Meeting of the Hawke's Bay Regional Council

Date: Wednesday 30 April 2014

Time: 9.00am

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

NAPIER

|

Agenda

Item Subject Page

1. Welcome/Prayer/Apologies/Notices

2. Conflict of Interest Declarations

3. Confirmation of Minutes of the

Regional Council Meeting held on 26 March 2014

4. Matters Arising from Minutes of the Regional Council

Meeting held on 26 March 2014

5. Call for any Minor Items Not on the Agenda

6. Follow-ups from Previous Council Meetings

Decision Items

7. Affixing of Common Seal

8. Recommendations from the Environment and Services

Committee Meeting Held 9 April 2014

9. Recommendations from the Corporate and Strategic Committee

10. Adoption of the RWSS Investment Statement of Proposal for

Public Consultation

11. HBRIC Ltd RWSS Budget Reforecast

12. Draft HBRIC Ltd 2014-15 Statement of Intent

Information or Performance Monitoring

13. Annual Plan 2013-14 Progress Report for Nine Months ending

31 March, Including Reforecasting

14. Monthly Work Plan Looking Forward Through May 2014

15. Chairman's Monthly Report (to be tabled)

16. Minor Items Not on the Agenda

Decision Items (Public Excluded)

17. Hawke's Bay Regional Investment Company Draft 2014-15

Statement of Intent

18. Confirmation

of Public Excluded Minutes of the Regional Council Meeting held on 26 March

2014

HAWKE’S BAY REGIONAL COUNCIL

Environment

and Services Committee

Wednesday 30 April 2014

SUBJECT: Call for any Minor Items Not on the Agenda

Reason for Report

1. Under standing orders,

SO 3.7.6:

“Where an item is not on the agenda for a

meeting,

(a) That item

may be discussed at that meeting if:

(i) that

item is a minor matter relating to the general business of the local authority;

and

(ii) the

presiding member explains at the beginning of the meeting, at a time when it is

open to the public, that the item will be discussed at the meeting; but

(b) No

resolution, decision, or recommendation may be made in respect of that item except

to refer that item to a subsequent meeting of the local authority for further

discussion.”

2. The Chairman will

request any items councillors wish to be added for discussion at today’s

meeting and these will be duly noted, if accepted by the Chairman, for

discussion as Agenda Item 16.

|

Recommendations

That Council accepts

the following minor items not on the agenda, for discussion as item 16:

1.

|

|

Leeanne Hooper

Governance & Corporate

Administration Manager

|

Liz Lambert

Chief Executive

|

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 30 April 2014

SUBJECT: Follow-ups from Previous Council Meetings

Reason for Report

1. Attachment

1 lists items raised at previous meetings that require follow-ups.

All items indicate who is responsible for each, when it is expected to be

completed and a brief status comment. Once the items have been completed and

reported to Council they will be removed from the list.

Decision Making Process

2. Council is required to make a decision in accordance with

Part 6 Sub-Part 1, of the Local Government Act 2002 (the Act). Staff have

assessed the requirements contained within this section of the Act in relation

to this item and have concluded that as this report is for information only and

no decision is required in terms of the Local Government Act’s provisions, the

decision making procedures set out in the Act do not apply.

|

Recommendation

1. That Council receives the report “Follow-ups

from Previous Council Meetings”.

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

|

1View

|

Follow-ups

from Previous Regional Council Meetings

|

|

|

|

Follow-ups from Previous Regional

Council Meetings

|

Attachment 1

|

Follow-ups from previous Regional Council Meetings

Meeting Held 26 March 2014

|

|

Agenda Item

|

Action

|

Responsible

|

Due Date

|

Status Comment

|

|

1

|

Recommendations

from Corporate & Strategic Committee

|

Councillors

to forward names to CE for appointment to Council Appointments Committee

|

Councillors

|

9 April

|

Paper

to make appointments at 28 May Council meeting

|

|

2

|

Recommendations

from Corporate & Strategic Committee

|

Local Governance

Statement to be published & publicly available

|

L Hooper

|

|

Final

proof completed and being published

|

|

3

|

Monthly Work Plan

Looking Forward

|

Investigate

effective means of including dates of upcoming events. Paper content to

reflect work being carried out in the immediate future, not historic

|

Exec

|

30 April

|

Refinement

of content will be ongoing

|

|

Follow-ups from Previous Regional

Council Meetings

|

Attachment 1

|

LGOIMA Requests Received

between 19 March and 22 April 2014

|

Request Status

|

Request Date

|

Requested By

|

Request Summary

|

Group Manager Responsible for Response

|

|

Active

|

15/04/2014

|

Ian McIntosh

|

Various information in relation to the wastewater discharges

from the Waipawa, Waipuk and Otane ww treatment plants

|

Iain Maxwell

|

|

Active

|

4/04/2014

|

Rex McIntyre

|

Data request for breakdown of investment made by HBRC and

Landowners over the last 25 years regarding 1) Flood protection, 2) Possum

Control, 3) Regional Landcare scheme , 4) New pest control projects

|

Mike Adye

|

|

Active

|

1/04/2014

|

Marty Sharp - DomPost

|

Consent applications or Pre applications from Tag Oil

|

Iain Maxwell

|

|

Completed

|

22/03/2014

|

Steve Moynihan

|

Haumoana Groyne System

1. Does the council agree that this is the geomorphological process taking

place?

2. Is the council monitoring these impacts?

3. Does the council consider that the impacts need to be evaluated?

4. Does the council consider that there is need for concern over the erosion

caused in the river mouth?

5. Does the council believe there is a need for mitigation of these effects?

|

Mike Adye

|

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 30 April 2014

SUBJECT: Affixing of Common Seal

Reason for Report

1. The Common Seal of the

Council has been affixed to the following documents and signed by the Chairman

or Deputy Chairman and Chief Executive or a Group Manager.

|

|

|

Seal No.

|

Date

|

|

1.1

|

Residential Leasehold Land Sales

1.1.1 Lot 12

DP 4488

CT 55/87

- Transfer

1.1.2 Lot 31

DP 12692

CT E1/53

- Transfer

1.1.3 Lot 406

DP 11483

CT C1/801

- Agreement for Sale and Purchase

- Transfer

1.1.4 Lot 457

DP 9059

CT K1/164

- Agreement for Sale and Purchase

- Transfer

1.1.5 Lot 2

DP 17073

CT J3/1403

- Agreement for Sale and Purchase

1.1.6 Lot 2

DP 13384

CT F1/1023

- Agreement for Sale and Purchase

|

3769

3770

3771

3775

3772

3773

3774

3776

|

25 March 2014

26 March 2014

4 April 2014

23 April 2014

14 April 2014

14 April 2014

14 April 2014

23 April 2014

|

Decision Making Process

2. Council is required to

make every decision in accordance with the provisions of Sections 77, 78, 80,

81 and 82 of the Local Government Act 2002 (the Act). Staff have assessed the

requirements contained within these sections of the Act in relation to this item

and have concluded the following:

2.1 Sections 97 and 88 of the Act do not apply;

2.2 Council can exercise its discretion under Section

79(1)(a) and 82(3) of the Act and make a decision on this issue without

conferring directly with the community or others due to the nature and

significance of the issue to be considered and decided;

2.3 That the decision to apply the

Common Seal reflects previous policy or other decisions of Council which (where

applicable) will have been subject to the Act’s required decision making

process.

|

Recommendations

That Council:

1. Agrees

that the decisions to be made are not significant under the criteria

contained in Council’s adopted policy on significance and that Council can

exercise its discretion under Sections 79(1)(a) and 82(3) of the Local

Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

2. Confirms

the action to affix the Common Seal.

|

|

Diane Wisely

Executive

Assistant

|

Liz Lambert

Chief

Executive

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 30 April 2014

SUBJECT: Recommendations from the Environment and Services Committee

Meeting Held 9 April 2014

Reason for Report

1. The following matters

were considered by the Environment and Services Committee on Wednesday 9 April 2014

and are now presented to Council for consideration and approval.

Decision Making

Process

2. These items have all

been specifically considered at Committee level.

|

Recommendations

That Council:

1. Agrees

that the decisions to be made are not significant under the criteria

contained in Council’s adopted policy on significance and that Council can

exercise its discretion under Sections 79(1)(a) and 82(3) of the Local

Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

Infrastructure Asset Insurance

2. Adopts the HBRC

Disaster Damage Risk Management Policy included following

recommendation 11.

Coastal Strategy

3. Agrees to

work with in collaboration with Napier City Council, Hastings District

Council and Treaty of Waitangi settlement groups with mana whenua mandate

over the portion of coast being considered, on the development of a strategy

for the management of the coast between Clifton and Tangoio.

4. Agrees

that the project will be governed by a Joint Committee made up of 2 elected

members from each of Napier City, Hastings District and Hawke’s Bay Regional

Councils and up to three Iwi representatives.

5. Agrees to

continue discussions with He Toa Takitini, Mana Ahuriri Inc, and Maungaharuru

Tangitū Trust, seeking their agreement to participate in the Strategy

development process and nominate one representative from each organisation to

sit on the Joint Committee to oversee the project

6. Agrees

that the Joint Committee will be delegated the authority to determine its

terms of Reference, the Terms of Reference for a Technical Advisory Group,

and the scope and timeline for the project, taking into account the size of

the project and the resource available to it.

7. Notes that

resourcing requirements for HBRC’s involvement in the development of the

Strategy will be included in the draft LTP 2015-25.

8. Appoints

Councillor Beaven and Councillor Scott as the HBRC representatives on the

Joint Committee.

Regional Pest Plan review

9. Establishes

a working group of 3-5 councillors to assist staff in:

9.1 Establishing a

timeline and scope for reviewing the Regional Pest Management plans, and

9.2 Completing the

review process.

10. Appoints

the following Councillors to the working group:

10.2 Councillor Christine

Scott

10.3 Councillor Rex Graham

10.4 Councillor Dave Pipe

10.5 Councillor Fenton

Wilson

10.6 Councillor Rick

Barker (on his agreement)

11. Notes that the

following reports were received at the Environment and Services Committee meeting

on Wednesday 9 April:

11.1 Follow-ups from previous Environment and Services Committee

meetings

11.2 Nimmo-Bell Alternative Investments Report

11.3 Science Reports, including:

11.3.1 Karamu Characterisation Report

11.4 National Horticultural Field Days

11.5 QEII National Trust Presentation

11.6 Statutory Advocacy.

HBRC Disaster Damage Risk

Management Policy

1. Background

This

policy supersedes HBRC’s Disaster Damage Risk Management Policy adopted by

Council in 2007, and subsequent decisions regarding this issue.

This

review (March 2014) has confirmed that HBRC continues to face considerable

ongoing financial risk from a natural disaster event.

This

policy deals specifically with disaster damage risks to HBRC owned or

administered infrastructure assets, and the requirement for HBRC to respond

to an event that causes major disruption to the community.

In

addition to its role as the manager of flood control and drainage schemes

throughout the region, HBRC will play a significant role in any response as a

result of its civil defence responsibilities including resourcing to the

civil defence emergency coordination centre, and the provision of

reconnaissance and hazard information to input to the response planning and

decision making. There may also be a significant cost in securing information

and data arising from the event, especially a flood event. Significant flood

events provide a valuable source of data to enable verification of models and

assumptions made as part of HBRC staff flood hazard assessment and flood

control and drainage activities.

HBRC

may qualify for Central Government assistance for the reinstatement of HBRC

infrastructure assets in the event of a disaster however such assistance is

more likely to be forthcoming following a significant disaster affecting the

Heretaunga Plains. Central government assistance is less likely to be

available for a disaster event impacting a small portion of the region.

While

HBRC should meet the expectations of central government by implementing this

policy, HBRC acknowledge that central government and LAPP funding may not be

available to cover the costs of every disaster. This policy also makes some

provision to cover that risk.

2. Financial

Risk Management Initiatives

HBRC

will mitigate its financial risk associated with a disaster event. The

following will make up HBRC risk mitigation approach.

2.1 Disaster

damage to Council-owned fixed assets

· Insurance policies

will be held with appropriate indemnity or replacement value cover; and

· Assets will continue

to be effectively maintained.

2.2 Disaster

damage leading to Third Party liability

· The employment of suitably qualified and

experienced staff and robust decision making processes.

· Appropriate and relevant HBRC policy and

sound technical practices for maintaining HBRC assets thereby minimising any

exposure through negligence.

· An insurance policy will be held to cover

this risk.

2.3 Disaster

impact on Council’s Business Continuance Capability

· A Business

Continuance Plan will be maintained and regularly updated which contains

specific actions and ongoing requirements to help check systems to enable

HBRC to continue to operate after a disaster.

2.4 Sound

maintenance of infrastructure assets

· Infrastructure assets

will be maintained in accordance with asset management plans. This will

include an annual programme of maintenance and a regular assessment of asset

condition.

· Where feasible and

economic this may include improvements to increase asset resilience to damage

from a natural disaster.

2.5 Use

of surplus operating funds and reprioritisation of maintenance and capital

works

· Following any disaster

event the first call to fund the reinstatement costs of infrastructure assets

will be any surplus operating funds held by the Scheme under which the assets

are administered.

· The second call will

be through the reprioritisation of the maintenance or capital expenditure

programme for that Scheme.

· Scheme depreciation

reserves will only be utilised where a depreciable asset requires

replacement, in which case the difference between the depreciated value of

that asset and its replacement cost can be sourced from the relevant

depreciation reserve. Note that if the new asset results in an increase in

the level of service provided by the Scheme, the difference between the cost

of the new asset and the replacement cost of the current asset will be a cost

on the Scheme.

· Only after these

options have been fully assessed and funding from these sources committed,

will Council agreement to funds from other financial reserves being drawn on

be sought.

2.6 HBRC

held financial reserves

· Financial reserves

will be held to mitigate HBRC’s financial exposure to

natural hazards. The following reserves will be held by HBRC

o The Wairoa

District Flood Reserve

o The small schemes

disaster reserve

o The Heretaunga

Plains Schemes disaster reserve

o The Regional

Disaster Reserve

2.7 Membership

of LAPP

· HBRC will maintain its

membership of the Local Authority Protection Programme (LAPP) and meet the

requirements of LAPP.

2.8 Maintain

proper planning for risk management

· In order to comply

with the criteria set out in the National Civil Defence Emergency Management

Plan, HBRC will maintain proper planning for risk management. Implementation

of this policy will demonstrate this.

3. Criteria

for Contributions and Withdrawals From Reserves

Criteria for

contributions and withdrawals from these reserves are:

3.1 The Wairoa

Flood Reserve

The reserve will be

managed such that the capital purchasing power of the reserve sum, less any

capital authorised to be withdrawn from the reserve by HBRC, shall be

maintained by increasing the reserve each year by 2.5% from interest earned

by the reserve.

The balance of

interest earned by the reserve shall be used to subsidise work undertaken

through the Wairoa Rivers and Streams Scheme to manage and reduce flood risk

to public and/or community infrastructure within the Wairoa District.

Council may

authorise capital sums to be drawn from the reserve to undertake specific

major flood mitigation or erosion protection projects within the Wairoa

District or for flood recovery works in the same area.

3.2 The Small

Schemes Disaster Reserve

The small schemes

disaster reserve shall provide for the following flood control and drainage

schemes:

· Upper Tukituki Flood

control scheme

· Upper Makara flood

control scheme

· Paeroa Scheme

· Porangahau flood

control Scheme

· Poukawa Drainage

Scheme

· Ohuia – Whakaki

Drainage Scheme

· Esk River flood

control Scheme

· Whirinaki Flood

Control Scheme

· Maraetotara River

Control Scheme

· Kopuawhara Flood

Scheme

· Te Ngarue River

Control Scheme

· Opoho Scheme

· Kairakau Community

Scheme

The following assets

within the Wairoa Rivers and Streams Scheme:

o Tawhara Flood

detention dam and outlet channel

o Tuhara Drain

o Nuhaka Railway

Drain

The reserve shall be

made up of all of the current Scheme disaster reserves held by each of the

above Schemes. As at 30 June 2013 the combined balance was $680,768.

Each Scheme will

contribute annually to the reserve in proportion to the value of Scheme

assets, the vulnerability of the scheme assets (vulnerability factor) and the

vulnerability of the Scheme (scheme factor). Annual contributions will be

calculated as follows.

(Value of asset class) x (vulnerability factor) x (scheme

factor)/1000

All Schemes with no

assets, e.g. Te Ngarue and Porangahau shall contribute a fixed amount of $20

per km, x a scheme vulnerability factor, of river channel under the Scheme.

Annual contributions

shall be made to the reserve as set out in Table 6 each year that the reserve

balance is below the LAPP excess (i.e. currently $1,259,000). Interest

earned by the reserve shall be credited to the reserve. Annual contributions

may increase each year in accordance with inflation.

When the reserve

balance is above the LAPP excess the Group Manager Asset Management and Group

Manager Corporate Services may agree to a discount on the annual contribution

from each scheme. No annual contributions from schemes will be made if the

reserve balance is in excess of 2 times the LAPP excess. If the reserve is

over 2.5 times the LAPP excess the Group Managers may agree to return money

from reserve income to the Schemes.

At Council

discretion individual schemes will be eligible to draw up to 100 times their

annual contribution from the reserve, provided the reserve holds adequate

funds.

The following costs

may be eligible for payment from this Reserve.

· The cost of

reinstatement of assets identified on the LAPP asset schedule, or their

replacement with alternative assets that will reinstate a similar level of

service provided by the original assets, less any provision held within the

Scheme depreciation fund for reinstatement of that asset, up to a maximum of

the LAPP excess or central government threshold, whichever is the greater.

· The cost of repair

works within a scheme area (excluding district wide schemes). Eligible

repair works may include channel works which improve flood flow capacity,

bank protection works where this work will assist in protecting a residential

dwelling (however this could be subject to a contribution from the building’s

owner to recognise any private good, and may be subject to the owner

providing details of other insurance claims made or received), or any other

works subject to Council approval. The Reserve will not be used for the

purchase of land. Where land upon which an asset has been sited is lost, the

asset should be relocated.

3.3 The

Heretaunga Plains Scheme Disaster Reserve

The Heretaunga

Plains Schemes disaster reserve shall provide for the following flood control

and drainage schemes.

· The Heretaunga Plains

Scheme – Rivers

· Napier Meeanee

Drainage area

· Brookfields Awatoto

Drainage area

· Pakowhai Drainage area

· Muddy Creek Drainage

area

· Haumoana Drainage area

· Karamu and Tributaries

Drainage area

· Raupare Twyford

drainage area

· Tutaekuri-Waimate

Drainage area

· Puninga Drainage area

The reserve shall be

made up of all of the current Scheme disaster reserves held by each of the

above Schemes. As at 30 June 2013 the combined balance was $1,799,022.

Each Scheme will

contribute annually to the reserve in proportion to the value of Scheme

assets, the vulnerability of the scheme assets (vulnerability factor) and the

vulnerability of the Scheme (scheme factor). Annual contributions will be

calculated as follows:

Value of asset class x vulnerability factor x scheme factor/1000.

Annual contributions

shall be made to the reserve as set out in Table 7 at any time that the

reserve balance is below the LAPP excess. (i.e. currently $1,259,000).

Annual contributions may increase each year in accordance with inflation.

When the reserve

balance is above the LAPP excess the Group Manager Asset Management and Group

Manager Corporate Services may agree to a lesser amount being contributed

from each scheme or a contribution from this reserve being made to the

regional disaster reserve. No Scheme contributions will be made if the

reserve balance is in excess of 1.5 times the LAPP excess. If the reserve is

over 2.0 times the LAPP excess the Group Managers may agree to return money

from the reserve income to the Schemes.

At Council

discretion individual schemes will be eligible to draw from the reserve up to

100 times their annual contribution from the reserve, provided the reserve

holds adequate funds.

Withdrawal from the

reserve will only be considered after consideration of deferment of routine

annual maintenance and programmed capital works. Any payments from the

reserve shall be at the discretion of Council.

The following costs

may be eligible for payment from this Reserve.

· The cost of

reinstatement of assets identified on the LAPP asset schedule, or their

replacement with alternative assets that will reinstate a similar level of

service provided by the original assets, less any provision held within the

Scheme depreciation fund for reinstatement of that asset, up to a maximum of

the LAPP excess or central government threshold, whichever is the greater.

· The cost of repair

works within a scheme area. Eligible repair works may include channel works

which improve flood flow capacity and bank protection works, however where

this work will assist in protecting a residential or commercial building this

may be subject to the owner providing details of other insurance claims made

or received and agreeing to an appropriate contribution, or any other works

subject to Council approval.

3.4 The

Regional Disaster Reserve

This reserve is to

be managed such that the value of its investments (including any cash)

remains within the range of $2.75m - $3.75m and that its investments exceed

$3.75m in value and some investments may be sold and the proceeds credited to

Council’s general funding operating account.

A return of 2.5% on

average balance held by the reserve during the year will accrue as an

increase in the value of the reserve, when the Reserve has a value in excess

of $3M. The earnings in excess of the 2.5% per annum will be credited to

Council’s general funding operating account.

The regional

disaster reserve may, at Council discretion, provide for the following.

a. The cost of

responding to and managing an event. This could include:

· Unbudgeted

staff time

· Plant and

equipment hire including helicopters

· Employment

of unbudgeted external resource to support staff in the response.

b. The cost of

reinstatement of any uninsured assets. This includes recreational assets that

are not part of a flood protection and drainage Scheme, i.e. pathways and

associated assets that are not constructed on a stopbank, and assets within

open space areas.

c. Any

difference between the deductable (excess) on any insurance or LAPP policy

and the threshold for eligibility for central government assistance, which is

unable to be funded through Scheme disaster Reserve or other funds.

d. Any

unfunded reinstatement costs above the excess of any insurance policy and the

threshold for eligibility for central government assistance because central

government determines that HBRC is not eligible for central government

assistance because the disaster does not trigger the criteria set out in the

Guide to the National Civil Defence Plan, and/or LAPP is unable to provide

cover for whatever reason.

e. The

possibility of the cost of reinstating the level of service provided by the assets costs considerably more than their estimated

replacement or optimised replacement value, and central government and/or

HBRC’s insurers refuse to cover a portion of that cost.

f. The cost

of any works that are considered betterment but are necessary to reinstate

community protection, or because the community demands a higher level of

protection.

g. Liability

as a member of LAPP in the event that the LAPP fund is exhausted.

4. Criteria

for the Build Up, Use and Maintenance of Disaster Damage Insurance Excess

Reserves

· Reserves will always

be a funding call of last resort e.g. if priorities can be re-established to

cover the expenditure, or if unbudgeted income is received these sources of

funds will be used.

· All efforts will be

made to maximise any disaster recovery contributions from Central Government

or any other sources.

5. Provision

to Meet Disaster Damage Insurance Excesses and Commitments

5.1 Regional

Disaster Reserve

The required reserve

will be managed in accordance with HBRC’s investment policies.

5.2 Flood and

Drainage Schemes

The

Group Manager, Asset Management and Group Manager Corporate Services have

delegated authority to manage the Small Scheme disaster reserve and the

Heretaunga Plains Scheme Disaster reserve in accordance with HBRC’s

investment policy.

6. Frequency

of Disaster Damage Risk Management Reviews

Reviews

will be carried out at least once every six years.

|

|

Mike Adye

Group

Manager

Asset

Management

|

Liz Lambert

Chief

Executive

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 30 April 2014

SUBJECT: Recommendations from the Corporate and Strategic Committee

Reason for Report

1. The following matters

were considered by the Corporate and Strategic Committee on 16 April 2014

and are now presented to Council for consideration and approval.

Decision Making

Process

2. These items have all

been specifically considered at the Committee level.

|

Recommendations

That Council:

1. Agrees

that the decisions to be made are not significant under the criteria

contained in Council’s adopted policy on significance and that Council can

exercise its discretion under Sections 79(1)(a) and 82(3) of the Local

Government Act 2002 and make decisions on this issue without conferring

directly with the community and persons likely to be affected by or to have

an interest in the decision due to the nature and

significance of the issue to be considered and decided.

Primary Producer's Roundtable -

Councillor Representative

2. Appoints

two Councillor representatives to the Hawke’s Bay Primary Producers Round

Table; being Councillors Rex Graham and Fenton Wilson.

RWSS Evaluation - Operating Position and Rates Impacts

3. Recommends

to HBRIC Ltd that it continues to negotiate with investors regarding the

timing of draw downs.

Draft Ruataniwha Water Storage

Scheme Investment Statement of Proposal

4. Approves

the content of the draft Statement of Proposal covering the proposed

investment in the Ruataniwha Water Storage Scheme, subject to receipt of a

satisfactory business case independent review report and subject to any

additions and amendments sought at the Corporate and Strategic Committee

meeting.

Ruataniwha Water Storage

Proposition Consultation

5. Approves

the expenditure of $50,000 from Project 876 (Unspecified Projects) for the

Ruataniwha Water Storage Proposition Consultation if Council decides to

recommend investment in the Scheme.

Review of Standing Orders

6. Continues

to amend the New Zealand Standard NZS 9202:2003 Model Standing Orders for

meetings of Local Authorities and Community Boards as the need arises.

7. Notes that

the following reports were received at the Corporate and Strategic Committee

meeting:

7.1 Follow-ups From

Previous Corporate and Strategic Committee Meetings

7.2 Environmental

Protection Authority Board of Enquiry Draft Decisions on Plan Change 6 and

RWSS Consents

7.3 Deloitte Peer

Review of HBRIC Ltd RWSS Business Case - Interim Report

7.4 RWSS

Evaluation - Operating Position and Rates Impacts

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

There are no

attachments for this report.

HAWKE’S BAY REGIONAL COUNCIL

Wednesday 30 April 2014

SUBJECT: Adoption of the RWSS Investment Statement of Proposal for

Public Consultation

Reason for Report

1. Having received a

business and investment case from Hawke’s Bay Regional Investment Company Ltd

to invest in the Ruataniwha Water Storage Scheme HBRC has advised HBRIC Ltd that

any decision to invest up to $80 million in the RWSS is subject to HBRC:

1.1. having received and

being satisfied with its own legal advice on the RWWS documents and all related

legal matters;

1.2. having received and

being satisfied with its advice from the RWSS Business Case Assessment process

and advisers;

1.3. having received and

being satisfied with its advice from the Alternative Investments Analysis

process and advisers;

1.4. having received the

Draft and Final Decisions of EPA Board of Inquiry processes on Plan Change 6

and the RWSS Resource Consents and being satisfied that the RWSS can proceed as

proposed under the decisions made;

1.5. having undertaken a

Special Consultative Procedure of public consultation regarding whether or not

to invest in the RWSS via HBRIC Ltd, and having made its determination to make such

an investment; and

1.6. receiving

confirmation from HBRIC Ltd that all Conditions Precedent to Financial Close of

the investment by all investing parties in the RWLP have been either satisfied

or waived by agreement of the parties.

2. This agenda item sets

out, for Council’s consideration, the proposed Summary for the Statement of

Proposal and the Statement of Proposal to trigger the Special Consultative

Procedure, as envisaged by 1.5 above. The other processes identified in para.1

above are at various stages of completion and must all be achieved if any final

investment is to be made.

3. At the Council Meeting

on 31 October 2012 it was resolved that a special consultative process should

be undertaken to determine community views on Council’s investment in the Ruataniwha

Water Storage Scheme.

4. The Statement of

Proposal is appended as Attachment 1.

5. The Summary of the Statement

of Proposal is appended as Attachment 2.

6. The proposed

distribution of these statements to interested parties in the community was set

out in the paper to the Corporate and Strategic Committee on 16 April which

outlined the proposition for consultation on the Statement of Proposal.

Special Consultative Procedure

7. For a number of

councillors this will be the first time that they will experience decision-making

under a Special Consultative Procedure. It is worthwhile explaining how it

works, as interpreted following findings of the courts through case law.

8. The Special

Consultative procedure is a process involving an exchange of information

between two parties (in this case HBRC and the Hawke’s Bay community). HBRC

provides its proposal(s) to resolve a particular issue, or information about

the issue or problem, in return the community provides its views on the issue

or problem. The third element of the consultative process involves the local

authority considering the information it received during the earlier part of

the process and deciding whether and how that should affect its proposal or its

view on the issue.

9. From time to time community groups may claim

that “their views were ignored” or “the council didn’t listen” or even “the

community voted against this decision”. That is to misunderstand the nature of

consultation under a model of representative democracy. The results of

consultation are a source of information into a decision-making process, not a

substitute for information. A local authority is obliged to consider

information received during a consultation process with an open mind, but

consultation need not be determinative.

10. Nor does consultation involve one party

presenting or telling the other what it intends to do. The party doing the

consultation may bring a proposal or working plan to the process (as is

proposed in the attached Statement of Proposal). This does not mean that the proposal

is “the final word”, indeed HBRC must demonstrate a willingness to hear views

and consider change (even if these means starting anew).

Statement of Proposal – Key Points

11. The Statement of

Proposal examines two options – that HBRC invests up to $80 million in the

Ruataniwha Water Storage Scheme (RWSS) or that HBRC not invest. No other

options have been considered, as:

11.1. If the RWSS is to proceed it will rely

upon up to $80 million from HBRC as a key investor (so no intermediate figures

are seen as feasible for the project); and

11.2. The specific resolution from 31 October

2012 as to undertake the Special Consultative Procedure on this proposed

investment, and did not envisage that HBRC would consider investments in any

other projects as part of this proposal.

12. The Statement of

Proposal includes the key elements of the RWSS:

12.1. The environmental rationale for the

construction of long-term sustainable water storage infrastructure on the

Ruataniwha Plains;

12.2. The economic objectives of this

investment – particularly improving agricultural production and productivity,

while enhancing environmental management of the Tukituki catchment;

12.3. The proposed governance and management

of HBRC’s investment through the Ruataniwha Water Limited Partnership (RWLP);

12.4. The risks of investing in RWLP, and the

conditions precedent which address these risks.

13. In addition the Statement of Proposal

refers interested parties to additional reports, already publicly available,

that provide further detailed information on the RWSS.

Preferred Option

14. The preferred option set out in the

Statement of Proposal is based upon the recommendations of Council’s investment

company – HBRIC Ltd – who have been tasked by Council with preparing a business

case for Council on the RWSS. The business case was delivered to HBRC on 26

March 2014 and referred to Deloitte for an independent peer review.

15. Upon receiving the Business and

Investment Case for the Ruataniwha Water Storage Scheme Council noted that the

HBRIC Ltd business case states that:

15.1. investment by Council, via HBRIC Ltd, in

the RWSS to a quantum of up to $80 million is essential, together with a

large level of Crown Irrigation Investment Ltd (CII) debt funding, in order for

the project to set a water price that is financially viable for both water

users and investors.

15.2. the RWSS will make an

important contribution to achieving Council’s strategic environmental

objectives for the Tukituki river and catchment as set out in Land Water Us

2050 and Proposed Plan Change 6, by:

15.2.1. ensuring a sustained minimum flow

on the Makaroro River below the dam of 1.23 cumecs, which will sustain

more than 20% of the 7-Day Mean Annual Flow of the Tukituki at Red Bridge;

15.2.2. providing for up

to four flushing flows per year of up to one million cubic metres each to

assist Council to manage and mitigate periphyton build-up in the lower Tukituki

in particular, thus enhancing the ecological and recreational status of the

river;

15.2.3. providing water

to sustain minimum flows set for the Waipawa River at the RDS gauging site and

Tukituki River at Tapairau Rd (also ensuring that current consent holders

linked to those flows are not adversely affected by the scheme);

15.2.4. enabling existing

water users supplied by run-of-river and connected groundwater takes (which

negatively affect the low flows of Waipawa and Tukituki rivers) to be supplied

with stored water as an alternative; and

15.2.5. there are six

substantial environmental management, mitigation and offset projects included

in the RWSS project ranging from the catchment headwater to the lower estuary.

15.3. the RWSS Consents will

require, at their own cost, Ruataniwha Water Limited Partnership (RWLP) and

Ruataniwha Water GP Ltd (RWGP) as the entities, respectively, owning and

operating the Scheme, to undertake comprehensive water quality monitoring of 15

variables monthly and two variables annually at 16 sites throughout the

catchment, commencing 24 months before any water is supplied, and that the data

from these measurements will be integrated with Council’s own environmental

monitoring programmes.

15.4. the proposed Production

Land Use Conditions of the RWSS consents:

15.4.1. requires that

production land water users being supplied by the RWSS must prepare Farm

Environmental Monitoring Plans (FEMP) which must be regularly audited;

15.4.2. ensures the

limits for nitrogen/nitrate management set in Proposed Plan Change 6 (which are

based on site-specific toxicity guidelines developed by NIWA) and phosphorus

emissions (no net increase in emissions at a sub-catchment level) are met;

15.4.3. requires E

coli levels in surface and groundwater, and a range of other environmental

monitoring and management requirements that are, individually and collectively,

at least as stringent and generally more stringent than are applied to

irrigated land use elsewhere in New Zealand;

15.4.4. requires that

stock are excluded from all lakes, wetlands, permanently or intermittently

flowing rivers on any property supplied by the RWSS.

15.5. the RWSS will make

substantial contributions to Council’s strategic regional economic development

objectives, and that:

15.5.1. the RWSS is projected to generate

$250 million per year of ongoing value-added (i.e. not gross) economic benefits

in total, and the one-off benefit of the construction project is estimated as

being $410 million over the construction period;

15.5.2. the value added

on-farm is projected to be $73 million/year; the value added to farm support

and services industries is projected to be $63 million/year; and the value

added to processing and processing support industries is projected to be $120

million/year;

15.5.3. the regional

economic multiplier of the value added on-farm is 3.4, and thus the added-value

economic benefits of the RWSS are distributed through the wider regional

economy, consistent with the findings of ex-post studies of the economic

benefits of the Opuha water storage dam; and

15.5.4. the ongoing

economic impact of value added from the RWSS is estimated to have a Net Present

Value of $3.7 billion, discounted at 5% over 70 years.

15.6. the RWSS is projected

to have substantial employment and social benefits, and is projected:

15.6.1. to generate more

than 2,500 full-time equivalent jobs, widely distributed over the agriculture,

manufacturing, wholesale and retail trade, transport and communications, rural

contracting, utilities and construction, and other services employment sectors;

and

15.6.2. to generate

ongoing household income of $60 million/year in farming and farm-support

industries (likely to be significantly concentrated in Central Hawkes Bay) and

$67 million/year in processing and processing support industries (likely to be

more widely distributed throughout the region).

15.7. in relation to

engagement and agreements with mana whenua and kaitiaki:

15.7.1. HBRIC Ltd has

entered into an agreement with Te Taiwhenua o Tamatea (Tamatea) that provides

for ongoing close engagement between RWLP, the intended owner of the RWSS, and

Tamatea through the life of the RWSS and that both the Concession Deed between

Council and RWLP and the Project Agreement between HBRIC Ltd and RWLP require

acknowledgement of and adherence to this agreement;

15.7.2. Council and HBRIC

Ltd have entered into two Joint Memoranda with Ngati Kahangunu Iwi Incorporated

(NKII) and Te Taiwhenau o Heretaunga with Te Taiwhenua o Tamatea (ToHTT) a

party to the first and confirming their agreement to the second, which, inter

alia, provides for engagement of all the Memoranda parties in a Kaitiaki

Runganga (expanding the membership of the Mana Whenua Working Group of the

Tamatea Agreement) and for additional monitoring activities in the lower

Tukituki, both of which have been added to the proposed RWSS Consent Conditions

presented to the Board of Inquiry (BoI); and

15.7.3. the Joint

Memoranda noted in 9.2 above are also acknowledged in the Concession Deed and

the Project Agreement documents in the same manner as the Tamatea Agreement,

requiring adherence to what is agreed in the Memoranda.

15.8. in regard to Council’s

Proposed Plan Change 6:

15.8.1. the BoI must

decide on Plan Change 6 first, then decide whether the Resource Consents sought

for the RWSS are in conformance with its decisions on Plan Change 6;

15.8.2. the key decision

to be made by the BoI that could affect the RWSS is likely to be between what

Council has proposed as nitrate limits for the Tukituki which are based on

nitrate toxicity to fish, OR much lower nitrate limits as sought by a range of

submitters (15% to 20% of Council’s proposal); and

15.8.3. if the BoI

decides to impose lower nitrate limits than proposed by Council there would be

significant consequences for the RWSS in regard to whether, and how, it could

manage nitrate emissions within a lower set of limits.

15.9. in regard to the

consents sought for the RWSS via the BoI process:

15.9.1. no expert

engineering evidence was submitted that contested the design, location,

foundation conditions, engineering geology and seismology in regard to the dam

and related infrastructure or the proposed operation of that infrastructure;

15.9.2. no expert

engineering evidence was submitted that contested the design, location or

proposed operation of the distribution system and its infrastructure such as

canals, pipelines, outfalls etc.

15.10. in relation to the

Environmental Protection Authority (EPA) decision-making process:

15.10.1. a Draft Decision on

Proposed Plan Change 6 and the RWSS Consents is expected on 15 April 2014; (Note:

these have been received) and

15.10.2. a Final Decision

must be made by 28 May 2014.

15.11. that HBRIC Ltd and

co-investors in the intended RWLP, are finalising a Design and Construction

contract that is, to the maximum extent practicable, on a fixed cost fixed time

basis for the Dam and Distribution infrastructure, which:

15.11.1. will be subject to

expert panel oversight in the final design stage prior to application for

building consent from Waikato Regional Council;

15.11.2. is able to deliver

an increased volume of 104 million cubic metres of water per year (a

significant increase from the 91 million cubic metres projected at Feasibility

stage) without affecting the residual or flushing or other environmental flows

required in the RWSS Consents;

15.11.3. provides water to

all users on piped distribution at a pressure of 3.5 bars at the farm gate (a

significant improvement on nil pressure and supply up to 2km from farm gate

projected at Feasibility stage); and

15.11.4. enables a

contracted water price of 23 c/cubic metre plus a variable charge for

pressurization of up to 3 c/cubic metre (in the mid range of 22-25 c/cubic

metre projected at Feasibility stage).

15.12. That:

15.12.1. HBRIC Ltd has

received Expressions of Interest (EoI) for 47 million cubic metres of

water/year to be purchased, and that HBRIC Ltd is now engaged on a process of

seeking confirmed contracts for purchase under a standard Water User Agreement

that requires compliance with all Land Use Conditions of the RWSS Consents

submitted to the BoI process; and

15.12.2. achieving a target

level of 40 milllion cubic metres/year of contracted water, or such other

volume as is agreed by the parties investing in RWLP, is a Condition Precedent

for Financial Close

15.13. That:

15.13.1. the RWSS is

intended to be owned and operated as a modified Build, Own, Operate and

Transfer project over a 70-year Concession Period, governed by a Concession

Deed between Council and RWLP, the intended Owner of the RWSS Assets and

Infrastructure during the Concession Period, and also by a Project Agreement

between HBRIC Ltd and RWLP;

15.13.2. Ruataniwha Water GP

Ltd, the General Partner of the RWLP, will be the Operator of the RWSS Assets

and Infrastructure during the Concession Period;

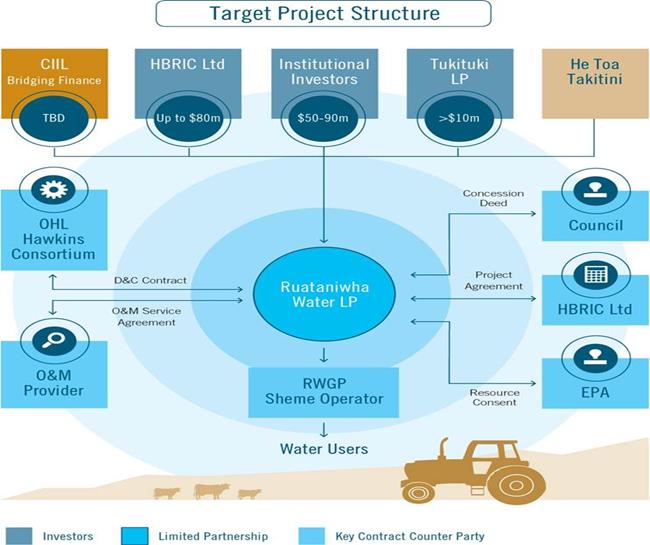

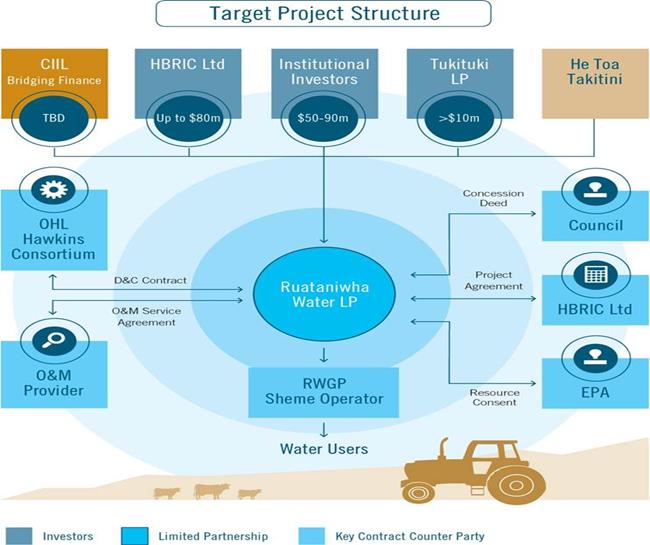

15.13.3. investors in RWLP

will hold shares in RWGP in the same proportions as their ownership in RWLP;

15.13.4. local eligible

investors, including farmers who have contracted for water from the RWSS, will

have their investment aggregated by another Limited Partnership (Tukituki

Investment LP) which will invest the aggregated amount in RWLP. It is also

expected that, to the extent that there is local iwi investment in the RWSS, a

similar separate LP (or LPs) will make any local iwi investment in RWLP;

15.13.5. at the end of the

Concession Period ownership of the RWSS Assets and Infrastructure will be

handed back to Council/HBRIC Ltd or successor, except that, to the proportional

extent of ownership of the RWLP by local investors LP, and any local iwi LP,

such owners will have continuing proportional ownership of the Assets and

Infrastructure, or of the entity succeeding RWLP that owns the Assets and

Infrastructure.

15.14. In regard to the capital

structure and capital raising process:

15.14.1. equity ownership in

RWLP is expected to be subscribed for, at Financial Close, by a combination of

HBRIC Ltd, a number of institutional investors, Tukituki Investment Limited

Partner (TILP), and possibly by an Iwi LP;

15.14.2. the capital raising

process will continue until Financial Close and will not be confirmed until all

Conditions Precedent are satisfied and/or waived by agreement of the investor

parties;

15.14.3. it is expected that

HBRIC Ltd will subscribe for up to $80 million of equity in RWLP, with a

current likely investment amount of $72 million, of which $63 million will be

in cash and $9 million of already expended development expenditure and

intellectual property which will be recognized by the allocation of equity

interests;

15.14.4. it is expected that

CII will provide debt financing to the RWLP subject to their investment terms

being met, the conditions precedent being met and shareholder approval;

15.14.5. the different

equity investors will have different terms reflecting, inter alia, their

different target rates of return, priority for cash-flows generated from water

sales, and whether they have interests terminating at the end of the Concession

Period or have ongoing equity interest beyond the Concession Period;

15.14.6. the terms

negotiated and agreed between the investor parties, at Financial Close, have

been (or will have been) negotiated and agreed between the parties on an

arms-length, commercial basis.

15.15. In relation to the terms

under which HBRIC Ltd proposes to invest in RWLP:

15.15.1. HBRIC Ltd will

accept a low priority for cash-flows during the uptake period before the exit

of CII, in order to ensure an acceptable water price and to encourage uptake;

15.15.2. during the uptake

period, HBRIC Ltd will make a lower rate of return (base-case modelled at 5%

post-tax internal rate of return (IRR), from both cash yield and incremental

increase in value of interests) than institutional investors over that period;

15.15.3. after the uptake

period, for the remainder of the Concession Period, HBRIC Ltd will make the

same return as all other investors (base-case modelled as 10% post-tax IRR) – a

good rate of return for a “brownfields” infrastructure investment);

15.15.4. the lower rate of

return and slower rate to profitability that HBRIC Ltd proposes to accept on

its investment in RWSS/RWLP are consistent with the provisions of its Statement

of Intent (SoI) with Council, when the investment is intended to “Help achieve

Council’s regional strategic economic development objectives by investing in

assets that will benefit the Hawke’s Bay Region as a whole.” (Pages 3 and 4

2013/2014 SoI)

15.15.5. As noted in 7

above, the RWSS is projected to make substantial contributions to Council’s

regional strategic economic development objectives.

15.16. That the Directors of

HBRIC Ltd have given detailed consideration to extensive negotiations with

counterparties in regard to investment quantum, risk and return, and have

exercised their judgment, in particular, on the following key points:

15.16.1. the quantum

proposed of up to $80 million to be invested by HBRIC Ltd (depending in part on

the amount of capital raised via TILP) is appropriate and necessary (together

with the large amount of CII funding) to achieve a water price that is viable

for users, that will encourage uptake, and will also make the project viable

for commercial investors;

15.16.2. the 5% post-tax IRR

on HBRIC Ltd’s investment that is modelled in the base case over the uptake

period is necessary (together with the low interest rate on CII debt) both to

set an appropriate water price and to enable early cash-flows to be prioritised

to institutional investors (delaying these cash-flows would be more expensive

for the project and for HBRIC Ltd overall);

15.16.3. the HBRIC Ltd rate

of return during the uptake period is less than a commercial rate of return,

but this is acceptable under HBRIC Ltd’s Statement of Intent in order to

achieve regional economic development;

15.16.4. the HBRIC Ltd rate

of return during the uptake period being less than a commercial rate of return

also reflects environmental contributions noted in 4 above;

15.16.5. the 10% post-tax

IRR return that is modelled in the base case for HBRIC Ltd (and all investors)

after the uptake period and CII has exited the project is an appropriate and

good commercial rate of return on the investment;

15.16.6. HBRIC Ltd’s low

rate of return during uptake and commercial rate of return post the uptake

period mean that HBRIC Ltd should be a long-term investor in the project, at

least until significantly more than halfway through the first consent period;

15.16.7. there is some level

of risk that, under a slow uptake scenario, a significant fraction of the CII

debt will have to be repaid as a lump sum under a “hard exit” by CII, after

about year 15 of the project. In such a situation, which is considered

unlikely, HBRIC Ltd could be required to fund in the order of $12-24 million of

that payback. HBRIC Ltd has a number of options to fund such a payment, if

that eventuates, or to avoid making its contribution by allowing other local

investors to take up or expand their equity interests in RWLP; and

15.16.8. the level of

governance representation that HBRIC Ltd will have in the Ruataniwha Water General Partner Ltd (which will operate the project) is

considered appropriate for the proportion of equity interests held by HBRIC

Ltd.

15.17. Discussions have been

held between HBRIC Ltd and Council management regarding the level of dividends

HBRIC Ltd can forecast in comparison with reduced cash flows to Council from

interest and other cash yields from its current investments, and:

15.17.1. Council's cash

investment into HBRIC Ltd is projected to be in two tranches – circa $22

million in 2014/15 and circa $41 million in 2015/16;

15.17.2. Discussions to date

indicate that in the years after 2015/16 there is unlikely to be significantly

less cash-flow from HBRIC Ltd to Council's operating budget than would be

received by Council if the current investments were maintained;

15.17.3. In 2014/15 there

may be a shortfall of circa $400,000 between forecast dividend payments and the

reduction in Council's cash-flow from its existing investments as a consequence

of withdrawing $22 million from cash-generating investments, and a shortfall of

circa $2,750,000 in 2015/16 as a consequence of withdrawing a further $41

million from cash-generating investments;

15.17.4. HBRIC Ltd holds the

view that these cash-flow differences for Council in 2014/15 and 2015/16 cannot

be prudently met by HBRIC Ltd requiring a higher level of dividend from Napier

Port than is currently projected in Napier Port's Statement of Corporate

Intent, particularly in 2015/16; and

15.17.5. Council and HBRIC

Ltd management will continue to discuss how to mitigate the impact on Council's

cash flows of changing $63 million of Council's investment portfolio from

cash-generating investments to growth investments from which cash-flow can not

be expected for a period of time.

15.17.6. HBRIC Ltd’s cash

distributions from the RWSS become more reliable after the three to five year

period post-construction, and increase significantly after the uptake period

which will enable HBRIC Ltd to meet shareholder dividend requirements.

15.18. The following Conditions

Precedent that must be either satisfied or waived by agreement before Financial

Close:

15.18.1. Granting of resource

consent for RWSS, which in turn is recommended as being workable by all

investors;

15.18.2. Subscription of a

minimum of 40 million cubic metres (m3) of water contracts (Water

User Agreements);

15.18.3. Securing the

private and public funding required to build Scheme infrastructure;

15.18.4. A bankable

construction contract with construction risk allocation adequately addressed

through a fixed-time, fixed-cost arrangement.

15.19. In the counter-factual

situation where the RWSS does not proceed either because of BoI

decisions or because Council declines to make the investment proposed in the

RWSS, that:

15.19.1. Plan Change 6, in

whatever form is decided by the BoI, will become effective, without the RWSS,

including increased minimum flows, water allocation limits, nutrient management

limits etc.

15.19.2. the environmental

minimum and flushing flows set out in 4.1 to 4.3 will not be provided;

15.19.3. existing water

users linked to minimum flows on Waipawa at the RDS gauging site and Tukituki

at Tapairau Rd will not be shielded from the increased minimum flows set out in

Proposed Plan Change 6;

15.19.4. existing water

users supplied by run-of-river and connected groundwater takes will suffer

economic impacts from the increased minimum flows in the catchment set out in

Proposed Plan Change 6;

15.19.5. the contributions

to strategic regional economic development, amounting to more than $4 billion,

set out in 7.1 to 7.4 will not be generated; and

15.19.6. the employment

(>2,500 jobs) and household income benefits (>$125 million/year) set out

in 8.1 and 8.2 will not be generated.

Deloitte

Business Case Peer Review

16. Deloitte was appointed by HBRC in January

2014 to undertake an independent peer review of the Business and Investment

Case presented by HBRIC Ltd to HBRC. The independent peer review of the

business case is an important part of the overall assessment process for HBRC

and has relevance for the assessment of options in the Statement of Proposal.

17. The final written report by Deloitte is

to be made public by the end of April. An interim report was presented to the

Corporate and Strategic Committee meeting on 16 April and the findings

contained in that presentation are summarised in the Statement of Proposal.

18. In particular, Deloitte was tasked with

addressing:

18.1. Whether HBRC can have comfort that its

exposure to calls on capital can be limited to its current funding envelope of

$60-80million;

18.2. The circumstances under which HBRC may

be required to contribute additional capital and where possible the quantity of

those potential calls and the risks that such calls could eventuate;

18.3. The extent to which HBRC can have

comfort that the projected returns on its investment have been accurately

calculated and are based on reasonable assumptions;

18.4. How investment returns could vary under

different scenarios;

18.5. Any other matters that Deloitte

consider ought to be brought to HBRC’s attention in connection with its

assessment of the business case.

19. Deloitte has identified the key

interlocking components of the business case from a financial perspective as

being:

19.1. The up-front capital investment in the

physical infrastructure of the RWSS;

19.2. The business model which drives the

operating cash flows necessary to provide the investor returns;

19.3. The ownership model and related

investment structure that allocates capital, risk and return to the different

investor;

19.4. Fundamentally however the critical

factor is demand – how long it takes to get to full uptake and the profile of

this uptake.

20. In assessing these factors as the core

building blocks of the project, Deloitte has satisfied itself as to the

reasonableness of the assumptions supporting these building blocks and the way

the financial model has been constructed and returns calculated within the

HBRIC Ltd business case. They have then used the model to:

20.1. Assess the overall return on capital

from the project under different uptake scenarios;

20.2. Demonstrate how the internal rate of

returns have been calculated;

20.3. Use sensitivity analysis to identify

which assumptions matter and which are immaterial in terms of the financial

case;

20.4. Identify the implications for HBRC

capital requirements and returns under different scenarios.

21. The key risk to the

project as identified by Deloitte is how long the project takes to get to full

uptake of water. This is important for two reasons:

21.1. If the level and pace

of uptake are lower and slower respectively than the base case then there is a

risk that HBRC will be called upon for additional capital (together with all

other investors)

21.2. There is a risk that

HBRC’s rate of return may be lower than that estimated in the business case e.g.

the business case assumes a rate of return of 6.9% at full uptake, but this

could range between 6.4 and 7.4% depending on the level and speed of uptake.

22. Deloitte is very

confident that the risks from any overruns in capital costs during construction

are very well covered by the fixed price, fixed time contract and will not

impact upon HBRC.

Conclusion

23. The Special Consultative Procedure is one

element of the six-part investigations that are being undertaken before HBRC

will confirm to HBRIC Ltd any decision to invest up to $80 million of new

equity in HBRIC Ltd for the RWSS.

24. HBRC has advised HBRIC Ltd that any final

decision is subject to HBRC:

24.1. having received and

being satisfied with its own legal advice on the RWWS documents and all related

legal matters;

24.2. having received and

being satisfied with its advice from the RWSS Business Case Assessment process

and advisers;

24.3. having received and

being satisfied with its advice from the Alternative Investments Analysis

process and advisers;

24.4. having received the

Draft and Final Decisions of EPA Board of Inquiry processes on Plan Change 6

and the RWSS Resource Consents and being satisfied that the RWSS can proceed as

proposed under the decisions made;

24.5. having undertaken a

Special Consultative Procedure of public consultation regarding whether or not

to invest in the RWSS via HBRIC Ltd, and having made its determination to make

such an investment; and

24.6. receiving confirmation

from HBRIC Ltd that all Conditions Precedent to Financial Close of the

investment by all investing parties in the RWLP have been either satisfied or

waived by agreement of the parties;

25. A decision on adopting the attached

Statement of Proposal, and the Summary of the Statement of Proposal, does not

commit Council to a final decision on its investment but fulfils an undertaking

given by Council in October 2012 to consult the public on the investment.

Decision Making

Process

26. The recommendations in

this paper cover the proposal to carry out a special consultative process for

the establishment of the proposed Investment Company. This special

consultative process is in accordance with the provisions of the Local

Government Act 2002.

|

Recommendations

1. That

Council adopts the Summary of Statement of Proposal

and the Statement of Proposal covering the proposed Hawke’s Bay Regional

Council investment of up to $80 million in the Ruataniwha Water Storage

Scheme and approves these as the basis for public consultation to be

undertaken under the Special Consultative Procedure provisions of the Local

Government Act 2002.

|

|

Liz Lambert

Chief

Executive

|

|

Attachment/s

|

1View

|

RWSS

Investment Statement of Proposal

|

|

|

|

2View

|

RWSS Summary

of Statement of Proposal

|

|

|

|

RWSS Investment Statement of Proposal

|

Attachment 1

|

STATEMENT OF

PROPOSAL –

INVESTING

IN THE RUATANIWHA WATER STORAGE SCHEME

Hawke’s Bay Regional Investment

Company Limited (HBRIC Ltd) has developed a business plan to invest in the Ruataniwha

Water Storage Scheme (RWSS). It has recommended to its owner, Hawke’s Bay

Regional Council (HBRC) that HBRC invest up to $80 million in accordance with its

intention to do so as announced in its Long Term Plan 2012-2022 (LTP 2012-2022).

The RWSS involves:

· Constructing a reservoir and dam in

the Tukituki Catchment in Central Hawke’s Bay to collect and store water.

· Developing and implementing a system

to distribute water to farm gates and other supply points to irrigate land in

Central Hawkes Bay.

· Operating the distribution system to

deliver stored water to farmers and other users on a commercial basis (i.e.

customers pay a price for distribution that makes the system financially

viable).

· Hydro-electric power generation

Investment in RWSS should generate

both short and long term social, cultural and economic benefits for the Hawke’s

Bay region and improve long term returns from HBRC’s investment portfolio.

LTP 2012-2022 included a proposal

that HBRC invest up to $80 million in RWSS, (including its initial investment

in feasibility studies) in partnership with other public and private sector

investors and subject to full evaluation of the proposal.

Following public consultation on the

LTP 2012-2022 and the establishment of HBRIC Ltd, HBRC transferred its initial

investment in feasibility and other studies on the RWSS to HBRIC Ltd, assigning

it the task of taking the proposed investment through technical and financial

evaluation; applying for consents required under the RMA and managing the

consenting process; commissioning contractors to build the reservoir and dam

and distribution system and formulating a robust plan for funding the

investment in conjunction with iwi, interested investors, farmers, and others. HBRIC

Ltd has completed these tasks and, supported by a Business Case, sought HBRC’s

approval for its investment proposition and funding sufficient to enable HBRIC

Ltd to acquire an approximately one-third share in the entity owning the RWSS.

Public meetings to discuss the issue

of potentially investing in the RWSS were held as part of the LTP 2012‑2022

consultation process. Following this, and in the consideration of comments and

submissions received from the public, HBRC resolved to undertake a process of

special consultation under the Local Government Act with the intention of

enabling HBRC to hear submissions and make appropriate decisions in 2014.

The Special Consultative Procedure

(SCP) involves releasing a proposal for public comment. HBRC has now begun the

procedure by adopting this Statement of Proposal as a statement of its intent. HBRC

wishes to invest in RWSS and this Statement of Proposal provides an evaluation

of the proposed course of action.

The RWSS is a long-term

sustainable water storage infrastructure investment intended to help unlock

high value agricultural production in the Ruataniwha Plains by collecting,

storing and distributing water in an efficient and effective way to irrigate

around 25,000ha of agricultural land on the Ruataniwha Plains.

Invested funds will be used to construct

a dam and reservoir on the upper Makaroro River and an associated distribution

system to store high winter water flows for irrigation use during summer when

the pressure on water available in the Tukituki catchment is highest, as well

as generating hydro electricity.

As a consequence RWSS will help

mitigate environmental degradation of the Tukituki catchment, while providing

the opportunity to generate significant regional economic and social benefits

by providing a stable and reliable source of water through irrigation to enable

more productive and higher value farming on the Ruataniwha Plains.

HBRC, through HBRIC Ltd, will

establish and invest in the Ruataniwha Water Limited Partnership (RWLP) to own

and operate the RWSS. HBRC (through HBRIC Ltd) currently proposes to invest up

to $71.5 million (as required in HBRIC Ltd’s Business Case) to own approximately

one-third share of RWLP. HBRIC Ltd’s business case states that the eventual

investment required from HBRC could be up to $80 million. Other shareholders

who will own the remaining two-thirds of RWLP are expected to include institutional

and interested infrastructure investors.

In addition Crown Irrigation

Investments Limited, a Crown-entity company under the Crown Entities Act 2004,

established by the Government to make bridging investments in development of

irrigation schemes (and other regional water infrastructure), is expected to

provide debt funding to RWLP on favourable terms, and any other financing

required will be borrowed on normal commercial terms.

The project cost is expected to be in

the vicinity of $275 million and construction of the dam, reservoir and

distribution system will take around three years from the date of receiving all

regulatory consents. Assuming approvals are received by mid 2014, it is expected

operations will commence in the third quarter of 2017.

2.1 Objectives

HBRC’s objectives for

this investment are to:

· Help achieve its strategic development objectives for

the Hawke’s Bay Region as a whole through establishing and managing a key

infrastructure resource to improve agricultural production and productivity

while enhancing environmental management of the Tukituki catchment;

· Encourage and enable increased private sector

investment in the region’s export oriented agricultural sector;

· Generate economic, social and cultural benefits in the

region;

· Help improve management and control of environmental

risks over the long term, especially those relating to water quantity and water

quality;

· Generate satisfactory tax paid returns to HBRC from the

financial performance of the invested assets;

· Quantify and manage particular investment risks

2.2 Nature and Scope of Activities

The nature and scope of

RWLP’s activities will be to:

· Own and manage the constructed

dam and reservoir together with the land on which they are built, the

distribution pipelines, pumps and stations carrying water to farm gates and any

other supply points and all other assets and liabilities necessary to operate

the RWSS effectively and profitably;

· Raise funds for working capital and

development as required by selling bonds, mortgages, preference shares and

other debt instruments;

· Assist any subsidiary and associated

companies to increase shareholder value and regional prosperity through growth

and investment;

· Apply best practice governance

procedures within the RWLP and any subsidiaries and other investments it may

have now or in the future; and,

· Help achieve HBRC’s regional

strategic economic development objectives by investing in assets that will

benefit the Hawke’s Bay Region as a whole.

3. DETAILS

OF THE PROPOSAL

3.1 rwss

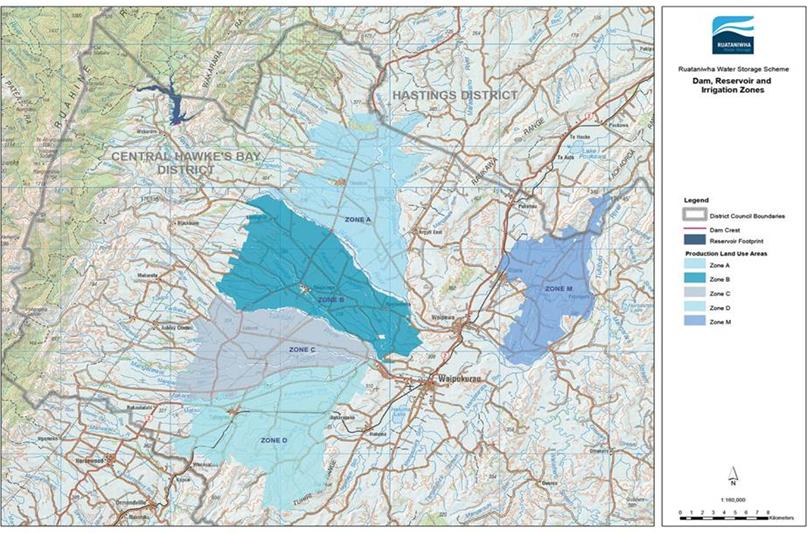

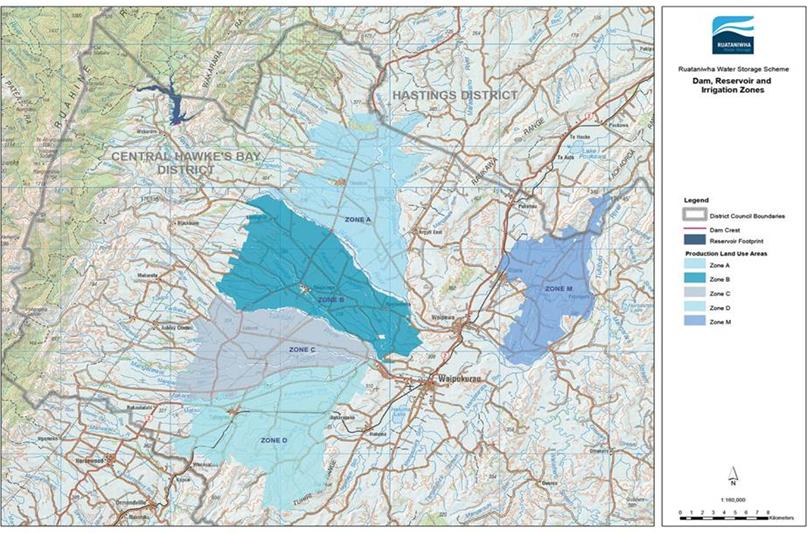

RWSS will consist of an 83 metre

high concrete dam on the Makaroro River in the Tukituki Catchment with a

reservoir having a maximum storage capacity of approximately 96 million m3,

which would be used to irrigate up to 25,000 hectares delivered through a mixed

and open canal and piped distribution system to farmers and other users in

Central Hawkes Bay. The dam and reservoir system will also include an

approximately 6.5kw hydro-electric power station.

As a result of a comprehensive

recruitment and selection process OHL/Hawkins joint venture was appointed the

preferred design and construction consortium for the RWSS. OHL is a listed

Spanish construction company with international operations and Hawkins

Infrastructure Limited is New Zealand’s largest privately owned construction

company.

It is intended RWSS will eventually

deliver approximately 104 million cubic metres of water each year to five zones

located across SH2 between Waipukurau in the south and Te Aute in the north.