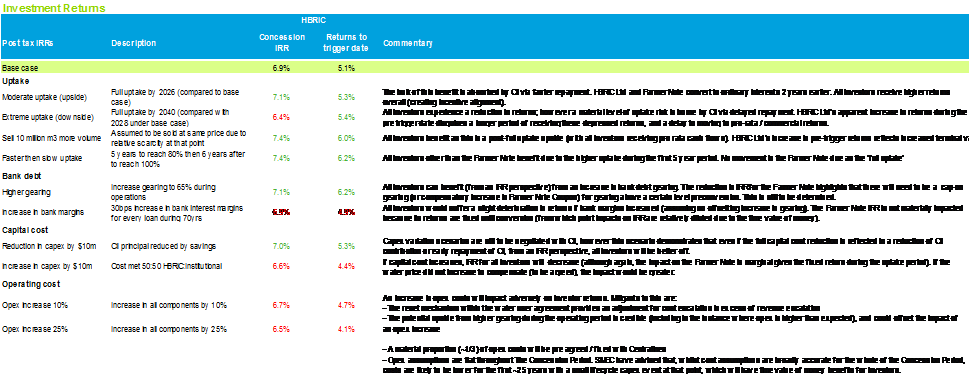

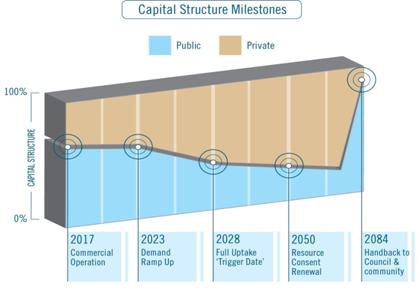

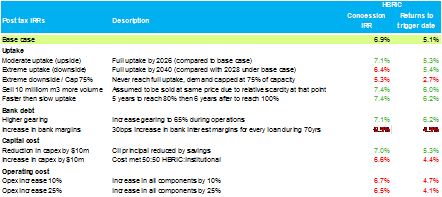

Financial Projections

The base case financial

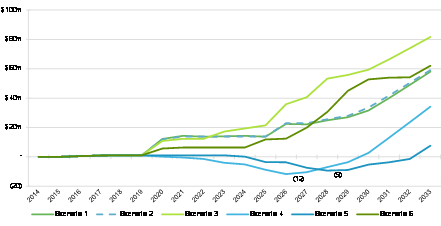

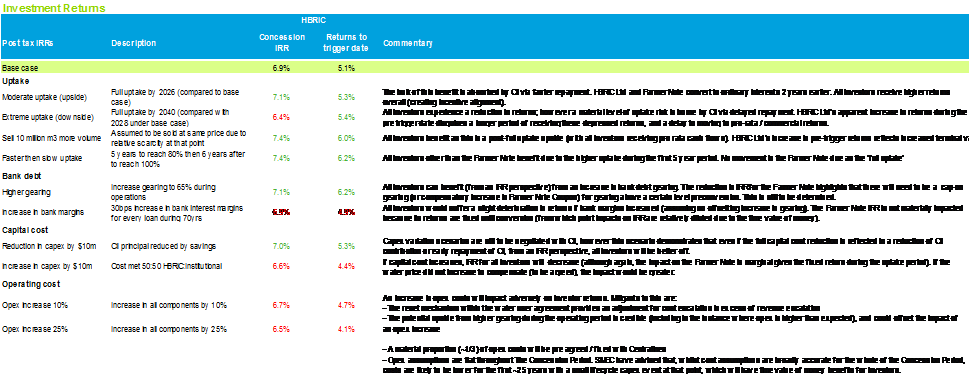

projections show HBRIC achieving a sub-commercial internal rate of return

(“IRR”) on its investment up to the point of full uptake which the

Base Case assumes is June 2028 (the “Trigger Date”) with an IRR

reflective of Brownfield investor returns (approximately 10% per annum) beyond

that point. We are satisfied that the IRRs have been correctly calculated but

note that a number of factors influence these calculations and in particular

assumptions as to:

· Uptake

· The quantum and timing of the introduction

of debt

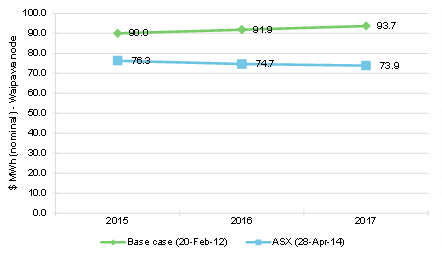

· Interest rate assumptions

· The assessed value of HBRIC’s

investment at full uptake

· Refinancing

The Base Case IRRs are

sensitive to changes in key assumptions such as the rate of uptake and increases

in capital expenditure. We note however that the proposed structure of the CIIL

capital significantly mitigates the risk to HBRIC of a lower than projected

uptake in the period up to the Trigger Date.

At full uptake the RWSS will

generate sufficient operating cash flows to provide market returns to all

capital providers. Further, at this point a range of options will be available

to HBRIC as to how it structures its investment. In particular infrastructure

assets such as the RWSS once fully committed are typically capable of

supporting a significant amount of bank debt thereby creating the opportunity

to return capital to the original investors.

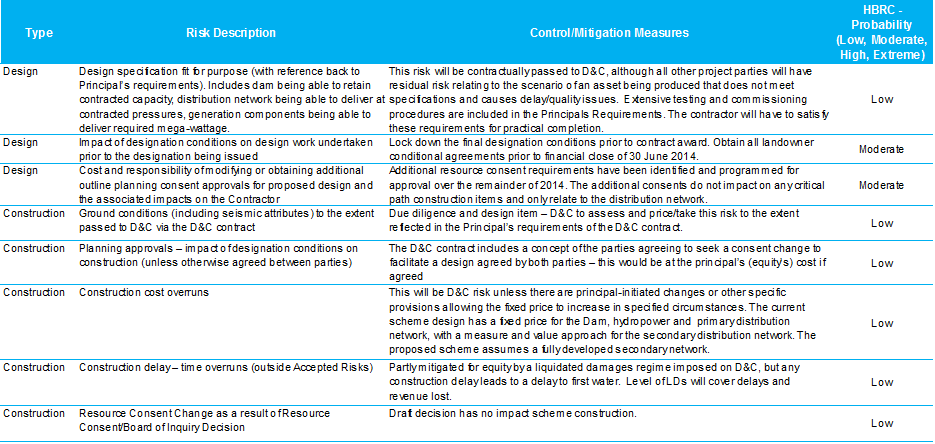

Risks and

Mitigants

In broad terms the risks are

allocated as follows:

· Design and construction risks are borne by

the D&C contractor. These include cost over runs and timing delays (where

there is no scope change initiated by the Scheme).

· Demand and uptake risk is borne by HBRIC

and the portion of the institutional investors’ return which is not met

by an investor fee. CIIL provides a timing buffer through the repayment

mechanism which depresses the repayment while uptake remains low thereby making

a higher proportion of cash flows available to HBRIC and institutional

investors than would otherwise be the case. If uptake was very slow then it

would also be likely to impact institutional investors’ investor fee.

· Operating costs and performance is largely

met by all parties in the post trigger date period, however in the ramp up

period this risk is borne by HBRIC and the proportion of institutional investor

returns not accounted for in the investor fee.

· Regulatory risk is borne by all investors

equally, assuming that the trigger date is reached prior to the end of the

first consent period.

Board of Inquiry

The RWSS is intended to be

a key component of the integrated management of the Tukituki catchment.

Increasing minimum flows and setting appropriate nutrient levels are expected

to improve environmental and cultural outcomes. Tukituki Plan Change 6 (a land

and water management plan) was developed to achieve these benefits and has been

subject to a Board of Inquiry (“BOI”) process under the management

of the Environmental Protection Agency (“EPA”). The BOI released

its draft determination on 15th April. We have not examined this determination

in detail but understand that while this does provide the necessary consents

for the RWSS to proceed, it also requires stricter limitations on nitrogen than

were requested in Plan Change 6. We understand the absolute levels required

under the BoIs draft decision are very stringent noting there is apparently

some ambiguity throughout the draft decision. This requirement as it is

currently framed is likely to affect land use options for farmers. A final

decision is now anticipated no later than June 28 at which point the economic

impacts will need to be fully assessed.

Conditions Precedent

The business case summarises

the key conditions precedent that must be met prior to financial close. These

are identified as being:

· Satisfactory EPA resource consent

conditions for the RWSS infrastructure and operations;

· A concession deed for the RWSS entered

into by HBRC and the Ruataniwha Water LP (“RWSS LP”) becoming

unconditional, including in respect of the required resource consents;

· A project agreement entered into between

HBRIC and RWSS LP becoming unconditional;

· A D&C agreement entered into between

the RWSS LP and the OHL-Hawkins consortium; and

· Receipt of commitments to purchase a

sufficient volume of irrigation water, as determined by agreement between HBRIC

and other investors. HBRIC has set its requirement at 40 M m3.

Conclusion

The business case for the

RWSS for the Hawkes Bay region is now at a critical stage. The draft

determination of the BOI has effectively given consent to the Scheme albeit

with restrictive terms in relation to the management of nitrogen. However, the

three major moving parts of the proposal – the construction contract, the

required level of initial contracted water and the capital structure –

have yet to be finalised. It is not unusual for projects of this nature to have

a degree of uncertainty right up to the point of financial close. However, in

our view there is a significant amount still to be achieved before financial

close. In this context we understand that the targeted contractual close has

been moved out by 3 months to 30 September 2014 with the expectation that water

user uptake will be well advanced by this time

Our review has been directed

at the business case for the RWSS as it currently stands. As note there are

still material elements of the RWSS proposition that have yet to be finalised.

It is likely that the final proposition will differ from that set out in the

current business case. Once the RWSS proposition is finalised there may be

benefit in a further review to confirm that HBRIC’s portion has not

altered materially.

Given the importance of the

RWSS and the significant effort and investment made in getting the Scheme to

its current state we believe that a decision to extend the financial close date

is sensible provided that there is a reasonable expectation that the conditions

precedent to financial close can be met within the extended timeframe.

|

Peer

Review of the Ruataniwha Water Storage Scheme Business Case

|

Attachment 1

|

2. Introduction

and Scope

In accordance with our letter of engagement dated 4

February 2014 Deloitte was engaged by HBRC to undertake a peer review of the

business case for the proposed RWSS prepared by HBRIC. This report sets out the

findings from our peer review.

Our Report will

be prepared for this purpose and no other.

Scope of Work

The scope and

basis of our work was limited to the matters set out in our Terms of Reference

as set out in Appendix 1 of this report. We make no comment as to the adequacy

of the scope.

Limitations of Scope

In undertaking

our assessment, we have relied upon and assumed without independent

verification, the accuracy and completeness of all information that is

available from public sources and all information that was provided to us by

HBRC and HBRIC. We have evaluated the information provided through analysis,

enquiry and examination for the purposes of forming our assessment. We accept

no responsibility for matters not covered by the Report or omitted due to the

limited nature of our review.

We note that the business

case, related financial analysis and supporting documentation that we have

reviewed were all prepared prior to the BOI issuing its draft determination.

Accordingly the scope of our work does not include any assessment of the

implications for the business case of this draft determination.

In preparing this report we

have been cognisant of the fact that much of the material reviewed is

commercially sensitive at this point in time. In this report we have

endeavoured to set out the basis for our finding without disclosing information

that could frustrate the ongoing process to finalise the details of the RWSS.

Report Use

The findings from

the procedures that we have conducted on your behalf have been reported to you

solely for the purpose of identifying potential issues that may be of interest to

HBRC. The report must not be made available or copied in whole or in part to

any person without the express written permission of Deloitte.

Deloitte accept

no responsibility for any reliance that may be placed on this report should it

be used by any party or for any purpose that has not been expressly agreed in

writing by Deloitte.

Report Conventions

Financial years

(“FY”) represented in this report represent the twelve months ended

31 March.

Figures presented

in this report are in New Zealand dollars (“$”) unless otherwise

stated and have been rounded to the nearest thousand. Tables have not been

adjusted to correct minor rounding errors.

Disclaimer

This report has

been prepared with care and diligence and the statements and conclusions in

this report are given in good faith and in the belief, on reasonable grounds,

that such statements and conclusions are not false or misleading. However, in

no way do we guarantee or otherwise warrant that any projections of future

profits, cash flows or financial position of the RWSS will be achieved.

Projections are inherently uncertain. They are predictions of future events

that cannot be assured. They are based upon assumptions, many of which are

beyond the control of HBRIC and its management. Actual results will vary from

the projections and these variations may be significantly more or less

favourable.

We assume no

responsibility arising in any way whatsoever for errors or omissions (including

responsibility to any person for negligence) for the preparation of this

assessment to the extent that such errors or omissions result from the

reasonable reliance on information provided by others or assumptions disclosed

in this report or assumptions reasonably taken as implicit.

|

Peer

Review of the Ruataniwha Water Storage Scheme Business Case

|

Attachment 1

|

3. Approach

Our approach has been directed at addressing:

· Whether the HBRC can have comfort

that its exposure to calls on capital can be limited to its current funding

envelope of up to $80 million;

· The circumstances under which HBRC may be

required to contribute additional capital and where possible the quantity of

those potential calls and the risks that such calls could eventuate;

· The extent to which HBRC can have comfort

that the projected returns on its investment have been accurately calculated

and are based on reasonable assumptions;

· How investment returns could vary under

different scenarios;

· Those other matters that we consider ought

to be brought to HBRIC’s attention in connection with its assessment of

the business case.

In undertaking our review we

have followed the process set out below:

· Reviewed relevant background information

including a cross section of submissions to the BOI process and local media

commentary;

· Provided guidance to HBRIC as to our

expectations as to the matters the business case would need to address;

· Reviewed the business case submitted to

HBRC on 16 March 2014;

· Reconciled the contents of the

business case to the guidance provided to HBRIC;

· Requested HBRIC and its financial advisor

(BNZ Advisory) to undertake additional analysis and documentation of the financial

case for the RWSS;

· Interviewed key advisors and reviewed

documentation relevant to their advice;

· Reviewed the financial case and related

assumptions;

· Cross referenced key assumptions back to

information obtained through our interview process or our review of relevant

documents;

· Requested HBRIC/BNZ Advisory undertake

additional financial analysis to test the sensitivity of financial outcomes to

changing key assumptions;

· Requested additional information and

comment from HBRIC’s advisors as necessary;

· Synthesised the information obtained and

the conclusions reached and documented these in our report.

We set out a summary of the

documents we have reviewed in Appendix 2. While we cross reference our analysis

to these documents extensively we have not sought to repeat the majority on the

analysis and commentary contained in those documents in this report. The key

documents that we reference are publicly available.

In following the process

outlined above we have identified the key interlocking components of the

business case from a financial perspective as being:

· The up-front capital investment in the

physical infrastructure of the RWSS;

· The business model which drives the

operating cash flows necessary to provide the investor returns;

· The ownership model and related investment

structure that allocates capital, risk and return to the different investor

categories;

· The interplay between these three

components underpins the financial case for the RWSS.

|

Peer

Review of the Ruataniwha Water Storage Scheme Business Case

|

Attachment 1

|

4. Investment Proposition

Overview

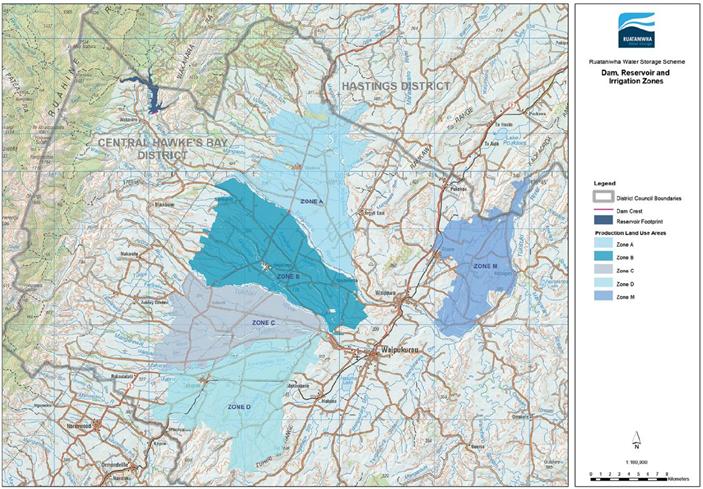

The RWSS is a proposed

long-term sustainable water storage solution for the Tukituki catchment.

Through the construction of a dam on the upper Makaroro River and associated

distribution system the RWSS will store high winter flows for irrigation use

during summer when pressure on water resource in the Tukituki catchment is at its

greatest. Appendix 3 sets out an overview map of the RWSS showing the reservoir

and dam site and the 5 currently defined water service zones (A, B, C, D &

M).

The scheme has been

established such that the dam will be built in the foothills where average

rainfall is significantly higher than on the plains. The dam will then release

water into the Makaroro River which feeds into the Waipawa River. From here the

flow moves down the river and is subsequently extracted at three separate river

intake structures located. The intakes are designed to supply water to Zone A,

Zones B-D, and Zone M, respectively. From the intakes the water is fed into the

main Primary Distribution System which consists of approximately 16km of canal

and 17km of pipeline. We note that an addition to the scheme from the original

feasibility report is that a new outfall from the canal on the Upper Tukituki

River to supply Zone M and other downstream irrigators. The water is then fed

into the Secondary Distribution Network which consists of approximately 200km

of pipeline length, property-off-takes, and pump stations which provide a fully

pressurised system at 35m of head pressure (3.5 bar) at the farm gate.

There are currently

significant environmental issues associated with the Tukituki Catchment. These

occur in the summer months when river flows are lowest. Generally there is a

nutrient imbalance in the system with excessive phosphorus generating slime and

algae growth. In addition, current water allocation exceeds Regional Plan limits

contributing to frequent very low flows during summer.

The RWSS is intended to help

mitigate environmental degradation of the Tukituki catchment while unlocking a

significant regional economic opportunity through the provision of water

through irrigation for more productive and higher value farming on the

Ruataniwha Plains. The RWSS is intended to be a key component of the integrated

management of the Tukituki catchment. Tukituki Plan Change 6 (a land and water

management plan) has been developed to achieve these benefits and has been

subject to a BOI process under the management of the EPA. The BOI submitted its

draft determination of 15th April 2014

Capital Cost

and Design

The capital cost of the RWSS

is currently estimated at approximately $276 million as set out Table 4 below.

In addition to the costs below there may

be an amount of capitalised interest on the CIIL funding which will accrue

during construction:

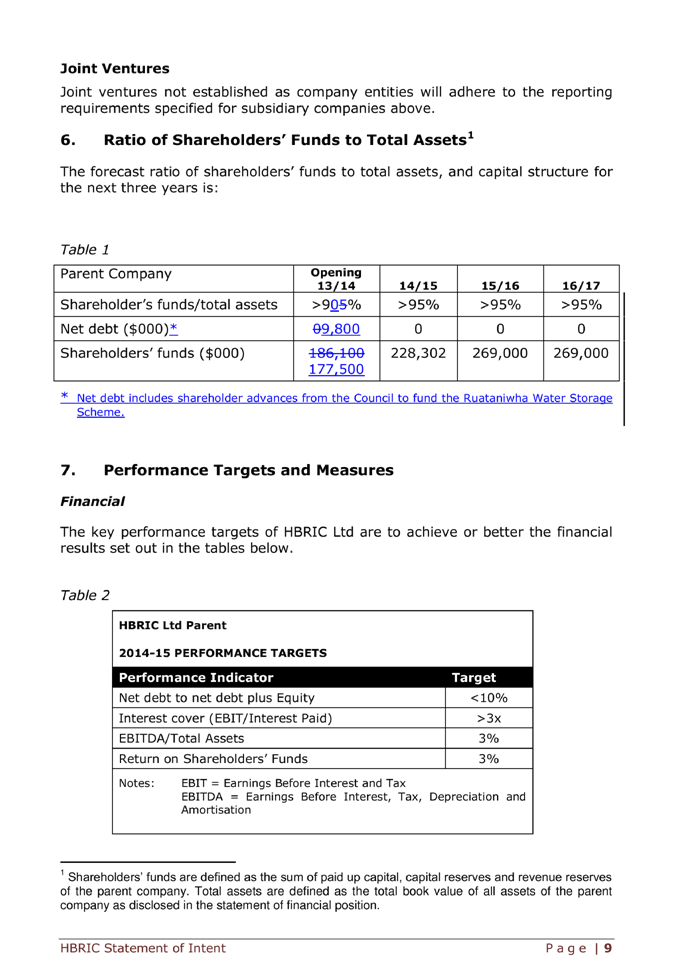

Table 4:

RWSS Capital Cost

|

Construction

Component

|

Price

|

%

|

Party

responsible

|

|

OHL-Hawkins (dam,

generation, distribution)

|

$243.0 million

|

87.9%

|

OHL-Hawkins

|

|

Development costs, Land,

Ancillary Roading & Surveying

|

$21.8 million

|

7.9%

|

Incurred or negotiated

prior to FC

|

|

Construction period

operating costs

|

$11.7 million

|

4.2%

|

RWSS Partnership

|

|

Total capital cost

|

$276.5 million

|

100%

|

|

The RWSS will comprise an 83 m high dam

capable of managing outflows of approximately 200 M m3 per year on

average and a primary (canal and pipeline) and secondary distribution network

(pipelines, pumps and property-off-takes). Due to the measure and value

component of the secondary distribution network a final cost will not be known

until final Scheme Design. All other facets of the RWSS OHL-Hawkins contract

(which comprises 87.9% of total capital costs) are based on a fixed cost and

measure and value component. We note that the development costs, land

purchases, and ancillary roading and surveying costs will be known at financial

close. On this basis approximately 95.8% of the capital cost will be known and

will be fixed (subject to no RWSS instigated design or scope changes).

The costed Scheme Design is based on a

hypothetical secondary distribution layout which:

· Provides for full uptake of 104 M m3 of

water per annum;

· Provides full workable pressure to 35 m

head[5];

and

· Takes account of approximately 44 M m3 of

water as signed up in irrigator EOI’s.

The RWSS has the potential

to increase farm productivity and allow higher value farming through irrigating

approximately 25,000 hectares (and an additional 17,000 hectare direct area of

influence) on the Ruataniwha Plains and down through the Tukituki catchment. In

addition to the 104 M m3 of water available to be contracted

for irrigation purposes a further 43.3 M m3 of water will be

available for environmental purposes (residual flows and flushing flows) and

52.3 M m3 for other purposes including being sold as spot water and

providing an additional buffer of water available for managing environmental

conditions.

Operating Model

The operating model is based

around the sale of water to farmers on a take or pay basis under the terms of a

water user agreement (“WUA”). A minimum level of contracted demand

of 40 M m3 (38.5 % of design capacity) has been specified by HBRIC

as being a condition precedent for financial close. The key driver of

financial performance for the RWSS is the rate at which uptake grows from this

initial level to full uptake of 104 M m3.

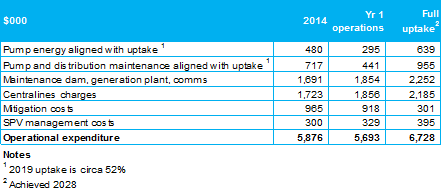

Operating costs are modest

and include pump energy costs, pump and distribution maintenance, mitigation

costs and SPV management costs.

Investment Model

The RWSS will be implemented

as a Build Own Operate Transfer (“BOOT”) contractual arrangement

with a 70 year concession period from the start of construction. At the end of

the Concession Period the Scheme assets will transfer back to the community:

primarily HBRC, but with minority interests continuing under eligible

investors.

Investment capital for the

RWSS is yet to be finalised but is assumed to be provided from a combination of

arm’s length sources (institutional investors, bank debt), related party

capital (farmers, local investors, local Iwi) and discounted capital sourced

from CIIL and HBRIC.

Because the RWSS will not

have full uptake immediately post construction subsidised capital is required

to support the Scheme until substantial uptake is achieved.

The proposed investment by

HBRIC is limited to a funding envelope of up to $80 million including the

approximately $9 million of development costs spent by HBRIC to date.

Key Benefits

The key benefits anticipated

from the Scheme are seen as being:

· Significant improvement in on farm

productivity due to the access to reliable water;

· Environmental improvements due to flushing

flows that will be available to be released into the Tukituki;

· Avoidance of the economic costs that will

occur should the RWSS not proceed and consequently access to water needing to

be scaled back;

· Increase in Regional GDP through a one-off

effect due to construction of the RWSS estimated at $330 million by Butcher

Partners Limited (“Butcher”); and

· Sustained increase in GDP from downstream

support and processing activities from land use changes estimated at $3,300

million by Butcher.

|

Peer

Review of the Ruataniwha Water Storage Scheme Business Case

|

Attachment 1

|

5. Capital

Investment

Introduction

In this section we consider

the risks generally associated with major capital projects and the challenges

specific to the RWSS. We consider the approach taken by the development team to

specifying and tendering the Scheme construction contract to date and assess

the proposed approach to contracting for the construction of the Scheme and the

effectiveness of this in managing the primary risks to which investors will be

exposed. We then consider the residual risks which investors will carry.

Financial risks in major capital

projects

Most major capital projects

contain three generic risks which expose investors in the projects to the risk

of financial loss. These are:

· Capital cost – the risk that the final project

cost is more than that expected at the point at which the investment commitment

is made. The investor then needs to make up the shortfall which impacts on the

investors’ returns and potentially the viability of the project.

· Delays – the risk that the project takes

longer to reach operation than expected meaning that revenues and other

benefits are delayed and returns to investors are delayed and/or reduced.

· Performance – the project fails to perform at

the expected level reducing the level of revenues generated and potentially

requiring additional capital to restore the project to an adequate level of

performance. Again, investor returns are reduced and, if the performance

shortfall is sufficiently large, the viability of the project may be

compromised.

These risks are allocated

between the investors and the construction contractor through the terms of the

construction contract signed between them with the financial consequences

resting with one or other under certain defined circumstances depending upon

the detail of the terms agreed.

The tendering process by

which a contractor is selected will determine the competitiveness of the price

for the construction contract and hence the value and returns to investors. A

competitive process with multiple parties tendering should deliver the lowest

market price for a given scope of work and best value to the investors.

Ruataniwha procurement process

HBRIC has run a competitive

process for the selection of its preferred construction contractor. The process

was structured as a request for expressions of interest followed by a

shortlisting and request for proposal.

HBRIC invited expressions of

interest from contractors for the combined design and construction of the

Scheme in February 2013. The process attracted five bidding consortia which

registered interest. This was reduced to a shortlist of two which were invited

to submit a full design and construct proposal. The successful shortlisted

consortia were:

· Bouygues Construction Australia Pty Ltd

– the Australian subsidiary of Bouygues SA, a listed global construction

company with headquarters in France; and

· OHL-Hawkins – 50/50 Joint Venture.

OHL is a listed Spanish construction company with international operations and

Hawkins Infrastructure Ltd a New Zealand owned construction company.

The shortlisted parties were

provided with an owner’s requirements document specifying the performance

requirements and scope of the Scheme with which bids were required to comply.

RFP’s were submitted by both parties in August 2013 and both proceeded to

a full detailed evaluation. The owners requirements document was updated on 16

April 2014, primarily in relation to the performance requirements for the

irrigation system.

The evaluation was

undertaken by an evaluation team comprising HBRIC, Trustpower (Investors),

National Australia Bank (financial advisor and debt specialist), SMEC Holdings

Limited (“SMEC”) (technical/engineering advisor), and an

independent technical procurement advisor. The panel was supported by other

subject matter experts.

Following the evaluation

process OHL-Hawkins was selected as the preferred contractor however the bid

price exceeded the affordability threshold. The evaluation team and its

advisors entered into a value engineering process with OHL-Hawkins and

identified alterations to scope and other changes which resulted in the design

and construct price being reduced to $240 million to $245 million.

Scheme construction scope

The business case provided

to Council in March 2014 contained the following summary of the OHL-Hawkins

scope of supply:

OHL-Hawkins

Dam and Associated Works Design Summary

· Central core rock fill dam (CCRD),

approximately 83m above existing river bed level, with a crest width of 7.0m at

RL 475.30m.

· Free overflow (ungated) Spillway located

on the left abutment with a sill level at RL 469.5m capable of passing the

Probable Maximum Flood of 775 cubic meters (“m3”) per

second and downstream plunge pool.

· A 4.5m D-shaped diversion tunnel

constructed by drill and blast methods and approximately 480m in length.

· Inclined reinforced concrete Intake

Structure with six distinct intake gates constructed with inverts between

462.95m RL to 414.7m.

· Outlet Works comprising 2200mm diameter

outlet pipe (penstock) and 600mm diameter environmental flow pipe, fixed cone

valves and stilling basin.

· Hydropower Station consisting of a Powerhouse

with installed turbine capacity of the order of 6.5 megawatts

(“MW”).

OHL-Hawkins

Distribution Design Summary

· Three screened and flow controlled river

intake structures located along the Waipawa River to supply water to Zone A,

Zones B-D, and Zone M, respectively.

· Primary Distribution System consisting of

approximately 16km of canal and 17km of pipeline length.

· A new outfall from the canal on the Upper

Tukituki River to supply Zone M and other downstream irrigators.

· Secondary Distribution Network consisting

of approximately 200km of pipeline length, 180 property-off-takes (with water

metering, isolation, and telemetry), and pump stations to provide a fully

pressurised system at 35m of head pressure (35 bar) at the farm gate.

Design and

Construction Contract – Transmission System

· In addition to the OHL-Hawkins contract

RWSS LP is currently negotiating a contract with Centralines for the provision

of electricity transmission to the dam site. While still in negotiation the

current proposal includes:

· A dedicated 33kV sub transmission feeder

to the new power station from the Transpower Waipawa GXP at Ongaonga;

· Five dedicated 11kV feeders to supply the

RWSS pumping stations;

· An upgrade to the Centralines existing

substation assets at Ongaonga, Takapau and Waipawa and Transpower assets

necessary to meet the projected loads (6.5MVA) and generation (6.5MW); and

· Fibre telecommunications infrastructure

between all RWSS load/generation locations.

Discussion of approach taken

The construction contract

tender process is not yet complete. OHL-Hawkins has been identified as the

preferred contractor and a revised scope negotiated. The contract has been

further updated on 16 April 2014 with more detail added in relation to the

commercial details including liquidated damages, however the construction

contract has yet to be finalised. To date the contract comprises the draft

provided to the contractor during the RFP process which has been updated with

some of the content from the contractor’s RFP response. We were advised

during discussions with management that the contract has been “left to

one side” whilst the value engineering exercise was completed. Our

comments on the approach are made in this context and are focussed on how the

three major risks above have been dealt with and how any specific challenges of

this Scheme have been addressed.

Price certainty

The bid was requested as a

fixed price for design and construct. This is normal practice where the

required performance and scope of the Scheme can be adequately specified. It

also eliminates the interface between designer and constructor which, if

managed as separate contracts by the investor or owner, can create additional

risk through unclear accountability in the event of problems with the Scheme or

its eventual performance.

One of the difficulties with

the Scheme is that the full extent of initial irrigation water take-up and the

location of the offtake points are currently unknown. The location of the

initial offtake points is likely to be spread throughout the total area to be

irrigated and it is extremely difficult to design a distribution system which